Accelerator Card Market Synopsis

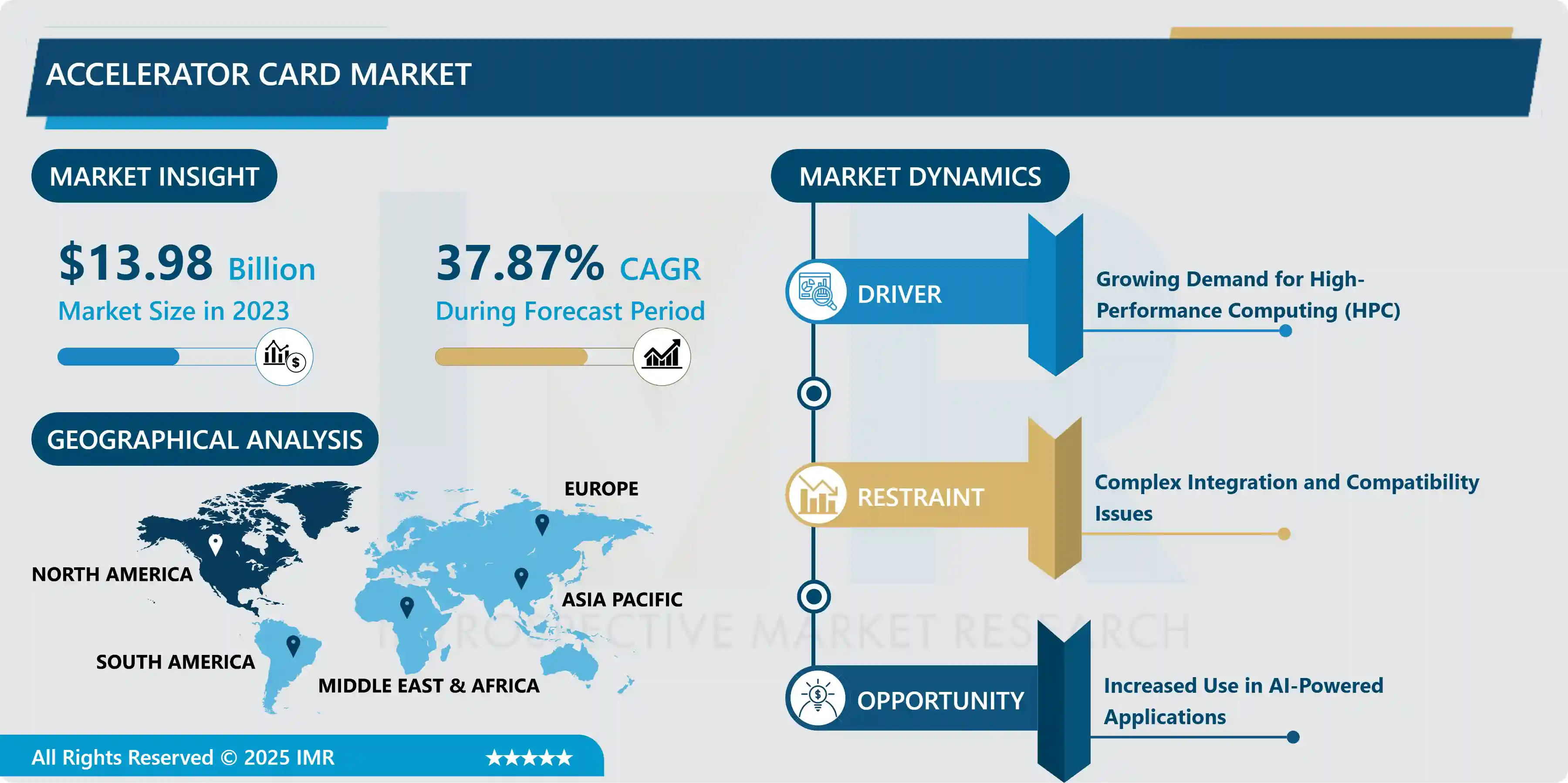

Accelerator Card Market Size Was Valued at USD 13.98 Billion in 2023, and is Projected to Reach USD 251.61 Billion by 2032, Growing at a CAGR of 37.87% From 2024-2032.

Accelerator cards are the PCI, AGP, or PCI-E development cards that make strides the video execution and the realistic calculation in a framework. These are more compelling and proficient as compared to the general-purpose chip and are utilized in high-performance cloud servers and information centres to quicken operations.

The foremost commonly utilized quickening agent cards are GPU and CPU. Quickening agent cards are too utilized in information centres to quicken machine learning applications. The quickening agent cards are outlined in a way that fathoms client issues, makes strides the client involvement and give tall quality quickened execution at an amazing taken a toll and control proficiency. In expansion to the showcase bits of knowledge such as advertise esteem, development rate, showcase portions, topographical scope, showcase players, and advertise situation, the showcase report curated by the Information Bridge Advertise Inquire about group incorporates in-depth master examination, import/export examination, estimating examination, generation utilization examination, and pestle investigation.

Accelerator Card Market Trend Analysis

Growing Demand for High-Performance Computing (HPC)

- The developing request for High-Performance Computing (HPC) is generally driven by the expanding complexity and volume of information in areas like counterfeit insights (AI), machine learning, and huge information analytics. As organizations look for to extricate experiences from tremendous datasets and create progressed AI models, the require for speedier and more proficient information preparing has ended up basic. Quickening agent cards, such as GPUs (Illustrations Handling Units), FPGAs (Field-Programmable Door Clusters), and custom ASICs (Application-Specific Coordinates Circuits), play a urgent part in assembly this request. These cards are planned to handle parallel handling assignments distant more proficiently than conventional CPUs, essentially boosting computing control.

- In HPC situations, where errands require monstrous computational assets, quickening agent cards empower speedier information preparing, more productive asset utilization, and decreased time-to-solution. This makes them crucial in businesses extending from logical investigate to budgetary modeling, where quick and precise computation is fundamental for development and competitive advantage. As a result, the HPC showcase is seeing a surge within the appropriation of quickening agent cards, driving assist progressions in innovation and extending the capabilities of present-day computing foundations.

Increased Use in AI-Powered Applications

- The broad appropriation of AI-powered applications over differing segments such as healthcare, fund, and car is making noteworthy openings for the quickening agent card advertise. In healthcare, AI is being utilized for errands like restorative imaging investigation, medicate revelation, and personalized treatment plans, all of which require quick and exact information preparing. Additionally, in fund, AI-driven calculations are utilized for real-time extortion location, algorithmic exchanging, and chance administration, requiring high-performance computing to prepare expansive volumes of information with negligible inactivity. The car industry is additionally leveraging AI for progressions in independent driving, where real-time handling of sensor information is significant for making split-second choices.

- These AI applications are computationally seriously and request effective preparing capabilities that go past what conventional CPUs can offer. Quickening agent cards, such as GPUs and TPUs (Tensor Handling Units), are particularly outlined to handle the parallel preparing needs of AI workloads, empowering quicker show preparing, induction, and decision-making. As AI proceeds to grow its reach over businesses, the request for quickening agent cards is anticipated to develop, driving advancement and opening unused roads for their application.

Accelerator Card Market Segment Analysis:

Accelerator Card market is segmented on the basis of Processor Type, and Accelerator Type.

By Application, Video and Image Processing Segment Is Expected to Dominate the Market During the Forecast Period

- Among the different applications of accelerator cards such as Video and Image Processing, Machine Learning, Monetary Computing, Information Analytics, and Portable Phones Machine Learning is the prevailing application. This dominance is driven by the expanding appropriation of AI and machine learning innovations over a wide run of businesses. Machine learning models, especially profound learning calculations, require monstrous computational control for preparing and induction, which quickening agent cards like GPUs and TPUs give. These quickening agents are particularly planned to handle the parallel preparing and expansive information sets that are characteristic of machine learning errands.

- As a result, businesses such as healthcare, fund, car, and e-commerce, which depend intensely on AI for applications like prescient analytics, common dialect handling, independent driving, and personalized suggestions, are critical customers of quickening agent cards. The developing significance of AI in driving development, progressing productivity, and picking up competitive advantage has made machine learning the driving application for quickening agent cards, outpacing other applications like video handling or monetary computing in terms of both request and advertise development.

By Accelerator Type, Cloud Accelerators Segment Held the Largest Share In 2023

- Within the domain of quickening agent sorts, Cloud Accelerators are right now more prevailing compared to High-Performance Computing (HPC) Quickening agents. This dominance is driven by the quick extension of cloud computing administrations and the developing request for adaptable, adaptable, and cost-effective computational control. Cloud suppliers, such as Amazon Web Administrations (AWS), Google Cloud, and Microsoft Sky blue, are progressively coordination quickening agent cards, especially GPUs and TPUs, into their offerings to improve the execution of AI, machine learning, and huge information workloads.

- These quickening agents empower cloud stages to convey high-performance computing capabilities to a broader run of clients without the required for critical forthright venture in physical framework. The move towards cloud-based arrangements permits organizations of all sizes to get to effective computational assets on request, making cloud quickening agents the favored choice for businesses looking to scale their operations effectively. Whereas HPC quickening agents stay basic for specialized, high-intensity computational assignments in logical inquire about and progressed reenactments, the flexibility and openness of cloud quickening agents have driven to their broader adoption, driving their dominance within the showcase.

Accelerator Card Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America is currently dominating the accelerator card market. This dominance is primarily driven by the region's leadership in technological innovation and its strong presence of key industry players like NVIDIA, Intel, AMD, and Xilinx. These companies are at the forefront of developing cutting-edge accelerator cards that are crucial for powering data centers, AI processing, and high-performance computing applications.

- The region's robust infrastructure for research and development, along with significant investments in artificial intelligence, cloud computing, and big data analytics, further fuels the demand for accelerator cards. Additionally, North America's large and rapidly growing market for advanced computing technologies, particularly in sectors such as finance, healthcare, and telecommunications, contributes to the high adoption of these cards.

- Moreover, the presence of major technology hubs, such as Silicon Valley, and strong collaboration between academia, industry, and government agencies create an environment conducive to continuous innovation. The region's leadership in setting global standards and trends in computing technology also positions North America as the dominant force in the global accelerator card market.

Accelerator Card Market Active Players

- NVIDIA Corporation (USA)

- Intel Corporation (USA)

- Advanced Micro Devices, Inc. (AMD) (USA)

- Xilinx, Inc. (USA)

- Qualcomm Technologies, Inc. (USA)

- Huawei Technologies Co., Ltd. (China)

- Broadcom Inc. (USA)

- Micron Technology, Inc. (USA)

- Marvell Technology Group Ltd. (USA)

- Achronix Semiconductor Corporation (USA)

- IBM Corporation (USA)

- Silicom Ltd. (Israel)

- NetApp, Inc. (USA)

- Fujitsu Limited (Japan)

- Dell Technologies Inc. (USA)

- Hewlett Packard Enterprise (HPE) (USA)

- Cisco Systems, Inc. (USA)

- Oracle Corporation (USA)

- Inspur Systems, Inc. (China)

- Efinix, Inc. (USA)

- Mellanox Technologies (NVIDIA) (Israel)

- Graphcore Ltd. (UK)

- Kalray S.A. (France)

- Synopsys, Inc. (USA)

- Alphabet Inc. (Google TPU) (USA)

- Other Active Players

Key Industry Developments in the Accelerator Card Market:

- In April 2024, Intel Unveils Ponte Vecchio - Intel officially launched its next-generation high-performance computing (HPC) accelerator card, the Ponte Vecchio. This powerhouse boasts a chiplet architecture with Xe HPC cores and HBM (High Bandwidth Memory) for exceptional performance and memory bandwidth.

- In March 2024, Nvidia Announces HGX A100 80GB Card - Nvidia introduced a new member to its HGX family, the HGX A100 80GB card. This card offers a substantial leap in memory capacity compared to previous models, reaching 80GB of HBM3 memory.

- In February 2024, AMD Introduces Instinct MI300 Series - AMD unveiled its latest generation of Instinct data center accelerators, the MI300 series. This series features the CDNA 3 architecture, promising significant performance improvements over the previous generation.

|

Accelerator Card Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.98 Bn. |

|

Forecast Period 2024-32 CAGR: |

37.87 % |

Market Size in 2032: |

USD 251.61 Bn. |

|

Segments Covered: |

By Processor Type |

|

|

|

By Accelerator Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Accelerator Card Market by Processor Type (2018-2032)

4.1 Accelerator Card Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Central Processing Units

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Graphics Processing Units

4.5 Field Programmable Gate Arrays

4.6 Application-Specific Integrated Circuit

Chapter 5: Accelerator Card Market by Accelerator Type (2018-2032)

5.1 Accelerator Card Market Snapshot and Growth Engine

5.2 Market Overview

5.3 High-Performance Computing Accelerator

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Cloud Accelerator

Chapter 6: Accelerator Card Market by Application (2018-2032)

6.1 Accelerator Card Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Video and Image Processing

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Machine Learning

6.5 Financial Computing

6.6 Data Analytics

6.7 Mobile Phones and Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Accelerator Card Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 NVIDIA CORPORATION (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 INTEL CORPORATION (USA)

7.4 ADVANCED MICRO DEVICES INC. (AMD) (USA)

7.5 XILINX INC. (USA)

7.6 QUALCOMM TECHNOLOGIES INC. (USA)

7.7 HUAWEI TECHNOLOGIES CO. LTD. (CHINA)

7.8 BROADCOM INC. (USA)

7.9 MICRON TECHNOLOGY INC. (USA)

7.10 MARVELL TECHNOLOGY GROUP LTD. (USA)

7.11 ACHRONIX SEMICONDUCTOR CORPORATION (USA)

7.12 IBM CORPORATION (USA)

7.13 SILICOM LTD. (ISRAEL)

7.14 NETAPP INC. (USA)

7.15 FUJITSU LIMITED (JAPAN)

7.16 DELL TECHNOLOGIES INC. (USA)

7.17 HEWLETT PACKARD ENTERPRISE (HPE) (USA)

7.18 CISCO SYSTEMS INC. (USA)

7.19 ORACLE CORPORATION (USA)

7.20 INSPUR SYSTEMS INC. (CHINA)

7.21 EFINIX INC. (USA)

7.22 MELLANOX TECHNOLOGIES (NVIDIA) (ISRAEL)

7.23 GRAPHCORE LTD. (UK)

7.24 KALRAY S.A. (FRANCE)

7.25 SYNOPSYS INC. (USA)

7.26 ALPHABET INC. (GOOGLE TPU) (USA)

7.27 OTHER ACTIVE PLAYERS

Chapter 8: Global Accelerator Card Market By Region

8.1 Overview

8.2. North America Accelerator Card Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Processor Type

8.2.4.1 Central Processing Units

8.2.4.2 Graphics Processing Units

8.2.4.3 Field Programmable Gate Arrays

8.2.4.4 Application-Specific Integrated Circuit

8.2.5 Historic and Forecasted Market Size by Accelerator Type

8.2.5.1 High-Performance Computing Accelerator

8.2.5.2 Cloud Accelerator

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Video and Image Processing

8.2.6.2 Machine Learning

8.2.6.3 Financial Computing

8.2.6.4 Data Analytics

8.2.6.5 Mobile Phones and Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Accelerator Card Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Processor Type

8.3.4.1 Central Processing Units

8.3.4.2 Graphics Processing Units

8.3.4.3 Field Programmable Gate Arrays

8.3.4.4 Application-Specific Integrated Circuit

8.3.5 Historic and Forecasted Market Size by Accelerator Type

8.3.5.1 High-Performance Computing Accelerator

8.3.5.2 Cloud Accelerator

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Video and Image Processing

8.3.6.2 Machine Learning

8.3.6.3 Financial Computing

8.3.6.4 Data Analytics

8.3.6.5 Mobile Phones and Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Accelerator Card Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Processor Type

8.4.4.1 Central Processing Units

8.4.4.2 Graphics Processing Units

8.4.4.3 Field Programmable Gate Arrays

8.4.4.4 Application-Specific Integrated Circuit

8.4.5 Historic and Forecasted Market Size by Accelerator Type

8.4.5.1 High-Performance Computing Accelerator

8.4.5.2 Cloud Accelerator

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Video and Image Processing

8.4.6.2 Machine Learning

8.4.6.3 Financial Computing

8.4.6.4 Data Analytics

8.4.6.5 Mobile Phones and Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Accelerator Card Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Processor Type

8.5.4.1 Central Processing Units

8.5.4.2 Graphics Processing Units

8.5.4.3 Field Programmable Gate Arrays

8.5.4.4 Application-Specific Integrated Circuit

8.5.5 Historic and Forecasted Market Size by Accelerator Type

8.5.5.1 High-Performance Computing Accelerator

8.5.5.2 Cloud Accelerator

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Video and Image Processing

8.5.6.2 Machine Learning

8.5.6.3 Financial Computing

8.5.6.4 Data Analytics

8.5.6.5 Mobile Phones and Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Accelerator Card Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Processor Type

8.6.4.1 Central Processing Units

8.6.4.2 Graphics Processing Units

8.6.4.3 Field Programmable Gate Arrays

8.6.4.4 Application-Specific Integrated Circuit

8.6.5 Historic and Forecasted Market Size by Accelerator Type

8.6.5.1 High-Performance Computing Accelerator

8.6.5.2 Cloud Accelerator

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Video and Image Processing

8.6.6.2 Machine Learning

8.6.6.3 Financial Computing

8.6.6.4 Data Analytics

8.6.6.5 Mobile Phones and Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Accelerator Card Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Processor Type

8.7.4.1 Central Processing Units

8.7.4.2 Graphics Processing Units

8.7.4.3 Field Programmable Gate Arrays

8.7.4.4 Application-Specific Integrated Circuit

8.7.5 Historic and Forecasted Market Size by Accelerator Type

8.7.5.1 High-Performance Computing Accelerator

8.7.5.2 Cloud Accelerator

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Video and Image Processing

8.7.6.2 Machine Learning

8.7.6.3 Financial Computing

8.7.6.4 Data Analytics

8.7.6.5 Mobile Phones and Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Accelerator Card Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 13.98 Bn. |

|

Forecast Period 2024-32 CAGR: |

37.87 % |

Market Size in 2032: |

USD 251.61 Bn. |

|

Segments Covered: |

By Processor Type |

|

|

|

By Accelerator Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||