Global Recreational Vehicle Market Overview

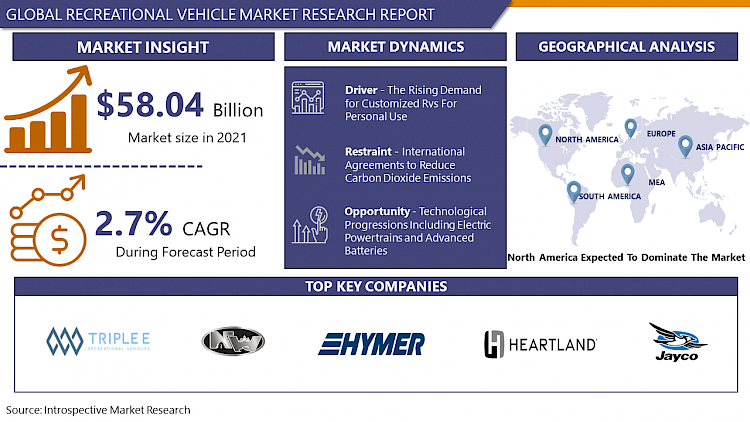

Global Recreational Vehicle Market was valued at USD 58.04 billion in 2021 and is expected to reach USD 69.94 billion by the year 2028, at a CAGR of 2.7%.

A recreational vehicle (RV) is a vehicle that is meant to provide temporary housing and is typically used for camping, seasonal use, pleasure, or travel. The majority of RVs have only one deck, while some customized RVs have two decks. Towable (truck campers, folding camping trailers, and travel trailers) or motorized vehicles are available (motorhomes). Caravans, motorhomes, and campervans, for example, are sometimes referred to as camper trailers and travel trailers, fifth-wheel trailers, popup campers, and truck campers. The growing demand for road trips as a means to get away from cities, the growing number of active campers, and the constantly expanding need for pleasant travel and lodging for big passenger groups are all contributing to the recreational vehicle market's rise. Furthermore, the number of first-time RV buyers is likely to increase during the post-lockdown period. With the growing trend of RV in western countries, the Recreational Vehicle market is expected a boom in the coming years.

Market Dynamics and Factors For Recreational Vehicle:

Drivers

Some consumers use RVs as their main residence owing to their benefits, such as lower insurance and maintenance costs, low fuel consumption, easily towable units, and depreciation value. The RV manufacturers have been concentrating on developing new RVs for particular applications as there are changing demands based on utilization. Therefore, key players have determined how improved attractiveness and luxury with advanced technologies can influence RV buyers. The rising demand for customized RVs for personal use drives the market growth in the coming years.

The increasing demand for adventure camping in the countryside areas. People prefer traveling to the countryside away from the urbanized cities for some relaxation from their daily hectic routine. The companies that design the RVs also provide various technological facilities that help people to stay connected and in contact in case of emergency with their family or friends.

Restraints

This business is hampered by international agreements to reduce carbon dioxide emissions and environmental laws regarding fuel economy. Increased fuel taxes are one of several environmental regulation ideas that are predicted to raise transportation costs and reduce RV demand. Furthermore, hybrid-electric engines can counteract growing environmental rules regarding fuel economy, but commercially viable choices in the RV area are currently unavailable.

Opportunities

Technological progressions including electric powertrains and advanced batteries have boosted the introduction of electric recreational vehicles. The implementation of stringent vehicle emission regulations is leading consumers to switch to hybrid & electric recreational vehicles, increasing their industry share. The integration of progressive technologies, such as collision mitigation systems and driver assistance, into motorhomes, will improve pedestrian and passenger safety, surging the market revenue. As vehicles go electric, the RV market has an optimistic opportunity to electrify the segment which can solve many hurdles in the challenges mainly clean carbon emission-free vehicles.

Challenges

Government regulations and restriction is the main challenge for the recreational market. Certain restrictions that are imposed by the governments of different countries are hindering the growth of this market. Strict Government regulations such as the dimensions and specifications of the vehicles based on the vehicle type, the type of electrical installation used inside the vehicle, weight of the vehicle after including the amenities inside these vehicles, and other reasons are expected to shrink the market. Many countries imposed strict carbon emission regulations on recreational vehicles and diesel engine norms which led to a series of modifications in motorhome vehicles. Therefore, to capture large geographical territory, manufacturers need to comply with regulations accordingly.

Market Segmentation

By Type, the Motorhome segment is dominating the recreational vehicles market. In 2020, the motorhome category accounted for a significant portion of the market. Due to the increased desire for a pleasant travel and superior accommodations, it is expected to be the fastest-growing industry in the next years. Furthermore, the rising popularity of leisure travel in motorhomes is reflected in the expanding number of campgrounds across the world. Furthermore, these vehicles are widely utilized in North America and Europe for a variety of purposes, including holiday travel, business travel, pet travel, tailgating, and as a preferred form of transportation for outdoor sports and other leisure activities. Also, modern RVs include advantages such as increased interior space and services such as a bathroom, sink, kitchen, and bedrooms, which are expected to boost market expansion.

By Class, Class B is dominating the recreational vehicle market. Motorhomes in the Class B category are compact, sleek, and ready to go. Class B motorhomes are more maneuverable and fuel-efficient than Class C motorhomes, and they provide living space that is best suited for small parties. Although most Class B motorhomes lack slide-outs, they nevertheless provide comfortable features such as galley kitchens, bedrooms, and bathrooms. The Class B's sleek, modern design makes the most of every square inch of inside space to cram a lot of goodies into a little space, making it excellent for narrow streets and busy streets, as well as being easy to maneuver, park, and turn around. It's also simple to squeeze into a garage or public parking spot. Tellaro Class B Van, Interstate 19, and Tranquility Mercedes Sprinter are some of the preferred recreational class B vans in the market. Such features put Class B as leading in the segment and expected to be dominating the market.

By Application, the Commercial segment is dominating the recreational vehicle market. Commercial RVs are gaining momentum due to the booming tourism sector throughout the world, and the commercial category is predicted to grow at the quickest rate in the market from 2021 to 2028. RVs are generally used for camping by locals and visitors. Camping has become the most popular outdoor leisure activity among visitors who want a small living space with a variety of excellent amenities. The commercial segment is also including the rental market which makes major contributions to market value. With growing rental service providers in Europe and North America, commercial RVs capture a larger share in the segment.

Players Covered in Recreational Vehicle market are :

- ADRIA MOBIL d.o.o

- Airstream; Chausson

- Coachmen RV a Division of Forest River Inc

- Erwin Hymer Group

- Forest River Inc

- Heartland Recreational Vehicles LLC

- Hobby-Wohnwagenwerk Ing. Harald Striewski GmbH

- Hymer GmbH & Co. KG

- Jayco Inc

- K-Z Inc

- Lunar Caravans

- Nexus RV

- Niesmann + Bischoff GmbH

- Northwood Manufacturing

- Palomino RV

- Pilote

- Pleasure-Way Industries Ltd

- REV Group Inc

- Starcraft RV Inc

- Swift Group

- Thor Industries Inc

- Tiffin Motorhomes Inc

- Trigano SA

- Triple E Recreational Vehicles

- Westfalen Mobil GmbH

- Winnebago Industries Inc and other major players.

Regional Analysis of Recreational Vehicle Market

In 2020, North America, led by the United States, dominated the industry, bringing in USD 23.65 billion in sales. The region's dominance is due to its tremendous popularity among Americans and the region's sustained significant development in outdoor leisure activities. Camping activities make up about a third of all outdoor activities, mostly in Canada and the United States. This element contributes to the region's increased demand for these automobiles. Additionally, the emergence of campgrounds with diverse amenities, such as hiking, white-water rafting, and fishing, as well as natural stunning landscapes, is creating market potential. Luxury RV resorts provide specialized amenities including gourmet restaurants, health spas, tennis courts, and golf courses, all of which help to boost area market sales.

Europe is the second-largest market for recreational vehicles. The majority of European countries have strong caravans and recreational vehicles culture and it is strongly followed by local and tourists. Europe has some of the scenic routes for traveling and road trips which can be from 3-10 days long. To travel to such an extent, many of the tourists prefer economy and luxury recreational vehicles. Some of the famous routes for caravanning includes Switzerland-France-Italy, Bergen to Norway, Costiera Amalfitana, Italy, Trans Romania, FurkaPass / Central Swiss Alps, Col de la Bonnette / Alps Maritimes and Grossglockner Hohenalpenstrasse, Austria. The rental companies provide recreational vehicles at a fair price with extensive service. Therefore, Europe possesses high potential for the growth of the recreational vehicle market.

Over the projection period, Asia Pacific is predicted to be the fastest-growing market. The Asia Pacific market is being driven by rapid expansion in the tourist sector, outdoor recreational activities, and disposable income. Many countries in the Asia Pacific are being liberal about regulating caravanning and regulative measures to promote recreational vehicles in the market.

Key Developments of Recreational Vehicle Market

- March 2021 – Lazydays Holdings, Inc. acquired Chilhowee RV Center Lazydays Holdings, Inc. acquired Chilhowee RV Center, a premier RV dealership located in Tennessee. This acquisition helps Lazydays Holdings, Inc. to expand its product offerings and footprint in the Eastern Tennessee market.

- December 2020 – Thor Industries, Inc. Acquired luxury RV manufacturer Tiffin Motor Homes, Inc. Thor Industries, Inc. acquired Tiffin Motor Homes, Inc., a premium manufacturer of luxury RVs. This transaction is consistent with THOR's long-term strategic growth plan of both its top and bottom lines.

Covid19 Impact on Recreational Vehicle Market

The COVID-19 epidemic has wreaked havoc on every industrial sector, including automotive and recreational vehicle makers. The COVID-19 pandemic had a huge influence on the global tourism sector in 2020. As a result, this circumstance has stymied the market's sales of these automobiles. Nonetheless, the market's gradual recovery and end-user preference for campervans over hotels may spur market expansion throughout the projection period. Many working professionals with higher disposable income moved to buying or renting recreational vehicles to work from remote places and being able to travel during a pandemic. The recreational vehicle market has experienced a momentarily boost in sales during such a period. With the lockdown mandates is being lifted off by countries. the market is expected to be propelled by the increasing proliferation of rental RV services in emerging nations.

|

Global Recreational Vehicle Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 58.04 Bn. |

|

Forecast Period 2022-28 CAGR: |

2.7% |

Market Size in 2028: |

USD 69.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Class |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Class

3.3 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Recreational Vehicle Market by Type

5.1 Recreational Vehicle Market Overview Snapshot and Growth Engine

5.2 Recreational Vehicle Market Overview

5.3 Towable RVs

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Towable RVs: Grographic Segmentation

5.4 Motorhomes

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Motorhomes: Grographic Segmentation

Chapter 6: Recreational Vehicle Market by Class

6.1 Recreational Vehicle Market Overview Snapshot and Growth Engine

6.2 Recreational Vehicle Market Overview

6.3 Class A

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Class A: Grographic Segmentation

6.4 Class B

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Class B: Grographic Segmentation

6.5 Class C

6.5.1 Introduction and Market Overview

6.5.2 Historic and Forecasted Market Size (2016-2028F)

6.5.3 Key Market Trends, Growth Factors and Opportunities

6.5.4 Class C: Grographic Segmentation

Chapter 7: Recreational Vehicle Market by Application

7.1 Recreational Vehicle Market Overview Snapshot and Growth Engine

7.2 Recreational Vehicle Market Overview

7.3 Domestic

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2016-2028F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Domestic: Grographic Segmentation

7.4 Commercial

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2016-2028F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Commercial: Grographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Recreational Vehicle Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Ansoff Matrix

8.1.5 Recreational Vehicle Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Recreational Vehicle Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 ADRIA MOBIL D.O.O

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 AIRSTREAM

8.4 CHAUSSON

8.5 COACHMEN RV A DIVISION OF FOREST RIVER INC.

8.6 ERWIN HYMER GROUP

8.7 FOREST RIVER INC.

8.8 HEARTLAND RECREATIONAL VEHICLES LLC

8.9 HOBBY-WOHNWAGENWERK ING. HARALD STRIEWSKI GMBH

8.10 HYMER GMBH & CO. KG

8.11 JAYCO INC.

8.12 K-Z INC

8.13 LUNAR CARAVANS

8.14 NEXUS RV

8.15 NIESMANN + BISCHOFF GMBH

8.16 NORTHWOOD MANUFACTURING

8.17 PALOMINO RV

8.18 PILOTE

8.19 PLEASURE-WAY INDUSTRIES LTD

8.20 REV GROUP INC.

8.21 STARCRAFT RV INC.

8.22 SWIFT GROUP

8.23 THOR INDUSTRIES INC.

8.24 TIFFIN MOTORHOMES INC.

8.25 TRIGANO SA

8.26 TRIPLE E RECREATIONAL VEHICLES

8.27 WESTFALEN MOBIL GMBH

8.28 WINNEBAGO INDUSTRIES INC.

8.29 OTHER MAJOR PLAYERS

Chapter 9: Global Recreational Vehicle Market Analysis, Insights and Forecast, 2016-2028

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Towable RVs

9.2.2 Motorhomes

9.3 Historic and Forecasted Market Size By Class

9.3.1 Class A

9.3.2 Class B

9.3.3 Class C

9.4 Historic and Forecasted Market Size By Application

9.4.1 Domestic

9.4.2 Commercial

Chapter 10: North America Recreational Vehicle Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Towable RVs

10.4.2 Motorhomes

10.5 Historic and Forecasted Market Size By Class

10.5.1 Class A

10.5.2 Class B

10.5.3 Class C

10.6 Historic and Forecasted Market Size By Application

10.6.1 Domestic

10.6.2 Commercial

10.7 Historic and Forecast Market Size by Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Europe Recreational Vehicle Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Towable RVs

11.4.2 Motorhomes

11.5 Historic and Forecasted Market Size By Class

11.5.1 Class A

11.5.2 Class B

11.5.3 Class C

11.6 Historic and Forecasted Market Size By Application

11.6.1 Domestic

11.6.2 Commercial

11.7 Historic and Forecast Market Size by Country

11.7.1 Germany

11.7.2 U.K.

11.7.3 France

11.7.4 Italy

11.7.5 Russia

11.7.6 Spain

11.7.7 Rest of Europe

Chapter 12: Asia-Pacific Recreational Vehicle Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Towable RVs

12.4.2 Motorhomes

12.5 Historic and Forecasted Market Size By Class

12.5.1 Class A

12.5.2 Class B

12.5.3 Class C

12.6 Historic and Forecasted Market Size By Application

12.6.1 Domestic

12.6.2 Commercial

12.7 Historic and Forecast Market Size by Country

12.7.1 China

12.7.2 India

12.7.3 Japan

12.7.4 Singapore

12.7.5 Australia

12.7.6 New Zealand

12.7.7 Rest of APAC

Chapter 13: Middle East & Africa Recreational Vehicle Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Towable RVs

13.4.2 Motorhomes

13.5 Historic and Forecasted Market Size By Class

13.5.1 Class A

13.5.2 Class B

13.5.3 Class C

13.6 Historic and Forecasted Market Size By Application

13.6.1 Domestic

13.6.2 Commercial

13.7 Historic and Forecast Market Size by Country

13.7.1 Turkey

13.7.2 Saudi Arabia

13.7.3 Iran

13.7.4 UAE

13.7.5 Africa

13.7.6 Rest of MEA

Chapter 14: South America Recreational Vehicle Market Analysis, Insights and Forecast, 2016-2028

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Towable RVs

14.4.2 Motorhomes

14.5 Historic and Forecasted Market Size By Class

14.5.1 Class A

14.5.2 Class B

14.5.3 Class C

14.6 Historic and Forecasted Market Size By Application

14.6.1 Domestic

14.6.2 Commercial

14.7 Historic and Forecast Market Size by Country

14.7.1 Brazil

14.7.2 Argentina

14.7.3 Rest of SA

Chapter 15 Investment Analysis

Chapter 16 Analyst Viewpoint and Conclusion

|

Global Recreational Vehicle Market |

|||

|

Base Year: |

2021 |

Forecast Period: |

2022-2028 |

|

Historical Data: |

2016 to 2020 |

Market Size in 2021: |

USD 58.04 Bn. |

|

Forecast Period 2022-28 CAGR: |

2.7% |

Market Size in 2028: |

USD 69.94 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Class |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. RECREATIONAL VEHICLE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. RECREATIONAL VEHICLE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. RECREATIONAL VEHICLE MARKET COMPETITIVE RIVALRY

TABLE 005. RECREATIONAL VEHICLE MARKET THREAT OF NEW ENTRANTS

TABLE 006. RECREATIONAL VEHICLE MARKET THREAT OF SUBSTITUTES

TABLE 007. RECREATIONAL VEHICLE MARKET BY TYPE

TABLE 008. TOWABLE RVS MARKET OVERVIEW (2016-2028)

TABLE 009. MOTORHOMES MARKET OVERVIEW (2016-2028)

TABLE 010. RECREATIONAL VEHICLE MARKET BY CLASS

TABLE 011. CLASS A MARKET OVERVIEW (2016-2028)

TABLE 012. CLASS B MARKET OVERVIEW (2016-2028)

TABLE 013. CLASS C MARKET OVERVIEW (2016-2028)

TABLE 014. RECREATIONAL VEHICLE MARKET BY APPLICATION

TABLE 015. DOMESTIC MARKET OVERVIEW (2016-2028)

TABLE 016. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA RECREATIONAL VEHICLE MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA RECREATIONAL VEHICLE MARKET, BY CLASS (2016-2028)

TABLE 019. NORTH AMERICA RECREATIONAL VEHICLE MARKET, BY APPLICATION (2016-2028)

TABLE 020. N RECREATIONAL VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE RECREATIONAL VEHICLE MARKET, BY TYPE (2016-2028)

TABLE 022. EUROPE RECREATIONAL VEHICLE MARKET, BY CLASS (2016-2028)

TABLE 023. EUROPE RECREATIONAL VEHICLE MARKET, BY APPLICATION (2016-2028)

TABLE 024. RECREATIONAL VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC RECREATIONAL VEHICLE MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC RECREATIONAL VEHICLE MARKET, BY CLASS (2016-2028)

TABLE 027. ASIA PACIFIC RECREATIONAL VEHICLE MARKET, BY APPLICATION (2016-2028)

TABLE 028. RECREATIONAL VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA RECREATIONAL VEHICLE MARKET, BY TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA RECREATIONAL VEHICLE MARKET, BY CLASS (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA RECREATIONAL VEHICLE MARKET, BY APPLICATION (2016-2028)

TABLE 032. RECREATIONAL VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA RECREATIONAL VEHICLE MARKET, BY TYPE (2016-2028)

TABLE 034. SOUTH AMERICA RECREATIONAL VEHICLE MARKET, BY CLASS (2016-2028)

TABLE 035. SOUTH AMERICA RECREATIONAL VEHICLE MARKET, BY APPLICATION (2016-2028)

TABLE 036. RECREATIONAL VEHICLE MARKET, BY COUNTRY (2016-2028)

TABLE 037. ADRIA MOBIL D.O.O: SNAPSHOT

TABLE 038. ADRIA MOBIL D.O.O: BUSINESS PERFORMANCE

TABLE 039. ADRIA MOBIL D.O.O: PRODUCT PORTFOLIO

TABLE 040. ADRIA MOBIL D.O.O: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. AIRSTREAM: SNAPSHOT

TABLE 041. AIRSTREAM: BUSINESS PERFORMANCE

TABLE 042. AIRSTREAM: PRODUCT PORTFOLIO

TABLE 043. AIRSTREAM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. CHAUSSON: SNAPSHOT

TABLE 044. CHAUSSON: BUSINESS PERFORMANCE

TABLE 045. CHAUSSON: PRODUCT PORTFOLIO

TABLE 046. CHAUSSON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. COACHMEN RV A DIVISION OF FOREST RIVER INC.: SNAPSHOT

TABLE 047. COACHMEN RV A DIVISION OF FOREST RIVER INC.: BUSINESS PERFORMANCE

TABLE 048. COACHMEN RV A DIVISION OF FOREST RIVER INC.: PRODUCT PORTFOLIO

TABLE 049. COACHMEN RV A DIVISION OF FOREST RIVER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. ERWIN HYMER GROUP: SNAPSHOT

TABLE 050. ERWIN HYMER GROUP: BUSINESS PERFORMANCE

TABLE 051. ERWIN HYMER GROUP: PRODUCT PORTFOLIO

TABLE 052. ERWIN HYMER GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. FOREST RIVER INC.: SNAPSHOT

TABLE 053. FOREST RIVER INC.: BUSINESS PERFORMANCE

TABLE 054. FOREST RIVER INC.: PRODUCT PORTFOLIO

TABLE 055. FOREST RIVER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. HEARTLAND RECREATIONAL VEHICLES LLC: SNAPSHOT

TABLE 056. HEARTLAND RECREATIONAL VEHICLES LLC: BUSINESS PERFORMANCE

TABLE 057. HEARTLAND RECREATIONAL VEHICLES LLC: PRODUCT PORTFOLIO

TABLE 058. HEARTLAND RECREATIONAL VEHICLES LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. HOBBY-WOHNWAGENWERK ING. HARALD STRIEWSKI GMBH: SNAPSHOT

TABLE 059. HOBBY-WOHNWAGENWERK ING. HARALD STRIEWSKI GMBH: BUSINESS PERFORMANCE

TABLE 060. HOBBY-WOHNWAGENWERK ING. HARALD STRIEWSKI GMBH: PRODUCT PORTFOLIO

TABLE 061. HOBBY-WOHNWAGENWERK ING. HARALD STRIEWSKI GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. HYMER GMBH & CO. KG: SNAPSHOT

TABLE 062. HYMER GMBH & CO. KG: BUSINESS PERFORMANCE

TABLE 063. HYMER GMBH & CO. KG: PRODUCT PORTFOLIO

TABLE 064. HYMER GMBH & CO. KG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. JAYCO INC.: SNAPSHOT

TABLE 065. JAYCO INC.: BUSINESS PERFORMANCE

TABLE 066. JAYCO INC.: PRODUCT PORTFOLIO

TABLE 067. JAYCO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. K-Z INC: SNAPSHOT

TABLE 068. K-Z INC: BUSINESS PERFORMANCE

TABLE 069. K-Z INC: PRODUCT PORTFOLIO

TABLE 070. K-Z INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. LUNAR CARAVANS: SNAPSHOT

TABLE 071. LUNAR CARAVANS: BUSINESS PERFORMANCE

TABLE 072. LUNAR CARAVANS: PRODUCT PORTFOLIO

TABLE 073. LUNAR CARAVANS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. NEXUS RV: SNAPSHOT

TABLE 074. NEXUS RV: BUSINESS PERFORMANCE

TABLE 075. NEXUS RV: PRODUCT PORTFOLIO

TABLE 076. NEXUS RV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. NIESMANN + BISCHOFF GMBH: SNAPSHOT

TABLE 077. NIESMANN + BISCHOFF GMBH: BUSINESS PERFORMANCE

TABLE 078. NIESMANN + BISCHOFF GMBH: PRODUCT PORTFOLIO

TABLE 079. NIESMANN + BISCHOFF GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. NORTHWOOD MANUFACTURING: SNAPSHOT

TABLE 080. NORTHWOOD MANUFACTURING: BUSINESS PERFORMANCE

TABLE 081. NORTHWOOD MANUFACTURING: PRODUCT PORTFOLIO

TABLE 082. NORTHWOOD MANUFACTURING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. PALOMINO RV: SNAPSHOT

TABLE 083. PALOMINO RV: BUSINESS PERFORMANCE

TABLE 084. PALOMINO RV: PRODUCT PORTFOLIO

TABLE 085. PALOMINO RV: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. PILOTE: SNAPSHOT

TABLE 086. PILOTE: BUSINESS PERFORMANCE

TABLE 087. PILOTE: PRODUCT PORTFOLIO

TABLE 088. PILOTE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. PLEASURE-WAY INDUSTRIES LTD: SNAPSHOT

TABLE 089. PLEASURE-WAY INDUSTRIES LTD: BUSINESS PERFORMANCE

TABLE 090. PLEASURE-WAY INDUSTRIES LTD: PRODUCT PORTFOLIO

TABLE 091. PLEASURE-WAY INDUSTRIES LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. REV GROUP INC.: SNAPSHOT

TABLE 092. REV GROUP INC.: BUSINESS PERFORMANCE

TABLE 093. REV GROUP INC.: PRODUCT PORTFOLIO

TABLE 094. REV GROUP INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. STARCRAFT RV INC.: SNAPSHOT

TABLE 095. STARCRAFT RV INC.: BUSINESS PERFORMANCE

TABLE 096. STARCRAFT RV INC.: PRODUCT PORTFOLIO

TABLE 097. STARCRAFT RV INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. SWIFT GROUP: SNAPSHOT

TABLE 098. SWIFT GROUP: BUSINESS PERFORMANCE

TABLE 099. SWIFT GROUP: PRODUCT PORTFOLIO

TABLE 100. SWIFT GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. THOR INDUSTRIES INC.: SNAPSHOT

TABLE 101. THOR INDUSTRIES INC.: BUSINESS PERFORMANCE

TABLE 102. THOR INDUSTRIES INC.: PRODUCT PORTFOLIO

TABLE 103. THOR INDUSTRIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. TIFFIN MOTORHOMES INC.: SNAPSHOT

TABLE 104. TIFFIN MOTORHOMES INC.: BUSINESS PERFORMANCE

TABLE 105. TIFFIN MOTORHOMES INC.: PRODUCT PORTFOLIO

TABLE 106. TIFFIN MOTORHOMES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. TRIGANO SA: SNAPSHOT

TABLE 107. TRIGANO SA: BUSINESS PERFORMANCE

TABLE 108. TRIGANO SA: PRODUCT PORTFOLIO

TABLE 109. TRIGANO SA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. TRIPLE E RECREATIONAL VEHICLES: SNAPSHOT

TABLE 110. TRIPLE E RECREATIONAL VEHICLES: BUSINESS PERFORMANCE

TABLE 111. TRIPLE E RECREATIONAL VEHICLES: PRODUCT PORTFOLIO

TABLE 112. TRIPLE E RECREATIONAL VEHICLES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112. WESTFALEN MOBIL GMBH: SNAPSHOT

TABLE 113. WESTFALEN MOBIL GMBH: BUSINESS PERFORMANCE

TABLE 114. WESTFALEN MOBIL GMBH: PRODUCT PORTFOLIO

TABLE 115. WESTFALEN MOBIL GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115. WINNEBAGO INDUSTRIES INC.: SNAPSHOT

TABLE 116. WINNEBAGO INDUSTRIES INC.: BUSINESS PERFORMANCE

TABLE 117. WINNEBAGO INDUSTRIES INC.: PRODUCT PORTFOLIO

TABLE 118. WINNEBAGO INDUSTRIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 119. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 120. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 121. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. RECREATIONAL VEHICLE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. RECREATIONAL VEHICLE MARKET OVERVIEW BY TYPE

FIGURE 012. TOWABLE RVS MARKET OVERVIEW (2016-2028)

FIGURE 013. MOTORHOMES MARKET OVERVIEW (2016-2028)

FIGURE 014. RECREATIONAL VEHICLE MARKET OVERVIEW BY CLASS

FIGURE 015. CLASS A MARKET OVERVIEW (2016-2028)

FIGURE 016. CLASS B MARKET OVERVIEW (2016-2028)

FIGURE 017. CLASS C MARKET OVERVIEW (2016-2028)

FIGURE 018. RECREATIONAL VEHICLE MARKET OVERVIEW BY APPLICATION

FIGURE 019. DOMESTIC MARKET OVERVIEW (2016-2028)

FIGURE 020. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA RECREATIONAL VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE RECREATIONAL VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC RECREATIONAL VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA RECREATIONAL VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA RECREATIONAL VEHICLE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Recreational Vehicle Market research report is 2022-2028.

ADRIA MOBIL d.o.o, Airstream; Chausson, Coachmen RV a Division of Forest River Inc, Erwin Hymer Group, Forest River Inc, Heartland Recreational Vehicles LLC, Hobby-Wohnwagenwerk Ing. Harald Striewski GmbH, Jayco Inc, K-Z Inc, Lunar Caravans, Nexus RV, Niesmann + Bischoff GmbH, Northwood Manufacturing, Palomino RV, Pilote, Pleasure-Way Industries Ltd, REV Group Inc, Starcraft RV Inc, Swift Group, Thor Industries Inc, Tiffin Motorhomes Inc, T rigano SA, Triple E Recreational Vehicles, Westfalen Mobil GmbH, Winnebago Industries Inc., and other major players.

The Recreational Vehicle Market is segmented into Type, Class, Application, and region. By Type, the market is categorized into Towable RVs and Motorhomes. By Class, the market is categorized into Class A, Class B, and Class C. By Application, the market is categorized into Domestic and Commercial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A recreational vehicle (RV) is a vehicle that is meant to provide temporary housing and is typically used for camping, seasonal use, pleasure, or travel.

The Recreational Vehicle Market was valued at USD 58.04 Billion in 2021 and is projected to reach USD 69.94 Billion by 2028, growing at a CAGR of 2.7% from 2022 to 2028.