Key Market Highlights

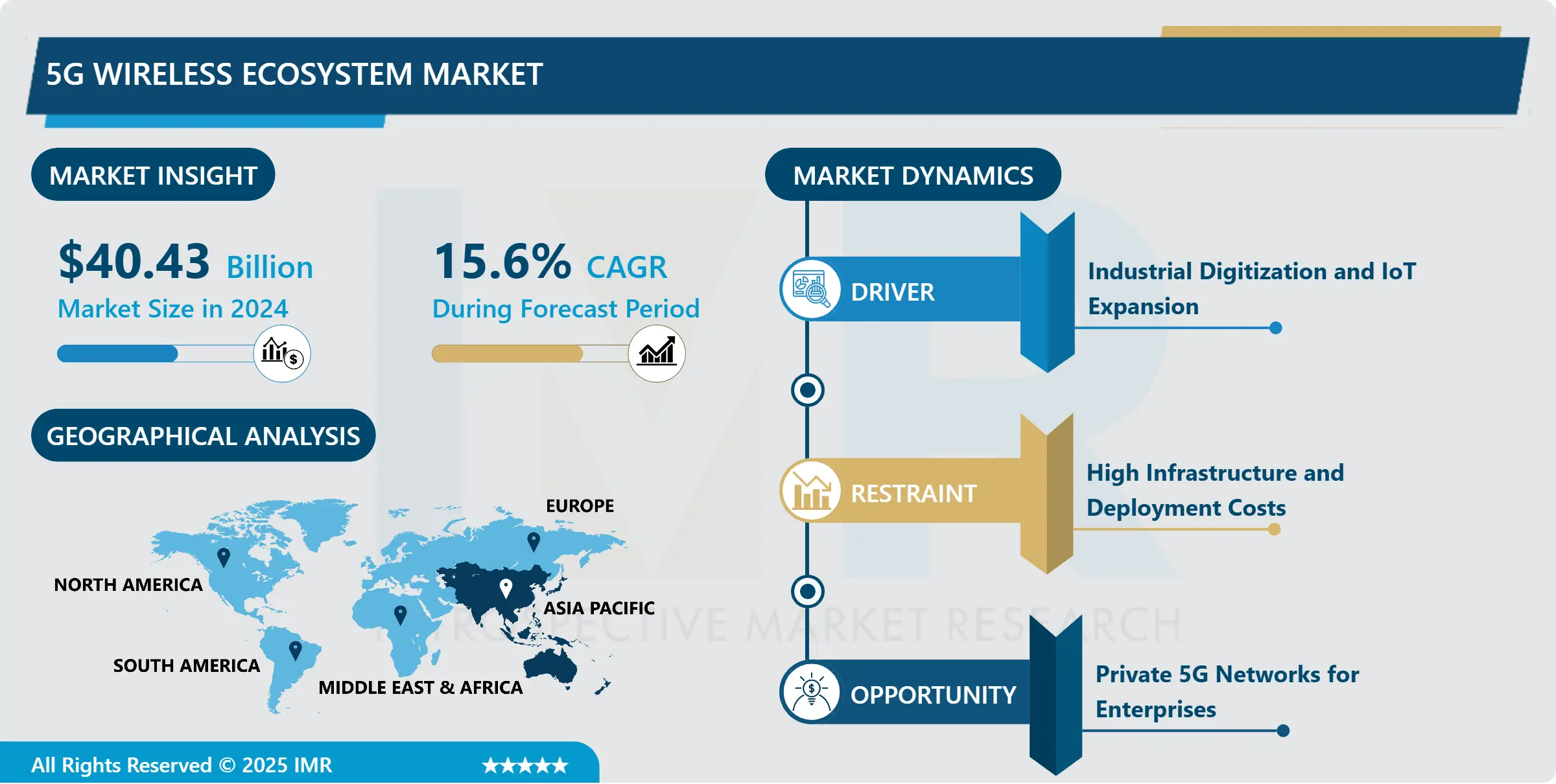

5G Wireless Ecosystem Market Size Was Valued at USD?40.43 Billion in 2024, and is Projected to Reach USD?199.18 Billion by 2035, Growing at a CAGR of 15.6 % from 2025-2035.

- Market Size in 2024: USD?40.43 Billion

- Projected Market Size by 2035: USD?199.18 Billion

- CAGR (2025–2035): 15.6 %

- Leading Market in 2024: Asia-Pacific

- Fastest-Growing Market: India

- By type: The Enhanced Mobile Broadband segment is anticipated to lead the market by accounting for 45% of the market share throughout the forecast period.

- By Application : The 5G subscriptions segment is expected to capture 53% of the market share, thereby maintaining its dominance over the forecast period.

- By Region: China region is projected to hold 35 % of the market share during the forecast period.

- Active Players: Affirmed Networks (United States), Altiostar (Japan), AT&T (United States), Bharti Airtel (India), China Mobile (China), Other Active Players

5G Wireless Ecosystem Market Synopsis:

The 5G wireless ecosystem is evolving into a multi?hundred-billion-dollar global market, fuelled by industrial digitisation, IoT expansion, edge innovation, and enterprise service opportunities. While regional maturity varies APAC leads, Europe lags the shift to standalone 5G, private networks, and edge computing is unlocking transformative use cases.

5G Wireless Ecosystem Market Dynamics and Trend Analysis:

5G Wireless Ecosystem Market Growth Driver - Industrial Digitization & IoT Expansion

- One of the biggest reasons the 5G wireless ecosystem is growing fast is because more industries are going digital. This is called industrial digitization, and it means that factories, hospitals, cars, and many other sectors are using new technology to work faster and smarter.

- For example, factories are now using robots, sensors, and smart machines to do work that was once done by people. These machines need fast, reliable internet to communicate and make quick decisions. 5G provides that with low latency, meaning there’s almost no delay in data transmission. This helps machines work more smoothly and efficiently.

- In healthcare, telemedicine is becoming more common. Doctors can now check on patients through video calls or monitor them using connected medical devices. 5G makes this easier and more accurate. IoT (Internet of Things) is also a big part of this change. It refers to billions of devices like smartwatches, home alarms, and sensors in vehicles that connect to the internet. 5G can support many of these devices at once, even in busy areas.

- In transportation, autonomous vehicles (self-driving cars) need real-time data to stay safe on the road. 5G helps send and receive this data very quickly. In short, as more industries adopt smart technology, the demand for 5G is increasing. This is helping the 5G wireless market grow across the world.

5G Wireless Ecosystem Market Limiting Factor - High Infrastructure & Deployment Costs

- One of the main problems slowing down the growth of 5G is the high cost of building the network. Setting up 5G is not simple or cheap. It needs a lot of new equipment, such as small cell towers, fibre cables, and advanced antennas. These are needed because 5G signals do not travel as far as 4G, so more towers must be placed closer together especially in cities.

- Telecom companies also need to buy spectrum, which is the space on radio frequencies used to send 5G signals. This spectrum is sold by governments and can be very expensive. On top of that, companies must upgrade their old 3G or 4G networks to support 5G. All of this costs a lot of money and takes time. These costs are known as capital expenditures (CAPEX). For cities and wealthy areas, this might be manageable. But in rural or developing regions, it’s much harder. There might not be enough customers or income to justify spending so much money on 5G there.

- As a result, many countries face slow rollouts, especially outside major urban centres. Smaller telecom companies may also struggle to compete because they can’t afford to invest in 5G at the same level as large global players. In short, the high cost of building 5G networks is a major barrier to making 5G available everywhere.

5G Wireless Ecosystem Market Expansion Opportunity - Private 5G Networks for Enterprises

- A major opportunity for 5G growth is the increasing use of private 5G networks by businesses. These are special 5G networks that a company builds and controls just for its own use. Unlike public networks used by everyone, a private 5G network is more secure, faster, and reliable perfect for important business operations.

- Many industries are starting to use these private networks. For example: In manufacturing, factories use 5G to connect robots and machines that need to work together in real time. In logistics, companies track packages and manage warehouses more efficiently. In oil and gas, remote sites use private 5G to safely run equipment and monitor safety. In healthcare, hospitals can use it for fast communication, remote monitoring, and even robotic surgery. College campuses and large buildings also use private 5G to support learning, communication, and campus safety.

- With private 5G, companies get faster speeds, low delays, and better control over data. They don’t need to rely on a telecom operator’s public network. Big technology companies like Nokia, Ericsson, and Cisco are helping businesses build these private networks. They create custom solutions based on each company’s needs. This trend is growing quickly. As more businesses look to improve operations with smart technology, private 5G networks will become an important part of the 5G market's future.

5G Wireless Ecosystem Market Challenge and Risk - Spectrum Fragmentation & Regulatory Complexity

- One of the biggest challenges facing the 5G wireless market is spectrum fragmentation and regulatory complexity. Spectrum is the part of the airwaves that 5G uses to send signals. For 5G to work well, this spectrum needs to be available, organized, and consistent across countries. But in reality, that’s not always the case.

- Different countries use different frequency bands for 5G. Some governments release spectrum early, while others take longer. In some places, companies have to wait months or even years for licenses to use the spectrum. These delays can slow down 5G deployment and create confusion.

- Also, many regulations and rules vary from one country to another. This makes it harder for global companies and telecom operators to offer the same services in different regions. It also affects equipment makers, who must adjust their products to meet different technical standards, increasing both costs and complexity.

- Because of this fragmentation, 5G networks in one country may not easily connect or work well with networks in another. This can limit roaming services, increase the cost of devices, and make it harder for companies to scale globally. In short, without better coordination among governments and global agencies, regulatory issues and inconsistent spectrum use will continue to be a major obstacle in the worldwide rollout of 5G.

5G Wireless Ecosystem Market Segment Analysis:

5G Wireless Ecosystem Market is segmented based on Type, Application, End-Users, and Region

By Type, 5G Wireless Ecosystem Segment is Expected to Dominate the Market During the Forecast Period

- Enhanced Mobile Broadband (eMBB) is one of the most important and widely used features of 5G technology. It provides high-speed internet access to mobile devices such as smartphones, tablets, and laptops. eMBB is designed to deliver faster download and upload speeds, smoother streaming, and a better overall internet experience.

- With eMBB, people can easily watch HD or 4K videos, play online games without lag, join video calls, and work or study from home without interruptions. It is especially useful in crowded places like stadiums, airports, and city centers, where many people are using the network at the same time.

- In 2024, eMBB held the largest share in the 5G market. This is because consumers around the world are switching to 5G phones and expecting faster and more reliable internet. As more people use smartphones and digital services every day, the demand for eMBB continues to grow.

- Telecom companies are also investing heavily in eMBB by upgrading their network towers, improving coverage, and launching affordable 5G plans. Thanks to this, eMBB is becoming available even in smaller towns and rural areas. In the coming years, eMBB will remain the main driver of 5G growth, helping people stay connected, informed, and entertained anywhere, anytime.

By Application, 5G Wireless Ecosystem Segment Held the Largest Share in 2024

- 5G subscriptions refer to the number of people and devices connected to 5G networks. This number is growing very quickly all over the world. As more countries roll out 5G networks and more people buy 5G smartphones, the total number of 5G users continues to rise each year.

- In cities and towns, people are switching from 4G to 5G to enjoy faster internet, better video streaming, and smoother mobile experiences. Businesses are also using 5G for smart devices, sensors, and machines that need fast and reliable internet.

- The growing number of subscriptions helps telecom companies make more money, which they can use to improve and expand their networks. With more users joining every day, the 5G market is becoming stronger and more valuable. Even in developing countries, the number of 5G users is rising as phones become cheaper and network coverage improves. Government support, better infrastructure, and competition among telecom providers are also helping increase subscriptions.

- 5G is also being used in cars, factories, farms, and homes connecting machines, tools, and devices to the internet. This is known as the Internet of Things (IoT). In short, the steady growth of 5G subscriptions plays a big role in the success and expansion of the 5G wireless ecosystem around the world.

5G Wireless Ecosystem Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia-Pacific (APAC) region is the most advanced and fastest-growing area in the world for 5G technology. Countries in this region are making large investments to build strong 5G networks that offer faster internet, smarter services, and better connectivity.

- China is the biggest player in the region. It has built millions of 5G towers and has the highest number of 5G users globally. The government strongly supports 5G, and local companies are using it in factories, transport, healthcare, and smart cities. South Korea was one of the first countries to launch full 5G services. It is known for its fast internet and advanced technology. People use 5G in everyday life, including streaming, gaming, and smart homes. Japan is using 5G in robotics, self-driving cars, and high-tech healthcare. Japanese companies are creating smart factories and cities using this fast network. India is growing quickly in 5G. Although it launched 5G later than others, big companies like Jio and Airtel are building networks across the country. The Indian government supports 5G to improve digital access for schools, farms, and remote areas. Other APAC countries like Australia, Singapore, and Thailand are also expanding 5G services.

- Overall, APAC is leading the 5G future with innovation, strong support, and fast user growth.

5G Wireless Ecosystem Market Active Players:

- Affirmed Networks (United States)

- Altiostar (Japan)

- AT&T (United States)

- Bharti Airtel (India)

- China Mobile (China)

- China Unicom (China)

- Cisco Systems (United States)

- Deutsche Telekom (Germany)

- Ericsson (Sweden)

- Fujitsu (Japan)

- Huawei (China)

- Intel Corporation (United States)

- Jio Platforms (India)

- Juniper Networks (United States)

- Keysight Technologies (United States)

- Mavenir Systems (United States)

- NEC Corporation (Japan)

- Nokia (Finland)

- Orange S.A. (France)

- Parallel Wireless (United States)

- Qualcomm (United States)

- Samsung Electronics (South Korea)

- SK Telecom (South Korea)

- Telefonica (Spain)

- Telstra Corporation (Australia)

- T-Mobile US (United States)

- Verizon Communications (United States)

- VMware (United States)

- Vodafone Group (United Kingdom)

- ZTE Corporation (China)

- Other Active Players

|

5G Wireless Ecosystem Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD?40.43 Billion |

|

Forecast Period 2025-35 CAGR: |

15.6 % |

Market Size in 2035: |

USD?199.18 Billion |

|

Segments Covered: |

By communication Type |

|

|

|

By Application

|

|

||

|

by End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics and Opportunity Analysis

3.1.1 Growth Drivers

3.1.2 Limiting Factors

3.1.3 Growth Opportunities

3.1.4 Challenges and Risks

3.2 Market Trend Analysis

3.3 Industry Ecosystem

3.4 Industry Value Chain Mapping

3.5 Strategic PESTLE Overview

3.6 Porter's Five Forces Framework

3.7 Regulatory Framework

3.8 Pricing Trend Analysis

3.9 Intellectual Property Review

3.10 Technology Evolution

3.11 Import-Export Analysis

3.12 Consumer Behavior Analysis

3.13 Investment Pocket Analysis

3.14 Go-To Market Strategy

Chapter 4: 5G Wireless Ecosystem Market by Communication Type (2018-2035)

4.1 5G Wireless Ecosystem Market Snapshot and Growth Engine

4.2 Market Overview

4.3 FWA

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 eMBB

4.5 URLLC

4.6 MMTC

Chapter 5: 5G Wireless Ecosystem Market by Operator Service (2018-2035)

5.1 5G Wireless Ecosystem Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Service Revenue

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Subscriptions

Chapter 6: 5G Wireless Ecosystem Market by End Users (2018-2035)

6.1 5G Wireless Ecosystem Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Consumers

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Enterprises

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 5G Wireless Ecosystem Market Share by Manufacturer/Service Provider(2024)

7.1.3 Industry BCG Matrix

7.1.4 PArtnerships, Mergers & Acquisitions

7.2 AFFIRMED NETWORKS (UNITED STATES)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Recent News & Developments

7.2.10 SWOT Analysis

7.3 ALTIOSTAR (JAPAN)

7.4 AT&T (UNITED STATES)

7.5 BHARTI AIRTEL (INDIA)

7.6 CHINA MOBILE (CHINA)

7.7 CHINA UNICOM (CHINA)

7.8 CISCO SYSTEMS (UNITED STATES)

7.9 DEUTSCHE TELEKOM (GERMANY)

7.10 ERICSSON (SWEDEN)

7.11 FUJITSU (JAPAN)

7.12 HUAWEI (CHINA)

7.13 INTEL CORPORATION (UNITED STATES)

7.14 JIO PLATFORMS (INDIA)

7.15 JUNIPER NETWORKS (UNITED STATES)

7.16 KEYSIGHT TECHNOLOGIES (UNITED STATES)

7.17 MAVENIR SYSTEMS (UNITED STATES)

7.18 NEC CORPORATION (JAPAN)

7.19 NOKIA (FINLAND)

7.20 ORANGE S.A. (FRANCE)

7.21 PARALLEL WIRELESS (UNITED STATES)

7.22 QUALCOMM (UNITED STATES)

7.23 SAMSUNG ELECTRONICS (SOUTH KOREA)

7.24 SK TELECOM (SOUTH KOREA)

7.25 TELEFONICA (SPAIN)

7.26 TELSTRA CORPORATION (AUSTRALIA)

7.27 T-MOBILE US (UNITED STATES)

7.28 VERIZON COMMUNICATIONS (UNITED STATES)

7.29 VMWARE (UNITED STATES)

7.30 VODAFONE GROUP (UNITED KINGDOM)

7.31 ZTE CORPORATION (CHINA)

7.32 AND OTHER ACTIVE PLAYERS.

Chapter 8: Global 5G Wireless Ecosystem Market By Region

8.1 Overview

8.2. North America 5G Wireless Ecosystem Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecast Market Size by Country

8.2.4.1 US

8.2.4.2 Canada

8.2.4.3 Mexico

8.3. Eastern Europe 5G Wireless Ecosystem Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecast Market Size by Country

8.3.4.1 Russia

8.3.4.2 Bulgaria

8.3.4.3 The Czech Republic

8.3.4.4 Hungary

8.3.4.5 Poland

8.3.4.6 Romania

8.3.4.7 Rest of Eastern Europe

8.4. Western Europe 5G Wireless Ecosystem Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecast Market Size by Country

8.4.4.1 Germany

8.4.4.2 UK

8.4.4.3 France

8.4.4.4 The Netherlands

8.4.4.5 Italy

8.4.4.6 Spain

8.4.4.7 Rest of Western Europe

8.5. Asia Pacific 5G Wireless Ecosystem Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecast Market Size by Country

8.5.4.1 China

8.5.4.2 India

8.5.4.3 Japan

8.5.4.4 South Korea

8.5.4.5 Malaysia

8.5.4.6 Thailand

8.5.4.7 Vietnam

8.5.4.8 The Philippines

8.5.4.9 Australia

8.5.4.10 New Zealand

8.5.4.11 Rest of APAC

8.6. Middle East & Africa 5G Wireless Ecosystem Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecast Market Size by Country

8.6.4.1 Turkiye

8.6.4.2 Bahrain

8.6.4.3 Kuwait

8.6.4.4 Saudi Arabia

8.6.4.5 Qatar

8.6.4.6 UAE

8.6.4.7 Israel

8.6.4.8 South Africa

8.7. South America 5G Wireless Ecosystem Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecast Market Size by Country

8.7.4.1 Brazil

8.7.4.2 Argentina

8.7.4.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

Chapter 10 Our Thematic Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

Chapter 11 Case Study

Chapter 12 Appendix

12.1 Sources

12.2 List of Tables and figures

12.3 Short Forms and Citations

12.4 Assumption and Conversion

12.5 Disclaimer

|

5G Wireless Ecosystem Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD?40.43 Billion |

|

Forecast Period 2025-35 CAGR: |

15.6 % |

Market Size in 2035: |

USD?199.18 Billion |

|

Segments Covered: |

By communication Type |

|

|

|

By Application

|

|

||

|

by End Users |

|

||

|

By Region |

|

||

|

Growth Driver: |

|

||

|

Limiting Factor |

|

||

|

Expansion Opportunity |

|

||

|

Challenge and Risk |

|

||

|

Companies Covered in the Report: |

|

||