US cigar market Synopsis

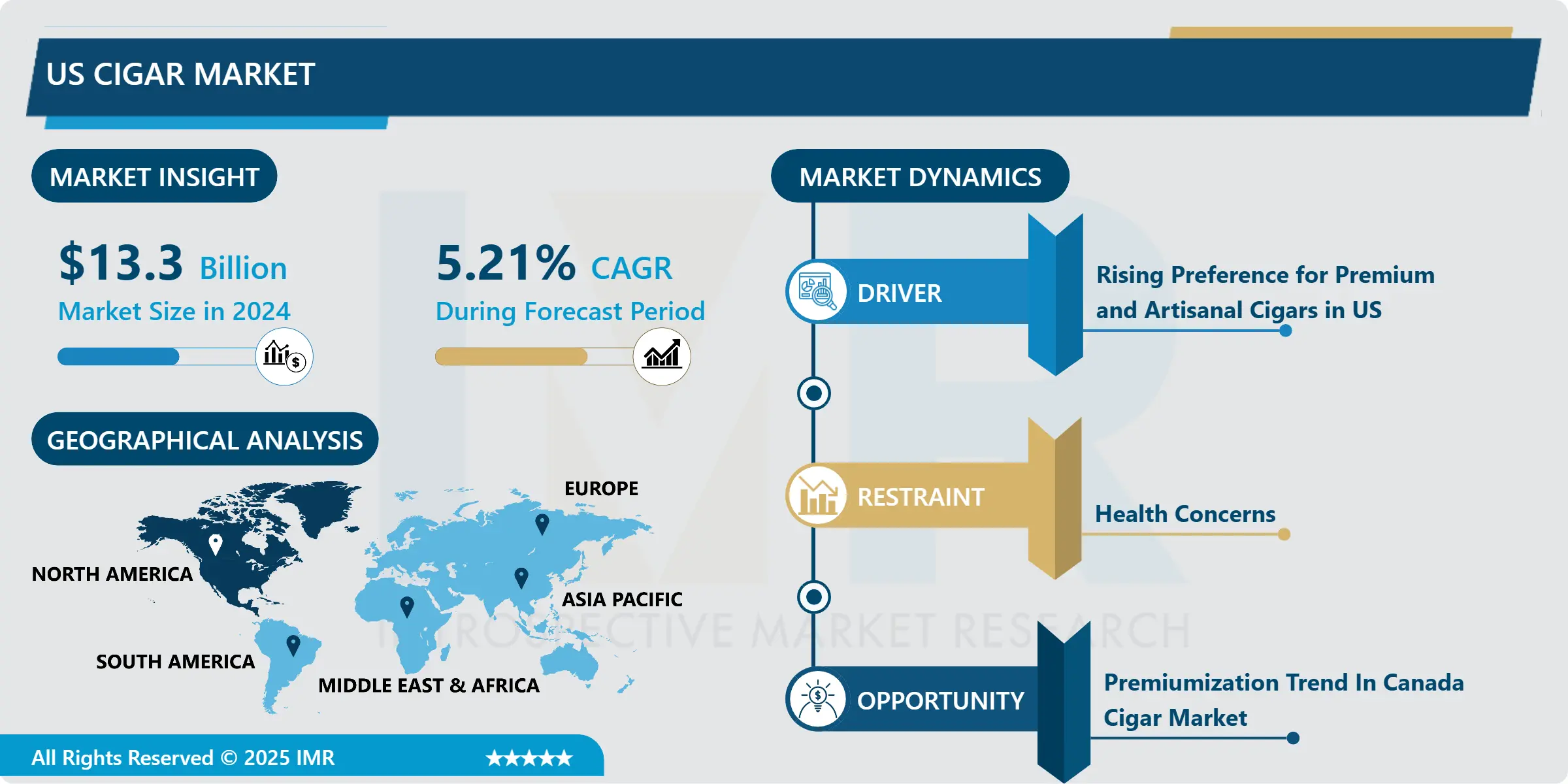

US cigar market Size Was Valued at USD 13.3 Billion in 2024 and is Projected to Reach USD 19.97 Billion by 2032, Growing at a CAGR of 5.21% From 2025-2032.

The industry involved in the production, distribution, and consumption of cigars inside Canada is referred to as the Canadian cigar market. Cigars are characterized as wrapped bundles of fermented and dried tobacco leaves; they are usually bigger than regular cigarettes and are frequently connected to the premium and luxury tobacco market segments. The cigar market in Canada serves a wide spectrum of customers, from casual smokers who save their cigars for special occasions or social situations to enthusiasts who value the tradition and artistry of cigars. The market includes a range of cigars, manufactured by indigenous and foreign manufacturers, both machine-made and hand-rolled. Regulations like tax laws and health advisories have a big impact on market dynamics, which affects prices and customer behavior. All things considered, the Canadian cigar market is a unique entity within the larger tobacco sector, reflecting a combination of custom, legislation, and customer preferences.

The cigar market in the US is fragmented product-wise, as the cigar options can be significantly different in terms of their size, flavor, and cost. Based on the quality and kind of preparation, cigars can be divided into Premium Cigars which are handmade, well-prepared from select tobacco leaves, and Machine-Made Cigars that are inexpensive and prepared in a large scale.

Specifically, a trend has been observed for several years in the cigar market of the United States, characterized by changes in the choice of products. Specialty cigars continue to enjoy strong sales among mature smokers who are willing to pay for high-quality Habanos and other quality cigars, however, there is quite a move towards flavored cigars and those of smaller ring gauge, which parents and younger generations of smokers and occasional smokers prefer. This diversification varies depending on culture, societal transformation, and even the initiative of manufacturers in offering a wide range of products.

The writing established that the market for cigar in the US has these following regulations the advertising and promotion of cigar and these affects the following The Family Smoking Prevention and Tobacco Control Act signed into law in 2009 provided the FDA with the ability to regulate various tobacco products, including cigars, with regard to public health. This has culminated to strict labeling regulations, ban of advertisement and sale of such products to persons below the legally required age and constant search for new products regulatory actions.

US Cigar Market Trend Analysis

US Cigar Market Growth Drivers- Rising Preference for Premium and Artisanal Cigars in the US

- Specifically, the differentiation within the most popular cigars in the Canadian market has shifted in recent years towards premium and artisanal cigars; this is an orientation, that parallels the movements in similar global markets, where consumers are aiming at purchasing only high-quality and unique cigars. This evolution is due, in part to a recent increased caloripennance of the Canadian smokers to the kind of efforts put by premium cigars and the variety of the flavors they come with. In contrast to the readily available counterparts, artisanal cigars are normally rolled by master is skilled rollers and made from fine tobaccos that have been carefully aged and properly unionized. This itself involves a great deal of precision and ensures the production of cigars that not only offer a better quality but also a class-apart experience that comes with smoking a cigar.

- It is also important to note that the shift towards the type of cigars that is more expensive and made with a focus on quality in Canada is also partly due to shifts in consumer palates and life priorities. Connoisseur smokers are going for cigars that give them the full range of sensory experience from the smell of the cigar to the multiple blend shades which a connoisseur smokes. To meet this demand, the small-scale manufacturers who are more focused on the quality of the cigars rather than the quantity of production offer to source their tobacco in specific regions with the best soil and climatic conditions necessary for the production of specific kinds of cigars. Thus, cigar’ buyer from Canada can find the wide choice starting from medium taste profiles having the notes of cedar and spices and up to full flavored cigars having with hints of chocolate and coffee. This variety corresponds to the different demands of consumers at large and ensures the development of the luxury and exclusive segment, with premium and artisanal cigars in the Canadian tobacco industry.

US Cigar Market Opportunities- Premiumization Trend In The US Cigar Market

- Premiumization of cigars in the markets of Canada and the US is another trend that embodies the movement towards quality and priced products due to the changes in customer behavior and the general conditions of the economic world. This is a trend observed in US more than in any other country as consumers look for premium cigars as they are associated with quality and hand-made and more importantly are perceived as prestige products. Macroeconomic factors which include increased disposable income among the people, changing fashion trends where people prefer to be associated with quality brands and products, and the desire for better quality cigars are the major drivers towards the increasing demand for premium cigars.

- This is mainly trailed by the growth in the culture of wellness and indulgence; and cigars are no longer seen simply as tobacco products but as luxuries for consumption during leisure activities and social functions. Likewise, the same trend of moving towards premium cigars is also evident in the US market are for similar reasons, including; There are more and more cigar lovers willing to spend a good amount of money on premium cigars specifically the boutique cigars that have earned a reputation for the best of flavors, that are rare and specially produced and manufactured. Therefore, there is a significant proportionate shift in the cigar market both in Canada and the US towards premium-priced cigar products which tends to redefine the buying behaviour and structure of cigars available in the global market.

US Cigar Market Segment Analysis:

The US cigar market is Segmented based on Type and Distribution Channel.

By Type, the Premium Cigar Segment Is Expected To Dominate The Market During The Forecast Period

- In the US cigar market, cigars are broadly categorized into two main types: CLASSIFICATION OF CIGARS It is conventional for people to classify cigars into two broad categories which include conventional cigars and premium cigars. Standard Cigars include normal cigars that are made through machinery which are usually readily available in the market that are cheap as compared to most cigars in the market. These cigars are usually produced with cheaper raw materials and technologies that can easily be obtained and are not too expensive to use.

- Premium cigars are cigars that are part of the higher line of cigars and are made from skilled craftsmanship, good quality tobaccos, and require longer periods to mature in comparison to machine made cigars. Often they are positioned at relatively higher price and target those consumers who are sensitive to the quality and taste of the cigar they are using besides being sensitive to the overall smoking experience. This segment is much less significant, but consumers can be found who seek better quality of a tobacco product and are willing to pay for skilled workmanship. In general, although regular cigars are much more widespread and easily available, they have a strong presence and the main financial focus in the premium cigars segment, providing for the variety in the product and the ability to meet different consumer preferences.

By Distribution Chanel, Offline Retail Stores segment held the largest share in 2024

- The channels of distribution to be discussed in detail later feature prominently in the US cigar market with regard to the consumer’s preference and purchasing habits. Specialty tobacco shops stand out as offline retail stores where people can directly buy cigars given that offline stores still provide the consumer with the options where they can easily access and choose from different brands and product types although they may not be allowed to use the internet in doing so. These shops give buyers a haptic experience since they offer cigars contrary to an online store where they cannot touch the cigars, ask the seller or another person of staff for help, and select cigars they believe are the best for them.

- As for the actual store, buyers actually are able to buy the merchandise they need, online retail store got a lot of attention particularly in the last few years due to its advantage of time and place utility. Cigars available on the internet sites are from different manufacturers; their prices are generally affordable compared to physical stores, and due to technology, people can purchase cigars wherever they are with the use of their smartphones. This channel suits the technologically aware consumers who need more choice, competitive prices, and who do not wish to go physically to a store. Offline and online, the two work hand in hand in ensuring that cigar consumers have a variety of options they may need across the United States as their habits change and their experiences peruse.

Active Key Players in the US Cigar Market

- Imperial Tobacco (Canada)

- Davidoff of Geneva (Canada)

- Habanos S.A. (Canada)

- General Cigar Canada

- Drew Estate Canada

- J.C. Newman Canada

- Other Active Players.

|

US cigar market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.21% |

Market Size in 2032: |

USD 19.97 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: U.S. Cigar Market by Product Type (2018-2032)

4.1 U.S. Cigar Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Conventional Cigar

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Premium Cigar

Chapter 5: U.S. Cigar Market by Distribution Channel (2018-2032)

5.1 U.S. Cigar Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Offline Retail store

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Online Retail Store

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 U.S. Cigar Market Share by Manufacturer (2023)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 IMPERIAL TOBACCO (CANADA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 DAVIDOFF OF GENEVA (CANADA)

6.4 HABANOS S.A. (CANADA)

6.5 GENERAL CIGAR CANADA

6.6 DREW ESTATE CANADA

6.7 J.C. NEWMAN CANADA AND OTHER KEY PLAYERS.

6.8

Chapter 7 Analyst Viewpoint and Conclusion

7.1 Recommendations and Concluding Analysis

7.2 Potential Market Strategies

Chapter 8 Research Methodology

8.1 Research Process

8.2 Primary Research

8.3 Secondary Research

|

US cigar market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 13.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.21% |

Market Size in 2032: |

USD 19.97 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Distribution Channel |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||