Dry Conditioner Market Synopsis

Dry Conditioner Market Size Was Valued at USD 4.36 Billion in 2023 and is Projected to Reach USD 6.93 Billion by 2032, Growing at a CAGR of 5.29% From 2024-2032.

Dry conditioner is a hair care product designed to provide a quick and convenient way to refresh and revitalize hair between washes. Unlike traditional conditioners that are applied to wet hair during the showering process, dry conditioner is intended for use on dry hair. It typically comes in the form of a spray or aerosol, allowing users to easily apply it to their hair without the need for water.

- The primary purpose of dry conditioner is to add moisture and softness to the hair, making it more manageable and reducing frizz. It often contains a combination of nourishing ingredients such as oils, vitamins, and proteins that help hydrate and condition the hair without the need for rinsing. Dry conditioner can be especially beneficial for individuals with dry or damaged hair, as it provides a quick and effective way to add shine and smoothness.

- The market for dry conditioners has witnessed growth due to the rising demand for timesaving and water-conserving hair care solutions. Consumers are increasingly adopting on-the-go lifestyles, and dry conditioners offer a convenient alternative for maintaining hair health between washes. The product typically comes in spray or aerosol form, delivering a lightweight formula that adds moisture, softness, and shine to the hair while detangling and reducing frizz.

- Key players in the beauty and personal care industry have recognized this trend and introduced innovative dry conditioner formulations to meet consumer preferences. The market is also influenced by the growing awareness of sustainable and eco-friendly beauty products, prompting brands to develop dry conditioners with environmentally conscious ingredients and packaging.

Dry Conditioner Market Trend Analysis

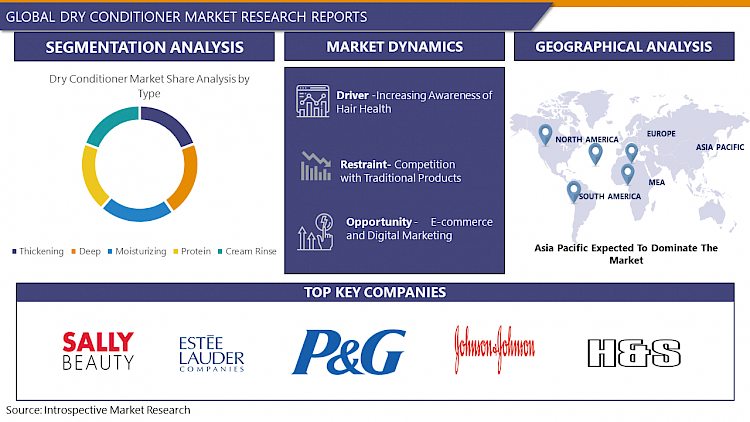

Increasing Awareness of Hair Health

- The dry conditioner market is experiencing a surge in growth primarily driven by the increasing awareness of hair health among consumers. As people become more conscious of the impact of environmental factors, styling products, and daily stressors on their hair, the demand for innovative and convenient solutions like dry conditioners is on the rise.

- Consumers are recognizing the importance of maintaining well-hydrated and nourished hair to prevent damage, split ends, and dullness. Dry conditioners offer a quick and efficient way to add moisture and shine to hair without the need for traditional wet application. This time-saving solution appeals to the modern, fast-paced lifestyle, making it a popular choice for individuals seeking effective hair care in minimal time.

- The dry conditioner market is benefitting from the growing preference for sustainable and eco-friendly beauty products. Many dry conditioners are formulated with environmentally friendly ingredients, aligning with the increasing demand for responsible and ethical choices in personal care.

E-commerce and Digital Marketing Creates an Opportunity for Dry Conditioner Market

- The dry conditioner market presents promising opportunities in the beauty and personal care industry. As consumers increasingly seek convenient and time-efficient hair care solutions, dry conditioners offer a convenient alternative to traditional liquid counterparts. These products are designed to nourish and revitalize hair without the need for water, making them ideal for on-the-go lifestyles.

- The market benefits from the rising demand for innovative and hassle-free beauty products. Dry conditioners cater to busy individuals who desire a quick and effective way to maintain healthy and well-groomed hair between regular washes. Additionally, the growing emphasis on sustainable and eco-friendly beauty options has fueled interest in dry conditioners, as they often come in environmentally friendly packaging and contribute to water conservation.

Dry Conditioner Market Segment Analysis:

Dry Conditioner Market Segmented based on type, Packaging, Distribution Channel, and end-users.

By Type, thickening segment is expected to dominate the market during the forecast period

- In the dynamic landscape of the Dry Conditioner Market, the Thickening segment stands poised to assert its dominance. Characterized by a surge in demand and a robust growth trajectory, the Thickening segment is anticipated to outshine its counterparts in the market. This dominance is underscored by the segment's ability to cater to a diverse consumer base seeking voluminous and textured hair.

- Consumers are increasingly gravitating towards dry conditioners with thickening properties, driven by the desire for fuller, more luxurious hair without the weight of traditional conditioning products. The Thickening segment responds adeptly to this consumer demand, offering formulations that enhance volume and texture while maintaining the convenience of a dry application.

By Packaging, Sprays segment held the largest share of 42.32% in 2022

- The Packaging Sprays segment's ascendancy can be attributed to its user-friendly design, allowing consumers to easily apply the dry conditioner without the need for water. This feature aligns perfectly with the growing trend of water conservation and the preference for sustainable beauty practices. Additionally, the aerosol packaging ensures even and controlled distribution of the product, enhancing its effectiveness and providing a seamless user experience.

- As beauty and personal care habits continue to evolve, the Packaging Sprays segment's dominance in the Dry Conditioner market is anticipated to persist, driven by its convenience, sustainability, and effectiveness in meeting the needs of today's discerning consumers. This segment's ability to marry innovation with practicality positions it as a key player in shaping the future of the Dry Conditioner industry.

Dry Conditioner Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to assert its dominance in the dry conditioner market, exhibiting robust growth and becoming a focal point for industry development. This trend is fueled by a combination of factors that position the region as a key player in the global dry conditioner market.

- Rapid urbanization and an expanding middle-class population in countries like China, India, and Southeast Asian nations have heightened consumer awareness and increased disposable income. There is a growing demand for personal care products, including dry conditioners, as consumers seek convenient and effective solutions for hair care.

- The beauty and personal care industry in the Asia Pacific region have witnessed substantial innovation and product diversification. Dry conditioners, offering time-efficient and water-free hair conditioning solutions, align with the evolving consumer preferences for convenience and sustainability.

Dry Conditioner Market Top Key Players:

- SALLY BEAUTY HOLDING (UNITED STATES)

- ESTEE LAUDER COMPANIES (UNITED STATES)

- PROCTER AND GAMBLE (UNITED STATES)

- JOHNSON & JOHNSON (UNITED STATES)

- H&S (UNITED STATES)

- HENKEL AG & CO. KGAA (GERMANY)

- L'ORÉAL (FRANCE)

- SEPHORA INC. (FRANCE)

- UNILEVER PLC (UNITED KINGDOM)

- SUNSILK (UNITED KINGDOM)

- ORIFLAME HOLDING AG (SWITZERLAND)

- GARNIER FRUCTIS (NEW YORK)

- NATURA & CO. (BRAZIL)

- KAO CORPORATION (JAPAN)

- HIMALAYA HERBALS (INDIA)

- HINDUSTAN UNILEVER LTD (INDIA)

- MARICO LTD (INDIA)

Key Industry Developments in the Dry Conditioner Market

- In September 2023, Petronas Lubricants International (PLI) and PT Kilang Pertamina Internasional (PT KPI) recently signed a Joint Study Agreement (JSA) to explore the possibility of developing a new greenfield lube base oil plant in Refinery Unit (RU) IV Cilacap, Central Java.

- In April 2022, Chevron Global Energy, Inc., a wholly-owned subsidiary of Chevron Corporation, acquired Neste Corporation’s NEXBASE brand, associated qualifications and approvals, and related sales and marketing business.

|

Global Dry Conditioner Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.29 % |

Market Size in 2032: |

USD 6.93 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging |

|

||

|

By End User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DRY CONDITIONER MARKET BY TYPE (2016-2030)

- DRY CONDITIONER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- THICKENING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- DEEP

- MOISTURIZING

- PROTEIN

- CREAM RINSE

- DRY CONDITIONER MARKET BY PACKAGING (2016-2030)

- DRY CONDITIONER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TUBES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BOTTLES

- SPRAYS

- POUCHES

- DRY CONDITIONER MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- DRY CONDITIONER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS & HYPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPECIALTY STORES

- ECOMMERCE

- PHARMACY STORES

- DRY CONDITIONER MARKET BY END USERS (2016-2030)

- DRY CONDITIONER MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WOMEN

- KIDS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- DRY CONDITIONER Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SALLY BEAUTY HOLDING (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ESTEE LAUDER COMPANIES (UNITED STATES)

- PROCTER AND GAMBLE (UNITED STATES)

- JOHNSON & JOHNSON (UNITED STATES)

- H&S (UNITED STATES)

- HENKEL AG & CO. KGAA (GERMANY)

- L'ORÉAL (FRANCE)

- SEPHORA INC. (FRANCE)

- UNILEVER PLC (UNITED KINGDOM)

- SUNSILK (UNITED KINGDOM)

- ORIFLAME HOLDING AG (SWITZERLAND)

- GARNIER FRUCTIS (NEW YORK)

- NATURA & CO. (BRAZIL)

- KAO CORPORATION (JAPAN)

- HIMALAYA HERBALS (INDIA)

- HINDUSTAN UNILEVER LTD (INDIA)

- MARICO LTD (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL DRY CONDITIONER MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Packaging

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Dry Conditioner Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 4.36 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.29 % |

Market Size in 2032: |

USD 6.93 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging |

|

||

|

By End User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DRY CONDITIONER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DRY CONDITIONER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DRY CONDITIONER MARKET COMPETITIVE RIVALRY

TABLE 005. DRY CONDITIONER MARKET THREAT OF NEW ENTRANTS

TABLE 006. DRY CONDITIONER MARKET THREAT OF SUBSTITUTES

TABLE 007. DRY CONDITIONER MARKET BY TYPE

TABLE 008. THICKENING MARKET OVERVIEW (2016-2028)

TABLE 009. DEEP MARKET OVERVIEW (2016-2028)

TABLE 010. MOISTURIZING MARKET OVERVIEW (2016-2028)

TABLE 011. PROTEIN MARKET OVERVIEW (2016-2028)

TABLE 012. CREAM RINSE MARKET OVERVIEW (2016-2028)

TABLE 013. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. DRY CONDITIONER MARKET BY PACKAGING

TABLE 015. TUBES MARKET OVERVIEW (2016-2028)

TABLE 016. BOTTLES MARKET OVERVIEW (2016-2028)

TABLE 017. SPRAYS MARKET OVERVIEW (2016-2028)

TABLE 018. POUCHES MARKET OVERVIEW (2016-2028)

TABLE 019. DRY CONDITIONER MARKET BY DISTRIBUTION CHANNELS

TABLE 020. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2028)

TABLE 021. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

TABLE 022. ECOMMERCE MARKET OVERVIEW (2016-2028)

TABLE 023. PHARMACY STORES MARKET OVERVIEW (2016-2028)

TABLE 024. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 025. DRY CONDITIONER MARKET BY END USERS

TABLE 026. MEN MARKET OVERVIEW (2016-2028)

TABLE 027. WOMEN MARKET OVERVIEW (2016-2028)

TABLE 028. NORTH AMERICA DRY CONDITIONER MARKET, BY TYPE (2016-2028)

TABLE 029. NORTH AMERICA DRY CONDITIONER MARKET, BY PACKAGING (2016-2028)

TABLE 030. NORTH AMERICA DRY CONDITIONER MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 031. NORTH AMERICA DRY CONDITIONER MARKET, BY END USERS (2016-2028)

TABLE 032. N DRY CONDITIONER MARKET, BY COUNTRY (2016-2028)

TABLE 033. EUROPE DRY CONDITIONER MARKET, BY TYPE (2016-2028)

TABLE 034. EUROPE DRY CONDITIONER MARKET, BY PACKAGING (2016-2028)

TABLE 035. EUROPE DRY CONDITIONER MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 036. EUROPE DRY CONDITIONER MARKET, BY END USERS (2016-2028)

TABLE 037. DRY CONDITIONER MARKET, BY COUNTRY (2016-2028)

TABLE 038. ASIA PACIFIC DRY CONDITIONER MARKET, BY TYPE (2016-2028)

TABLE 039. ASIA PACIFIC DRY CONDITIONER MARKET, BY PACKAGING (2016-2028)

TABLE 040. ASIA PACIFIC DRY CONDITIONER MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 041. ASIA PACIFIC DRY CONDITIONER MARKET, BY END USERS (2016-2028)

TABLE 042. DRY CONDITIONER MARKET, BY COUNTRY (2016-2028)

TABLE 043. MIDDLE EAST & AFRICA DRY CONDITIONER MARKET, BY TYPE (2016-2028)

TABLE 044. MIDDLE EAST & AFRICA DRY CONDITIONER MARKET, BY PACKAGING (2016-2028)

TABLE 045. MIDDLE EAST & AFRICA DRY CONDITIONER MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 046. MIDDLE EAST & AFRICA DRY CONDITIONER MARKET, BY END USERS (2016-2028)

TABLE 047. DRY CONDITIONER MARKET, BY COUNTRY (2016-2028)

TABLE 048. SOUTH AMERICA DRY CONDITIONER MARKET, BY TYPE (2016-2028)

TABLE 049. SOUTH AMERICA DRY CONDITIONER MARKET, BY PACKAGING (2016-2028)

TABLE 050. SOUTH AMERICA DRY CONDITIONER MARKET, BY DISTRIBUTION CHANNELS (2016-2028)

TABLE 051. SOUTH AMERICA DRY CONDITIONER MARKET, BY END USERS (2016-2028)

TABLE 052. DRY CONDITIONER MARKET, BY COUNTRY (2016-2028)

TABLE 053. SALLY BEAUTY HOLDING: SNAPSHOT

TABLE 054. SALLY BEAUTY HOLDING: BUSINESS PERFORMANCE

TABLE 055. SALLY BEAUTY HOLDING: PRODUCT PORTFOLIO

TABLE 056. SALLY BEAUTY HOLDING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. KAO CORPORATION: SNAPSHOT

TABLE 057. KAO CORPORATION: BUSINESS PERFORMANCE

TABLE 058. KAO CORPORATION: PRODUCT PORTFOLIO

TABLE 059. KAO CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. L'ORÉAL: SNAPSHOT

TABLE 060. L'ORÉAL: BUSINESS PERFORMANCE

TABLE 061. L'ORÉAL: PRODUCT PORTFOLIO

TABLE 062. L'ORÉAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. UNILEVER PLC: SNAPSHOT

TABLE 063. UNILEVER PLC: BUSINESS PERFORMANCE

TABLE 064. UNILEVER PLC: PRODUCT PORTFOLIO

TABLE 065. UNILEVER PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. PROCTER AND GAMBLE: SNAPSHOT

TABLE 066. PROCTER AND GAMBLE: BUSINESS PERFORMANCE

TABLE 067. PROCTER AND GAMBLE: PRODUCT PORTFOLIO

TABLE 068. PROCTER AND GAMBLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. THE ESTEE LAUDER: SNAPSHOT

TABLE 069. THE ESTEE LAUDER: BUSINESS PERFORMANCE

TABLE 070. THE ESTEE LAUDER: PRODUCT PORTFOLIO

TABLE 071. THE ESTEE LAUDER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. SEPHORA INC.: SNAPSHOT

TABLE 072. SEPHORA INC.: BUSINESS PERFORMANCE

TABLE 073. SEPHORA INC.: PRODUCT PORTFOLIO

TABLE 074. SEPHORA INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. CLINIC PLUS: SNAPSHOT

TABLE 075. CLINIC PLUS: BUSINESS PERFORMANCE

TABLE 076. CLINIC PLUS: PRODUCT PORTFOLIO

TABLE 077. CLINIC PLUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. H&S: SNAPSHOT

TABLE 078. H&S: BUSINESS PERFORMANCE

TABLE 079. H&S: PRODUCT PORTFOLIO

TABLE 080. H&S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. SUNSILK: SNAPSHOT

TABLE 081. SUNSILK: BUSINESS PERFORMANCE

TABLE 082. SUNSILK: PRODUCT PORTFOLIO

TABLE 083. SUNSILK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. HIMALAYA HERBALS: SNAPSHOT

TABLE 084. HIMALAYA HERBALS: BUSINESS PERFORMANCE

TABLE 085. HIMALAYA HERBALS: PRODUCT PORTFOLIO

TABLE 086. HIMALAYA HERBALS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. GARNIER FRUCTIS: SNAPSHOT

TABLE 087. GARNIER FRUCTIS: BUSINESS PERFORMANCE

TABLE 088. GARNIER FRUCTIS: PRODUCT PORTFOLIO

TABLE 089. GARNIER FRUCTIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 090. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 091. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 092. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DRY CONDITIONER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DRY CONDITIONER MARKET OVERVIEW BY TYPE

FIGURE 012. THICKENING MARKET OVERVIEW (2016-2028)

FIGURE 013. DEEP MARKET OVERVIEW (2016-2028)

FIGURE 014. MOISTURIZING MARKET OVERVIEW (2016-2028)

FIGURE 015. PROTEIN MARKET OVERVIEW (2016-2028)

FIGURE 016. CREAM RINSE MARKET OVERVIEW (2016-2028)

FIGURE 017. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. DRY CONDITIONER MARKET OVERVIEW BY PACKAGING

FIGURE 019. TUBES MARKET OVERVIEW (2016-2028)

FIGURE 020. BOTTLES MARKET OVERVIEW (2016-2028)

FIGURE 021. SPRAYS MARKET OVERVIEW (2016-2028)

FIGURE 022. POUCHES MARKET OVERVIEW (2016-2028)

FIGURE 023. DRY CONDITIONER MARKET OVERVIEW BY DISTRIBUTION CHANNELS

FIGURE 024. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2028)

FIGURE 025. SPECIALTY STORES MARKET OVERVIEW (2016-2028)

FIGURE 026. ECOMMERCE MARKET OVERVIEW (2016-2028)

FIGURE 027. PHARMACY STORES MARKET OVERVIEW (2016-2028)

FIGURE 028. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 029. DRY CONDITIONER MARKET OVERVIEW BY END USERS

FIGURE 030. MEN MARKET OVERVIEW (2016-2028)

FIGURE 031. WOMEN MARKET OVERVIEW (2016-2028)

FIGURE 032. NORTH AMERICA DRY CONDITIONER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. EUROPE DRY CONDITIONER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. ASIA PACIFIC DRY CONDITIONER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 035. MIDDLE EAST & AFRICA DRY CONDITIONER MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 036. SOUTH AMERICA DRY CONDITIONER MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Dry Conditioner Market research report is 2024-2032.

Sally Beauty Holding (United States), Estee Lauder Companies (United States), Procter And Gamble (United States), Johnson & Johnson (United States), H&S (United States),Henkel Ag & Co. Kgaa (Germany), L’Oréal (France), Sephora Inc. (France), Unilever Plc (United Kingdom), Sunsilk (United Kingdom), Oriflame Holding Ag (Switzerland), Garnier Fructis (New York), Natura & Co. (Brazil), Kao Corporation (Japan), Himalaya Herbals (India), Hindustan Unilever Ltd (India), Marico Ltd (India) and Other Major Players.

The Dry Conditioner Market is segmented into Type, Nature, Packaging, Distribution Channels, End Users, and region. By Type, the market is categorized into Thickening, Deep, Moisturizing, Protein, Cream Rinse. By Packaging, the market is categorized into Tubes, Bottles, Sprays, Pouches. By Distribution Channels, the market is categorized into Supermarkets & Hypermarkets, Specialty Stores, Ecommerce, Pharmacy Stores. By End Users, the market is categorized into Men, Women, Kids. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Dry conditioner is a hair care product designed to provide a quick and convenient way to refresh and revitalize hair between washes. Unlike traditional conditioners that are applied to wet hair during the showering process, dry conditioner is intended for use on dry hair. It typically comes in the form of a spray or aerosol, allowing users to easily apply it to their hair without the need for water.

Dry Conditioner Market Size Was Valued at USD 4.36 Billion in 2023 and is Projected to Reach USD 6.93 Billion by 2032, Growing at a CAGR of 5.29% From 2024-2032.