Global Electric Ships Market Overview

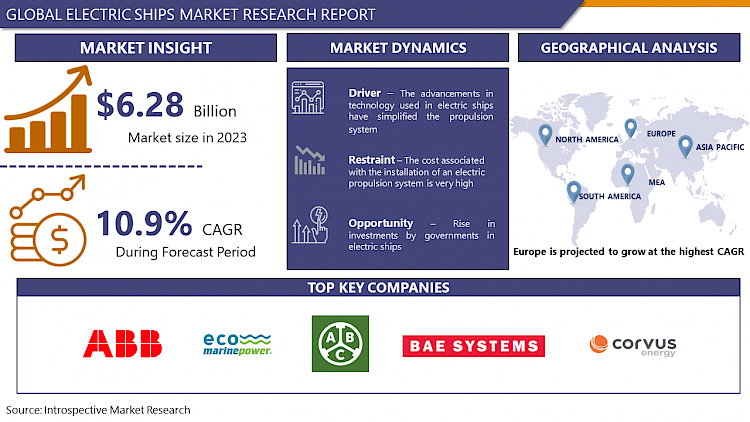

Global Electric Ships Market Size Was Valued at USD 6.28 Billion In 2023 And Is Projected to Reach USD 15.93 Billion By 2032, Growing at A CAGR of 10.9% From 2024 To 2032.

The electric ship industry is emerging with promising prospects driven by stringent environmental regulations, growing demand for sustainable transportation, and breakthroughs in battery technology. These ships, ranging from fully electric to hybrid models, are becoming favored choices for short-haul trips and longer voyages alike, offering cleaner and more efficient alternatives to traditional vessels.

Electric ships are champions of clean air, producing zero emissions during operation. This translates to better air quality, particularly in port cities and coastal communities, and combats greenhouse gas emissions, a key factor in climate change. Electric motors hum quietly compared to the roar of diesel engines. This tranquility benefits not only marine life but also people living and working near ports. Electric ships can turn out to be more economical in the long run. They require less maintenance for electric motors compared to complex diesel engines, and electricity can sometimes be cheaper than fuel, especially with the rising prices of oil.

Market Dynamics and Key Factors In Electric Ships Market

Drivers:

The advancements in technology used in electric ships have simplified the propulsion system, including the sophisticated reduction gear used to run the ship thus propelling the expansion of electric ship markets in the period of forecast. Moreover, the incorporation of electric ships has decreased the financial burden of maintenance and repair including life cycle costs due to the fact, electric ship utilizes integrated propulsion motors with power generation motors to support the internal electrical load. Furthermore, electric ships aids in silencing the onboard noise thus reducing the impact caused by the movement of the ship on the marine animals. Additionally, electric ships enhance fuel efficiency during travel owing to the ability to maintain a constant rotational speed that offers good fuel efficiency in the motors used for producing propulsive electric power. All these factors strengthen the growth of the electric ship market during the forecast period.

The transmission of severe stresses such as torsional and vibration is restricted as there is no direct connection of propeller shaft and prime mover in electric propulsion motors. Moreover, electric ships provide more flexibility in the installation of machinery. The space required for the installation of electric propulsion motors is very less and compact as compared to the conventional system. The motor used in electric ships generates maximum torque across the entire speed range at the propeller. Furthermore, the electric motor used in electric ships provides a much-enhanced dynamic response from zero to maximum propelling speed as compared to other conventional propelling systems. In addition, the time required for maintenance and service is very less thus encouraging the electric ship market development in the period of forecast.

The revised rules and regulations implemented by International Maritime Organization (IMO) in 2020 have compelled ship operators to use fuels having 0.50% sulfur content. Thus, ship operators are integrating the use of electric or hybrid propulsion systems instead of conventional diesel-driven engines. Such rules and regulations are promoting the diversification of the Electric ship's market.

Restraints:

The cost associated with the installation of an electric propulsion system is very high. Moreover, as the system involved in the electric ship is completely different from the mechanical system, an improvised training program to generate skilled and qualified labor is required. Additionally, this is a time-consuming and costly process, thus negatively impacting the growth of the electric ship market. The distance traveled by electric ships on a single charge is the limiting factor hindering the electric ship's market growth. In addition, the current battery technology doesn't facilitate the energy required for large merchant ships. Electric ships require charging stations to recharge the depleted batteries, as the use of electric ships is limited it will take time for the charging facilities to spread globally. Moreover, the speed offered by the electric propulsion system is low as compared to the conventional diesel engines. In certain instances, the load on the electric propulsion system can cause battery breakdown, thus all these factors are hampering the electric ship market growth during the period of forecast.

Opportunities:

Recently there has been a rise in investments by governments in electric ships, to make them compatible for long-distance transportation and to deploy charging stations at numerous points. Moreover, advancements in technology have improvised the efficiency of hybrid-electric propulsion systems utilized in electric ships. Maritime tourism has observed significant growth in recent years. The increasing popularity of cruises, yachts, personalized boats and small boats is proving a vital opportunity for the market players to develop electric ships according to need. Furthermore, the rapid rise in the integration of electric or hybrid propulsion systems to reduce carbon emission and to preserve the natural flora and fauna of the marine ecosystem is instigating market players to manufacture electric motors.

Challenges:

To increase the capacity of the batteries and to make them lightweight are some of the major challenges faced by the manufacturers of electric ships. Current technologies used in the manufacturing of electric ship does not guarantee zero-emission standard thus, to make them emission-free is a vital challenge as major of commodity transportation takes place through ships.

Market Segmentation

Segmentation Analysis of Electric Ships Market:

Depending on Power Source, the hybrid segment is anticipated to dominate the market in the period of forecast. Hybrid electric propulsion systems generate less pollution compared to conventional engines which use heavy fuel. In hybrid engines, the power to propel the shaft is provided by natural gas/diesel generator and prime mover assembly as the shaft is directly connected to the AC/DC motor. It has been discovered that there has been a 20% decrease in the consumption of fuel and about a 15% reduction in carbon dioxide emissions when hybrid engines are used, thus boosting the growth of the hybrid segment.

Depending upon the Mode of Operation, the semi-autonomous segment is predicted to have the highest share of the electric ship market. To sustain the proper functioning and maintenance of a hybrid propulsion system there is a need for crew members to look after it, thus propelling the growth of this segment. The autonomous segment is forecasted to have the second-highest share of the market owing to the reduction in labor cost and decrease in errors caused by humans.

Depending upon Battery Type, the lithium-ion battery is forecasted to lead the electric ship market. Lithium-ion batteries have long-lasting life as compared to lead-acid batteries. Moreover, lithium-ion batteries are light in weight, get charged quickly, and discharge electricity according to the need. Lithium-ion batteries can operate at adverse temperatures efficiently compared to the other solutions available in the market, thus supporting the growth of this segment.

Depending on Vessel Type, the commercial segment is expected to dominate the electric ship market throughout the forecast. The commercial segment comprises tanker ships, container vessels, general cargo ships, yachts, cruise, and ferries. The increase in seaborne trade and the growing maritime tourism industry is strengthening the growth of the commercial segment. Various rules and regulations implemented by governments to decrease the use of sulfur in fuels are expected to increase the demand for commercial electric ships.

Depending on the System, the energy storage segment is anticipated to have significant growth. Features such as lower emissions, fuel savings, and increased safety during operation and maintenance are driving the need for energy storage systems in electric ships, thus fueling the development of this segment.

Regional Analysis of Electric Ships Market:

Europe's dominance in the global electric ship market is driven by several factors, including strong government support for clean energy initiatives, robust infrastructure for electric transportation, and a focus on reducing emissions in the maritime industry. Countries like Norway, Denmark, and Sweden have been at the forefront of developing electric and hybrid vessels, with significant investments in research and development.

The European Union's ambitious environmental policies, such as the European Green Deal and the Clean Energy for All Europeans package. These initiatives aim to accelerate the transition to a low-carbon economy and promote the adoption of sustainable technologies across various sectors, including maritime transportation. As a result, European shipbuilders and maritime companies are increasingly investing in electric propulsion systems and alternative fuel technologies to meet the growing demand for eco-friendly vessels.

Europe's strategic location and extensive network of ports make it an ideal market for electric ships, as these vessels offer significant environmental benefits, such as reduced greenhouse gas emissions and noise pollution. With growing concerns about climate change and air quality, European countries are increasingly prioritizing the adoption of electric and hybrid vessels to achieve their environmental targets and improve the sustainability of their maritime operations. Overall, Europe's leadership in the electric ship market is expected to continue as the region continues to invest in clean energy technologies and promotes sustainable transportation solutions.

Players Covered in Electric Ships market are :

- ABB (Switzerland)

- ECO Marine Power Co Ltd. (UK)

- Anglo Belgian Corporation NV (Belgium)

- Bae Systems (UK)

- Corvus Energy (Canada)

- Echandia Marine AB (Sweden)

- EST Floattech (Netherlands)

- General Dynamics Electric Boat (US)

- General Electric (US)

- Kongsberg Gruppen (Norway)

- Leclanché SA (Switzerland)

- Man Energy Solutions (Germany)

- Norwegian Electric Systems (Norway)

- Siemens (Germany)

- Wartsila (Finland) and other major players.

Key Industry Developments In Electric Ships Market

-

In March 2023, ABB secured a deal with Fincantieri to provide eight mid-range Azipod propulsion systems for the construction of four medium-sized cruise ships. Each passenger vessel will be equipped with two 7.7-megawatt Azipod propulsion units. Delivery of these ships is scheduled for 2024, 2025, 2026, and 2027. The Azipod system, featuring an electric drive motor housed within a pod located beyond the ship's hull, offers the unique capability to rotate 360 degrees, facilitating smooth docking in harbors with limited turning space.

In February 2023, Kongsberg Maritime (KONGSBERG) secured an agreement to supply a range of equipment for a newly constructed vessel named SDO-SuRS (Special and Diving Operations - Submarine Rescue Ship), being built by the Italian shipyard T.Mariotti for the Marina Militare Italiana (The Italian Navy).

In February 2023, GE's local subsidiary in India finalized a contract with Cochin Shipyard to deliver a comprehensive digital solutions package aimed at enhancing the performance of the LM2500 marine gas turbines that drive the Indian Navy's inaugural Indigenous Aircraft Carrier-1 (IAC-1) Vikrant. Vikrant was commissioned in August 2022.

|

Global Electric Ships Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 5.66 Bn. |

|

Forecast Period 2022-28 CAGR: |

10.9% |

Market Size in 2030: |

USD 12.94 Bn. |

|

Segments Covered: |

By Power Source |

|

|

|

By Autonomy Level |

|

||

|

By Vessel Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Power Source

3.2 By Autonomy Level

3.3 By Vessel Type

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Electric Ships Market by Power Source

5.1 Electric Ships Market Overview Snapshot and Growth Engine

5.2 Electric Ships Market Overview

5.3 Hybrid

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Hybrid: Grographic Segmentation

5.4 Fully Electric

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Fully Electric: Grographic Segmentation

Chapter 6: Electric Ships Market by Autonomy Level

6.1 Electric Ships Market Overview Snapshot and Growth Engine

6.2 Electric Ships Market Overview

6.3 Semi-Autonomous

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Semi-Autonomous: Grographic Segmentation

6.4 Fully Autonomous

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Fully Autonomous: Grographic Segmentation

Chapter 7: Electric Ships Market by Vessel Type

7.1 Electric Ships Market Overview Snapshot and Growth Engine

7.2 Electric Ships Market Overview

7.3 Commercial

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Commercial: Grographic Segmentation

7.4 Defense

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Defense: Grographic Segmentation

7.5 Special

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Special: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Electric Ships Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Electric Ships Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Electric Ships Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 ABB

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 ECO MARINE POWER CO LTD

8.4 ANGLO BELGIAN CORPORATION NV

8.5 BAE SYSTEMS

8.6 CORVUS ENERGY

8.7 ECHANDIA MARINE AB

8.8 EST FLOATTECH

8.9 GENERAL DYNAMICS ELECTRIC BOAT

8.10 GENERAL ELECTRI

8.11 KONGSBERG GRUPPEN

8.12 LECLANCHÉ SA

8.13 MAN ENERGY SOLUTIONS

8.14 NORWEGIAN ELECTRIC SYSTEMS

8.15 SIEMENS

8.16 WARTSILA

8.17 OTHER MAJOR PLAYERS

Chapter 9: Global Electric Ships Market Analysis, Insights and Forecast, 2017-2032

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Power Source

9.2.1 Hybrid

9.2.2 Fully Electric

9.3 Historic and Forecasted Market Size By Autonomy Level

9.3.1 Semi-Autonomous

9.3.2 Fully Autonomous

9.4 Historic and Forecasted Market Size By Vessel Type

9.4.1 Commercial

9.4.2 Defense

9.4.3 Special

Chapter 10: North America Electric Ships Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Power Source

10.4.1 Hybrid

10.4.2 Fully Electric

10.5 Historic and Forecasted Market Size By Autonomy Level

10.5.1 Semi-Autonomous

10.5.2 Fully Autonomous

10.6 Historic and Forecasted Market Size By Vessel Type

10.6.1 Commercial

10.6.2 Defense

10.6.3 Special

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Electric Ships Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Power Source

11.4.1 Hybrid

11.4.2 Fully Electric

11.5 Historic and Forecasted Market Size By Autonomy Level

11.5.1 Semi-Autonomous

11.5.2 Fully Autonomous

11.6 Historic and Forecasted Market Size By Vessel Type

11.6.1 Commercial

11.6.2 Defense

11.6.3 Special

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Electric Ships Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Power Source

12.4.1 Hybrid

12.4.2 Fully Electric

12.5 Historic and Forecasted Market Size By Autonomy Level

12.5.1 Semi-Autonomous

12.5.2 Fully Autonomous

12.6 Historic and Forecasted Market Size By Vessel Type

12.6.1 Commercial

12.6.2 Defense

12.6.3 Special

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Electric Ships Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Power Source

13.4.1 Hybrid

13.4.2 Fully Electric

13.5 Historic and Forecasted Market Size By Autonomy Level

13.5.1 Semi-Autonomous

13.5.2 Fully Autonomous

13.6 Historic and Forecasted Market Size By Vessel Type

13.6.1 Commercial

13.6.2 Defense

13.6.3 Special

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Electric Ships Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Power Source

14.4.1 Hybrid

14.4.2 Fully Electric

14.5 Historic and Forecasted Market Size By Autonomy Level

14.5.1 Semi-Autonomous

14.5.2 Fully Autonomous

14.6 Historic and Forecasted Market Size By Vessel Type

14.6.1 Commercial

14.6.2 Defense

14.6.3 Special

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Electric Ships Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 5.66 Bn. |

|

Forecast Period 2022-28 CAGR: |

10.9% |

Market Size in 2030: |

USD 12.94 Bn. |

|

Segments Covered: |

By Power Source |

|

|

|

By Autonomy Level |

|

||

|

By Vessel Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. ELECTRIC SHIPS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. ELECTRIC SHIPS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. ELECTRIC SHIPS MARKET COMPETITIVE RIVALRY

TABLE 005. ELECTRIC SHIPS MARKET THREAT OF NEW ENTRANTS

TABLE 006. ELECTRIC SHIPS MARKET THREAT OF SUBSTITUTES

TABLE 007. ELECTRIC SHIPS MARKET BY POWER SOURCE

TABLE 008. HYBRID MARKET OVERVIEW (2016-2028)

TABLE 009. FULLY ELECTRIC MARKET OVERVIEW (2016-2028)

TABLE 010. ELECTRIC SHIPS MARKET BY AUTONOMY LEVEL

TABLE 011. SEMI-AUTONOMOUS MARKET OVERVIEW (2016-2028)

TABLE 012. FULLY AUTONOMOUS MARKET OVERVIEW (2016-2028)

TABLE 013. ELECTRIC SHIPS MARKET BY VESSEL TYPE

TABLE 014. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 015. DEFENSE MARKET OVERVIEW (2016-2028)

TABLE 016. SPECIAL MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA ELECTRIC SHIPS MARKET, BY POWER SOURCE (2016-2028)

TABLE 018. NORTH AMERICA ELECTRIC SHIPS MARKET, BY AUTONOMY LEVEL (2016-2028)

TABLE 019. NORTH AMERICA ELECTRIC SHIPS MARKET, BY VESSEL TYPE (2016-2028)

TABLE 020. N ELECTRIC SHIPS MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE ELECTRIC SHIPS MARKET, BY POWER SOURCE (2016-2028)

TABLE 022. EUROPE ELECTRIC SHIPS MARKET, BY AUTONOMY LEVEL (2016-2028)

TABLE 023. EUROPE ELECTRIC SHIPS MARKET, BY VESSEL TYPE (2016-2028)

TABLE 024. ELECTRIC SHIPS MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC ELECTRIC SHIPS MARKET, BY POWER SOURCE (2016-2028)

TABLE 026. ASIA PACIFIC ELECTRIC SHIPS MARKET, BY AUTONOMY LEVEL (2016-2028)

TABLE 027. ASIA PACIFIC ELECTRIC SHIPS MARKET, BY VESSEL TYPE (2016-2028)

TABLE 028. ELECTRIC SHIPS MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA ELECTRIC SHIPS MARKET, BY POWER SOURCE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA ELECTRIC SHIPS MARKET, BY AUTONOMY LEVEL (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA ELECTRIC SHIPS MARKET, BY VESSEL TYPE (2016-2028)

TABLE 032. ELECTRIC SHIPS MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA ELECTRIC SHIPS MARKET, BY POWER SOURCE (2016-2028)

TABLE 034. SOUTH AMERICA ELECTRIC SHIPS MARKET, BY AUTONOMY LEVEL (2016-2028)

TABLE 035. SOUTH AMERICA ELECTRIC SHIPS MARKET, BY VESSEL TYPE (2016-2028)

TABLE 036. ELECTRIC SHIPS MARKET, BY COUNTRY (2016-2028)

TABLE 037. ABB: SNAPSHOT

TABLE 038. ABB: BUSINESS PERFORMANCE

TABLE 039. ABB: PRODUCT PORTFOLIO

TABLE 040. ABB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. ECO MARINE POWER CO LTD: SNAPSHOT

TABLE 041. ECO MARINE POWER CO LTD: BUSINESS PERFORMANCE

TABLE 042. ECO MARINE POWER CO LTD: PRODUCT PORTFOLIO

TABLE 043. ECO MARINE POWER CO LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. ANGLO BELGIAN CORPORATION NV: SNAPSHOT

TABLE 044. ANGLO BELGIAN CORPORATION NV: BUSINESS PERFORMANCE

TABLE 045. ANGLO BELGIAN CORPORATION NV: PRODUCT PORTFOLIO

TABLE 046. ANGLO BELGIAN CORPORATION NV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. BAE SYSTEMS: SNAPSHOT

TABLE 047. BAE SYSTEMS: BUSINESS PERFORMANCE

TABLE 048. BAE SYSTEMS: PRODUCT PORTFOLIO

TABLE 049. BAE SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. CORVUS ENERGY: SNAPSHOT

TABLE 050. CORVUS ENERGY: BUSINESS PERFORMANCE

TABLE 051. CORVUS ENERGY: PRODUCT PORTFOLIO

TABLE 052. CORVUS ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. ECHANDIA MARINE AB: SNAPSHOT

TABLE 053. ECHANDIA MARINE AB: BUSINESS PERFORMANCE

TABLE 054. ECHANDIA MARINE AB: PRODUCT PORTFOLIO

TABLE 055. ECHANDIA MARINE AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. EST FLOATTECH: SNAPSHOT

TABLE 056. EST FLOATTECH: BUSINESS PERFORMANCE

TABLE 057. EST FLOATTECH: PRODUCT PORTFOLIO

TABLE 058. EST FLOATTECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. GENERAL DYNAMICS ELECTRIC BOAT: SNAPSHOT

TABLE 059. GENERAL DYNAMICS ELECTRIC BOAT: BUSINESS PERFORMANCE

TABLE 060. GENERAL DYNAMICS ELECTRIC BOAT: PRODUCT PORTFOLIO

TABLE 061. GENERAL DYNAMICS ELECTRIC BOAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. GENERAL ELECTRI: SNAPSHOT

TABLE 062. GENERAL ELECTRI: BUSINESS PERFORMANCE

TABLE 063. GENERAL ELECTRI: PRODUCT PORTFOLIO

TABLE 064. GENERAL ELECTRI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. KONGSBERG GRUPPEN: SNAPSHOT

TABLE 065. KONGSBERG GRUPPEN: BUSINESS PERFORMANCE

TABLE 066. KONGSBERG GRUPPEN: PRODUCT PORTFOLIO

TABLE 067. KONGSBERG GRUPPEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. LECLANCHÉ SA: SNAPSHOT

TABLE 068. LECLANCHÉ SA: BUSINESS PERFORMANCE

TABLE 069. LECLANCHÉ SA: PRODUCT PORTFOLIO

TABLE 070. LECLANCHÉ SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. MAN ENERGY SOLUTIONS: SNAPSHOT

TABLE 071. MAN ENERGY SOLUTIONS: BUSINESS PERFORMANCE

TABLE 072. MAN ENERGY SOLUTIONS: PRODUCT PORTFOLIO

TABLE 073. MAN ENERGY SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. NORWEGIAN ELECTRIC SYSTEMS: SNAPSHOT

TABLE 074. NORWEGIAN ELECTRIC SYSTEMS: BUSINESS PERFORMANCE

TABLE 075. NORWEGIAN ELECTRIC SYSTEMS: PRODUCT PORTFOLIO

TABLE 076. NORWEGIAN ELECTRIC SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. SIEMENS: SNAPSHOT

TABLE 077. SIEMENS: BUSINESS PERFORMANCE

TABLE 078. SIEMENS: PRODUCT PORTFOLIO

TABLE 079. SIEMENS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. WARTSILA: SNAPSHOT

TABLE 080. WARTSILA: BUSINESS PERFORMANCE

TABLE 081. WARTSILA: PRODUCT PORTFOLIO

TABLE 082. WARTSILA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 083. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 084. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 085. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. ELECTRIC SHIPS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. ELECTRIC SHIPS MARKET OVERVIEW BY POWER SOURCE

FIGURE 012. HYBRID MARKET OVERVIEW (2016-2028)

FIGURE 013. FULLY ELECTRIC MARKET OVERVIEW (2016-2028)

FIGURE 014. ELECTRIC SHIPS MARKET OVERVIEW BY AUTONOMY LEVEL

FIGURE 015. SEMI-AUTONOMOUS MARKET OVERVIEW (2016-2028)

FIGURE 016. FULLY AUTONOMOUS MARKET OVERVIEW (2016-2028)

FIGURE 017. ELECTRIC SHIPS MARKET OVERVIEW BY VESSEL TYPE

FIGURE 018. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 019. DEFENSE MARKET OVERVIEW (2016-2028)

FIGURE 020. SPECIAL MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA ELECTRIC SHIPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE ELECTRIC SHIPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC ELECTRIC SHIPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA ELECTRIC SHIPS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA ELECTRIC SHIPS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Electric Ships Market research report is 2023-2030.

ABB (Switzerland), ECO Marine Power Co Ltd. (UK), Anglo Belgian Corporation NV (Belgium), Bae Systems (UK), Corvus Energy (Canada), Echandia Marine AB (Sweden), EST Floattech (Netherlands), General Dynamics Electric Boat (US), General Electric (US), Kongsberg Gruppen (Norway), Leclanché SA (Switzerland), Man Energy Solutions (Germany), Norwegian Electric Systems (Norway), Siemens (Germany), Wartsila (Finland), and other major players.

The Electric Ships Market is segmented into power source, autonomy level, vessel type, and region. By Power Source, the market is categorized into Hybrid and Fully Electric. By Autonomy Level, the market is categorized into Semi-Autonomous and Fully Autonomous. By Vessel Type, the market is categorized into Commercial, Defense, and Special. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Fully electric ships use lead-corrosive or lithium batteries, power modules or solar energy as a force source. Hybrid electric ships show less contamination when compared to the traditional marine drive systems which consume large-scale oil.

Global Electric Ships Market Size Was Valued at USD 6.28 Billion In 2023 And Is Projected to Reach USD 15.93 Billion By 2032, Growing at A CAGR of 10.9% From 2024 To 2032.