Unmanned Aerial Vehicle Market Synopsis

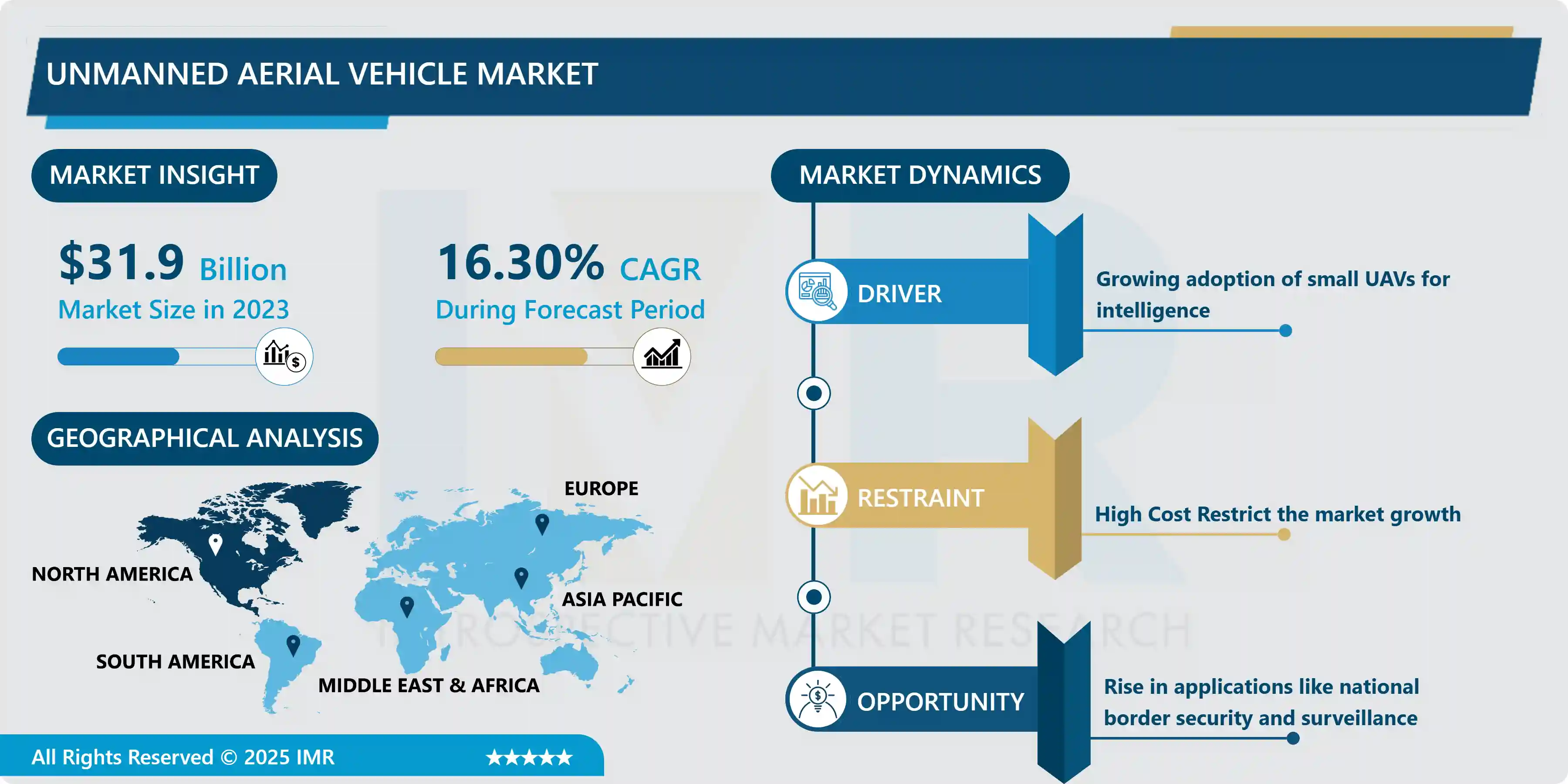

Unmanned Aerial Vehicle Market Size Was Valued at USD 31.9 Billion in 2023, and is Projected to Reach USD 124.2 Billion by 2032, Growing at a CAGR of 16.30% From 2024-2032.

Key elements of a UAV, which is also sometimes called a drone, are the processors located on the vehicle, which is controlled from ground stations. A UAV has been designed with aerodynamic structures that have multi role capability when coupled with the right navigation systems. First, the technology was introduced in a number of military activities in order to make perilous military activities reduce the threats of human lives being lost during the operation. Military UAVs have missiles that are operated from high distances and intended for hitting certain objectives. The military then uses liquid hydrogen fuel that is altered to power UAVs that are modified for long-range operations against enemy forces.

Currently the main fields of using consumer drones are the aerial mapping, cinematography, and surveying. However, the application of consumer drones has grown massively in a number of industries and businesses ranging from commercial and research pursuits to more leisure and other services.

In the past few years, several bigwigs of this industry such as Alphabet’s Google, Amazon, DHL, Uber, Boeing, and Airbus have also stepped up their R&D efforts for this market owing to enormous profit potentials.

Drones are self-propelled, remotely piloted or pre-programmed aerial vehicles that do not transport passengers. Drones are also referred to as Unmanned Aerial Vehicles (UAVs) and they may be remotely partially or fully automated although human on board control is still the primary.

Drones are equipped with highly advanced and active real-time onboard systems that are controlled by operators/remote systems independently from the drone. UAVs comprise an aircraft body that has an aero dynamic shape that performs other functions besides the intended control of navigation system.

Such drones have application in several industries, which include but are not limited to defense, monitoring, search and rescue, weather reporting, taking of pictures and videos, transport, and delivery. Above all, their application is expanding from different sectors such as commercial, scientific, recreational, and civil. Second, the military and defense scope of these UAVs for terrorism and wars are broadening. Hence, the technological specifications of the UAVs, and the increased application of these vehicles in various domains are fueling the global demand for the UAVs market.

Security concerns, cybersecurity risks for example hacking or loss of control between operations, the high cost involved in the use of unmanned aircraft systems, and strict laws governing their use such as the FAA Modernization Act of 2012 are all factors that are minimising the growth of the UAV market worldwide.

Like consumer drones, commercial UAVs rely on GPS for the precise location of their vehicles. Therefore, the provided controllers receive the correct information concerning the position of this unmanned vehicle, no matter the significant distance it can be from this very location.

However, a problem occurs concerning the GPS – whether it would not be able to inform the controllers about the surrounding area. Moreover, there are other security risks related to this type of drone, for example, the risk of third parties getting access to the command unit components that could lead to change of the vehicle’s navigation, and the server might lose the vehicle’s GPS, as well.

Consequently, the use of UAVs might restrict other airplanes’ flight paths and pose dangers to other airborne objects if the drones are unable to distinguish the former.

Unmanned Aerial Vehicle Market Trend Analysis

Expanding Market Development of Drone-in-a-Box (DiaB) Technology Will Drive Advancement

- The DiaB technology consists of a hovering drone that can fly back to a base station and initiate battery recharging after accomplishing a mission. One of its most common applications is in the various fields because it leads to the minimization of human work.

- The technology has been employed in various industries such as telecommunication industry, maritime industry and the space industry. The telecom industry will adopt the drone-in-a-box system to facilitate the establishment of the communication network faster and more efficiently.

- For instance, in May 2023, Nokia revealed that it signed a deal with Citymesh, a Belgian telecom operator to supply seventy drone-in-a-box systems. These units will continue introducing an automated drone grid across Belgium on a 5G network, helping speed up resource mobilization during emergency cases.

- Also it is important to note that this technology can be used in other industries such as agriculture. The unmanned aerial vehicles that are fitted with a combination of cameras and sensors can be used to either keep track of the health of the crops or even the control the rate of growth of the crops. These drones make the military attacking and defending on the battlefield easier.

- At the same time, personnel sit at a safe location, operating the facility remotely. DiaB also finds applications in other related industries such as construction and mining as well as where BVLOS drone operations may be involved. Also, these drones can be used for mapping Solar fields, Power Plant, Oil and Gas wells, and Mining Sites.

- For instance, the Israeli company Percepto announced in November 2022 that the FAA had issued the first-ever hemispherical waiver to its drone-in-a-box. DiaB approval, AI-powered The DiaB approval launches Percepto to BVLOS workflows at suitable venues across the country.

Military procurement of drones is anticipated to increase, driving market expansion.

- Modern wars are no longer held as they used to be with the assumption that the better armed side always comes out the winner to the assumption that the side with a better ISR stands a higher chance of winning. This phase of electronic warfare means the military has a huge market for the unmanned aerial vehicles (UAVs).

- UAVs as defined do not have a human pilot present during flights and can be remotely controlled by personnel on the ground under a certain safe distance.

- Another combat use of UAVs is for offensive missions by ISR. Drone technology can give missiles a battle size comparable to small planes while fully autonomous drone, often just called drones, can be reduced to roughly the size of a bird’s wingspan and used in suicide missions.

- The drones become an absolute necessity for any military because of the functionalities that the vehicles possess; the functionalities that make push-back of adversary happen from the safety of the ground stations.

Unmanned Aerial Vehicle Market Segment Analysis:

Unmanned Aerial Vehicle Market is Segmented based on UAV Class, Operational Mode, Fully Autonomous, Solutions, Application, and End-User.

By Operational Mode, remotely operated segment is expected to dominate the market during the forecast period

- The market is segmented into three operational modes: completely independent, partially independent, and/or teleoperated. The remotely operated segment represented the largest application of the market in 2022. Besides the fact that there is neither a crew nor occupants in a UAV. UAVs are also referred to as remotely piloted vehicles (RPVs) or automated ‘drones. ‘ Unmanned aerial vehicles (UAVS) have the capacity to continue a flight for long hours at low altitudes. Various nations have experienced an elevated need for UAVs being operated from distant locations in recent years due to the rising popularity of drone innovations and their usage for various purposes.

- For instance, it is projected that India will purchase $3 Billion quadcopters- 31 MQ-9B RPAS. 07 billion in July 2023 through the foreign military sales (FMS) of the United States government . This will further strengthen the ISTAR assets of the Indian Armed Forces.

- The fully-autonomous segment is expected to record the highest CAGR during 2023-2030. The system includes the CDS (Command Delivery System) and the FPS (Flight Planning System) for determining the flight path and the radius beforehand. The UAV controls everything in the situation without any input from the ground human pilot. High payload mission-based UAVs also includes UAVs produced by the United States, China, Russia and Israel for specific missions.

- For example, in May 2023, (SSCI) received an approximately 5-year multimillion-dollar prime award from the U. S. Army Combat Capability Development Command (DEVCOM) C5ISR Center to develop, demonstrate, and transition autonomous UAVs.

By Fully Autonomous, Individual Autonomous segment held the largest share in 2023

- Fully autonomous occupies the lion’s share with the help of Drone-in-a-Box (DiaB) and individual autonomous systems, correspondingly. Segment related to individual autonomous systems accounted for the major share of the market in 2022. The software controlled system is a complex system that needs a whole system for its operation. These systems give high value since they have the ability to operate independently in accomplishing missions and tasks.

- For example, the autonomous flight technology company Near Earth Autonomy announced in May 2023 that the AFWERX program of the United States Air Force has selected the company to establish a Reliability Standard for Autonomous Aerial Transport under the umbrella of Autonomy Prime. It shows Near Earth’s commitment to advancing the progress of autonomous planes into the next levels.

- Drone-in-a-Box (DiaB) is expected to be the fastest growing segment in terms of both volume and value during the forecast period. With the help of the drone-in-a-box, users receive the necessary information on the go and the system records aerial images for the administration of a facility. Participate in the process of the control over the other maintenance issues, inform facility users about gas/water breaches, trace human/vehicle activity with the use of designed tasks.

- For instance, DroneMatrix and Infrabel signed a framework contract that will last till February 2032. The contract requires the provision of service for nine years and supply of four years for the purchase of drone-in-a-box solutions. Another feature associated with the issue of video reconnaissance is the multi-purpose application of the drone-in-a-box solution by the client for the video monitoring of the processing of rail vehicles at the port of Antwerp and in other areas of Belgium..

Unmanned Aerial Vehicle Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America remained the leader in the UAV market during the whole forecast period and holds the highest shares. The application of UAVs in the market and for military application is on the rise as is the investment in the procurement of autonomous drones.

- According to the FAA, in July 2023 the number of registered drones increased in the United States and amounted to approximately 900 thousand units. The total number of registered drones for was 369,528 for commercial use while 416, 095 drones were used for recreational use. Furthermore the FAA granted 331,573 remote pilot certificates.

- Moreover, the United States Department of Defense is constantly on the lookout for effective and innovative ways on how enhance its capabilities and combat adversaries like Russia and China without having to spend too much.

- For instance, in April 2023, the Pentagon announced a new program called XOS and its goal is to build thousands of autonomous systems, including drones, in response to China’s rapidly growing military power. In March 2023 the United States Army awarded contracts for future Tactical UAVs to 5 companies. Companies chosen for the purpose included AeroVironment, Griffon Aerospace, Northrop Grumman, Sierra Nevada Corporation, and Textron Systems.

- Moreover, Canada Defence Forces plan acquire UAVs and consider improving the defence capabilities. The MALE UAV Project – Operational Analyses Phase for the Royal Canadian Air Force has Begun. Several nicknames have been given to the RPAS Project. Consequently, the use of RPAS in the military under the Canadian national defense strategy has been influential in the adaptation of the military in the contemporary world, which is a major leap forward in military operations. The introduction of these programs will drive the growth of regional markets.

Active Key Players in the Unmanned Aerial Vehicle Market

- AeroVironment, Inc. (U.S.)

- Autel Robotics (U.S.)

- Parrot Drone S.A.S. (Switzerland)

- Yuneec (China)

- BAE Systems PLC (U.K.)

- Boeing (U.S.)

- Elbit Systems Ltd. (Israel)

- General Atomics Aeronautical Systems (U.S.)

- Hexagon AB (Sweden)

- Israel Aerospace Industries (Israel)

- Lockheed Martin Corporation (U.S.)

- Northrop Grumman Corporation (U.S.)

- Other Key Players

Key Industry Developments in the Unmanned Aerial Vehicle Market:

- July 2023 – IoTechWorld Avigation Pvt. Ltd. – an agriculture drones manufacturer has secured a major order of 500 drones from a cooperative major, IFFCO, to spray nano liquid urea and DAP.

- June 2023 – U. S. Defense contracts AeroVironment to develop its high-altitude solar-powered UAV. AeroVironment has stated that it intends to develop a constellation of high-altitude long-range UAVs that will be used to facilitate internet access across the world. The fixed-wing aircraft is expected to operate at a speed of at an altitude of almost 65 000 ft. or 19 812 m and will have sensors.

- June 2023 - Barfield Inc. announced that it has a formal partnership agreement with UAV manufacturer Skydrone Robotics to market and support Skydrone product UAVs in the U.S., Canada, and Latin America.

- May 2023 – Garuda Aerospace which is one of the world’s largest drone manufacturing company on 27th May 2022 signed a Joint Development Partnership with HAL Naini Aeronautics Limited a subsidiary of HAL under the administrative control of MoD , Govt. of India. This JDP envisions helping the Garuda Aerospace to manufacture APDs in India for applications, including defense.

- January 2023 – A contract for the provision of UAVs was issued by Primoco UAV SE. The Czech UAV manufacturer will deliver machines which total value is USD 2. over 50 million to a European customer.

|

Global Unmanned Aerial Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 31.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.30% |

Market Size in 2032: |

USD 124.2 Bn. |

|

Segments Covered: |

By UAV Class |

|

|

|

By Operational Mode |

|

||

|

By Fully Autonomous |

|

||

|

By Solutions |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Unmanned Aerial Vehicle Market by UAV Class (2018-2032)

4.1 Unmanned Aerial Vehicle Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Micro UAVs (Below 2 Kg)

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Mini UAVs (2-20 Kg)

4.5 Small UAVs (20-50 Kg)

4.6 Tactical UAVs (MALE & HALE)

Chapter 5: Unmanned Aerial Vehicle Market by Operational Mode (2018-2032)

5.1 Unmanned Aerial Vehicle Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Fully Autonomous

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Semi-Autonomous

5.5 Remotely-Operated

Chapter 6: Unmanned Aerial Vehicle Market by Fully Autonomous (2018-2032)

6.1 Unmanned Aerial Vehicle Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Individual Autonomous System

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Drone-in-a-Box (DiaB)

Chapter 7: Unmanned Aerial Vehicle Market by Solutions (2018-2032)

7.1 Unmanned Aerial Vehicle Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Aerostructures & Mechanisms

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Securing System

7.5 Operating Software

7.6 Tethering Cord

7.7 Power Sources & Management System

7.8 Payload

7.9 Propulsion System

7.10 Others

Chapter 8: Unmanned Aerial Vehicle Market by Application (2018-2032)

8.1 Unmanned Aerial Vehicle Market Snapshot and Growth Engine

8.2 Market Overview

8.3 Perimeter Security & Border Management

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Combat and Combat Support Missions

8.5 Situational Awareness

8.6 Disaster Management & First Responders

8.7 Surveying

8.8 Mapping

8.9 & Monitoring

8.10 Precision Agricultural Management

8.11 Power Station Management

8.12 Asset & Operations Management

8.13 Emergency Medical Logistics

8.14 Others

Chapter 9: Unmanned Aerial Vehicle Market by End-User (2018-2032)

9.1 Unmanned Aerial Vehicle Market Snapshot and Growth Engine

9.2 Market Overview

9.3 Government & Defense

9.3.1 Introduction and Market Overview

9.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

9.3.3 Key Market Trends, Growth Factors, and Opportunities

9.3.4 Geographic Segmentation Analysis

9.4 Energy

9.5 Power

9.6 Oil & Gas

9.7 Construction & Mining

9.8 Agriculture

9.9 Forestry & Wild Life Conservation

9.10 Public Infrastructure & Homeland Security

9.11 Hospitals & Emergency Medical Services

9.12 Transportation & Logistics

9.13 Event Management

9.14 Others

Chapter 10: Company Profiles and Competitive Analysis

10.1 Competitive Landscape

10.1.1 Competitive Benchmarking

10.1.2 Unmanned Aerial Vehicle Market Share by Manufacturer (2024)

10.1.3 Industry BCG Matrix

10.1.4 Heat Map Analysis

10.1.5 Mergers and Acquisitions

10.2 GOPRO INC. - UNITED STATES

10.2.1 Company Overview

10.2.2 Key Executives

10.2.3 Company Snapshot

10.2.4 Role of the Company in the Market

10.2.5 Sustainability and Social Responsibility

10.2.6 Operating Business Segments

10.2.7 Product Portfolio

10.2.8 Business Performance

10.2.9 Key Strategic Moves and Recent Developments

10.2.10 SWOT Analysis

10.3 360FLY - UNITED STATES

10.4 KODAK PIXPRO- UNITED STATES

10.5 RYLO INC. - UNITED STATES

10.6 ALLIE CAMERA - UNITED STATES

10.7 LUCIDCAM - UNITED STATES

10.8 MADV MINI 360 - UNITED STATES

10.9 INSTA360 - CHINA

10.10 YI TECHNOLOGY - CHINA

10.11 KANDAO TECHNOLOGY - CHINA

10.12 DETU - CHINA

10.13 Z CAM - CHINA

10.14 XIAOMI CORPORATION - CHINA

10.15 LENOVO GROUP LIMITED - CHINA

10.16 QOOCAM (KANDAO TECHNOLOGY) - CHINA

10.17 GARMIN LTD. - SWITZERLAND

10.18 GIROPTIC - FRANCE

10.19 VUZE (HUMANEYES TECHNOLOGIES) - ISRAEL

10.20 VUZE XR (HUMANEYES TECHNOLOGIES) - ISRAEL

10.21 SAMSUNG ELECTRONICS COLTD. - SOUTH KOREA

10.22 LG ELECTRONICS INC. - SOUTH KOREA

10.23 LG 360 CAM - SOUTH KOREA

10.24 RICOH COMPANY LTD. - JAPAN

10.25 NIKON CORPORATION - JAPAN

Chapter 11: Global Unmanned Aerial Vehicle Market By Region

11.1 Overview

11.2. North America Unmanned Aerial Vehicle Market

11.2.1 Key Market Trends, Growth Factors and Opportunities

11.2.2 Top Key Companies

11.2.3 Historic and Forecasted Market Size by Segments

11.2.4 Historic and Forecasted Market Size by UAV Class

11.2.4.1 Micro UAVs (Below 2 Kg)

11.2.4.2 Mini UAVs (2-20 Kg)

11.2.4.3 Small UAVs (20-50 Kg)

11.2.4.4 Tactical UAVs (MALE & HALE)

11.2.5 Historic and Forecasted Market Size by Operational Mode

11.2.5.1 Fully Autonomous

11.2.5.2 Semi-Autonomous

11.2.5.3 Remotely-Operated

11.2.6 Historic and Forecasted Market Size by Fully Autonomous

11.2.6.1 Individual Autonomous System

11.2.6.2 Drone-in-a-Box (DiaB)

11.2.7 Historic and Forecasted Market Size by Solutions

11.2.7.1 Aerostructures & Mechanisms

11.2.7.2 Securing System

11.2.7.3 Operating Software

11.2.7.4 Tethering Cord

11.2.7.5 Power Sources & Management System

11.2.7.6 Payload

11.2.7.7 Propulsion System

11.2.7.8 Others

11.2.8 Historic and Forecasted Market Size by Application

11.2.8.1 Perimeter Security & Border Management

11.2.8.2 Combat and Combat Support Missions

11.2.8.3 Situational Awareness

11.2.8.4 Disaster Management & First Responders

11.2.8.5 Surveying

11.2.8.6 Mapping

11.2.8.7 & Monitoring

11.2.8.8 Precision Agricultural Management

11.2.8.9 Power Station Management

11.2.8.10 Asset & Operations Management

11.2.8.11 Emergency Medical Logistics

11.2.8.12 Others

11.2.9 Historic and Forecasted Market Size by End-User

11.2.9.1 Government & Defense

11.2.9.2 Energy

11.2.9.3 Power

11.2.9.4 Oil & Gas

11.2.9.5 Construction & Mining

11.2.9.6 Agriculture

11.2.9.7 Forestry & Wild Life Conservation

11.2.9.8 Public Infrastructure & Homeland Security

11.2.9.9 Hospitals & Emergency Medical Services

11.2.9.10 Transportation & Logistics

11.2.9.11 Event Management

11.2.9.12 Others

11.2.10 Historic and Forecast Market Size by Country

11.2.10.1 US

11.2.10.2 Canada

11.2.10.3 Mexico

11.3. Eastern Europe Unmanned Aerial Vehicle Market

11.3.1 Key Market Trends, Growth Factors and Opportunities

11.3.2 Top Key Companies

11.3.3 Historic and Forecasted Market Size by Segments

11.3.4 Historic and Forecasted Market Size by UAV Class

11.3.4.1 Micro UAVs (Below 2 Kg)

11.3.4.2 Mini UAVs (2-20 Kg)

11.3.4.3 Small UAVs (20-50 Kg)

11.3.4.4 Tactical UAVs (MALE & HALE)

11.3.5 Historic and Forecasted Market Size by Operational Mode

11.3.5.1 Fully Autonomous

11.3.5.2 Semi-Autonomous

11.3.5.3 Remotely-Operated

11.3.6 Historic and Forecasted Market Size by Fully Autonomous

11.3.6.1 Individual Autonomous System

11.3.6.2 Drone-in-a-Box (DiaB)

11.3.7 Historic and Forecasted Market Size by Solutions

11.3.7.1 Aerostructures & Mechanisms

11.3.7.2 Securing System

11.3.7.3 Operating Software

11.3.7.4 Tethering Cord

11.3.7.5 Power Sources & Management System

11.3.7.6 Payload

11.3.7.7 Propulsion System

11.3.7.8 Others

11.3.8 Historic and Forecasted Market Size by Application

11.3.8.1 Perimeter Security & Border Management

11.3.8.2 Combat and Combat Support Missions

11.3.8.3 Situational Awareness

11.3.8.4 Disaster Management & First Responders

11.3.8.5 Surveying

11.3.8.6 Mapping

11.3.8.7 & Monitoring

11.3.8.8 Precision Agricultural Management

11.3.8.9 Power Station Management

11.3.8.10 Asset & Operations Management

11.3.8.11 Emergency Medical Logistics

11.3.8.12 Others

11.3.9 Historic and Forecasted Market Size by End-User

11.3.9.1 Government & Defense

11.3.9.2 Energy

11.3.9.3 Power

11.3.9.4 Oil & Gas

11.3.9.5 Construction & Mining

11.3.9.6 Agriculture

11.3.9.7 Forestry & Wild Life Conservation

11.3.9.8 Public Infrastructure & Homeland Security

11.3.9.9 Hospitals & Emergency Medical Services

11.3.9.10 Transportation & Logistics

11.3.9.11 Event Management

11.3.9.12 Others

11.3.10 Historic and Forecast Market Size by Country

11.3.10.1 Russia

11.3.10.2 Bulgaria

11.3.10.3 The Czech Republic

11.3.10.4 Hungary

11.3.10.5 Poland

11.3.10.6 Romania

11.3.10.7 Rest of Eastern Europe

11.4. Western Europe Unmanned Aerial Vehicle Market

11.4.1 Key Market Trends, Growth Factors and Opportunities

11.4.2 Top Key Companies

11.4.3 Historic and Forecasted Market Size by Segments

11.4.4 Historic and Forecasted Market Size by UAV Class

11.4.4.1 Micro UAVs (Below 2 Kg)

11.4.4.2 Mini UAVs (2-20 Kg)

11.4.4.3 Small UAVs (20-50 Kg)

11.4.4.4 Tactical UAVs (MALE & HALE)

11.4.5 Historic and Forecasted Market Size by Operational Mode

11.4.5.1 Fully Autonomous

11.4.5.2 Semi-Autonomous

11.4.5.3 Remotely-Operated

11.4.6 Historic and Forecasted Market Size by Fully Autonomous

11.4.6.1 Individual Autonomous System

11.4.6.2 Drone-in-a-Box (DiaB)

11.4.7 Historic and Forecasted Market Size by Solutions

11.4.7.1 Aerostructures & Mechanisms

11.4.7.2 Securing System

11.4.7.3 Operating Software

11.4.7.4 Tethering Cord

11.4.7.5 Power Sources & Management System

11.4.7.6 Payload

11.4.7.7 Propulsion System

11.4.7.8 Others

11.4.8 Historic and Forecasted Market Size by Application

11.4.8.1 Perimeter Security & Border Management

11.4.8.2 Combat and Combat Support Missions

11.4.8.3 Situational Awareness

11.4.8.4 Disaster Management & First Responders

11.4.8.5 Surveying

11.4.8.6 Mapping

11.4.8.7 & Monitoring

11.4.8.8 Precision Agricultural Management

11.4.8.9 Power Station Management

11.4.8.10 Asset & Operations Management

11.4.8.11 Emergency Medical Logistics

11.4.8.12 Others

11.4.9 Historic and Forecasted Market Size by End-User

11.4.9.1 Government & Defense

11.4.9.2 Energy

11.4.9.3 Power

11.4.9.4 Oil & Gas

11.4.9.5 Construction & Mining

11.4.9.6 Agriculture

11.4.9.7 Forestry & Wild Life Conservation

11.4.9.8 Public Infrastructure & Homeland Security

11.4.9.9 Hospitals & Emergency Medical Services

11.4.9.10 Transportation & Logistics

11.4.9.11 Event Management

11.4.9.12 Others

11.4.10 Historic and Forecast Market Size by Country

11.4.10.1 Germany

11.4.10.2 UK

11.4.10.3 France

11.4.10.4 The Netherlands

11.4.10.5 Italy

11.4.10.6 Spain

11.4.10.7 Rest of Western Europe

11.5. Asia Pacific Unmanned Aerial Vehicle Market

11.5.1 Key Market Trends, Growth Factors and Opportunities

11.5.2 Top Key Companies

11.5.3 Historic and Forecasted Market Size by Segments

11.5.4 Historic and Forecasted Market Size by UAV Class

11.5.4.1 Micro UAVs (Below 2 Kg)

11.5.4.2 Mini UAVs (2-20 Kg)

11.5.4.3 Small UAVs (20-50 Kg)

11.5.4.4 Tactical UAVs (MALE & HALE)

11.5.5 Historic and Forecasted Market Size by Operational Mode

11.5.5.1 Fully Autonomous

11.5.5.2 Semi-Autonomous

11.5.5.3 Remotely-Operated

11.5.6 Historic and Forecasted Market Size by Fully Autonomous

11.5.6.1 Individual Autonomous System

11.5.6.2 Drone-in-a-Box (DiaB)

11.5.7 Historic and Forecasted Market Size by Solutions

11.5.7.1 Aerostructures & Mechanisms

11.5.7.2 Securing System

11.5.7.3 Operating Software

11.5.7.4 Tethering Cord

11.5.7.5 Power Sources & Management System

11.5.7.6 Payload

11.5.7.7 Propulsion System

11.5.7.8 Others

11.5.8 Historic and Forecasted Market Size by Application

11.5.8.1 Perimeter Security & Border Management

11.5.8.2 Combat and Combat Support Missions

11.5.8.3 Situational Awareness

11.5.8.4 Disaster Management & First Responders

11.5.8.5 Surveying

11.5.8.6 Mapping

11.5.8.7 & Monitoring

11.5.8.8 Precision Agricultural Management

11.5.8.9 Power Station Management

11.5.8.10 Asset & Operations Management

11.5.8.11 Emergency Medical Logistics

11.5.8.12 Others

11.5.9 Historic and Forecasted Market Size by End-User

11.5.9.1 Government & Defense

11.5.9.2 Energy

11.5.9.3 Power

11.5.9.4 Oil & Gas

11.5.9.5 Construction & Mining

11.5.9.6 Agriculture

11.5.9.7 Forestry & Wild Life Conservation

11.5.9.8 Public Infrastructure & Homeland Security

11.5.9.9 Hospitals & Emergency Medical Services

11.5.9.10 Transportation & Logistics

11.5.9.11 Event Management

11.5.9.12 Others

11.5.10 Historic and Forecast Market Size by Country

11.5.10.1 China

11.5.10.2 India

11.5.10.3 Japan

11.5.10.4 South Korea

11.5.10.5 Malaysia

11.5.10.6 Thailand

11.5.10.7 Vietnam

11.5.10.8 The Philippines

11.5.10.9 Australia

11.5.10.10 New Zealand

11.5.10.11 Rest of APAC

11.6. Middle East & Africa Unmanned Aerial Vehicle Market

11.6.1 Key Market Trends, Growth Factors and Opportunities

11.6.2 Top Key Companies

11.6.3 Historic and Forecasted Market Size by Segments

11.6.4 Historic and Forecasted Market Size by UAV Class

11.6.4.1 Micro UAVs (Below 2 Kg)

11.6.4.2 Mini UAVs (2-20 Kg)

11.6.4.3 Small UAVs (20-50 Kg)

11.6.4.4 Tactical UAVs (MALE & HALE)

11.6.5 Historic and Forecasted Market Size by Operational Mode

11.6.5.1 Fully Autonomous

11.6.5.2 Semi-Autonomous

11.6.5.3 Remotely-Operated

11.6.6 Historic and Forecasted Market Size by Fully Autonomous

11.6.6.1 Individual Autonomous System

11.6.6.2 Drone-in-a-Box (DiaB)

11.6.7 Historic and Forecasted Market Size by Solutions

11.6.7.1 Aerostructures & Mechanisms

11.6.7.2 Securing System

11.6.7.3 Operating Software

11.6.7.4 Tethering Cord

11.6.7.5 Power Sources & Management System

11.6.7.6 Payload

11.6.7.7 Propulsion System

11.6.7.8 Others

11.6.8 Historic and Forecasted Market Size by Application

11.6.8.1 Perimeter Security & Border Management

11.6.8.2 Combat and Combat Support Missions

11.6.8.3 Situational Awareness

11.6.8.4 Disaster Management & First Responders

11.6.8.5 Surveying

11.6.8.6 Mapping

11.6.8.7 & Monitoring

11.6.8.8 Precision Agricultural Management

11.6.8.9 Power Station Management

11.6.8.10 Asset & Operations Management

11.6.8.11 Emergency Medical Logistics

11.6.8.12 Others

11.6.9 Historic and Forecasted Market Size by End-User

11.6.9.1 Government & Defense

11.6.9.2 Energy

11.6.9.3 Power

11.6.9.4 Oil & Gas

11.6.9.5 Construction & Mining

11.6.9.6 Agriculture

11.6.9.7 Forestry & Wild Life Conservation

11.6.9.8 Public Infrastructure & Homeland Security

11.6.9.9 Hospitals & Emergency Medical Services

11.6.9.10 Transportation & Logistics

11.6.9.11 Event Management

11.6.9.12 Others

11.6.10 Historic and Forecast Market Size by Country

11.6.10.1 Turkiye

11.6.10.2 Bahrain

11.6.10.3 Kuwait

11.6.10.4 Saudi Arabia

11.6.10.5 Qatar

11.6.10.6 UAE

11.6.10.7 Israel

11.6.10.8 South Africa

11.7. South America Unmanned Aerial Vehicle Market

11.7.1 Key Market Trends, Growth Factors and Opportunities

11.7.2 Top Key Companies

11.7.3 Historic and Forecasted Market Size by Segments

11.7.4 Historic and Forecasted Market Size by UAV Class

11.7.4.1 Micro UAVs (Below 2 Kg)

11.7.4.2 Mini UAVs (2-20 Kg)

11.7.4.3 Small UAVs (20-50 Kg)

11.7.4.4 Tactical UAVs (MALE & HALE)

11.7.5 Historic and Forecasted Market Size by Operational Mode

11.7.5.1 Fully Autonomous

11.7.5.2 Semi-Autonomous

11.7.5.3 Remotely-Operated

11.7.6 Historic and Forecasted Market Size by Fully Autonomous

11.7.6.1 Individual Autonomous System

11.7.6.2 Drone-in-a-Box (DiaB)

11.7.7 Historic and Forecasted Market Size by Solutions

11.7.7.1 Aerostructures & Mechanisms

11.7.7.2 Securing System

11.7.7.3 Operating Software

11.7.7.4 Tethering Cord

11.7.7.5 Power Sources & Management System

11.7.7.6 Payload

11.7.7.7 Propulsion System

11.7.7.8 Others

11.7.8 Historic and Forecasted Market Size by Application

11.7.8.1 Perimeter Security & Border Management

11.7.8.2 Combat and Combat Support Missions

11.7.8.3 Situational Awareness

11.7.8.4 Disaster Management & First Responders

11.7.8.5 Surveying

11.7.8.6 Mapping

11.7.8.7 & Monitoring

11.7.8.8 Precision Agricultural Management

11.7.8.9 Power Station Management

11.7.8.10 Asset & Operations Management

11.7.8.11 Emergency Medical Logistics

11.7.8.12 Others

11.7.9 Historic and Forecasted Market Size by End-User

11.7.9.1 Government & Defense

11.7.9.2 Energy

11.7.9.3 Power

11.7.9.4 Oil & Gas

11.7.9.5 Construction & Mining

11.7.9.6 Agriculture

11.7.9.7 Forestry & Wild Life Conservation

11.7.9.8 Public Infrastructure & Homeland Security

11.7.9.9 Hospitals & Emergency Medical Services

11.7.9.10 Transportation & Logistics

11.7.9.11 Event Management

11.7.9.12 Others

11.7.10 Historic and Forecast Market Size by Country

11.7.10.1 Brazil

11.7.10.2 Argentina

11.7.10.3 Rest of SA

Chapter 12 Analyst Viewpoint and Conclusion

12.1 Recommendations and Concluding Analysis

12.2 Potential Market Strategies

Chapter 13 Research Methodology

13.1 Research Process

13.2 Primary Research

13.3 Secondary Research

|

Global Unmanned Aerial Vehicle Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 31.9 Bn. |

|

Forecast Period 2024-32 CAGR: |

16.30% |

Market Size in 2032: |

USD 124.2 Bn. |

|

Segments Covered: |

By UAV Class |

|

|

|

By Operational Mode |

|

||

|

By Fully Autonomous |

|

||

|

By Solutions |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||