Global Starter Cultures Market Overview

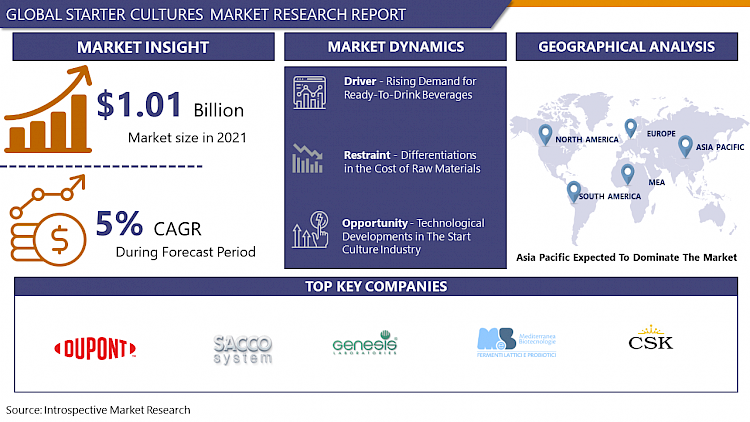

The Global Starter Cultures market was valued at USD 1.01 billion in 2021 and is expected to reach USD 1.42 billion by the year 2028, at a CAGR of 5%.

Starter cultures are referred to as the microorganisms that are utilized in the manufacturing of cultured dairy products such as yogurt and cheese. The natural microflora of the milk is either uncontrollable, inefficient, and unpredictable, or is destroyed thoroughly by the heat treatments given to the milk. Additionally, a starter culture can have special properties in a more controlled and predictable fermentation. The primary function of lactic starters is the development of lactic acid from lactose. Other functions of starter cultures may include such as flavor, aroma, and alcohol production, proteolytic and lipolytic activities, retardation of nasty organisms. Furthermore, starter cultures or starters are individual or mixed microbial cultures used in known concentrations to assist and conduct fermentation in meat products. Bacteria, particularly coagulase-negative staphylococci (CNS), lactic acid bacteria (LAB), and as well as yeasts and molds, are utilized as starters, thus contributing to growing the safety of fermented meat products.

In addition, starters may support standardizing product properties and condense maturing times of fermented meat products. Starter cultures, which are pondering as GRAS (Generally Regarded as Safe) by the US Food and Drug Administration (FDA), are capable to impede the growth of undesirable microbiota, such as pathogenic and spoilage microorganisms. Moreover, selection criteria for starter cultures should take into account the raw material, the properties of the strain(s), food safety requirements, and quality features. Additionally, starter culture improves the lifespan of these products and controls bacterial activity. On the back of these signs of using a starter culture, the dairy industry is anticipated to develop as the largest end-use segment in the global starter culture market.

COVID-19 Impact on Global Starter Cultures Market

During the global COVID19 outbreak and the lock-down over the world, the consumer food & beverage industry observed high demand in the markets. The top producers in the industry are experienced with low consumption of their products in the market and disrupt in sales channel system makes a huge decline in sales and revenue growth. Owing to the closure of supermarkets and other stores and supplies, the companies are targeting more on modifying their distributional channel system to strengthen the online platform and delivery service. The closure of production units owing to lockdown is poorly impacted by the scale of production and the global starter culture market.

Market Dynamics and Factors for the Global Starter Cultures Market

Drivers:

Growing Offering of Dairy-Based Products and Meat and Seafood

The rising production of dairy-based products and meat & seafood has led to growth in demand for starter cultures. By the growing consciousness of the significance of using starter cultures and the rising number of manufacturers, the starter culture market has shown consistent growth over the years. Starter cultures have been utilized in dairy applications for a long time. During the production of yogurt, cheese, butter, and kefir, starter cultures are used for the fermentation process to take place. The drop in pH, which takes place when the bacteria ferment lactose to form lactic acid, has a preservative effect on the product, while at the same time enhancing the digestibility and nutritional abilities. Yogurt starter cultures are utilized to ferment (lactose) to produce lactic acid. This process supports the formation of milk clots, which are a characteristic of yogurt. Cheese starter cultures majorly comprise of thermophilic bacteria, which helps in lactic acid production over the industrial manufacturing of cheese. Additionally, acid manufacturing is the key factor in the expulsion of moisture from the cheese curd and aids in boosting the quality and texture of the cheese produced.

Growing Demand of Ready-to-Drink Beverages

The rising demand for ready-to-drink beverages is another factor turning the global starter culture market over the forecast period. Shifting lifestyle along with the increasing health concern and busy schedules of people over the globe is further turning its market. Moreover, as consumers seek benefits the ready-to-drink sector has been quick to fulfill this demand with a torrent of new innovative offerings thus turning its market growth.

Restraints:

Differentiations In the Cost of Raw Materials

The prices of raw materials for starter cultures are explosive, leading to variability in the food & beverage market. Yeast mainly increases in beet or cane molasses, and these are the main substrates for its production. In recent years, the cost of molasses is rising owing to their applications in other industrial applications such as feed and bio-ethanol production. Yeast also develops on sugar substrates such as sugar syrups. Hence, growth in the cost of sugar has a direct influence on the cost of yeast starter cultures.

Strict Government Ordinance on Application of Microorganism in Food Products

Strict government regulation on the use of microorganisms in food products is hampering the market growth over the forecast period. The increased application of food culture to ferment perishable raw materials has strengthened the requirement of regulation to access and assure the safety of food culture and their uses thereby hindering its market growth.

Opportunities:

Apart from the surging demand from the food and beverages industry, rising healthcare awareness among the consumers is another major factor accelerating the demand in the global starter culture market. In addition, technological developments in the start culture industry, for example genetically modified start cultures, are anticipated to flourish the market growth throughout the forecast period.

Furthermore, the incoming second generation of starter cultures is anticipated to build its range of capabilities further to cover fruits, vegetables, and other food substances as well. The existing market involving seafood, meat, and alcoholic beverages continues to present avenues for growth as the producer's participation in this segment is still the least. Key Players such as DSM (Netherlands) and Chr. Hansen (Denmark) is leading the way toward introducing themselves in the Asia Pacific market region over the projected period to merge their positions in the global starter culture market. Furthermore, the utilization of starter cultures in their current state is special to fermented foods and dairy products; nevertheless, improvements of new strain types and mixed multi-strains are anticipated to build the capabilities of starter cultures to non-fermented products and other food types.

Market Segmentation

Segmentation Analysis of Global Starter Cultures Market:

Based on the Form, freeze-dried is projected to account for the maximum market share during the forecast period. With freeze-drying, microorganisms can be preserved without causing harmful damage to their physical or molecular functions. Consequently, the adoption of the freeze-drying method has raised significantly for microbe-based applications. These cultures can simply be rehydrated, depending on the application's need. Freeze drying is utilized in different application areas such as fermented milk and cheese.

Based on the Microorganism, the bacteria segment is expected to dominate the market over the forecast period. Bacteria is the most common microorganism utilized for starter cultures, especially owing to their large-scale application in dairy & dairy-based products. Streptococcus thermophilus is the second-major commercially important starter culture. It is used, along with the Lactobacillus species, as a multi-strain mixed starter culture for the production of different fermented dairy foods such as fermented milk, yogurt, and mozzarella cheese. Thermophilic bacteria are majorly used as starter cultures compared to mesophilic bacteria, based on the product portfolio of several producers.

Based on the Application, dairy products are expected to record the largest market share throughout the market share due to the growing demand for yogurt, cheese, kefir, and other cultured milk products as well as in butter making and cheese making and the increasing demand in bakery & confectionary. Moreover, the sourdough application has been widely praised in the last few years due to the customer's demand for food utilization without the addition of chemical preservatives. Furthermore, different starter cultures have been utilized in sourdough bread making focusing on the rise of bread self-life and the development of sensorial character.

Regional Analysis of Global Starter Cultures Market:

The Asia Pacific is one of the fastest-growing regions globally, concerning the population and economy, and is expected to dominate the market over the forecast period. This region has the highest number of customers of dairy and meat products. Most Asian economies have emerging markets, and the demand for packaged food & beverage products is rising significantly in these markets. The growing launching of new dairy products and packaged meat products in these markets is anticipated to stimulate the growth of the global starter culture market in the Asia Pacific region. Global key players in the dairy market such as Groupe Lactalis S.A., Schreiber Foods Inc., Saputo Inc., Ltd., and Meiji Holdings Company, focus on the augmentation of their businesses in the Asia Pacific region by acquisitions, mergers, and collaborations with local players.

Europe and North America regions together hold a leading share in the global starter culture market over the projected period. Europe is one of the maximum consumers of dairy products, comprising sour milk, yogurt, cheese, and cream, which produce massive demand for starter culture in this region. Furthermore, North America is the leading utilization for meat and meat-based products, including processed meat, fermented meat, cured meat products, and packaged meat, along with the leading consumer of dairy and bakery products, which is anticipated to significantly enhance the growth of the global starter culture market in the region. As per the Food and Agriculture Organization (FAO) of the United States, North America registers for the highest per-capita utilization of processed meat, globally. In addition, as per the North America Meat Institute, the North American region was the largest consumer of processed and packaged meat in the past few years.

Players Covered in Starter Cultures Market are :

- Chr. Hansen (Denmark)

- DSM (Netherlands)

- DuPont (US)

- Genesis Laboratories (Bulgaria)

- Sacco SRL (Italy)

- Mediterranea Biotecnologie SRL (Italy)

- Biochem SRL (Italy)

- Dalton Biotecnologie SRL (Italy)

- THT S.A. (Belgium)

- CSK Food (Netherlands)

- IGEA SRL (Italy)

- Codex-ing Biotech Ingredients (US)

- Bioprox (France)

- Benny Impex. (US)

- ABsource Biologics (India)

- Alliance India (India)

- Lactina Ltd. (Bulgaria)

- BDF Natural Ingredients (Spain)

- GEM Cultures (US)

- Kultured Wellness (Australia)

- Benebios Inc. (US)

- Binea (Canada)

- Biolacter Inc. (Italy)

Key Industry Developments in the Global Starter Cultures Market

- In May 2021, Chr. Hansen introduces VEGA™ Culture Kit specifically designed for fermented plant bases. As dairy-free substitutes to yogurt, "figures", gain propulsion globally, competition continues to grow among manufacturers aiming to provide consumers tasty, healthy, and sustainable products. With this launch of the VEGA™ Culture Kit developed for optimal results over the full scope of plant bases, Chr. Hansen aims to improve its help of plant-based innovation.

- In September 2020, the US-based company DuPont Nutrition & Biosciences has declared the launch of the latest series of cultures and probiotic formulations for China, catering yogurt manufacturers new solutions for differentiation and positioning them for future development. The latest culture can faster fermentation and higher probiotic counts at the time of maintaining a mild taste and premium texture for consumers. Furthermore, the launch comprises YO-MIX PRIME, which is developed to manufacture the capability to produce optimal mildness and premium creamy texture for customers.

- In July 2019, Netherlands-based company DSM introduced their latest Delvo cheese -120 culture segment for young cheddar and barrel cheese to serve the demand in the dairy industry.

|

Global Starter Cultures Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.01 Bn. |

|

Forecast Period 2022-28 CAGR: |

5% |

Market Size in 2028: |

USD 1.42 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Composition |

|

||

|

By Microorganism |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Form

3.2 By Composition

3.3 By Microorganism

3.4 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Starter Cultures Market by Form

5.1 Starter Cultures Market Overview Snapshot and Growth Engine

5.2 Starter Cultures Market Overview

5.3 Freeze-Dried

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Freeze-Dried: Grographic Segmentation

5.4 Frozen

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Frozen: Grographic Segmentation

Chapter 6: Starter Cultures Market by Composition

6.1 Starter Cultures Market Overview Snapshot and Growth Engine

6.2 Starter Cultures Market Overview

6.3 Multi-strain Mix

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Multi-strain Mix: Grographic Segmentation

6.4 Single strain

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Single strain: Grographic Segmentation

6.5 Multi-strain

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Multi-strain: Grographic Segmentation

Chapter 7: Starter Cultures Market by Microorganism

7.1 Starter Cultures Market Overview Snapshot and Growth Engine

7.2 Starter Cultures Market Overview

7.3 Bacteria

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Bacteria: Grographic Segmentation

7.4 Yeast

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Yeast: Grographic Segmentation

7.5 Molds

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2016-2028F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Molds: Grographic Segmentation

Chapter 8: Starter Cultures Market by Application

8.1 Starter Cultures Market Overview Snapshot and Growth Engine

8.2 Starter Cultures Market Overview

8.3 Meat & Seafood

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size (2016-2028F)

8.3.3 Key Market Trends, Growth Factors and Opportunities

8.3.4 Meat & Seafood: Grographic Segmentation

8.4 Dairy & Dairy-Based Products

8.4.1 Introduction and Market Overview

8.4.2 Historic and Forecasted Market Size (2016-2028F)

8.4.3 Key Market Trends, Growth Factors and Opportunities

8.4.4 Dairy & Dairy-Based Products: Grographic Segmentation

8.5 Alcoholic

8.5.1 Introduction and Market Overview

8.5.2 Historic and Forecasted Market Size (2016-2028F)

8.5.3 Key Market Trends, Growth Factors and Opportunities

8.5.4 Alcoholic: Grographic Segmentation

8.6 Non-Alcoholic Beverages

8.6.1 Introduction and Market Overview

8.6.2 Historic and Forecasted Market Size (2016-2028F)

8.6.3 Key Market Trends, Growth Factors and Opportunities

8.6.4 Non-Alcoholic Beverages: Grographic Segmentation

8.7 Animal Feed

8.7.1 Introduction and Market Overview

8.7.2 Historic and Forecasted Market Size (2016-2028F)

8.7.3 Key Market Trends, Growth Factors and Opportunities

8.7.4 Animal Feed: Grographic Segmentation

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Positioning

9.1.2 Starter Cultures Sales and Market Share By Players

9.1.3 Industry BCG Matrix

9.1.4 Ansoff Matrix

9.1.5 Starter Cultures Industry Concentration Ratio (CR5 and HHI)

9.1.6 Top 5 Starter Cultures Players Market Share

9.1.7 Mergers and Acquisitions

9.1.8 Business Strategies By Top Players

9.2 CHR. HANSEN

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Operating Business Segments

9.2.5 Product Portfolio

9.2.6 Business Performance

9.2.7 Key Strategic Moves and Recent Developments

9.2.8 SWOT Analysis

9.3 DSM

9.4 DUPONT

9.5 GENESIS LABORATORIES

9.6 SACCO SRL

9.7 MEDITERRANEA BIOTECNOLOGIE SRL

9.8 BIOCHEM SRL

9.9 DALTON BIOTECNOLOGIE SRL

9.10 THT S.A.

9.11 CSK FOOD

9.12 IGEA SRL

9.13 CODEX-ING BIOTECH INGREDIENTS

9.14 BIOPROX

9.15 BENNY IMPEX

9.16 ABSOURCE BIOLOGICS

9.17 ALLIANCE INDIA

9.18 LACTINA LTD.

9.19 BDF NATURAL INGREDIENTS

9.20 GEM CULTURES

9.21 KULTURED WELLNESS

9.22 BENEBIOS INC.

9.23 BINEA

9.24 BIOLACTER INC.

9.25 OTHER MAJOR PLAYERS

Chapter 10: Global Starter Cultures Market Analysis, Insights and Forecast, 2016-2028

10.1 Market Overview

10.2 Historic and Forecasted Market Size By Form

10.2.1 Freeze-Dried

10.2.2 Frozen

10.3 Historic and Forecasted Market Size By Composition

10.3.1 Multi-strain Mix

10.3.2 Single strain

10.3.3 Multi-strain

10.4 Historic and Forecasted Market Size By Microorganism

10.4.1 Bacteria

10.4.2 Yeast

10.4.3 Molds

10.5 Historic and Forecasted Market Size By Application

10.5.1 Meat & Seafood

10.5.2 Dairy & Dairy-Based Products

10.5.3 Alcoholic

10.5.4 Non-Alcoholic Beverages

10.5.5 Animal Feed

Chapter 11: North America Starter Cultures Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Form

11.4.1 Freeze-Dried

11.4.2 Frozen

11.5 Historic and Forecasted Market Size By Composition

11.5.1 Multi-strain Mix

11.5.2 Single strain

11.5.3 Multi-strain

11.6 Historic and Forecasted Market Size By Microorganism

11.6.1 Bacteria

11.6.2 Yeast

11.6.3 Molds

11.7 Historic and Forecasted Market Size By Application

11.7.1 Meat & Seafood

11.7.2 Dairy & Dairy-Based Products

11.7.3 Alcoholic

11.7.4 Non-Alcoholic Beverages

11.7.5 Animal Feed

11.8 Historic and Forecast Market Size by Country

11.8.1 U.S.

11.8.2 Canada

11.8.3 Mexico

Chapter 12: Europe Starter Cultures Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Form

12.4.1 Freeze-Dried

12.4.2 Frozen

12.5 Historic and Forecasted Market Size By Composition

12.5.1 Multi-strain Mix

12.5.2 Single strain

12.5.3 Multi-strain

12.6 Historic and Forecasted Market Size By Microorganism

12.6.1 Bacteria

12.6.2 Yeast

12.6.3 Molds

12.7 Historic and Forecasted Market Size By Application

12.7.1 Meat & Seafood

12.7.2 Dairy & Dairy-Based Products

12.7.3 Alcoholic

12.7.4 Non-Alcoholic Beverages

12.7.5 Animal Feed

12.8 Historic and Forecast Market Size by Country

12.8.1 Germany

12.8.2 U.K.

12.8.3 France

12.8.4 Italy

12.8.5 Russia

12.8.6 Spain

12.8.7 Rest of Europe

Chapter 13: Asia-Pacific Starter Cultures Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Form

13.4.1 Freeze-Dried

13.4.2 Frozen

13.5 Historic and Forecasted Market Size By Composition

13.5.1 Multi-strain Mix

13.5.2 Single strain

13.5.3 Multi-strain

13.6 Historic and Forecasted Market Size By Microorganism

13.6.1 Bacteria

13.6.2 Yeast

13.6.3 Molds

13.7 Historic and Forecasted Market Size By Application

13.7.1 Meat & Seafood

13.7.2 Dairy & Dairy-Based Products

13.7.3 Alcoholic

13.7.4 Non-Alcoholic Beverages

13.7.5 Animal Feed

13.8 Historic and Forecast Market Size by Country

13.8.1 China

13.8.2 India

13.8.3 Japan

13.8.4 Singapore

13.8.5 Australia

13.8.6 New Zealand

13.8.7 Rest of APAC

Chapter 14: Middle East & Africa Starter Cultures Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Form

14.4.1 Freeze-Dried

14.4.2 Frozen

14.5 Historic and Forecasted Market Size By Composition

14.5.1 Multi-strain Mix

14.5.2 Single strain

14.5.3 Multi-strain

14.6 Historic and Forecasted Market Size By Microorganism

14.6.1 Bacteria

14.6.2 Yeast

14.6.3 Molds

14.7 Historic and Forecasted Market Size By Application

14.7.1 Meat & Seafood

14.7.2 Dairy & Dairy-Based Products

14.7.3 Alcoholic

14.7.4 Non-Alcoholic Beverages

14.7.5 Animal Feed

14.8 Historic and Forecast Market Size by Country

14.8.1 Turkey

14.8.2 Saudi Arabia

14.8.3 Iran

14.8.4 UAE

14.8.5 Africa

14.8.6 Rest of MEA

Chapter 15: South America Starter Cultures Market Analysis, Insights and Forecast, 2016-2028

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Form

15.4.1 Freeze-Dried

15.4.2 Frozen

15.5 Historic and Forecasted Market Size By Composition

15.5.1 Multi-strain Mix

15.5.2 Single strain

15.5.3 Multi-strain

15.6 Historic and Forecasted Market Size By Microorganism

15.6.1 Bacteria

15.6.2 Yeast

15.6.3 Molds

15.7 Historic and Forecasted Market Size By Application

15.7.1 Meat & Seafood

15.7.2 Dairy & Dairy-Based Products

15.7.3 Alcoholic

15.7.4 Non-Alcoholic Beverages

15.7.5 Animal Feed

15.8 Historic and Forecast Market Size by Country

15.8.1 Brazil

15.8.2 Argentina

15.8.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Starter Cultures Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 1.01 Bn. |

|

Forecast Period 2022-28 CAGR: |

5% |

Market Size in 2028: |

USD 1.42 Bn. |

|

Segments Covered: |

By Form |

|

|

|

By Composition |

|

||

|

By Microorganism |

|

||

|

By Applications |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. STARTER CULTURES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. STARTER CULTURES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. STARTER CULTURES MARKET COMPETITIVE RIVALRY

TABLE 005. STARTER CULTURES MARKET THREAT OF NEW ENTRANTS

TABLE 006. STARTER CULTURES MARKET THREAT OF SUBSTITUTES

TABLE 007. STARTER CULTURES MARKET BY FORM

TABLE 008. FREEZE-DRIED MARKET OVERVIEW (2016-2028)

TABLE 009. FROZEN MARKET OVERVIEW (2016-2028)

TABLE 010. STARTER CULTURES MARKET BY COMPOSITION

TABLE 011. MULTI-STRAIN MIX MARKET OVERVIEW (2016-2028)

TABLE 012. SINGLE STRAIN MARKET OVERVIEW (2016-2028)

TABLE 013. MULTI-STRAIN MARKET OVERVIEW (2016-2028)

TABLE 014. STARTER CULTURES MARKET BY MICROORGANISM

TABLE 015. BACTERIA MARKET OVERVIEW (2016-2028)

TABLE 016. YEAST MARKET OVERVIEW (2016-2028)

TABLE 017. MOLDS MARKET OVERVIEW (2016-2028)

TABLE 018. STARTER CULTURES MARKET BY APPLICATION

TABLE 019. MEAT & SEAFOOD MARKET OVERVIEW (2016-2028)

TABLE 020. DAIRY & DAIRY-BASED PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 021. ALCOHOLIC MARKET OVERVIEW (2016-2028)

TABLE 022. NON-ALCOHOLIC BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 023. ANIMAL FEED MARKET OVERVIEW (2016-2028)

TABLE 024. NORTH AMERICA STARTER CULTURES MARKET, BY FORM (2016-2028)

TABLE 025. NORTH AMERICA STARTER CULTURES MARKET, BY COMPOSITION (2016-2028)

TABLE 026. NORTH AMERICA STARTER CULTURES MARKET, BY MICROORGANISM (2016-2028)

TABLE 027. NORTH AMERICA STARTER CULTURES MARKET, BY APPLICATION (2016-2028)

TABLE 028. N STARTER CULTURES MARKET, BY COUNTRY (2016-2028)

TABLE 029. EUROPE STARTER CULTURES MARKET, BY FORM (2016-2028)

TABLE 030. EUROPE STARTER CULTURES MARKET, BY COMPOSITION (2016-2028)

TABLE 031. EUROPE STARTER CULTURES MARKET, BY MICROORGANISM (2016-2028)

TABLE 032. EUROPE STARTER CULTURES MARKET, BY APPLICATION (2016-2028)

TABLE 033. STARTER CULTURES MARKET, BY COUNTRY (2016-2028)

TABLE 034. ASIA PACIFIC STARTER CULTURES MARKET, BY FORM (2016-2028)

TABLE 035. ASIA PACIFIC STARTER CULTURES MARKET, BY COMPOSITION (2016-2028)

TABLE 036. ASIA PACIFIC STARTER CULTURES MARKET, BY MICROORGANISM (2016-2028)

TABLE 037. ASIA PACIFIC STARTER CULTURES MARKET, BY APPLICATION (2016-2028)

TABLE 038. STARTER CULTURES MARKET, BY COUNTRY (2016-2028)

TABLE 039. MIDDLE EAST & AFRICA STARTER CULTURES MARKET, BY FORM (2016-2028)

TABLE 040. MIDDLE EAST & AFRICA STARTER CULTURES MARKET, BY COMPOSITION (2016-2028)

TABLE 041. MIDDLE EAST & AFRICA STARTER CULTURES MARKET, BY MICROORGANISM (2016-2028)

TABLE 042. MIDDLE EAST & AFRICA STARTER CULTURES MARKET, BY APPLICATION (2016-2028)

TABLE 043. STARTER CULTURES MARKET, BY COUNTRY (2016-2028)

TABLE 044. SOUTH AMERICA STARTER CULTURES MARKET, BY FORM (2016-2028)

TABLE 045. SOUTH AMERICA STARTER CULTURES MARKET, BY COMPOSITION (2016-2028)

TABLE 046. SOUTH AMERICA STARTER CULTURES MARKET, BY MICROORGANISM (2016-2028)

TABLE 047. SOUTH AMERICA STARTER CULTURES MARKET, BY APPLICATION (2016-2028)

TABLE 048. STARTER CULTURES MARKET, BY COUNTRY (2016-2028)

TABLE 049. CHR. HANSEN: SNAPSHOT

TABLE 050. CHR. HANSEN: BUSINESS PERFORMANCE

TABLE 051. CHR. HANSEN: PRODUCT PORTFOLIO

TABLE 052. CHR. HANSEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. DSM: SNAPSHOT

TABLE 053. DSM: BUSINESS PERFORMANCE

TABLE 054. DSM: PRODUCT PORTFOLIO

TABLE 055. DSM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. DUPONT: SNAPSHOT

TABLE 056. DUPONT: BUSINESS PERFORMANCE

TABLE 057. DUPONT: PRODUCT PORTFOLIO

TABLE 058. DUPONT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. GENESIS LABORATORIES: SNAPSHOT

TABLE 059. GENESIS LABORATORIES: BUSINESS PERFORMANCE

TABLE 060. GENESIS LABORATORIES: PRODUCT PORTFOLIO

TABLE 061. GENESIS LABORATORIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. SACCO SRL: SNAPSHOT

TABLE 062. SACCO SRL: BUSINESS PERFORMANCE

TABLE 063. SACCO SRL: PRODUCT PORTFOLIO

TABLE 064. SACCO SRL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. MEDITERRANEA BIOTECNOLOGIE SRL: SNAPSHOT

TABLE 065. MEDITERRANEA BIOTECNOLOGIE SRL: BUSINESS PERFORMANCE

TABLE 066. MEDITERRANEA BIOTECNOLOGIE SRL: PRODUCT PORTFOLIO

TABLE 067. MEDITERRANEA BIOTECNOLOGIE SRL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. BIOCHEM SRL: SNAPSHOT

TABLE 068. BIOCHEM SRL: BUSINESS PERFORMANCE

TABLE 069. BIOCHEM SRL: PRODUCT PORTFOLIO

TABLE 070. BIOCHEM SRL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. DALTON BIOTECNOLOGIE SRL: SNAPSHOT

TABLE 071. DALTON BIOTECNOLOGIE SRL: BUSINESS PERFORMANCE

TABLE 072. DALTON BIOTECNOLOGIE SRL: PRODUCT PORTFOLIO

TABLE 073. DALTON BIOTECNOLOGIE SRL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. THT S.A.: SNAPSHOT

TABLE 074. THT S.A.: BUSINESS PERFORMANCE

TABLE 075. THT S.A.: PRODUCT PORTFOLIO

TABLE 076. THT S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. CSK FOOD: SNAPSHOT

TABLE 077. CSK FOOD: BUSINESS PERFORMANCE

TABLE 078. CSK FOOD: PRODUCT PORTFOLIO

TABLE 079. CSK FOOD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. IGEA SRL: SNAPSHOT

TABLE 080. IGEA SRL: BUSINESS PERFORMANCE

TABLE 081. IGEA SRL: PRODUCT PORTFOLIO

TABLE 082. IGEA SRL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. CODEX-ING BIOTECH INGREDIENTS: SNAPSHOT

TABLE 083. CODEX-ING BIOTECH INGREDIENTS: BUSINESS PERFORMANCE

TABLE 084. CODEX-ING BIOTECH INGREDIENTS: PRODUCT PORTFOLIO

TABLE 085. CODEX-ING BIOTECH INGREDIENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. BIOPROX: SNAPSHOT

TABLE 086. BIOPROX: BUSINESS PERFORMANCE

TABLE 087. BIOPROX: PRODUCT PORTFOLIO

TABLE 088. BIOPROX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. BENNY IMPEX: SNAPSHOT

TABLE 089. BENNY IMPEX: BUSINESS PERFORMANCE

TABLE 090. BENNY IMPEX: PRODUCT PORTFOLIO

TABLE 091. BENNY IMPEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. ABSOURCE BIOLOGICS: SNAPSHOT

TABLE 092. ABSOURCE BIOLOGICS: BUSINESS PERFORMANCE

TABLE 093. ABSOURCE BIOLOGICS: PRODUCT PORTFOLIO

TABLE 094. ABSOURCE BIOLOGICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. ALLIANCE INDIA: SNAPSHOT

TABLE 095. ALLIANCE INDIA: BUSINESS PERFORMANCE

TABLE 096. ALLIANCE INDIA: PRODUCT PORTFOLIO

TABLE 097. ALLIANCE INDIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. LACTINA LTD.: SNAPSHOT

TABLE 098. LACTINA LTD.: BUSINESS PERFORMANCE

TABLE 099. LACTINA LTD.: PRODUCT PORTFOLIO

TABLE 100. LACTINA LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. BDF NATURAL INGREDIENTS: SNAPSHOT

TABLE 101. BDF NATURAL INGREDIENTS: BUSINESS PERFORMANCE

TABLE 102. BDF NATURAL INGREDIENTS: PRODUCT PORTFOLIO

TABLE 103. BDF NATURAL INGREDIENTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. GEM CULTURES: SNAPSHOT

TABLE 104. GEM CULTURES: BUSINESS PERFORMANCE

TABLE 105. GEM CULTURES: PRODUCT PORTFOLIO

TABLE 106. GEM CULTURES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. KULTURED WELLNESS: SNAPSHOT

TABLE 107. KULTURED WELLNESS: BUSINESS PERFORMANCE

TABLE 108. KULTURED WELLNESS: PRODUCT PORTFOLIO

TABLE 109. KULTURED WELLNESS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. BENEBIOS INC.: SNAPSHOT

TABLE 110. BENEBIOS INC.: BUSINESS PERFORMANCE

TABLE 111. BENEBIOS INC.: PRODUCT PORTFOLIO

TABLE 112. BENEBIOS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. BINEA: SNAPSHOT

TABLE 113. BINEA: BUSINESS PERFORMANCE

TABLE 114. BINEA: PRODUCT PORTFOLIO

TABLE 115. BINEA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. BIOLACTER INC.: SNAPSHOT

TABLE 116. BIOLACTER INC.: BUSINESS PERFORMANCE

TABLE 117. BIOLACTER INC.: PRODUCT PORTFOLIO

TABLE 118. BIOLACTER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 119. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 120. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 121. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. STARTER CULTURES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. STARTER CULTURES MARKET OVERVIEW BY FORM

FIGURE 012. FREEZE-DRIED MARKET OVERVIEW (2016-2028)

FIGURE 013. FROZEN MARKET OVERVIEW (2016-2028)

FIGURE 014. STARTER CULTURES MARKET OVERVIEW BY COMPOSITION

FIGURE 015. MULTI-STRAIN MIX MARKET OVERVIEW (2016-2028)

FIGURE 016. SINGLE STRAIN MARKET OVERVIEW (2016-2028)

FIGURE 017. MULTI-STRAIN MARKET OVERVIEW (2016-2028)

FIGURE 018. STARTER CULTURES MARKET OVERVIEW BY MICROORGANISM

FIGURE 019. BACTERIA MARKET OVERVIEW (2016-2028)

FIGURE 020. YEAST MARKET OVERVIEW (2016-2028)

FIGURE 021. MOLDS MARKET OVERVIEW (2016-2028)

FIGURE 022. STARTER CULTURES MARKET OVERVIEW BY APPLICATION

FIGURE 023. MEAT & SEAFOOD MARKET OVERVIEW (2016-2028)

FIGURE 024. DAIRY & DAIRY-BASED PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 025. ALCOHOLIC MARKET OVERVIEW (2016-2028)

FIGURE 026. NON-ALCOHOLIC BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 027. ANIMAL FEED MARKET OVERVIEW (2016-2028)

FIGURE 028. NORTH AMERICA STARTER CULTURES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. EUROPE STARTER CULTURES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. ASIA PACIFIC STARTER CULTURES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. MIDDLE EAST & AFRICA STARTER CULTURES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 032. SOUTH AMERICA STARTER CULTURES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Starter Cultures Market research report is 2022-2028.

Chr. Hansen (Denmark), DSM (Netherlands), DuPont (US), Genesis Laboratories (Bulgaria), Sacco SRL (Italy), Mediterranea Biotecnologie SRL (Italy), Biochem SRL (Italy), Dalton Biotecnologie SRL (Italy), THT S.A. (Belgium), CSK Food (Netherlands), IGEA SRL (Italy), Codex-ing Biotech Ingredients (US), Bioprox (France), Benny Impex. (US), ABsource Biologics (India), Alliance India (India), Lactina Ltd. (Bulgaria), BDF Natural Ingredients (Spain), GEM Cultures (US), Kultured Wellness (Australia), Benebios Inc. (US), Binea (Canada), Biolacter Inc. (Italy).and other major players.

The Starter Cultures Market is segmented into Form, Composition, Microorganism, Application, and region. By Form, the market is categorized into Freeze-Dried, Frozen. By Composition the market is categorized into Multi-strain mix, Single strain, and Multi-strain. By Microorganism the market is categorized into Bacteria, Yeast, and Mold. By Application, the market is categorized into Meat & Seafood, Dairy & Dairy-Based Products, Alcoholic, Non-Alcoholic Beverages, and Animal Feed. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Starter cultures are referred to as the microorganisms that are utilized in the manufacturing of cultured dairy products such as yogurt and cheese. The natural microflora of the milk is either uncontrollable, inefficient, and unpredictable, or is destroyed thoroughly by the heat treatments given to the milk.

The Global Starter Cultures market was valued at USD 1.01 billion in 2021 and is expected to reach USD 1.42 billion by the year 2028, at a CAGR of 5%.