Waste To Energy Market Synopsis

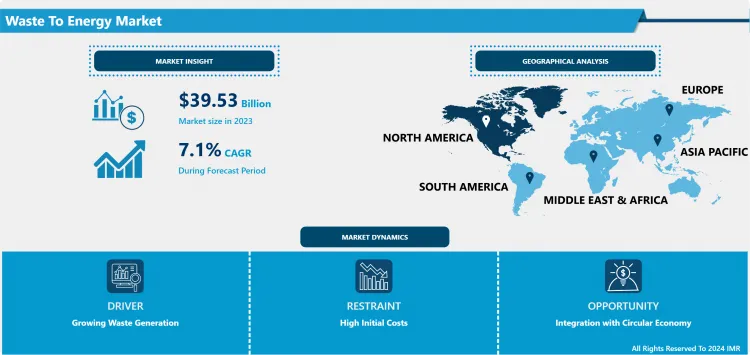

Waste To Energy Market Size Was Valued at USD 39.53 Billion in 2023, and is Projected to Reach USD 73.29 Billion by 2032, Growing at a CAGR of 7.10% From 2024-2032.

The Waste to Energy (WtE) market involves the conversion of non-recyclable waste materials into usable heat, electricity, or fuel through various technologies such as incineration, gasification, and anaerobic digestion. This process not only reduces the volume of waste in landfills but also generates energy, contributing to sustainable waste management and renewable energy solutions. The WtE market is driven by increasing waste generation, growing energy demand, and rising environmental concerns, making it a crucial component in advancing circular economy principles and reducing greenhouse gas emissions.

- The Waste to Energy (WtE) market is a rapidly growing sector driven by increasing waste generation and the need for sustainable waste management solutions. As urbanization and industrialization continue to expand, the volume of waste produced has surged, leading to significant environmental and disposal challenges. WtE technologies, including incineration, gasification, and anaerobic digestion, offer effective solutions by converting waste into valuable energy, thus addressing waste disposal issues while generating electricity and heat. Governments and municipalities are increasingly adopting WtE systems to reduce landfill use, decrease greenhouse gas emissions, and achieve energy security. The market is bolstered by supportive policies and incentives aimed at promoting renewable energy and reducing carbon footprints. Additionally, advancements in WtE technologies, such as improved efficiency and reduced emissions, are enhancing the attractiveness of these systems. Key players in the market include major waste management companies and technology providers who are investing in research and development to enhance the performance and sustainability of WtE solutions. Despite challenges such as high initial capital costs and public opposition, the WtE market is expected to witness robust growth as nations seek to address waste management issues and transition towards a circular economy.

Waste To Energy Market Trend Analysis

Emphasis on Sustainability and Circular Economy Driving Growth in Waste to Energy Technologies

- The increasing emphasis on sustainability and circular economy principles is a pivotal trend shaping the Waste to Energy (WtE) market. As global awareness of environmental issues grows, there is a concerted push towards reducing reliance on landfills and mitigating greenhouse gas emissions. This shift is reflected in the adoption of WtE technologies, which offer a practical solution for managing waste while simultaneously generating energy. By converting waste into usable energy, WtE technologies help address two critical challenges: waste management and energy production. This dual benefit aligns with broader sustainability goals, fostering a circular economy where waste is not merely discarded but repurposed to create value.

- Governments and municipalities are at the forefront of this transition, implementing regulatory frameworks and incentives designed to support WtE initiatives. Policies aimed at minimizing landfill use, such as landfill diversion mandates and waste-to-energy targets, are encouraging the deployment of WtE technologies. Financial incentives, such as subsidies and tax credits, are also being provided to offset initial investment costs and encourage private sector participation. These measures are crucial in driving the adoption of WtE systems, ensuring that waste is effectively managed and converted into energy, thereby contributing to a more sustainable and circular economic model.

Technological Advancements Enhancing Efficiency and Effectiveness in Waste to Energy Sector

- Technological advancements are revolutionizing the Waste to Energy (WtE) sector, significantly enhancing the efficiency and effectiveness of waste conversion processes. Innovations in combustion technologies, such as advanced grate and fluidized bed combustion systems, have improved energy recovery rates and reduced emissions. Meanwhile, gasification technologies are enabling the conversion of waste into syngas, which can be used to generate electricity or produce valuable chemicals. These advancements have made WtE plants more versatile and capable of handling a broader range of waste types, contributing to their increased efficiency and output.

- Similarly, progress in anaerobic digestion technologies is enhancing the ability to convert organic waste into biogas and digestate. Modern anaerobic digesters are more efficient and capable of processing higher volumes of organic waste, resulting in increased biogas production and improved waste stabilization. These technological improvements not only boost the economic viability of WtE plants by increasing energy production and reducing operational costs but also enhance their environmental performance by minimizing waste and lowering greenhouse gas emissions. As a result, these innovations are driving the sector's growth and reinforcing the role of WtE technologies in sustainable waste management and energy generation.

Waste To Energy Market Segment Analysis:

Waste To Energy Market Segmented based on By Technology, By Waste Type and By Application

By Technology, Thermochemical segment is expected to dominate the market during the forecast period

- Thermochemical technologies are pivotal in the waste-to-energy sector due to their robust efficiency in converting diverse types of waste into valuable energy forms. These technologies encompass incineration, gasification, and pyrolysis, each of which plays a crucial role in addressing various waste management needs. Incineration, the most established among them, is extensively used for processing municipal solid waste (MSW) and industrial by-products. This method involves burning waste at high temperatures, leading to the generation of heat and electricity. Its ability to handle large volumes of waste while significantly reducing the waste volume through ash and gases makes it a preferred choice for urban and industrial areas. Incineration not only alleviates the pressure on landfills but also contributes to energy recovery, thereby supporting sustainable waste management practices.

- Gasification and pyrolysis, while less prevalent than incineration, also offer substantial benefits in waste-to-energy applications. Gasification converts waste into syngas (a mixture of hydrogen and carbon monoxide) at high temperatures in a low-oxygen environment. This syngas can be used to produce electricity or as a feedstock for further chemical processes. Pyrolysis, on the other hand, involves heating waste in the absence of oxygen to produce bio-oil, syngas, and char. These products can be utilized for energy generation or as raw materials in various industries. Both technologies provide valuable alternatives to incineration, particularly for handling heterogeneous waste streams and producing cleaner energy outputs. Collectively, thermochemical methods are integral to advancing waste-to-energy solutions, enabling efficient waste processing while mitigating environmental impacts.

By Application, Electricity segment held the largest share in 2023

- The production of electricity from waste stands as the largest application segment within the waste-to-energy sector due to its significant impact on both energy and waste management strategies. Thermochemical methods, such as incineration and gasification, are particularly adept at converting various waste materials into electrical power. Incineration involves the combustion of waste at high temperatures, which generates steam that drives turbines to produce electricity. This process not only helps in managing the volume of municipal solid waste and industrial by-products but also contributes to reducing reliance on fossil fuels by providing a renewable source of energy. The widespread adoption of incineration for electricity generation is fueled by its ability to offer a steady and controllable energy output, making it a reliable option for many urban areas and industrial facilities.

- Gasification, another prominent thermochemical technology, converts waste into a synthesis gas (syngas) through partial oxidation at high temperatures. This syngas can then be used in gas engines or turbines to generate electricity. Gasification is particularly beneficial for its ability to handle a variety of waste types and produce cleaner energy compared to traditional incineration. The demand for electricity generated from waste is increasingly driven by the need for sustainable and renewable energy sources amidst growing environmental concerns. As the push for greener energy solutions intensifies, waste-to-energy technologies that focus on electricity production are poised to play a crucial role in addressing both energy needs and waste management challenges. This dual benefit enhances their appeal and drives continued investment and development in this sector.

Waste To Energy Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America stands out as a leading force in the Waste to Energy (WtE) market, with the United States spearheading the adoption of these technologies. The country's commitment to minimizing landfill waste and expanding its renewable energy portfolio drives significant market momentum. As municipalities and industries seek effective waste management solutions, WtE technologies offer a compelling option by converting waste into valuable energy resources. This approach not only reduces landfill dependency but also supports sustainability goals. Advanced WtE technologies, including state-of-the-art incineration and anaerobic digestion systems, are being increasingly implemented, supported by substantial investments in infrastructure. These investments help in developing and upgrading WtE facilities, ensuring they meet modern efficiency and environmental standards.

- The favorable market environment in the United States is further enhanced by stringent environmental regulations and government incentives. Federal and state-level policies aim to reduce greenhouse gas emissions and encourage the use of renewable energy sources, creating a supportive landscape for WtE projects. Incentives such as tax credits, grants, and subsidies for renewable energy and waste management initiatives contribute to the financial viability of WtE investments. Additionally, local governments are increasingly integrating WtE solutions into their waste management strategies, driven by the dual objectives of reducing waste and generating clean energy. This comprehensive regulatory and financial support fosters continued growth and innovation in the North American WtE market.

Active Key Players in the Waste To Energy Market

- Veolia (France)

- Huawei Enterprise (China)

- China Everbright Limited (China)

- Wheelabrator Technologies Inc. (New Hampshire)

- SUEZ (Paris)

- Covanta (U.S.)

- EDF (France)

- Ramboll Group (Denmark)

- AVR (Rotterdam-Botlek)

- Allseas (Switzerland)

- Attero (India)

- Viridor (U.K.)

- Other Key Players

Key Industry Developments in the Waste To Energy Market:

- June 2022 – AVR decided to explore the possibility of locally managing its hazardous flue gas cleaning residues by partnering with Swedish company HaloSep AB. The HaloSep operation is a distinct solution that turns hazardous waste into harmless and helpful snatches. Choosing HaloSep's solution would make AVR in Rotterdam more circular by recovering material resources and reducing the plant's environmental footprint.

- June 2022 – Veolia tendered the sales of Suez's U.K. waste business segment and continues to build the global pioneer of ecological transformation. The project focuses on ecological change by bringing together Veolia and most of Suez's international activities. The merger has already proved to help add new skills, technologies, and regions. Additionally, it will speed up the execution of the strategic program Impact 2023, strengthen Veolia's international presence, and increase invocation capacity.

|

Global Waste To Energy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 39.53 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.10% |

Market Size in 2032: |

USD 73.29 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Waste Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Waste To Energy Market by Technology

4.1 Waste To Energy Market Snapshot and Growth Engine

4.2 Waste To Energy Market Overview

4.3 Thermochemical

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.3.3 Key Market Trends, Growth Factors and Opportunities

4.3.4 Thermochemical: Geographic Segmentation Analysis

4.4 Biochemical

4.4.1 Introduction and Market Overview

4.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

4.4.3 Key Market Trends, Growth Factors and Opportunities

4.4.4 Biochemical: Geographic Segmentation Analysis

Chapter 5: Waste To Energy Market by Waste Type

5.1 Waste To Energy Market Snapshot and Growth Engine

5.2 Waste To Energy Market Overview

5.3 Municipal Solid Waste

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Municipal Solid Waste: Geographic Segmentation Analysis

5.4 Process Waste

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Process Waste: Geographic Segmentation Analysis

5.5 Agriculture Waste

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Agriculture Waste: Geographic Segmentation Analysis

5.6 Others

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Others: Geographic Segmentation Analysis

Chapter 6: Waste To Energy Market by Application

6.1 Waste To Energy Market Snapshot and Growth Engine

6.2 Waste To Energy Market Overview

6.3 Electricity

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Electricity: Geographic Segmentation Analysis

6.4 Heat

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size in Value USD and Volume Units (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Heat: Geographic Segmentation Analysis

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Waste To Energy Market Share by Manufacturer (2023)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 VEOLIA (FRANCE)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 HUAWEI ENTERPRISE (CHINA)

7.4 CHINA EVERBRIGHT LIMITED (CHINA)

7.5 WHEELABRATOR TECHNOLOGIES INC (NEW HAMPSHIRE)

7.6 SUEZ (PARIS)

7.7 COVANTA (U.S.)

7.8 EDF (FRANCE)

7.9 RAMBOLL GROUP (DENMARK)

7.10 AVR (ROTTERDAM-BOTLEK)

7.11 ALLSEAS (SWITZERLAND)

7.12 ATTERO (INDIA)

7.13 VIRIDOR (U.K.)

7.14 OTHER MAJOR PLAYERS

Chapter 8: Global Waste To Energy Market By Region

8.1 Overview

8.2 . North America Waste To Energy Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size By Technology

8.2.4.1 Thermochemical

8.2.4.2 Biochemical

8.2.5 Historic and Forecasted Market Size By Waste Type

8.2.5.1 Municipal Solid Waste

8.2.5.2 Process Waste

8.2.5.3 Agriculture Waste

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size By Application

8.2.6.1 Electricity

8.2.6.2 Heat

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3 . Eastern Europe Waste To Energy Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size By Technology

8.3.4.1 Thermochemical

8.3.4.2 Biochemical

8.3.5 Historic and Forecasted Market Size By Waste Type

8.3.5.1 Municipal Solid Waste

8.3.5.2 Process Waste

8.3.5.3 Agriculture Waste

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size By Application

8.3.6.1 Electricity

8.3.6.2 Heat

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Bulgaria

8.3.7.2 The Czech Republic

8.3.7.3 Hungary

8.3.7.4 Poland

8.3.7.5 Romania

8.3.7.6 Rest of Eastern Europe

8.4 . Western Europe Waste To Energy Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size By Technology

8.4.4.1 Thermochemical

8.4.4.2 Biochemical

8.4.5 Historic and Forecasted Market Size By Waste Type

8.4.5.1 Municipal Solid Waste

8.4.5.2 Process Waste

8.4.5.3 Agriculture Waste

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size By Application

8.4.6.1 Electricity

8.4.6.2 Heat

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 Netherlands

8.4.7.5 Italy

8.4.7.6 Russia

8.4.7.7 Spain

8.4.7.8 Rest of Western Europe

8.5 . Asia Pacific Waste To Energy Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size By Technology

8.5.4.1 Thermochemical

8.5.4.2 Biochemical

8.5.5 Historic and Forecasted Market Size By Waste Type

8.5.5.1 Municipal Solid Waste

8.5.5.2 Process Waste

8.5.5.3 Agriculture Waste

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size By Application

8.5.6.1 Electricity

8.5.6.2 Heat

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6 . Middle East & Africa Waste To Energy Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size By Technology

8.6.4.1 Thermochemical

8.6.4.2 Biochemical

8.6.5 Historic and Forecasted Market Size By Waste Type

8.6.5.1 Municipal Solid Waste

8.6.5.2 Process Waste

8.6.5.3 Agriculture Waste

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size By Application

8.6.6.1 Electricity

8.6.6.2 Heat

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkey

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7 . South America Waste To Energy Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size By Technology

8.7.4.1 Thermochemical

8.7.4.2 Biochemical

8.7.5 Historic and Forecasted Market Size By Waste Type

8.7.5.1 Municipal Solid Waste

8.7.5.2 Process Waste

8.7.5.3 Agriculture Waste

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size By Application

8.7.6.1 Electricity

8.7.6.2 Heat

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Waste To Energy Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2024: |

USD 39.53 Bn. |

|

Forecast Period 2024-32 CAGR: |

7.10% |

Market Size in 2032: |

USD 73.29 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Waste Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||