Transportation Analytics Market Synopsis

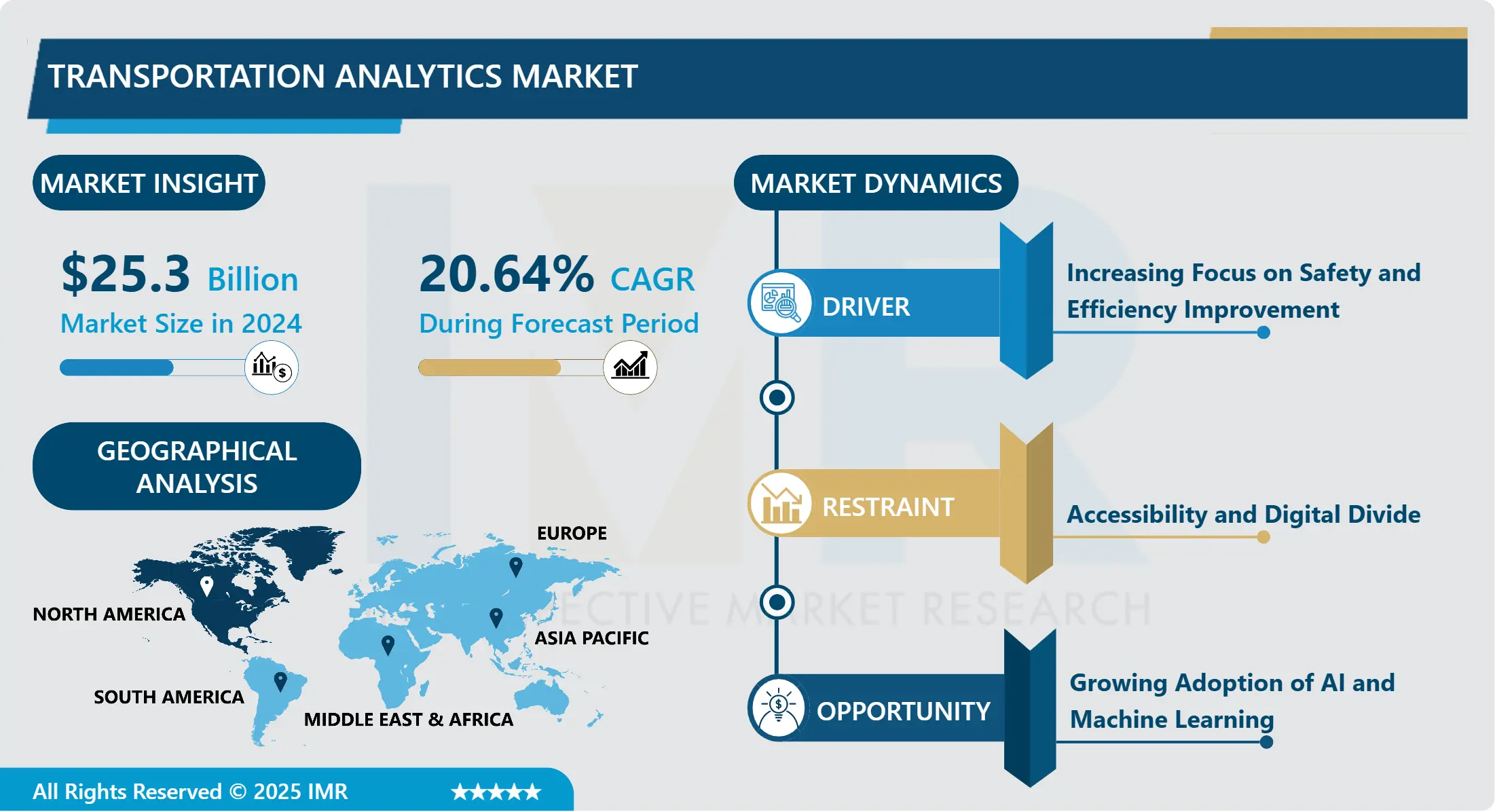

Transportation Analytics Market Size Was Valued at USD 25.3 Billion in 2024, and is Projected to Reach USD 113.51 Billion by 2032, Growing at a CAGR of 20.64% From 2025-2032.

Transportation analytics market utilizes advanced data analysis, big data, IoT, AI, and machine learning to enhance efficiency, safety, and sustainability of transportation systems. It provides options for highways, train tracks, air routes, and water routes. Primary purposes consist of traffic optimization, logistics enhancement, public transportation improvement, and predictive maintenance for accident and breakdown prevention.

Advances in technology like big data and analytics, the Internet of Things (IoT), and cloud computing are transforming transportation systems. Data gathering via sensors and smartphones, combined with sophisticated analysis using artificial intelligence, offer in-depth information for improved predictions. IoT technology in vehicles and infrastructure enables instant tracking of traffic conditions, while cloud computing provides flexibility and remote access for data processing and shared decision-making regardless of location. These advancements are enhancing the efficiency of transportation and the ability to address problems more quickly.

Consumer demands for transportation services are changing as they now seek reliability and safety. Operators utilize analytics to enhance schedules, deliver personalized services, and offer real-time updates on traffic and safety incidents. Analyzing driver behaviour and vehicle conditions through analytics enhances safety for passengers and goods. The urban population is growing due to rapid urbanization, leading to escalated traffic congestion. Urban areas are putting money into smart infrastructure, such as advanced transportation systems, in order to handle the increasing number of residents.

Aging infrastructure and increased public transport needs are obstacles demanding innovative solutions to enhance efficiency and improve the quality of service. Transportation operators must utilize advanced analytics to adhere to safety regulations and manage risks in order to enhance passenger safety and decrease accidents. Environmental regulations aim to decrease emissions, prompting operators to enhance routes and boost fuel efficiency with analytics to achieve sustainability objectives established by cities and countries.

Transportation Analytics Market Trend Analysis

Transportation Analytics Market Growth Driver- Increasing Focus on Safety and Efficiency Improvement

- Urban growth results in increased traffic jams in cities, causing economic burdens due to reduced productivity, fuel inefficiency, and heightened pollution levels. Efficient traffic control is extremely important. Governments implement stringent safety regulations for transportation providers, while environmental guidelines push for the adoption of efficiency-enhancing technologies in order to decrease emissions and support sustainability. Utilizing analytics to predict passenger needs and make necessary service adjustments, monitoring data to enhance operations in scheduling, fleet management, and resource allocation.

- Consumers desire dependable transportation services, advocating for greater effectiveness. The demand for enhanced safety measures among passengers and transporters is fueled by safety concerns. IoT devices gather data to enhance safety and efficiency, while AI forecasts potential dangers and enhances route planning. Both improvements increase safety and efficiency in technology. Enhanced traffic movement with live data analysis to monitor and modify signals, routes, and speeds. Swift identification and quick reaction to reduce interruptions.

- Inspecting sensor information to predict potential vehicle problems, enhance safety, and decrease periods of inactivity. Forecasting infrastructure maintenance requirements to avoid incidents and guarantee prompt repairs. Optimizing routes and loads for effective logistics and freight management. Examining traffic, weather conditions, and vehicle weight to diminish travel duration, fuel usage, and guarantee safety and economic efficiency. Examining accident information to avoid repeat incidents and utilizing telematics to track and enhance driver performance for enhanced safety in public transportation effectiveness.

Transportation Analytics Market Expansion Opportunity- Growing Adoption of AI and Machine Learning

- AI and ML algorithms improve the ability to predict maintenance needs and traffic patterns. Vehicle health monitoring utilizes data from sensors to predict maintenance requirements and avoid breakdowns for predictive maintenance. Maintenance of infrastructure forecasts the deterioration of roads, bridges, and railways in order to make repairs promptly. In traffic flow prediction, real-time analysis forecasts congestion patterns and recommends different routes, while incident prediction anticipates accidents for preventative safety actions.

- AI-driven technology can improve delivery and transportation routes instantly by considering traffic, weather, and other factors, resulting in decreased fuel usage and faster delivery speeds. AI assists in effectively overseeing fleets by streamlining routes, cutting down on idle time, and enhancing overall vehicle utilization. ML algorithms forecast passenger demand in public transportation and logistics to improve resource allocation by adapting the number of vehicles in operation and scheduling staff shifts, as well as enhancing the loading of goods in transport vehicles to ensure safety and effectiveness.

- AI-powered systems utilize telematics information to observe driver actions, identify signs of tiredness, and offer suggestions to enhance safety. Automated response systems have the capability to identify incidents as they happen and promptly initiate actions to prevent accidents. Improved customer satisfaction by providing customized services such as personalized suggestions and flexible pricing with the help of AI and ML technologies. AI systems offer up-to-the-minute data such as travel notifications and assistance from chatbots and virtual assistants to ensure a smooth travel journey.

- From 2021 to 2023, the global automotive artificial intelligence market grew steadily, increasing from $20.49 billion in 2021 to $26.49 billion in 2022 and reaching $32.49 billion in 2023. This growth underscores the rising importance of AI in transforming transportation analytics, enhancing efficiency, safety, and innovation within the automotive sector.

Transportation Analytics Market Segment Analysis:

Transportation Analytics Market Segmented on the basis of Type, Mode of Transportation, Component, Application, Deployment Model, and Region.

By Type, Predictive Segment is Expected to Dominate the Market During the Forecast Period

- Predictive analytics helps in predicting traffic patterns and foreseeing incidents through the examination of past data and live updates. This allows city planners to predict traffic jams and put in place strategies like changing signal schedules and sending out traffic officers. Authorities have the ability to decrease accidents and traffic congestion by identifying patterns and factors and implementing preventive measures. Utilizing predictive analytics to track data from sensors and systems enables pre-emptive upkeep of vehicles and infrastructure. This decrease in downtime and expenses extends the life of assets and allows for prompt repairs to prevent major failures in roads, bridges, and railways.

- Predictive analytics in logistics improve delivery routes by taking into account traffic conditions, weather, and past data. This leads to on-time deliveries, lower fuel consumption, and less strain on vehicles. Forecasting passenger demand for public transportation is important for optimizing schedules and resources, which leads to increased efficiency and passenger satisfaction.

- Predictive models examine driver behaviour information to detect dangerous actions such as speeding and abrupt braking. Suggestions may include additional training or safety precautions. Ways to avoid accidents involve enhancing road layout and enforcing traffic regulations efficiently. Predictive analytics aids in urban and transportation planning by forecasting upcoming trends through demographic shifts, economic changes, and transportation requirements. It helps policymakers by creating simulations to improve their decision-making on infrastructure investments and regulatory changes.

By Application, Traffic Management Segment Held the Largest Share in 2024

- Urbanization and growing population have resulted in a higher number of cars on streets, which has resulted in traffic jams in cities worldwide. The existing road infrastructure is finding it difficult to support this increase, necessitating the implementation of sophisticated traffic management strategies for enhancement. Sensors and IoT devices provide the ability to collect real-time traffic data, giving information on vehicle speeds and congestion levels. Big data analytics allow for flexible traffic control, enhancing the flow through signal and route adjustments.

- Sophisticated algorithms, such as predictive analytics and machine learning, assist traffic managers in predicting patterns and congestion points for taking proactive actions. Improved traffic control decreases travel duration, resulting in economic gains due to higher efficiency and lower fuel usage. Effective traffic movement reduces expenses for maintenance of both vehicles and infrastructure. Furthermore, enhanced traffic flow leads to decreased emissions and supports eco-friendly transportation choices, resulting in enhanced air quality in cities.

- Enhancing safety in incident management includes utilizing traffic management systems to promptly identify accidents and other incidents, ensuring a swift response for public safety and efficiency. Moreover, up-to-the-minute traffic information aids in directing emergency vehicles more effectively, leading to decreased response times. Adaptive traffic signals in traffic signal optimization change timings to improve traffic flow, decrease wait times, and decrease congestion. Analytics allow networks to work together to improve traffic flow in cities.

Transportation Analytics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

- North America, particularly the United States, is a center for technological progress with IBM, Microsoft, Oracle, and Google at the forefront of software, hardware, and data analytics advancements, including transportation options. Both the government and private industries make significant investments in projects focused on smart infrastructure, such as intelligent transportation systems and initiatives for smart cities. The area has sophisticated transportation systems that require detailed analysis for efficient control.

- Government funding and assistance in North America, especially in the US and Canada, help with transportation infrastructure projects. Implemented rules also support the utilization of analytics to boost safety, reduce traffic, and enhance transportation effectiveness. Key players in transportation analytics, such as IBM, Oracle, and Microsoft, work together with government agencies and stakeholders to create and implement solutions. Their existence supports a strong environment for the expansion of businesses.

- Strong market demand for solutions addressing traffic congestion, logistics optimization, public transportation efficiency, and freight management is driving high adoption rates of transportation analytics among North American companies and government entities. Substantial investments in research and development by both private and public sectors are crucial for fostering innovation in transportation analytics. North American colleges and research centers are crucial in driving progress in data analytics and transportation engineering.

Transportation Analytics Market Active Players

- IBM Corporation (USA)

- SAP SE (Germany)

- Oracle Corporation (USA)

- Microsoft Corporation (USA)

- Siemens AG (Germany)

- Trimble Inc. (USA)

- Cubic Corporation (USA)

- Kapsch TrafficCom AG (Austria)

- TomTom International BV (Netherlands)

- Iteris, Inc. (USA)

- TransCore (USA)

- T-Systems International GmbH (Germany)

- Inrix, Inc. (USA)

- Thales Group (France)

- Hitachi Ltd. (Japan)

- Alteryx, Inc. (USA)

- Cellint Traffic Solutions (Israel)

- Esri (USA)

- Hexagon AB (Sweden)

- Cubeware GmbH (Germany)

- AECOM (USA)

- Conduent Inc. (USA)

- Accenture plc (Ireland)

- TSS-Transport Simulation Systems (Spain)

- Other Active Players.

|

Global Transportation Analytics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 25.3 Bn |

|

Forecast Period 2025-32 CAGR: |

20.64 % |

Market Size in 2032: |

USD 113.51 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Mode of Transportation |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By Deployment Model |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Transportation Analytics Market by Type (2018-2032)

4.1 Transportation Analytics Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Descriptive

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Predictive

4.5 Prescriptive

4.6 Diagnostic

Chapter 5: Transportation Analytics Market by Mode of Transportation (2018-2032)

5.1 Transportation Analytics Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Roadways

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Railways

5.5 Airways

5.6 Waterways

5.7 Intermodal

Chapter 6: Transportation Analytics Market by Component (2018-2032)

6.1 Transportation Analytics Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Software

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Services

Chapter 7: Transportation Analytics Market by Application (2018-2032)

7.1 Transportation Analytics Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Traffic Management

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Traffic Management

7.5 Public Transport

7.6 Freight Management

7.7 Passenger Travel

7.8 Others {Incident Management

7.9 Route Optimization}

Chapter 8: Transportation Analytics Market by Deployment Model (2018-2032)

8.1 Transportation Analytics Market Snapshot and Growth Engine

8.2 Market Overview

8.3 On-Premise

8.3.1 Introduction and Market Overview

8.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

8.3.3 Key Market Trends, Growth Factors, and Opportunities

8.3.4 Geographic Segmentation Analysis

8.4 Cloud

8.5 Hybrid

Chapter 9: Company Profiles and Competitive Analysis

9.1 Competitive Landscape

9.1.1 Competitive Benchmarking

9.1.2 Transportation Analytics Market Share by Manufacturer (2024)

9.1.3 Industry BCG Matrix

9.1.4 Heat Map Analysis

9.1.5 Mergers and Acquisitions

9.2 IBM CORPORATION (USA)

9.2.1 Company Overview

9.2.2 Key Executives

9.2.3 Company Snapshot

9.2.4 Role of the Company in the Market

9.2.5 Sustainability and Social Responsibility

9.2.6 Operating Business Segments

9.2.7 Product Portfolio

9.2.8 Business Performance

9.2.9 Key Strategic Moves and Recent Developments

9.2.10 SWOT Analysis

9.3 SAP SE (GERMANY)

9.4 ORACLE CORPORATION (USA)

9.5 MICROSOFT CORPORATION (USA)

9.6 SIEMENS AG (GERMANY)

9.7 TRIMBLE INC. (USA)

9.8 CUBIC CORPORATION (USA)

9.9 KAPSCH TRAFFICCOM AG (AUSTRIA)

9.10 TOMTOM INTERNATIONAL BV (NETHERLANDS)

9.11 ITERIS INC. (USA)

9.12 TRANSCORE (USA)

9.13 T-SYSTEMS INTERNATIONAL GMBH (GERMANY)

9.14 INRIX INC. (USA)

9.15 THALES GROUP (FRANCE)

9.16 HITACHI LTD. (JAPAN)

9.17 ALTERYX INC. (USA)

9.18 CELLINT TRAFFIC SOLUTIONS (ISRAEL)

9.19 ESRI (USA)

9.20 HEXAGON AB (SWEDEN)

9.21 CUBEWARE GMBH (GERMANY)

9.22 AECOM (USA)

9.23 CONDUENT INC. (USA)

9.24 ACCENTURE PLC (IRELAND)

9.25 TSS-TRANSPORT SIMULATION SYSTEMS (SPAIN)

9.26 KLD ENGINEERING

9.27 P.C. (USA)

9.28 ALTERYX INC. (USA)

9.29 WABTEC CORPORATION (USA)

Chapter 10: Global Transportation Analytics Market By Region

10.1 Overview

10.2. North America Transportation Analytics Market

10.2.1 Key Market Trends, Growth Factors and Opportunities

10.2.2 Top Key Companies

10.2.3 Historic and Forecasted Market Size by Segments

10.2.4 Historic and Forecasted Market Size by Type

10.2.4.1 Descriptive

10.2.4.2 Predictive

10.2.4.3 Prescriptive

10.2.4.4 Diagnostic

10.2.5 Historic and Forecasted Market Size by Mode of Transportation

10.2.5.1 Roadways

10.2.5.2 Railways

10.2.5.3 Airways

10.2.5.4 Waterways

10.2.5.5 Intermodal

10.2.6 Historic and Forecasted Market Size by Component

10.2.6.1 Software

10.2.6.2 Services

10.2.7 Historic and Forecasted Market Size by Application

10.2.7.1 Traffic Management

10.2.7.2 Traffic Management

10.2.7.3 Public Transport

10.2.7.4 Freight Management

10.2.7.5 Passenger Travel

10.2.7.6 Others {Incident Management

10.2.7.7 Route Optimization}

10.2.8 Historic and Forecasted Market Size by Deployment Model

10.2.8.1 On-Premise

10.2.8.2 Cloud

10.2.8.3 Hybrid

10.2.9 Historic and Forecast Market Size by Country

10.2.9.1 US

10.2.9.2 Canada

10.2.9.3 Mexico

10.3. Eastern Europe Transportation Analytics Market

10.3.1 Key Market Trends, Growth Factors and Opportunities

10.3.2 Top Key Companies

10.3.3 Historic and Forecasted Market Size by Segments

10.3.4 Historic and Forecasted Market Size by Type

10.3.4.1 Descriptive

10.3.4.2 Predictive

10.3.4.3 Prescriptive

10.3.4.4 Diagnostic

10.3.5 Historic and Forecasted Market Size by Mode of Transportation

10.3.5.1 Roadways

10.3.5.2 Railways

10.3.5.3 Airways

10.3.5.4 Waterways

10.3.5.5 Intermodal

10.3.6 Historic and Forecasted Market Size by Component

10.3.6.1 Software

10.3.6.2 Services

10.3.7 Historic and Forecasted Market Size by Application

10.3.7.1 Traffic Management

10.3.7.2 Traffic Management

10.3.7.3 Public Transport

10.3.7.4 Freight Management

10.3.7.5 Passenger Travel

10.3.7.6 Others {Incident Management

10.3.7.7 Route Optimization}

10.3.8 Historic and Forecasted Market Size by Deployment Model

10.3.8.1 On-Premise

10.3.8.2 Cloud

10.3.8.3 Hybrid

10.3.9 Historic and Forecast Market Size by Country

10.3.9.1 Russia

10.3.9.2 Bulgaria

10.3.9.3 The Czech Republic

10.3.9.4 Hungary

10.3.9.5 Poland

10.3.9.6 Romania

10.3.9.7 Rest of Eastern Europe

10.4. Western Europe Transportation Analytics Market

10.4.1 Key Market Trends, Growth Factors and Opportunities

10.4.2 Top Key Companies

10.4.3 Historic and Forecasted Market Size by Segments

10.4.4 Historic and Forecasted Market Size by Type

10.4.4.1 Descriptive

10.4.4.2 Predictive

10.4.4.3 Prescriptive

10.4.4.4 Diagnostic

10.4.5 Historic and Forecasted Market Size by Mode of Transportation

10.4.5.1 Roadways

10.4.5.2 Railways

10.4.5.3 Airways

10.4.5.4 Waterways

10.4.5.5 Intermodal

10.4.6 Historic and Forecasted Market Size by Component

10.4.6.1 Software

10.4.6.2 Services

10.4.7 Historic and Forecasted Market Size by Application

10.4.7.1 Traffic Management

10.4.7.2 Traffic Management

10.4.7.3 Public Transport

10.4.7.4 Freight Management

10.4.7.5 Passenger Travel

10.4.7.6 Others {Incident Management

10.4.7.7 Route Optimization}

10.4.8 Historic and Forecasted Market Size by Deployment Model

10.4.8.1 On-Premise

10.4.8.2 Cloud

10.4.8.3 Hybrid

10.4.9 Historic and Forecast Market Size by Country

10.4.9.1 Germany

10.4.9.2 UK

10.4.9.3 France

10.4.9.4 The Netherlands

10.4.9.5 Italy

10.4.9.6 Spain

10.4.9.7 Rest of Western Europe

10.5. Asia Pacific Transportation Analytics Market

10.5.1 Key Market Trends, Growth Factors and Opportunities

10.5.2 Top Key Companies

10.5.3 Historic and Forecasted Market Size by Segments

10.5.4 Historic and Forecasted Market Size by Type

10.5.4.1 Descriptive

10.5.4.2 Predictive

10.5.4.3 Prescriptive

10.5.4.4 Diagnostic

10.5.5 Historic and Forecasted Market Size by Mode of Transportation

10.5.5.1 Roadways

10.5.5.2 Railways

10.5.5.3 Airways

10.5.5.4 Waterways

10.5.5.5 Intermodal

10.5.6 Historic and Forecasted Market Size by Component

10.5.6.1 Software

10.5.6.2 Services

10.5.7 Historic and Forecasted Market Size by Application

10.5.7.1 Traffic Management

10.5.7.2 Traffic Management

10.5.7.3 Public Transport

10.5.7.4 Freight Management

10.5.7.5 Passenger Travel

10.5.7.6 Others {Incident Management

10.5.7.7 Route Optimization}

10.5.8 Historic and Forecasted Market Size by Deployment Model

10.5.8.1 On-Premise

10.5.8.2 Cloud

10.5.8.3 Hybrid

10.5.9 Historic and Forecast Market Size by Country

10.5.9.1 China

10.5.9.2 India

10.5.9.3 Japan

10.5.9.4 South Korea

10.5.9.5 Malaysia

10.5.9.6 Thailand

10.5.9.7 Vietnam

10.5.9.8 The Philippines

10.5.9.9 Australia

10.5.9.10 New Zealand

10.5.9.11 Rest of APAC

10.6. Middle East & Africa Transportation Analytics Market

10.6.1 Key Market Trends, Growth Factors and Opportunities

10.6.2 Top Key Companies

10.6.3 Historic and Forecasted Market Size by Segments

10.6.4 Historic and Forecasted Market Size by Type

10.6.4.1 Descriptive

10.6.4.2 Predictive

10.6.4.3 Prescriptive

10.6.4.4 Diagnostic

10.6.5 Historic and Forecasted Market Size by Mode of Transportation

10.6.5.1 Roadways

10.6.5.2 Railways

10.6.5.3 Airways

10.6.5.4 Waterways

10.6.5.5 Intermodal

10.6.6 Historic and Forecasted Market Size by Component

10.6.6.1 Software

10.6.6.2 Services

10.6.7 Historic and Forecasted Market Size by Application

10.6.7.1 Traffic Management

10.6.7.2 Traffic Management

10.6.7.3 Public Transport

10.6.7.4 Freight Management

10.6.7.5 Passenger Travel

10.6.7.6 Others {Incident Management

10.6.7.7 Route Optimization}

10.6.8 Historic and Forecasted Market Size by Deployment Model

10.6.8.1 On-Premise

10.6.8.2 Cloud

10.6.8.3 Hybrid

10.6.9 Historic and Forecast Market Size by Country

10.6.9.1 Turkiye

10.6.9.2 Bahrain

10.6.9.3 Kuwait

10.6.9.4 Saudi Arabia

10.6.9.5 Qatar

10.6.9.6 UAE

10.6.9.7 Israel

10.6.9.8 South Africa

10.7. South America Transportation Analytics Market

10.7.1 Key Market Trends, Growth Factors and Opportunities

10.7.2 Top Key Companies

10.7.3 Historic and Forecasted Market Size by Segments

10.7.4 Historic and Forecasted Market Size by Type

10.7.4.1 Descriptive

10.7.4.2 Predictive

10.7.4.3 Prescriptive

10.7.4.4 Diagnostic

10.7.5 Historic and Forecasted Market Size by Mode of Transportation

10.7.5.1 Roadways

10.7.5.2 Railways

10.7.5.3 Airways

10.7.5.4 Waterways

10.7.5.5 Intermodal

10.7.6 Historic and Forecasted Market Size by Component

10.7.6.1 Software

10.7.6.2 Services

10.7.7 Historic and Forecasted Market Size by Application

10.7.7.1 Traffic Management

10.7.7.2 Traffic Management

10.7.7.3 Public Transport

10.7.7.4 Freight Management

10.7.7.5 Passenger Travel

10.7.7.6 Others {Incident Management

10.7.7.7 Route Optimization}

10.7.8 Historic and Forecasted Market Size by Deployment Model

10.7.8.1 On-Premise

10.7.8.2 Cloud

10.7.8.3 Hybrid

10.7.9 Historic and Forecast Market Size by Country

10.7.9.1 Brazil

10.7.9.2 Argentina

10.7.9.3 Rest of SA

Chapter 11 Analyst Viewpoint and Conclusion

11.1 Recommendations and Concluding Analysis

11.2 Potential Market Strategies

Chapter 12 Research Methodology

12.1 Research Process

12.2 Primary Research

12.3 Secondary Research

|

Global Transportation Analytics Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 25.3 Bn |

|

Forecast Period 2025-32 CAGR: |

20.64 % |

Market Size in 2032: |

USD 113.51 Bn |

|

Segments Covered: |

By Type |

|

|

|

By Mode of Transportation |

|

||

|

By Component |

|

||

|

By Application |

|

||

|

By Deployment Model |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||