Transportation Management System Market Synopsis:

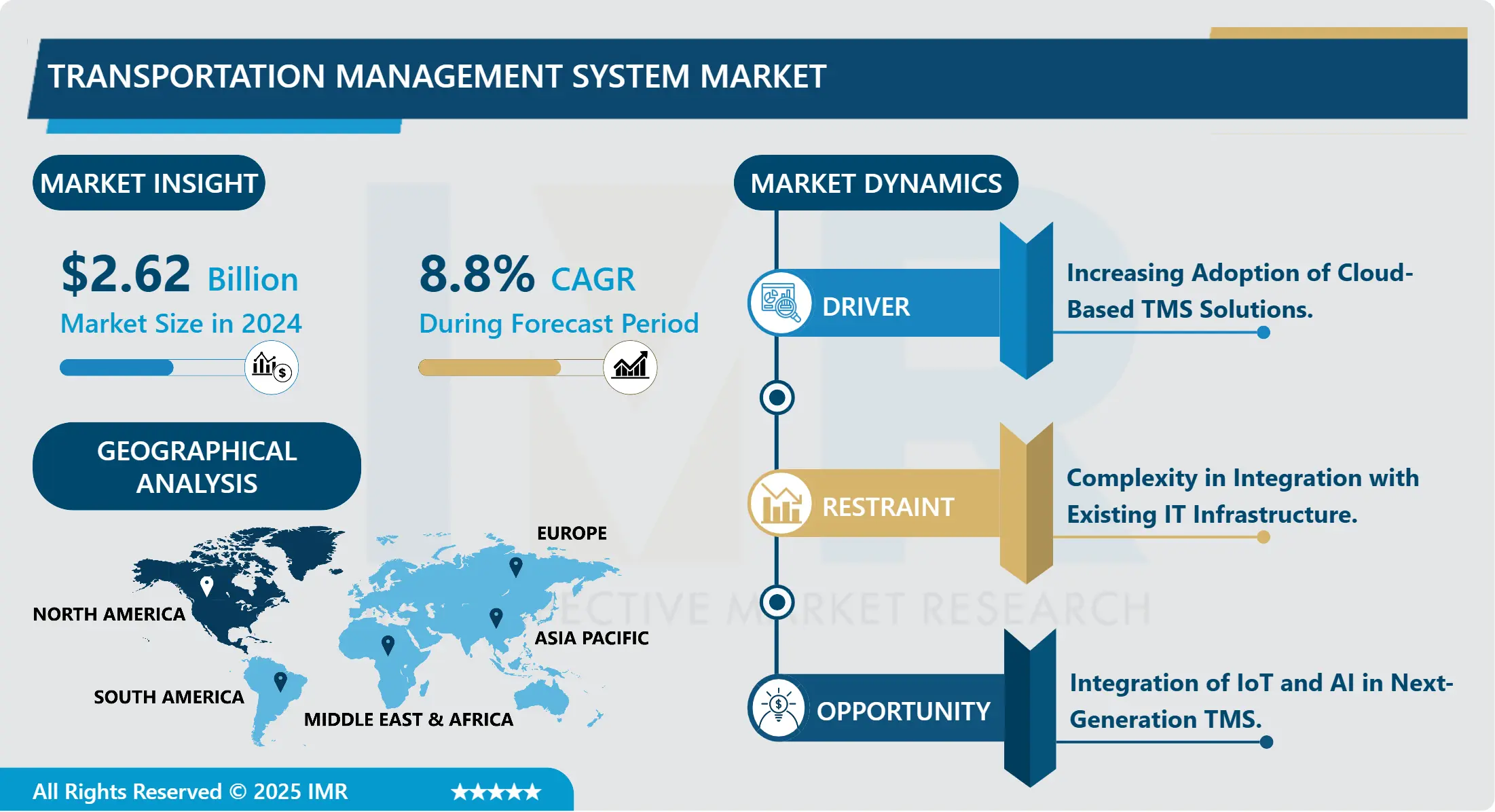

Transportation Management System Market Size is Valued at USD 2.62 Billion in 2024, and is Projected to Reach USD 5.14 Billion by 2032, Growing at a CAGR of 8.80% From 2025-2032.

The TMS Market touches on the various software and services that are employed in the efficient planning, coordination, and controlling of the transportation flow of goods. These systems support the various transport operations in the various modes of transport which include road, rail, aviation and marine transport in aspects such as freight recovery and payment, routing, network, and order. TMS solutions are either installed in-house or can be accessed over cloud solutions that are relevant for the retail, health care, manufacturing and logistics sectors among other industries. It targets business clients of all sizes such as multinational businesses and SMEs by geographical regions of the world; North America, Europe, Asia Pacific, Middle East & Africa, Latin America.

The global TMS market is mainly fueled by the trendy globalization of trade requiring organized transportation methods to handle intricate supply chains. Many business organizations have started implementing TMS solutions in order to enhance their supply chain management and cut down their expenses and delivery time. Therefore, there are specific factors like the increased use of internet and e-commerce and the need for real time shipment tracking as well. All the versions offer proper resources for route schedules, freight checks, as well as payments to support certain processes and enhance performance.

Also, increased subsequent technologies investment into TMS concerning Artificial Intelligence (AI), Machine Learning (ML), and Internet of Things (IoT) are also boosting the market growth. These technologies complement TMS by sharing forecasting capabilities, big data processing, and self-driving power, all of which mean that TMS becomes more effective in transportation management. The transition from on-premise TMS solutions to cloud-based services is also key, given the latter’s better scalability, malleability, and, importantly, more affordable upfront costs. Also, the concerns such as compliance, environmental, social, and economic responsibility that have become more relevant in today’s world and the concern for embracing environmental KPIs are prompting companies to consider the adoption of superior TMS solutions.

Transportation Management System Market Trend Analysis

The Impact of Cloud-Based TMS on Supply Chain Efficiency

- The market for TMS is expanding because of the integration of technologies as well as the growing requirement for improvement in transport operations. The wave of change in preference for cloud-based TMS solutions can be attributed to this factor owing to the versatility, availability at a cheaper price, and ease of implementation. It is also amicable that the cloud solutions provide real-time access to the data that is compiled by the supply chain, and can easily integrate with other supply chain management solutions to make operation more efficient. Moreover, the use of AI and ML within TMS is transforming the market with the features in terms of providing analytical insights, decision-making assistance, and route optimisation with the purpose of decreasing operational costs and delivery effectiveness.

- Other noticeable tendencies are associated with sustainability and green logistics coming to the forefront of the industry’s development. TMS solutions are finding more and more application in firms as they are essential for reducing their emissions and meeting legal requirements. This entails working out optimal means of transport in order to cut on expenditure such as fuel costs, working on load management and the use of vehicles that run on non-conventional fuels. Also, due to increasing adoption of online shopping more businesses require TMS solutions because they need to track their shipments, which still require additional handling. Internet of Things (IoT) integration is also on the rise helping real-time tracking and monitoring of the shipments making the process more transparent to the customers.

Driving Efficiency, Emerging Trends and Opportunities in TMS Solutions

- Features on the TMS market to be associated with supply chain requirement growth and increasing technology use are as follows: Due to a larger variety of e-commerce and globalization, the firms are in search for effective and efficient systems to manage their supply chains with lower cost and high customer value. Cloud-based TMS solutions are quickly becoming popular among firms due to the high level of expansion, adaptability, and factors such as low initial investments. Furthermore, artificial intelligence, machine learning, and big data analysis solutions are helping make TMS more complex and accurate to even design powerful routes, improve the management of stocks, and get accurate real-time business know-how.

- Also, the requirements for end-to-end approaches with full transparency of every level throughout the chain are rising. This trend is more evident in industries like retailing services, the health sector, and manufacturing industries as delivery and transport are vital. Asia-Pacific and Latin America are also presenting good opportunities due to factors such as, industrialization and urbanization, which calls for effective transportation management systems. Due to increasing regulatory environment on transportation safety and emissions in the international market, TMS providers can establish new solutions that enable firms to meet the regulations while managing the operations.

Transportation Management System Market Segment Analysis:

Transportation Management System Market Segmented on the basis of Transportation Mode, Mode of Deployment, Enterprise Size, and Region.

By Transportation Mode, Airways segment is expected to dominate the market during the forecast period

- The segmentation in the TMS market is based on transportation means, such as Airways, Railways, and Roads. All the segments present distinct opportunities and difficulties within the field of logistics and supply chain management. Airways TMS solutions are designed to address the nature of air cargo operation, namely, swift action, strict time frames, and compliance with legislation.

- Railway TMS solutions focus on the best practices in freight management, routes management and shipment tracking across rail networks to increase the operational performance and decrease time for shipment delivery. Roadways TMS solutions are aimed at the fleet, rout optimization, and the last mile that is crucial for industries relying on ground delivery of goods. These segments in coordination add to the phenomenon and impending growth of the TMS market by providing solutions adapted to each transportation mode’s requirements.

By Enterprise Size, Large Enterprise segment held the largest share in 2024

- The TMS market can be divided based on the enterprise size for the companies implementing transportation management solutions into SMEs and large enterprise categories. Due to their nature, they require TMS solutions that are affordable, easy to integrate, and flexible enough to accommodate the business expansion of the SMEs. They assist SMEs to have better control on its logistics chain, control stock levels effectively, and get better in supply chains.

- On the other hand, large enterprises use TMS solutions to support the supply chains that involve several establishments in different regions or countries. These solutions provide superior elements like analytics, live tracking, compatibility with other systems of the large enterprises that help them in getting better results in operational cost, transportation cost, and effective customer satisfaction. Large enterprises and SMEs are involved in the growth and development of TMS and the attractiveness of the market for its implementation in different industries of the world economy.

Transportation Management System Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The market for the Transportation Management System (TMS) in North America is defined by a strong growth rate due to the factors like well-developed logistics industry and increased use of the modern technologies in the enterprises of various kinds located in the region. North America holds the largest market share for TMS across the globe due to the existence of market bigshots and increased implementation of superior transportation services. The main drivers for this market are the concerns for better supply chain management, the reduction of the actual costs of transporting goods, and the growing tendency towards obtaining real-time information and performance statistics. Business fields like retail, manufacturing, healthcare, and automotive industries depend massively on TMS solutions for their logistics flow, route planning, and, in general, for the overall transportation performance.

- The United States leads the market for TMS systems in North America credited to the extensive transportation connections in the country as well as the key TMS providers with sophisticated solutions that address the needs of a variety of industries. Hence, the regional market also comprises of Canada and Mexico where the infrastructure investment of logistics and cloud-based TMS solutions is also growing. Since e-commerce is increasing at a rapid rate across the region, there is a increase in need for TMS that can address keeping pace with transportation complexities, solve last mile delivery puzzle and at the same time integrate easily with the current information technology systems. The TMS market in North America is quite competitive, uses technologies actively in an attempt to develop sophisticated services and create partnerships to further penetration in the market as the environment changes with regards to customer needs and regulations.

Active Key Players in the Transportation Management System Market

- 3Gtms Inc. (Sumeru Equity Partners) (USA)

- CargoSmart Ltd (China)

- Descartes Systems Group Inc. (Canada)

- Manhattan Associates Inc. (USA)

- JDA Software Group Inc. (USA)

- Oracle Corporation (USA)

- SAP SE: Walldorf, Germany

- Precision Software Inc. (QAD Inc) (USA)

- MercuryGate International Inc. (Summit Partners) (USA)

- Other Active Players.

|

Global Transportation Management System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.62 Bn. |

|

Forecast Period 2025-32 CAGR: |

8.80 % |

Market Size in 2032: |

USD 5.14 Bn. |

|

Segments Covered: |

By Transportation Mode |

|

|

|

Mode Of Deployment |

|

||

|

By Enterprise Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Transportation Management System Market by Transportation Mode (2018-2032)

4.1 Transportation Management System Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Airways

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Railways

4.5 Roadways

4.6 Mode Of Deployment

4.7 On-premise

4.8 Cloud

Chapter 5: Transportation Management System Market by Enterprise Size (2018-2032)

5.1 Transportation Management System Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Small and Medium Enterprises

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Large Enterprises

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Transportation Management System Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 3GTMS INC. (SUMERU EQUITY PARTNERS) (USA)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 CARGOSMART LTD (CHINA)

6.4 DESCARTES SYSTEMS GROUP INC. (CANADA)

6.5 MANHATTAN ASSOCIATES INC. (USA)

6.6 JDA SOFTWARE GROUP INC. (USA)

6.7 ORACLE CORPORATION (USA)

6.8 SAP SE WALLDORF

6.9 GERMANY

6.10 PRECISION SOFTWARE INC. (QAD INC) (USA)

6.11 MERCURYGATE INTERNATIONAL INC. (SUMMIT PARTNERS) (USA)

6.12 OTHERS

Chapter 7: Global Transportation Management System Market By Region

7.1 Overview

7.2. North America Transportation Management System Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Transportation Mode

7.2.4.1 Airways

7.2.4.2 Railways

7.2.4.3 Roadways

7.2.4.4 Mode Of Deployment

7.2.4.5 On-premise

7.2.4.6 Cloud

7.2.5 Historic and Forecasted Market Size by Enterprise Size

7.2.5.1 Small and Medium Enterprises

7.2.5.2 Large Enterprises

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Transportation Management System Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Transportation Mode

7.3.4.1 Airways

7.3.4.2 Railways

7.3.4.3 Roadways

7.3.4.4 Mode Of Deployment

7.3.4.5 On-premise

7.3.4.6 Cloud

7.3.5 Historic and Forecasted Market Size by Enterprise Size

7.3.5.1 Small and Medium Enterprises

7.3.5.2 Large Enterprises

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Transportation Management System Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Transportation Mode

7.4.4.1 Airways

7.4.4.2 Railways

7.4.4.3 Roadways

7.4.4.4 Mode Of Deployment

7.4.4.5 On-premise

7.4.4.6 Cloud

7.4.5 Historic and Forecasted Market Size by Enterprise Size

7.4.5.1 Small and Medium Enterprises

7.4.5.2 Large Enterprises

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Transportation Management System Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Transportation Mode

7.5.4.1 Airways

7.5.4.2 Railways

7.5.4.3 Roadways

7.5.4.4 Mode Of Deployment

7.5.4.5 On-premise

7.5.4.6 Cloud

7.5.5 Historic and Forecasted Market Size by Enterprise Size

7.5.5.1 Small and Medium Enterprises

7.5.5.2 Large Enterprises

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Transportation Management System Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Transportation Mode

7.6.4.1 Airways

7.6.4.2 Railways

7.6.4.3 Roadways

7.6.4.4 Mode Of Deployment

7.6.4.5 On-premise

7.6.4.6 Cloud

7.6.5 Historic and Forecasted Market Size by Enterprise Size

7.6.5.1 Small and Medium Enterprises

7.6.5.2 Large Enterprises

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Transportation Management System Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Transportation Mode

7.7.4.1 Airways

7.7.4.2 Railways

7.7.4.3 Roadways

7.7.4.4 Mode Of Deployment

7.7.4.5 On-premise

7.7.4.6 Cloud

7.7.5 Historic and Forecasted Market Size by Enterprise Size

7.7.5.1 Small and Medium Enterprises

7.7.5.2 Large Enterprises

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Transportation Management System Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 2.62 Bn. |

|

Forecast Period 2025-32 CAGR: |

8.80 % |

Market Size in 2032: |

USD 5.14 Bn. |

|

Segments Covered: |

By Transportation Mode |

|

|

|

Mode Of Deployment |

|

||

|

By Enterprise Size |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||