Key Market Highlights

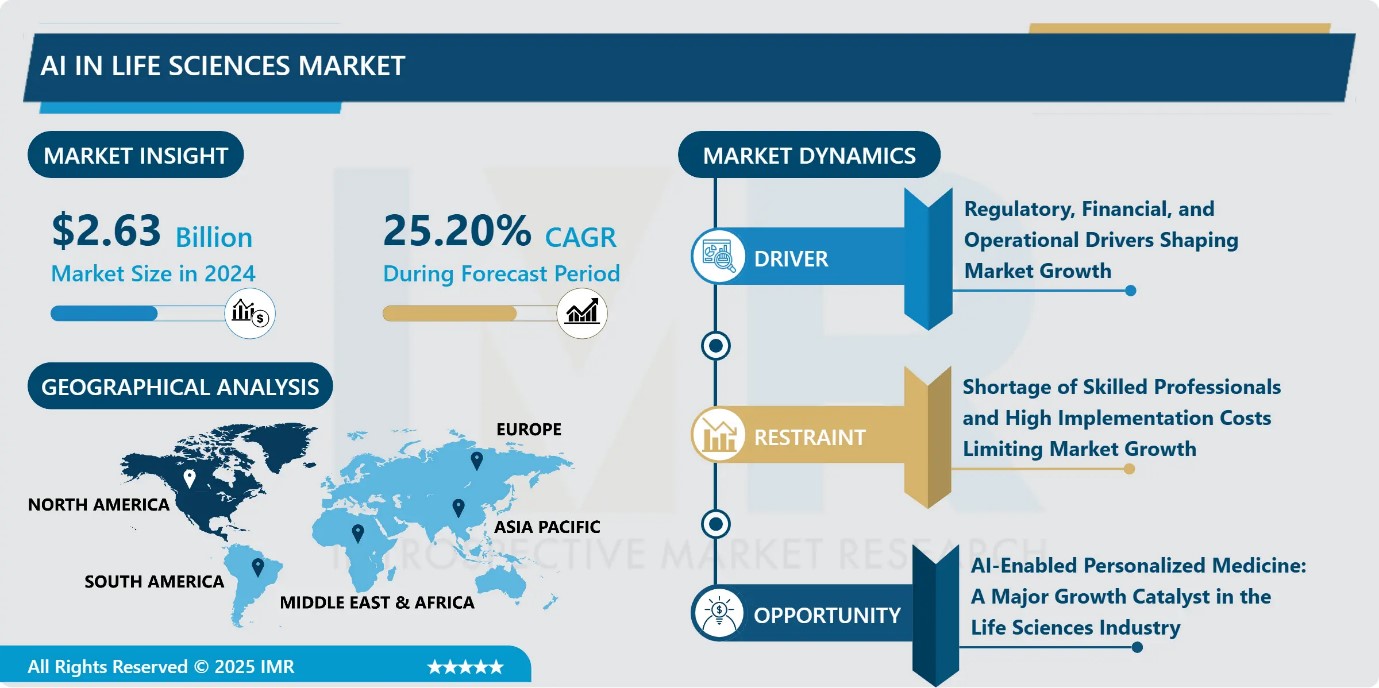

AI In Life Sciences Market Size Was Valued at USD 2.63 Billion in 2024, and is Projected to Reach USD 31.16 Billion by 2035, Growing at a CAGR of 25.20% from 2025-2035.

- Market Size in 2024: USD 2.63 Billion

- Projected Market Size by 2035: USD 31.16 Billion

- CAGR (2025–2035): 25.20%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Component: The Software segment is anticipated to lead the market by accounting for 40% of the market share throughout the forecast period.

- By Deployment: The Cloud segment is expected to capture 56.78% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 27.60% of the market share during the forecast period.

- Active Players: AIcure LLC (USA), APIXIO, Inc. (USA), Atomwise, Inc. (USA), Axtria, Inc. (USA), Databricks (USA), Other Active Players, and Other Active Players.

AI In Life Sciences Market Synopsis:

Artificial intelligence (AI) in life sciences involves the application of AI technologies such as machine learning, deep learning, and generative AI across healthcare, biotechnology, pharmaceuticals, and medical research. It enables the analysis of large-scale and complex biological and clinical data to accelerate drug discovery, improve diagnostics, and support precision and personalized medicine. AI solutions include software, hardware, and services deployed on-premises or in the cloud, with applications in clinical trials, genomics, medical imaging, patient monitoring, and biotechnology. Market growth is driven by rising investments, government initiatives, technological advancements, and the increasing demand for efficient, data-driven healthcare solutions. Despite challenges like regulatory compliance and data privacy concerns, AI adoption continues to expand rapidly in the life sciences sector.

AI In Life Sciences Market Dynamics and Trend Analysis:

AI In Life Sciences Market Growth Driver

Regulatory, Financial, and Operational Drivers Shaping Market Growth

- The AI in life sciences market is primarily propelled by supportive regulatory frameworks, the drive for operational efficiency, and increasing financial investments. Regulatory agencies, including the FDA, are establishing clear guidelines for AI-enabled medical devices, facilitating faster adoption and enhancing trust in AI applications. Life science organizations are leveraging AI to streamline workflows, automate administrative tasks, optimize clinical trial management, and achieve up to 30% reductions in operational costs, while freeing healthcare professionals to focus on patient care. Concurrently, investment in AI technologies is rising sharply, with venture funding reaching approximately 10 billion dollars, and pharmaceutical firms partnering with AI companies to develop advanced algorithms, predictive models, and machine learning solutions. Together, these factors are driving sustained market expansion and innovation.

AI In Life Sciences Market Limiting Factor

Shortage of Skilled Professionals and High Implementation Costs Limiting Market Growth

- The AI in life sciences market faces significant challenges due to a shortage of professionals skilled in both AI technologies and life sciences. Developing and deploying AI solutions requires expertise in data analytics, machine learning, and domain-specific knowledge, which is currently limited. Additionally, the high costs associated with AI implementation, including software, hardware, and integration into existing workflows, act as a barrier for many organizations, particularly smaller biotech and research firms. These factors slow the adoption of AI technologies, limiting the market’s growth potential despite increasing demand for advanced, data-driven solutions in drug discovery, diagnostics, and personalized medicine.

AI In Life Sciences Market Expansion Opportunity

AI-Enabled Personalized Medicine: A Major Growth Catalyst in the Life Sciences Industry

- The shift toward personalized medicine is creating a major opportunity for AI in the life sciences industry. As more genetic, clinical, and lifestyle data becomes available, AI helps turn this information into tailored treatment plans by spotting patterns and predicting how individual patients may respond to specific therapies. This reduces trial-and-error in treatment, improves accuracy, and leads to better outcomes. AI is also speeding up precision diagnostics, biomarker discovery, and the development of targeted therapies. With the rise of wearable devices, biosensors, and other digital health tools, even more real-time patient data is available for analysis. As healthcare moves toward more personalized, affordable, and patient-centered care, the demand for AI-driven solutions is expected to grow rapidly.

AI In Life Sciences Market Challenge and Risk

Restricted Data Diversity and Quality as a Barrier to AI Advancement in Life Sciences

- A significant challenge in the AI in life sciences market is the limited availability of high-quality and diverse datasets. Many existing datasets are small, fragmented, biased, or fail to represent different populations, leading to AI models that may produce inaccurate or non-generalizable results. This limitation hampers the development of reliable algorithms for personalized medicine, diagnostics, and drug discovery. Improving data quality through standardization, harmonization, collaboration between pharmaceutical companies, research institutions, and healthcare providers, and using approaches like federated learning or synthetic data can help overcome these barriers and support effective AI adoption.

AI In Life Sciences Market Trend

AI-Powered Clinical Trials and Drug Discovery

- The AI in life sciences market is witnessing rapid growth due to the increasing complexity and volume of data generated in clinical trials, drug discovery, diagnostics, and personalized medicine. Clinical trials, which account for nearly 50% of global trials by the pharmaceutical sector, produce massive datasets that are difficult to analyze using traditional methods. AI algorithms help identify meaningful patterns, correlations, and predictive insights, reducing time, costs, and errors in research. The growing availability of public clinical trial data, particularly in the U.S., Europe, and China, encourages the adoption of AI by research institutes and biotech firms. Key trends driving growth include deep learning, neural networks, natural language processing, and AI-powered diagnostic imaging. These technologies improve drug discovery, streamline documentation, enhance precision medicine, and support remote patient monitoring. The efficiency, accuracy, and scalability offered by AI make it an indispensable tool, fueling widespread adoption in life sciences.

AI In Life Sciences Market Segment Analysis:

AI In Life Sciences Market is segmented based on Component, Deployment, Application, End-User, and Region

By Component, Software segment is expected to dominate the market with around 40% share during the forecast period.

- The AI in life sciences market is primarily driven by the software segment, which accounted for 40% of the market. Software leads because it delivers the essential algorithms, analytics engines, and AI platforms required to process large volumes of genomic, clinical, and imaging data. Its scalability, lower infrastructure requirements, and availability through cloud-based, subscription-friendly models make adoption easier for pharmaceutical and biotech companies.

- Organizations increasingly relied on AI tools for drug discovery, biomarker identification, and clinical trial optimization. Meanwhile, the services segment is projected to grow by the rising need for integration expertise, workflow customization, and technical support as life science firms adopt more complex AI systems.

By Deployment, Cloud is expected to dominate with close to 56.78% market share during the forecast period.

- Cloud deployment leads the AI in life sciences market, holding 56.78% of the market share in 2024, due to its scalability, flexibility, and cost-effectiveness. Organizations increasingly prefer cloud platforms because they allow access to large volumes of data from anywhere, facilitate collaboration across multiple locations, and reduce the need for expensive on-site infrastructure and maintenance. Cloud solutions also provide pre-built AI algorithms, automated workflows, and development frameworks, simplifying model training, deployment, and management. Strong security measures and regulatory compliance features address concerns around sensitive healthcare and genomic data.

- While on-premise solutions remain important for highly regulated or latency-critical applications, the convenience, adaptability, and innovation-enabling capabilities of cloud platforms make them the preferred choice for drug discovery, genomics, precision medicine, and other life science applications.

AI In Life Sciences Market Regional Insights:

North America region is estimated to lead the market with around 27.60% share during the forecast period.

- North America continues to dominate the AI in life sciences market, with the U.S. accounting for about 27.60% of the global share. This leadership is supported by strong demand for advanced AI solutions, a mature digital environment, and the concentration of major pharmaceutical and biotechnology companies. The region consistently invests in drug discovery, clinical trials, and AI-driven research, which strengthens its position.

- National institutions play a major role as well NIH programs push AI-enabled biomedical research, and the FDA has already cleared more than 1,200 AI-based medical devices, encouraging wider adoption. North America’s well-established healthcare systems, strong innovation ecosystem, and early embrace of new technologies further reinforce its dominance. In contrast, the Asia Pacific region is emerging as the fastest-growing market due to rising AI investments and increasing focus on improving operational efficiency.

AI In Life Sciences Market Active Players:

- AIcure LLC (USA)

- APIXIO, Inc. (USA)

- Atomwise, Inc. (USA)

- Axtria, Inc. (USA)

- Databricks (USA)

- IBM Corporation (USA)

- Indegene (India)

- Insilico Medicine, Inc. (USA)

- IQVIA (USA)

- Lexalytics (USA)

- NuMedii, Inc. (USA)

- Nuance Communications, Inc. (USA)

- Sensely, Inc. (USA)

- Sorcero (USA)

- Zebra Medical Vision (Israel)

- Other Active Players

Key Industry Developments in the AI In Life Sciences Market:

- In March 2025, Insilico Medicine launched PandaOmics Box, an on-premise AI target-discovery solution tailored for data-sensitive pharmaceutical organizations, alongside its autonomous patient portal, reimbursement platform, and advanced agentic EHR system.

- In June 2025, IQVIA unveiled its new AI agents at the GTC Paris conferencedeveloped in partnership with NVIDIA to streamline workflows and accelerate decision-making across the life sciences sector.

Advanced Computational Frameworks Strengthening the Technical Core of AI in Life Sciences

- The technical backbone of AI in life sciences relies on powerful computational models that can handle the huge volumes of biological, genomic, and clinical data generated today. Machine learning and deep learning systems especially transformer models and modern neural networks help scientists make accurate predictions, find new biomarkers, and identify promising drug targets much faster than before. Natural language processing tools are now widely used to read and interpret research papers, clinical notes, and regulatory documents, cutting down hours of manual review. Cloud-based AI platforms support large-scale model training, federated learning, and secure data sharing without compromising privacy.

- High-performance computing, GPU acceleration, and emerging quantum-inspired techniques further boost the ability to analyze complex multi-omics datasets. To keep everything reliable, MLOps pipelines continuously track, test, and validate models to meet regulatory standards. All these technologies together create a strong, flexible ecosystem that drives progress in drug discovery, clinical trials, diagnostics, and personalized medicine.

|

AI In Life Sciences Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.63 Bn. |

|

Forecast Period 2025-32 CAGR: |

25.20% |

Market Size in 2035: |

USD 31.16 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment

|

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: AI In Life Sciences Market by Component (2018-2035)

4.1 AI In Life Sciences Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Software

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hardware

4.5 Services

Chapter 5: AI In Life Sciences Market by Deployment (2018-2035)

5.1 AI In Life Sciences Market Snapshot and Growth Engine

5.2 Market Overview

5.3 On-Premise

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cloud

Chapter 6: AI In Life Sciences Market by Application (2018-2035)

6.1 AI In Life Sciences Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Medical Diagnosis

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Drug Discovery

6.5 Precision and Personalized Medicine

6.6 Biotechnology

6.7 Clinical Trials

6.8 Others

Chapter 7: AI In Life Sciences Market by End-User (2018-2035)

7.1 AI In Life Sciences Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Pharmaceutical and Biotechnology Companies

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Academic and Research Institutes

7.5 Others

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 AI In Life Sciences Market Share by Manufacturer/Service Provider(2024)

8.1.3 Industry BCG Matrix

8.1.4 PArtnerships, Mergers & Acquisitions

8.2 AICURE LLC (USA)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Recent News & Developments

8.2.10 SWOT Analysis

8.3 APIXIO

8.4 INC. (USA)

8.5 ATOMWISE

8.6 INC. (USA)

8.7 AXTRIA

8.8 INC. (USA)

8.9 DATABRICKS (USA)

8.10 IBM CORPORATION (USA)

8.11 INDEGENE (INDIA)

8.12 INSILICO MEDICINE

8.13 INC. (USA)

8.14 IQVIA (USA)

8.15 LEXALYTICS (USA)

8.16 NUMEDII

8.17 INC. (USA)

8.18 NUANCE COMMUNICATIONS

8.19 INC. (USA)

8.20 SENSELY

8.21 INC. (USA)

8.22 SORCERO (USA)

8.23 ZEBRA MEDICAL VISION (ISRAEL) AND OTHER ACTIVE PLAYERS

Chapter 9: Global AI In Life Sciences Market By Region

9.1 Overview

9.2. North America AI In Life Sciences Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecast Market Size by Country

9.2.4.1 US

9.2.4.2 Canada

9.2.4.3 Mexico

9.3. Eastern Europe AI In Life Sciences Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecast Market Size by Country

9.3.4.1 Russia

9.3.4.2 Bulgaria

9.3.4.3 The Czech Republic

9.3.4.4 Hungary

9.3.4.5 Poland

9.3.4.6 Romania

9.3.4.7 Rest of Eastern Europe

9.4. Western Europe AI In Life Sciences Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecast Market Size by Country

9.4.4.1 Germany

9.4.4.2 UK

9.4.4.3 France

9.4.4.4 The Netherlands

9.4.4.5 Italy

9.4.4.6 Spain

9.4.4.7 Rest of Western Europe

9.5. Asia Pacific AI In Life Sciences Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecast Market Size by Country

9.5.4.1 China

9.5.4.2 India

9.5.4.3 Japan

9.5.4.4 South Korea

9.5.4.5 Malaysia

9.5.4.6 Thailand

9.5.4.7 Vietnam

9.5.4.8 The Philippines

9.5.4.9 Australia

9.5.4.10 New Zealand

9.5.4.11 Rest of APAC

9.6. Middle East & Africa AI In Life Sciences Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecast Market Size by Country

9.6.4.1 Turkiye

9.6.4.2 Bahrain

9.6.4.3 Kuwait

9.6.4.4 Saudi Arabia

9.6.4.5 Qatar

9.6.4.6 UAE

9.6.4.7 Israel

9.6.4.8 South Africa

9.7. South America AI In Life Sciences Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecast Market Size by Country

9.7.4.1 Brazil

9.7.4.2 Argentina

9.7.4.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

Chapter 11 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 12 Case Study

Chapter 13 Appendix

11.1 Sources

11.2 List of Tables and figures

11.3 Short Forms and Citations

11.4 Assumption and Conversion

11.5 Disclaimer

|

AI In Life Sciences Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.63 Bn. |

|

Forecast Period 2025-32 CAGR: |

25.20% |

Market Size in 2035: |

USD 31.16 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Deployment

|

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||