Advanced Motion Controller Market Synopsis

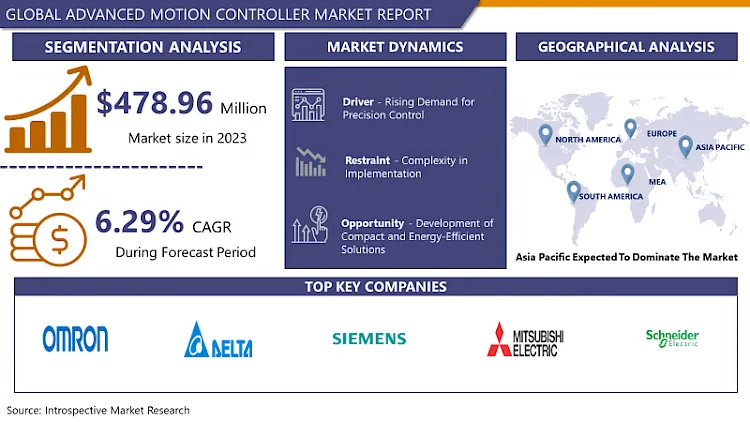

Advanced Motion Controller Market Size Was Valued at USD 509.09 Million in 2024, and is Projected to Reach USD 829.34 Million by 2032, Growing at a CAGR of 6.29 % From 2025-2032.

The advanced motion controller market is the one where sophisticated devices are created and used to control precisely the movement of machinery and equipment in various industries. These remote controls exceed the simple motion control systems by incorporating advanced algorithms, sensors, and processing capabilities to handle complex motions with high accuracy and flexibility. They are employed in different fields such as manufacturing, robotics, aerospace, automotive, and healthcare which makes possible tasks like robotic arm movements CNC machining automated assembly, and high-speed positioning. The advanced motion controllers can control the movement along different axes, synchronize the movements between various components, and possess real-time responsiveness and compatibility with different motor types. As Industry 4. 0 and automation trends are still on the rise, the market for advanced motion controllers is also changing with innovations in sensor technology and connectivity. This leads to efficiency improvement and expanding their applications into a wide range of industrial processes.

The advanced motion controller market is growing rapidly because many industries are becoming more automated. Motion controllers are the key components in increasing the accuracy, speed, and efficiency of automated systems which is why they are so much in demand. The main areas such as manufacturing, automotive, aerospace, and robotics are now using advanced motion control technologies to improve production processes and get more precise.

Nowadays, the technological progress is mainly in sensors and connection which transform the motion controllers. The IoT (Internet of Things) functions and the coming Industry 4. 0 are in addition promoting the growth of this market. These advancements make the system to be able for real-time monitoring, remote control, and predictive maintenance that in turn increases overall efficiency of operation and cuts downtime.

The Asia-Pacific region is becoming a major market for advanced motion controllers as a result of the fast industrialization and infrastructure development. The countries such as China, Japan and South Korea are the main promoters of automation technologies. These create great opportunities for motion control solution providers to grow significantly. Besides, North America and Europe are still the main markets because of their industry foundations and their emphasis on technological innovations.

The major trends for instance the more use of servo and stepper systems, demand for integrated motion control solutions, and the change from monolithic to modular architectures are affecting the competitive environment. The market players are now concentrating on the compact, energy-efficient and cost-effective solutions to satisfy different application needs and get a competitive advantage.

Nevertheless, the issues like high initial costs of advanced motion controllers and the difficulty in combining these systems with existing infrastructure may be obstacles for market development. However, the present research and development activities that are aimed at solving these problems and also improving product performance will be the fuel for market growth in future.

Advanced Motion Controller Market Trend Analysis

Advancements in IoT-Enabled Motion Control Systems

- The rising use of IoT (Internet of Things) and Industry 4. The zero waste in manufacturing processes is a new trend that is changing the way industrial operations are done. Through the combination of IoT technologies and motion control systems, manufacturers can attain very high levels of connectivity and automation. IoT allows the construction of the linked networks where machines, sensors and devices can talk to each other and exchange data in real time. This connectivity results in the increased monitoring and control of motion control systems, which leads to the improved operational efficiency and productivity.

- One of the main advantages of combining IoT with motion control systems is that you can collect and process huge amounts of data from sensors that are in machines. This data can be used to enhance the performance, forecast the maintenance requirements, and find out any possible problems before they get worse. For instance, the motion controllers which are designed with IoT features can give us a clue about how to use them and why they consume energy. This way manufacturers will be able to make decisions that would result in efficiency improvement and downtime reduction. In the end, IoT in manufacturing processes not only improves the functions of motion control systems but also makes it possible to have more intelligent and adaptive industrial environments.

- Furthermore, Industry 4. 0 practices are the main focus on connecting of digital technologies through all levels of manufacturing, including motion control. This integration makes it possible to implement the most advanced automation, predictive analytics, and real-time decision-making which are all necessary for making a company competitive and agile in today's manufacturing world. The more industries Industry 4. 0 the basic principles, it is obvious that the demand for modern motion controllers that can easily be integrated with IoT-enabled systems will keep on growing. The companies that make use of these technologies well will be in a better condition to streamline their operations, cut costs, and produce higher quality products which are needed by the customers now.

Innovations Driving Miniaturization in Motion Control Systems

- The increased demand for miniaturization and compactness in motion control solutions is a result of the change in the needs of modern industries such as robotics, medical devices, and aerospace. These sectors are now more than ever dependent on advanced motion control technologies to achieve precision and efficiency in confined spaces or weight-limited applications. With the increasing number of robotics in different industries, from manufacturing to healthcare, there is a need for small but strong motion controllers. In the same vein, in aviation and defense where weight and space are of utmost importance compact motion control systems aid in developing less heavy but at the same time more agile aircraft and spacecraft.

- Companies are reacting to this trend by producing motion control systems that have both good performance and small size. The advanced design and engineering techniques, plus the advances in materials and electronics allow for the creation of highly integrated motion controllers that are very functional but take only a little space. These systems are based on the use of technologies like miniaturized sensors, high-efficiency motors, and advanced control algorithms to reach precise motion control in constrained environments.

- Besides, miniaturized motion control solutions are being mainly developed due to the fast progress of medical devices. Starting from surgical robots to wearable medical equipment, the medical industry needs motion control systems that are not only small but also reliable and precise. Miniaturized motion controllers are the key to making minimally invasive procedures and improving patient outcomes a reality. The tendency of portable and implantable medical devices is on the increase, thus manufacturers will keep investing in research and development to satisfy the demand for compact and high-performance motion control solutions that are intended especially for the needs of the medical field. This insistence on small size reflects the significance of technological advancement in promoting development in various fields that depend on motion control systems.

Advanced Motion Controller Market Segment Analysis:

Advanced Motion Controller Market is segmented Based on Controller Type,Technology, Application and Region

By Controller Type, Servo controllers segment is expected to dominate the market during the forecast period

- Servo controllers are the foundation of today's motion control technology, and they have a major share in all industries because of their precision and versatility which is unmatched. The main advantage of servo controllers is their capacity to achieve very accurate positioning, which makes them an essential tool in tasks where precise motion control is the most important thing. In manufacturing, the servo controllers drive robotic assembly lines with great precision and thus position and manipulate components so that they are in exact positions. The accuracy of the servo-controlled systems is so high that it extends to healthcare applications, where they are used for fine and precise surgical procedures with sub-millimeter precision which in turn reduces risks and improves patient outcomes. Besides, in the consumer electronics industry, servo controllers help to make smooth and controlled movements of devices like cameras and 3D printers which leads to better performance and user experience.

- The other thing that servo controllers have to be proud of is their ability for advanced speed and torque control. In the industrial automation areas, servo controllers are good at controlling the speed and acceleration of machines which means that they optimize production efficiency while still keeping safety standards. This flexibility is also applicable to packaging machinery where the servo-controlled systems exactly control the flow and movement of materials during packing processes, thus reducing waste and increasing productivity. Besides, the real-time feedback system of servo controllers enables to modification the operation according to the changes in operating conditions, thus obtaining a high performance in complex automation environments. As industries keep on exploring new ways to automate and robotize, servo controllers are still at the top with their outstanding accuracy and flexibility in motion control tasks in manufacturing, healthcare, and consumer electronics fields. Their supremacy is proof of [their] being the main technology that drives the automation in the next generation systems.

By Application, Packaging Machinery segment held the largest share in 2024

- Packaging machinery is a vital part of the automation industry with a big share which mainly comes from its popularity in some important sectors like food and beverage, pharmaceuticals and consumer goods. In these industries, the automated packaging systems are of vital importance as they help to improve the operational efficiency and meet the rising demand for standardized and reliable packaging.

- In the food and beverage industry, automated packaging machinery is widely used for filling up of products, sealing them, labeling them and palletizing too. This automation not only boosts the production throughput but also secures that packaging is of high quality and free from contamination, hence it meets the stringent regulatory requirements.

- On the other hand, in the pharmaceutical industry, automated packaging systems are of great importance for safe and accurate packaging of medicine, medical devices and healthcare products. These systems are made to work with the sensitive materials and guarantee that the correct dose, label, and tracking of pharmaceutical products will be done. Automating the pharmaceutical packaging process not only makes products safer and more authentic but also improves traceability and compliance with regulatory standards.

- In the consumer goods industry, automated packaging solutions are used to pack a lot of things such as cosmetics, toiletries, household items and electronics. The fusion of robotics and smart technologies in the packaging machinery allows for faster changeovers between different product lines, customization of packaging designs and reduction in material wastage which leads to cost savings and sustainability.

- The packaging machinery segment is also influenced by the technological advancements, in particular, the integration of robotics and artificial intelligence (AI). Robotics in packaging systems provide advantages like the enhancement of flexibility, precision and scalability which allow manufacturers to adjust fast to the market changes and product varieties. The technologies, which are powered by AI, provide the predictive maintenance, real-time monitoring and process optimization for packaging that leads to higher operational efficiency and lower downtime.

- In general, the major part of automation in packaging machinery is due to its main function which is to improve productivity, quality and flexibility in such industries as food and beverage, pharmaceuticals and consumer goods. The industries that are the reason of these changes will continue to concentrate on efficiency and innovation in packaging operations, thus automation is a crucial factor for sustainable growth and competitiveness in the global market.

Advanced Motion Controller Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region, which includes the countries of China, Japan and South Korea is the leader in this market for advanced motion controllers because it has a fast growth in manufacturing activities and automation. China is the leading manufacturing center of the world and it takes a prominent place in this expansion by consuming great amounts of high-tech motion control devices. The country has been concentrating on the industrialization modernization and efficiency improvement which resulted in a lot of investments into robotics and automation in different industries such as electronics, automotive etc. This sudden increase in automation is mainly driven by the need to make production processes as efficient as possible, to improve product quality and to satisfy the growing demand for consumer goods both at home and abroad.

- Japan, the country that is famous for its technological achievements, still plays a big role in the development of advanced motion controller market in Asia Pacific. Japanese industries, mostly in the electronics, semiconductors and automotive sectors are applying advanced motion control systems to get precision speed and reliability during their production processes. This adoption is the result of Japan's determination to be innovative and efficient, using automation technologies in order to remain competitive on the global market. The same is the case with South Korea which is also experiencing a remarkable increase in the utilization of advanced motion controllers, thanks to its strong electronics industry and fast expansion of e-commerce platforms. The urge for the efficient material handling and logistics automation in South Korea's busy trade environment is also one of the drivers that leads to the demand for sophisticated motion control solutions.

- To sum up, the Asia Pacific region's market for advanced motion controllers is mainly driven by a combination of such things as industrial growth, automation investments and e-commerce development. As these countries keep on giving more importance to the technological advancement and operational excellence, the need for advanced motion controllers is predicted to increase even further thus leading innovation and changing manufacturing and logistics capabilities in that region.

Active Key Players in the Advanced Motion Controller Market

- Rockwell Automation

- Siemens AG

- ABB

- Schneider Electric

- Mitsubishi Electric Corporation

- Bosch Rexroth AG

- Yaskawa Electric Corporation

- Delta Electronics, Inc.

- Omron Corporation

- Beckhoff Automation GmbH & Co. KG

- Other Active Players

|

Global Advanced Motion Controller Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 509.09 Mn. |

|

Forecast Period 2025-32 CAGR: |

6.29 % |

Market Size in 2032: |

USD 829.34 Mn. |

|

Segments Covered: |

By Controller Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Rockwell Automation, Siemens AG, ABB, Schneider Electric, Mitsubishi Electric Corporation, Bosch Rexroth AG, Yaskawa Electric Corporation, Delta Electronics, Inc., Omron Corporation, Beckhoff Automation GmbH & Co. KG and Other Active Players. |

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Advanced Motion Controller Market by Controller Type (2018-2032)

4.1 Advanced Motion Controller Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Servo Controllers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Stepper Controllers

4.5 Multi-axis Controllers

Chapter 5: Advanced Motion Controller Market by Technology (2018-2032)

5.1 Advanced Motion Controller Market Snapshot and Growth Engine

5.2 Market Overview

5.3 PID Controllers

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Adaptive Controllers

5.5 Fuzzy Logic Controllers

Chapter 6: Advanced Motion Controller Market by Application (2018-2032)

6.1 Advanced Motion Controller Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Industrial Automation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Medical Devices

6.5 Semiconductor Equipment

6.6 Packaging Machinery

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Advanced Motion Controller Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ABSOLUTE FENCING GEAR (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 ALLSTAR FENCING US (USA)

7.4 BLADE FENCING EQUIPMENT (USA)

7.5 BLUE GAUNTLET FENCING (USA)

7.6 BG FENCING (USA)

7.7 ALLIANCE FENCING EQUIPMENT (USA)

7.8 AMERICAN FENCERS SUPPLY (USA)

7.9 FENCING ARMOR (USA)

7.10 TRIPLETTE COMPETITION ARMS (USA)

7.11 VICTORY FENCING GEAR (USA)

7.12 PEGASUS FENCING (USA)

7.13 GOPHER FENCING EQUIPMENT (USA)

7.14 RADICAL FENCING (USA)

7.15 LEON PAUL (UNITED KINGDOM)

7.16 PBT FENCING (HUNGARY)

7.17 UHLMANN (GERMANY)

7.18 NEGRINI FENCING LINE (ITALY)

7.19 FWF FENCING EQUIPMENT (AUSTRIA)

7.20 STM FENCING EQUIPMENT (FRANCE)

7.21 PRIEUR SPORTS (FRANCE)

7.22 FAVERO ELECTRONICS (ITALY)

7.23 GAJARDONI FENCING EQUIPMENT (ITALY)

7.24 NIHON FENCING GEAR (JAPAN)

Chapter 8: Global Advanced Motion Controller Market By Region

8.1 Overview

8.2. North America Advanced Motion Controller Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Controller Type

8.2.4.1 Servo Controllers

8.2.4.2 Stepper Controllers

8.2.4.3 Multi-axis Controllers

8.2.5 Historic and Forecasted Market Size by Technology

8.2.5.1 PID Controllers

8.2.5.2 Adaptive Controllers

8.2.5.3 Fuzzy Logic Controllers

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Industrial Automation

8.2.6.2 Medical Devices

8.2.6.3 Semiconductor Equipment

8.2.6.4 Packaging Machinery

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Advanced Motion Controller Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Controller Type

8.3.4.1 Servo Controllers

8.3.4.2 Stepper Controllers

8.3.4.3 Multi-axis Controllers

8.3.5 Historic and Forecasted Market Size by Technology

8.3.5.1 PID Controllers

8.3.5.2 Adaptive Controllers

8.3.5.3 Fuzzy Logic Controllers

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Industrial Automation

8.3.6.2 Medical Devices

8.3.6.3 Semiconductor Equipment

8.3.6.4 Packaging Machinery

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Advanced Motion Controller Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Controller Type

8.4.4.1 Servo Controllers

8.4.4.2 Stepper Controllers

8.4.4.3 Multi-axis Controllers

8.4.5 Historic and Forecasted Market Size by Technology

8.4.5.1 PID Controllers

8.4.5.2 Adaptive Controllers

8.4.5.3 Fuzzy Logic Controllers

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Industrial Automation

8.4.6.2 Medical Devices

8.4.6.3 Semiconductor Equipment

8.4.6.4 Packaging Machinery

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Advanced Motion Controller Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Controller Type

8.5.4.1 Servo Controllers

8.5.4.2 Stepper Controllers

8.5.4.3 Multi-axis Controllers

8.5.5 Historic and Forecasted Market Size by Technology

8.5.5.1 PID Controllers

8.5.5.2 Adaptive Controllers

8.5.5.3 Fuzzy Logic Controllers

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Industrial Automation

8.5.6.2 Medical Devices

8.5.6.3 Semiconductor Equipment

8.5.6.4 Packaging Machinery

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Advanced Motion Controller Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Controller Type

8.6.4.1 Servo Controllers

8.6.4.2 Stepper Controllers

8.6.4.3 Multi-axis Controllers

8.6.5 Historic and Forecasted Market Size by Technology

8.6.5.1 PID Controllers

8.6.5.2 Adaptive Controllers

8.6.5.3 Fuzzy Logic Controllers

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Industrial Automation

8.6.6.2 Medical Devices

8.6.6.3 Semiconductor Equipment

8.6.6.4 Packaging Machinery

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Advanced Motion Controller Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Controller Type

8.7.4.1 Servo Controllers

8.7.4.2 Stepper Controllers

8.7.4.3 Multi-axis Controllers

8.7.5 Historic and Forecasted Market Size by Technology

8.7.5.1 PID Controllers

8.7.5.2 Adaptive Controllers

8.7.5.3 Fuzzy Logic Controllers

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Industrial Automation

8.7.6.2 Medical Devices

8.7.6.3 Semiconductor Equipment

8.7.6.4 Packaging Machinery

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Advanced Motion Controller Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 509.09 Mn. |

|

Forecast Period 2025-32 CAGR: |

6.29 % |

Market Size in 2032: |

USD 829.34 Mn. |

|

Segments Covered: |

By Controller Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

Rockwell Automation, Siemens AG, ABB, Schneider Electric, Mitsubishi Electric Corporation, Bosch Rexroth AG, Yaskawa Electric Corporation, Delta Electronics, Inc., Omron Corporation, Beckhoff Automation GmbH & Co. KG and Other Active Players. |

||