Key Market Highlights

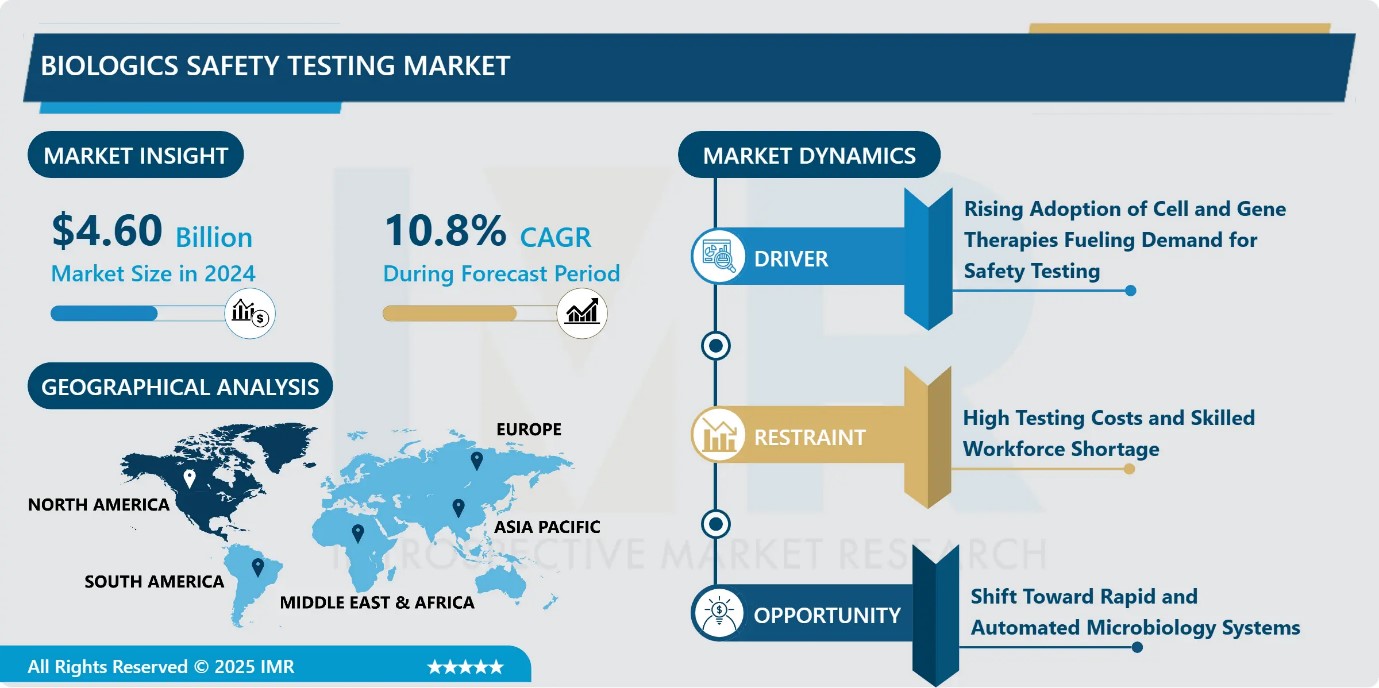

Biologics Safety Testing Market Size Was Valued at USD 4.60 Billion in 2024, and is Projected to Reach USD 14.21 Billion by 2035, Growing at a CAGR of 10.8% from 2025-2035.

- Market Size in 2024: USD 4.60 Billion

- Projected Market Size by 2035: USD 14.21 Billion

- CAGR (2025–2035): 10.8%

- Leading Market in 2024: North America

- Fastest-Growing Market: Asia-Pacific

- By Product and Services: The Kits & Reagents segment is anticipated to lead the market by accounting for 39.2% of the market share throughout the forecast period.

- By End User: The Pharmaceutical and Biotechnology Companies segment is expected to capture 33.7% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: North America region is projected to hold 31.5% of the market share during the forecast period.

- Active Players: Becton, Dickinson and Company (BD) (United States), Bio-Rad Laboratories, Inc. (United States), Eurofins Scientific SE (Luxembourg/France), GenScript Biotech Corporation (United States), Lonza Group AG (Switzerland), and Other Active Players.

Biologics Safety Testing Market Synopsis:

The biologics safety testing market ensures the safety, quality, and efficacy of biological products such as vaccines, therapeutics, and cell- and gene-based therapies before market release. It involves procedures including sterility testing, endotoxin assessment, cell line authentication, bioburden analysis, and virus/adventitious agent detection. The market is primarily driven by growing demand for biologics, increased R&D activities, and supportive government regulations mandating safety compliance. Key industry players invest heavily in innovative testing tools, with emerging integration of AI and automation enhancing testing accuracy and efficiency. Expansion in biopharmaceuticals, rising adoption in emerging markets, and heightened focus on pandemic preparedness further propel growth. However, high testing costs and complex, region-specific regulatory requirements remain key challenges, influencing market dynamics and strategic planning for stakeholders.

Biologics Safety Testing Market Dynamics and Trend Analysis:

Biologics Safety Testing Market Growth Driver-Rising Adoption of Cell and Gene Therapies Fueling Demand for Safety Testing

- The rapid expansion of biologics particularly cell and gene therapies are a major driver of the global biologics safety testing market. These advanced therapies involve complex manufacturing processes with elevated risks of contamination, necessitating stringent and frequent safety testing across all production stages. The increasing number of clinical trials and the commercialization of personalized biologics further amplify the demand for validated safety profiling. Rising prevalence of chronic diseases, cancer, and autoimmune disorders is accelerating biologics development and large-scale production, reinforcing the need for robust safety testing frameworks. Technological advancements by key market players continue to strengthen testing capabilities and support sustained market growth.

Biologics Safety Testing Market Limiting Factor-High Testing Costs and Skilled Workforce Shortage

- The global biologics safety testing market faces notable restraints due to high testing costs and a limited availability of skilled professionals. Biological safety testing requires advanced instrumentation, specialized laboratory infrastructure, and costly reagents, resulting in substantial operational expenses. These high costs can restrict smaller companies and research institutions from adopting comprehensive testing protocols. Additionally, the complexity of biologics safety testing demands highly trained personnel with specialized expertise. The ongoing shortage of qualified professionals’ limits testing capacity, reduces operational efficiency, and places increased workload pressure on existing staff, collectively constraining market growth and wider adoption of safety testing services.

Biologics Safety Testing Market Expansion Opportunity-Shift Toward Rapid and Automated Microbiology Systems

- The growing adoption of rapid and automated microbiology systems presents a significant growth opportunity in the global biologics safety testing market. These advanced systems enhance testing efficiency by offering rapid sterility testing, real-time microbial detection, and AI-enabled colony counting. Compared to conventional methods, automated platforms significantly shorten quality control timelines and enable faster identification of contamination risks.

- This is particularly critical for biologics with limited shelf lives, including cell and gene therapies. Increasing collaborations among key industry players to deploy automated microbiology solutions are further improving operational efficiency, accelerating product release, and creating lucrative opportunities for market expansion.

Biologics Safety Testing Market Challenge and Risk-Regulatory Complexity, Ethical Constraints, and Operational Risks

- The global biologics safety testing market faces multiple challenges driven by regulatory, ethical, and operational pressures. Continuously evolving regulatory requirements demand stringent compliance, advanced testing technologies, and specialized expertise, increasing operational complexity and costs. Ethical concerns surrounding animal-based toxicity testing further challenge market growth, pushing companies to seek alternative methods.

- Additionally, prolonged testing timelines delay product development and regulatory approvals. Rising risks of microbial contamination intensify regulatory scrutiny, often leading to production halts, batch rejections, and financial losses. Collectively, these factors slow innovation, strain resources, and limit scalability, particularly for small and emerging biopharmaceutical players.

Biologics Safety Testing Market Trend-Technological Advancements Driving Market Growth

- Technological advancements represent a significant trend shaping the global biologics safety testing market. Innovations such as automation, high-throughput screening, real-time PCR, advanced chromatography, and next-generation sequencing have substantially enhanced testing efficiency, sensitivity, and accuracy. These technologies enable faster and more reliable detection of contaminants and impurities, supporting comprehensive safety assessments of biologic products.

- The adoption of advanced analytical tools reduces testing timelines while improving consistency and regulatory compliance. Continuous investment in research and development is accelerating the adoption of these modern testing methods, positioning technological innovation as a critical driver of market growth and improved biologics safety standards.

Biologics Safety Testing Market Segment Analysis:

Biologics Safety Testing Market is segmented based on Testing Type, Products and Services, Test Type, Application, End User, and Region.

By Product, Reagents and kits segment is expected to dominate the market with around 39.2% share during the forecast period.

- The reagents and kits segment held the largest share of the biological safety testing market in 2024 and is projected to maintain its leading position throughout the forecast period. This dominance is driven by continuous advancements in reagent and kit formulations, which enhance accuracy, sensitivity, and ease of use in laboratory workflows. These improvements have increased adoption among laboratory professionals, particularly for toxicology and routine safety assessments. Additionally, the rising demand for high-throughput testing across biopharmaceutical and research laboratories has significantly supported segment growth. The repeat usage, standardized protocols, and compatibility with automated testing platforms further explain why reagents and kits remain the most dominant segment in the market.

By End User, Pharmaceutical and Biopharmaceutical is expected to dominate with close to 33.7% market share during the forecast period.

- The pharmaceutical and biopharmaceutical companies segment dominates the biologics safety testing market, accounting for the largest share in 2024. This dominance is driven by their role as primary developers, manufacturers, and commercializers of biologics, which requires extensive and repeated safety testing throughout development and production.

- Strong capital investment enables these companies to adopt advanced safety testing technologies and expand in-house testing capabilities. Additionally, large-scale manufacturing operations, expanding biologics pipelines, and strict compliance with global regulatory standards significantly increase testing volumes. Continuous investments in GMP-certified facilities and biosafety testing centers further reinforce the leading position of pharmaceutical and biopharmaceutical companies in the market.

Biologics Safety Testing Market Regional Insights:

North America region is estimated to lead the market with around 31.5% share during the forecast period.

- North America dominates the biologics safety testing market, contributing over 31.5% of global revenue in 2024, with the U.S. as the key driver. The region’s growth is fueled by a robust biopharmaceutical sector, advanced healthcare infrastructure, and increasing R&D investments. Major players such as Thermo Fisher Scientific, Charles River Laboratories, and Merck KGaA lead innovation, supported by venture-backed biotech clusters and regulatory oversight from the FDA. Expansions, like Thermo Fisher’s Rockville facility, and harmonized regulations in Canada and FDA-recognized sites in Mexico enhance efficiency. The high concentration of biopharma companies, strict compliance requirements, and a growing pipeline of biologics and gene therapies reinforce North America’s leadership globally.

Biologics Safety Testing Market Active Players:

- Becton, Dickinson and Company (BD) (United States)

- Bio?Rad Laboratories, Inc. (United States)

- Eurofins Scientific SE (Luxembourg/France)

- GenScript Biotech Corporation (United States

- Lonza Group AG (Switzerland)

- Merck KGaA (MilliporeSigma) (Germany)

- Nelson Laboratories, LLC (United States)

- Pace Analytical Services, LLC (United States)

- Promega Corporation (United States)

- Q2 Solutions (IQVIA Lab Subsidiary) (United States)

- Sartorius AG (Germany)

- SGS S.A. (Switzerland

- Stemcell Technologies Inc. (Canada)

- Thermo Fisher Scientific Inc. (United States)

- WuXi AppTec (China)

- Other Active Players

Key Industry Developments in the Biologics Safety Testing Market:

- In September 2025, Nelson Laboratories, LLC, part of Sotera Health, introduced RapidCert, a rapid biological indicator sterility testing service. The method integrates traditional BIs with advanced rapid microbiological techniques. It enables sterility confirmation for medical and pharmaceutical products in just three days.

- In May 2025, Thermo Fisher Scientific launched the Thermo Scientific 1500 Series Class II, Type A2 Biological Safety Cabinet (BSC). Designed for improved protection, ergonomics, and ease of use in labs.

Technical Overview of Testing Methodologies, Technologies, and Regulatory Requirements in the Biologics Safety Testing Market

- The biologics safety testing market encompasses a range of analytical and microbiological techniques used to ensure the safety, purity, and quality of biologic products throughout development and manufacturing. Key testing areas include sterility testing, endotoxin and pyrogen testing, adventitious agent detection, mycoplasma testing, and viral safety testing.

- These tests are conducted using advanced technologies such as polymerase chain reaction (PCR), next-generation sequencing (NGS), cell-based assays, chromatography, and mass spectrometry. High-throughput and automated platforms are increasingly adopted to improve testing efficiency, reduce turnaround time, and ensure reproducibility. Regulatory compliance with guidelines issued by agencies such as the FDA, EMA, and WHO is a critical technical requirement, mandating validated methods and Good Laboratory Practice (GLP) standards. Continuous technological innovation, including rapid microbiological methods and AI-enabled analytical tools, is further enhancing sensitivity, accuracy, and scalability in biologics safety testing workflows.

|

Biologics Safety Testing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 4.60 Bn. |

|

Forecast Period 2025-32 CAGR: |

10.8% |

Market Size in 2035: |

USD 14.21 Bn. |

|

Segments Covered: |

By Testing Type |

|

|

|

By Products & Services |

|

||

|

By Application |

|

||

|

By Test Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: Biologics Safety Testing Market by By Testing Type (2018-2035)

4.1 Biologics Safety Testing Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Sterility Testing

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Endotoxin Testing

4.5 Bioburden Testing

4.6 and Validation Testing

Chapter 5: Biologics Safety Testing Market by Products & Services (2018-2035)

5.1 Biologics Safety Testing Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Kits & Reagents

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Instruments

5.5 and Services

Chapter 6: Biologics Safety Testing Market by Test Type (2018-2035)

6.1 Biologics Safety Testing Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Sterility Tests

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Endotoxin/Pyrogen Tests

6.5 Mycoplasma Tests

6.6 Bioburden Tests

6.7 Viral Safety/Adventitious Agent Tests

6.8 Residual Host Contamination Tests

6.9 Cell Line Characterization Tests

6.10 and Others

Chapter 7: Biologics Safety Testing Market by Application Segment (2018-2035)

7.1 Biologics Safety Testing Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Monoclonal Antibodies & Recombinant Proteins

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Vaccines

7.5 Cell & Gene Therapies

7.6 Blood & Plasma Products

7.7 and Tissue & Stem Cell-Based Products

Chapter 8: Biologics Safety Testing Market by End User (2018-2035)

8.1 Biologics Safety Testing Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Pharmaceutical and Biotechnology Companies

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Research Institutions

8.5 CROs/CDMOs

8.6 and Academic & Government/Regulatory Labs

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Biologics Safety Testing Market Share by Manufacturer/Service Provider(2024)

9.1.3 Industry BCG Matrix

9.1.4 PArtnerships, Mergers & Acquisitions

9.2 BECTON

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Recent News & Developments

9.2.10 SWOT Analysis

9.3 DICKINSON AND COMPANY (BD) (UNITED STATES)

9.4 BIO-RAD LABORATORIES

9.5 INC. (UNITED STATES)

9.6 EUROFINS SCIENTIFIC SE (LUXEMBOURG/FRANCE)

9.7 GENSCRIPT BIOTECH CORPORATION (UNITED STATES)

9.8 LONZA GROUP AG (SWITZERLAND)

9.9 MERCK KGAA (MILLIPORESIGMA) (GERMANY)

9.10 NELSON LABORATORIES

9.11 LLC (UNITED STATES)

9.12 PACE ANALYTICAL SERVICES

9.13 LLC (UNITED STATES)

9.14 PROMEGA CORPORATION (UNITED STATES)

9.15 Q2 SOLUTIONS (IQVIA LAB SUBSIDIARY) (UNITED STATES)

9.16 SARTORIUS AG (GERMANY)

9.17 SGS S.A. (SWITZERLAND)

9.18 STEMCELL TECHNOLOGIES INC. (CANADA)

9.19 THERMO FISHER SCIENTIFIC INC. (UNITED STATES)

9.20 WUXI APPTEC (CHINA)

9.21 AND OTHER ACTIVE PLAYERS.

Chapter 10: Global Biologics Safety Testing Market By Region

10.1 Overview

10.2. North America Biologics Safety Testing Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecast Market Size by Country

10.2.4.1 US

10.2.4.2 Canada

10.2.4.3 Mexico

10.3. Eastern Europe Biologics Safety Testing Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecast Market Size by Country

10.3.4.1 Russia

10.3.4.2 Bulgaria

10.3.4.3 The Czech Republic

10.3.4.4 Hungary

10.3.4.5 Poland

10.3.4.6 Romania

10.3.4.7 Rest of Eastern Europe

10.4. Western Europe Biologics Safety Testing Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecast Market Size by Country

10.4.4.1 Germany

10.4.4.2 UK

10.4.4.3 France

10.4.4.4 The Netherlands

10.4.4.5 Italy

10.4.4.6 Spain

10.4.4.7 Rest of Western Europe

10.5. Asia Pacific Biologics Safety Testing Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecast Market Size by Country

10.5.4.1 China

10.5.4.2 India

10.5.4.3 Japan

10.5.4.4 South Korea

10.5.4.5 Malaysia

10.5.4.6 Thailand

10.5.4.7 Vietnam

10.5.4.8 The Philippines

10.5.4.9 Australia

10.5.4.10 New Zealand

10.5.4.11 Rest of APAC

10.6. Middle East & Africa Biologics Safety Testing Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecast Market Size by Country

10.6.4.1 Turkiye

10.6.4.2 Bahrain

10.6.4.3 Kuwait

10.6.4.4 Saudi Arabia

10.6.4.5 Qatar

10.6.4.6 UAE

10.6.4.7 Israel

10.6.4.8 South Africa

10.7. South America Biologics Safety Testing Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecast Market Size by Country

10.7.4.1 Brazil

10.7.4.2 Argentina

10.7.4.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

Chapter 12 Our Thematic Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

Chapter 13 Case Study

Chapter 14 Appendix

14.1 Sources

14.2 List of Tables and figures

14.3 Short Forms and Citations

14.4 Assumption and Conversion

14.5 Disclaimer

|

Biologics Safety Testing Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 4.60 Bn. |

|

Forecast Period 2025-32 CAGR: |

10.8% |

Market Size in 2035: |

USD 14.21 Bn. |

|

Segments Covered: |

By Testing Type |

|

|

|

By Products & Services |

|

||

|

By Application |

|

||

|

By Test Type |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||