Global Sea Freight Forwarding Market Synopsis

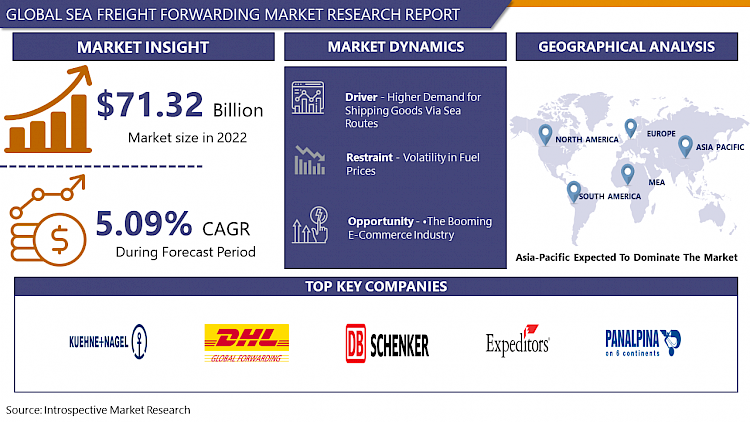

The global Sea Freight Forwarding market was worth USD 71.32 billion in 2022. As such, the forecast is that the market is expected to reach USD 106.1 Billion by 2030 with a CAGR of 5.09 % over the period from 2023 to 2030.

An ocean freight forwarder specializes in moving freight via cargo ships. This specialization enables ocean forwarders to know precisely how to complete any shipment and build the relationships necessary to get the best ocean rates, which they can then pass on to their customers.

- Sea freight forwarding is fundamental for importing and exporting goods across borders, enabling businesses to access markets worldwide. It forms an integral part of supply chain logistics, ensuring the timely and cost-effective movement of goods from manufacturers to distributors and retailers. It is ideal for transporting large volumes of bulk commodities such as grains, ores, and petroleum products, efficiently accommodating the high capacity requirements of these shipments.

- Sea freight forwarding manages the transportation of perishable goods like fruits, vegetables, and pharmaceuticals, ensuring proper temperature control throughout the journey.

- The sea freight forwarding market facilitates the transportation of goods via ocean vessels. It encompasses a range of services including booking cargo space, customs clearance, documentation, and cargo tracking. Key players in the market include freight forwarders, shipping lines, and logistics companies. The market is highly competitive with a focus on efficiency, cost-effectiveness, and sustainability. Emerging trends include digitalization, blockchain integration, and green initiatives to reduce carbon emissions. In 2022, Kuehne + Nagel was ranked the world's leading ocean freight forwarder, with almost 4.4 million twenty-foot equivalent units of ocean freight. The sea freight forwarding market remains integral to global trade logistics, connecting businesses worldwide.

Global Sea Freight Forwarding Market Trend Analysis

Higher Demand for Shipping Goods Via Sea Routes

- Globalization has led to an increase in international trade, with businesses sourcing materials and selling products across borders. Sea freight offers a cost-effective and efficient mode of transportation for large quantities of goods over long distances, making it a preferred choice for businesses seeking to optimize their supply chains.

- The expansion of manufacturing industries, particularly in regions like Asia, has fuelled demand for raw materials and finished goods to be transported globally. Sea routes provide the infrastructure to accommodate the bulk transportation needs of these industries.

- Additionally, advancements in technology and logistics have enhanced the efficiency and reliability of sea freight forwarding services. Real-time tracking, containerization, and automated systems streamline operations, reducing transit times and improving overall service quality. Environmental concerns and regulations aimed at reducing carbon emissions have encouraged the use of sea transport, which is inherently eco-friendlier compared to air or road transport.

- In 2020, the global commercial shipping fleet grew by 3 percent, reaching 99,800 ships of 100 gross tons and above. By January 2021, capacity was equivalent to 2,13 billion deadweight tons. During 2020, delivery of ships declined by 12 percent, partly due to lockdown-induced labor shortages that disrupted marine-industrial activity. The ships delivered were mostly bulk carriers, followed by oil tankers and container ships.

|

World fleet by principal vessel type, 2020–2021 (thousand dead-weight tons and percentage) |

|||

|

Principal types |

2020 |

2021 |

Percentage change 2021 over 2020 |

|

Bulk carriers |

879 725 |

913 032 |

3.79% |

|

Oil tankers |

601 342 |

619 148 |

2.96% |

|

Container ships |

274 973 |

281 784 |

2.48% |

|

Other types of ships: |

238 705 |

243 922 |

2.19% |

|

Offshore supply |

84 049 |

84 094 |

0.05% |

|

Gas carriers |

73 685 |

77 455 |

5.12% |

|

Chemical tankers |

47 480 |

48 858 |

2.90% |

|

Ferries and passenger ships |

7 992 |

8 109 |

1.46% |

The Booming E-Commerce Industry Creates an Opportunity for Global Sea Freight Forwarding Market

- The exponential growth of the e-commerce industry creates an opportunity for the global sea freight forwarding market. As consumers increasingly turn to online platforms for their shopping needs, businesses are compelled to optimize their supply chains to meet growing demands efficiently. Sea freight forwarding emerges as a critical component in this process due to its cost-effectiveness, reliability, and ability to handle large volumes of goods.

- E-commerce giants and smaller retailers alike are leveraging sea freight forwarding services to transport goods across international borders. By partnering with experienced freight forwarders, businesses can ensure timely delivery, streamline customs clearance processes, and reduce transportation costs. Moreover, advancements in technology have enhanced visibility and tracking capabilities, allowing stakeholders to monitor shipments in real time and mitigate potential disruptions.

- Forward-thinking logistics companies are investing in digitalization, automation, and sustainable practices to stay competitive in this dynamic landscape. By innovation and adapting to evolving consumer preferences, sea freight forwarders can capitalize on the growth of e-commerce and forge stronger partnerships with businesses worldwide.

Global Sea Freight Forwarding Market Segment Analysis:

Global Sea Freight Forwarding Market is Segmented into the Service and Application.

By Service, Full Container Load Segment Is Expected to Dominate the Market During the Forecast Period.

- The full Container Load (FCL) segment is anticipated to assert dominance by service. FCL involves the shipment of goods in fully packed containers, typically by a single consignee. This method offers several advantages, including lower risk of damage or loss, greater security, and faster transit times compared to less-than-container-load (LCL) shipments.

- The dominance of FCL in the sea freight forwarding market is its suitability for businesses with large shipment volumes or bulky items that require dedicated container space. Additionally, FCL shipments are often preferred for their simplicity in documentation and customs clearance processes, contributing to smoother logistics operations.

By Application, Agricultural Segment Held the Largest Share Of 22.3% In 2022.

- The agricultural segment is anticipated to assert dominance in the sea freight forwarding market. Agriculture is a fundamental sector in many economies, with a constant demand for efficient transportation of products across borders. Sea freight offers a cost-effective and reliable solution for the global transportation of agricultural goods, including grains, fruits, vegetables, and other perishable items.

- Moreover, the agricultural industry often deals with large volumes of goods requiring transportation over long distances. Sea freight provides the capacity needed to accommodate such bulk shipments efficiently. Additionally, advancements in refrigeration and storage technologies have enabled sea freight forwarding companies to cater to the specific requirements of perishable agricultural products, ensuring their freshness and quality are maintained throughout transit.

Global Sea Freight Forwarding Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is poised to dominate the sea freight forwarding market, the region's robust economic growth and burgeoning trade volumes have created significant demand for efficient shipping services. As countries like China, India, and Southeast Asian nations continue to experience rapid industrialization and globalization, the need for reliable and cost-effective transportation of goods across borders becomes paramount.

- The strategic investments in infrastructure development, including ports, terminals, and transportation networks, have enhanced the region's connectivity and logistics capabilities. This infrastructure modernization facilitates smoother cargo movement and attracts international trade flows and investment.

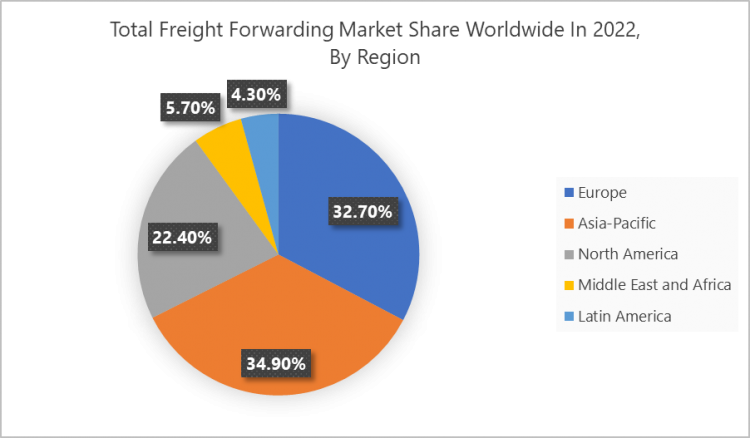

- Additionally, the Asia Pacific region benefits from its geographic advantage as a gateway between major global trade routes, serving as a vital link for maritime trade between East Asia, Europe, and the Americas. In 2022, Asia Pacific overtook Europe as the largest market for global freight forwarding, with a share of 34.9 percent. International trade is one of the main drivers of growth in the freight forwarding market.

Global Sea Freight Forwarding Market Top Key Players:

- Kuehne + Nagel (Switzerland)

- DHL Global Forwarding (Germany)

- DB Schenker (Germany)

- Expeditors International (United States)

- Panalpina (Switzerland)

- DSV (Denmark)

- Sinotrans (China)

- Nippon Express (Japan)

- CEVA Logistics (Switzerland)

- Hellmann Worldwide Logistics (Germany)

- Yusen Logistics (Japan)

- Agility (Kuwait)

- Kerry Logistics (Hong Kong)

- C.H. Robinson (United States)

- Bolloré Logistics (France)

- Damco (Netherlands)

- Geodis (France)

- Ceva Freight Management (Switzerland)

- UTi Worldwide (United States)

- Dachser (Germany)

- Kintetsu World Express (Japan)

- Schenker (Germany)

- Expeditors (United States)

- Hitachi Transport System (Japan)

- Yusen (Japan), and Other Major Players

Key Industry Developments in the Global Sea Freight Forwarding Market:

- In July 2023, Expeditors International, a US-based global logistics provider, acquired Air & Sea Logistics, a Chinese freight forwarding company, for $3.3 billion. This move aimed to expand Expeditors' footprint in the growing Chinese market and enhance its airfreight capabilities.

- In March 2023, US-based C.H. Robinson acquired Ingram Micro's Commerce & Lifecycle Services division for $8 billion. This acquisition broadened C.H. Robinson's contract logistics and freight forwarding offerings, particularly in the e-commerce and technology sectors.

- In February 2023, German logistics giant DB Schenker acquired BDP International, a leading US-based freight forwarding company, for $4.2 billion. This move strengthened Schenker's presence in the US market and expanded its air and ocean freight forwarding capabilities.

|

Global Sea Freight Forwarding Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 71.32 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.09 % |

Market Size in 2030: |

USD 106.1 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- FORM EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SEA FREIGHT FORWARDING MARKET BY SERVICE (2017-2030)

- SEA FREIGHT FORWARDING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FULL CONTAINER LOAD

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LESS-THAN CONTAINER LOAD

- SPECIALIZED SERVICES

- SEA FREIGHT FORWARDING MARKET BY APPLICATION (2017-2030)

- SEA FREIGHT FORWARDING MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMOTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2030F)

- Historic And Forecasted Market Size in Volume (2017 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- RETAIL

- ELECTRONICS

- PHARMACEUTICALS

- AGRICULTURE

- OTHERS (FMCG, CHEMICALS, CONSTRUCTION)

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- SEA FREIGHT FORWARDING Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- KUEHNE + NAGEL (SWITZERLAND)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- KUEHNE + NAGEL (SWITZERLAND)

- DHL GLOBAL FORWARDING (GERMANY)

- DB SCHENKER (GERMANY)

- EXPEDITORS INTERNATIONAL (UNITED STATES)

- PANALPINA (SWITZERLAND)

- DSV (DENMARK)

- SINOTRANS (CHINA)

- NIPPON EXPRESS (JAPAN)

- CEVA LOGISTICS (SWITZERLAND)

- HELLMANN WORLDWIDE LOGISTICS (GERMANY)

- YUSEN LOGISTICS (JAPAN)

- AGILITY (KUWAIT)

- KERRY LOGISTICS (HONG KONG)

- C.H. ROBINSON (UNITED STATES)

- BOLLORÉ LOGISTICS (FRANCE)

- DAMCO (NETHERLANDS)

- GEODIS (FRANCE)

- CEVA FREIGHT MANAGEMENT (SWITZERLAND)

- UTI WORLDWIDE (UNITED STATES)

- DACHSER (GERMANY)

- KINTETSU WORLD EXPRESS (JAPAN)

- SCHENKER (GERMANY)

- EXPEDITORS (UNITED STATES)

- HITACHI TRANSPORT SYSTEM (JAPAN)

- YUSEN (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL SEA FREIGHT FORWARDING MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Service

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Sea Freight Forwarding Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 71.32 Bn. |

|

Forecast Period 2023-30 CAGR: |

5.09 % |

Market Size in 2030: |

USD 106.1 Bn. |

|

Segments Covered: |

By Service |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Global Sea Freight Forwarding Market research report is 2023-2030.

Kuehne + Nagel (Switzerland), DHL Global Forwarding (Germany), DB Schenker (Germany), Expeditors International (United States), Panalpina (Switzerland), DSV (Denmark), Sinotrans (China), Nippon Express (Japan), CEVA Logistics (Switzerland), Hellmann Worldwide Logistics (Germany), Yusen Logistics (Japan), Agility (Kuwait), Kerry Logistics (Hong Kong), C.H. Robinson (United States), Bolloré Logistics (France), Damco (Netherlands), Geodis (France), Ceva Freight Management (Switzerland), UTi Worldwide (United States), Dachser (Germany), Kintetsu World Express (Japan), Schenker (Germany), Expeditors (United States), Hitachi Transport System (Japan), Yusen (Japan), and Other Major Players.

The Global Sea Freight Forwarding Market is segmented into Service, Application, and region. By Service, the market is categorized into Full Container Load and less-than Container Load. By Application, the market is categorized into Automotive, Retail, Electronics, Pharmaceuticals, Agriculture, and Others (FMCG, Chemicals, Construction). By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

An ocean freight forwarder specializes in moving freight via cargo ships. This specialization enables ocean forwarders to know precisely how to complete any shipment and build the relationships necessary to get the best ocean rates, which they can then pass on to their customers.

The global Sea Freight Forwarding market was worth USD 71.32 billion in 2022. As such, the forecast is that the market is expected to reach USD 106.1 Billion by 2030 with a CAGR of 5.09 % over the period from 2023 to 2030.