Whey Protein Market Synopsis

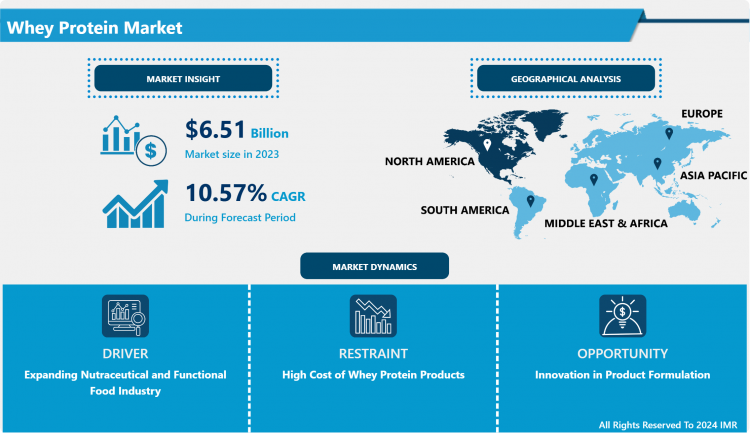

Whey Protein Market Size is Valued at USD 6.51 Billion in 2023, and is Projected to Reach USD 16.08 Billion by 2032, Growing at a CAGR of 10.57% From 2024-2032.

The whey protein market encompasses the production, distribution, and sale of whey protein, a high-quality protein derived from milk during the cheese-making process. Whey protein is widely recognized for its complete amino acid profile and rapid digestibility, making it a popular supplement for muscle building, weight management, and overall health. The market includes various forms such as concentrates, isolates, and hydrolysates, catering to diverse consumer needs ranging from athletic performance to dietary supplementation. Key players in this market focus on product innovation, quality enhancement, and expanding their consumer base across sports nutrition, functional foods, and dietary supplements segments.

- The global whey protein market is experiencing robust growth driven by increasing consumer awareness about health and fitness, growing demand for dietary supplements, and expanding applications in various food and beverage products.

- Whey protein, derived from milk during cheese production, is rich in essential amino acids and bioactive peptides, making it highly sought after in sports nutrition, infant formula, and functional foods. North America and Europe dominate the market due to high protein consumption and strong presence of fitness enthusiasts.

- However, Asia Pacific is witnessing rapid growth fueled by rising disposable incomes, changing dietary patterns, and increasing adoption of western lifestyles. Key players in the market are focusing on product innovation, expanding distribution networks, and strategic partnerships to capitalize on emerging opportunities and maintain competitiveness in this dynamic market landscape.

Whey Protein Market Trend Analysis

Growth Drivers of the Whey Protein Market

- The whey protein market has experienced significant growth over recent years, driven by increasing health consciousness and the rising demand for protein supplements. This trend is particularly evident among fitness enthusiasts and athletes who seek to enhance muscle recovery and growth. Whey protein, derived from milk during the cheese-making process, is valued for its high biological value and rapid digestibility, which makes it an ideal protein source for post-exercise nutrition. The superior amino acid profile of whey protein, rich in branched-chain amino acids (BCAAs) like leucine, isoleucine, and valine, contributes significantly to muscle protein synthesis, enhancing its popularity among those engaged in strength training and endurance sports. Moreover, the scientific backing of whey protein’s benefits in muscle repair and hypertrophy has been instrumental in increasing its adoption within the athletic community, further solidifying its market position.

- Additionally, the growing prevalence of health and wellness trends has encouraged consumers to incorporate protein supplements into their daily diets, contributing to market expansion. Beyond the fitness sector, there is a rising awareness of the importance of adequate protein intake for overall health, including weight management, immune support, and aging health. This awareness has led to an uptick in the consumption of whey protein among various demographics, including the elderly, who seek to prevent age-related muscle loss, and individuals aiming for weight loss, who benefit from the satiety-promoting effects of protein. Furthermore, the convenience and versatility of whey protein products, available in various forms such as powders, bars, and ready-to-drink shakes, have made it easier for consumers to integrate them into their busy lifestyles. As a result, the whey protein market continues to expand, driven by a broadening consumer base and the ongoing pursuit of health and wellness.

Impact of Industry Innovation and E-Commerce on the Whey Protein Market

- The food and beverage industry's innovation plays a pivotal role in propelling the whey protein market forward by fostering the development of new and diverse product offerings. Manufacturers are continuously introducing innovative formulations and flavors of whey protein products, catering to evolving consumer preferences and lifestyles. This includes not only traditional whey protein powders but also convenient formats such as protein bars, ready-to-drink shakes, and even protein-enriched snacks. These innovations not only expand the product range but also enhance the appeal of whey protein to a broader audience, including busy professionals, athletes, and health-conscious individuals seeking convenient nutrition options.

- Furthermore, the rise of e-commerce platforms has revolutionized the distribution and availability of whey protein products, further fueling market growth. Online retail channels provide consumers with unprecedented access to a wide array of whey protein brands and products, regardless of their geographical location. This accessibility has democratized the market, allowing consumers to compare prices, read reviews, and make informed purchasing decisions conveniently from their homes or mobile devices. Moreover, e-commerce offers manufacturers direct access to a global consumer base, enabling them to expand their reach beyond traditional brick-and-mortar retail channels and capitalize on the growing demand for health and wellness products. As a result, the synergy between industry innovation and e-commerce capabilities continues to drive the expansion of the whey protein market, fostering both consumer engagement and market competitiveness.

Whey Protein Market Segment Analysis:

Whey Protein Market Segmented based on By Type and By Application.

By Type, Whey Protein Isolates (WPI) segment is expected to dominate the market during the forecast period

- Whey Protein Isolates (WPI) occupy a prominent position in the market due to their exceptional purity and high protein concentration, typically exceeding 90%. This purity is achieved through advanced filtration processes that remove most of the lactose, fat, and other non-protein components present in whey. As a result, WPI offers a protein source that is virtually free from impurities, making it highly desirable for consumers in sports nutrition and dietary supplements. Athletes and fitness enthusiasts favor WPI because it provides a concentrated dose of protein per serving, crucial for supporting muscle recovery, repair, and growth post-exercise.

- In sports nutrition, where optimizing performance and muscle synthesis are paramount, WPI stands out for its rapid absorption rate and rich amino acid profile. The quick digestion and absorption of WPI ensure that amino acids are readily available to muscles during the critical post-workout window, facilitating faster recovery and muscle tissue repair. Moreover, WPI's minimal lactose content makes it suitable for individuals who are lactose intolerant or sensitive, broadening its appeal across a wider consumer base.

- Beyond sports nutrition, the popularity of WPI extends to the broader dietary supplements market. Consumers seeking high-quality protein supplements often choose WPI for its ability to deliver a significant protein boost without unnecessary calories or carbohydrates. This makes it an ideal choice for those looking to maintain lean muscle mass while managing their overall caloric intake. The demand for WPI continues to grow as health-conscious consumers prioritize products that offer superior nutritional benefits and purity, reinforcing its role as a cornerstone ingredient in premium-grade protein supplements and functional foods.

By Application, Sports Nutrition segment held the largest share in 2023

- Sports nutrition is a thriving sector where whey protein, particularly Whey Protein Isolates (WPIs) and Whey Protein Concentrates (WPCs), plays a crucial role in supporting athletes and fitness enthusiasts. These proteins are highly valued for their rapid absorption and rich amino acid profile, which are essential for muscle recovery and growth. After intense physical activity, muscles require adequate protein to repair micro-tears and rebuild tissue, a process facilitated by the fast-digesting nature of whey proteins. WPIs, in particular, with their high protein content and minimal lactose and fat, are favored for their ability to deliver a concentrated dose of protein without unnecessary calories or carbohydrates, making them ideal for supporting lean muscle development.

- The efficacy of whey protein in sports nutrition is bolstered by extensive scientific research demonstrating its benefits in enhancing muscle protein synthesis and improving recovery times. Studies consistently show that supplementing with whey protein post-exercise helps athletes recover faster from workouts, reduce muscle soreness, and maintain overall muscle integrity. This scientific validation has solidified whey protein's reputation as a staple in athletic diets globally, where athletes rely on its nutritional advantages to optimize their performance and achieve their fitness goals. Beyond muscle recovery, whey protein also supports immune function and overall health, contributing to its widespread adoption among elite athletes and recreational fitness enthusiasts alike.

- The sports nutrition market continues to evolve with innovations in product formulations and delivery systems, catering to diverse consumer preferences and dietary needs. Whey protein supplements are available in various forms such as powders, bars, and ready-to-drink beverages, providing convenient options for athletes to incorporate protein into their daily routines. As the demand for effective sports nutrition solutions grows, whey protein's role as a trusted and scientifically-backed ingredient remains pivotal in meeting the nutritional demands of active individuals seeking optimal performance and recovery.

Whey Protein Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America's dominance in the whey protein market is underpinned by several key factors that collectively drive its robust growth trajectory. The region boasts a pervasive fitness culture, where individuals prioritize physical health and wellness, leading to a substantial demand for nutritional supplements like whey protein. This cultural emphasis on fitness, coupled with increasing awareness about the benefits of protein supplementation in muscle recovery and overall health, significantly boosts market uptake.

- The United States stands out within North America as the frontrunner in whey protein consumption. With one of the highest per capita consumption rates globally, the U.S. market benefits from a mature health and wellness industry supported by extensive research and development in nutrition science. The country's affluent consumer base, comprising fitness enthusiasts, athletes, and health-conscious individuals, drives continuous innovation in sports nutrition products, including whey protein powders, bars, and ready-to-drink formulations

- Moreover, the well-established retail infrastructure and distribution networks in the United States facilitate widespread availability of whey protein products across various channels, from specialty stores to online platforms. Brands capitalize on consumer trust in quality and efficacy, often leveraging endorsements from athletes and fitness influencers to bolster product credibility. As the market continues to evolve, technological advancements in manufacturing processes and formulations ensure that whey protein products meet the diverse needs and preferences of American consumers, sustaining the market's leadership position in North America and globally.

Active Key Players in the Whey Protein Market

- Hilmar Cheese Company, Inc.

- Saputo Inc.

- Glanbia plc

- Fonterra Co-operative Group Ltd.

- Arla Foods

- Alpavit

- Wheyco GmbH

- Milk Specialties

- Carbery Group

- LACTALIS Ingredients

- Olam International

- Davisco Foods International, Inc.

- Milkaut SA

- Leprino Foods Company

- Maple Island, Inc.

- Nestle S.A.

- Nutricia (Danone)

- Abbott

- Sanofi S.A.

- Other Key Players

Key Industry Developments in the Whey Protein Market:

- In November 2023, FrieslandCampina Ingredients, a leading global protein supplier, announced the launch of Nutri Whey ProHeat. The company's new ingredient is microparticulated and heat-stable, designed for the medical nutrition market.

- In January 2023, Molvest Group announced the launch of its all-new milk protein concentrate manufacturing plant in Russia to cut down on import dependency.

|

Global Whey Protein Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.51 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.57% |

Market Size in 2032: |

USD 16.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Whey Protein Market by Type

4.1 Whey Protein Market Snapshot and Growth Engine

4.2 Whey Protein Market Overview

4.3 Whey Protein Isolates (WPI)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Whey Protein Isolates (WPI): Geographic Segmentation Analysis

4.4 Whey Protein Concentrates (WPC)

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Whey Protein Concentrates (WPC): Geographic Segmentation Analysis

4.5 Whey Protein Hydrolysates (WPH)

4.5.1 Introduction and Market Overview

4.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.5.3 Key Market Trends, Growth Factors and Opportunities

4.5.4 Whey Protein Hydrolysates (WPH): Geographic Segmentation Analysis

Chapter 5: Whey Protein Market by Application

5.1 Whey Protein Market Snapshot and Growth Engine

5.2 Whey Protein Market Overview

5.3 Sports Nutrition

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Sports Nutrition: Geographic Segmentation Analysis

5.4 Dietary Supplements

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Dietary Supplements: Geographic Segmentation Analysis

5.5 Infant Formula

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Infant Formula: Geographic Segmentation Analysis

5.6 Food Additives

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Food Additives: Geographic Segmentation Analysis

5.7 Beverages & Feed

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Beverages & Feed: Geographic Segmentation Analysis

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Whey Protein Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 HILMAR CHEESE COMPANY INC

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 SAPUTO INC

6.4 GLANBIA PLC

6.5 FONTERRA CO-OPERATIVE GROUP LTD

6.6 ARLA FOODS

6.7 ALPAVIT

6.8 WHEYCO GMBH

6.9 MILK SPECIALTIES

6.10 CARBERY GROUP

6.11 LACTALIS INGREDIENTS

6.12 OLAM INTERNATIONAL

6.13 DAVISCO FOODS INTERNATIONAL INC

6.14 MILKAUT SA

6.15 LEPRINO FOODS COMPANY

6.16 MAPLE ISLAND INC

6.17 NESTLE S A

6.18 NUTRICIA

6.19 ABBOTT

6.20 SANOFI S A

6.21 OTHER ACTIVE PLAYERS

Chapter 7: Global Whey Protein Market By Region

7.1 Overview

7.2. North America Whey Protein Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size By Type

7.2.4.1 Whey Protein Isolates (WPI)

7.2.4.2 Whey Protein Concentrates (WPC)

7.2.4.3 Whey Protein Hydrolysates (WPH)

7.2.5 Historic and Forecasted Market Size By Application

7.2.5.1 Sports Nutrition

7.2.5.2 Dietary Supplements

7.2.5.3 Infant Formula

7.2.5.4 Food Additives

7.2.5.5 Beverages & Feed

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Whey Protein Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size By Type

7.3.4.1 Whey Protein Isolates (WPI)

7.3.4.2 Whey Protein Concentrates (WPC)

7.3.4.3 Whey Protein Hydrolysates (WPH)

7.3.5 Historic and Forecasted Market Size By Application

7.3.5.1 Sports Nutrition

7.3.5.2 Dietary Supplements

7.3.5.3 Infant Formula

7.3.5.4 Food Additives

7.3.5.5 Beverages & Feed

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Bulgaria

7.3.6.2 The Czech Republic

7.3.6.3 Hungary

7.3.6.4 Poland

7.3.6.5 Romania

7.3.6.6 Rest of Eastern Europe

7.4. Western Europe Whey Protein Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size By Type

7.4.4.1 Whey Protein Isolates (WPI)

7.4.4.2 Whey Protein Concentrates (WPC)

7.4.4.3 Whey Protein Hydrolysates (WPH)

7.4.5 Historic and Forecasted Market Size By Application

7.4.5.1 Sports Nutrition

7.4.5.2 Dietary Supplements

7.4.5.3 Infant Formula

7.4.5.4 Food Additives

7.4.5.5 Beverages & Feed

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 Netherlands

7.4.6.5 Italy

7.4.6.6 Russia

7.4.6.7 Spain

7.4.6.8 Rest of Western Europe

7.5. Asia Pacific Whey Protein Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size By Type

7.5.4.1 Whey Protein Isolates (WPI)

7.5.4.2 Whey Protein Concentrates (WPC)

7.5.4.3 Whey Protein Hydrolysates (WPH)

7.5.5 Historic and Forecasted Market Size By Application

7.5.5.1 Sports Nutrition

7.5.5.2 Dietary Supplements

7.5.5.3 Infant Formula

7.5.5.4 Food Additives

7.5.5.5 Beverages & Feed

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Whey Protein Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size By Type

7.6.4.1 Whey Protein Isolates (WPI)

7.6.4.2 Whey Protein Concentrates (WPC)

7.6.4.3 Whey Protein Hydrolysates (WPH)

7.6.5 Historic and Forecasted Market Size By Application

7.6.5.1 Sports Nutrition

7.6.5.2 Dietary Supplements

7.6.5.3 Infant Formula

7.6.5.4 Food Additives

7.6.5.5 Beverages & Feed

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkey

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Whey Protein Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size By Type

7.7.4.1 Whey Protein Isolates (WPI)

7.7.4.2 Whey Protein Concentrates (WPC)

7.7.4.3 Whey Protein Hydrolysates (WPH)

7.7.5 Historic and Forecasted Market Size By Application

7.7.5.1 Sports Nutrition

7.7.5.2 Dietary Supplements

7.7.5.3 Infant Formula

7.7.5.4 Food Additives

7.7.5.5 Beverages & Feed

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Whey Protein Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 6.51 Bn. |

|

Forecast Period 2024-32 CAGR: |

10.57% |

Market Size in 2032: |

USD 16.08 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Whey Protein Market research report is 2024-2032.

Hilmar Cheese Company, Inc.; Saputo Inc.; Glanbia plc; Fonterra Co-operative Group Ltd.; Arla Foods; Alpavit; Wheyco GmbH; Milk Specialties; Carbery Group; LACTALIS Ingredients; Olam International; Davisco Foods International, Inc.; Milkaut SA; Leprino Foods Company; Maple Island Inc., Nestle S.A, Nutricia (Danone), Abbott, Sanofi S.A. and Other Major Players.

The Whey Protein Market is segmented into By Type, By Application and region. By Type, the market is categorized into Whey Protein Isolates (WPI), Whey Protein Concentrates (WPC) and Whey Protein Hydrolysates (WPH). By Application, the market is categorized into Sports Nutrition, Dietary Supplements, Infant Formula, Food Additives, Beverages and Feed. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The whey protein market encompasses the production, distribution, and sale of whey protein, a high-quality protein derived from milk during the cheese-making process. Whey protein is widely recognized for its complete amino acid profile and rapid digestibility, making it a popular supplement for muscle building, weight management, and overall health. The market includes various forms such as concentrates, isolates, and hydrolysates, catering to diverse consumer needs ranging from athletic performance to dietary supplementation. Key players in this market focus on product innovation, quality enhancement, and expanding their consumer base across sports nutrition, functional foods, and dietary supplements segments.

Whey Protein Market Size is Valued at USD 6.51 Billion in 2023, and is Projected to Reach USD 16.08 Billion by 2032, Growing at a CAGR of 10.57% From 2024-2032.