Aircraft Radome Market Synopsis:

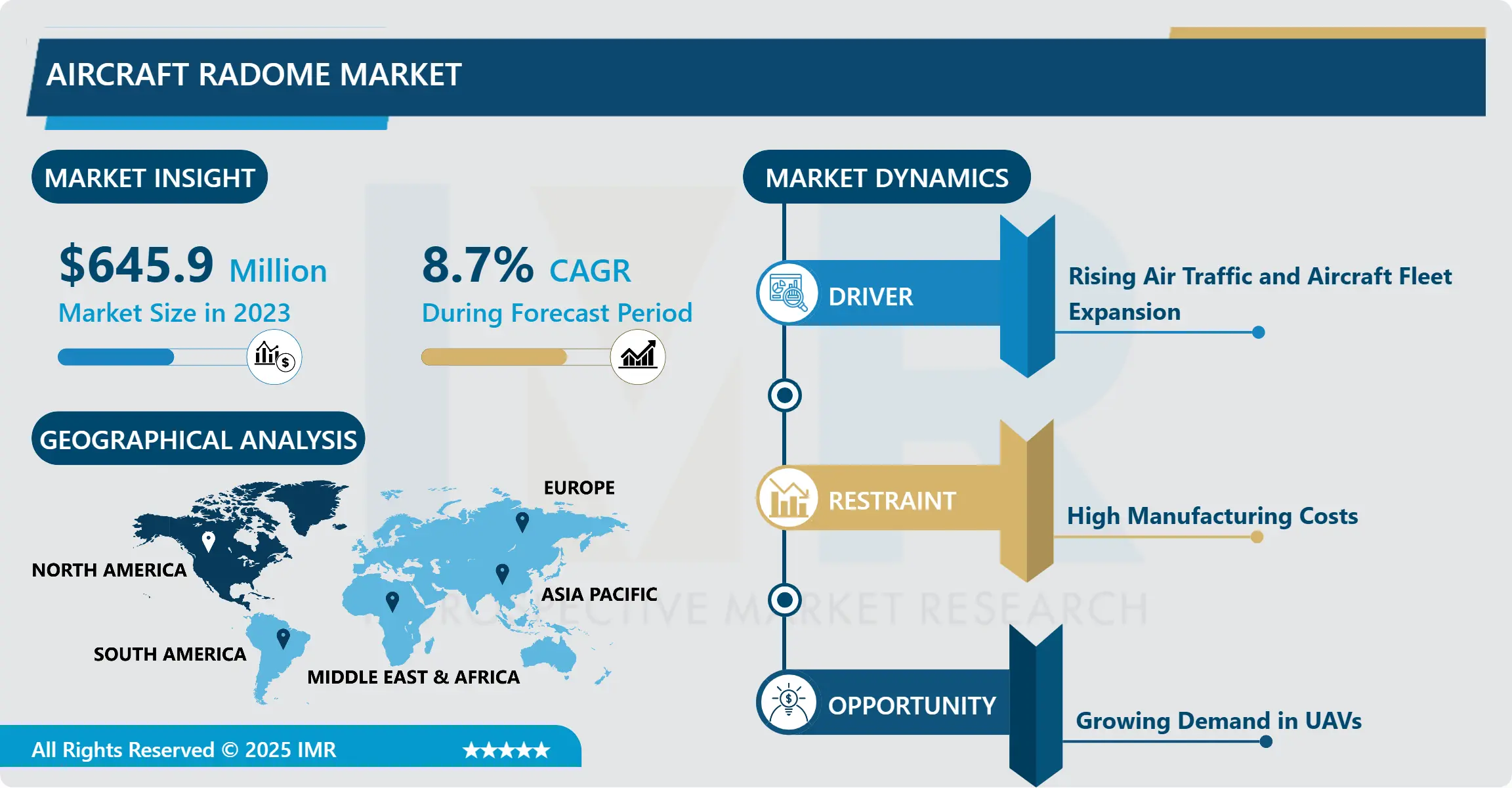

Aircraft Radome Market Size Was Valued at USD 645.9 Million in 2023, and is Projected to Reach USD 1,368.5 Million by 2032, Growing at a CAGR of 8.7% From 2024-2032.

The aircraft radome refers to a protective shell of aircraft that safeguards radar and communication apparatus and that has a capacities to transmit and receive electromagnetic signals. Such protective covers are usually manufactured from fiberglass epoxy, resin that can sustain velocity forces of air flows, besides protecting operational communication and surveillance systems on board. They can be mounted on commercial, military or even UAV, and are paramount for safety and efficiency of the flight.

The aircraft radome market has been exhibiting constant growth trends over the last years due to the necessity of protecting radar and communication systems in aircraft. Radomes shield delicate avionics and electric equipment from weather factors for example wind, rain, ice as well as electromagnetic emanations though permitting such systems to operate effectively. The high demand for radomes has been attributed to the increase in air traffic, innovation of better-quality radar systems, and increased emphasis on aircraft improvement, which embraces new communication and radar technology. Manufacturers of airplanes and other aircrafts need radomes that are at the same time small, light and strong, since all of these aspects add to the durability of the flight.

There are some significant factors which are prevailent in the market among them fewones are; the commercial aviation segment where more airplanes are being used to fulfil global traffic. As air transport develops, there is always a requirement for superior radar and telecom apparatus for navigation, to avoid collisions, and inner flight communication. The need for stealth, surveillance and reconnaissance by the military sector has created the need for radomes especially those that are specially designed for particular military use. Military use, armed UAVs and the advancing needs of civil UAVs have also fostered the growth of radome market due to the necessity to protect UAV communication equipment.

The other driver to the market is the technological developments that have been made in materials used to develop various products and in the manufacturing processes. Contemporary radomes are made out of more sophisticated composite that are actually lighter in weight, more rigid thereby over-time decreasing aircraft weight. Technological advancement in radar systems also gives impetus, given that newer systems are bigger and have different form and function from previous systems, and as a result need better radome designs. In addition, mainly in the aviation industry, more emphasis has been placed on the sustainability of aircraft operation by designing and using environmental materials for the construction of the radomes.

Aircraft Radome Market Trend Analysis:

Advanced Material Technology

-

This has made advanced material technologies one of the looming trends noticeable in the aircraft radome market. According to the increasing capability of radar equipment on size, strength, durability, and lightweight, the radomes are being built with advanced and efficient material. New materials carbons fibres and glasses fibres and composites are being used more often in constructing radomes to suit today radar system requirements. These materials not only improve the radome performance, but also help to decrease aircraft’s weight that in turn decrease operational cost through increased fuel efficiency.

- It also fully supports the desire for higher sustainability levels within the aerospace community. New composite materials are usually developed with enhanced capabilities, durability, and resistance to environmental degradation, which helps in designing long-lasting new structures.” This trend is of particularly importance for the commercial aviation segment where business are increasingly focused on cutting their CO2 emissions and reaching the best of flight performance as well as safety levels. The calibration of these high-end materials for use in radomes is expected to progress further this is likely to strengthen the competitive positioning of the aircraft radome market.

Growing Demand in UAVs

-

The rising demand for UAVs in various segment is a major factor for the growth of the aircraft radome market. Common UAV use includes military reconnaissance, civil purposes including agriculture, new areas of application include, transportation and disaster management. The trend in UAV technologies requires lightweight, highly effective, and affordable radomes to shield their critical radar and communication equipment. The development of new, smaller and more advanced radomes matched for UAV manufacturers’ platforms is enabling new opportunities in the market.

- In addition, the growth in the military and civil uses of UAVs will create an increased market for radomes that will be made exclusively for these vehicles. For example, UAVs perform in different environments; thus, body protection in the form of the radome is required to shield radar and communication equipment from severe weather while still facilitating top performance. Greater employment of UAV radomes thus offer an important opportunity for manufacturers to develop more unique UAV solutions owing to their distinctive UAV needs.

Aircraft Radome Market Segment Analysis:

Aircraft Radome Market is Segmented on the basis of Product Type, Material Type, Technology, Application, End User, and Region.

By Product Type, Nose Radomes segment is expected to dominate the market during the forecast period

-

The aircraft radome market segmented as nose radome, tail radome and wing radome. The most popular type is nose radomes and these are usually the biggest because they are built to encompass the radar equipment to be mounted at the front of the plane. They are of significant importance in creating visually transparency for the radar systems in navigation and weather monitoring. C Tail radomes are relatively smaller and can be mounted within the rear part of the aircraft, that is used for communication and radar systems situated in the mentioned part of the plane. These are present in wing part of the aircraft and are used for communication and radar including facets that are used in military aircrafts since more complex designs are usually embedded on wings.

- Every product type has certain uses, its intended purpose or the style of which it should be built. Nose radomes, because they would be mounted on the aircraft’s external structure, need robust yet light materials that would not easily be torn apart by the wind at a considerable air speed. Smaller in comparison to the entire plane, tail and wing radomes also require the same level of protection for the radar and communication equipment, and, at the same time, should not contribute to the overall weight of the aircraft or hinder air flow. The need for these radomes differ based on the differences in the aircraft, where fighter aircraft require rather more special kind of radomes than the commercial or civil aircraft.

By Application, Commercial Aircraft segment expected to held the largest share

-

The global aircraft radome market is classified by application as commercial, military & UAVs (unmanned aerial vehicles). Commercial aircraft are the largest segment as most of these aircrafts use radar and communication systems for navigation, weather and passenger facilities. Aviation industries, along with increased safety and efficiency of fly, are one of the major driving factors of radome market in this segment. The proliferation of new aircraft as well as the upgrade of existing old aircrafts has led firms within the airline industry to seek more contemporary and sophisticated radomes capable of effectively supporting new radar systems, which guarantee safety and efficiency.

- Military aircraft is another important segment due to the fact that the radomes are developed for military purposes; including stealth, surveillance, and reconnaissance among others. Military radomes are constructed to operate in worse operating environments and usually use superior materials and technology as used in avionic equipments used in tactical and strategic military operations. Another category is UAVs, or unmanned aerial vehicles, that is increasing section due to military, reconnaissance, and civil uses. Manufacturing UAV radomes needs to be small and lightweight while at the same time offer the required levels of protection to the communications and radar instruments. With UAVs being adopted in virtually all sectors in the future, this segment shall be seen to grow rapidly.

Aircraft Radome Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

-

The aircraft radome market in North America is expected to experience higher growth rates in the near future because of the presence of leading aerospace manufacturers and significant needs of a well-developed aviation industry. One of the largest manufacturers of aircrafts are Boeing and Lockheed Martin companies from the United States; thereby they influence the overall demand for aircraft radomes. North America military and defense industry also form a large customer base of radomes due to the regions ongoing commitment to the development and use of new radar technologies both Military and Commercial.

- The region enjoys plentiful research and development spending, which in turn, leads to advancements in the radome material and structures. Burgeoning North America continues to be the leading region in aviation and defense industries, therefore the demand for lightweight, durable and efficient radomes in North America is the market driver that is expected to attain the highest CAGR in the aircraft radome market.

Active Key Players in the Aircraft Radome Market

- Aviation Partners, Inc. (USA)

- GKN Aerospace (UK)

- Honeywell International Inc. (USA)

- L-3 Communications (USA)

- Nordam (USA)

- Raytheon Technologies Corporation (USA)

- RBC Bearings Incorporated (USA)

- Safran SA (France)

- Sierra Nevada Corporation (USA)

- The Boeing Company (USA)

- UTC Aerospace Systems (USA)

- Other Active Players.

|

Global Aircraft Radome Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 645.9 Million |

|

Forecast Period 2024-32 CAGR: |

8.7% |

Market Size in 2032: |

USD 1,368.5 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Materials Type |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Aircraft Radome Market by Material Type

4.1 Aircraft Radome Market Snapshot and Growth Engine

4.2 Aircraft Radome Market Overview

4.3 Composite Materials

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Composite Materials: Geographic Segmentation Analysis

4.4 Plastic Materials

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Plastic Materials: Geographic Segmentation Analysis

4.5 Other

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Other: Geographic Segmentation Analysis

Chapter 5: Aircraft Radome Market by Application

5.1 Aircraft Radome Market Snapshot and Growth Engine

5.2 Aircraft Radome Market Overview

5.3 Commercial Aircraft

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Commercial Aircraft: Geographic Segmentation Analysis

5.4 Military Aircraft

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Military Aircraft: Geographic Segmentation Analysis

5.5 UAVs (Unmanned Aerial Vehicles)

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 UAVs (Unmanned Aerial Vehicles): Geographic Segmentation Analysis

Chapter 6: Aircraft Radome Market by End-User

6.1 Aircraft Radome Market Snapshot and Growth Engine

6.2 Aircraft Radome Market Overview

6.3 OEM (Original Equipment Manufacturer

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 OEM (Original Equipment Manufacturer: Geographic Segmentation Analysis

Chapter 7: Aircraft Radome Market by Product Type

7.1 Aircraft Radome Market Snapshot and Growth Engine

7.2 Aircraft Radome Market Overview

7.3 Nose Radomes

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Nose Radomes: Geographic Segmentation Analysis

7.4 Tail Radomes

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Tail Radomes: Geographic Segmentation Analysis

7.5 Wing Radomes

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Wing Radomes: Geographic Segmentation Analysis

Chapter 8: Aircraft Radome Market by Technology

8.1 Aircraft Radome Market Snapshot and Growth Engine

8.2 Aircraft Radome Market Overview

8.3 Passive Radomes

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Passive Radomes: Geographic Segmentation Analysis

8.4 Active Radomes.

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Active Radomes.: Geographic Segmentation Analysis

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Aircraft Radome Market Share by Manufacturer (2023)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 NORDAM (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 AVIATION PARTNERS INC. (USA)

9.4 GKN AEROSPACE (UK)

9.5 HONEYWELL INTERNATIONAL INC. (USA)

9.6 L-3 COMMUNICATIONS (USA)

9.7 RAYTHEON TECHNOLOGIES CORPORATION (USA)

9.8 RBC BEARINGS INCORPORATED (USA)

9.9 SIERRA NEVADA CORPORATION (USA)

9.10 THE BOEING COMPANY (USA)

9.11 SAFRAN SA (FRANCE)

9.12 UTC AEROSPACE SYSTEMS (USA)

9.13 OTHER ACTIVE PLAYERS

Chapter 10: Global Aircraft Radome Market By Region

10.1 Overview

10.2. North America Aircraft Radome Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size By Material Type

10.2.4.1 Composite Materials

10.2.4.2 Plastic Materials

10.2.4.3 Other

10.2.5 Historic and Forecasted Market Size By Application

10.2.5.1 Commercial Aircraft

10.2.5.2 Military Aircraft

10.2.5.3 UAVs (Unmanned Aerial Vehicles)

10.2.6 Historic and Forecasted Market Size By End-User

10.2.6.1 OEM (Original Equipment Manufacturer

10.2.7 Historic and Forecasted Market Size By Product Type

10.2.7.1 Nose Radomes

10.2.7.2 Tail Radomes

10.2.7.3 Wing Radomes

10.2.8 Historic and Forecasted Market Size By Technology

10.2.8.1 Passive Radomes

10.2.8.2 Active Radomes.

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Aircraft Radome Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size By Material Type

10.3.4.1 Composite Materials

10.3.4.2 Plastic Materials

10.3.4.3 Other

10.3.5 Historic and Forecasted Market Size By Application

10.3.5.1 Commercial Aircraft

10.3.5.2 Military Aircraft

10.3.5.3 UAVs (Unmanned Aerial Vehicles)

10.3.6 Historic and Forecasted Market Size By End-User

10.3.6.1 OEM (Original Equipment Manufacturer

10.3.7 Historic and Forecasted Market Size By Product Type

10.3.7.1 Nose Radomes

10.3.7.2 Tail Radomes

10.3.7.3 Wing Radomes

10.3.8 Historic and Forecasted Market Size By Technology

10.3.8.1 Passive Radomes

10.3.8.2 Active Radomes.

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Aircraft Radome Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size By Material Type

10.4.4.1 Composite Materials

10.4.4.2 Plastic Materials

10.4.4.3 Other

10.4.5 Historic and Forecasted Market Size By Application

10.4.5.1 Commercial Aircraft

10.4.5.2 Military Aircraft

10.4.5.3 UAVs (Unmanned Aerial Vehicles)

10.4.6 Historic and Forecasted Market Size By End-User

10.4.6.1 OEM (Original Equipment Manufacturer

10.4.7 Historic and Forecasted Market Size By Product Type

10.4.7.1 Nose Radomes

10.4.7.2 Tail Radomes

10.4.7.3 Wing Radomes

10.4.8 Historic and Forecasted Market Size By Technology

10.4.8.1 Passive Radomes

10.4.8.2 Active Radomes.

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Aircraft Radome Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size By Material Type

10.5.4.1 Composite Materials

10.5.4.2 Plastic Materials

10.5.4.3 Other

10.5.5 Historic and Forecasted Market Size By Application

10.5.5.1 Commercial Aircraft

10.5.5.2 Military Aircraft

10.5.5.3 UAVs (Unmanned Aerial Vehicles)

10.5.6 Historic and Forecasted Market Size By End-User

10.5.6.1 OEM (Original Equipment Manufacturer

10.5.7 Historic and Forecasted Market Size By Product Type

10.5.7.1 Nose Radomes

10.5.7.2 Tail Radomes

10.5.7.3 Wing Radomes

10.5.8 Historic and Forecasted Market Size By Technology

10.5.8.1 Passive Radomes

10.5.8.2 Active Radomes.

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Aircraft Radome Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size By Material Type

10.6.4.1 Composite Materials

10.6.4.2 Plastic Materials

10.6.4.3 Other

10.6.5 Historic and Forecasted Market Size By Application

10.6.5.1 Commercial Aircraft

10.6.5.2 Military Aircraft

10.6.5.3 UAVs (Unmanned Aerial Vehicles)

10.6.6 Historic and Forecasted Market Size By End-User

10.6.6.1 OEM (Original Equipment Manufacturer

10.6.7 Historic and Forecasted Market Size By Product Type

10.6.7.1 Nose Radomes

10.6.7.2 Tail Radomes

10.6.7.3 Wing Radomes

10.6.8 Historic and Forecasted Market Size By Technology

10.6.8.1 Passive Radomes

10.6.8.2 Active Radomes.

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Aircraft Radome Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size By Material Type

10.7.4.1 Composite Materials

10.7.4.2 Plastic Materials

10.7.4.3 Other

10.7.5 Historic and Forecasted Market Size By Application

10.7.5.1 Commercial Aircraft

10.7.5.2 Military Aircraft

10.7.5.3 UAVs (Unmanned Aerial Vehicles)

10.7.6 Historic and Forecasted Market Size By End-User

10.7.6.1 OEM (Original Equipment Manufacturer

10.7.7 Historic and Forecasted Market Size By Product Type

10.7.7.1 Nose Radomes

10.7.7.2 Tail Radomes

10.7.7.3 Wing Radomes

10.7.8 Historic and Forecasted Market Size By Technology

10.7.8.1 Passive Radomes

10.7.8.2 Active Radomes.

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Aircraft Radome Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 645.9 Million |

|

Forecast Period 2024-32 CAGR: |

8.7% |

Market Size in 2032: |

USD 1,368.5 Million |

|

Segments Covered: |

By Product Type |

|

|

|

By Materials Type |

|

||

|

By Technology |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||