Dairy Alternatives Market Synopsis

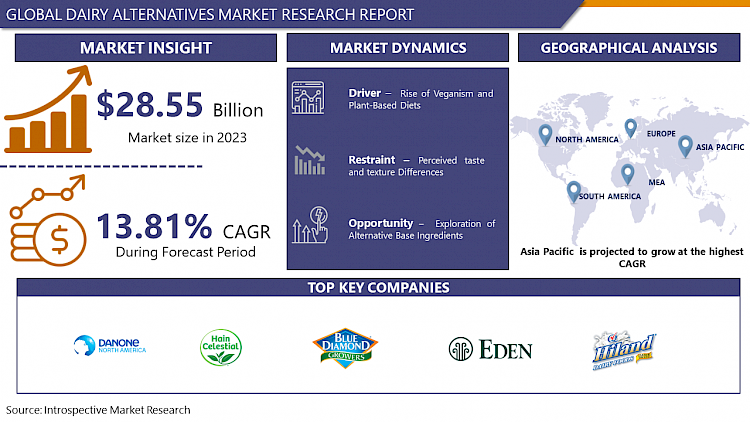

Dairy Alternatives Market Size Was Valued at USD 28.55 billion in 2023, and is Projected to Reach USD 91.15 Billion by 2032, Growing at a CAGR of 13.81% From 2024-2032.

Dairy alternatives are plant-based products that mimic traditional dairy products like milk, cheese, and yogurt. Made from almonds, soybeans, oats, and coconuts, they cater to dietary restrictions like lactose intolerance and vegan lifestyles. These nutritious, sustainable alternatives offer a sustainable, environmentally friendly alternative to conventional dairy.

- Dairy alternatives, also referred to as plant-based dairy substitutes, present numerous benefits, fueling their growing demand and versatile applications across the food industry. Firstly, these substitutes cater to individuals with dietary limitations such as lactose intolerance, dairy allergies, or those adhering to vegan or plant-based diets. Additionally, dairy alternatives typically boast lower calorie, cholesterol, and saturated fat content compared to traditional dairy products, appealing to health-conscious consumers. With options ranging from almond milk to soy yogurt and oat-based cheese, these alternatives offer flexibility for diverse culinary uses.

- The surge in demand for dairy alternatives is driven by changing consumer preferences favoring healthier, more sustainable, and ethical food options. Increased awareness of animal welfare issues, environmental sustainability concerns, and the health advantages associated with plant-based eating has propelled the adoption of dairy alternatives globally.

- These substitutes find application across various food and beverage segments, including beverages, snacks, desserts, and baked goods. They serve as ingredients in cooking, baking, and food preparation, providing functional attributes and taste profiles akin to conventional dairy items. Moreover, emerging trends in the dairy alternative realm encompass the development of innovative formulations, flavors, and packaging, alongside a heightened emphasis on organic, non-GMO, and sustainably sourced ingredients to meet evolving consumer demands for clean-label products and environmental stewardship.

Dairy Alternatives Market Trend Analysis

Rise of Veganism and Plant-Based Diets

- The surge in veganism and plant-based diets is a pivotal driving force propelling the dairy alternatives market forward. Veganism, which refrains from all animal products including dairy, and plant-based diets, prioritizing plant-derived foods, has garnered widespread traction in recent years.

- This trend is fueled by various factors, encompassing ethical concerns regarding animal welfare, environmental anxieties related to the ecological footprint of animal agriculture, and health considerations linked to plant-centric eating patterns. Consumers are increasingly adopting vegan and plant-based lifestyles to reduce their environmental impact, promote sustainable food systems, and enhance personal well-being.

- There is a burgeoning demand for dairy alternatives that offer plant-based substitutes to traditional dairy staples like milk, cheese, yogurt, and butter. This shift in consumer preferences is catalyzing innovation and product advancement within the dairy alternatives market, fostering a broader array of options, improved taste and texture, and greater accessibility of dairy-free alternatives on a global scale.

Exploration of Alternative Base Ingredients

- Exploring alternative base ingredients emerges as a promising opportunity within the dairy alternatives market. With increasing consumer demand for dairy-free options, there's a growing necessity for innovative plant-based elements to serve as the core of these alternatives. This trend allows for experimentation with diverse plant sources beyond conventional choices like soy, almond, and coconut.

- Ingredients such as oats, hemp, quinoa, cashews, peas, and rice offer distinctive nutritional profiles, flavors, and textures, enhancing the variety and appeal of dairy alternatives. Moreover, these alternatives cater to consumers with specific dietary preferences, allergies, or sensitivities, widening the market scope of dairy alternative products.

- Delving into alternative base ingredients aligns with consumer preferences for natural, minimally processed foods, as many plant sources are perceived as sustainable and wholesome. By leveraging the versatility and nutritional advantages of alternative base ingredients, businesses in the dairy alternatives sector can distinguish their offerings, address evolving consumer needs, and foster innovation in the realm of plant-based foods.

Dairy Alternatives Market Segment Analysis:

Dairy Alternatives Market Segmented on the basis of Type, Source, Application, Formulation, and Distribution Channel.

By Type, Plant-Based Milk Alternatives segment is expected to dominate the market during the forecast period

- The Plant-Based Milk Alternatives segment is poised to dominate the dairy alternatives market due to several pivotal factors. Firstly, these alternatives have garnered widespread consumer acceptance as individuals increasingly opt for dairy-free options driven by health, ethical, and environmental considerations. Offering a diverse range of choices including almond, soy, coconut, oat, and rice milk, these alternatives cater to a broad spectrum of dietary preferences and tastes.

- Moreover, their versatility is a key driver, as plant-based milk alternatives find application in various uses such as beverages, cooking, baking, and cereal consumption. This versatility extends their appeal across different consumer segments. The rising prevalence of lactose intolerance, dairy allergies, and vegan lifestyles further propels the demand for plant-based milk alternatives, providing a suitable alternative to traditional dairy milk without compromising on taste, texture, or nutritional value.

- Furthermore, ongoing advancements in processing techniques and product formulations have led to notable enhancements in the taste, texture, and nutritional profiles of plant-based milk alternatives, further boosting their attractiveness to consumers. Hence, it is anticipated that the Plant-Based Milk Alternatives segment will continue to maintain its dominant position in the dairy alternatives market moving forward.

By Source, Soy segment is expected to dominate the market during the forecast period

- The Soy segment is anticipated to lead the dairy alternatives market due to several key factors. Firstly, soy-based products have enjoyed early and extensive availability, establishing a robust presence in the market. This early introduction has fostered broad consumer acceptance and familiarity with soy-derived alternatives.

- Soy-based dairy alternatives offer a diverse array of products, including milk, cheese, yogurt, and ice cream, providing consumers with versatile options to substitute traditional dairy items. This flexibility appeals to individuals seeking alternatives for various dairy products in their diet.

- Additionally, soy is renowned for its nutritional value, serving as a rich source of protein, essential amino acids, vitamins, and minerals. As health-conscious consumers increasingly prioritize nutrient-dense foods, soy-based dairy alternatives emerge as a viable and wholesome choice. Soy's widespread cultivation and relatively economical production compared to some other plant-based options ensure accessibility to soy-based dairy alternatives across diverse socio-economic demographics.

Dairy Alternatives Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is poised to dominate the dairy alternatives market due to several significant factors. Firstly, the region's rapid urbanization and economic growth have led to a burgeoning middle class with increased disposable incomes. This demographic shift fuels the demand for healthier and more sustainable food options, including dairy alternatives.

- Changing dietary preferences and heightened awareness of health and environmental issues are driving the adoption of plant-based diets and dairy-free alternatives across the Asia Pacific. Consumers in the region are increasingly seeking out dairy alternatives as substitutes for traditional dairy products. Asia Pacific boasts some of the world's largest populations, such as China and India, where lactose intolerance and dairy allergies are prevalent. This demographic factor significantly contributes to the demand for dairy alternatives in the region.

- The presence of key industry players and investments in product innovation and marketing further propel market growth in Asia Pacific. Consequently, Asia Pacific is anticipated to emerge as the dominant force in the global dairy alternatives market in the foreseeable future.

Dairy Alternatives Market Top Key Players:

- Danone North America Public Benefit Corporation (US)

- The Hain Celestial Group, Inc. (US)

- Blue Diamond Growers (US)

- Eden Foods, Inc. (US)

- Hiland Dairy (US)

- Ripple Foods (US)

- Kite Hill (US)

- Califia Farms, LLC (US)

- Rude Health (US)

- Miyoko’s Creamery (US)

- PANOS Brand (US)

- Earth’s Own Food Company Inc. (Canada)

- Daiya Foods Inc. (Canada)

- SunOpta (Canada)

- Elmhurst Milked Direct LLC (New York)

- Valsoia S.p.A (Italy)

- Nutriops, S.L. (Spain)

- Qatly Group AB (Sweden)

- Triballat Noyal (France)

- One Good (India)

- Freedom Foods Group Limited (Australia)

- PureHarvest (Australia)

- Sanitarium (New Zealand)

- Green Spot Co., Ltd. (Thailand), and Other Major Players.

Key Industry Developments in the Dairy Alternatives Market:

- In March 2024, Kerry Dairy Consumer Foods launched its "category-first" Smug Dairy range, blending oats and dairy, in response to health, environmental, and ethical concerns cited by one in four UK shoppers according to YouGov and ComRes data. The range, featuring three 'cheddar' alternatives, two butter-style products, and milk, debuted gradually across Tesco, Sainsbury’s, Morrisons, and The Co-op, with Tesco and Morrisons stocking the full range by May. The move aimed to introduce innovation to the dairy category, challenging traditional perceptions of dairy and non-dairy markets.

- In October 2023, Little Freddie introduced its dairy-free yogurt alternatives to the baby food category. The organic brand unveiled two flavors, Banana & Raspberry and Strawberry, priced at £1.50/90g. Packaged in recyclable pouches, the range utilized a Sri Lankan coconut yogurt base, addressing the need for a calcium source in the baby food aisle. Little Freddie aimed to cater to parents with cow’s milk protein-allergic babies and those opting for plant-based weaning.

|

Global Dairy Alternatives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.81 % |

Market Size in 2032: |

USD 91.15 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Formulation |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- DAIRY ALTERNATIVES MARKET BY TYPE (2017-2032)

- DAIRY ALTERNATIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLANT-BASED MILK ALTERNATIVES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CHEESE ALTERNATIVES

- YOGURT ALTERNATIVES

- BUTTER ALTERNATIVES

- CREAM ALTERNATIVES

- DAIRY ALTERNATIVES MARKET BY SOURCE (2017-2032)

- DAIRY ALTERNATIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ALMOND

- COCONUT

- OAT

- RICE

- OTHERS

- DAIRY ALTERNATIVES MARKET BY APPLICATION (2017-2032)

- DAIRY ALTERNATIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FOOD PRODUCTS

- DAIRY ALTERNATIVES MARKET BY FORMULATION (2017-2032)

- DAIRY ALTERNATIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ORIGINAL/PLAIN

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FLAVORED

- SWEETENED

- UNSWEETENED

- DAIRY ALTERNATIVES MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- DAIRY ALTERNATIVES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS/HYPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONVENIENCE STORES

- SPECIALTY STORES

- ONLINE RETAILERS

- FOODSERVICE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Dairy Alternatives Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- DANONE NORTH AMERICA PUBLIC BENEFIT CORPORATION (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- THE HAIN CELESTIAL GROUP, INC. (US)

- BLUE DIAMOND GROWERS (US)

- EDEN FOODS, INC. (US)

- HILAND DAIRY (US)

- RIPPLE FOODS (US)

- KITE HILL (US)

- CALIFIA FARMS, LLC (US)

- RUDE HEALTH (US)

- MIYOKO’S CREAMERY (US)

- PANOS BRAND (US)

- EARTH’S OWN FOOD COMPANY INC. (CANADA)

- DAIYA FOODS INC. (CANADA)

- SUNOPTA (CANADA)

- ELMHURST MILKED DIRECT LLC (NEW YORK)

- VALSOIA S.P.A (ITALY)

- NUTRIOPS, S.L. (SPAIN)

- QATLY GROUP AB (SWEDEN)

- TRIBALLAT NOYAL (FRANCE)

- ONE GOOD (INDIA)

- FREEDOM FOODS GROUP LIMITED (AUSTRALIA)

- PUREHARVEST (AUSTRALIA)

- SANITARIUM (NEW ZEALAND)

- GREEN SPOT CO., LTD. (THAILAND)

- COMPETITIVE LANDSCAPE

- GLOBAL DAIRY ALTERNATIVES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Source

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Formulation

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Dairy Alternatives Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 28.55 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.81 % |

Market Size in 2032: |

USD 91.15 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Source |

|

||

|

By Application |

|

||

|

By Formulation |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. DAIRY ALTERNATIVES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. DAIRY ALTERNATIVES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. DAIRY ALTERNATIVES MARKET COMPETITIVE RIVALRY

TABLE 005. DAIRY ALTERNATIVES MARKET THREAT OF NEW ENTRANTS

TABLE 006. DAIRY ALTERNATIVES MARKET THREAT OF SUBSTITUTES

TABLE 007. DAIRY ALTERNATIVES MARKET BY TYPE

TABLE 008. NON-DAIRY MILK MARKET OVERVIEW (2016-2028)

TABLE 009. YOGHURT MARKET OVERVIEW (2016-2028)

TABLE 010. ICE-CREAMS MARKET OVERVIEW (2016-2028)

TABLE 011. CHEESE MARKET OVERVIEW (2016-2028)

TABLE 012. CREAMERS MARKET OVERVIEW (2016-2028)

TABLE 013. AND OTHERS MARKET OVERVIEW (2016-2028)

TABLE 014. DAIRY ALTERNATIVES MARKET BY APPLICATION

TABLE 015. FOOD AND BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 016. DAIRY-FREE PROBIOTICS DRINKS MARKET OVERVIEW (2016-2028)

TABLE 017. AND OTHERS MARKET OVERVIEW (2016-2028)

TABLE 018. DAIRY ALTERNATIVES MARKET BY SOURCE

TABLE 019. COCONUT MARKET OVERVIEW (2016-2028)

TABLE 020. SOY MARKET OVERVIEW (2016-2028)

TABLE 021. ALMOND MARKET OVERVIEW (2016-2028)

TABLE 022. HEMP SEEDS MARKET OVERVIEW (2016-2028)

TABLE 023. RICE MARKET OVERVIEW (2016-2028)

TABLE 024. OATS MARKET OVERVIEW (2016-2028)

TABLE 025. SUNFLOWER MARKET OVERVIEW (2016-2028)

TABLE 026. WHEAT MARKET OVERVIEW (2016-2028)

TABLE 027. BARLEY MARKET OVERVIEW (2016-2028)

TABLE 028. DAIRY ALTERNATIVES MARKET BY DISTRIBUTION CHANNEL

TABLE 029. SPECIALITY STORES MARKET OVERVIEW (2016-2028)

TABLE 030. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

TABLE 031. HEALTH FOOD STORES MARKET OVERVIEW (2016-2028)

TABLE 032. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

TABLE 033. RETAILS MARKET OVERVIEW (2016-2028)

TABLE 034. NORTH AMERICA DAIRY ALTERNATIVES MARKET, BY TYPE (2016-2028)

TABLE 035. NORTH AMERICA DAIRY ALTERNATIVES MARKET, BY APPLICATION (2016-2028)

TABLE 036. NORTH AMERICA DAIRY ALTERNATIVES MARKET, BY SOURCE (2016-2028)

TABLE 037. NORTH AMERICA DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 038. N DAIRY ALTERNATIVES MARKET, BY COUNTRY (2016-2028)

TABLE 039. EUROPE DAIRY ALTERNATIVES MARKET, BY TYPE (2016-2028)

TABLE 040. EUROPE DAIRY ALTERNATIVES MARKET, BY APPLICATION (2016-2028)

TABLE 041. EUROPE DAIRY ALTERNATIVES MARKET, BY SOURCE (2016-2028)

TABLE 042. EUROPE DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 043. DAIRY ALTERNATIVES MARKET, BY COUNTRY (2016-2028)

TABLE 044. ASIA PACIFIC DAIRY ALTERNATIVES MARKET, BY TYPE (2016-2028)

TABLE 045. ASIA PACIFIC DAIRY ALTERNATIVES MARKET, BY APPLICATION (2016-2028)

TABLE 046. ASIA PACIFIC DAIRY ALTERNATIVES MARKET, BY SOURCE (2016-2028)

TABLE 047. ASIA PACIFIC DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 048. DAIRY ALTERNATIVES MARKET, BY COUNTRY (2016-2028)

TABLE 049. MIDDLE EAST & AFRICA DAIRY ALTERNATIVES MARKET, BY TYPE (2016-2028)

TABLE 050. MIDDLE EAST & AFRICA DAIRY ALTERNATIVES MARKET, BY APPLICATION (2016-2028)

TABLE 051. MIDDLE EAST & AFRICA DAIRY ALTERNATIVES MARKET, BY SOURCE (2016-2028)

TABLE 052. MIDDLE EAST & AFRICA DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 053. DAIRY ALTERNATIVES MARKET, BY COUNTRY (2016-2028)

TABLE 054. SOUTH AMERICA DAIRY ALTERNATIVES MARKET, BY TYPE (2016-2028)

TABLE 055. SOUTH AMERICA DAIRY ALTERNATIVES MARKET, BY APPLICATION (2016-2028)

TABLE 056. SOUTH AMERICA DAIRY ALTERNATIVES MARKET, BY SOURCE (2016-2028)

TABLE 057. SOUTH AMERICA DAIRY ALTERNATIVES MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 058. DAIRY ALTERNATIVES MARKET, BY COUNTRY (2016-2028)

TABLE 059. EARTH'S OWN FOOD COMPANY INC. (CANADA): SNAPSHOT

TABLE 060. EARTH'S OWN FOOD COMPANY INC. (CANADA): BUSINESS PERFORMANCE

TABLE 061. EARTH'S OWN FOOD COMPANY INC. (CANADA): PRODUCT PORTFOLIO

TABLE 062. EARTH'S OWN FOOD COMPANY INC. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. FREEDOM FOODS GROUP LTD. (AUSTRALIA): SNAPSHOT

TABLE 063. FREEDOM FOODS GROUP LTD. (AUSTRALIA): BUSINESS PERFORMANCE

TABLE 064. FREEDOM FOODS GROUP LTD. (AUSTRALIA): PRODUCT PORTFOLIO

TABLE 065. FREEDOM FOODS GROUP LTD. (AUSTRALIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. THE HAIN CELESTIAL GROUP: SNAPSHOT

TABLE 066. THE HAIN CELESTIAL GROUP: BUSINESS PERFORMANCE

TABLE 067. THE HAIN CELESTIAL GROUP: PRODUCT PORTFOLIO

TABLE 068. THE HAIN CELESTIAL GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. INC. (THE US): SNAPSHOT

TABLE 069. INC. (THE US): BUSINESS PERFORMANCE

TABLE 070. INC. (THE US): PRODUCT PORTFOLIO

TABLE 071. INC. (THE US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. LIVING HARVEST FOODS INC. (US): SNAPSHOT

TABLE 072. LIVING HARVEST FOODS INC. (US): BUSINESS PERFORMANCE

TABLE 073. LIVING HARVEST FOODS INC. (US): PRODUCT PORTFOLIO

TABLE 074. LIVING HARVEST FOODS INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. SUNOPTA INC. (CANADA): SNAPSHOT

TABLE 075. SUNOPTA INC. (CANADA): BUSINESS PERFORMANCE

TABLE 076. SUNOPTA INC. (CANADA): PRODUCT PORTFOLIO

TABLE 077. SUNOPTA INC. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. CP KELCO (GEORGIA): SNAPSHOT

TABLE 078. CP KELCO (GEORGIA): BUSINESS PERFORMANCE

TABLE 079. CP KELCO (GEORGIA): PRODUCT PORTFOLIO

TABLE 080. CP KELCO (GEORGIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. ORGANIC VALLEY FAMILY OF FARMS (US): SNAPSHOT

TABLE 081. ORGANIC VALLEY FAMILY OF FARMS (US): BUSINESS PERFORMANCE

TABLE 082. ORGANIC VALLEY FAMILY OF FARMS (US): PRODUCT PORTFOLIO

TABLE 083. ORGANIC VALLEY FAMILY OF FARMS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. DANONE (FRANCE): SNAPSHOT

TABLE 084. DANONE (FRANCE): BUSINESS PERFORMANCE

TABLE 085. DANONE (FRANCE): PRODUCT PORTFOLIO

TABLE 086. DANONE (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. OATLY (SWEDEN): SNAPSHOT

TABLE 087. OATLY (SWEDEN): BUSINESS PERFORMANCE

TABLE 088. OATLY (SWEDEN): PRODUCT PORTFOLIO

TABLE 089. OATLY (SWEDEN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. VITASOY INTERNATIONAL HOLDINGS LIMITED (HONG KONG): SNAPSHOT

TABLE 090. VITASOY INTERNATIONAL HOLDINGS LIMITED (HONG KONG): BUSINESS PERFORMANCE

TABLE 091. VITASOY INTERNATIONAL HOLDINGS LIMITED (HONG KONG): PRODUCT PORTFOLIO

TABLE 092. VITASOY INTERNATIONAL HOLDINGS LIMITED (HONG KONG): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. DAIYA FOODS INC. (CANADA): SNAPSHOT

TABLE 093. DAIYA FOODS INC. (CANADA): BUSINESS PERFORMANCE

TABLE 094. DAIYA FOODS INC. (CANADA): PRODUCT PORTFOLIO

TABLE 095. DAIYA FOODS INC. (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. MELT ORGANIC (IDAHO): SNAPSHOT

TABLE 096. MELT ORGANIC (IDAHO): BUSINESS PERFORMANCE

TABLE 097. MELT ORGANIC (IDAHO): PRODUCT PORTFOLIO

TABLE 098. MELT ORGANIC (IDAHO): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. RIPPLE FOODS (US): SNAPSHOT

TABLE 099. RIPPLE FOODS (US): BUSINESS PERFORMANCE

TABLE 100. RIPPLE FOODS (US): PRODUCT PORTFOLIO

TABLE 101. RIPPLE FOODS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. ADM (US): SNAPSHOT

TABLE 102. ADM (US): BUSINESS PERFORMANCE

TABLE 103. ADM (US): PRODUCT PORTFOLIO

TABLE 104. ADM (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. THE WHITEWAVE FOODS COMPANY (US): SNAPSHOT

TABLE 105. THE WHITEWAVE FOODS COMPANY (US): BUSINESS PERFORMANCE

TABLE 106. THE WHITEWAVE FOODS COMPANY (US): PRODUCT PORTFOLIO

TABLE 107. THE WHITEWAVE FOODS COMPANY (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. EDEN FOODS: SNAPSHOT

TABLE 108. EDEN FOODS: BUSINESS PERFORMANCE

TABLE 109. EDEN FOODS: PRODUCT PORTFOLIO

TABLE 110. EDEN FOODS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. INC. (US): SNAPSHOT

TABLE 111. INC. (US): BUSINESS PERFORMANCE

TABLE 112. INC. (US): PRODUCT PORTFOLIO

TABLE 113. INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. BLUE DIAMOND GROWERS (US): SNAPSHOT

TABLE 114. BLUE DIAMOND GROWERS (US): BUSINESS PERFORMANCE

TABLE 115. BLUE DIAMOND GROWERS (US): PRODUCT PORTFOLIO

TABLE 116. BLUE DIAMOND GROWERS (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 116. AND OTHERS.: SNAPSHOT

TABLE 117. AND OTHERS.: BUSINESS PERFORMANCE

TABLE 118. AND OTHERS.: PRODUCT PORTFOLIO

TABLE 119. AND OTHERS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. DAIRY ALTERNATIVES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. DAIRY ALTERNATIVES MARKET OVERVIEW BY TYPE

FIGURE 012. NON-DAIRY MILK MARKET OVERVIEW (2016-2028)

FIGURE 013. YOGHURT MARKET OVERVIEW (2016-2028)

FIGURE 014. ICE-CREAMS MARKET OVERVIEW (2016-2028)

FIGURE 015. CHEESE MARKET OVERVIEW (2016-2028)

FIGURE 016. CREAMERS MARKET OVERVIEW (2016-2028)

FIGURE 017. AND OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 018. DAIRY ALTERNATIVES MARKET OVERVIEW BY APPLICATION

FIGURE 019. FOOD AND BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 020. DAIRY-FREE PROBIOTICS DRINKS MARKET OVERVIEW (2016-2028)

FIGURE 021. AND OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 022. DAIRY ALTERNATIVES MARKET OVERVIEW BY SOURCE

FIGURE 023. COCONUT MARKET OVERVIEW (2016-2028)

FIGURE 024. SOY MARKET OVERVIEW (2016-2028)

FIGURE 025. ALMOND MARKET OVERVIEW (2016-2028)

FIGURE 026. HEMP SEEDS MARKET OVERVIEW (2016-2028)

FIGURE 027. RICE MARKET OVERVIEW (2016-2028)

FIGURE 028. OATS MARKET OVERVIEW (2016-2028)

FIGURE 029. SUNFLOWER MARKET OVERVIEW (2016-2028)

FIGURE 030. WHEAT MARKET OVERVIEW (2016-2028)

FIGURE 031. BARLEY MARKET OVERVIEW (2016-2028)

FIGURE 032. DAIRY ALTERNATIVES MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 033. SPECIALITY STORES MARKET OVERVIEW (2016-2028)

FIGURE 034. SUPERMARKET/HYPERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 035. HEALTH FOOD STORES MARKET OVERVIEW (2016-2028)

FIGURE 036. PHARMACEUTICALS MARKET OVERVIEW (2016-2028)

FIGURE 037. RETAILS MARKET OVERVIEW (2016-2028)

FIGURE 038. NORTH AMERICA DAIRY ALTERNATIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 039. EUROPE DAIRY ALTERNATIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 040. ASIA PACIFIC DAIRY ALTERNATIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 041. MIDDLE EAST & AFRICA DAIRY ALTERNATIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 042. SOUTH AMERICA DAIRY ALTERNATIVES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Dairy Alternatives Market research report is 2024-2032.

Danone North America Public Benefit Corporation (US), The Hain Celestial Group, Inc. (US), Blue Diamond Growers (US), Eden Foods, Inc. (US), Hiland Dairy (US), Ripple Foods (US), Kite Hill (US), Califia Farms, LLC (US), Rude Health (US), Miyoko’s Creamery (US), PANOS Brand (US), Earth’s Own Food Company Inc. (Canada), Daiya Foods Inc. (Canada), SunOpta (Canada), Elmhurst Milked Direct LLC (New York), Valsoia S.p.A (Italy), Nutriops, S.L. (Spain), Qatly Group AB (Sweden), Triballat Noyal (France), One Good (India), Freedom Foods Group Limited (Australia), PureHarvest (Australia), Sanitarium (New Zealand), Green Spot Co., Ltd. (Thailand) and Other Major Players.

The Dairy Alternatives Market is segmented into Type, Source, Application, Formulation, Distribution Channel, and region. By Type, the market is categorized into Plant-Based Milk Alternatives, Cheese Alternatives, Yogurt Alternatives, Butter Alternatives, and Cream Alternatives. By Source, the market is categorized into Soy, Almond, Coconut, Oat, Rice, and Others. By Application, the market is categorized into Beverages, Food Products. By Formulation, the market is categorized into Original/Plain, Flavored, Sweetened, and Unsweetened. By Distribution Channel, the market is categorized into Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retailers, Foodservice. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Dairy alternatives are plant-based products that mimic traditional dairy products like milk, cheese, and yogurt. Made from almonds, soybeans, oats, and coconuts, they cater to dietary restrictions like lactose intolerance and vegan lifestyles. These nutritious, sustainable alternatives offer a sustainable, environmentally friendly alternative to conventional dairy.

Dairy Alternatives Market Size Was Valued at USD 28.55 billion in 2023, and is Projected to Reach USD 91.15 Billion by 2032, Growing at a CAGR of 13.81% From 2024-2032.