Key Market Highlights

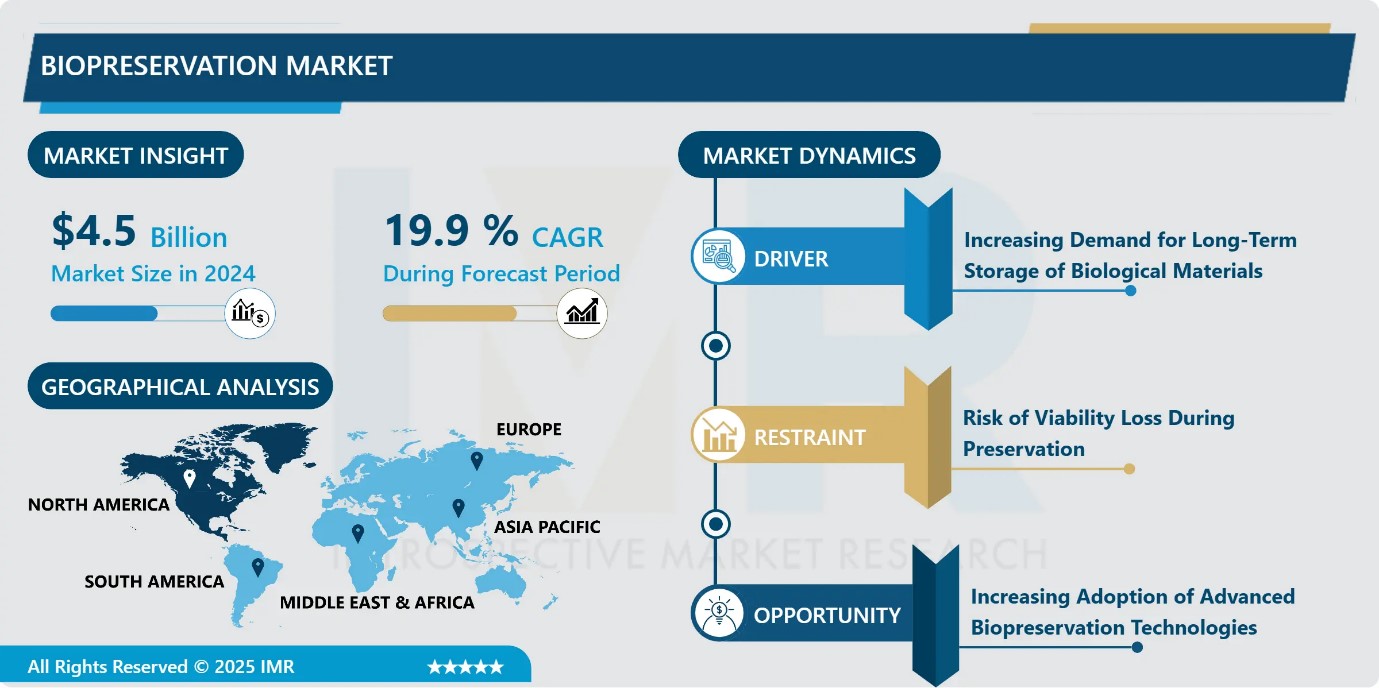

Biopreservation Market Size Was Valued at USD 4.5 Billion in 2024, and is Projected to Reach USD 33.13 Billion by 2035, Growing at a CAGR of 19.9% from 2025-2035.

- Market Size in 2024: USD 4.5 Billion

- Projected Market Size by 2035: USD 33.13 Billion

- CAGR (2025–2035): 19.9%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By End User: The Biotechnology and Pharmaceutical segment is anticipated to lead the market by accounting for 30.9% of the market share throughout the forecast period.

- By Application: The Biobanking segment is expected to capture 26.4% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: The North America region is projected to hold 33.2% of the market share during the forecast period.

- Active Players: Arctiko A/S (Denmark), Avantor, Inc. (United States), Azenta US, Inc. (United States), BioLife Solutions, Inc. (United States), Biomatrica, Inc. (United States), and Other Active Players.

Biopreservation Market Synopsis:

The Biopreservation market refers to the global ecosystem of technologies, products, and services used to preserve biological materials such as cells, tissues, DNA, organs, and biologics under controlled conditions to maintain their viability, stability, and functionality over extended periods. This market plays a critical role in clinical diagnostics, biobanking, regenerative medicine, drug discovery, and advanced biologics manufacturing. Growing demand is driven by rising chronic disease prevalence, expansion of cell and gene therapies, personalized medicine, and vaccine development. Advancements in cryopreservation, hypothermic storage, predictive modeling, automation, and digital biobank management are enhancing efficiency and reliability. Strong government and private-sector investments, particularly in stem cell research and biologics R&D, further support market growth, despite challenges related to skilled labor shortages and high operational costs.

Biopreservation Market Dynamics and Trend Analysis:

Biopreservation Market Growth Driver-Increasing Demand for Long-Term Storage of Biological Materials

- The expanding adoption of biobanks, stem cell research, regenerative medicine, and precision healthcare is significantly driving demand for advanced biopreservation solutions. Reliable long-term storage is essential to maintain the viability, functionality, and integrity of biological materials such as cells, tissues, organs, and DNA used in research and clinical applications. Rising chronic disease prevalence and growing reliance on personalized medicine further accelerate this demand. The increasing number of global biorepositories supporting oncology, neurology, and infectious disease research highlights this trend. Additionally, widespread use of biopreserved samples in pharmaceutical drug discovery and cell-based therapies is boosting demand for cryopreservation media, freezing systems, and cold chain infrastructure.

Biopreservation Market Limiting Factor-Risk of Viability Loss During Preservation

- The potential loss of biological sample viability during preservation remains a key restraint for the biopreservation market. Challenges such as ice crystal formation, osmotic stress, and thermal shock can negatively impact post-thaw cell recovery and functionality. Studies on sensitive cell types, including mesenchymal stem cells, indicate variable outcomes even when using approved preservation media, reinforcing concerns among end users. Although advances such as vitrification techniques and novel cryoprotectants have improved preservation success rates, lingering perceptions of quality and performance risk persist. These concerns are particularly significant for high-value clinical and therapeutic applications, limiting broader adoption and constraining near-term market growth.

Biopreservation Market Expansion Opportunity-Increasing Adoption of Advanced Biopreservation Technologies

- The growing adoption of advanced biopreservation techniques presents a significant opportunity for market expansion. Continuous technological innovationssuc h as cryoprotectant-free storage, vitrification methods, automated freezing systems, and AI-enabled monitoring are enhancing sample viability, operational efficiency, and regulatory compliance. Integration of digital inventory management, cloud-based tracking, and IoT-enabled monitoring is streamlining biorepository operations and improving sample security.

- Advancements in preservation media and freezing protocols are also improving outcomes for stem cells and immune cells used in cell and gene therapies. As pharmaceutical, biotechnology, and research institutions increasingly seek scalable, cost-effective, and data-driven preservation solutions, companies investing in automation and next-generation biostorage technologies are well-positioned to capitalize on emerging market opportunities.

Biopreservation Market Challenge and Risk-High Costs and Reimbursement Limitations

- High capital and operational costs remain a major challenge restraining the growth of the biopreservation market, particularly in Europe. Significant investments are required for advanced cryogenic equipment, ultra-low temperature freezers, monitoring systems, and ongoing energy and maintenance expenses. These costs create adoption barriers for smaller research institutes and healthcare providers, especially in cost-sensitive and emerging regions. Additionally, fragmented and inconsistent reimbursement policies across countries and insurers create financial uncertainty, discouraging wider implementation. Delayed reimbursement cycles and low patient volumes further strain smaller facilities. Collectively, high upfront expenditures and reimbursement constraints limit market penetration, slow adoption of advanced technologies, and restrict accessibility to biopreservation services.

Biopreservation Market Trend-Growing Role of Biopreservation in Cancer Research and Personalized Medicine

- Advancements in cancer research and the rapid shift toward personalized medicine are emerging as key trends shaping the biopreservation market. Cryopreservation is increasingly essential for maintaining the stability and efficacy of cell-based oncological therapies, offering extended shelf life and improved logistical flexibility. Large-scale biobanking initiatives are evolving into integrated data platforms that support precision diagnostics and longitudinal research, driving demand for high-quality preservation media and advanced storage systems. The convergence of genomic and clinical data is increasing repeat sample utilization and long-term storage needs. Alongside this, continuous innovations in cryopreservation technologies, automation, and cost-efficient preservation solutions are enhancing sample viability, operational efficiency, and scalability across research and clinical applications.

Biopreservation Market Segment Analysis:

Biopreservation Market is segmented based on Application, Product Type, Storage Type, Cell Provider, End User, and Region.

By End-User, pharmaceutical and biotechnology segment is expected to dominate the market with around 30.9% share during the forecast period.

- The pharmaceutical and biotechnology segment is emerging as the dominant end user in the biopreservation market due to its large-scale commercial operations and growing focus on advanced therapies. Biopharma companies are increasingly outsourcing cold chain logistics while strengthening in-house analytical and quality control capabilities, driving demand for integrated biopreservation solutions. Strategic partnerships between manufacturers and specialized cryogenic transport providers ensure product integrity across global supply chains. Additionally, the rapid expansion of cell and gene therapy pipelines significantly increases the need for reliable long-term storage and transportation. High R&D investments, stringent regulatory requirements, and rising clinical trial activity position the pharma-biotech segment as the leading contributor to market revenue growth.

By Application, Biobanking is expected to dominate with close to 26.4% market share during the forecast period.

- Biobanking continues to hold the largest share of the biopreservation market, driven by its critical role in providing well-annotated biological samples to academic institutions and life science companies for biomarker discovery, disease research, and translational studies. Its dominance stems from long-term storage requirements, high sample volumes, and consistent demand across multiple research disciplines. In parallel, regenerative medicine is the fastest-growing application segment, supported by a strong pipeline of autologous and allogeneic cell therapies in advanced clinical trials. Each clinical advancement increases demand for GMP-compliant storage, transportation, and thawing solutions. Additionally, drug discovery, preclinical toxicology, and forensic science applications further support market expansion and diversification.

Biopreservation Market Regional Insights:

North America region is estimated to lead the market with around 33.2% share during the forecast period.

- North America dominates the biopreservation market due to its advanced biomedical research ecosystem, strong biobanking infrastructure, and high adoption of regenerative and personalized medicine. The region accounted for over 40% of global revenue, driven by increasing demand for cell therapies, organ transplantation, vaccines, and clinical trials requiring reliable sample preservation.

- The United States leads the region, supported by substantial funding from organizations such as the NIH and NCI, favorable regulatory frameworks, and active participation of major industry players. Continuous investments, technological advancements, and rising chronic disease prevalence further reinforce North America’s market leadership.

Biopreservation Market Active Players:

- Arctiko A/S (Denmark)

- Avantor, Inc. (United States)

- Azenta US, Inc. (United States)

- BioLife Solutions, Inc. (United States)

- Biomatrica, Inc. (United States)

- Brooks Life Sciences (Azenta Life Sciences) (United States)

- Chart Industries, Inc. (Cryoport Systems) (United States)

- Eppendorf AG (Germany)

- Helmer Scientific (United States)

- LabVantage Solutions, Inc. (United States)

- Merck KGaA (Germany)

- MVE Biological Solutions (United States)

- Panasonic Corporation (Japan)

- Stirling Ultracold (United States)

- Thermo Fisher Scientific, Inc. (United States)

- Other Active Players

Key Industry Developments in the Biopreservation Market:

- In January 2025, Azenta entered into a strategic agreement with UK Biocentre to deploy its BioArc Ultra automation system. The installation will significantly enhance biobanking operations by adding capacity for 16 million samples.

- In October 2024, Thermo Fisher Scientific launched advanced biopreservation media tailored for cell and gene therapy applications. The new media are designed to improve cell viability and stability during storage and transportation.

Overview of Biopreservation Technologies and Preservation Mechanisms

- Biopreservation involves the stabilization and long-term storage of biological materials including cells, tissues, organs, DNA, and biofluids under controlled conditions to maintain structural integrity and functional viability. Core techniques include cryopreservation, vitrification, hypothermic storage, and lyophilization, with cryopreservation being the most widely adopted due to its suitability for cellular and molecular samples.

- The process relies on ultra-low temperature freezers or liquid nitrogen systems, combined with cryoprotective agents to minimize ice crystal formation and osmotic stress. Recent technical advancements focus on cryoprotectant optimization, controlled-rate freezing, and automated thawing systems to improve post-recovery outcomes. Integration of digital inventory management, IoT-enabled temperature monitoring, and GMP-compliant workflows enhances traceability, regulatory compliance, and operational efficiency across biobanks, pharmaceutical manufacturing, and clinical research facilities.

|

Biopreservation Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 4.5 Bn. |

|

Forecast Period 2025-32 CAGR: |

19.9% |

Market Size in 2035: |

USD 33.13 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By Product Type |

|

||

|

By storage Type |

|

||

|

By Cell Provider |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Biopreservation Market by Application (2018-2035)

4.1 Biopreservation Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cell and Tissue Culture

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Gene and Drug Therapy

4.5 Clinical Applications

4.6 Regenerative Medicine

4.7 and Biobanking

Chapter 5: Biopreservation Market by Product Type (2018-2035)

5.1 Biopreservation Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Biopreservation Media

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Freezers

5.5 Cryogenic Storage Systems

5.6 and Accessories

Chapter 6: Biopreservation Market by Storage Type (2018-2035)

6.1 Biopreservation Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cryopreservation

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Controlled Rate Freezing

6.5 and Ultra-Low Temperature Storage

Chapter 7: Biopreservation Market by Cell Provider (2018-2035)

7.1 Biopreservation Market Snapshot and Growth Engine

7.2 Market Overview

7.3 CD34+

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 CD19+

7.5 MSC

7.6 iPSC

7.7 hESC

7.8 Tumor Cells

7.9 and Others

Chapter 8: Biopreservation Market by End User (2018-2035)

8.1 Biopreservation Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Biotechnology and Pharmaceutical Companies

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Research Institutions

8.5 Hospitals

8.6 and Clinics

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Biopreservation Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 ABBOTT LABORATORIES (UNITED STATES)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 AMWAY CORP. (UNITED STATES)

9.4 ATKINS NUTRITIONALS

9.5 INC. (UNITED STATES)

9.6 ELI LILLY AND COMPANY (UNITED STATES)

9.7 GLANBIA PLC (IRELAND)

9.8 HERBALIFE NUTRITION LTD. (UNITED STATES)

9.9 JOHNSON & JOHNSON SERVICES

9.10 INC. (UNITED STATES)

9.11 KELLOGG COMPANY (UNITED STATES)

9.12 MEDIFAST

9.13 INC. (UNITED STATES)

9.14 NESTLÉ HEALTH SCIENCE (SWITZERLAND)

9.15 NOOM

9.16 INC. (UNITED STATES)

9.17 NOVO NORDISK (DENMARK)

9.18 NUTRISYSTEM

9.19 INC. (UNITED STATES)

9.20 TECHNOGYM S.P.A. (ITALY)

9.21 WW INTERNATIONAL

9.22 INC. – WEIGHT WATCHERS (UNITED STATES)

9.23 AND OTHER ACTIVE PLAYERS.

Chapter 10: Global Biopreservation Market By Region

10.1 Overview

10.2. North America Biopreservation Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Biopreservation Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Biopreservation Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Biopreservation Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Biopreservation Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Biopreservation Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

14.1 Sources

14.2 List of Tables and figures

14.3 Short Forms and Citations

14.4 Assumption and Conversion

14.5 Disclaimer

|

Biopreservation Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 4.5 Bn. |

|

Forecast Period 2025-32 CAGR: |

19.9% |

Market Size in 2035: |

USD 33.13 Bn. |

|

Segments Covered: |

By Application |

|

|

|

By Product Type |

|

||

|

By storage Type |

|

||

|

By Cell Provider |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||