US Kids Food and Beverage Market Synopsis

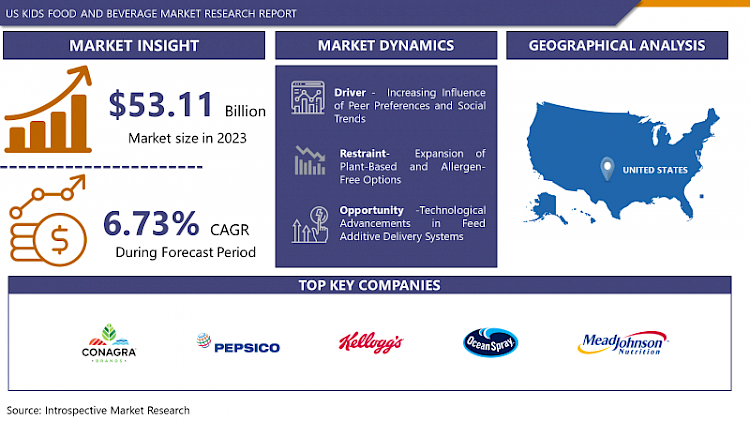

US Kids Food and Beverage Market Size Was Valued at USD 53.11 Billion in 2023 and is Projected to Reach USD 95.45 Billion by 2032, Growing at a CAGR of 6.73% From 2024-2032.

The food and beverage market for children in The U. S contains products that are a wide assortment of foods and beverages aiming at satisfying children’s preferences. This category of products is snacks, meals and drinks that may convey a healthy image, convenience and good taste as their key selling points and may also encompass dietary supplements. To capture the market niche and meet the needs and requirements of Health conscious parents and regulatory authorities, manufacturers often target at such features as lower sugar content, organic and fortified nutrients.

- The food and beverage products consumed by the U. S. kids brings about a complex but vital market within the food industry due to the varying needs, and demands associated with children. This market encompasses all snack foods, both nondurable and perishable – from conventional products that parents like to consume while watching TV to snacks children prefer to have mainly between school hours, as well as healthier snacks that children would like to have as much as their parents. In the recent past, there has been a notable trend towards a healthier lifestyle, due to the growth in childhood and other diseases that are believed to result from unhealthy eating. The role of a parent has been shifting more to having to make conscious decision regarding the quality and nutritious value of foods that is to be consumed by children, and this is the reason why producers are now being forced to introduce new products into the market that contain Vitamins and minerals with low sugar and artificial additives content.

- Some of the leading brands from the market that have adopted include; General Mills, Kellogg and the pepsi group are among the brands that have shifted strategies to reformulate their products and introduce new lines that focus on the health related benefits as they contain less concentrations of Trans fats. For example, brands have opted to produce and sell whole grain cereal, low sugar pumps and vitamin enriched snacks. Moreover, the organic and natural food segment has continuously expanded throughout the years, especially with companies like Annie’s Organic Foods coupled with Horizon Organic Foods in terms of offering a purer list of ingredients.

- Marketing efforts targeting kids’ food and beverages are especially subtle since it needs to capture the child-like palate while remaining acceptable to parents’ health-conscious attitudes and knowledge. There are usually entertaining attributes depicted in advertisements and always more focus on the health aspects that parents may pick for their children. Digital marketing and Social media consumer electronics: today’s brands have appropriately targeted and involved influencers and interactive content common to children and their parents.

- The market remains very dynamic, with new products constantly being launched and updated to keep consumers’ attention and excitement and also to meet their new needs and preferences. For instance, increased consumption of plant-based products has paved way for lactose-free yogurts and nutritious reads for children with Lactose intolerance or peculiar dietary selection due to their vegetarian nut-based diabetic or vegan diets. Furthermore, the theme of convenience has not lost its relevance over the years and is also essential for parents, successfully targeting which ready-to-consume and easily portable products can easily fit into a tight family time table.

- The market has also been affected due to the COVID-19 pandemic: With people preferring to consume take away/home based meals and an increased demand for more comfort foods. While the prevalence of the disease has forced people into changing their habits, this period has also contributed to increased focus on the diet as the parents tried to strengthen the immune systems of the children. As such, the market has witnessed the combining in some instances of luxury products with those that focus on health.

- The market for kids’ food and beverages in United States has grown with an added influence of health conscious populations, demands of parents, and newer product line offerings. Companies In this space, must always work under the condition of targeting children but at the same time, providing the healthful meals that parents would want their children to have, all during a state of high competition and constant change. This future might be more of refined technological processes, increased clarity regarding ingredients’ source, sustainability, and emphasis on health benefits.

U.S. Kids Food and Beverage Market Trend Analysis

Rise of Health-Conscious Choices

- Healthier food and beverages more readily available in United States for children has influenced the growth of the kids food market due increased awareness concerning the impact nutrition has on the young population. This is due to the constantly increasing issue of childhood obesity, diabetes, and other diseases attributed to an unhealthy diet. Consequently, people are inclined to purchase products which are natural and consist of less amounts of sugar than going to the market for products which contain some additives and preservatives. Business are seeking to satisfy this demand by recalling products and launching new ones that boast natural materials and thermo-stable products.

- Also, aware brewing and innovative educational campaigns that have led to availability of detailed information on proper diet have enhanced the increase in this trend. This focus on the healthier products is changing the market and new products for children, with brands being driven to continuous creating new products to fit the needs of health-conscious families.

Expansion of Plant-Based and Allergen-Free Options

- The health conscious eating habits among children and the increasing intolerance for certain types of food are some of the major trends visible in the current US kids food and beverage market, willingness to pay for plant-based and allergen-free products. This change is caused by the following reasons: Firstly, awareness about food allergies and intolerance has grown among consumers; Secondly, vegan and vegetarian diets are evolving in popularity among consumers; Thirdly, the consciousness concerning global health and sustainability in modern societies remains a significant factor for this shift. As many parents become more aware of healthy foods for their children, and what is likely to cause harm to their children, they become aware of foods that are safe, healthy and humane to consume. This has encouraged the development and expansion of product portfolios and usage of plant-based proteins like soy, almond, oat, and pea proteins since they are derived from plants, are allergen-free and can also fit vegan customers’ dietary restrictions.

- Also, these products come with a label of being clean label products that having only organic items, and such nutritional value add-on as vitamins and minerals to ensure they meet the nutritional needs of growing kids. Market demand to cater for this groups’ needs is well illustrated by the existence in the market of such products as dairy free milks, egg free snacks, gluten free cereals and plant based meals for kids especially those who are cocooned from one or the other nutritional deficiencies. Fortunately, the plant-based and allergen-free segment is not only growing at an extremely fast pace but also changing the face of the kids’ food and beverages space, while providing more value that links to health, tolerance, and sustainability.

U.S. Kids Food and Beverage Market Segment Analysis:

U.S. Kids Food and Beverage Market Segmented based on By Type, and By Distribution Channel .

By Type, Snacks segment is expected to dominate the market during the forecast period

- The analysis of the U. S. Kids Food and Beverage Market based on the type of food and beverages served shows a small and a large number of players in the market providing food and beverages that are suitable for children. Cereals are another typical group found in breakfast and this group extends from genotype sugar-coated to complex cereals which are whole grain containing vitamins and minerals. Beverages can be further categorized as Plain like milk and juice, but also Novelty products, new forms that embrace the new environments like flavored water and functional drinks for children. Dairy products are vital as they offer support to bones in form of calcium and also as sources of proteins for body growth, products range from yogurts to cheese and chemically flavored milk. Convenience: in today’s busy world, frozen foods do not reduce on the quality of foods and they have cubed portions of meals, ready to prepare meals and snacks, ready snacks for the family especially for busy parents.

- Meal in a bag, or packaged meal is a very convenient food solution for the fast-paced lives of families today, as they provide the full range of themes from American classics to international variety, plus, more often than not, decreased calorie content and portion size suitable for kids. Snacks are a quite large category, which could include baked goods such as cookies and crisps, ‘treat’ products like chocolate, candies, etc and health food items like dried fruits and cereal bars. The ‘Others’ category can be broken down into different sections as it presumably regards different categories of relatively niche products, including organic, gluten-free, or allergy-specific products, which may suit children’s needs in recent years. In a way, this segmentation shows that the sector is complex because choice, practicality, and nourishment intertwine in the Kids Food and Beverage Market in the United States to accommodate the variety of requirements of children and their households.

By Distribution Channel , Online segment held the largest share in 2023

- In the United States Kid’s Food and Beverage market, distribution channel have a strategic role in identifying and reaching out the target consumers. Internet retail stores have as a result recorded themselves as one of the most important outlets through which parents who want balanced and tender meals and snack for their children can easily access them since they are easily available online. Supermarkets are still a significant part of retaining a personal buying experience because they let parents go to the store and choose products from first hand, as well as get advice from shop personnel. Superstores also have the power, allowing the families to purchase grocery as well as the items in particular that are preferably for the kid.

- Other distribution channels like specialty stores and subscription services also bring another level of variation within the market since some may include preferences that are specific or offer only selected kinds of products. All these diverse points together guarantee that there is reach and realizability of children’s food and beverage products to serve different consumer need profiles and shopping behaviors in the U. S. market.

Active Key Players in the U.S. Kids Food and Beverage Market

- Conagra Brands Inc (US)

- PepsiCo Inc. (US)

- The Kellogg Company (US)

- Ocean Spray Inc (US)

- Mead Johnson & Company, LLC. (US)

- Nestlé Company (US)

- The Hershey Company (US)

- Campbell Soup Company (US)

- General Mills Inc (US)

- Abbott Laboratories (US)

- Skinny Dipped (US)

- Danone North America (US)

- Mondelez International, Inc. (US)

- Kraft Heinz Company (US)

- Unilever (US)

- Coca-Cola Company (US)

- Chobani, LLC (US)

- Hormel Foods Corporation (US)

- Dean Foods (US)

- Post Holdings, Inc. (US)

- TreeHouse Foods, Inc. (US)

- Harvest Hill Beverage Co. (US) Other Key Players

Key Industry Developments in the US Kids Food and Beverage Market :

- In April 2024, Baldwin Richardson Foods, a leading custom ingredients manufacturer for the food and beverage industry, announced the completion of its acquisition of New Jersey-based Pennsauken Packing Company, LLC. This strategic transaction enhances Baldwin Richardson Foods' aseptic beverage manufacturing capabilities, extending its reach to serve customers nationwide. It aligns with the company's long-term goal of becoming a comprehensive liquid products supplier in the food and beverage sector. The unified organization, including the Pennsauken facility, will now operate under the Baldwin Richardson Foods name, strengthening its position and service capacity across the industry.

- In April 2024, Italian investment firm QuattroR completed its 50% acquisition of Massimo Zanetti Beverage Group S.p.A. (MZB), a privately owned Italian multinational coffee giant. Following the acquisition, the group’s board appointed Pierluigi Tosato, a veteran in the food and beverage industry, as CEO. Tosato succeeded Massimo Zanetti, the founder and former principal owner of the company, who stepped down from the position.

|

U.S. Kids Food and Beverage Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 53.11 Bn |

|

Forecast Period 2024-32 CAGR: |

6.73% |

Market Size in 2032: |

USD 95.45 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: U.S. Kids Food And Beverage Market by Type

5.1 U.S. Kids Food And Beverage Market Overview Snapshot and Growth Engine

5.2 U.S. Kids Food And Beverage Market Overview

5.3 Cereal

5.3.1 Introduction and Market Overview

5.3.2 Key Market Trends, Growth Factors and Opportunities

5.3.3 Impact of Covid-19

5.3.4 Historic and Forecasted Market Size (2017-2032F)

5.3.5 Key Market Trends, Growth Factors and Opportunities

5.3.6 Cereal: Geographic Segmentation

5.4 Beverage

5.4.1 Introduction and Market Overview

5.4.2 Key Market Trends, Growth Factors and Opportunities

5.4.3 Impact of Covid-19

5.4.4 Historic and Forecasted Market Size (2017-2032F)

5.4.5 Key Market Trends, Growth Factors and Opportunities

5.4.6 Beverage: Geographic Segmentation

5.5 Dairy Products

5.5.1 Introduction and Market Overview

5.5.2 Key Market Trends, Growth Factors and Opportunities

5.5.3 Impact of Covid-19

5.5.4 Historic and Forecasted Market Size (2017-2032F)

5.5.5 Key Market Trends, Growth Factors and Opportunities

5.5.6 Dairy Products: Geographic Segmentation

5.6 Frozen Foods

5.6.1 Introduction and Market Overview

5.6.2 Key Market Trends, Growth Factors and Opportunities

5.6.3 Impact of Covid-19

5.6.4 Historic and Forecasted Market Size (2017-2032F)

5.6.5 Key Market Trends, Growth Factors and Opportunities

5.6.6 Frozen Foods: Geographic Segmentation

5.7 Packaged Meals

5.7.1 Introduction and Market Overview

5.7.2 Key Market Trends, Growth Factors and Opportunities

5.7.3 Impact of Covid-19

5.7.4 Historic and Forecasted Market Size (2017-2032F)

5.7.5 Key Market Trends, Growth Factors and Opportunities

5.7.6 Packaged Meals: Geographic Segmentation

5.8 Snacks

5.8.1 Introduction and Market Overview

5.8.2 Key Market Trends, Growth Factors and Opportunities

5.8.3 Impact of Covid-19

5.8.4 Historic and Forecasted Market Size (2017-2032F)

5.8.5 Key Market Trends, Growth Factors and Opportunities

5.8.6 Snacks: Geographic Segmentation

5.9 Others

5.9.1 Introduction and Market Overview

5.9.2 Key Market Trends, Growth Factors and Opportunities

5.9.3 Impact of Covid-19

5.9.4 Historic and Forecasted Market Size (2017-2032F)

5.9.5 Key Market Trends, Growth Factors and Opportunities

5.9.6 Others: Geographic Segmentation

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Positioning

6.1.2 U.S. Kids Food And Beverage Sales and Market Share By Players

6.1.3 Industry BCG Matrix

6.1.4 Ansoff Matrix

6.1.5 U.S. Kids Food And Beverage Industry Concentration Ratio (CR5 and HHI)

6.1.6 Top 5 U.S. Kids Food And Beverage Players Market Share

6.1.7 Mergers and Acquisitions

6.1.8 Business Strategies By Top Players

6.2 CONAGRA BRANDS INC

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Operating Business Segments

6.2.5 Product Portfolio

6.2.6 Business Performance

6.2.7 Key Strategic Moves and Recent Developments

6.2.8 SWOT Analysis

6.3 PEPSICO INC.

6.4 THE KELLOGG COMPANY

6.5 OCEAN SPRAY INC

6.6 MEAD JOHNSON & COMPANY LLC.

6.7 NESTLÉ COMPANY

6.8 THE HERSHEY COMPANY

6.9 CAMPBELL SOUP COMPANY

6.10 GENERAL MILLS INC

6.11 ABBOTT LABORATORIES

6.12 SKINNY DIPPED

6.13 HARVEST HILL BEVERAGE CO.

6.14 MINUTE MAID COMPANY

6.15 OTHER MAJOR PLAYERS

Chapter 7 Investment Analysis

Chapter 8 Analyst Viewpoint and Conclusion

|

U.S. Kids Food and Beverage Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 53.11 Bn |

|

Forecast Period 2024-32 CAGR: |

6.73% |

Market Size in 2032: |

USD 95.45 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. U.S. KIDS FOOD AND BEVERAGE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. U.S. KIDS FOOD AND BEVERAGE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. U.S. KIDS FOOD AND BEVERAGE MARKET COMPETITIVE RIVALRY

TABLE 005. U.S. KIDS FOOD AND BEVERAGE MARKET THREAT OF NEW ENTRANTS

TABLE 006. U.S. KIDS FOOD AND BEVERAGE MARKET THREAT OF SUBSTITUTES

TABLE 007. U.S. KIDS FOOD AND BEVERAGE MARKET BY TYPE

TABLE 008. CEREAL MARKET OVERVIEW (2016-2028)

TABLE 009. BEVERAGE MARKET OVERVIEW (2016-2028)

TABLE 010. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 011. FROZEN FOODS MARKET OVERVIEW (2016-2028)

TABLE 012. PACKAGED MEALS MARKET OVERVIEW (2016-2028)

TABLE 013. SNACKS MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. U.S. KIDS FOOD AND BEVERAGE MARKET, BY TYPE (2016-2028)

TABLE 016. U.S. KIDS FOOD AND BEVERAGE MARKET, BY COUNTRY (2016-2028)

TABLE 017. CONAGRA BRANDS INC: SNAPSHOT

TABLE 018. CONAGRA BRANDS INC: BUSINESS PERFORMANCE

TABLE 019. CONAGRA BRANDS INC: PRODUCT PORTFOLIO

TABLE 020. CONAGRA BRANDS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 020. PEPSICO INC.: SNAPSHOT

TABLE 021. PEPSICO INC.: BUSINESS PERFORMANCE

TABLE 022. PEPSICO INC.: PRODUCT PORTFOLIO

TABLE 023. PEPSICO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 023. THE KELLOGG COMPANY: SNAPSHOT

TABLE 024. THE KELLOGG COMPANY: BUSINESS PERFORMANCE

TABLE 025. THE KELLOGG COMPANY: PRODUCT PORTFOLIO

TABLE 026. THE KELLOGG COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 026. OCEAN SPRAY INC: SNAPSHOT

TABLE 027. OCEAN SPRAY INC: BUSINESS PERFORMANCE

TABLE 028. OCEAN SPRAY INC: PRODUCT PORTFOLIO

TABLE 029. OCEAN SPRAY INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 029. MEAD JOHNSON & COMPANY LLC.: SNAPSHOT

TABLE 030. MEAD JOHNSON & COMPANY LLC.: BUSINESS PERFORMANCE

TABLE 031. MEAD JOHNSON & COMPANY LLC.: PRODUCT PORTFOLIO

TABLE 032. MEAD JOHNSON & COMPANY LLC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 032. NESTLÉ COMPANY: SNAPSHOT

TABLE 033. NESTLÉ COMPANY: BUSINESS PERFORMANCE

TABLE 034. NESTLÉ COMPANY: PRODUCT PORTFOLIO

TABLE 035. NESTLÉ COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. THE HERSHEY COMPANY: SNAPSHOT

TABLE 036. THE HERSHEY COMPANY: BUSINESS PERFORMANCE

TABLE 037. THE HERSHEY COMPANY: PRODUCT PORTFOLIO

TABLE 038. THE HERSHEY COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. CAMPBELL SOUP COMPANY: SNAPSHOT

TABLE 039. CAMPBELL SOUP COMPANY: BUSINESS PERFORMANCE

TABLE 040. CAMPBELL SOUP COMPANY: PRODUCT PORTFOLIO

TABLE 041. CAMPBELL SOUP COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. GENERAL MILLS INC: SNAPSHOT

TABLE 042. GENERAL MILLS INC: BUSINESS PERFORMANCE

TABLE 043. GENERAL MILLS INC: PRODUCT PORTFOLIO

TABLE 044. GENERAL MILLS INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. ABBOTT LABORATORIES: SNAPSHOT

TABLE 045. ABBOTT LABORATORIES: BUSINESS PERFORMANCE

TABLE 046. ABBOTT LABORATORIES: PRODUCT PORTFOLIO

TABLE 047. ABBOTT LABORATORIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. SKINNY DIPPED: SNAPSHOT

TABLE 048. SKINNY DIPPED: BUSINESS PERFORMANCE

TABLE 049. SKINNY DIPPED: PRODUCT PORTFOLIO

TABLE 050. SKINNY DIPPED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. HARVEST HILL BEVERAGE CO.: SNAPSHOT

TABLE 051. HARVEST HILL BEVERAGE CO.: BUSINESS PERFORMANCE

TABLE 052. HARVEST HILL BEVERAGE CO.: PRODUCT PORTFOLIO

TABLE 053. HARVEST HILL BEVERAGE CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. MINUTE MAID COMPANY: SNAPSHOT

TABLE 054. MINUTE MAID COMPANY: BUSINESS PERFORMANCE

TABLE 055. MINUTE MAID COMPANY: PRODUCT PORTFOLIO

TABLE 056. MINUTE MAID COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 057. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 058. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 059. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. U.S. KIDS FOOD AND BEVERAGE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. U.S. KIDS FOOD AND BEVERAGE MARKET OVERVIEW BY TYPE

FIGURE 012. CEREAL MARKET OVERVIEW (2016-2028)

FIGURE 013. BEVERAGE MARKET OVERVIEW (2016-2028)

FIGURE 014. DAIRY PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 015. FROZEN FOODS MARKET OVERVIEW (2016-2028)

FIGURE 016. PACKAGED MEALS MARKET OVERVIEW (2016-2028)

FIGURE 017. SNACKS MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. U.S. KIDS FOOD AND BEVERAGE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the US Kids Food and Beverage Market research report is 2024-2032.

Conagra Brands Inc (US),PepsiCo Inc. (US) ,The Kellogg Company (US),Ocean Spray Inc (US),Mead Johnson & Company, LLC. (US) ,Nestlé Company (US) ,The Hershey Company (US) ,Campbell Soup Company (US) ,General Mills Inc (US) ,Abbott Laboratories (US) ,Skinny Dipped (US),Danone North America (US),Mondelez International, Inc. (US),Kraft Heinz Company (US),Unilever (US),Coca-Cola Company (US),Chobani, LLC (US),Hormel Foods Corporation (US),Dean Foods (US),Post Holdings, Inc. (US),TreeHouse Foods, Inc. (US),Harvest Hill Beverage Co. (US) Other Key Players

The US Kids Food and Beverage Market is segmented into Type , Distribution Channel Channel and Region. By Type,Cereal, Beverage, Dairy Products, Frozen Foods, Packaged Meals, Snacks, Others. By Distribution Channel , the market is categorized into Online Stores, Retail Stores, Supermarkets, Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The food and beverage market for children in The U. S contains products that are a wide assortment of foods and beverages aiming at satisfying children’s preferences. This category of products is snacks, meals and drinks that may convey a healthy image, convenience and good taste as their key selling points and may also encompass dietary supplements. To capture the market niche and meet the needs and requirements of Health conscious parents and regulatory authorities, manufacturers often target at such features as lower sugar content, organic and fortified nutrients.

US Kids Food and Beverage Market Size Was Valued at USD 53.11 Billion in 2023 and is Projected to Reach USD 95.45 Billion by 2032, Growing at a CAGR of 6.73% From 2024-2032.