Tracking as a Service Market Synopsis

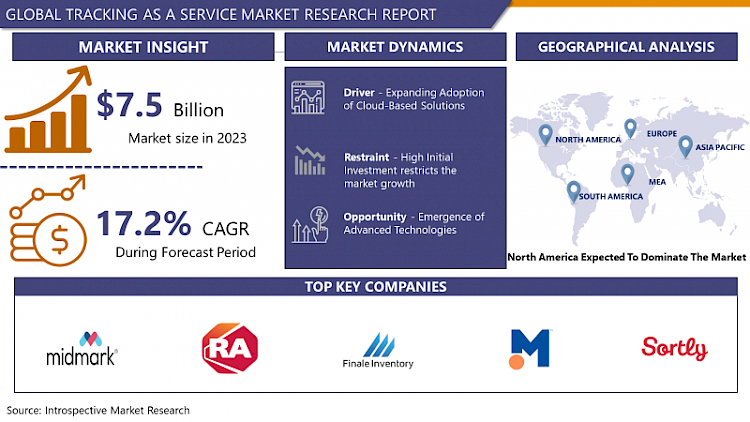

Tracking as a Service Market Size Was Valued at USD 7.5 Billion in 2023, and is Projected to Reach USD 31.3 Billion by 2032, Growing at a CAGR of 17.2% From 2024-2032.

A particular type of cloud-based digital monitoring system, tracking as a service, was developed to help many industries with everyday enterprise activities. Tracking-as-a-service systems offer an ideal tracking solution, which helps businesses monitor the desired aspects of their operations and assets. Tracking-as-a-service is an essential concept that may help a company enhance its production and supply chain and reduce expenses. These services include system integration tools, optimization tools, and end-user job management skills. Also, the tracking service technology seeks to identify the real-time location of all the assets in service. They give us an obvious picture of the support used as a result. It is anticipated that the need for enhanced fleet operator efficiency systems will increase in the course of the projected period, thereby resulting in clear advancement in the tracking-as-a-service market.

- The tracking as a service must be imperative in an organization so that it can increase its financial profitability through the increase of manufacturing and logistic strategies. These services include system integration instruments, optimization instruments, and end-user task management skills. Additionally, tracking service technology aims to keep track of the location of all assets on the premises. Thus, they paint a vivid picture of how various assets have been used in the organization.

- These factors including real-time tracking, data analytics, optimization, logistics, healthcare, transport, and third-party supply chain management have been the key demand driving factors for the market growth. This growth is supported by development in the sensors industry, IoT, and the cloud which has enabled the development of perfect and cheap methods of tracking. It helps enterprise reach an unprecedented level of accuracy in terms of tracking assets, vehicles, shipments and people which in turn decreases the level of risk, increases the efficiency of the resources, and brings down the cost of operations.

- Another major consideration that is attributed to the increasing demand for tracking solutions is the increasing importance accorded to data and analytics when deciding a way of gaining a competitive edge. New and emerging opportunities such as the increasing digitalization of many sectors including the logistics industry will work in favor of the market. For instance, in June 2022, Accenture conducted a survey of over 600 logistics executives as well as a series of interviews with 14 industry leaders to evaluate the industry's digital maturity. According to the survey of the leaders, they spend 2. Research shows that it is five times more difficult to catapult laggards to a higher level of digital maturity than to overcome low-spending nations.

- The tracking-as-a-service market is expected to gain growth at a significant pace in the near future because of increasing demand for a better fleet operator efficiency system. Moreover, the growth of the market is anticipated to be stimulated by advancements in eye-tracking systems combined with the increased adoption of smartphones. Furthermore, the actual increase in the volume of investments in better logistics and supply chain infrastructure is expected to boost the market rapidly.

Tracking as a Service Market Trend Analysis

Increasing application of technology in manufacturing

- It is estimated that the industry will grow as more businesses adopt technology in their production lines, in health sectors, commerce, and other logistic JIT industries, and advancement of smart-smartphone technology. On the same note, the ability to navigate inventories, assets, and vehicles through an application that can be installed in a smartphone is among the features that have boosted the growth of the market, particularly in the logistics and supply chain management area. Telecommunications companies in the Asia-Pacific region and North America are the leading regions for creating and delivering tracking service solutions associated with the 5G mobile network. The fact that 5G tracking infrastructure is available for enhanced tracking solutions is also the reason that the deployment of tracking as a service in China, Japan, the U. S, and South Korea has increased, this aspect is one of the more influential aspects boosting the global tracking as a service technology market.

Rise in the use of IoT

- The tracking as a service market has become more popular with IoT-based locating system solution offerings over the recent past. Hence, the Internet of Things technology facility of real-time location tracking of inventory shipments, assets, and items tends to be very accurate and cheap in comparison to conventional approaches. As such, there is increased usage of applications that use the Internet of Things to track services. In the same way, it was forecasted that tracking-as-a-service technology will see its growth further instigated by the increasing number of 5G network-based application requirements in retail, manufacturing, and industrial segments in the forecasted period.

Tracking as a Service Market Segment Analysis:

Tracking as a Service Market is segmented based on Component, Enterprise Size, Asset Type, and, End-User.

By Component, the software segment is expected to dominate the market during the forecast period

- The software segment held the largest market share in 2022 and was followed by the hardware segment, which captured more than 35% share. It yet contributes 0% of the global revenue. Thus, the development of the software segment can be explained by the following factors: advancement in the technological field has brought about more complex tracking software solution capacities. Such software tools include tracking capabilities for real-time tracking, data analysis and modeling, and the ability to link to other business systems. These software offerings are appealing to businesses because of their ability to deliver value in the form of customer insights, better organizational functioning, and enhanced decision-making capabilities.

- The services segment has been predicted to grow at a faster rate than other segments in the forecast period. Professional and managed services are experiencing growth because they help clients integrate solutions that align with business objectives and needs. These services target the complex requirements of the corporate world through customization, integrations, and ongoing management of tracking services. By outsourcing their tracking-related work, businesses can concentrate on their key activities, as well as adapt to the constant technological advancements in tracking technologies with the help of MSPs. These services also include risk management, compliance, and flexibility, guaranteeing that tracking systems follow implemented regulations and adapt as the business evolves.

By Enterprise Size, large enterprises segment held the largest share in 2023

- The large enterprise segment held the major market size in the tracking-as-a-service market in the year 2022 and has emerged with a share of more than 65%. The growth could be attributed to the advanced usage of tracking-as-a-service software and services across various opportunities for value creation, including real-time tracking by massive firms. These solutions provide real-time tracking and monitoring of operations, enabling businesses to reduce costs by minimizing distances, mitigating risks, and adhering to the set rules and regulations. By using tracking systems, entities are able to incorporate updated accurate information that helps in decision-making while at the same time improving the customer experience by offering transparency.

- Touting the small and medium enterprise (SME) segment is projected to grow at the highest CAGR over the forecast period. SMEs are attracted to tracking-as-a-service solutions and services because they offer low financial commitments to gain access to sophisticated tracking tools. These solutions also enhance business operations and management, effectively utilizing resources in a manner suitable to the flexible operations of SMEs. Thanking tracking technologies will help SMEs to better meet customers’ demand in a timely update and reduce risk by gaining more visibility in the supply chain.

Tracking as a Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America held the largest share in the tracking-as-a-service market during the year 2022 and registered a value share of over 29 percent. 0%. This growth can be attributed to market players like Rockwell Automation Inc., and MicroMain Corporation which has added its charm. A strong technological foundation in the region to adapt to tracking-as-a-service is a proper solution for the nature of number tracking real-time requirements and dataset analysis. Its focus on the efficiency of decision-making using information technology and the use of advanced technology promotes the use of tracking solutions which improve on supply chain of goods, customer experience, and efficiency of operations within this region and environment characterized by high competition.

Active Key Players in the Tracking as a Service Market

- Rockwell Automation

- MicroMain

- Sortly

- EZO

- Finale Inventory

- Infor

- Midmark Co.

- Mojix

- PCCW Solutions

- Trimble Inc., and Other Key Players

|

Global Tracking as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.2 % |

Market Size in 2032: |

USD 31.3 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Enterprise Size |

|

||

|

By Asset Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- TRACKING AS A SERVICE MARKET BY COMPONENT (2017-2032)

- TRACKING AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOFTWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- TRACKING AS A SERVICE MARKET BY ENTERPRISE SIZE (2017-2032)

- TRACKING AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LARGE ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SMALL & MEDIUM ENTERPRISES

- TRACKING AS A SERVICE MARKET BY ASSET TYPE (2017-2032)

- TRACKING AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ELECTRONICS & IT ASSETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- IN-TRANSIT EQUIPMENT

- MANUFACTURING ASSETS

- OTHERS

- TRACKING AS A SERVICE MARKET BY END-USER (2017-2032)

- TRACKING AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TRANSPORTATION & LOGISTIC

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MANUFACTURING

- FOOD & BEVERAGE

- RETAIL

- IT & TELECOM

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- TRACKING AS A SERVICE Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ROCKWELL AUTOMATION

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- MICROMAIN

- SORTLY

- EZO

- FINALE INVENTORY

- INFOR

- MIDMARK CO.

- MOJIX

- PCCW SOLUTIONS

- TRIMBLE INC.

- COMPETITIVE LANDSCAPE

- GLOBAL TRACKING AS A SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Enterprise Size

- Historic And Forecasted Market Size By Asset Type

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Tracking as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 7.5 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.2 % |

Market Size in 2032: |

USD 31.3 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Enterprise Size |

|

||

|

By Asset Type |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TRACKING AS A SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TRACKING AS A SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TRACKING AS A SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. TRACKING AS A SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. TRACKING AS A SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. TRACKING AS A SERVICE MARKET BY TYPE

TABLE 008. PLATFORM-AS-A-SERVICE MARKET OVERVIEW (2016-2028)

TABLE 009. SOFTWARE-AS-A-SERVICE MARKET OVERVIEW (2016-2028)

TABLE 010. TRACKING AS A SERVICE MARKET BY LOCATION OF USE

TABLE 011. INDOOR MARKET OVERVIEW (2016-2028)

TABLE 012. OUTDOOR MARKET OVERVIEW (2016-2028)

TABLE 013. TRACKING AS A SERVICE MARKET BY END-USER

TABLE 014. BFSI MARKET OVERVIEW (2016-2028)

TABLE 015. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

TABLE 016. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 017. HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA TRACKING AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA TRACKING AS A SERVICE MARKET, BY LOCATION OF USE (2016-2028)

TABLE 021. NORTH AMERICA TRACKING AS A SERVICE MARKET, BY END-USER (2016-2028)

TABLE 022. N TRACKING AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 023. EUROPE TRACKING AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 024. EUROPE TRACKING AS A SERVICE MARKET, BY LOCATION OF USE (2016-2028)

TABLE 025. EUROPE TRACKING AS A SERVICE MARKET, BY END-USER (2016-2028)

TABLE 026. TRACKING AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 027. ASIA PACIFIC TRACKING AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 028. ASIA PACIFIC TRACKING AS A SERVICE MARKET, BY LOCATION OF USE (2016-2028)

TABLE 029. ASIA PACIFIC TRACKING AS A SERVICE MARKET, BY END-USER (2016-2028)

TABLE 030. TRACKING AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA TRACKING AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA TRACKING AS A SERVICE MARKET, BY LOCATION OF USE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA TRACKING AS A SERVICE MARKET, BY END-USER (2016-2028)

TABLE 034. TRACKING AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA TRACKING AS A SERVICE MARKET, BY TYPE (2016-2028)

TABLE 036. SOUTH AMERICA TRACKING AS A SERVICE MARKET, BY LOCATION OF USE (2016-2028)

TABLE 037. SOUTH AMERICA TRACKING AS A SERVICE MARKET, BY END-USER (2016-2028)

TABLE 038. TRACKING AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 039. AT&T INC.: SNAPSHOT

TABLE 040. AT&T INC.: BUSINESS PERFORMANCE

TABLE 041. AT&T INC.: PRODUCT PORTFOLIO

TABLE 042. AT&T INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. DATALOGIC S.P.A. (HYDRA S.P.A.): SNAPSHOT

TABLE 043. DATALOGIC S.P.A. (HYDRA S.P.A.): BUSINESS PERFORMANCE

TABLE 044. DATALOGIC S.P.A. (HYDRA S.P.A.): PRODUCT PORTFOLIO

TABLE 045. DATALOGIC S.P.A. (HYDRA S.P.A.): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. GEOTAB INC.: SNAPSHOT

TABLE 046. GEOTAB INC.: BUSINESS PERFORMANCE

TABLE 047. GEOTAB INC.: PRODUCT PORTFOLIO

TABLE 048. GEOTAB INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. HONEYWELL INTERNATIONAL INC.: SNAPSHOT

TABLE 049. HONEYWELL INTERNATIONAL INC.: BUSINESS PERFORMANCE

TABLE 050. HONEYWELL INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 051. HONEYWELL INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. MOJIX INC.: SNAPSHOT

TABLE 052. MOJIX INC.: BUSINESS PERFORMANCE

TABLE 053. MOJIX INC.: PRODUCT PORTFOLIO

TABLE 054. MOJIX INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. MOTOROLA SOLUTIONS INC.: SNAPSHOT

TABLE 055. MOTOROLA SOLUTIONS INC.: BUSINESS PERFORMANCE

TABLE 056. MOTOROLA SOLUTIONS INC.: PRODUCT PORTFOLIO

TABLE 057. MOTOROLA SOLUTIONS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. PCCW SOLUTIONS: SNAPSHOT

TABLE 058. PCCW SOLUTIONS: BUSINESS PERFORMANCE

TABLE 059. PCCW SOLUTIONS: PRODUCT PORTFOLIO

TABLE 060. PCCW SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. SPIDER TRACKS LIMITED: SNAPSHOT

TABLE 061. SPIDER TRACKS LIMITED: BUSINESS PERFORMANCE

TABLE 062. SPIDER TRACKS LIMITED: PRODUCT PORTFOLIO

TABLE 063. SPIDER TRACKS LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. TOPCON CORPORATION: SNAPSHOT

TABLE 064. TOPCON CORPORATION: BUSINESS PERFORMANCE

TABLE 065. TOPCON CORPORATION: PRODUCT PORTFOLIO

TABLE 066. TOPCON CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. TRIMBLE INC.: SNAPSHOT

TABLE 067. TRIMBLE INC.: BUSINESS PERFORMANCE

TABLE 068. TRIMBLE INC.: PRODUCT PORTFOLIO

TABLE 069. TRIMBLE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. VERIZON COMMUNICATIONS INC.: SNAPSHOT

TABLE 070. VERIZON COMMUNICATIONS INC.: BUSINESS PERFORMANCE

TABLE 071. VERIZON COMMUNICATIONS INC.: PRODUCT PORTFOLIO

TABLE 072. VERIZON COMMUNICATIONS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. WABCO DIGITAL SOLUTIONS: SNAPSHOT

TABLE 073. WABCO DIGITAL SOLUTIONS: BUSINESS PERFORMANCE

TABLE 074. WABCO DIGITAL SOLUTIONS: PRODUCT PORTFOLIO

TABLE 075. WABCO DIGITAL SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. ZEBRA TECHNOLOGIES CORP.: SNAPSHOT

TABLE 076. ZEBRA TECHNOLOGIES CORP.: BUSINESS PERFORMANCE

TABLE 077. ZEBRA TECHNOLOGIES CORP.: PRODUCT PORTFOLIO

TABLE 078. ZEBRA TECHNOLOGIES CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 079. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 080. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 081. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TRACKING AS A SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TRACKING AS A SERVICE MARKET OVERVIEW BY TYPE

FIGURE 012. PLATFORM-AS-A-SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 013. SOFTWARE-AS-A-SERVICE MARKET OVERVIEW (2016-2028)

FIGURE 014. TRACKING AS A SERVICE MARKET OVERVIEW BY LOCATION OF USE

FIGURE 015. INDOOR MARKET OVERVIEW (2016-2028)

FIGURE 016. OUTDOOR MARKET OVERVIEW (2016-2028)

FIGURE 017. TRACKING AS A SERVICE MARKET OVERVIEW BY END-USER

FIGURE 018. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 019. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

FIGURE 020. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 021. HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA TRACKING AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE TRACKING AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC TRACKING AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA TRACKING AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA TRACKING AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Tracking as a Service Market research report is 2024-2032.

Rockwell Automation; MicroMain; Sortly; EZO; Finale Inventory; Infor; Midmark Co.; Mojix; PCCW Solutions; Trimble Inc, and Other Major Players.

The Tracking as a Service Market is segmented into components, enterprise size, asset type, industry, and region. By component, the market is categorized into software and services. By enterprise size, the market is categorized into large enterprises and small & medium enterprises. By asset type, the market is categorized into electronics & its assets, in-transit equipment, manufacturing assets, and others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Tracking as a Service (TaaS) can be described as a SaaS model that enables the tracking of elements such as assets, activities, or processes in real time, where the vendor is responsible for the management and analytics of the data collected. This service targets using technology such as GPS, the Internet of Things, and data analysis to offer details about the location, condition, and productivity of the entities in question. primarily and is widely applied in logistics, fleet monitoring, supply chains tracking, and other industries connected with effective assets tracking and management

Tracking as a Service Market Size Was Valued at USD 7.5 Billion in 2023, and is Projected to Reach USD 31.3 Billion by 2032, Growing at a CAGR of 17.2% From 2024-2032.