Track Inspection Vehicles Market Synopsis

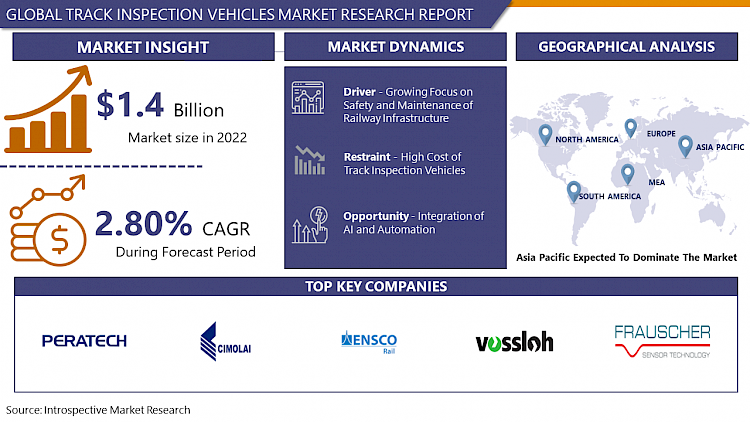

Track Inspection Vehicles Market Size Was Valued at USD 1.4 Billion in 2022, and is Projected to Reach USD 1.75 Billion by 2030, Growing at a CAGR of 2.80% From 2023-2030.

Track Inspection Vehicles are specialized railway vehicles designed for assessing and maintaining the condition of railway tracks. Equipped with advanced sensors, these vehicles monitor track geometry, detect flaws, and ensure compliance with safety standards. They play a crucial role in preventive maintenance and identifying potential issues to enhance railway safety and operational efficiency.

- The Track Inspection Vehicles play an essential role in enhancing rail safety by conducting precise and regular inspections of railway tracks. Equipped with advanced sensor technologies, they detect flaws, monitor track geometry, and enable preventive maintenance, contributing to the overall reliability and efficiency of rail networks. The importance of preventive maintenance over corrective measures aligns with industry trends, ensuring optimal track conditions and minimizing disruptions.

- Market trends also indicate a rising demand for Track Inspection Vehicles due to the global expansion of rail networks. Governments and private stakeholders are investing in railway infrastructure projects to meet the growing demand for transportation. As urbanization increases and environmental concerns drive sustainable transport solutions, the demand for efficient and safe rail systems grows.

- The integration of technology, such as artificial intelligence and remote monitoring, is a prominent trend in the Track Inspection Vehicles market. These technologies enhance predictive maintenance capabilities and provide real-time data, addressing the evolving needs of the rail industry. Track Inspection Vehicles contribute to the overall reliability of rail networks by offering comprehensive and timely assessments of track conditions, facilitating proactive maintenance measures, and supporting the sustainable development of railway infrastructure.

- The demand for Track Inspection Vehicles is further fueled by the increasing adoption of high-speed rail networks and the development of smart cities, where efficient and safe rail transportation is a priority. As the railway industry continues to modernize and expand globally, the Track Inspection Vehicles market is poised for sustained growth, driven by the imperative of maintaining safe and reliable rail infrastructure.

Track Inspection Vehicles Market Trend Analysis

Growing Focus on Safety and Maintenance of Railway Infrastructure

- The growing focus on safety and maintenance within the railway sector stands out as a pivotal driving factor for the Track Inspection Vehicles market. Safety concerns are dominant in the rail industry, given the potential consequences of track failures and operational disruptions. Governments, regulatory bodies, and railway operators worldwide are increasingly prioritizing safety measures, necessitating advanced inspection and maintenance practices.

- Track Inspection Vehicles play a crucial role in addressing concerns by offering a comprehensive solution for monitoring and evaluating the condition of railway tracks. Equipped with advanced sensing technologies, these vehicles can detect defects, and track geometry irregularities, and potential issues early on. The rail industry is prioritizing safety, with a shift towards preventive maintenance strategies. Track Inspection Vehicles help identify and rectify issues before they escalate, reducing accident risks and ensuring overall rail operations safety. As safety remains a top priority, the demand for these tools is expected to grow, making them essential for maintaining the integrity of global railway infrastructure.

Integration of AI and Automation

- The adoption of AI technology in these vehicles enhances their capabilities by enabling advanced data analytics and machine learning algorithms. AI can process vast amounts of data collected by sensors on the Track Inspection Vehicles, allowing for real-time analysis of track conditions and the identification of potential issues. This predictive maintenance approach helps in proactively addressing track irregularities before they escalate, reducing the risk of accidents and improving overall safety.

- Automation and AI can bring efficiency to track inspection processes. Automated Track Inspection Vehicles can operate with precision, covering extensive track lengths without the need for constant human intervention. This not only reduces labor costs but also ensures a more consistent and thorough inspection. Moreover, the integration of AI allows for the development of intelligent systems capable of learning from historical data, optimizing inspection routes, and adapting to evolving track conditions. As the rail industry embraces digital transformation, the opportunity to enhance Track Inspection Vehicles with AI and automation technologies not only improves safety and efficiency but also aligns with the broader trend of technological advancements within the railway infrastructure sector.

Track Inspection Vehicles Market Segment Analysis:

Track Inspection Vehicles Market Segmented based on Type, Technology, Application and End-User.

By Type, Geometry Inspection Vehicles segment is expected to dominate the market during the forecast period

- Geometry Inspection Vehicles are equipped with advanced sensors and measurement devices that precisely assess various parameters, including track alignment, curving, and elevation. These vehicles play a vital role in maintaining track geometry within specified tolerances, which is essential for the safe and efficient operation of rail networks.

- Railway operators increasingly recognize the importance of regular track geometry inspections to prevent issues such as misalignments or uneven tracks that can lead to derailments or operational disruptions. The demand for Geometry Inspection Vehicles is driven by a growing emphasis on rail safety, adherence to stringent regulatory standards, and the need for proactive maintenance strategies.

By Technology, Automated Inspection Vehicles segment held the largest share of xx% in 2022

- Automated Inspection Vehicles leverage advanced technologies such as robotics, artificial intelligence, and sophisticated sensors to conduct precise and efficient inspections of railway tracks. The automation of these vehicles significantly reduces the reliance on manual labor, ensuring consistent and thorough assessments across extensive track lengths.

- Automation improves inspection speed and accuracy, enabling real-time data collection and analysis. Automated Inspection Vehicles, equipped with machine learning algorithms, can navigate tracks and anticipate issues before they escalate. Railway operators prioritize the adoption of these vehicles for optimization and efficiency. Their cost-effectiveness, reliability, and advanced capabilities contribute to the modernization and sustainability of rail networks, driving their dominance in the Track Inspection Vehicles market.

Track Inspection Vehicles Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The Asia Pacific region is expected to dominate the Track Inspection Vehicles market in the forecast period due to economic growth and urbanization in countries like China and India, which are investing heavily in railway infrastructure projects to quarter growing populations and improve transportation efficiency.

- The increasing emphasis on high-speed rail networks and the development of smart cities in the Asia Pacific region further increases the need for advanced track inspection and maintenance solutions. With rapid technological advancements and a commitment to sustainable transportation, governments and railway operators in the region are likely to prioritize the adoption of cutting-edge inspection technologies, contributing to the dominance of the market.

Track Inspection Vehicles Market Top Key Players:

- ENSCO Rail (US)

- RailPod (US)

- VPI Engineering (US)

- BBR Network Laboratories (US)

- Hi-Rail Corporation (US)

- Plasser American (US)

- TrackIQ (Canada)

- Plasser & Theurer (Austria)

- Frauscher Sensortechnik (Austria)

- Vossloh (Germany)

- Cimolai (Italy)

- Geotronics (Italy)

- Pandrol (UK)

- Newtons (UK)

- Peratech (UK)

- Speno International (Switzerland)

- Strukton Rail (Netherlands)

- Inspectronic (France)

- Matisa (Australia)

- China Railway Track Equipment Co., Ltd. (CRTE) (China)

Key Industry Developments in the Track Inspection Vehicles Market:

- In April 2023, ENSCO, Inc., a well-known global innovator in railway inspection technology, acquired KLD Labs, Inc., a leading provider of automated wayside inspection technology and laser profiling solutions worldwide. As a result of this acquisition, KLD will operate as an ENSCO subsidiary, continuing to provide top-tier solutions and services to its customers.

- In June 2023, Plasser & Theurer has introduced ÖBB electric maintenance vehicles as part of a €250 million order. The order includes 29 CatenaryCrafter 15.4 E3 vehicles for overhead electrification, 21 MultiCrafter vehicles for track maintenance, and six TransportUnits for transporting equipment such as tunnel cleaning tools. These vehicles can be powered by either 15 kV, 16·7 Hz overhead lines or onboard batteries.

|

Global Track Inspection Vehicles Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.4 Bn. |

|

Forecast Period 2023-30 CAGR: |

2.80 % |

Market Size in 2030: |

USD 1.75 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- TRACK INSPECTION VEHICLES MARKET BY TYPE (2016-2030)

- TRACK INSPECTION VEHICLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GEOMETRY INSPECTION VEHICLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ULTRASONIC RAIL FLAW DETECTION VEHICLES

- TRACK INSPECTION VEHICLES MARKET BY TECHNOLOGY (2016-2030)

- TRACK INSPECTION VEHICLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MANUAL INSPECTION VEHICLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- AUTOMATED INSPECTION VEHICLES

- TRACK INSPECTION VEHICLES MARKET BY APPLICATION (2016-2030)

- TRACK INSPECTION VEHICLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HIGH-SPEED RAILWAYS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HEAVY-HAUL RAILWAYS

- CONVENTIONAL RAILWAYS

- URBAN TRANSPORT

- TRACK INSPECTION VEHICLES MARKET BY END-USER (2016-2030)

- TRACK INSPECTION VEHICLES MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RAILWAY OPERATORS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONTRACTORS AND SERVICE PROVIDERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Track Inspection Vehicles Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ENSCO RAIL (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- RAILPOD (US)

- VPI ENGINEERING (US)

- BBR NETWORK LABORATORIES (US)

- HI-RAIL CORPORATION (US)

- PLASSER AMERICAN (US)

- TRACKIQ (CANADA)

- PLASSER & THEURER (AUSTRIA)

- FRAUSCHER SENSORTECHNIK (AUSTRIA)

- VOSSLOH (GERMANY)

- CIMOLAI (ITALY)

- GEOTRONICS (ITALY)

- PANDROL (UK)

- NEWTONS (UK)

- PERATECH (UK)

- SPENO INTERNATIONAL (SWITZERLAND)

- STRUKTON RAIL (NETHERLANDS)

- INSPECTRONIC (FRANCE)

- MATISA (AUSTRALIA)

- COMPETITIVE LANDSCAPE

- GLOBAL TRACK INSPECTION VEHICLES MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Track Inspection Vehicles Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.4 Bn. |

|

Forecast Period 2023-30 CAGR: |

2.80 % |

Market Size in 2030: |

USD 1.75 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Technology |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TRACK INSPECTION VEHICLES MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TRACK INSPECTION VEHICLES MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TRACK INSPECTION VEHICLES MARKET COMPETITIVE RIVALRY

TABLE 005. TRACK INSPECTION VEHICLES MARKET THREAT OF NEW ENTRANTS

TABLE 006. TRACK INSPECTION VEHICLES MARKET THREAT OF SUBSTITUTES

TABLE 007. TRACK INSPECTION VEHICLES MARKET BY TYPE

TABLE 008. PORTABLE TRACK INSPECTION VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 009. ORDINARY TRACK INSPECTION VEHICLE MARKET OVERVIEW (2016-2028)

TABLE 010. TRACK INSPECTION VEHICLES MARKET BY APPLICATION

TABLE 011. HIGH-SPEED RAILWAY MARKET OVERVIEW (2016-2028)

TABLE 012. HEAVY HAUL RAILWAY MARKET OVERVIEW (2016-2028)

TABLE 013. CONVENTIONAL RAILWAY MARKET OVERVIEW (2016-2028)

TABLE 014. URBAN TRANSPORT MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA TRACK INSPECTION VEHICLES MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA TRACK INSPECTION VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 017. N TRACK INSPECTION VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE TRACK INSPECTION VEHICLES MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE TRACK INSPECTION VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 020. TRACK INSPECTION VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC TRACK INSPECTION VEHICLES MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC TRACK INSPECTION VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 023. TRACK INSPECTION VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA TRACK INSPECTION VEHICLES MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA TRACK INSPECTION VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 026. TRACK INSPECTION VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA TRACK INSPECTION VEHICLES MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA TRACK INSPECTION VEHICLES MARKET, BY APPLICATION (2016-2028)

TABLE 029. TRACK INSPECTION VEHICLES MARKET, BY COUNTRY (2016-2028)

TABLE 030. AMBERG TECHNOLOGIES: SNAPSHOT

TABLE 031. AMBERG TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 032. AMBERG TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 033. AMBERG TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. ENSCO: SNAPSHOT

TABLE 034. ENSCO: BUSINESS PERFORMANCE

TABLE 035. ENSCO: PRODUCT PORTFOLIO

TABLE 036. ENSCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. TRIMBLE RAILWAY: SNAPSHOT

TABLE 037. TRIMBLE RAILWAY: BUSINESS PERFORMANCE

TABLE 038. TRIMBLE RAILWAY: PRODUCT PORTFOLIO

TABLE 039. TRIMBLE RAILWAY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. MERMEC: SNAPSHOT

TABLE 040. MERMEC: BUSINESS PERFORMANCE

TABLE 041. MERMEC: PRODUCT PORTFOLIO

TABLE 042. MERMEC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. HARSCO RAIL: SNAPSHOT

TABLE 043. HARSCO RAIL: BUSINESS PERFORMANCE

TABLE 044. HARSCO RAIL: PRODUCT PORTFOLIO

TABLE 045. HARSCO RAIL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. NORDCO: SNAPSHOT

TABLE 046. NORDCO: BUSINESS PERFORMANCE

TABLE 047. NORDCO: PRODUCT PORTFOLIO

TABLE 048. NORDCO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. LORAM (GREX): SNAPSHOT

TABLE 049. LORAM (GREX): BUSINESS PERFORMANCE

TABLE 050. LORAM (GREX): PRODUCT PORTFOLIO

TABLE 051. LORAM (GREX): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. FUGRO: SNAPSHOT

TABLE 052. FUGRO: BUSINESS PERFORMANCE

TABLE 053. FUGRO: PRODUCT PORTFOLIO

TABLE 054. FUGRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. MRX TECHNOLOGIES: SNAPSHOT

TABLE 055. MRX TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 056. MRX TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 057. MRX TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. HOLLAND L.P.: SNAPSHOT

TABLE 058. HOLLAND L.P.: BUSINESS PERFORMANCE

TABLE 059. HOLLAND L.P.: PRODUCT PORTFOLIO

TABLE 060. HOLLAND L.P.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TRACK INSPECTION VEHICLES MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TRACK INSPECTION VEHICLES MARKET OVERVIEW BY TYPE

FIGURE 012. PORTABLE TRACK INSPECTION VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 013. ORDINARY TRACK INSPECTION VEHICLE MARKET OVERVIEW (2016-2028)

FIGURE 014. TRACK INSPECTION VEHICLES MARKET OVERVIEW BY APPLICATION

FIGURE 015. HIGH-SPEED RAILWAY MARKET OVERVIEW (2016-2028)

FIGURE 016. HEAVY HAUL RAILWAY MARKET OVERVIEW (2016-2028)

FIGURE 017. CONVENTIONAL RAILWAY MARKET OVERVIEW (2016-2028)

FIGURE 018. URBAN TRANSPORT MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA TRACK INSPECTION VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE TRACK INSPECTION VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC TRACK INSPECTION VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA TRACK INSPECTION VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA TRACK INSPECTION VEHICLES MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Track Inspection Vehicles Market research report is 2023-2030.

ENSCO Rail (US), RailPod (US), VPI Engineering (US), BBR Network Laboratories (US), Hi-Rail Corporation (US), Plasser American (US), TrackIQ (Canada), Plasser & Theurer (Austria), Frauscher Sensortechnik (Austria), Vossloh (Germany), Cimolai (Italy), Geotronics (Italy), Pandrol (UK), Newtons (UK), Peratech (UK), Speno International (Switzerland), Strukton Rail (Netherlands), Inspectronic (France), Matisa (Australia), China Railway Track Equipment Co., Ltd. (CRTE) (China) and Other Major Players.

The Track Inspection Vehicles Market is segmented into Type, Technology, Application, End-User, and region. By Type, the market is categorized into Geometry inspection vehicles, and Ultrasonic Rail Flaw Detection Vehicles. By Technology, the market is categorized into Manual Inspection Vehicles, and Automated Inspection Vehicles. By Application, the market is categorized into High-speed railways, Heavy-haul railways, Conventional railways, and Urban transport. By End-User, the market is categorized into Railway Operators, and Contractors and Service Providers. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Track Inspection Vehicles are specialized railway vehicles designed for assessing and maintaining the condition of railway tracks. Equipped with advanced sensors, these vehicles monitor track geometry, detect flaws, and ensure compliance with safety standards. They play a crucial role in preventive maintenance and identifying potential issues to enhance railway safety and operational efficiency.

Track Inspection Vehicles Market Size Was Valued at USD 1.4 Billion in 2022, and is Projected to Reach USD 1.75 Billion by 2030, Growing at a CAGR of 2.80% From 2023-2030.