Brake and Clutch Fluid Market Synopsis

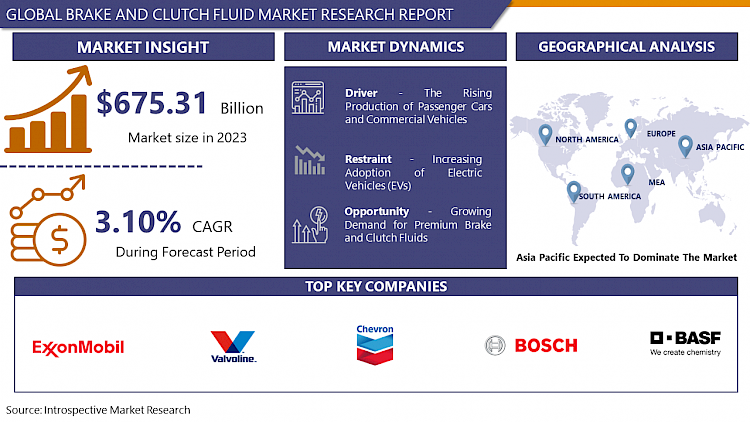

The Brake and Clutch Fluid Size Was Valued at USD 675.31 Billion in 2023, and is Projected to Reach USD 888.86 Billion by 2032, Growing at a CAGR of 3.10% From 2024-2032.

Brake fluid is a hydraulic fluid used in brake systems to transmit pressure when the brake pedal is depressed, enabling the vehicle to stop. It's typically glycol-ether-based. Clutch fluid, also known as hydraulic clutch fluid, operates similarly, facilitating the movement of the clutch pedal in vehicles with manual transmissions. Both fluids must have specific properties like high boiling points and compatibility with rubber seals to ensure the efficient operation of their respective systems.

- The market is characterized by the presence of both global players and regional manufacturers, offering a wide range of products catering to different vehicle types and performance requirements. Synthetic fluids, known for their superior performance under extreme conditions, are gaining popularity, particularly in high-performance and racing vehicle segments.

- The innovations in formulation technologies expected to enhance fluid durability, corrosion resistance, and compatibility with modern braking systems are shaping product development strategies in the market. The transition towards electric vehicles presents new opportunities for fluid manufacturers to develop specialized formulations tailored to the unique requirements of electric braking systems.

- The Brake and Clutch Fluids market is established for continued expansion, driven by the ongoing evolution of automotive technology, increasing vehicle safety and performance by both consumers and regulatory authorities.

Brake and Clutch Fluid Market Trend Analysis

The Rising Production of Passenger Cars and Commercial Vehicles

- The increasing production of passenger cars and commercial vehicles significantly drives the demand for brake and clutch fluid in the automotive industry. The increasing number of vehicles on the road creates demand for maintenance and replacement of various components, including brake and clutch systems.

- Brake and clutch fluids play a crucial role in ensuring the smooth operation and safety of these systems. They transmit force from the brake pedal to the brakes and enable continuous gear shifting in manual transmission vehicles. With more vehicles being manufactured, there's a parallel surge in the requirement for brake and clutch fluids to fill and service these systems. The advancements in automotive technology have led to the development of high-performance vehicles with increasing demand for brake and clutch systems.

Growing Demand for Premium Brake and Clutch Fluids

- The Premium fluids are formulated with high-quality additives and base materials, offering superior performance and durability compared to standard fluids. They enhance performance and lead to increased safety and reliability concerns for vehicle owners and manufacturers alike.

- As automotive technology continues to advance, vehicles are becoming more sophisticated and demanding higher-performing fluids to meet their operational requirements. Premium fluids are designed to meet evolving needs, providing better resistance to extreme temperatures, corrosion, and wear, thereby extending the lifespan of brake and clutch components.

- The rising consumer awareness regarding vehicle maintenance and performance is a growing preference for premium products and enhanced benefits. The change in consumer behavior towards quality and reliability creates a favorable environment for the expansion of the premium brake and clutch fluid market.

Brake and Clutch Fluid Market Segment Analysis:

Brake and Clutch Fluid Market Segmented based on Product Type, Vehicle Type, End-User.

By Product Type, Glycol-based Fluids segment is expected to dominate the market during the forecast period

- Glycol-based fluids are widely recognized for their excellent performance characteristics, including high boiling points and resistance to moisture absorption. These properties make them ideal for high-stress applications like braking and clutch systems, where consistent performance under varying conditions is essential. The glycol-based fluids are compatible with various materials commonly found in automotive systems, ensuring compatibility with existing infrastructure and components.

- Their versatility and effectiveness across a range of temperatures and operating conditions further contribute to their dominance in the market. The combination of superior performance characteristics, compatibility, regulatory compliance, and ongoing technological advancements positions glycol-based fluids as the dominant segment in the clutch fluid market.

By End-User, the Automotive segment held the largest share of xx% in 2022

- The automotive sector's dependence on clutch systems for manual transmission vehicles and the increasing adoption of automated manual transmissions (AMTs) in both passenger and commercial vehicles contributed to the robust demand for clutch fluid. The automotive industry's continuous efforts to enhance vehicle performance, efficiency, and safety standards necessitated the use of high-quality clutch fluids to ensure smooth operation and longevity of clutch systems.

- Manufacturers in the automotive segment also emphasized the importance of regular maintenance and replacement of clutch fluids to prevent clutch slippage, corrosion, and other performance issues, fuelling the demand for clutch fluid products. The automotive industry is embracing eco-friendly clutch fluids due to increasing consumer preference for sustainable solutions.

Brake and Clutch Fluid Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The rapid industrialization and urbanization across countries in this region have led to a surge in automotive production and sales, driving the demand for brake and clutch fluids. The demand for passenger vehicles and commercial vehicles drives the need for maintenance products like brake and clutch fluids.

- The stringent regulations regarding vehicle safety and environmental standards are pushing automotive manufacturers to use high-quality fluids that ensure optimal performance and compliance. As a result, the demand for premium brake and clutch fluids, which offer better performance and durability, is on the rise in the Asia Pacific region.

- The growing awareness among consumers regarding vehicle maintenance and safety is influencing their purchasing decisions, prompting them to opt for reliable and high-performance brake and clutch fluids. The presence of major automotive manufacturers and a well-established aftermarket network in countries like China, Japan, South Korea, and India further strengthens the dominance of the Asia Pacific region in the brake and clutch fluid market.

- The combination of increased vehicle production, stringent regulations, rising consumer awareness, and a robust automotive ecosystem positions the Asia Pacific region to dominate the brake and clutch fluid market in the forecast period.

Brake and Clutch Fluid Market Top Key Players:

- Chevron Corporation (United States)

- Dow Chemical Company (United States)

- ExxonMobil (United States)

- Pennzoil (United States)

- Valvoline (United States)

- TotalEnergies (France)

- Bosch (Germany)

- Fuchs Petrolub SE (Germany)

- Liqui Moly (Germany)

- BASF SE (Germany)

- Pentosin (Germany)

- Castrol (United Kingdom)

- Motul (France)

- Total S.A. (France)

- Idemitsu Kosan Co., Ltd. (Japan), and Other Major Players.

Key Industry Developments in the Brake and Clutch Fluid Market:

- In August 2023, BASF revealed plans to increase its manufacturing capacity for brake fluid additives at its Tarragona facility in Spain. This decision was made in light of the increasing need for top-quality brake fluids, especially in Asian and emerging markets.

- In December 2023, Fuchs Petrolub SE secured approval from Airbus under the latest Airbus Process Specification AIPS00-00-010. The boron-free, water-miscible cutting fluid is tailored for aerospace and other industrial applications. Allison Dreznes, Product Manager at FUCHS Lubricants Co., emphasized the significance of this approval for FUCHS' premium performance in the aerospace sector.

|

Global Brake and Clutch Fluid Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 675.31 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.10 % |

Market Size in 2032: |

USD 888.86 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Vehicle Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BRAKE AND CLUTCH FLUID MARKET BY PRODUCT TYPE (2017-2032)

- BRAKE AND CLUTCH FLUID MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GLYCOL-BASED FLUIDS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SILICONE-BASED FLUIDS

- MINERAL OIL-BASED FLUIDS

- BRAKE AND CLUTCH FLUID MARKET BY VEHICLE TYPE (2017-2032)

- BRAKE AND CLUTCH FLUID MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PASSENGER VEHICLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL VEHICLES

- TWO-WHEELERS

- OFF-ROAD VEHICLES

- BRAKE AND CLUTCH FLUID MARKET BY END-USER (2017-2032)

- BRAKE AND CLUTCH FLUID MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032F)

- Historic And Forecasted Market Size in Volume (2017-2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AEROSPACE

- INDUSTRIAL MACHINERY

- MARINE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Brake and Clutch Fluid Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CHEVRON CORPORATION (UNITED STATES)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- DOW CHEMICAL COMPANY (UNITED STATES)

- EXXONMOBIL (UNITED STATES)

- PENNZOIL (UNITED STATES)

- VALVOLINE (UNITED STATES)

- TOTALENERGIES (FRANCE)

- BOSCH (GERMANY)

- FUCHS PETROLUB SE (GERMANY)

- LIQUI MOLY (GERMANY)

- BASF SE (GERMANY)

- PENTOSIN (GERMANY)

- CASTROL (UNITED KINGDOM)

- MOTUL (FRANCE)

- TOTAL S.A. (FRANCE)

- IDEMITSU KOSAN CO., LTD. (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL BRAKE AND CLUTCH FLUID MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Vehicle Type

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Brake and Clutch Fluid Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 675.31 Bn. |

|

Forecast Period 2024-32 CAGR: |

3.10 % |

Market Size in 2032: |

USD 888.86 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Vehicle Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BRAKE AND CLUTCH FLUIDS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BRAKE AND CLUTCH FLUIDS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BRAKE AND CLUTCH FLUIDS MARKET COMPETITIVE RIVALRY

TABLE 005. BRAKE AND CLUTCH FLUIDS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BRAKE AND CLUTCH FLUIDS MARKET THREAT OF SUBSTITUTES

TABLE 007. BRAKE AND CLUTCH FLUIDS MARKET BY TYPE

TABLE 008. DOT 3 MARKET OVERVIEW (2016-2028)

TABLE 009. DOT 4 MARKET OVERVIEW (2016-2028)

TABLE 010. DOT 5 MARKET OVERVIEW (2016-2028)

TABLE 011. DOT 5.1 MARKET OVERVIEW (2016-2028)

TABLE 012. BRAKE AND CLUTCH FLUIDS MARKET BY APPLICATION

TABLE 013. AUTOMOTIVE OEM MARKET OVERVIEW (2016-2028)

TABLE 014. AUTOMOTIVE AFTERMARKET MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. NORTH AMERICA BRAKE AND CLUTCH FLUIDS MARKET, BY TYPE (2016-2028)

TABLE 017. NORTH AMERICA BRAKE AND CLUTCH FLUIDS MARKET, BY APPLICATION (2016-2028)

TABLE 018. N BRAKE AND CLUTCH FLUIDS MARKET, BY COUNTRY (2016-2028)

TABLE 019. EUROPE BRAKE AND CLUTCH FLUIDS MARKET, BY TYPE (2016-2028)

TABLE 020. EUROPE BRAKE AND CLUTCH FLUIDS MARKET, BY APPLICATION (2016-2028)

TABLE 021. BRAKE AND CLUTCH FLUIDS MARKET, BY COUNTRY (2016-2028)

TABLE 022. ASIA PACIFIC BRAKE AND CLUTCH FLUIDS MARKET, BY TYPE (2016-2028)

TABLE 023. ASIA PACIFIC BRAKE AND CLUTCH FLUIDS MARKET, BY APPLICATION (2016-2028)

TABLE 024. BRAKE AND CLUTCH FLUIDS MARKET, BY COUNTRY (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA BRAKE AND CLUTCH FLUIDS MARKET, BY TYPE (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA BRAKE AND CLUTCH FLUIDS MARKET, BY APPLICATION (2016-2028)

TABLE 027. BRAKE AND CLUTCH FLUIDS MARKET, BY COUNTRY (2016-2028)

TABLE 028. SOUTH AMERICA BRAKE AND CLUTCH FLUIDS MARKET, BY TYPE (2016-2028)

TABLE 029. SOUTH AMERICA BRAKE AND CLUTCH FLUIDS MARKET, BY APPLICATION (2016-2028)

TABLE 030. BRAKE AND CLUTCH FLUIDS MARKET, BY COUNTRY (2016-2028)

TABLE 031. BP: SNAPSHOT

TABLE 032. BP: BUSINESS PERFORMANCE

TABLE 033. BP: PRODUCT PORTFOLIO

TABLE 034. BP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. EXXON MOBIL: SNAPSHOT

TABLE 035. EXXON MOBIL: BUSINESS PERFORMANCE

TABLE 036. EXXON MOBIL: PRODUCT PORTFOLIO

TABLE 037. EXXON MOBIL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. TOTAL: SNAPSHOT

TABLE 038. TOTAL: BUSINESS PERFORMANCE

TABLE 039. TOTAL: PRODUCT PORTFOLIO

TABLE 040. TOTAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. FUCHS: SNAPSHOT

TABLE 041. FUCHS: BUSINESS PERFORMANCE

TABLE 042. FUCHS: PRODUCT PORTFOLIO

TABLE 043. FUCHS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. CCI: SNAPSHOT

TABLE 044. CCI: BUSINESS PERFORMANCE

TABLE 045. CCI: PRODUCT PORTFOLIO

TABLE 046. CCI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. BASF: SNAPSHOT

TABLE 047. BASF: BUSINESS PERFORMANCE

TABLE 048. BASF: PRODUCT PORTFOLIO

TABLE 049. BASF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. CHEVRON: SNAPSHOT

TABLE 050. CHEVRON: BUSINESS PERFORMANCE

TABLE 051. CHEVRON: PRODUCT PORTFOLIO

TABLE 052. CHEVRON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. DOW: SNAPSHOT

TABLE 053. DOW: BUSINESS PERFORMANCE

TABLE 054. DOW: PRODUCT PORTFOLIO

TABLE 055. DOW: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. REPSOL: SNAPSHOT

TABLE 056. REPSOL: BUSINESS PERFORMANCE

TABLE 057. REPSOL: PRODUCT PORTFOLIO

TABLE 058. REPSOL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. VALVOLINE: SNAPSHOT

TABLE 059. VALVOLINE: BUSINESS PERFORMANCE

TABLE 060. VALVOLINE: PRODUCT PORTFOLIO

TABLE 061. VALVOLINE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. BENDIX: SNAPSHOT

TABLE 062. BENDIX: BUSINESS PERFORMANCE

TABLE 063. BENDIX: PRODUCT PORTFOLIO

TABLE 064. BENDIX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. SINOPEC LUBRICANT: SNAPSHOT

TABLE 065. SINOPEC LUBRICANT: BUSINESS PERFORMANCE

TABLE 066. SINOPEC LUBRICANT: PRODUCT PORTFOLIO

TABLE 067. SINOPEC LUBRICANT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. MORRIS: SNAPSHOT

TABLE 068. MORRIS: BUSINESS PERFORMANCE

TABLE 069. MORRIS: PRODUCT PORTFOLIO

TABLE 070. MORRIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. CNPC: SNAPSHOT

TABLE 071. CNPC: BUSINESS PERFORMANCE

TABLE 072. CNPC: PRODUCT PORTFOLIO

TABLE 073. CNPC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. BOSCH: SNAPSHOT

TABLE 074. BOSCH: BUSINESS PERFORMANCE

TABLE 075. BOSCH: PRODUCT PORTFOLIO

TABLE 076. BOSCH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. DATEX: SNAPSHOT

TABLE 077. DATEX: BUSINESS PERFORMANCE

TABLE 078. DATEX: PRODUCT PORTFOLIO

TABLE 079. DATEX: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. HKS: SNAPSHOT

TABLE 080. HKS: BUSINESS PERFORMANCE

TABLE 081. HKS: PRODUCT PORTFOLIO

TABLE 082. HKS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. GRANVILLE: SNAPSHOT

TABLE 083. GRANVILLE: BUSINESS PERFORMANCE

TABLE 084. GRANVILLE: PRODUCT PORTFOLIO

TABLE 085. GRANVILLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. GULF: SNAPSHOT

TABLE 086. GULF: BUSINESS PERFORMANCE

TABLE 087. GULF: PRODUCT PORTFOLIO

TABLE 088. GULF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. MOTUL: SNAPSHOT

TABLE 089. MOTUL: BUSINESS PERFORMANCE

TABLE 090. MOTUL: PRODUCT PORTFOLIO

TABLE 091. MOTUL: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BRAKE AND CLUTCH FLUIDS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BRAKE AND CLUTCH FLUIDS MARKET OVERVIEW BY TYPE

FIGURE 012. DOT 3 MARKET OVERVIEW (2016-2028)

FIGURE 013. DOT 4 MARKET OVERVIEW (2016-2028)

FIGURE 014. DOT 5 MARKET OVERVIEW (2016-2028)

FIGURE 015. DOT 5.1 MARKET OVERVIEW (2016-2028)

FIGURE 016. BRAKE AND CLUTCH FLUIDS MARKET OVERVIEW BY APPLICATION

FIGURE 017. AUTOMOTIVE OEM MARKET OVERVIEW (2016-2028)

FIGURE 018. AUTOMOTIVE AFTERMARKET MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. NORTH AMERICA BRAKE AND CLUTCH FLUIDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. EUROPE BRAKE AND CLUTCH FLUIDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. ASIA PACIFIC BRAKE AND CLUTCH FLUIDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. MIDDLE EAST & AFRICA BRAKE AND CLUTCH FLUIDS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. SOUTH AMERICA BRAKE AND CLUTCH FLUIDS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Brake and Clutch Fluid Market research report is 2024-2032.

Chevron Corporation (United States), Dow Chemical Company (United States), ExxonMobil (United States), Valvoline (United States), Pennzoil (United States), Valvoline (United States), TotalEnergies (France), Bosch (Germany), Fuchs Petrolub SE (Germany), Liqui Moly (Germany), BASF SE (Germany), Pentosin (Germany), Castrol (United Kingdom), Motul (France), Total S.A. (France), Idemitsu Kosan Co., Ltd. (Japan), and Other Major Players.

The Brake and Clutch Fluid Market is segmented into Product Type, Vehicle Type, End-User, and region. By Product Type, the market is categorized into Glycol-based Fluids, Silicone-based Fluids, and Mineral Oil-based Fluids. By Vehicle Type, the market is categorized into Passenger Vehicles, Commercial Vehicles, Two-Wheelers, and Off-Road Vehicles. By End-User, the market is categorized into Automotive, Aerospace, Industrial Machinery, and Marine. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Brake fluid is a hydraulic fluid used in brake systems to transmit pressure when the brake pedal is depressed, enabling the vehicle to stop. It's typically glycol-ether-based. Clutch fluid, also known as hydraulic clutch fluid, operates similarly, facilitating the movement of the clutch pedal in vehicles with manual transmissions. Both fluids must have specific properties like high boiling points and compatibility with rubber seals to ensure the efficient operation of their respective systems.

The Brake and Clutch Fluid Size Was Valued at USD 675.31 Billion in 2023, and is Projected to Reach USD 888.86 Billion by 2032, Growing at a CAGR of 3.10% From 2024-2032.