Video Conferencing Equipment Market Synopsis

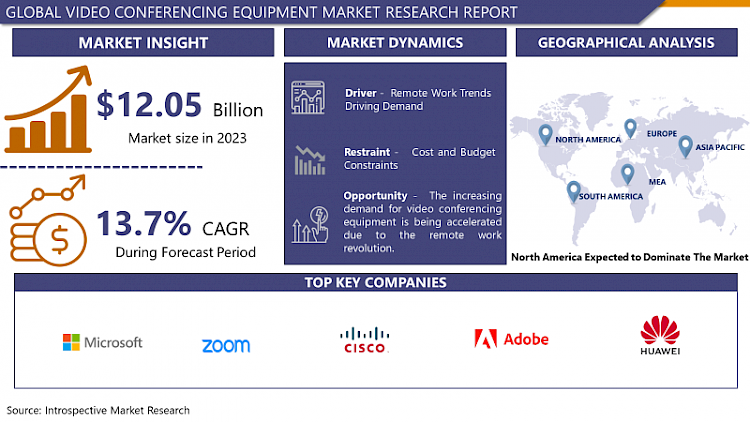

Video Conferencing Equipment Market Size Was Valued at USD 12.05 Billion in 2023, and is Projected to Reach USD 38.27 Billion by 2032, Growing at a CAGR of 13.7 % From 2024-2032.

Video conferencing equipment may be defined as physical and electronic devices which are utilized in facilitating videophone meetings between separate participants. This equipment often includes webcams, computers, headsets, microphones, speakers, and sometimes video monitors or large-screen televisions, plus software that allows people to communicate over the internet. Such systems provide participants with the ability to view each other, hear one another, and communicate in a real-time environment, which also promotes collaboration and the minimization of physical attendance requirements.

- The video conferencing equipment market has been skyrocketing in the last decade due to the rising trend of the remote work and virtual meeting tools. With people in different organizations across the globe adapting to the remote working systems, competent and enriching video-conferencing applications experienced a significant growth of the market.

- Some of the major trends that have enabled the video conferencing equipment market to flourish include technology. Optical improvements in video and audio resolution coupled with the introduction of shared meeting functionality including screen sharing, virtual backgrounds, live co-editing documents among others have personalized the video conferencing experience and made it more interactive and effective. there has been integration of the artificial intelligence (AI) and machine learning to add intelligent features such as automatic noise cancellation, facial recognition, and gesture controls that further enhance the quality and functionality of the video conferencing systems.

- COVID-19 pandemic was the key enabler for faster adoption of video conferencing solutions. With quarantine and working from home emerging as the new social and professional norms, business organizations, schools and universities, and healthcare organizations increasingly relied on video communication tools to continue operations, provide education, and offer medical care remotely. This increase in demand not only helped in the revenue collection of the video conferencing equipment vendors but also in the progress of innovation and development in the video conferencing equipment as many companies started giving much attention to research and development in order to fulfill the new and upcoming challenges.

- Another trend that has been registered in the video conferencing equipment market is a transition towards the cloud-based offering. Video conferencing is definitely more secure and reliable in the cloud due to the fact that the cloud solves such issues as easy scaling of the entire video conferencing infrastructure according to the demand for many organizations and, finally, we should not pay for those resources that we simply do not use. Further, as there is no local hardware, there is no hardware maintenance, hardware upgrade costs, or other associated hardware costs, which greatly reduces the total cost of ownership and makes cloud-based solutions appealing to businesses of all sizes.

- The growing trends and preferences towards adopting some form of ‘hybrid working’ – where employees are able to choose whether to work in the office or from home – is likely to continue to drive growth in the video conferencing equipment market. In an effort to ensure that participants connect and communicate seamlessly, whether they are in the same room or thousands of miles away, organizations will buy solutions that offer video conferencing capabilities alongside other collaboration and productivity tools like messaging interfaces, task management systems, and scheduling applications.

- There are still some minor issues in the field of video conferencing equipment market. The issue of security and privacy of organizations continues to receive a lot of attention particularly with regard to the increasing cases of hacks and incidents of information theft. Some vendors are integrating strong security capabilities like end-to-end encryption or multi-factor authentication alongside compliance certifications to address these concerns and gain the trust of the customers.

- The industry prospects for the video conferencing equipment market are favorable and the global market is expected to register significant growth due to technological progress, changes in the workplace and working conditions, and the development of solutions based on cloud technologies. Video communication will continue to be an essential factor in the business successes of organizations as they focus on promoting effective communication while embracing change in the new era of digitalization.

Video Conferencing Equipment Market Trend Analysis

Transition to Hybrid Work Environments Driving Demand for Flexible Solutions

- The global trend towards remote and flexible work arrangements and the subsequent transition towards hybrid work environments coupled with the great need for flexible solutions have significantly heightened the demand for the flexible video conferencing equipment market.

- While organizations transition into the hybrid workplace and many of their employees work from offices alongside those working remotely, there is an urgent demand for solutions that allow for interaction between both groups.

- This demand is responsible for the development in the sphere of the video conferencing technology; the accents are placed on the features, like a high–definition video and sound, the difficulty of integrating and using the framework of the collaboration platforms, the compatibility of devices and systems.

- Companies are looking for tools that can support the expanding and contracting workforce through the ability to add or remove users from a system as well as to provide varying levels of deployment across office environments, individual working spaces, and meeting rooms.

- The video conferencing equipment market continues to play an important role in the way organizations want to do business as we transition into a flexible, effective, and productive hybrid work culture..

The increasing demand for video conferencing equipment is being accelerated due to the remote work revolution.

- Due to the fact that the culture of the so-called “remote work revolution” has recently gained special popularity, there has been a sharp increase in orders for video conferencing equipment. The world continues to become a global village and work from home becoming a normal phenomenon, the importance of communication and collaboration software is inevitable. Video communication has become critical tools for organizations as they provide means for teams to communicate across the distances created by geography. This increase in the need for virtual meetings has encouraged organizations to incorporate advanced technology to improve the quality and consistency of online meetings. Some businesses are even investing in technology that can accurately mimic the in-person meeting experience such as High Definition cameras for screens, advanced audio, etc.

- The COVID-19 pandemic crash course on remote work has proven to be long-term, which means the demand for video conferencing will continue to rise in the future. As such, the market is expected to continue growing significantly in the coming years as increased adoption of video-conferencing equipment is being facilitated by the ever-increasing number of employees switching to remote working.

Video Conferencing Equipment Market Segment Analysis:

Video Conferencing Equipment Market is Segmented based on Type and Application.

By Type, Collaboration Room Endpoint segment is expected to dominate the market during the forecast period

- The video conferencing equipment market by type, two main categories emerge: Video Conferencing Systems and Personal Video Conferencing Devices. Collaboration Room Endpoints are generally designed for use in larger-sized rooms and are suitable for rooms of a size large enough to accommodate a conference room or boardroom.

- Usually these endpoints have high definition cameras, high quality microphone arrays and large displays to enable easy communication between participants. Video collaboration endpoints are targeted for use by one or two users in small meeting settings from users’ desktops or a home office.

- These features can be described as compacter designs, incorporating cameras and microphones, and are able to work with a variety of devices ranging from laptop computers to desktop computers to mobile phones.

- The demand for both types of endpoints is influenced by various factors like the rising trend of working from home or other remote locations, the trend of expanding their operations to new locations around the world, and the need for effective communication channels between geographically dispersed employees in today’s globalized workplaces.

- The progress of artificial intelligence and cloud technologies accelerated by the pandemic also keeps changing the video conferencing equipment market conditions and providing users with even more opportunities for the professional and everyday use of such devices.

By Application, Consulting/Professional Services segment held the largest share in 2023

- The global market for video conferencing equipment is highly fractured based on organizational use; it accounts for application across education- both public and private, consulting/ professional, government organizations, manufacturing, and finances sectors.

- Globally, in the recent past, the education sector has been at the forefront of adopting video conferencing equipment that is used to connect classrooms virtually; this is caused by the need for the education sector to integrate interesting ways of teaching and learning.

- With the need for real time and fluid interaction with clients and multinational teams, the consulting and professional services industry continues to be a key market for adoption of video conferencing solutions for virtual meetings or presentations. Video conferencing solution helps in Government agencies for remote working, agency communications & public services. In the industrial sector, video conferencing is used to carry out supply-chain management, resolve peripheral problems from a central location, and connect geographically separated groups in a factory.

- Like most financial institutions, video conferencing is used to hold clients meetings, provide remote consultations, and internal communication to keep efficient and clients satisfied.

- This helps to explain why video conferencing equipment has seen continuous adoption across numerous industries and applications and further demonstrates how the technology continues to develop and expand the video conferencing market.

Video Conferencing Equipment Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- It can be inferred that the market for video conferencing equipment in North America would continue to remain a significant leader. There are a number of reasons that contribute towards this projected supremacy such as some good technological foundation in the country, high penetration of advanced communication solutions coupled with establishment of many of the key market players. Moreover, the region’s busy business environment also enhances the demand for video conferencing equipment, apart from the rise of teleworking and working remotely online.

- The rise of the new style of work where people do their work both in person and remotely intensified the demand for meeting solutions, which North American providers are ready to meet on equal terms. Going forward, there will be a continued focus on making communications more efficient and dynamic, and this will ensure that North America remains the premier market for video conferencing equipment within the world, and the primary force for development of the concept of electronic meeting rooms in the future.

Active Key Players in the Video Conferencing Equipment Market

- Microsoft (US)

- Zoom Video Communications (US)

- Cisco (US)

- Adobe (US)

- Huawei (China)

- Avaya, Inc. (US)

- AWS (US)

- Google, LLC (US)

- HP (US)

- GoTo (US)

- Enghouse Systems (Canada)

- Pexip (Norway)

- Qumu Corporation (US)

- Sonic Foundry Inc. (US)

- Lifesize, Inc. (US)

- Kaltura Inc. (US)

- BlueJeans Network (US)

- Kollective Technology, Inc. (US)

- Other Key Players

Key Industry Developments in the Video Conferencing Equipment Market

- In March 2023: Zerify Inc., announced collaboration with SpeakSpace, LLC to boost its sales and increase brand recognition. The company offers cybersecurity solutions for video conferencing that help businesses in having secured communication.

- In February 2023: RingCentral, Inc., announced that it had entered into an expanded and extended strategic partnership with Avaya, Inc. They agreed to extend its multiyear partnership with an improved and aligned incentive structure to accelerate the migration to Avaya Cloud Office.

- In February 2023: Qualcomm Technologies, Inc. launched a new video conferencing solution with artificial intelligence capabilities to offer more immersive communication. The solution eliminates distractions and enhances user participation.

- In January 2023: New York-based Cordoniq, a smart video collaboration platform provider, announced a new offering for enterprise businesses to access secured video conferencing solutions beyond standard solutions.

|

Global Video Conferencing Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.05Bn. |

|

Forecast Period 2024-32 CAGR: |

13.7% |

Market Size in 2032: |

USD 38.27 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- VIDEO CONFERENCING EQUIPMENT MARKET BY TYPE (2017-2032)

- VIDEO CONFERENCING EQUIPMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COLLABORATION ROOM ENDPOINT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COLLABORATION PERSONAL ENDPOINT

- VIDEO CONFERENCING EQUIPMENT MARKET BY APPLICATION (2017-2032)

- VIDEO CONFERENCING EQUIPMENT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- EDUCATION - PUBLIC/PRIVATE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONSULTING/PROFESSIONAL SERVICES

- GOVERNMENT

- MANUFACTURING

- FINANCIAL SERVICES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- VIDEO CONFERENCING EQUIPMENT Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- MICROSOFT (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ZOOM VIDEO COMMUNICATIONS (US)

- CISCO (US)

- ADOBE (US)

- HUAWEI (CHINA)

- AVAYA, INC. (US)

- AWS (US)

- GOOGLE, LLC (US)

- HP (US)

- GOTO (US)

- ENGHOUSE SYSTEMS (CANADA)

- PEXIP (NORWAY)

- QUMU CORPORATION (US)

- SONIC FOUNDRY INC. (US)

- LIFESIZE, INC. (US)

- KALTURA INC. (US)

- BLUEJEANS NETWORK (US)

- KOLLECTIVE TECHNOLOGY, INC. (US)

- COMPETITIVE LANDSCAPE

- GLOBAL VIDEO CONFERENCING EQUIPMENT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Video Conferencing Equipment Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 12.05Bn. |

|

Forecast Period 2024-32 CAGR: |

13.7% |

Market Size in 2032: |

USD 38.27 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. VIDEO CONFERENCING EQUIPMENT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. VIDEO CONFERENCING EQUIPMENT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. VIDEO CONFERENCING EQUIPMENT MARKET COMPETITIVE RIVALRY

TABLE 005. VIDEO CONFERENCING EQUIPMENT MARKET THREAT OF NEW ENTRANTS

TABLE 006. VIDEO CONFERENCING EQUIPMENT MARKET THREAT OF SUBSTITUTES

TABLE 007. VIDEO CONFERENCING EQUIPMENT MARKET BY TYPE

TABLE 008. COLLABORATION ROOM ENDPOINT MARKET OVERVIEW (2016-2028)

TABLE 009. COLLABORATION PERSONAL ENDPOINT MARKET OVERVIEW (2016-2028)

TABLE 010. VIDEO CONFERENCING EQUIPMENT MARKET BY APPLICATION

TABLE 011. EDUCATION - PUBLIC/PRIVATE MARKET OVERVIEW (2016-2028)

TABLE 012. CONSULTING/PROFESSIONAL SERVICES MARKET OVERVIEW (2016-2028)

TABLE 013. GOVERNMENT MARKET OVERVIEW (2016-2028)

TABLE 014. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 015. FINANCIAL SERVICES MARKET OVERVIEW (2016-2028)

TABLE 016. COMPETITIVE LANDSCAPE: MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA VIDEO CONFERENCING EQUIPMENT MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA VIDEO CONFERENCING EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 019. N VIDEO CONFERENCING EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE VIDEO CONFERENCING EQUIPMENT MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE VIDEO CONFERENCING EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 022. VIDEO CONFERENCING EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC VIDEO CONFERENCING EQUIPMENT MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC VIDEO CONFERENCING EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 025. VIDEO CONFERENCING EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA VIDEO CONFERENCING EQUIPMENT MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA VIDEO CONFERENCING EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 028. VIDEO CONFERENCING EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA VIDEO CONFERENCING EQUIPMENT MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA VIDEO CONFERENCING EQUIPMENT MARKET, BY APPLICATION (2016-2028)

TABLE 031. VIDEO CONFERENCING EQUIPMENT MARKET, BY COUNTRY (2016-2028)

TABLE 032. CISCO(TANDBERG): SNAPSHOT

TABLE 033. CISCO(TANDBERG): BUSINESS PERFORMANCE

TABLE 034. CISCO(TANDBERG): PRODUCT PORTFOLIO

TABLE 035. CISCO(TANDBERG): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. POLYCOM: SNAPSHOT

TABLE 036. POLYCOM: BUSINESS PERFORMANCE

TABLE 037. POLYCOM: PRODUCT PORTFOLIO

TABLE 038. POLYCOM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. HUAWEI: SNAPSHOT

TABLE 039. HUAWEI: BUSINESS PERFORMANCE

TABLE 040. HUAWEI: PRODUCT PORTFOLIO

TABLE 041. HUAWEI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. ZTE: SNAPSHOT

TABLE 042. ZTE: BUSINESS PERFORMANCE

TABLE 043. ZTE: PRODUCT PORTFOLIO

TABLE 044. ZTE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. AVAYA (RADVISION): SNAPSHOT

TABLE 045. AVAYA (RADVISION): BUSINESS PERFORMANCE

TABLE 046. AVAYA (RADVISION): PRODUCT PORTFOLIO

TABLE 047. AVAYA (RADVISION): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. LIFESIZE: SNAPSHOT

TABLE 048. LIFESIZE: BUSINESS PERFORMANCE

TABLE 049. LIFESIZE: PRODUCT PORTFOLIO

TABLE 050. LIFESIZE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. VIDYO: SNAPSHOT

TABLE 051. VIDYO: BUSINESS PERFORMANCE

TABLE 052. VIDYO: PRODUCT PORTFOLIO

TABLE 053. VIDYO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. STARLEAF: SNAPSHOT

TABLE 054. STARLEAF: BUSINESS PERFORMANCE

TABLE 055. STARLEAF: PRODUCT PORTFOLIO

TABLE 056. STARLEAF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. KEDACOM: SNAPSHOT

TABLE 057. KEDACOM: BUSINESS PERFORMANCE

TABLE 058. KEDACOM: PRODUCT PORTFOLIO

TABLE 059. KEDACOM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. TELY LABS: SNAPSHOT

TABLE 060. TELY LABS: BUSINESS PERFORMANCE

TABLE 061. TELY LABS: PRODUCT PORTFOLIO

TABLE 062. TELY LABS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. CLEARONE: SNAPSHOT

TABLE 063. CLEARONE: BUSINESS PERFORMANCE

TABLE 064. CLEARONE: PRODUCT PORTFOLIO

TABLE 065. CLEARONE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. SONY: SNAPSHOT

TABLE 066. SONY: BUSINESS PERFORMANCE

TABLE 067. SONY: PRODUCT PORTFOLIO

TABLE 068. SONY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. YEALINK: SNAPSHOT

TABLE 069. YEALINK: BUSINESS PERFORMANCE

TABLE 070. YEALINK: PRODUCT PORTFOLIO

TABLE 071. YEALINK: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. VIDEO CONFERENCING EQUIPMENT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. VIDEO CONFERENCING EQUIPMENT MARKET OVERVIEW BY TYPE

FIGURE 012. COLLABORATION ROOM ENDPOINT MARKET OVERVIEW (2016-2028)

FIGURE 013. COLLABORATION PERSONAL ENDPOINT MARKET OVERVIEW (2016-2028)

FIGURE 014. VIDEO CONFERENCING EQUIPMENT MARKET OVERVIEW BY APPLICATION

FIGURE 015. EDUCATION - PUBLIC/PRIVATE MARKET OVERVIEW (2016-2028)

FIGURE 016. CONSULTING/PROFESSIONAL SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 017. GOVERNMENT MARKET OVERVIEW (2016-2028)

FIGURE 018. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 019. FINANCIAL SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 020. COMPETITIVE LANDSCAPE: MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA VIDEO CONFERENCING EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE VIDEO CONFERENCING EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC VIDEO CONFERENCING EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA VIDEO CONFERENCING EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA VIDEO CONFERENCING EQUIPMENT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Video Conferencing Equipment Market research report is 2024-2032.

Microsoft (US), Zoom Video Communications (US), Cisco (US), Adobe (US), Huawei (China), Avaya, Inc. (US), AWS (US) and Other Major Players.

The Video Conferencing Equipment Market is segmented into Type , Application and Region By Type, the market is categorized into Collaboration Room Endpoint, Collaboration Personal Endpoint. By Application, the market is categorized into Education - Public/Private, Consulting/Professional Services, Government, Manufacturing, Financial Services.By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Video conferencing equipment refers to hardware and software tools used to facilitate virtual meetings and discussions between individuals or groups in different locations. This equipment typically includes cameras, microphones, speakers, and displays, as well as software platforms that enable seamless communication over the internet. These systems allow participants to see, hear, and interact with each other in real-time, fostering collaboration and reducing the need for physical presence.

Video Conferencing Equipment Market Size Was Valued at USD 12.05 Billion in 2023, and is Projected to Reach USD 38.27 Billion by 2032, Growing at a CAGR of 13.7 % From 2024-2032.