Transportation as a service Market Synopsis

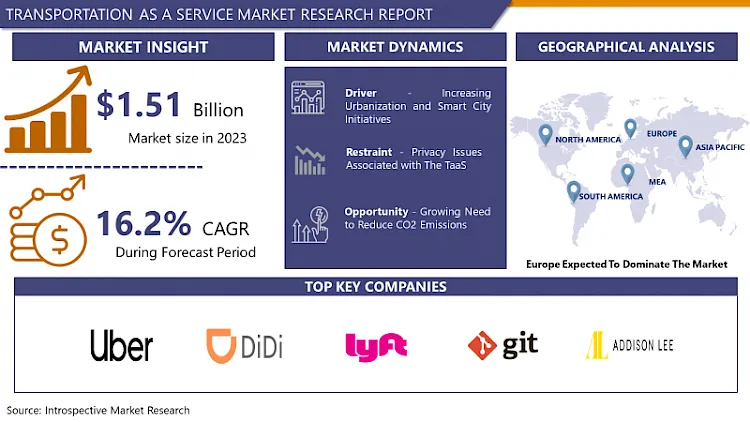

Transportation as a service Market Size Was Valued at USD 1.75 Billion in 2024, and is Projected to Reach USD 5.82 Billion by 2032, Growing at a CAGR of 16.2% From 2025-2032.

The transportation as a service (TaaS) market has been growing worldwide due to the factors such as the need for on-demand, affordable, and eco-friendly transport solutions. This growth is fostered by factors such as population increase particularly in cities, technological developments, and shifting market trends that support shared and unattended transport systems. Here are some factors that are driving the TaaS market forward. Technological advancements such as self-driving cars have emerged as prominent factors while connectivity has also improved. Smart cities and the application of IoT especially in the transportation sector has also been another factor that has contributed to the advancement. Also, the factors such as global environmental concerns and government policies to curb carbon emissions to promote electric and shared mobility solutions are expected to fuel the growth of the market.

First, the TaaS market can be divided into various types of services, vehicles, and users. The types of services offered are ride-hailing, car-sharing, bike-sharing, and shuttle services. Vehicle types are as diverse as the conventional vehicles all the way to electric and self-driving vehicles. The end-users may be classified into two broad categories namely the individual consumers and the enterprises. The growth of each segment is different and differs by category; at the moment, the most popular and fastest-growing categories are ride-hailing and car-sharing, which offer people comfort, affordability, and convenience.

North America and Europe are likely to dominate the TaaS market owing to the increased technology penetration, advanced infrastructure and favorable policies in these regions. The Asia Pacific region, in particular, is expected to experience the fastest growth due to factors such as increased urbanization, the increasing use of smartphones, and significant investments in smart city projects. Some of the leading countries include China and India, which have made large investments in autonomous and electric vehicles.

Analyzing the current and future trends in the TaaS market, it can be stated that the market is expected to grow significantly in the coming years due to technological advancements, environmental concerns, and shifting customer attitudes. This is an ever-evolving market, which means that it offers great prospects for companies and investors interested in the field.

Transportation as a service Market Trend Analysis

Autonomous and Electric Vehicles

- The advancement in artificial intelligence, coupled with the availability of better sensors, has led to the rapid adoption of autonomous cars. Currently, Waymo, Tesla and other firms along with traditional automotive companies are working hard in the development of better autonomous vehicles. This integration is to improve safety, minimize the instances of human mistakes, and better manage traffic flow.

- This global push towards sustainability has seen the EV market grow rapidly. As more stringent emission standards are set by governments and incentives are provided for EVs, more people are using them. Hence, we are seeing more EVs being introduced into the market, with the development in battery systems that enhance the driving range and cut down the cost of EVs to make them affordable to consumers.

- TaaS has been on the rise, and more and more consumers are opting for ride-hailing services, car-sharing, and subscription services instead of purchasing vehicles. The primary drivers of this evolution include population growth in cities, changing perceptions towards car ownership, and the flexibility that comes with using on-demand mobility services. Examples include Uber and Lyft, which have been leading the way for the deployment of AEVs into their offerings.

- Infrastructure and Policy Developments: The shift to AEVs and TaaS is underpinned by large capital investments in charging networks and advanced urban systems. Governments and private sectors are making efforts to provide policies that allow integration of AEVs into public transport, whether it is a bus or a train, to create an efficient transport system.

Mobility as a Service (MaaS) Integration

- MaaS platforms capitalize on the convenience of users by providing a one-stop app where people can find different modes of transport including buses, trains, bicycles, ride-hailing, and scooters. This integration has helped in easing the navigation and the payment options in travel planning hence giving the best services.

- The advent of digital technologies such as real-time data and analytics, mobile applications, and IoT has contributed to the growth of MaaS. These technologies help in the integration and management of different forms of transport services with the user able to receive information on the most appropriate and timely routes.

- MaaS aims to achieve sustainable transport through a shift of focus from the use of privately-owned automobiles to public and shared transport. This shift can help minimize traffic jam, cut down emissions of greenhouse gases, and increase the efficiency of moving around cities thus creating improved urban environments.

- The Transportation as a Service (TaaS) market is rapidly growing, and this has been influenced by factors like population density and shifts in consumer behavior. The market is expected to expand rapidly, with large capital injections from both the public and the private domains. This growth is opening up new market opportunities and driving the development of new products and business models in the transportation industry.

Transportation as a service Market Segment Analysis:

Transportation as a service Market is Segmented on the basis of Type, Deployment Model, and Region.

By Type, Delivery Services segment is expected to dominate the market during the forecast period.

- Due to the growing popularity of e-commerce and delivery services such as UberRUSH, delivery services play a significant role in the TaaS ecosystem. Presently, companies like Uber Eats and Amazon are using TaaS to provide faster and reliable delivery services to consumers as they seek efficient delivery services.

- Rental transportation consists of bikes, scooters, and cars giving users an easy and convenient way to access vehicles for short periods. This segment is on the rise especially in the cities where it may be more economical and convenient to own a car due to high prices of automobiles and limited parking space.

- The conventional car rental service providers are changing their delivery models to address the changing demand from consumers. These are companies such as Hertz and Avis that have embraced technology in an effort to provide convenient car rental services to tourists and businesspeople who require the use of cars for a short period.

- Uber and Lyft are examples of rideshare services that have transformed the transport sector in urban centers by offering a convenient way of getting a ride. On the same note, there is Care by Volvo, a service that allows customers to have access to a car for a monthly fee that also includes maintenance and insurance.

By Deployment Model, Android Platform segment held the largest share in 2024

- The Android OS is widely used by consumers worldwide and is based on an open-source model, making the platform an important candidate for providing TaaS services. Android’s penetration especially in the developing countries means that the TaaS providers can easily reach a large number of consumers. Furthermore, the Android platform offers great versatility that enables the incorporation of different services and features that can be customized according to the local requirements in order to improve user retention and satisfaction.

- iOS, which is highly secured, fast and has rich user engagement, is another important platform for TaaS implementation. TaaS applications on iOS have the advantage of being in a solid environment that promotes reliability and smoothness. The iOS platform is especially beneficial in regions with a high level of smartphone adoption and offers a high-quality service that would be attractive to users who are looking for the best possible service.

- Offering TaaS services on both Android and iOS operating systems provides broad market coverage, thus reaching more users. Cross compatibility benefits the user since they are provided with similar features and services across different platforms, which increases the chances of the user sticking to the platform and being satisfied with it.

- It is notable that both platforms have opportunities to integrate modern technologies like real-time data analysis, GPS, and mobile payments, which are crucial for the effective implementation of TaaS services. These integrations allow the providers to provide real-time tracking details, route optimization, and payment gateway options in order to enhance the service delivery and convenience.

Transportation as a service Market Regional Insights:

Europe dominated the largest market in 2024

- European countries have put a large amount of capital into the development of efficient transportation infrastructure and have put into place policies for the adoption of TaaS. This has been done by implementing policies that have embraced more efficient, integrated and sustainable transport systems which has in turn boosted the development of TaaS.

- Due to the growing population and development in Europe, there is the need for better transport services that are reliable and adaptable. Several European cities are adopting smart city solutions that incorporate TaaS into their city development plans to increase mobility, decrease traffic, and enhance citizens’ quality of life.

- The European market primarily relies on environmental protection, and this has led to the promotion of TaaS. EU countries continue to encourage citizens to ride public transportation, carpool, or use other forms of shared mobility to help achieve environmental objectives of green mobility and minimize CO2 emissions from the transport sector.

- The European region can be considered to be leading in the development of TaaS in the technological field. There are countless start-ups and established companies that are focused on innovation in the areas of self-driving cars, electric vehicles, and integrated transport systems, making Europe a frontrunner on the global market for TaaS.

Active Key Players in the Transportation as a service Market

- Uber (United States)

- Didi (China)

- Lyft (United States)

- GETT (Israel)

- Hailo(United States)

- Addison Lee (United Kingdom)

- Ola Cabs (India)

- Meru (India)

- BlaBla Car (France)

- FREE NOW (Germany)

- Grab Taxi (Singapore)

- Kakao T (South Korea),

- Cabify (Spain)

- Careem (United Arab Emirates)

- Via (United States)

- Bolt (formerly Taxify) (Estonia)

- Gojek (Indonesia)

- Other Active Players

Key Industry Developments in the Transportation as a service Market:

- In April 2024, MODE Global, a multi-billion, multi-brand 3PL platform and leading logistics company, announced a collaboration with Transporeon, a Trimble company. This partnership aimed to leverage automation for tendering both spot and dedicated freight using Transporeon's Autonomous Procurement. As a leading Transportation Management Platform, it was to be white-labeled and customized for MODE as the MODE Global Marketplace.

- In March 2024, Transit Technologies, a visionary in transforming public and private mobility, announced it had acquired TripShot, a leading fleet management software company known for its powerful platform in public and private commuter transportation. This acquisition aimed to redefine the standards of transportation services and fleet management by further integrating technology solutions into Transit Technologies' comprehensive mobility platform.

|

Global Transportation as a service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.75 Bn. |

|

Forecast Period 2025-32 CAGR: |

16.2%

|

Market Size in 2032: |

USD 5.82 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Model |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Transportation as a service Market by Type (2018-2032)

4.1 Transportation as a service Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Delivery Services

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Rental Transportation

4.5 Car Rental Service

4.6 Rideshare Services

4.7 Car Subscription Services

Chapter 5: Transportation as a service Market by Deployment Model (2018-2032)

5.1 Transportation as a service Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Android Platform

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 IOS Platform

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Transportation as a service Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BASWARE CORPORATION (FINLAND)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 BIRCHSTREET SYSTEMS (UNITED STATES)

6.4 BRAVOSOLUTION (ITALY)

6.5 BUYERQUEST HOLDINGS INC. (UNITED STATES)

6.6 COUPA SOFTWARE (UNITED STATES)

6.7 DETERMINE INC. (UNITED STATES)

6.8 GEP (UNITED STATES)

6.9 IBM (UNITED STATES)

6.10 IVALUA INC. (FRANCE)

6.11 JAGGAER (UNITED STATES)

6.12 OPUSCAPITA GROUP (FINLAND)

6.13 ORACLE CORPORATION (UNITED STATES)

6.14 PROACTIS HOLDINGS (UNITED KINGDOM)

6.15 SAP ARIBA (GERMANY)

6.16 SYNERTRADE SA (FRANCE)

6.17 TRADESHIFT (UNITED STATES)

6.18 VROOZI INC. (UNITED STATES)

6.19 WAX DIGITAL LTD. (UNITED KINGDOM)

6.20 XEEVA INC. (UNITED STATES)

6.21 ZYCUS INC. (UNITED STATES)

6.22 OTHER KEY PLAYERS

Chapter 7: Global Transportation as a service Market By Region

7.1 Overview

7.2. North America Transportation as a service Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Delivery Services

7.2.4.2 Rental Transportation

7.2.4.3 Car Rental Service

7.2.4.4 Rideshare Services

7.2.4.5 Car Subscription Services

7.2.5 Historic and Forecasted Market Size by Deployment Model

7.2.5.1 Android Platform

7.2.5.2 IOS Platform

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Transportation as a service Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Delivery Services

7.3.4.2 Rental Transportation

7.3.4.3 Car Rental Service

7.3.4.4 Rideshare Services

7.3.4.5 Car Subscription Services

7.3.5 Historic and Forecasted Market Size by Deployment Model

7.3.5.1 Android Platform

7.3.5.2 IOS Platform

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Transportation as a service Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Delivery Services

7.4.4.2 Rental Transportation

7.4.4.3 Car Rental Service

7.4.4.4 Rideshare Services

7.4.4.5 Car Subscription Services

7.4.5 Historic and Forecasted Market Size by Deployment Model

7.4.5.1 Android Platform

7.4.5.2 IOS Platform

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Transportation as a service Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Delivery Services

7.5.4.2 Rental Transportation

7.5.4.3 Car Rental Service

7.5.4.4 Rideshare Services

7.5.4.5 Car Subscription Services

7.5.5 Historic and Forecasted Market Size by Deployment Model

7.5.5.1 Android Platform

7.5.5.2 IOS Platform

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Transportation as a service Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Delivery Services

7.6.4.2 Rental Transportation

7.6.4.3 Car Rental Service

7.6.4.4 Rideshare Services

7.6.4.5 Car Subscription Services

7.6.5 Historic and Forecasted Market Size by Deployment Model

7.6.5.1 Android Platform

7.6.5.2 IOS Platform

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Transportation as a service Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Delivery Services

7.7.4.2 Rental Transportation

7.7.4.3 Car Rental Service

7.7.4.4 Rideshare Services

7.7.4.5 Car Subscription Services

7.7.5 Historic and Forecasted Market Size by Deployment Model

7.7.5.1 Android Platform

7.7.5.2 IOS Platform

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Global Transportation as a service Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 1.75 Bn. |

|

Forecast Period 2025-32 CAGR: |

16.2%

|

Market Size in 2032: |

USD 5.82 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Model |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||