Virtual Office Market Synopsis

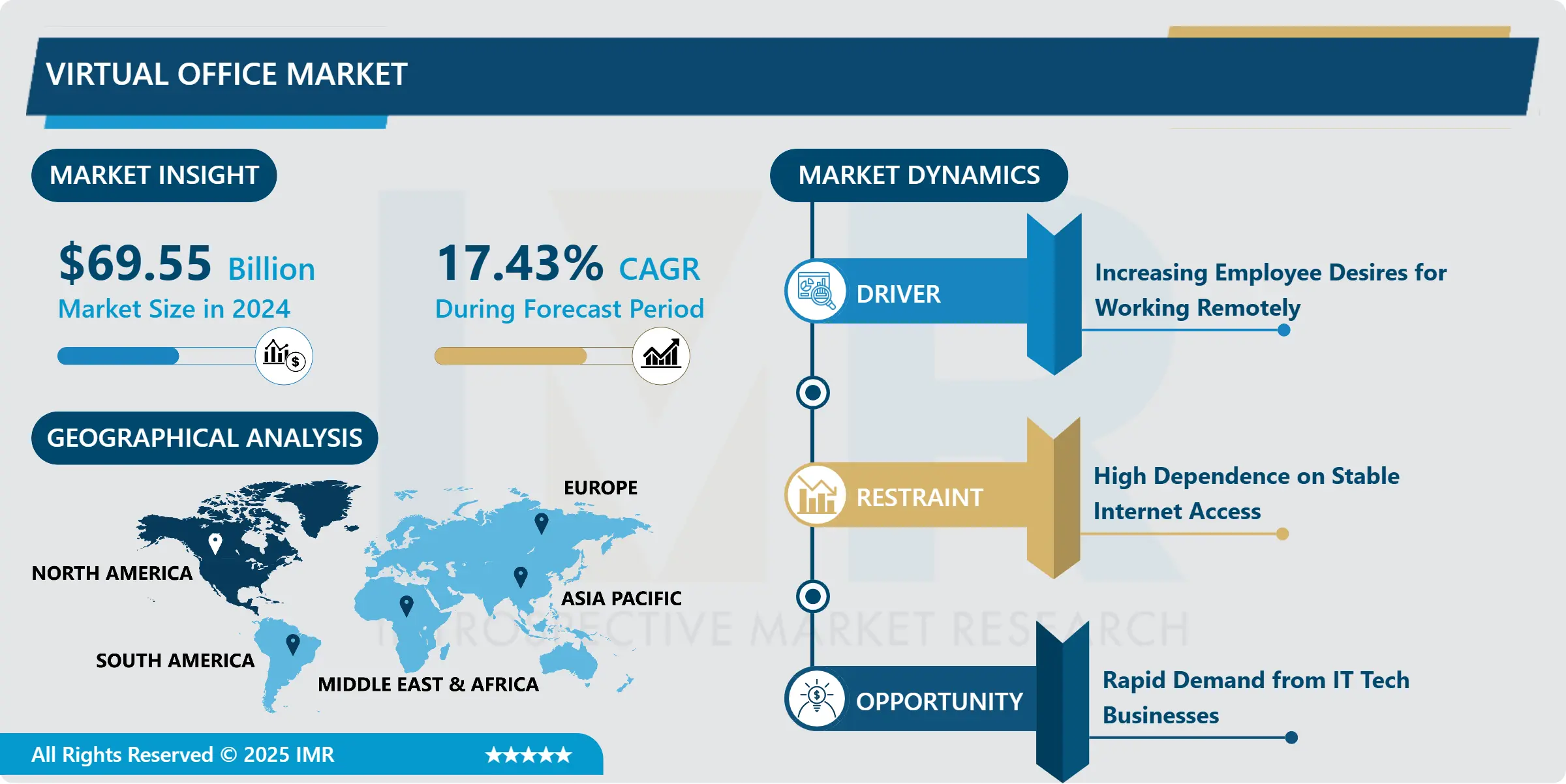

Virtual Office Market Size Was Valued at USD 69.55 Billion in 2024, and is Projected to Reach USD 251.50 Billion by 2032, Growing at a CAGR of 17.43% From 2025-2032.

Virtual offices offer a comprehensive solution for remote work, enabling employees and business owners to work from any location with internet access. This flexibility is crucial for the modern workforce, allowing professionals to maintain productivity without being tied to a physical office space. The virtual office provides essential business functions accessible online, ensuring seamless communication, collaboration, and task management.

Organizations benefit from the ability to establish and maintain a professional presence without the financial burden of renting physical office space. Virtual offices eliminate the need for traditional brick-and-mortar locations, saving businesses significant costs associated with leases, utilities, and maintenance. This cost-effective approach is particularly appealing to freelancers and entrepreneurs, allowing them to allocate resources more efficiently while still enjoying essential services like mailing addresses, phone answering, and meeting room access.

For freelancers and entrepreneurs working from home, a virtual business address provided by virtual offices enhances credibility by presenting a professional image. This professional address is instrumental in building trust with clients and partners. Moreover, virtual offices offer valuable services such as phone answering and meeting room facilities, contributing to a business's accessibility and professionalism. The virtual office becomes a strategic tool for attracting customers and partners, creating a positive impression, and fostering business success.

Virtual Office Market Trend Analysis

Virtual Office Market Trend Analysis

Increasing Employee Desires for Working Remotely

- The increasing desire for remote work among employees is driven by a shift in work-life preferences. Modern professionals prioritize a flexible work environment that allows for a better balance between personal and professional life. Working remotely through virtual offices caters to this desire, providing employees with the autonomy to choose where they work. As work-life integration becomes more crucial, the virtual office market responds to the evolving needs of employees who seek a remote work setup that aligns with their lifestyle choices.

- Advancements in technology and improved connectivity play a pivotal role in fueling the demand for virtual offices. High-speed internet, collaborative platforms, and communication tools facilitate seamless remote work experiences. Employees now can work efficiently from various locations without compromising productivity. This technological empowerment enhances the appeal of virtual offices, making them a preferred choice for businesses seeking to attract and retain talent.

-

Rapid Demand from IT Tech Businesses

- The rapid demand for virtual offices from IT tech businesses stems from the nature of their operations, often characterized by agile project teams and remote collaboration. Virtual offices provide an ideal solution for IT professionals who need a flexible and collaborative workspace. These businesses can establish a virtual presence, allowing their teams to work seamlessly from different locations while maintaining essential services like professional mailing addresses and virtual meeting rooms. This agility aligns with the dynamic requirements of IT and tech companies that frequently engage in project-based work.

- Virtual offices offer IT tech businesses a cost-effective alternative to traditional office setups. With the demand for skilled IT professionals transcending geographical boundaries, companies can leverage virtual offices to establish a global presence without the overhead costs of physical office spaces. This scalability is particularly advantageous for startups and growing tech firms, allowing them to allocate resources strategically while projecting a professional image.

Virtual Office Market Segment Analysis:

Virtual Office Market Segmented on the basis of type, Service Type, and Application.

By Type, Cloud-Based segment is expected to dominate the market during the forecast period

- The dominance of the cloud-based segment in the virtual office market can be attributed to the inherent advantages of cloud technology. Cloud-based virtual office solutions offer unparalleled accessibility and flexibility, allowing users to access their virtual office services from anywhere with an internet connection. This aligns perfectly with the remote work trends and the evolving preferences of businesses for agile, location-independent operations. Cloud-based virtual offices enable seamless collaboration and communication among distributed teams, making them a preferred choice for organizations seeking a dynamic and adaptable workspace solution.

- Cloud-based virtual offices provide a scalable and cost-effective alternative for businesses of all sizes. The scalability of cloud solutions allows organizations to easily adjust their virtual office services based on changing requirements, whether they are scaling up or down. Moreover, the pay-as-you-go model often associated with cloud services ensures that businesses only pay for the resources they consume, eliminating the need for significant upfront investments.

By Application, Small and Medium-sized Enterprises (SMEs) segment held the largest share of 43.8% in 2022

- Small and Medium-sized Enterprises (SMEs) favor virtual offices due to the cost-efficiency they provide. For SMEs, allocating resources strategically is crucial, and virtual offices offer an affordable solution compared to maintaining physical office spaces. By opting for virtual offices, SMEs can establish a professional business address, access services like call answering and mail forwarding, and benefit from virtual meeting spaces without the significant overhead costs associated with traditional office setups. This cost-effectiveness allows SMEs to enhance their operational efficiency and invest resources in core business activities.

- SMEs often operate in dynamic environments, requiring agility and adaptability to respond to market changes quickly. Virtual offices cater to these needs by providing SMEs with a flexible and scalable workspace solution. SMEs can easily expand or contract their virtual office services based on business requirements, accommodating growth without the constraints of a fixed physical location.

Virtual Office Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America's virtual office market is considered mature, primarily due to its early adoption and the presence of well-established players such as Regus and Servcorp. The maturity of the market indicates that virtual office solutions have been prevalent in the region for an extended period. With a robust infrastructure and a history of successful implementations, businesses in North America are more inclined to explore and invest in virtual office services. The presence of these established players also contributes to a competitive landscape, encouraging a focus on customization to meet the diverse and evolving needs of businesses in the region.

- The high adoption rate of virtual office solutions in North America is accompanied by a diverse range of business requirements. Corporations and startups in the region have varied needs when it comes to virtual offices, ranging from basic services like mail forwarding to advanced technology integrations. To address this diversity, the market places a significant emphasis on customization. Virtual office providers recognize the importance of tailoring their services to meet the specific demands of different businesses. This focus on customization ensures that virtual office solutions can be adapted to various industries, company sizes, and technological preferences, allowing businesses in North America to leverage virtual offices in a way that aligns precisely with their unique operational requirements.

Virtual Office Market Top Key Players:

- Executive Suites (United States)

- WeWork (United States)

- Alliance Virtual Offices (United States)

- BusinessLink (United States)

- Serviced Offices (United States)

- NoMad CoWork (United States)

- Alpha Offices (United States)

- Breather (United States)

- Regus (Luxembourg)

- Office Space International (United Kingdom)

- Spaces (Netherlands)

- IWG Plc (United Kingdom)

- The Regus Group (Luxembourg)

- Uncommon Capital (United Kingdom)

- Office Hub (Australia)

- Instant Offices (United Kingdom)

- Servcorp(Australia)

- Compass Offices (Hong Kong)

- The Executive Centre (Hong Kong)

- Vserv Virtual Offices (India)

- Coworking India (India)

- Worklane (Belgium)

- Mindspace (Israel)

- Landmark Group (United Arab Emirates)

- The Hive (Hong Kong)

- Other Active Players

Key Industry Developments in the Virtual Office Market:

- In June 2023, The Great Room by Industrious has expanded into the Australian market with the opening of its first location in Sydney’s CBD. Partnering with 151 Property, the premium hospitality-led coworking space debuted at Level 29, 85 Castlereagh Street, spanning 1,200 sqm. The space featured 35 dedicated offices and enterprise customized areas, offering the signature comfort, aesthetics, and performance of The Great Room brand, with views of Hyde Park.

- In July 2023, Instacart, a leading grocery aggregator, announced a partnership with Industrious, a coworking space provider with over 160 locations across 65 cities. The collaboration offered same-day delivery at all U.S. offices and free yearlong Instacart+ memberships to Industrious' business customers. This partnership aimed to attract employees back to the office by offering convenient perks for both small and large teams, addressing the growing interest in remote work.

|

Global Virtual Office Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 69.55 Bn. |

|

Forecast Period 2025-32 CAGR: |

17.43% |

Market Size in 2032: |

USD 251.50 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Service Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Virtual Office Market by Type (2018-2032)

4.1 Virtual Office Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Cloud-Based

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Web-Based

Chapter 5: Virtual Office Market by Service Type (2018-2032)

5.1 Virtual Office Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Call Answering Services

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Mail Forwarding

5.5 Virtual Assistant Services

Chapter 6: Virtual Office Market by Application (2018-2032)

6.1 Virtual Office Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Large Enterprises

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Small and Medium-sized Enterprises (SMEs)

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Virtual Office Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 CLOCKWISE OFFICES (UNITED KINGDOM)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 GORILLA PROPERTY SOLUTIONS (AUSTRALIA)

7.4 INSTANT (UNITED KINGDOM)

7.5 OREGA MANAGEMENT LTD (UNITED KINGDOM)

7.6 PRIME OFFICE SEARCH (CHINA)

7.7 REGUS (LUXEMBOURG)

7.8 SERVCORP (AUSTRALIA)

7.9 STARTUPS (UNITED KINGDOM)

7.10 THE WORK LOFT COLTD. (THAILAND)

7.11 OTHER KEY PLAYERS

7.12

Chapter 8: Global Virtual Office Market By Region

8.1 Overview

8.2. North America Virtual Office Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Type

8.2.4.1 Cloud-Based

8.2.4.2 Web-Based

8.2.5 Historic and Forecasted Market Size by Service Type

8.2.5.1 Call Answering Services

8.2.5.2 Mail Forwarding

8.2.5.3 Virtual Assistant Services

8.2.6 Historic and Forecasted Market Size by Application

8.2.6.1 Large Enterprises

8.2.6.2 Small and Medium-sized Enterprises (SMEs)

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Virtual Office Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Type

8.3.4.1 Cloud-Based

8.3.4.2 Web-Based

8.3.5 Historic and Forecasted Market Size by Service Type

8.3.5.1 Call Answering Services

8.3.5.2 Mail Forwarding

8.3.5.3 Virtual Assistant Services

8.3.6 Historic and Forecasted Market Size by Application

8.3.6.1 Large Enterprises

8.3.6.2 Small and Medium-sized Enterprises (SMEs)

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Virtual Office Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Type

8.4.4.1 Cloud-Based

8.4.4.2 Web-Based

8.4.5 Historic and Forecasted Market Size by Service Type

8.4.5.1 Call Answering Services

8.4.5.2 Mail Forwarding

8.4.5.3 Virtual Assistant Services

8.4.6 Historic and Forecasted Market Size by Application

8.4.6.1 Large Enterprises

8.4.6.2 Small and Medium-sized Enterprises (SMEs)

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Virtual Office Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Type

8.5.4.1 Cloud-Based

8.5.4.2 Web-Based

8.5.5 Historic and Forecasted Market Size by Service Type

8.5.5.1 Call Answering Services

8.5.5.2 Mail Forwarding

8.5.5.3 Virtual Assistant Services

8.5.6 Historic and Forecasted Market Size by Application

8.5.6.1 Large Enterprises

8.5.6.2 Small and Medium-sized Enterprises (SMEs)

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Virtual Office Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Type

8.6.4.1 Cloud-Based

8.6.4.2 Web-Based

8.6.5 Historic and Forecasted Market Size by Service Type

8.6.5.1 Call Answering Services

8.6.5.2 Mail Forwarding

8.6.5.3 Virtual Assistant Services

8.6.6 Historic and Forecasted Market Size by Application

8.6.6.1 Large Enterprises

8.6.6.2 Small and Medium-sized Enterprises (SMEs)

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Virtual Office Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Type

8.7.4.1 Cloud-Based

8.7.4.2 Web-Based

8.7.5 Historic and Forecasted Market Size by Service Type

8.7.5.1 Call Answering Services

8.7.5.2 Mail Forwarding

8.7.5.3 Virtual Assistant Services

8.7.6 Historic and Forecasted Market Size by Application

8.7.6.1 Large Enterprises

8.7.6.2 Small and Medium-sized Enterprises (SMEs)

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Global Virtual Office Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 69.55 Bn. |

|

Forecast Period 2025-32 CAGR: |

17.43% |

Market Size in 2032: |

USD 251.50 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Service Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||