Vehicle Electrification Market Synopsis:

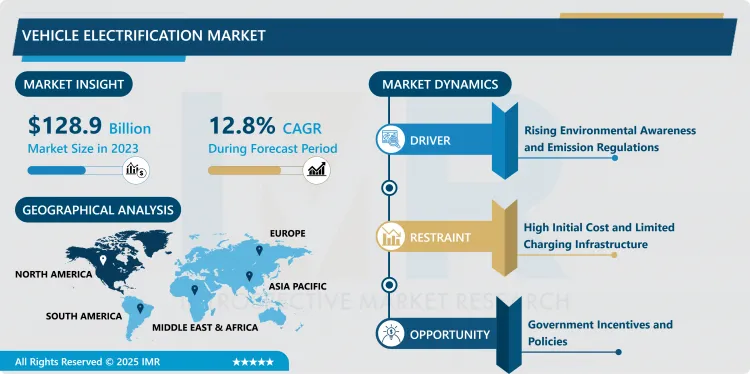

Vehicle Electrification Market Size Was Valued at USD 128.9 Billion in 2023, and is Projected to Reach USD 381.1 Billion by 2032, Growing at a CAGR of 12.8% From 2024-2032.

The Vehicle Electrification Market can be defined as the notion and application of electrification technology as well as electric powertrain and its components including battery, electric motor and power electronics for operating vehicles instead of the traditional Internal Combustion Engine systems. The various types of EVs in this market are battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV), hybrid electric vehicles (HEVs), and reduce carbon dioxide emissions from cars powered by conventional fossil fuels.

The market of vehicle electrification is introduced due to the growing need in more promising vehicles than the ones with internal combustion engines. Due to increased global awareness about climate change and poor air quality, there are increased calls for improved emission controls) that act as incentives to consumers and automotive companies to consider the use of EVs. This trend is likely to continue as environmental sustainability forms part of global transport policies.

In regard to automotive electrification, the subject encompasses electric drives, batteries, recuperation, as well as smart grid applications. New advancements within battery technology including the latest one, the solid-state battery, are on course to elevate the range, efficiency as well as cost of electric vehicles, thus facilitating the market’s growth. Similar to electrification, self-driving cars also find support in electric architectures because electric architectures are more suitable for self-driving systems than are conventional architectures.

One more significant factor associated with vehicle electrification is the transition to renewable energy systems all over the world. Since the grid is becoming greener, it means the use of EVs benefits from the environment adding to the use of the vehicles. Another advantage of vehicle electrification is the diversification of power and energy in transport and thus, reduction on fossil fuel and vulnerability to huge or frequent hikes in fuel prices. In addition to the environmental benefits, consumer adoption of EVs is being complemented by charging facilities in the market. Electric utilities, car manufacturers through their subsidiarities, and governments are actively engaged in developing a dense network of charging infrastructure for EVs for both city and rural use.

The market is likely to grow at a fast pace in the coming years as a result of development in electric vehicles, a reduction in battery costs, and increased funding on green mobility solutions. The utilisation of electric automobiles in different segments, passenger, transportation, public transportation, and industrial applications, contributes to the growth of the market significantly. The automotive market is currently in a transition phase mainly with the established auto manufacturers moving to EV and hybrids while new market entrants like Tesla continue to grow in the market.

Unfortunately, there are some barriers to the widespread use of electric vehicles such as high initial costs, few charging stations, and consumer anxiety regarding vehicle range even with the rapidly changing technological landscape that seems ever brighter for vehicle electrification. But as governments continue to lend their support, advancements in battery technology continue to emerge and consumers learn more about the advantages of electric mobility these issues will be gradually solved, allowing to bring in a new chapter of electrification in the automotive industry.

Vehicle Electrification Market Trend Analysis:

Integration of Advanced Battery Technology

- Another important trend that is currently characteristic of the vehicle electrification market is the use of breakthrough developments in battery systems. There is a need for battery evolution especially in the production of high capacity batteries to support the expansion of electric cars. Solid-state batteries, which are seen as the next big leap in battery technology are said to have double the energy density, be safer and to charge much faster than lithium-ion batteries. This will most definitely help downside the weight and price of batteries used in electric vehicles, and hence make them much more practical for everyday use.

- Battery recycling and second-life applications can also be added to the list helping improve the sustainability of electric vehicles. Electric vehicles are going to be on the rise as more and more companies embrace them, making batteries a needed product with a need for recycling and disposal without harming the environment. To address these issues, new approaches to battery recycling, for example, the use of EV batteries for second life energy storage systems, are being investigated. The current toward improved and sustainable battery forms is one of the causes of the growth in vehicle electrification market.

Government Incentives and Policies

- An enormous potential for increasing the vehicle electrification market is governmental incentives and measures towards limiting the emission of carbon and developing eco-friendly products. Several countries over the globe especially the ones in Europe, North America and Asia have encouraged through subsidies, tax credit and positive regulations for the consumers and producers to encourage EV technology. besides incentivizing purchases of EVs, it also directs investments into infrastructure related to the market such as charging stations, therefore increasing the market potentiality.

- This is due to increased government goals centered on making the world shift to zero-emission vehicles for emission and carbon neutrality. For example, diverse European countries have committed to an objective to phase out new ICEV sales by 2030 or at latest by 2040, which increases demand for EVs. These emerging market segments are also becoming more important as these regulations become more stringent so that automakers are moving toward the electrification of automotive vehicles to meet the new standards and therefore, new growth opportunities are arising within this market.

Vehicle Electrification Market Segment Analysis:

Vehicle Electrification Market is Segmented on the basis of Vehicle Type, Component, Electric Vehicle Type, Propulsion Type, Application, End User, and Region.

By Vehicle Type, Passenger Cars segment is expected to dominate the market during the forecast period

- Passenger cars are the largest category in the market of vehicle electrification. The demand for passenger vehicles seems to be following this shift in a positive way owing to the fact that electric passenger cars are not only environmentally friendly, but also cheaper to maintain. Most consumers are pulled by the ability of the EVs to be silent and smooth to drive, plus increased innovations on aspects like the autonomous driving systems. Today’s major auto makers such as Tesla, Volkswagen, and Nissan are.blue launching new electric cars to meet this emerging market niche.

- Similarly, commercial vehicles, two and three-wheeler, and heavy vehicles are also being electrified at a faster pace. Battery-powered electric trucks, buses and delivery vehicles are becoming a common addition to logistics and transportation industries due to high cost of operation and environmental concerns. Motorbikes and especially electric motorbikes and scooters are particularly suited to developing or as a last-mile transport solution in developing cities as they are personal, affordable and clean. Long-haul freight vehicles are expected to be dominated by electrification, particularly battery electric vehicles which are likely to dominate the heavy-duty segment.

By Application, Commercial segment expected to held the largest share

- The greatest market implementation of vehicle electrification is in commercial uses, especially in densely populated areas because of tightening emission requirements. Electric automobiles are gradually being used within the commercial fleets for the use of taxis, delivery vehicles, and transports. There are significant operating cost benefits from a fuel consumption and maintenance perspective, and from an operational perspective, they are electric / low noise, key interpersonal objectives and contemporary environmental and governmental imperatives reflect these trends. Businesses and local governments are buying electric vehicles, meaning the market ???InSecondsShift has potential for growth, despite potential setbacks.

- Leveraging vehicle electrification for residential use aims at electric vehicles for individuals such as electric cars, bikes and scooters. This segment is among the fastest-growing segments in the industry, caused by the switching demand of consumers from conventional vehicles with high emissions and low fuel efficiency. The charging facilities in home environment are vital to develop, and as home charging equipment technologies cheapen, more families will adapt to electric cars. Charging of automobiles at home together with reduced battery expenses and enhanced driving range convinces private persons to purchase electric cars.

Vehicle Electrification Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- In terms of geographic location, North America especially United States and Canada characterizes a high growth in terms of vehicle electrification market due mainly to government policies and support, well established automotive industry and awareness among car users. Different states in the US have also exerted pressure through Federal and State incentives inclusive of tax credit and rebates to electric vehicle buyers. In addition, the availability of the charging points has also assisted the consumers to overcome the range challenges hence allowing consumers to think about the EVs. There are also the rising customer interest in sustainable energy sources and technologies, and environmental concerns that create more demand for electric cars to such an extent that North America is among the world leaders in this market.

- For that, North America has regulatory support, and is dominated by key automotive players such as Tesla, General Motors, Ford, which are increasingly moving to electrify their fleet. This has led to encouraging the development and the production of electric cars. This consolidation will persist owing to shifting global focus to cutting carbon emissions across North America, consequently fuelling the vehicle electrification’s demand across the region.

Active Key Players in the Vehicle Electrification Market:

- Tesla (USA)

- General Motors (USA)

- Nissan (Japan)

- Ford (USA)

- BMW (Germany)

- Volkswagen (Germany)

- Audi (Germany)

- Toyota (Japan)

- Hyundai (South Korea)

- Kia (South Korea)

- Volvo (Sweden)

- Rivian (USA)

- Other Active Players

|

Global Vehicle Electrification Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 128.9 Billion |

|

Forecast Period 2024-32 CAGR: |

12.8% |

Market Size in 2032: |

USD 381.1 Billion |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Component |

|

||

|

By Electric Vehicle Type |

|

||

|

By Propulsion Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Vehicle Electrification Market by Vehicle Type (2018-2032)

4.1 Vehicle Electrification Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Passenger Cars

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Commercial Vehicles

4.5 Two-Wheelers

4.6 Heavy Duty Vehicles

Chapter 5: Vehicle Electrification Market by Component (2018-2032)

5.1 Vehicle Electrification Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Electric Powertrain

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Battery

5.5 Charging Infrastructure

5.6 Electric Motors

5.7 Inverter & Converter

Chapter 6: Vehicle Electrification Market by Electric Vehicle Type (2018-2032)

6.1 Vehicle Electrification Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Battery Electric Vehicle (BEV)

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Plug-in Hybrid Electric Vehicle (PHEV)

Chapter 7: Vehicle Electrification Market by Propulsion Type (2018-2032)

7.1 Vehicle Electrification Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Fully Electric

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Hybrid Electric

7.5 Plug-in Hybrid

Chapter 8: Vehicle Electrification Market by Application (2018-2032)

8.1 Vehicle Electrification Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Commercial

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Residential

Chapter 9: Vehicle Electrification Market by End User (2018-2032)

9.1 Vehicle Electrification Market Snapshot and Growth Engine

9.2 Market Overview

9.3 OEMs (Original Equipment Manufacturers)

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Aftermarket

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Vehicle Electrification Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 TESLA (USA)

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 GENERAL MOTORS (USA)

10.4 NISSAN (JAPAN)

10.5 FORD (USA)

10.6 BMW (GERMANY)

10.7 VOLKSWAGEN (GERMANY)

10.8 AUDI (GERMANY)

10.9 TOYOTA (JAPAN)

10.10 HYUNDAI (SOUTH KOREA)

10.11 KIA (SOUTH KOREA)

10.12 VOLVO (SWEDEN)

10.13 RIVIAN (USA)

10.14 OTHER ACTIVE PLAYERS

Chapter 11: Global Vehicle Electrification Market By Region

11.1 Overview

11.2. North America Vehicle Electrification Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by Vehicle Type

11.2.4.1 Passenger Cars

11.2.4.2 Commercial Vehicles

11.2.4.3 Two-Wheelers

11.2.4.4 Heavy Duty Vehicles

11.2.5 Historic and Forecasted Market Size by Component

11.2.5.1 Electric Powertrain

11.2.5.2 Battery

11.2.5.3 Charging Infrastructure

11.2.5.4 Electric Motors

11.2.5.5 Inverter & Converter

11.2.6 Historic and Forecasted Market Size by Electric Vehicle Type

11.2.6.1 Battery Electric Vehicle (BEV)

11.2.6.2 Plug-in Hybrid Electric Vehicle (PHEV)

11.2.7 Historic and Forecasted Market Size by Propulsion Type

11.2.7.1 Fully Electric

11.2.7.2 Hybrid Electric

11.2.7.3 Plug-in Hybrid

11.2.8 Historic and Forecasted Market Size by Application

11.2.8.1 Commercial

11.2.8.2 Residential

11.2.9 Historic and Forecasted Market Size by End User

11.2.9.1 OEMs (Original Equipment Manufacturers)

11.2.9.2 Aftermarket

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Vehicle Electrification Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by Vehicle Type

11.3.4.1 Passenger Cars

11.3.4.2 Commercial Vehicles

11.3.4.3 Two-Wheelers

11.3.4.4 Heavy Duty Vehicles

11.3.5 Historic and Forecasted Market Size by Component

11.3.5.1 Electric Powertrain

11.3.5.2 Battery

11.3.5.3 Charging Infrastructure

11.3.5.4 Electric Motors

11.3.5.5 Inverter & Converter

11.3.6 Historic and Forecasted Market Size by Electric Vehicle Type

11.3.6.1 Battery Electric Vehicle (BEV)

11.3.6.2 Plug-in Hybrid Electric Vehicle (PHEV)

11.3.7 Historic and Forecasted Market Size by Propulsion Type

11.3.7.1 Fully Electric

11.3.7.2 Hybrid Electric

11.3.7.3 Plug-in Hybrid

11.3.8 Historic and Forecasted Market Size by Application

11.3.8.1 Commercial

11.3.8.2 Residential

11.3.9 Historic and Forecasted Market Size by End User

11.3.9.1 OEMs (Original Equipment Manufacturers)

11.3.9.2 Aftermarket

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Vehicle Electrification Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by Vehicle Type

11.4.4.1 Passenger Cars

11.4.4.2 Commercial Vehicles

11.4.4.3 Two-Wheelers

11.4.4.4 Heavy Duty Vehicles

11.4.5 Historic and Forecasted Market Size by Component

11.4.5.1 Electric Powertrain

11.4.5.2 Battery

11.4.5.3 Charging Infrastructure

11.4.5.4 Electric Motors

11.4.5.5 Inverter & Converter

11.4.6 Historic and Forecasted Market Size by Electric Vehicle Type

11.4.6.1 Battery Electric Vehicle (BEV)

11.4.6.2 Plug-in Hybrid Electric Vehicle (PHEV)

11.4.7 Historic and Forecasted Market Size by Propulsion Type

11.4.7.1 Fully Electric

11.4.7.2 Hybrid Electric

11.4.7.3 Plug-in Hybrid

11.4.8 Historic and Forecasted Market Size by Application

11.4.8.1 Commercial

11.4.8.2 Residential

11.4.9 Historic and Forecasted Market Size by End User

11.4.9.1 OEMs (Original Equipment Manufacturers)

11.4.9.2 Aftermarket

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Vehicle Electrification Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by Vehicle Type

11.5.4.1 Passenger Cars

11.5.4.2 Commercial Vehicles

11.5.4.3 Two-Wheelers

11.5.4.4 Heavy Duty Vehicles

11.5.5 Historic and Forecasted Market Size by Component

11.5.5.1 Electric Powertrain

11.5.5.2 Battery

11.5.5.3 Charging Infrastructure

11.5.5.4 Electric Motors

11.5.5.5 Inverter & Converter

11.5.6 Historic and Forecasted Market Size by Electric Vehicle Type

11.5.6.1 Battery Electric Vehicle (BEV)

11.5.6.2 Plug-in Hybrid Electric Vehicle (PHEV)

11.5.7 Historic and Forecasted Market Size by Propulsion Type

11.5.7.1 Fully Electric

11.5.7.2 Hybrid Electric

11.5.7.3 Plug-in Hybrid

11.5.8 Historic and Forecasted Market Size by Application

11.5.8.1 Commercial

11.5.8.2 Residential

11.5.9 Historic and Forecasted Market Size by End User

11.5.9.1 OEMs (Original Equipment Manufacturers)

11.5.9.2 Aftermarket

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Vehicle Electrification Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by Vehicle Type

11.6.4.1 Passenger Cars

11.6.4.2 Commercial Vehicles

11.6.4.3 Two-Wheelers

11.6.4.4 Heavy Duty Vehicles

11.6.5 Historic and Forecasted Market Size by Component

11.6.5.1 Electric Powertrain

11.6.5.2 Battery

11.6.5.3 Charging Infrastructure

11.6.5.4 Electric Motors

11.6.5.5 Inverter & Converter

11.6.6 Historic and Forecasted Market Size by Electric Vehicle Type

11.6.6.1 Battery Electric Vehicle (BEV)

11.6.6.2 Plug-in Hybrid Electric Vehicle (PHEV)

11.6.7 Historic and Forecasted Market Size by Propulsion Type

11.6.7.1 Fully Electric

11.6.7.2 Hybrid Electric

11.6.7.3 Plug-in Hybrid

11.6.8 Historic and Forecasted Market Size by Application

11.6.8.1 Commercial

11.6.8.2 Residential

11.6.9 Historic and Forecasted Market Size by End User

11.6.9.1 OEMs (Original Equipment Manufacturers)

11.6.9.2 Aftermarket

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Vehicle Electrification Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by Vehicle Type

11.7.4.1 Passenger Cars

11.7.4.2 Commercial Vehicles

11.7.4.3 Two-Wheelers

11.7.4.4 Heavy Duty Vehicles

11.7.5 Historic and Forecasted Market Size by Component

11.7.5.1 Electric Powertrain

11.7.5.2 Battery

11.7.5.3 Charging Infrastructure

11.7.5.4 Electric Motors

11.7.5.5 Inverter & Converter

11.7.6 Historic and Forecasted Market Size by Electric Vehicle Type

11.7.6.1 Battery Electric Vehicle (BEV)

11.7.6.2 Plug-in Hybrid Electric Vehicle (PHEV)

11.7.7 Historic and Forecasted Market Size by Propulsion Type

11.7.7.1 Fully Electric

11.7.7.2 Hybrid Electric

11.7.7.3 Plug-in Hybrid

11.7.8 Historic and Forecasted Market Size by Application

11.7.8.1 Commercial

11.7.8.2 Residential

11.7.9 Historic and Forecasted Market Size by End User

11.7.9.1 OEMs (Original Equipment Manufacturers)

11.7.9.2 Aftermarket

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Vehicle Electrification Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 128.9 Billion |

|

Forecast Period 2024-32 CAGR: |

12.8% |

Market Size in 2032: |

USD 381.1 Billion |

|

Segments Covered: |

By Vehicle Type |

|

|

|

By Component |

|

||

|

By Electric Vehicle Type |

|

||

|

By Propulsion Type |

|

||

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||