Train Battery Market Synopsis

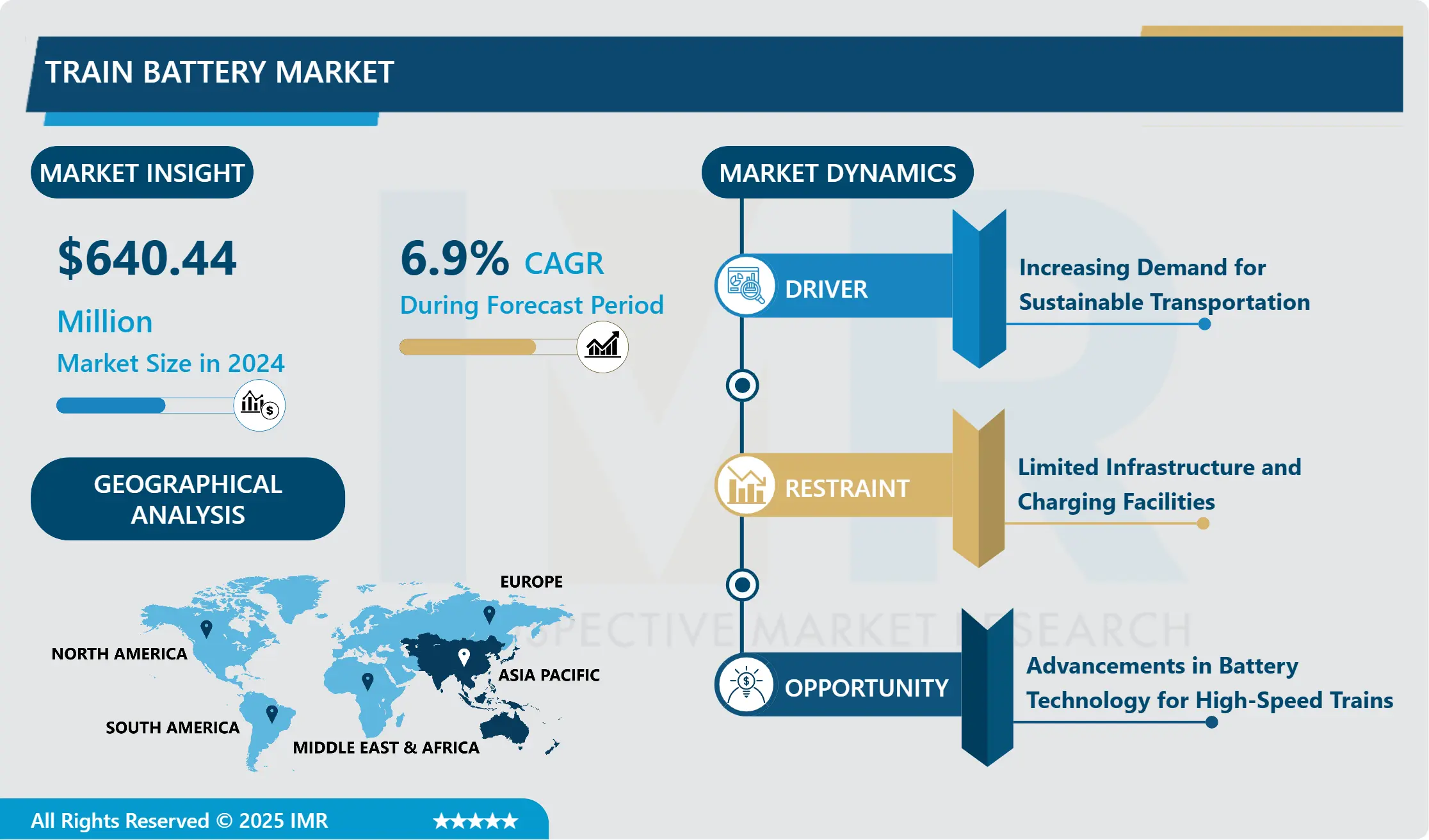

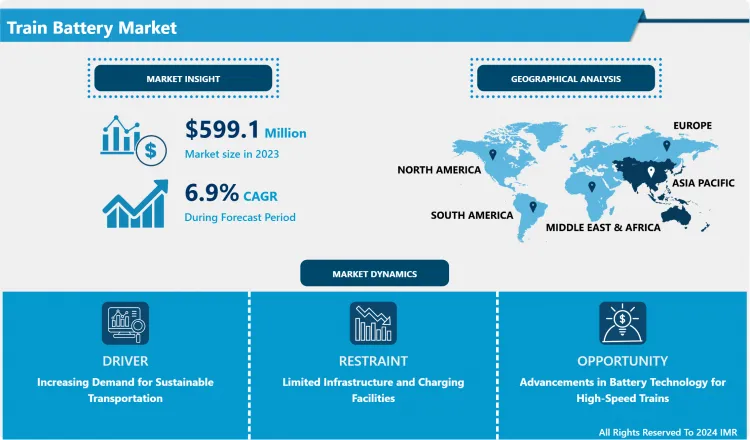

Train Battery Market Size Was Valued at USD 640.44 Million in 2024 and is Projected to Reach USD 1,092.19 Million by 2032, Growing at a CAGR of 6.90% From 2025-2032.

A train battery can be described as a crucial aspect of railway technology utilized in modern trains to meet their various electrical needs. It keeps many important facilities’ operations going uninterrupted, including lighting, communications, signaling, and emergency facilities, on standby in the event that the main power source is unavailable. Hence, train batteries are generally constructed in a robust manner and with the ability to deliver high capacity, durability, and reduced risk to ensure that train operation remains continuously smooth and effective.

The market for train batteries has been steadily growing, and there are considerable variations in this segment due to the need for efficient and environmentally friendly railway transportation. With the focus on cutting down carbon footprint across the world, railways opt for electrification along with hybrid solutions where the battery energy storage is significant. These batteries are important in the electric and hybrid train systems, emergency power support and other non-propulsive applications such as illumination, ventilation, and carborne equipment. Thus the market offers many types of batteries such as Lithium-ion, Nickel Cadmium, Lead-acid batteries each having its own set of merits in terms of energy density, life-cycle cost, maintenance and cost.

It has changed the market clientele of train batteries since lithium-ion batteries have higher energy density, longer life cycle, and lower maintenance. Such characteristics make them most appropriate for applications in new generation of electrical trains and hybrid power systems where high-performance energy storage systems are needed. The constant improvements in the lithium-ion technology have added to their use since advances in technology are focused on increased safety, decreased costs, together with high energy density. Moreover, the invention of the next-generation solid-state batteries, which offer higher energy densities and better safety characteristics, is expected to continue its transformational effect on the market in the near future.

Another source of market influence is regional policies and investment in rail transport undertaking facilities. As the two major continents with great environmental awareness, strict rules on pollution control, considerable investments in high speed rails and more focus on green technology Europe and Asia-Pacific are ranked as the biggest markets for train batteries. In Europe, for instance, the European Green Deal together with the EU’s goal to cut its greenhouse gas emissions has led to massive investment in conversion and the creation of battery electric rail vehicles. The same situation can be observed in Asia-Pacific region; China, Japan and India are investing millions of dollars in developing new railway systems to meet the needs of the growing urban population and avoid the problems linked with congestion and air pollution in major cities.

The market for the train battery is moderately competitive with many players ranging from those dealing in batteries to those dealing in railway components. Current players like Saft Groupe, EnerSys, Toshiba Corporation, and Hitachi Rail are continuously unveiling new technologies and entering into new partnerships that help to strengthen their positions in this industry. These players are more concerned with segmental solutions, creating batteries that will serve a particular class of train, whether high-speed, or one meant for urban use. Moreover, ongoing relationships between battery manufacturers and railway operators are crucial for the appropriate incorporation of battery in current and future railway systems.

In conclusion, it is possible to note that the train battery market will continuously grow in the future since people pay much attention to eco-friendly transportation, and the scientific progress is improving battery’s performance. Currently the most popular technology is associated with lithium-ion batteries; their potential successors can be the technologies like solid-state batteries. Government strategies and initiatives to promote rail transport and develop railway networks, investments in railway technologies, and cooperation between market players will remain the key drivers of the development of the battery-powered train market. Train batteries are gradually set to become an important part of the railway industry’s ongoing efforts to develop a cleaner, efficient, and sustainable system in the future.

Train Battery Market Trend Analysis

Train Battery Market Growth Driver- Rise of Hybrid and Electric Trains

- The train battery market is forecasted to grow largely due to the increasing use of hybrid as well as fully electric train vehicles with the overall push toward green energy solutions to mitigate the effects of climate change. The governments of this world are now coming up with strict emission standards and incentives that are geared towards encouraging manufacturers to incorporate cleaner means of transport and this in turn drives the need for better battery systems. Electrification of trains including hybrid and electric trains which have lower emission rates and operating costs as compared to that of diesel driven trains has emerged popular in recent decades. Some notable areas include the improvements in the energy density, rates of charging, and cycle life of batteries which make these trains ideal for use.

- Moreover, utilization of renewable power enabling independent rail infrastructure also strengthens the argument for an appropriate storage system. The market is also experiencing high investments towards rail infrastructure especially in areas such as Europe and Asia pacific where rail More (2016) noted that rail infrastructure industry is large and government are keen on green energy sources. In view of this, the global train battery market is expected to grow significantly in the coming years owing to factors like the advancement in technology and increased focus on making changes to the railway systems across the world by adopting technologies such as hybrid and electric trains.

Train Battery Market Expansion Opportunity- Advancements in Battery Technology for High-Speed Trains

- The train battery market is experiencing innovations due to the fact that high-speed trains are taking shape due to the efficiency and environmental friendliness of electric batteries. The developments in lithium-ion and the solid-state battery have led to improvements in the energy density, charging, and cycle life capabilities which meet the requirements of high-speed rail solutions. Advanced power systems such as high capacity fast charging batteries alleviate the need for standard electrified rails, thus empowering operational versatility while lowering infrastructure investments.

- Moreover, BMS and Thermal technologies that manage energy storage and cooling of these high-performance batteries maintain safety and effectiveness, even when operating in high-speed rail applications. These technological advancements are supported by constant developments in other chemistries like lithium sulphur and metal-foil batteries which promise higher energy concentration that is more friendly to the environment. As the governments and private sectors are putting efforts to establish low carbon societies, the advancement of high-speed train with innovative battery technologies becomes the integral part of the low carbon societies revolution. As a result, the train battery market is rapidly growing with prominent companies investing in research and development for the technology as well as increasing needs for better performing batteries designed specifically for high-speed rail service.

Train Battery Market Segment Analysis:

Train Battery Market Segmented based on Tain Type, Battery Type, Locomotive Type, Application, and Region.

By Train Type, Hybrid Locomotives segment is expected to dominate the market during the forecast period

- The train battery market on the basis of train type, which comprises of Autonomous Trains, Hybrid Locomotives, and Fully Battery Operated Trains is expected to grow at a rapid pace because of the presence of a large number of end user industries, who are involved in the manufacturing of train batteries. New generation of trains that can move and operate on its own without human intervention with the aid of the battery is likely to transform the rail transport map in the coming years through optimization of operations and reduced likelihood of human factors contributing to accidents. Diesel-electric and diesel-hydraulic models are also used today as they are an efficient transition from the traditional usage of diesel engines with battery addition systems as the intermediate models are a step ahead with lower rates of emissions and fuel consumption and has become the first preference among the rail operating companies who wish to replace their whole fleet partially.

- Battery electric new generation trains are considered as environmentally friendly trains as these do not require any outside power_supply and have zero emissions, are absolutely noiseless, and do not require any fuel other than batteries. The demand for these trains is driven by increased capabilities of the battery technology in energy density, charging time and battery life, which makes it applicable for long distance and cargo use. Furthermore, incentives and policies regarding energy-efficient vehicles to decrease carbon emissions also drive the procurement of battery-powered trains, creating a healthy market rivalry.

By Battery Type , Lithium Ion Battery segment held the largest share in 2024

- In the train battery market, segmentation has been done based on the battery type now widely used, as follows: the lead acid, nickel cadmium, and lithium-ion battery. Lead acid batteries are more traditionally preferred since they are cheap, reliable and widely proven to be dependable especially for applications where weight is not an issue. The case of nickel cadmium batteries entails its better performance in extremes of temperatures and stamina that has the potential to support the trains in various climatic conditions. They are however more expensive compared to their counterparts which are made from other materials for instance the cadmium toxicity make them unsuitable for the environment. For instance, lithium-ion batteries have gradually dominated more attention due to their high energy density and light weight, long cycle life, and a general sense of consistency with the trends in rail transportation in terms of efficiency and environmental sustainability.

- The adoption of lithium-ion technology is as result of the global policy push for reduction in carbon emission and rise of energy efficiency for public transport. There are compelling reasons for higher initial costs of lithium-ion batteries such as lower costs in terms of maintenance and improved overall performance, which makes lithium-ion batteries the preferred choice in modern train systems. In conclusion, the train battery market is gradually shifting toward a new level of higher advancement with a much higher concern toward sustainability with lithium-ion batteries emerging as the future’s train battery technology.

Train Battery Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region would continue to demand for train battery market due to several factors which include the following over the forcasted period: First of all, one significant factor which has steered emphasis on rail transport is rapid advancement in urbanization and industrialization especially in Asian countries such as China and India. Therefore, the increased construction of rail infrastructure increases the demand for reliable and efficient energy systems, which in turn increases demand for improved train batteries. Also, the increased spending by the government in the development of green energy across the region and developing the maturity of low CO2 emissions fuels the demand for train batteries.

- Moreover, the Asia Pacific region is also one of the greatest automobile manufacturers and electric vehicles particularly for the affordable technologies and trains battery conducive manufacturing environment. Consequently, as investments in rail electrification projects are slowly rising and as awareness on the benefits of electrified transport grows in importance, APAC is anticipated to remain the largest train battery market in the report’s forecast period.

Active Key Players in the Train Battery Market

- Aeg Power Solutions (Netherlands)

- Amara Raja Group (India)

- East Penn Manufacturing Company (USA)

- Enersys. (USA)

- Exide Industries Ltd. (India)

- First National Battery, (South Africa)

- Furukawa Electric Co., Ltd. (Japan)

- Gs Yuasa International Ltd. (Japan)

- Hitachi Rail Limited (Japan)

- Hoppecke Carl Zoellner & Sohn Gmbh (Germany)

- Fengri Power & Electric Co., Limited. (Japan)

- Power & Industrial Battery Systems Gmbh (Germany)

- Saft2022 (France)

- Sec Battery (Hong Kong)

- Shuangdeng Group Co, Ltd (China)

- Other Active Players.

Key Industry Developments in the Train Battery Market

- In April 2023, EnerSys acquired Industrial Battery and Charger Services Limited (IBCS) based out in the UK to strengthen its motive power service offerings in the UK. The acquisition is a strategic maneuver by EnerSys aimed at broadening the scope of its motive power services and fortifying its position within the UK market.

- In January 2023, EnerSys and Verkor SAS, a European battery technology company, initiated a non-binding Memorandum of Understanding to investigate establishing a lithium battery gigafactory in the US. This upcoming factory will provide a growth opportunity for both companies and allow EnerSys to optimize cell sizing in battery solutions for its customers.

|

Global Train Battery Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 640.44 Mn. |

|

Forecast Period 2025-32 CAGR: |

6.90% |

Market Size in 2032: |

USD 1,092.19 Mn. |

|

Segments Covered: |

By TainType |

|

|

|

By Battery Type |

|

||

|

By Locomotive Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Train Battery Market by TainType (2018-2032)

4.1 Train Battery Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Autonomous Trains

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Hybrid Locomotives

4.5 Fully Battery Operated Trains

Chapter 5: Train Battery Market by Battery Type (2018-2032)

5.1 Train Battery Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Lead Acid Battery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Nickel Cadmium Battery

5.5 Lithium Ion Battery

Chapter 6: Train Battery Market by Locomotive Type (2018-2032)

6.1 Train Battery Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Diesel Locomotive

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Diesel Multiple Units

6.5 Electric Locomotive

6.6 Electric Multiple Units

6.7 Bullet Train

6.8 Metros

6.9 Light Monorail

6.10 Passenger Coaches

6.11 Freight Wagon

Chapter 7: Train Battery Market by Application (2018-2032)

7.1 Train Battery Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Starter Battery

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Auxiliary Function Battery

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Train Battery Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 AEG POWER SOLUTIONS (NETHERLANDS)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 AMARA RAJA GROUP (INDIA)

8.4 EAST PENN MANUFACTURING COMPANY (USA)

8.5 ENERSYS. (USA)

8.6 EXIDE INDUSTRIES LTD. (INDIA)

8.7 FIRST NATIONAL BATTERY

8.8 (SOUTH AFRICA)

8.9 FURUKAWA ELECTRIC COLTD. (JAPAN)

8.10 GS YUASA INTERNATIONAL LTD. (JAPAN)

8.11 HITACHI RAIL LIMITED (JAPAN)

8.12 HOPPECKE CARL ZOELLNER & SOHN GMBH (GERMANY)

8.13 FENGRI POWER & ELECTRIC COLIMITED. (JAPAN)

8.14 POWER & INDUSTRIAL BATTERY SYSTEMS GMBH (GERMANY)

8.15 SAFT2022 (FRANCE)

8.16 SEC BATTERY (HONG KONG)

8.17 SHUANGDENG GROUP CO LTD (CHINA)

8.18 OTHER KEY PLAYERS.

Chapter 9: Global Train Battery Market By Region

9.1 Overview

9.2. North America Train Battery Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by TainType

9.2.4.1 Autonomous Trains

9.2.4.2 Hybrid Locomotives

9.2.4.3 Fully Battery Operated Trains

9.2.5 Historic and Forecasted Market Size by Battery Type

9.2.5.1 Lead Acid Battery

9.2.5.2 Nickel Cadmium Battery

9.2.5.3 Lithium Ion Battery

9.2.6 Historic and Forecasted Market Size by Locomotive Type

9.2.6.1 Diesel Locomotive

9.2.6.2 Diesel Multiple Units

9.2.6.3 Electric Locomotive

9.2.6.4 Electric Multiple Units

9.2.6.5 Bullet Train

9.2.6.6 Metros

9.2.6.7 Light Monorail

9.2.6.8 Passenger Coaches

9.2.6.9 Freight Wagon

9.2.7 Historic and Forecasted Market Size by Application

9.2.7.1 Starter Battery

9.2.7.2 Auxiliary Function Battery

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Train Battery Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by TainType

9.3.4.1 Autonomous Trains

9.3.4.2 Hybrid Locomotives

9.3.4.3 Fully Battery Operated Trains

9.3.5 Historic and Forecasted Market Size by Battery Type

9.3.5.1 Lead Acid Battery

9.3.5.2 Nickel Cadmium Battery

9.3.5.3 Lithium Ion Battery

9.3.6 Historic and Forecasted Market Size by Locomotive Type

9.3.6.1 Diesel Locomotive

9.3.6.2 Diesel Multiple Units

9.3.6.3 Electric Locomotive

9.3.6.4 Electric Multiple Units

9.3.6.5 Bullet Train

9.3.6.6 Metros

9.3.6.7 Light Monorail

9.3.6.8 Passenger Coaches

9.3.6.9 Freight Wagon

9.3.7 Historic and Forecasted Market Size by Application

9.3.7.1 Starter Battery

9.3.7.2 Auxiliary Function Battery

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Train Battery Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by TainType

9.4.4.1 Autonomous Trains

9.4.4.2 Hybrid Locomotives

9.4.4.3 Fully Battery Operated Trains

9.4.5 Historic and Forecasted Market Size by Battery Type

9.4.5.1 Lead Acid Battery

9.4.5.2 Nickel Cadmium Battery

9.4.5.3 Lithium Ion Battery

9.4.6 Historic and Forecasted Market Size by Locomotive Type

9.4.6.1 Diesel Locomotive

9.4.6.2 Diesel Multiple Units

9.4.6.3 Electric Locomotive

9.4.6.4 Electric Multiple Units

9.4.6.5 Bullet Train

9.4.6.6 Metros

9.4.6.7 Light Monorail

9.4.6.8 Passenger Coaches

9.4.6.9 Freight Wagon

9.4.7 Historic and Forecasted Market Size by Application

9.4.7.1 Starter Battery

9.4.7.2 Auxiliary Function Battery

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Train Battery Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by TainType

9.5.4.1 Autonomous Trains

9.5.4.2 Hybrid Locomotives

9.5.4.3 Fully Battery Operated Trains

9.5.5 Historic and Forecasted Market Size by Battery Type

9.5.5.1 Lead Acid Battery

9.5.5.2 Nickel Cadmium Battery

9.5.5.3 Lithium Ion Battery

9.5.6 Historic and Forecasted Market Size by Locomotive Type

9.5.6.1 Diesel Locomotive

9.5.6.2 Diesel Multiple Units

9.5.6.3 Electric Locomotive

9.5.6.4 Electric Multiple Units

9.5.6.5 Bullet Train

9.5.6.6 Metros

9.5.6.7 Light Monorail

9.5.6.8 Passenger Coaches

9.5.6.9 Freight Wagon

9.5.7 Historic and Forecasted Market Size by Application

9.5.7.1 Starter Battery

9.5.7.2 Auxiliary Function Battery

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Train Battery Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by TainType

9.6.4.1 Autonomous Trains

9.6.4.2 Hybrid Locomotives

9.6.4.3 Fully Battery Operated Trains

9.6.5 Historic and Forecasted Market Size by Battery Type

9.6.5.1 Lead Acid Battery

9.6.5.2 Nickel Cadmium Battery

9.6.5.3 Lithium Ion Battery

9.6.6 Historic and Forecasted Market Size by Locomotive Type

9.6.6.1 Diesel Locomotive

9.6.6.2 Diesel Multiple Units

9.6.6.3 Electric Locomotive

9.6.6.4 Electric Multiple Units

9.6.6.5 Bullet Train

9.6.6.6 Metros

9.6.6.7 Light Monorail

9.6.6.8 Passenger Coaches

9.6.6.9 Freight Wagon

9.6.7 Historic and Forecasted Market Size by Application

9.6.7.1 Starter Battery

9.6.7.2 Auxiliary Function Battery

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Train Battery Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by TainType

9.7.4.1 Autonomous Trains

9.7.4.2 Hybrid Locomotives

9.7.4.3 Fully Battery Operated Trains

9.7.5 Historic and Forecasted Market Size by Battery Type

9.7.5.1 Lead Acid Battery

9.7.5.2 Nickel Cadmium Battery

9.7.5.3 Lithium Ion Battery

9.7.6 Historic and Forecasted Market Size by Locomotive Type

9.7.6.1 Diesel Locomotive

9.7.6.2 Diesel Multiple Units

9.7.6.3 Electric Locomotive

9.7.6.4 Electric Multiple Units

9.7.6.5 Bullet Train

9.7.6.6 Metros

9.7.6.7 Light Monorail

9.7.6.8 Passenger Coaches

9.7.6.9 Freight Wagon

9.7.7 Historic and Forecasted Market Size by Application

9.7.7.1 Starter Battery

9.7.7.2 Auxiliary Function Battery

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Train Battery Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2024: |

USD 640.44 Mn. |

|

Forecast Period 2025-32 CAGR: |

6.90% |

Market Size in 2032: |

USD 1,092.19 Mn. |

|

Segments Covered: |

By TainType |

|

|

|

By Battery Type |

|

||

|

By Locomotive Type |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||