Textile Market Synopsis

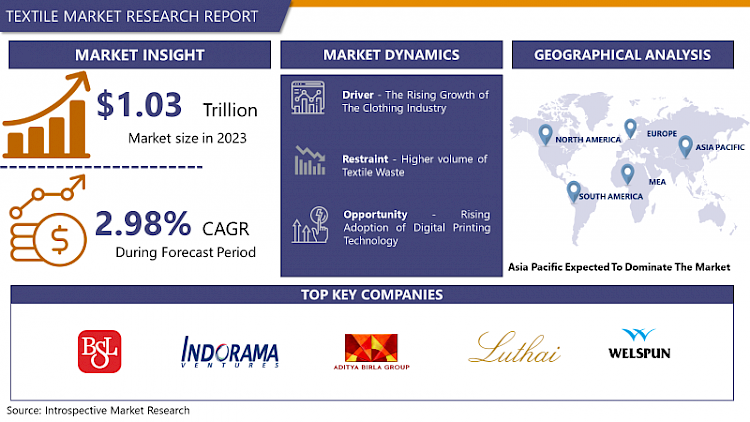

The global market for Textile estimated at USD 1.03 trillion in the year 2023, is anticipated to reach a revised size of USD 1.34 trillion by 2032, growing at a CAGR of 2.98% over the period 2024-2032.

The textile industry is an industry that involves the sections like research, design, development, manufacturing and distribution of textiles, fabrics, and clothing. The textile market is a vast and dynamic industry that encompasses the production, distribution, and sale of textiles, fabrics, and related products.

Textiles (textiles, textile materials) are not only daily necessities but also basic materials or accessories that other industries need to use in some capacity. They are also one of the manifestations of history and culture. The textile industry is a light industry that contributes to people's livelihood.

The textile industry has a very broad scope. According to the combination of raw materials, processes, products, management, and information, it is estimated that there are more than 15,000 textile-related industries. According to key processes and products, the entire textile industry can be divided into six groups: the textile fiber industry, the textile yarn industry, the textile fabric and nonwoven industry, the textile dyeing, printing, and finishing industry, and the textile final product industry.

Depending on the type and characteristics of textile fibers, each has its own unique production method. For example, cotton needs to be rolled to remove cotton seeds, silkworm cocoons need to be selected, wool needs to be washed to remove sand and grease, and linen needs to be processed. Degumming, etc., can proceed to the next spinning process.

The Above Graph Shows the Share in world exports of the leading clothing exporters in 2021 where, China has reported highest number in export than other countries.

The Textile Market Trend Analysis

The Rising Growth of the Clothing Industry

- The expansion and development of the textile market have been significantly fuelled by the clothing industry's rising growth. One of the biggest and most important subsectors within the textile market is the clothing industry, also referred to as the apparel or fashion industry. Changing fashion trends, consumer preferences, and population growth all contribute to the demand for clothing, which in turn drives the demand for textiles and fabrics used in the manufacture of clothing.

- The clothing industry is highly responsive to changing fashion trends and consumer demands. As consumers seek new styles and designs, clothing manufacturers and retailers require a steady supply of innovative and diverse textiles to create trendy and appealing garments.

- As the world's population continues to grow, so too does the demand for clothing. Because of the rising demand for clothing due to an expanding global population, there is an increase in the demand for textiles and fabrics. The clothing industry has undergone a revolution thanks to fast fashion, which has resulted in short production cycles and frequent updates to fashion collections. Textile producers must deliver fabrics quickly and effectively if they want to keep up with the fast-moving fashion industry.

- The clothing industry experiences seasonal peaks during holidays and special occasions, such as festivals and vacations. These seasonal sales spur higher demand for clothing, which, in turn, drives the need for increased textile production.

Rising Adoption of Digital Printing Technology

- The rising adoption of digital printing technology presents significant opportunities for the textile market, revolutionizing the way fabrics are designed, produced, and consumed. Digital printing has emerged as a game-changer in the textile industry, offering several advantages over traditional printing methods.

- Precision-based intricate and detailed designs are possible with digital printing. Customers can choose from a variety of customization options thanks to the ease with which designers and manufacturers can produce distinctive patterns, colors, and textures. This design adaptability creates new market niches and draws clients looking for unique and expensive textiles.

- Digital printing speeds up and improves efficiency by doing away with the need for expensive and time-consuming screen preparation. As a result, textile businesses can react quickly to shifting consumer preferences and fashion trends, shortening the time it takes to market fresh collections and designs.

- Digital printing technology can be integrated with other technologies, such as data-driven designs, augmented reality (AR), and wearable tech. This integration enhances product offerings and opens up possibilities for interactive and smart textiles.

Segmentation Analysis of the Textile Market

Textile market segments cover the Raw Material, Product, and Application, By Raw Material, the cotton segment is Anticipated to Dominate the Market Over the Forecast period.

- Cotton enjoys widespread consumer acceptance and demand, with many individuals preferring cotton clothing and textiles for everyday use due to its comfortless. This strong demand drives the need for continuous cotton production and processing in the textile market.

- Cotton is a natural fiber and biodegradable, aligning with sustainability trends and environmentally conscious consumer preferences. Its biodegradability helps reduce the environmental impact of textile waste, and hence is the main reason for use widely in the textile industry.

- The cotton market segment supports a significant number of jobs across its supply chain, from cotton farmers to textile manufacturers and retailers. It plays a vital role in the economic development of countries involved in cotton production. Cotton textiles are generally affordable and cost-effective for consumers, making them accessible to a wide range of income groups. The cost-effectiveness of cotton contributes to its popularity in the textile market.

Regional Analysis of the Textile Market

Asia Pacific is Expected to Dominate the Market Over the Forecast Period.

- Asia Pacific is dominating the textile market on a global scale, playing a pivotal role in the production, consumption, and export of textiles and textile products. This region encompasses diverse countries with varied strengths and capabilities, collectively contributing to the textile industry's dominance.

- Asia Pacific is home to some of the world's largest textile-manufacturing countries, including China, India, Bangladesh, Vietnam, Pakistan, and Indonesia. These nations have established themselves as major players in the industry, boasting significant production capacities and extensive supply chains.

- The area enjoys access to a sizable pool of skilled and reasonably priced labor, which gives it a significant competitive advantage in the production of textiles. The availability of inexpensive labor enables producers to keep the prices of a variety of textile products competitive.

- The Asia Pacific region has easy access to a variety of synthetic fibers, cotton, silk, jute, and other abundant raw materials. The production of a wide variety of textiles that serve various market segments is made possible by the accessibility of a variety of raw materials.

COVID-19 Impact Analysis on Textile Market

The COVID-19 pandemic has had a significant impact on the textile market, causing disruptions in production, supply chains, and consumer demand. The textile industry, which includes apparel, home textiles, technical textiles, and more, faced numerous challenges as countries implemented lockdowns and social distancing measures to curb the spread of the virus. Due to temporary closures and restrictions, manufacturing facilities and logistics experienced the pandemic, which caused disruptions in the world supply chain.

This had an impact on the availability of fabric, raw materials, and other inputs for the textile industry. Consumer spending on non-essential items like clothing and home textiles decreased as a result of the general economic unrest and job losses. Many consumers gave priority to buying necessities, which resulted in a decline in the demand for textile goods. Consumer preferences for practical clothing like loungewear and athleisure changed as a result of the pandemic. As a result, less formal and fashionable clothing was purchased, which had an effect on the textile industry.

Top Key Players Covered in the Textile Market

- BSL Limited (India)

- Shandong Ruyi Technology Group Co., Ltd. (China)

- Indorama Ventures Public Company Limited (Thailand)

- Aditya Birla Group (India)

- Luthai Textile Co., Ltd. (China)

- Welspun India Ltd. (India)

- Lenzing AG (Austria)

- ALBIS PLASTIC GmbH (Germany)

- Grasim Industries Limited (India)

- Toray Industries, Inc. (Japan)

- Teijin Limited (Japan)

- Milliken & Company(USA)

- Fibre2Fashion Pvt. Ltd. (India) and Other Major Players

Key Industry Developments in the Textile Market

- In December 2023, RSWM announced the acquisition of Ginni Filaments, an India-based producer of combed cotton & open-end yarns. This acquisition will help RSWN to enhance its productivity and product diversity to cater to its premium customers.

- In May 2023, Aditya Birla Fashion and Retail (ABFRL) entered into definitive agreements to acquire TCNS Clothing, the owner of ethnic brands, including W, Aurelia, Wishful, Folksong, and Elleven.

- In August 2019, Bombay Dyeing announced to open 100 new franchise stores to propel its expansion and growth of its business.

- In August 2017, Jeans giant Levi’s has collaborated with EVRNU to come up with eco-friendly jeans into the market.

|

Global Textile Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.03 Trn. |

|

Forecast Period 2024-32 CAGR: |

2.98% |

Market Size in 2032: |

USD 1.34 Trn. |

|

Segments Covered: |

By Raw Material |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power of Supplier

- Threat of New Entrants

- Threat of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact on The Overall Market

- Impact on The Supply Chain

- Impact on The Key Manufacturers

- Impact on The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- TEXTILE MARKET BY RAW MATERIAL (2016-2030)

- TEXTILE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- WOOL

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017 – 2032F)

- Historic and Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- CHEMICAL

- SILK

- TEXTILE MARKET BY PRODUCT (2016-2030)

- TEXTILE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NATURAL FIBERS

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017 – 2032F)

- Historic and Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- POLYESTER

- TEXTILE MARKET BY APPLICATION (2016-2030)

- TEXTILE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOUSEHOLD

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2017 – 2032F)

- Historic and Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- FASHION & CLOTHING

- TECHNICAL

- OTHERS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- TEXTILE Market Share by Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BSL LIMITED (INDIA)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves and Recent Developments

- SWOT Analysis

- SHANDONG RUYI TECHNOLOGY GROUP CO., LTD. (CHINA)

- INDORAMA VENTURES PUBLIC COMPANY LIMITED (THAILAND)

- ADITYA BIRLA GROUP (INDIA)

- LUTHAI TEXTILE CO., LTD. (CHINA)

- WELSPUN INDIA LTD. (INDIA)

- LENZING AG (AUSTRIA)

- ALBIS PLASTIC GMBH (GERMANY)

- GRASIM INDUSTRIES LIMITED (INDIA)

- TORAY INDUSTRIES, INC. (JAPAN)

- TEIJIN LIMITED (JAPAN)

- MILLIKEN & COMPANY (USA)

- FIBRE2FASHION PVT. LTD. (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL TEXTILE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors and Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic and Forecasted Market Size By RAW MATERIAL

- Historic and Forecasted Market Size By PRODUCT

- Historic and Forecasted Market Size By APPLICATION

- Historic and Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Textile Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 1.03 Trn. |

|

Forecast Period 2024-32 CAGR: |

2.98% |

Market Size in 2032: |

USD 1.34 Trn. |

|

Segments Covered: |

By Raw Material |

|

|

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. TEXTILE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. TEXTILE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. TEXTILE MARKET COMPETITIVE RIVALRY

TABLE 005. TEXTILE MARKET THREAT OF NEW ENTRANTS

TABLE 006. TEXTILE MARKET THREAT OF SUBSTITUTES

TABLE 007. TEXTILE MARKET BY RAW MATERIAL

TABLE 008. WOOL MARKET OVERVIEW (2016-2030)

TABLE 009. CHEMICAL MARKET OVERVIEW (2016-2030)

TABLE 010. SILK MARKET OVERVIEW (2016-2030)

TABLE 011. TEXTILE MARKET BY PRODUCT

TABLE 012. NATURAL FIBERS MARKET OVERVIEW (2016-2030)

TABLE 013. POLYESTER MARKET OVERVIEW (2016-2030)

TABLE 014. TEXTILE MARKET BY APPLICATION

TABLE 015. HOUSEHOLD MARKET OVERVIEW (2016-2030)

TABLE 016. FASHION & CLOTHING MARKET OVERVIEW (2016-2030)

TABLE 017. TECHNICAL MARKET OVERVIEW (2016-2030)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 019. NORTH AMERICA TEXTILE MARKET, BY RAW MATERIAL (2016-2030)

TABLE 020. NORTH AMERICA TEXTILE MARKET, BY PRODUCT (2016-2030)

TABLE 021. NORTH AMERICA TEXTILE MARKET, BY APPLICATION (2016-2030)

TABLE 022. N TEXTILE MARKET, BY COUNTRY (2016-2030)

TABLE 023. EASTERN EUROPE TEXTILE MARKET, BY RAW MATERIAL (2016-2030)

TABLE 024. EASTERN EUROPE TEXTILE MARKET, BY PRODUCT (2016-2030)

TABLE 025. EASTERN EUROPE TEXTILE MARKET, BY APPLICATION (2016-2030)

TABLE 026. TEXTILE MARKET, BY COUNTRY (2016-2030)

TABLE 027. WESTERN EUROPE TEXTILE MARKET, BY RAW MATERIAL (2016-2030)

TABLE 028. WESTERN EUROPE TEXTILE MARKET, BY PRODUCT (2016-2030)

TABLE 029. WESTERN EUROPE TEXTILE MARKET, BY APPLICATION (2016-2030)

TABLE 030. TEXTILE MARKET, BY COUNTRY (2016-2030)

TABLE 031. ASIA PACIFIC TEXTILE MARKET, BY RAW MATERIAL (2016-2030)

TABLE 032. ASIA PACIFIC TEXTILE MARKET, BY PRODUCT (2016-2030)

TABLE 033. ASIA PACIFIC TEXTILE MARKET, BY APPLICATION (2016-2030)

TABLE 034. TEXTILE MARKET, BY COUNTRY (2016-2030)

TABLE 035. MIDDLE EAST & AFRICA TEXTILE MARKET, BY RAW MATERIAL (2016-2030)

TABLE 036. MIDDLE EAST & AFRICA TEXTILE MARKET, BY PRODUCT (2016-2030)

TABLE 037. MIDDLE EAST & AFRICA TEXTILE MARKET, BY APPLICATION (2016-2030)

TABLE 038. TEXTILE MARKET, BY COUNTRY (2016-2030)

TABLE 039. SOUTH AMERICA TEXTILE MARKET, BY RAW MATERIAL (2016-2030)

TABLE 040. SOUTH AMERICA TEXTILE MARKET, BY PRODUCT (2016-2030)

TABLE 041. SOUTH AMERICA TEXTILE MARKET, BY APPLICATION (2016-2030)

TABLE 042. TEXTILE MARKET, BY COUNTRY (2016-2030)

TABLE 043. BSL LIMITED (INDIA): SNAPSHOT

TABLE 044. BSL LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 045. BSL LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 046. BSL LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. SHANDONG RUYI TECHNOLOGY GROUP CO.: SNAPSHOT

TABLE 047. SHANDONG RUYI TECHNOLOGY GROUP CO.: BUSINESS PERFORMANCE

TABLE 048. SHANDONG RUYI TECHNOLOGY GROUP CO.: PRODUCT PORTFOLIO

TABLE 049. SHANDONG RUYI TECHNOLOGY GROUP CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. LTD. (CHINA): SNAPSHOT

TABLE 050. LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 051. LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 052. LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. INDORAMA VENTURES PUBLIC COMPANY LIMITED (THAILAND): SNAPSHOT

TABLE 053. INDORAMA VENTURES PUBLIC COMPANY LIMITED (THAILAND): BUSINESS PERFORMANCE

TABLE 054. INDORAMA VENTURES PUBLIC COMPANY LIMITED (THAILAND): PRODUCT PORTFOLIO

TABLE 055. INDORAMA VENTURES PUBLIC COMPANY LIMITED (THAILAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ADITYA BIRLA GROUP (INDIA): SNAPSHOT

TABLE 056. ADITYA BIRLA GROUP (INDIA): BUSINESS PERFORMANCE

TABLE 057. ADITYA BIRLA GROUP (INDIA): PRODUCT PORTFOLIO

TABLE 058. ADITYA BIRLA GROUP (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. LUTHAI TEXTILE CO.: SNAPSHOT

TABLE 059. LUTHAI TEXTILE CO.: BUSINESS PERFORMANCE

TABLE 060. LUTHAI TEXTILE CO.: PRODUCT PORTFOLIO

TABLE 061. LUTHAI TEXTILE CO.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. LTD. (CHINA): SNAPSHOT

TABLE 062. LTD. (CHINA): BUSINESS PERFORMANCE

TABLE 063. LTD. (CHINA): PRODUCT PORTFOLIO

TABLE 064. LTD. (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. WELSPUN INDIA LTD. (INDIA): SNAPSHOT

TABLE 065. WELSPUN INDIA LTD. (INDIA): BUSINESS PERFORMANCE

TABLE 066. WELSPUN INDIA LTD. (INDIA): PRODUCT PORTFOLIO

TABLE 067. WELSPUN INDIA LTD. (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. LENZING AG (AUSTRIA): SNAPSHOT

TABLE 068. LENZING AG (AUSTRIA): BUSINESS PERFORMANCE

TABLE 069. LENZING AG (AUSTRIA): PRODUCT PORTFOLIO

TABLE 070. LENZING AG (AUSTRIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. ALBIS PLASTIC GMBH (GERMANY): SNAPSHOT

TABLE 071. ALBIS PLASTIC GMBH (GERMANY): BUSINESS PERFORMANCE

TABLE 072. ALBIS PLASTIC GMBH (GERMANY): PRODUCT PORTFOLIO

TABLE 073. ALBIS PLASTIC GMBH (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. GRASIM INDUSTRIES LIMITED (INDIA): SNAPSHOT

TABLE 074. GRASIM INDUSTRIES LIMITED (INDIA): BUSINESS PERFORMANCE

TABLE 075. GRASIM INDUSTRIES LIMITED (INDIA): PRODUCT PORTFOLIO

TABLE 076. GRASIM INDUSTRIES LIMITED (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. TORAY INDUSTRIES: SNAPSHOT

TABLE 077. TORAY INDUSTRIES: BUSINESS PERFORMANCE

TABLE 078. TORAY INDUSTRIES: PRODUCT PORTFOLIO

TABLE 079. TORAY INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. INC. (JAPAN): SNAPSHOT

TABLE 080. INC. (JAPAN): BUSINESS PERFORMANCE

TABLE 081. INC. (JAPAN): PRODUCT PORTFOLIO

TABLE 082. INC. (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. TEIJIN LIMITED (JAPAN): SNAPSHOT

TABLE 083. TEIJIN LIMITED (JAPAN): BUSINESS PERFORMANCE

TABLE 084. TEIJIN LIMITED (JAPAN): PRODUCT PORTFOLIO

TABLE 085. TEIJIN LIMITED (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. MILLIKEN & COMPANY (USA): SNAPSHOT

TABLE 086. MILLIKEN & COMPANY (USA): BUSINESS PERFORMANCE

TABLE 087. MILLIKEN & COMPANY (USA): PRODUCT PORTFOLIO

TABLE 088. MILLIKEN & COMPANY (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. FIBRE2FASHION PVT. LTD. (INDIA): SNAPSHOT

TABLE 089. FIBRE2FASHION PVT. LTD. (INDIA): BUSINESS PERFORMANCE

TABLE 090. FIBRE2FASHION PVT. LTD. (INDIA): PRODUCT PORTFOLIO

TABLE 091. FIBRE2FASHION PVT. LTD. (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 092. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 093. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 094. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. TEXTILE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. TEXTILE MARKET OVERVIEW BY RAW MATERIAL

FIGURE 012. WOOL MARKET OVERVIEW (2016-2030)

FIGURE 013. CHEMICAL MARKET OVERVIEW (2016-2030)

FIGURE 014. SILK MARKET OVERVIEW (2016-2030)

FIGURE 015. TEXTILE MARKET OVERVIEW BY PRODUCT

FIGURE 016. NATURAL FIBERS MARKET OVERVIEW (2016-2030)

FIGURE 017. POLYESTER MARKET OVERVIEW (2016-2030)

FIGURE 018. TEXTILE MARKET OVERVIEW BY APPLICATION

FIGURE 019. HOUSEHOLD MARKET OVERVIEW (2016-2030)

FIGURE 020. FASHION & CLOTHING MARKET OVERVIEW (2016-2030)

FIGURE 021. TECHNICAL MARKET OVERVIEW (2016-2030)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 023. NORTH AMERICA TEXTILE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. EASTERN EUROPE TEXTILE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. WESTERN EUROPE TEXTILE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. ASIA PACIFIC TEXTILE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. MIDDLE EAST & AFRICA TEXTILE MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 028. SOUTH AMERICA TEXTILE MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Textile Market research report is 2024-2032.

BSL Limited (India), Shandong Ruyi Technology Group Co., Ltd. (China), Indorama Ventures Public Company Limited (Thailand), Aditya Birla Group (India), Luthai Textile Co., Ltd. (China), Welspun India Ltd. (India), Lenzing AG (Austria), ALBIS PLASTIC GmbH (Germany), Grasim Industries Limited (India), Toray Industries, Inc. (Japan), Teijin Limited (Japan), Milliken & Company (USA), Fibre2Fashion Pvt. Ltd. (India) and Other Major Players

The Textile Market is segmented into Raw Materials, Products, Applications, and Regions. By Type, the market is categorized as Wool, Chemical, and Silk. By Product, the market is categorized into Natural Fibers, Polyester. By Application, the market is categorized into Household, Fashion & Clothing, Technical, and Others. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The textile industry is an industry that involves the sections like research, design, development, manufacturing and distribution of textiles, fabrics, and clothing. The textile market is a vast and dynamic industry that encompasses the production, distribution, and sale of textiles, fabrics, and related products. Textiles (textiles, textile materials) are not only daily necessities but also basic materials or accessories that other industries need to use in some capacity. They are also one of the manifestations of history and culture. The textile industry is a light industry that contributes to people's livelihood.

The global market for Textile estimated at USD 1.03 trillion in the year 2023, is anticipated to reach a revised size of USD 1.34 trillion by 2032, growing at a CAGR of 2.98% over the period 2024-2032.