Aerospace Tester Market Synopsis

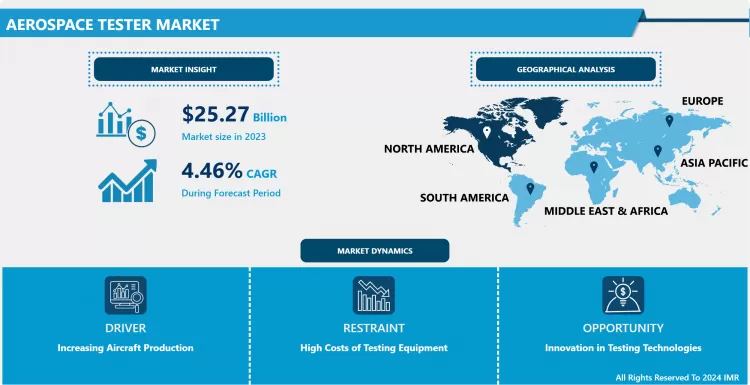

Aerospace Tester Market Size Was Valued at USD 25.27 Billion in 2023, and is Projected to Reach USD 37.42 Billion by 2032, Growing at a CAGR of 4.46% From 2024-2032.

The aerospace tester market encompasses the industry that designs, manufactures, and supplies testing equipment and services used in the aerospace sector. This market includes tools and technologies employed to assess the performance, safety, and reliability of aerospace components and systems, such as aircraft, spacecraft, and related equipment. Testing in this sector covers a range of parameters, including structural integrity, avionics functionality, and environmental resilience. The goal is to ensure that aerospace products meet stringent regulatory standards and operational requirements, thereby supporting the advancement of aerospace technology and the safety of air and space travel.

- The aerospace tester market is poised for significant growth, driven by the increasing demand for advanced testing solutions in the aerospace industry. Aerospace testers, essential for ensuring the reliability and safety of aircraft components and systems, are crucial due to the high standards and stringent regulations imposed on aerospace manufacturing and maintenance. This market's expansion is fueled by the rising investments in research and development, advancements in testing technologies, and the growing need for enhancing the performance and safety of aerospace systems.

- The market is characterized by a diverse range of testing solutions, including structural, non-destructive, and electronic testing. Structural testing assesses the physical integrity of aircraft components, non-destructive testing ensures that materials and structures are free from defects without causing damage, and electronic testing focuses on the functionality of avionics and other electronic systems. Innovations in testing technologies, such as automated and digital solutions, are enhancing the efficiency and accuracy of these tests, driving market growth.

- Geographically, North America holds a significant share of the aerospace tester market due to the presence of major aerospace manufacturers and suppliers, as well as stringent regulatory standards. However, the Asia-Pacific region is expected to experience the fastest growth, driven by increasing aerospace production and modernization efforts in countries like China and India. Additionally, advancements in aerospace technology and the expansion of commercial aviation in emerging markets are contributing to the market's growth.

- Overall, the aerospace tester market is set to expand as the aerospace industry continues to evolve, with a focus on enhancing safety, performance, and efficiency. Companies investing in advanced testing technologies and solutions are well-positioned to capitalize on the growing demand for reliable and accurate aerospace testing.

Aerospace Tester Market Trend Analysis

Automation and Digitalization Transforming the Industry

- The integration of automation and digitalization in aerospace testing represents a major shift in how testing procedures are conducted. Advanced aerospace testers are increasingly equipped with automated systems that streamline the entire testing process, from setup to data collection and analysis. These automated systems reduce the need for manual intervention, which not only accelerates the testing cycle but also minimizes the potential for human error. Automated testers can perform complex tasks with high precision, ensuring consistent and accurate results across multiple test iterations. This automation not only improves the efficiency of testing processes but also enhances the reliability of the data generated, which is critical for meeting stringent aerospace standards and regulations.

- Digital interfaces further augment the capabilities of automated aerospace testers by providing real-time data visualization and analysis. These digital platforms enable engineers and technicians to monitor test performance, track metrics, and analyze results instantly, facilitating quicker decision-making and problem-solving. The ability to access and interpret data in real time also supports more informed adjustments and calibrations during testing, leading to more accurate and actionable insights. As a result, the integration of automation and digitalization not only enhances the precision and speed of aerospace testing but also contributes to overall operational efficiency, helping aerospace manufacturers maintain competitive advantages in a rapidly evolving industry.

The Shift Towards Lightweight and Compact Testing Equipment in Aerospace

- As aerospace manufacturers increasingly prioritize reducing the weight of aircraft and spacecraft to enhance fuel efficiency and performance, there is a notable shift towards lightweight and compact testing equipment. The demand for such equipment arises from the need to align testing tools with the same design principles applied to aerospace components. Lightweight testers not only adhere to the broader industry trend of weight reduction but also offer practical benefits, such as easier transport and setup. These compact systems are designed to fit seamlessly into various testing environments, including confined spaces within manufacturing facilities or maintenance areas, without compromising their effectiveness.

- The adoption of lightweight and compact testing equipment also enhances overall operational efficiency. By minimizing the size and weight of the equipment, aerospace companies can streamline their testing processes, reduce logistical challenges, and improve workflow integration. Compact testers are often easier to maneuver and install, which accelerates the setup process and reduces downtime. Additionally, these advanced testing systems are engineered to deliver high performance despite their smaller size, ensuring that they meet the rigorous standards required for aerospace testing while contributing to a more efficient and effective testing regimen.

Aerospace Tester Market Segment Analysis:

Aerospace Tester Market Segmented based on By Type and By Applications

By Type, Tensile Tester segment is expected to dominate the market during the forecast period

- In the aircraft material testing market, the Tensile Tester segment stands out as the most dominant due to its critical role in ensuring the safety and durability of aircraft components. Tensile testers are designed to evaluate the mechanical properties of materials, particularly their strength and elasticity, by applying controlled tension until the material fails. This testing is essential for identifying the limits of different materials, such as metals, composites, and alloys, which are commonly used in aircraft construction. Given the extreme conditions that aircraft materials must withstand, including high pressures, varying temperatures, and mechanical stress, tensile testing is integral to the design and manufacturing process. The ability to accurately assess how materials will behave under stress ensures that only those with the required performance characteristics are used, thereby significantly reducing the risk of material failure in flight.

- The demand for tensile testers is further amplified by the stringent regulations imposed by aviation authorities, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). These bodies mandate rigorous testing standards to ensure that all materials used in aircraft construction meet specific safety criteria. Compliance with these regulations is non-negotiable, driving aircraft manufacturers and suppliers to invest heavily in advanced tensile testing equipment. Furthermore, as the aerospace industry continues to innovate with new materials, such as advanced composites and lightweight alloys, the need for precise and reliable tensile testing becomes even more critical. This constant evolution in material science and engineering keeps the tensile tester segment at the forefront of the aircraft material testing market, maintaining its dominant share and importance in ensuring the safety and longevity of modern aircraft.

By Applications, Passenger Aircraft segment held the largest share in 2023

- In the aircraft material testing market, the Tensile Tester segment stands out as the most dominant due to its critical role in ensuring the safety and durability of aircraft components. Tensile testers are designed to evaluate the mechanical properties of materials, particularly their strength and elasticity, by applying controlled tension until the material fails. This testing is essential for identifying the limits of different materials, such as metals, composites, and alloys, which are commonly used in aircraft construction. Given the extreme conditions that aircraft materials must withstand, including high pressures, varying temperatures, and mechanical stress, tensile testing is integral to the design and manufacturing process. The ability to accurately assess how materials will behave under stress ensures that only those with the required performance characteristics are used, thereby significantly reducing the risk of material failure in flight.

- The demand for tensile testers is further amplified by the stringent regulations imposed by aviation authorities, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). These bodies mandate rigorous testing standards to ensure that all materials used in aircraft construction meet specific safety criteria. Compliance with these regulations is non-negotiable, driving aircraft manufacturers and suppliers to invest heavily in advanced tensile testing equipment. Furthermore, as the aerospace industry continues to innovate with new materials, such as advanced composites and lightweight alloys, the need for precise and reliable tensile testing becomes even more critical. This constant evolution in material science and engineering keeps the tensile tester segment at the forefront of the aircraft material testing market, maintaining its dominant share and importance in ensuring the safety and longevity of modern aircraft.

Aerospace Tester Market Regional Insights:

North America's is Expected to Dominate the Market Over the Forecast period

- North America's dominance in the aerospace tester market is largely attributed to the region's well-established aerospace sector, which encompasses both defense and commercial aviation. The U.S., in particular, plays a pivotal role, with its extensive network of aerospace manufacturers, including industry giants such as Boeing, Lockheed Martin, and Northrop Grumman. These companies drive the demand for cutting-edge testing solutions to ensure the reliability and safety of their aircraft and systems. Moreover, North America's robust technological infrastructure supports continuous innovation in aerospace testing equipment, enabling the development of more advanced, precise, and efficient testing methodologies. This ongoing technological advancement is crucial as aerospace systems become increasingly complex, requiring sophisticated testing to meet stringent industry standards

- Additionally, the region benefits from significant government investments aimed at modernizing and expanding aerospace capabilities. U.S. government initiatives, such as those led by NASA and the Department of Defense, focus on advancing aerospace technology and maintaining the country’s competitive edge in the global aerospace market. These initiatives often involve large-scale projects that require extensive testing and validation, further driving the demand for aerospace testers. Furthermore, collaborations between government agencies and private sector companies foster innovation in testing solutions, ensuring that North America remains at the forefront of aerospace testing technology. As a result, the aerospace tester market in this region continues to grow, supported by a combination of industry leadership, technological prowess, and strong government backing.

Active Key Players in the Aerospace Tester Market

- Element Materials Technology

- NTS

- MOOG

- Qualitest International

- ADMET

- Groupe Gorge

- Avtron Aerospace

- Teradyne

- Astronics

- Other Active Players

|

Global Aerospace Tester Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25.57 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.46 % |

Market Size in 2032: |

USD 37.42 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Aerospace Tester Market by Type (2018-2032)

4.1 Aerospace Tester Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Tensile Tester

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Fogging Tester

4.5 Surface Roughness Tester

4.6 Others

Chapter 5: Aerospace Tester Market by Applications (2018-2032)

5.1 Aerospace Tester Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Passenger Aircraft

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Goods Aircraft

5.5 Naval Aircraft

5.6 Others

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Aerospace Tester Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ELEMENT MATERIALS TECHNOLOGY

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 NTS

6.4 MOOG

6.5 QUALITEST INTERNATIONAL

6.6 ADMET

6.7 GROUPE GORGE

6.8 AVTRON AEROSPACE

6.9 TERADYNE

6.10 ASTRONICS

6.11

Chapter 7: Global Aerospace Tester Market By Region

7.1 Overview

7.2. North America Aerospace Tester Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Tensile Tester

7.2.4.2 Fogging Tester

7.2.4.3 Surface Roughness Tester

7.2.4.4 Others

7.2.5 Historic and Forecasted Market Size by Applications

7.2.5.1 Passenger Aircraft

7.2.5.2 Goods Aircraft

7.2.5.3 Naval Aircraft

7.2.5.4 Others

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Aerospace Tester Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Tensile Tester

7.3.4.2 Fogging Tester

7.3.4.3 Surface Roughness Tester

7.3.4.4 Others

7.3.5 Historic and Forecasted Market Size by Applications

7.3.5.1 Passenger Aircraft

7.3.5.2 Goods Aircraft

7.3.5.3 Naval Aircraft

7.3.5.4 Others

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Aerospace Tester Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Tensile Tester

7.4.4.2 Fogging Tester

7.4.4.3 Surface Roughness Tester

7.4.4.4 Others

7.4.5 Historic and Forecasted Market Size by Applications

7.4.5.1 Passenger Aircraft

7.4.5.2 Goods Aircraft

7.4.5.3 Naval Aircraft

7.4.5.4 Others

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Aerospace Tester Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Tensile Tester

7.5.4.2 Fogging Tester

7.5.4.3 Surface Roughness Tester

7.5.4.4 Others

7.5.5 Historic and Forecasted Market Size by Applications

7.5.5.1 Passenger Aircraft

7.5.5.2 Goods Aircraft

7.5.5.3 Naval Aircraft

7.5.5.4 Others

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Aerospace Tester Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Tensile Tester

7.6.4.2 Fogging Tester

7.6.4.3 Surface Roughness Tester

7.6.4.4 Others

7.6.5 Historic and Forecasted Market Size by Applications

7.6.5.1 Passenger Aircraft

7.6.5.2 Goods Aircraft

7.6.5.3 Naval Aircraft

7.6.5.4 Others

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Aerospace Tester Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Tensile Tester

7.7.4.2 Fogging Tester

7.7.4.3 Surface Roughness Tester

7.7.4.4 Others

7.7.5 Historic and Forecasted Market Size by Applications

7.7.5.1 Passenger Aircraft

7.7.5.2 Goods Aircraft

7.7.5.3 Naval Aircraft

7.7.5.4 Others

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Aerospace Tester Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 25.57 Bn. |

|

Forecast Period 2024-32 CAGR: |

4.46 % |

Market Size in 2032: |

USD 37.42 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Aerospace Tester Market research report is 2024-2032.

Element Materials Technology, NTS, MOOG, Qualitest International, ADMET, Groupe Gorge, Avtron Aerospace, Teradyne, Astronics and Other Major Players.

The Aerospace Tester Market is segmented into By Type, By Applications and region. By Type, the market is categorized into Tensile Tester, Fogging Tester, Surface Roughness Tester and Others. By Applications, the market is categorized into Passenger Aircraft, Goods Aircraft, Naval Aircraft and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The aerospace tester market encompasses the industry that designs, manufactures, and supplies testing equipment and services used in the aerospace sector. This market includes tools and technologies employed to assess the performance, safety, and reliability of aerospace components and systems, such as aircraft, spacecraft, and related equipment. Testing in this sector covers a range of parameters, including structural integrity, avionics functionality, and environmental resilience. The goal is to ensure that aerospace products meet stringent regulatory standards and operational requirements, thereby supporting the advancement of aerospace technology and the safety of air and space travel.

Aerospace Tester Market Size Was Valued at USD 25.27 Billion in 2023, and is Projected to Reach USD 37.42 Billion by 2032, Growing at a CAGR of 4.46% From 2024-2032.