Vegan Cheese Market Overview

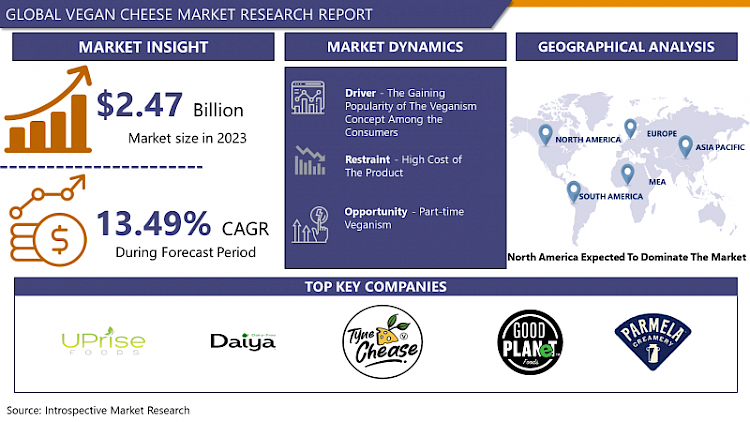

The Vegan Cheese market estimated at USD 2.47 Billion in the year 2023, is projected to reach a revised size of USD 7.71 Billion by 2032, growing at a CAGR of 13.49% over the analysis period 2024-2032.

Veganism is referred to as the refusal from the utilizations of animal-based products, especially in food and beverage products. Vegan cheese is the substitute for dairy cheese that is derived from plant-based sources such as almond milk, coconut milk, cashew milk, soy milk, pine nuts, hazelnut, others. Moreover, with the switching consumer tastes and preferences and shifting consumer lifestyle, producers are developing with the flavors of vegan cheese such as herbs, spice, and blends. In addition, vegan cheese is the least in fat and gluten-free which helps to growth of the vegan cheese market. Furthermore, increased interest in plant-based foods has been raised owing to awareness associated with health, sustainability, and animal welfare. Regarding conventional production of dairy, there are three key areas of concern environment impact (pollution of soil and water, emissions of greenhouse gases, and land use), human health (increased antibiotic resistance and exposure to zoonotic diseases), and animal welfare (treatment of farmed animals, including disease, injury, and mental/emotional well-being). Hence, plant-based products provide a more sustainable and ethical option to consumers that are significantly growing in popularity among consumers. Furthermore, according to the testament to this, U.S. retail sales of plant-based alternatives that directly replace animal products grew 29% from the period 2017 to 2019 to gain a USD 5 billion market. In the dairy category, vegan Cheese substitutes saw the most growth in a year-over-year retail sales comparison by rising 95% in 2020.

Market Dynamics and Factors for the Vegan Cheese Market:

Drivers:

Growing consciousness regarding health issues about the utilization of dairy products is further affecting consumers to switch to vegan products. Recent researches have suspected the application of antibiotics, hormones, and allergens on cattle for rising cattle production producing a negative outlook of the dairy industry. Moreover, rising consciousness regarding the environmental pollution caused owing to dairy farming practices are turning the shift towards dairy alternatives

The gaining popularity of the veganism concept among the consumers has prompted food productions units to incorporate dairy-free substitutes in the production of a different variety of food products. Vegan cheese is generating widespread adoption in bakeries and fast-food joints. To capitalize on the rising demand for vegan cheese, leading fast-food ventures such as Domino's and MacDonald's have already started catering vegan burgers, pizzas, and other vegan fast-food products. Moreover, a growing number of grocery and retail stores are starting to sell different varieties of vegan cheese. In addition, the accessibility of vegan cheese in different flavors such as cranberry, caramel, blueberry, and many other flavors is supplying the consumers a chance to experience new tastes. Additionally, vegan cheese is cholesterol-free and a great source of protein making it a healthy substitute for obese and lactose intolerant individuals. The market is gradually gaining rising penetration as producers continue to boost the texture and mouthfeel of vegan cheese to match the qualities of its dairy counterpart.

Restraints:

Within the plant-based product market, vegan cheese is a developing segment that has yet to gain traction or interest from a diversified consumer base. Even though vegan cheese sales continue to grow, the category remains in its rising compared to other plant-based analog categories (i.e., dairy and meat) as vegan cheese only accounts for less than 1% of all total dollar sales of retail cheese. Concerning the growing acceptance of these products, sensory methods can be applied to better understand sensory and quality attributes and whether they offer the desirable qualities of a conventional dairy-based product.

Opportunities:

Part-time Veganism

When you consider a part-time vegan lifestyle, it can occur in a few different ways, but it means you stay away from junk food and eat vegan food most of the time, only eating non-vegan one day a week or for a couple of hours at the end of every day. Many people who eat a flexitarian diet follow these basic guidelines such as eating vegetables and fruit in abundance, eating fewer animal products, staying away from junk food, don't eat out; cooking at home as much as you can, eat high-quality foods.

Furthermore, part-time veganism is a growing sector, which is grabbing the attention of stakeholders in the North American vegan cheese market. Veganuary is another trend, which is translating into sales opportunities for plant-based cheese choices in the market. Manufacturers are developing products that are fortified with probiotics, calcium, protein, and vitamin D to help consumers choose a dairy-free lifestyle. Apart from nutritional advantages, delivering an appealing texture and taste is of prime importance for its use in pizza and other dishes.

Market Segmentation

Based on the product type, the Mozzarella segment is expected to account for the largest vegan cheese market share over the forecast period. Mozzarella is widely used in Italian dishes, such as pasta, pizzas, croquettes, and Caprese salad, and is available in the form of slices, cubes, shredded, and spreads. The demand for mozzarella is significantly high in countries where Italian cuisine is popular.

Based on the source, the almond milk segment is expected to dominate the vegan cheese market during the forecast period. Almond milk cheese is one of the widely used sources in vegan cheese preparation. The naturally higher fat content of the almond milk gives the cheese a smoother texture without an astringent taste. Almond milk has been known for its high nutritional profile that has further fueled its demand for vegan cheese preparation. Almond milk is low in calories that have garnered attention from health-conscious consumers all over the world. Thus, the high nutritional profile of almond milk has been one of the major contributing factors for its source base in vegan cheese production.

Based on the end-use, the household/retail segment is expected to register the maximum vegan cheese market share over the forecast period. Growing consumer disposable income levels and preference to spend on premium products have helped to an increase in demand for vegan cheese in the household segment. Additionally, easy product accessibility in supermarkets and convenience stores has improved the growth of this segment.

Based on the nature, the organic segment is anticipated to record the maximum market share during the forecast period. Owing to the gaining popularity for plant-based food as well as an organic product among the consumers. Also, with this trend key players are offering the product accordingly to the consumers which helps to growth of the market over the forecast period. For instance, US-based company Follow Your Heart offers numerous varieties of vegan cheese containing certified organic ingredients such as Mozzarella – 81 percent organic, Nacho – 70 percent organic, Monterey Jack – 80 percent organic, Cheddar – 74 percent organic, Cream Cheese – 70 percent organic. Moreover, Follow Your Heart provides vegan goods online and in wholefood shops in the U.S., Mexico, the U.K., and Germany. Some other types include provolone, American, garden herb, Parmesan, pepper jack, and smoked Gouda.

Based on distribution channels, the vegan cheese market is segmented into direct sales, indirect sales, specialty retail stores, traditional grocery stores, hypermarkets/supermarkets, convenience stores, online retailers. The hypermarkets/supermarkets segment led the vegan cheese market during the forecast period. Vegan cheese is majorly sold in hypermarkets/supermarkets. Consumers opted to purchase vegan cheese from supermarkets and hypermarkets due to the trust of high-quality products, various attractive offers, and a one-stop shopping experience. Furthermore, online retailers' segment is gaining popularity after the leading segment supermarket owing to home delivery service, highly emergence of the smartphones, laptops, and availability of the high speed of internet activity which is triggering the segment growth and is expected to growth of the vegan cheese market over the forecast period.

Players Covered in Vegan Cheese Market are :

- UPrise Foods

- Daiya Foods

- Parmela Creamery

- Tyne Cheese Limited

- Good Planet Foods

- Vtopian Artisan Cheese Company

- Kite Hill

- Feel Foods Ltd.

- Tesco

- Miyoko's Kitchen Company

- Vermont Farmstead Company

- Follow Your Heart

- Galaxy Nutritional Foods Inc.

- Violife Foods

- Mad Millie

- Field Roast Grain Meat Co.

- Nush

- Go Veggie and other major players.

Regional Analysis for the Vegan Cheese Market:

- North America region is expected to dominate the vegan cheese market during the forecast period. This is mainly owing to strong consciousness of animal inhumanity owing to vigorous vegan outreaches in the region coupled with the rising consciousness of veganism as a healthy lifestyle. Furthermore, the presence of a large number of key players such as Follow Your Heart, UPrise Foods, Daiya Foods, Miyoko's Kitchen Company, and others allows the product to be sold at a cheap cost and is easily available in other regions over the world.

- In the European region, customers are increasingly choosing more eco-friendly and vegan products due to the growing consciousness regarding animal inhumanity and rising carbon footprint owing to the utilization of food products obtained from animals such as milk, meat, honey, eggs, pork, and seafood.

- Asia-Pacific is the fastest-growing vegan cheese market and is anticipated to continue its growth during the forecast period. This is majorly attributed to rising spending on nutritional and plant-based products. An increase in urbanization, rising spending on health products, and consciousness about the medicinal benefits of plants based dairy products are anticipated to turn the vegan cheese market growth in Asia-Pacific during the forecast period. Moreover, change in lifestyle and growth in trend of eating out and drastic changes in the food preference is after influencing the growth of the vegan cheese market.

Key Industry Developments in Vegan Cheese Market

- In March 2024, Daiya, the brand that cracked the code on dairy-free cheese, announced the launch of their new Dairy-Free Cheese Shreds tailored specifically for food service operators. Leveraging the success of its new proprietary ingredient, the Daiya Oat Cream blend, these innovative shreds promise a dairy-like melt that browns just like cheese - perfect for food service operators and restaurateurs looking to level up their plant-based offerings.

- In October 2023, Compleat Food Group acquired plant-based cheese maker Palace Culture for an undisclosed sum, expanding its portfolio of plant-based properties. The acquisition builds on existing brands like Squeaky Bean and Vadasz. Compleat aims to support Palace Culture's growth and expansion by gaining national listings in major UK retailers. Palace Culture is chosen due to its high quality, exciting product offering, and growth potential.

|

Global Vegan Cheese Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 2.47 Bn. |

|

Forecast Period 2023-32 CAGR: |

13.49% |

Market Size in 2032: |

USD 7.71 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Source

3.3 By End-Use

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Vegan Cheese Market by Type

5.1 Vegan Cheese Market Overview Snapshot and Growth Engine

5.2 Vegan Cheese Market Overview

5.3 Mozzarella

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Mozzarella: Grographic Segmentation

5.4 Gouda

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Gouda: Grographic Segmentation

5.5 Parmesan

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 Parmesan: Grographic Segmentation

5.6 Cheddar

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Cheddar: Grographic Segmentation

5.7 Cream Cheese

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 Cream Cheese: Grographic Segmentation

5.8 Ricotta

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2016-2028F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 Ricotta: Grographic Segmentation

5.9 Others

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size (2016-2028F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 Others: Grographic Segmentation

Chapter 6: Vegan Cheese Market by Source

6.1 Vegan Cheese Market Overview Snapshot and Growth Engine

6.2 Vegan Cheese Market Overview

6.3 Almond Milk

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Almond Milk: Grographic Segmentation

6.4 Coconut Milk

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Coconut Milk: Grographic Segmentation

6.5 Cashew Milk

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Cashew Milk: Grographic Segmentation

6.6 Soy Milk

6.6.1 Introduction and Market Overview

6.6.2 Historic and Forecasted Market Size (2016-2028F)

6.6.3 Key Market Trends, Growth Factors and Opportunities

6.6.4 Soy Milk: Grographic Segmentation

6.7 Pine Nuts

6.7.1 Introduction and Market Overview

6.7.2 Historic and Forecasted Market Size (2016-2028F)

6.7.3 Key Market Trends, Growth Factors and Opportunities

6.7.4 Pine Nuts: Grographic Segmentation

6.8 Hazelnut

6.8.1 Introduction and Market Overview

6.8.2 Historic and Forecasted Market Size (2016-2028F)

6.8.3 Key Market Trends, Growth Factors and Opportunities

6.8.4 Hazelnut: Grographic Segmentation

6.9 Others

6.9.1 Introduction and Market Overview

6.9.2 Historic and Forecasted Market Size (2016-2028F)

6.9.3 Key Market Trends, Growth Factors and Opportunities

6.9.4 Others: Grographic Segmentation

Chapter 7: Vegan Cheese Market by End-Use

7.1 Vegan Cheese Market Overview Snapshot and Growth Engine

7.2 Vegan Cheese Market Overview

7.3 Food Service Industry

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Food Service Industry: Grographic Segmentation

7.4 Household/Retail

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Household/Retail: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Vegan Cheese Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Vegan Cheese Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Vegan Cheese Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 UPRISE FOODS

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 DAIYA FOODS

8.4 PARMELA CREAMERY

8.5 TYNE CHEESE LIMITED

8.6 GOOD PLANET FOODS

8.7 VTOPIAN ARTISAN CHEESE COMPANY

8.8 KITE HILL

8.9 FEEL FOODS LTD.

8.10 TESCO

8.11 MIYOKO'S KITCHEN COMPANY

8.12 VERMONT FARMSTEAD COMPANY

8.13 FOLLOW YOUR HEART

8.14 GALAXY NUTRITIONAL FOODS INC.

8.15 VIOLIFE FOODS

8.16 MAD MILLIE

8.17 FIELD ROAST GRAIN MEAT CO.

8.18 NUSH

8.19 GO VEGGIE

8.20 OTHER MAJOR PLAYERS

Chapter 9: Global Vegan Cheese Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Mozzarella

9.2.2 Gouda

9.2.3 Parmesan

9.2.4 Cheddar

9.2.5 Cream Cheese

9.2.6 Ricotta

9.2.7 Others

9.3 Historic and Forecasted Market Size By Source

9.3.1 Almond Milk

9.3.2 Coconut Milk

9.3.3 Cashew Milk

9.3.4 Soy Milk

9.3.5 Pine Nuts

9.3.6 Hazelnut

9.3.7 Others

9.4 Historic and Forecasted Market Size By End-Use

9.4.1 Food Service Industry

9.4.2 Household/Retail

Chapter 10: North America Vegan Cheese Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Mozzarella

10.4.2 Gouda

10.4.3 Parmesan

10.4.4 Cheddar

10.4.5 Cream Cheese

10.4.6 Ricotta

10.4.7 Others

10.5 Historic and Forecasted Market Size By Source

10.5.1 Almond Milk

10.5.2 Coconut Milk

10.5.3 Cashew Milk

10.5.4 Soy Milk

10.5.5 Pine Nuts

10.5.6 Hazelnut

10.5.7 Others

10.6 Historic and Forecasted Market Size By End-Use

10.6.1 Food Service Industry

10.6.2 Household/Retail

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Vegan Cheese Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Mozzarella

11.4.2 Gouda

11.4.3 Parmesan

11.4.4 Cheddar

11.4.5 Cream Cheese

11.4.6 Ricotta

11.4.7 Others

11.5 Historic and Forecasted Market Size By Source

11.5.1 Almond Milk

11.5.2 Coconut Milk

11.5.3 Cashew Milk

11.5.4 Soy Milk

11.5.5 Pine Nuts

11.5.6 Hazelnut

11.5.7 Others

11.6 Historic and Forecasted Market Size By End-Use

11.6.1 Food Service Industry

11.6.2 Household/Retail

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Vegan Cheese Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Mozzarella

12.4.2 Gouda

12.4.3 Parmesan

12.4.4 Cheddar

12.4.5 Cream Cheese

12.4.6 Ricotta

12.4.7 Others

12.5 Historic and Forecasted Market Size By Source

12.5.1 Almond Milk

12.5.2 Coconut Milk

12.5.3 Cashew Milk

12.5.4 Soy Milk

12.5.5 Pine Nuts

12.5.6 Hazelnut

12.5.7 Others

12.6 Historic and Forecasted Market Size By End-Use

12.6.1 Food Service Industry

12.6.2 Household/Retail

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Vegan Cheese Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Mozzarella

13.4.2 Gouda

13.4.3 Parmesan

13.4.4 Cheddar

13.4.5 Cream Cheese

13.4.6 Ricotta

13.4.7 Others

13.5 Historic and Forecasted Market Size By Source

13.5.1 Almond Milk

13.5.2 Coconut Milk

13.5.3 Cashew Milk

13.5.4 Soy Milk

13.5.5 Pine Nuts

13.5.6 Hazelnut

13.5.7 Others

13.6 Historic and Forecasted Market Size By End-Use

13.6.1 Food Service Industry

13.6.2 Household/Retail

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Vegan Cheese Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Mozzarella

14.4.2 Gouda

14.4.3 Parmesan

14.4.4 Cheddar

14.4.5 Cream Cheese

14.4.6 Ricotta

14.4.7 Others

14.5 Historic and Forecasted Market Size By Source

14.5.1 Almond Milk

14.5.2 Coconut Milk

14.5.3 Cashew Milk

14.5.4 Soy Milk

14.5.5 Pine Nuts

14.5.6 Hazelnut

14.5.7 Others

14.6 Historic and Forecasted Market Size By End-Use

14.6.1 Food Service Industry

14.6.2 Household/Retail

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Vegan Cheese Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 2.47 Bn. |

|

Forecast Period 2023-32 CAGR: |

13.49% |

Market Size in 2032: |

USD 7.71 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By End-Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. VEGAN CHEESE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. VEGAN CHEESE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. VEGAN CHEESE MARKET COMPETITIVE RIVALRY

TABLE 005. VEGAN CHEESE MARKET THREAT OF NEW ENTRANTS

TABLE 006. VEGAN CHEESE MARKET THREAT OF SUBSTITUTES

TABLE 007. VEGAN CHEESE MARKET BY TYPE

TABLE 008. MOZZARELLA MARKET OVERVIEW (2016-2028)

TABLE 009. GOUDA MARKET OVERVIEW (2016-2028)

TABLE 010. PARMESAN MARKET OVERVIEW (2016-2028)

TABLE 011. CHEDDAR MARKET OVERVIEW (2016-2028)

TABLE 012. CREAM CHEESE MARKET OVERVIEW (2016-2028)

TABLE 013. RICOTTA MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. VEGAN CHEESE MARKET BY SOURCE

TABLE 016. ALMOND MILK MARKET OVERVIEW (2016-2028)

TABLE 017. COCONUT MILK MARKET OVERVIEW (2016-2028)

TABLE 018. CASHEW MILK MARKET OVERVIEW (2016-2028)

TABLE 019. SOY MILK MARKET OVERVIEW (2016-2028)

TABLE 020. PINE NUTS MARKET OVERVIEW (2016-2028)

TABLE 021. HAZELNUT MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. VEGAN CHEESE MARKET BY END-USE

TABLE 024. FOOD SERVICE INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 025. HOUSEHOLD/RETAIL MARKET OVERVIEW (2016-2028)

TABLE 026. NORTH AMERICA VEGAN CHEESE MARKET, BY TYPE (2016-2028)

TABLE 027. NORTH AMERICA VEGAN CHEESE MARKET, BY SOURCE (2016-2028)

TABLE 028. NORTH AMERICA VEGAN CHEESE MARKET, BY END-USE (2016-2028)

TABLE 029. N VEGAN CHEESE MARKET, BY COUNTRY (2016-2028)

TABLE 030. EUROPE VEGAN CHEESE MARKET, BY TYPE (2016-2028)

TABLE 031. EUROPE VEGAN CHEESE MARKET, BY SOURCE (2016-2028)

TABLE 032. EUROPE VEGAN CHEESE MARKET, BY END-USE (2016-2028)

TABLE 033. VEGAN CHEESE MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC VEGAN CHEESE MARKET, BY TYPE (2016-2028)

TABLE 035. ASIA PACIFIC VEGAN CHEESE MARKET, BY SOURCE (2016-2028)

TABLE 036. ASIA PACIFIC VEGAN CHEESE MARKET, BY END-USE (2016-2028)

TABLE 037. VEGAN CHEESE MARKET, BY COUNTRY (2016-2028)

TABLE 038. MIDDLE EAST & AFRICA VEGAN CHEESE MARKET, BY TYPE (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA VEGAN CHEESE MARKET, BY SOURCE (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA VEGAN CHEESE MARKET, BY END-USE (2016-2028)

TABLE 041. VEGAN CHEESE MARKET, BY COUNTRY (2016-2028)

TABLE 042. SOUTH AMERICA VEGAN CHEESE MARKET, BY TYPE (2016-2028)

TABLE 043. SOUTH AMERICA VEGAN CHEESE MARKET, BY SOURCE (2016-2028)

TABLE 044. SOUTH AMERICA VEGAN CHEESE MARKET, BY END-USE (2016-2028)

TABLE 045. VEGAN CHEESE MARKET, BY COUNTRY (2016-2028)

TABLE 046. UPRISE FOODS: SNAPSHOT

TABLE 047. UPRISE FOODS: BUSINESS PERFORMANCE

TABLE 048. UPRISE FOODS: PRODUCT PORTFOLIO

TABLE 049. UPRISE FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. DAIYA FOODS: SNAPSHOT

TABLE 050. DAIYA FOODS: BUSINESS PERFORMANCE

TABLE 051. DAIYA FOODS: PRODUCT PORTFOLIO

TABLE 052. DAIYA FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. PARMELA CREAMERY: SNAPSHOT

TABLE 053. PARMELA CREAMERY: BUSINESS PERFORMANCE

TABLE 054. PARMELA CREAMERY: PRODUCT PORTFOLIO

TABLE 055. PARMELA CREAMERY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. TYNE CHEESE LIMITED: SNAPSHOT

TABLE 056. TYNE CHEESE LIMITED: BUSINESS PERFORMANCE

TABLE 057. TYNE CHEESE LIMITED: PRODUCT PORTFOLIO

TABLE 058. TYNE CHEESE LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. GOOD PLANET FOODS: SNAPSHOT

TABLE 059. GOOD PLANET FOODS: BUSINESS PERFORMANCE

TABLE 060. GOOD PLANET FOODS: PRODUCT PORTFOLIO

TABLE 061. GOOD PLANET FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. VTOPIAN ARTISAN CHEESE COMPANY: SNAPSHOT

TABLE 062. VTOPIAN ARTISAN CHEESE COMPANY: BUSINESS PERFORMANCE

TABLE 063. VTOPIAN ARTISAN CHEESE COMPANY: PRODUCT PORTFOLIO

TABLE 064. VTOPIAN ARTISAN CHEESE COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. KITE HILL: SNAPSHOT

TABLE 065. KITE HILL: BUSINESS PERFORMANCE

TABLE 066. KITE HILL: PRODUCT PORTFOLIO

TABLE 067. KITE HILL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. FEEL FOODS LTD.: SNAPSHOT

TABLE 068. FEEL FOODS LTD.: BUSINESS PERFORMANCE

TABLE 069. FEEL FOODS LTD.: PRODUCT PORTFOLIO

TABLE 070. FEEL FOODS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. TESCO: SNAPSHOT

TABLE 071. TESCO: BUSINESS PERFORMANCE

TABLE 072. TESCO: PRODUCT PORTFOLIO

TABLE 073. TESCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. MIYOKO'S KITCHEN COMPANY: SNAPSHOT

TABLE 074. MIYOKO'S KITCHEN COMPANY: BUSINESS PERFORMANCE

TABLE 075. MIYOKO'S KITCHEN COMPANY: PRODUCT PORTFOLIO

TABLE 076. MIYOKO'S KITCHEN COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. VERMONT FARMSTEAD COMPANY: SNAPSHOT

TABLE 077. VERMONT FARMSTEAD COMPANY: BUSINESS PERFORMANCE

TABLE 078. VERMONT FARMSTEAD COMPANY: PRODUCT PORTFOLIO

TABLE 079. VERMONT FARMSTEAD COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. FOLLOW YOUR HEART: SNAPSHOT

TABLE 080. FOLLOW YOUR HEART: BUSINESS PERFORMANCE

TABLE 081. FOLLOW YOUR HEART: PRODUCT PORTFOLIO

TABLE 082. FOLLOW YOUR HEART: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. GALAXY NUTRITIONAL FOODS INC.: SNAPSHOT

TABLE 083. GALAXY NUTRITIONAL FOODS INC.: BUSINESS PERFORMANCE

TABLE 084. GALAXY NUTRITIONAL FOODS INC.: PRODUCT PORTFOLIO

TABLE 085. GALAXY NUTRITIONAL FOODS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. VIOLIFE FOODS: SNAPSHOT

TABLE 086. VIOLIFE FOODS: BUSINESS PERFORMANCE

TABLE 087. VIOLIFE FOODS: PRODUCT PORTFOLIO

TABLE 088. VIOLIFE FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. MAD MILLIE: SNAPSHOT

TABLE 089. MAD MILLIE: BUSINESS PERFORMANCE

TABLE 090. MAD MILLIE: PRODUCT PORTFOLIO

TABLE 091. MAD MILLIE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. FIELD ROAST GRAIN MEAT CO.: SNAPSHOT

TABLE 092. FIELD ROAST GRAIN MEAT CO.: BUSINESS PERFORMANCE

TABLE 093. FIELD ROAST GRAIN MEAT CO.: PRODUCT PORTFOLIO

TABLE 094. FIELD ROAST GRAIN MEAT CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. NUSH: SNAPSHOT

TABLE 095. NUSH: BUSINESS PERFORMANCE

TABLE 096. NUSH: PRODUCT PORTFOLIO

TABLE 097. NUSH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. GO VEGGIE: SNAPSHOT

TABLE 098. GO VEGGIE: BUSINESS PERFORMANCE

TABLE 099. GO VEGGIE: PRODUCT PORTFOLIO

TABLE 100. GO VEGGIE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 101. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 102. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 103. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. VEGAN CHEESE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. VEGAN CHEESE MARKET OVERVIEW BY TYPE

FIGURE 012. MOZZARELLA MARKET OVERVIEW (2016-2028)

FIGURE 013. GOUDA MARKET OVERVIEW (2016-2028)

FIGURE 014. PARMESAN MARKET OVERVIEW (2016-2028)

FIGURE 015. CHEDDAR MARKET OVERVIEW (2016-2028)

FIGURE 016. CREAM CHEESE MARKET OVERVIEW (2016-2028)

FIGURE 017. RICOTTA MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. VEGAN CHEESE MARKET OVERVIEW BY SOURCE

FIGURE 020. ALMOND MILK MARKET OVERVIEW (2016-2028)

FIGURE 021. COCONUT MILK MARKET OVERVIEW (2016-2028)

FIGURE 022. CASHEW MILK MARKET OVERVIEW (2016-2028)

FIGURE 023. SOY MILK MARKET OVERVIEW (2016-2028)

FIGURE 024. PINE NUTS MARKET OVERVIEW (2016-2028)

FIGURE 025. HAZELNUT MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. VEGAN CHEESE MARKET OVERVIEW BY END-USE

FIGURE 028. FOOD SERVICE INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 029. HOUSEHOLD/RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 030. NORTH AMERICA VEGAN CHEESE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. EUROPE VEGAN CHEESE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. ASIA PACIFIC VEGAN CHEESE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 033. MIDDLE EAST & AFRICA VEGAN CHEESE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 034. SOUTH AMERICA VEGAN CHEESE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Vegan Cheese Market research report is 2023-2032.

UPrise Foods, Daiya Foods, Parmela Creamery, Tyne Cheese Limited, Good Planet Foods, Vtopian Artisan Cheese Company, Kite Hill, Feel Foods Ltd., Tesco, Miyoko's Kitchen Company, Vermont Farmstead Company, Follow Your Heart, Galaxy Nutritional Foods Inc., Violife Foods, Mad Millie, Field Roast Grain Meat Co., Nush, Go Veggie and other major players.

The Vegan Cheese Market is segmented into Type, Source, End-Use, and region. By Type, the market is categorized into Mozzarella, Gouda, Parmesan, Cheddar, Cream Cheese, Ricotta, Others. By Source, the market is categorized into Almond Milk, Coconut Milk, Cashew Milk, Soy Milk, Pine Nuts, Hazelnut, Others. By End-Use, the market is categorized into Food Service Industry, Household/Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Veganism is referred to as the refusal from the utilizations of animal-based products, especially in food and beverage products. Vegan cheese is the substitute for dairy cheese that is derived from plant-based sources such as almond milk, coconut milk, cashew milk, soy milk, pine nuts, hazelnut, others.

The Vegan Cheese market estimated at USD 2.47 Billion in the year 2023, is projected to reach a revised size of USD 7.71 Billion by 2032, growing at a CAGR of 13.49% over the analysis period 2024-2032.