Bottled Water Market Synopsis

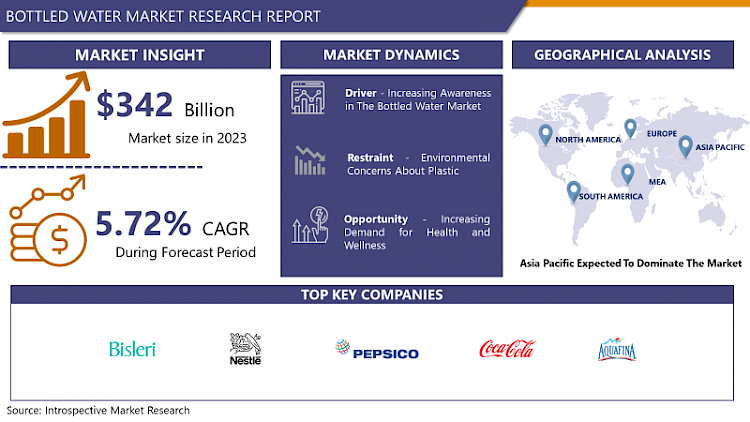

Global Bottled Market size was valued at USD 342 billion in 2023 and is projected to reach USD 564.21 Billion by 2032, growing at a CAGR of 5.72%from 2024 to 2032.

The bottled water industry originated in the late 18th century with mineral water sales in Europe, evolving now with eco-friendly packaging, advanced purification, and a consumer focus on sustainability and tap water awareness.

- The bottled water market to the industry segment that involves the production, packaging, and distribution of drinking water that is intended for consumption and sold in sealed containers, typically made of plastic, glass, or other materials. Types of bottled drinking water in the market are Spring water bottled drinking water, Mineral water, Purified water bottled, Alkaline water bottled, Sparkling water bottled, and Electrolyte-enhanced water bottled. this packaged water is sold to consumers through various retail channels such as supermarkets, convenience stores, vending machines, and online platforms.

- The global bottled water market increases health consciousness, changing lifestyles, the convenience of on-the-go hydration, concerns about tap water quality in some regions, and aggressive marketing strategies by bottled water companies. Bottled water offers several benefits. It provides a reliable and pure source of hydration, free from the chlorine taste often found in tap water. This makes bottled water a reliable choice, especially when on the go or outside, ensuring a safe, refreshing, and high-quality drinking experience. Additionally, the convenience of bottled water allows you to stay hydrated effortlessly throughout the day.

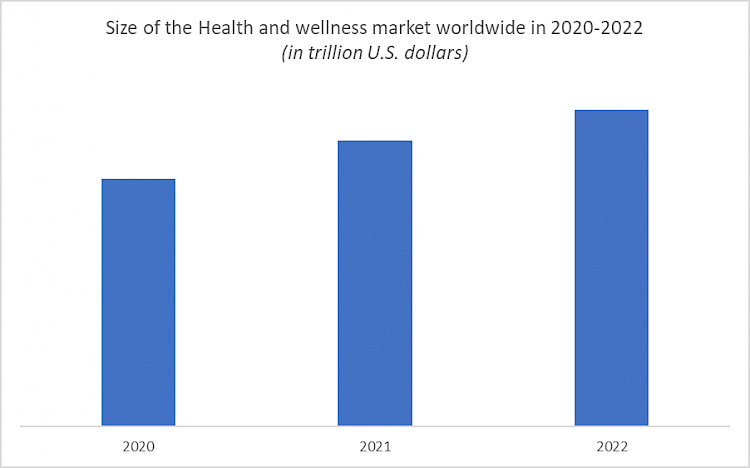

- The significant impact of the market is demonstrated through its substantial revenue generation, creation of employment opportunities, and its influence on shaping consumer preferences within the domains of Health and Wellness, Urbanization, and Changing Lifestyles. The market is expanding its scope from conventional still and sparkling water products to incorporate functional and enhanced waters that contain vitamins, minerals, electrolytes, and other advantageous additives, and health wellness requirements.

Key player

Bisleri International(India), Nestlé(Switzerland), PepsiCo (United States), The Coca-Cola Company (United States), DANONE (France), Primo Water Corporation (United States), Gerolsteiner Brunnen (Germany), Tata Consumer Products (India), VOSS WATER (US), Nongfu Spring (China), National Beverage Corp. (US), Kinley (India), Aquafina (India), Bailey (India), Himalayan Mineral Water (India), Kingfisher Mineral Water (India), Qua Mineral Water (India), Tata Water Plus (India), Rail Neer (India), Ferrarelle Spa (Italy), Fonti di Vinadio SpA (Italy), Suntory beverage (Japan), Mountain Valley Spring (US), CG Roxane (US), Fiji water (US), Keurig Dr Pepper Inc. (US) and Other Major Player.

Bottled Water Market Trend Analysis

Increasing awareness in the Bottled Water Market

- The growing focus on health and well-being among consumers is a key factor in the bottled water market forward. This shift in consumer preferences is leading people to choose healthier drink alternatives such as purified and ultra-purified bottled water. the increasing desire for water enriched with nutrients is becoming a trend, among travelers, professionals, and those looking for convenient at-home hydration. These are fueling the expansion of the bottled water market and are anticipated to sustain its growth in the future.

- Rapid population growth and the expansion of urban areas’ roles in water supplies across various regions globally. there is a rising trend in allocating more resources toward enhancing water infrastructure, including the construction of dams, reservoirs, and facilities for water purification and treatment.

- The growing popularity of sustainable packaging. Consumers are becoming more concerned about the environmental impact of plastic bottles, and manufacturers are responding with more sustainable packaging options, such as glass and aluminum bottles. Some consumers are looking for bottled water that is infused with vitamins or minerals.

- Bottled water companies have expanded their product offerings to encompass a diverse range of options, encompassing flavored variations and functional enhancements. This strategic diversification is particularly attractive to consumers with greater choices and additional advantages from their bottled water selections. This trend reflects a proactive approach by manufacturers to cater to evolving consumer preferences, capitalizing on the growing demand for innovative and health-oriented beverages.

Growing Demand in Health and Wellness

- As consumers become more health-conscious, there's a growing demand for healthier beverages. Bottled water is perceived as a better alternative to sugary soft drinks and juices. Brands that highlight the health benefits of their water, such as natural mineral content or pH balance.

- Urbanization is leading to a decline in the quality of tap water in many areas. This is driving demand for bottled water. Tourists prefer to drink bottled water, as they do not trust the quality of tap water in the places they are visiting.

- Companies are introducing various types of bottled water with added functional benefits, such as electrolytes, vitamins, minerals, and other additives that cater to specific health needs. Concerns about the environmental impact of single-use plastics have also contributed to the growth of the bottled water market.

This global preference for bottled water is a move by a shared aspiration for healthier lifestyles. As individuals around the world become increasingly conscious of their well-being, they choices that align with their health goals. Bottled water, often perceived as a cleaner and safer option compared to tap water, has gained popularity as a convenient means of hydration while avoiding potential contaminants. This perception, by the rigorous purification processes that many bottled water brands emphasize, reinforces the demand for this product on a global scale.

Segmentation Analysis of the Bottled Water Market

Bottle Market segments cover the Type, Application, and, Distribution Channel. By Type, The Mineral Water and Sparkling Water segment is Anticipated to Dominate the Market Over the Forecast period.

- Mineral water is sourced from natural springs or wells and contains minerals and trace elements that are naturally present. It is marketed as a healthier alternative to regular tap water due to its potential health benefits.

- Sparkling water is water that has been artificially carbonated to create bubbles or fizz. It has gained popularity as a low-calorie and refreshing beverage option in the market.

- The sparkling water segment will take a leading role in the market and could suggest a change in consumer preferences toward beverages that are both health-conscious and enjoyable, while still retaining the satisfying fizz.

- Polyethylene terephthalate (PET) is known for its clarity and transparency, making it an excellent choice for products like beverages and food items. PET is highly recyclable and can be reprocessed into new PET products or other materials, reducing waste and resource consumption.

Bottled Water Market Regional Analysis:

Asia Pacific region is dominating the Market Over the Forecast period.

- The Asia Pacific region is specified as a growth in the middle-class population. As people move up the economic ladder, their preferences shift toward products that provide safety, hygiene, and convenience. Bottled water, being a packaged and regulated product, fits well within this preference, as it offers an assurance of clean and safe drinking water.

- Asia Pacific regions (China, India, Indonesia, Japan, and Vietnam) are among the most popular in the region bottled water market. Rapid economic growth, urbanization, and an increasing middle class in these countries have led to a surge in the demand for bottled water. factors such as industrialization and pollution in some of these countries might contribute to concerns about tap water quality, driving consumers towards bottled alternatives.

- Middle-income customers tend to prioritize their health and are ready to invest extra in items they perceive as secure and beneficial. In numerous areas of the Asia Pacific, where water quality can be an issue, bottled water is considered to be pure and more dependable compared to tap water. bottled water has the advantages of convenience and portability.

- North America is the 2nd largest market for bottles, the region is driven by the increasing demand for bottled water, beverages, and personal care products.

Key Industry Developments in the Bottled Water Market

- In April 2023, Nestlé Waters North America announced a new partnership with PepsiCo to expand its presence in the premium bottled water market. Nestlé Waters North America will be acquiring PepsiCo's premium bottled water brands, including Aquafina, Propel, and Smartwater, for a total of $4.3 billion.

- In April 2023, PepsiCo announced a new partnership with Constellation Brands to expand its presence in the alcoholic beverage market. PepsiCo will be acquiring Constellation Brands' wine and spirits brands, including Svedka vodka, Corona Extra beer, and Robert Mondavi wine, for a total of $41 billion.

- In May 2023, Coca-Cola announced an investment of $50 million in plant-based packaging company Aseptic Packaging. Aseptic Packaging's technology allows for the production of shelf-stable bottled water without the use of preservatives or artificial flavors.

- In May 2023, Danone announced a new partnership with Evian to expand its presence in the bottled water market in China. Danone will be acquiring Evian's Chinese bottling and distribution operations for an undisclosed amount.

|

Bottled Water Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 342 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.72 % |

Market Size in 2032: |

USD 564.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- Bottle Water MARKET BY TYPE (2017-2032)

- Bottle Water MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MINERAL WATER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SPRING WATER

- SPARKLING WATER

- FLAVOURED WATER

- ALKALINE WATER

- ARTESIAN WATER

- SPARKLING WATER

- Bottle Water MARKET BY PACKAGING (2017-2032)

- Bottle Water MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- POLYETHYLENE TEREPHTHALATE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- HIGH-DENSITY POLYETHYLENE

- POLYCARBONATE

- CANS

- Bottle Water MARKET BY DISTRIBUTION CHANNEL (2017-2032)

- Bottle Water MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS & HYPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONVENIENCE STORES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Bottle Water Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BISLERI INTERNATIONAL

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- NESTLÉ

- PEPSICO

- THE COCA-COLA COMPANY

- DANONE

- PRIMO WATER CORPORATION

- GEROLSTEINER BRUNNEN

- TATA CONSUMER PRODUCTS

- VOSS WATER

- NONGFU SPRING

- NATIONAL BEVERAGE CORP.

- KINLEY

- AQUAFINA

- BAILEY

- HIMALAYAN MINERAL WATER

- KINGFISHER MINERAL WATER

- QUA MINERAL WATER

- TATA WATER PLUS

- RAIL NEER

- FERRARELLE SPA

- FONTI DI VINADIO SPA

- SUNTORY BEVERAGE

- MOUNTAIN VALLEY SPRING

- CG ROXANE

- FIJI WATER

- KEURIG DR PEPPER INC.

- COMPETITIVE LANDSCAPE

- GLOBAL Bottle Water MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segment1

- Historic And Forecasted Market Size By Segment2

- Historic And Forecasted Market Size By Segment3

- Historic And Forecasted Market Size By Segment4

- Historic And Forecasted Market Size By Segment5

- Historic And Forecasted Market Size By Segment6

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Bottled Water Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 342 Bn. |

|

Forecast Period 2024-32 CAGR: |

5.72 % |

Market Size in 2032: |

USD 564.21 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the Report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BOTTLED WATER MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BOTTLED WATER MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BOTTLED WATER MARKET COMPETITIVE RIVALRY

TABLE 005. BOTTLED WATER MARKET THREAT OF NEW ENTRANTS

TABLE 006. BOTTLED WATER MARKET THREAT OF SUBSTITUTES

TABLE 007. BOTTLED WATER MARKET BY TYPE

TABLE 008. MINERAL WATER MARKET OVERVIEW (2016-2030)

TABLE 009. SPRING WATER MARKET OVERVIEW (2016-2030)

TABLE 010. SPARKLING WATER MARKET OVERVIEW (2016-2030)

TABLE 011. FLAVOURED WATER MARKET OVERVIEW (2016-2030)

TABLE 012. ALKALINE WATER MARKET OVERVIEW (2016-2030)

TABLE 013. ARTESIAN WATER MARKET OVERVIEW (2016-2030)

TABLE 014. FLUORIDATED MARKET OVERVIEW (2016-2030)

TABLE 015. GROUNDWATER MARKET OVERVIEW (2016-2030)

TABLE 016. SPARKLING WATER MARKET OVERVIEW (2016-2030)

TABLE 017. STERILE WATER MARKET OVERVIEW (2016-2030)

TABLE 018. STERILE WATERWHEEL WATER MARKET OVERVIEW (2016-2030)

TABLE 019. OTHER MARKET OVERVIEW (2016-2030)

TABLE 020. BOTTLED WATER MARKET BY PACKAGING

TABLE 021. POLYETHYLENE TEREPHTHALATE MARKET OVERVIEW (2016-2030)

TABLE 022. HIGH-DENSITY POLYETHYLENE MARKET OVERVIEW (2016-2030)

TABLE 023. POLYCARBONATE MARKET OVERVIEW (2016-2030)

TABLE 024. CANS MARKET OVERVIEW (2016-2030)

TABLE 025. BOTTLED WATER MARKET BY DISTRIBUTION CHANNEL

TABLE 026. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2030)

TABLE 027. CONVENIENCE STORES MARKET OVERVIEW (2016-2030)

TABLE 028. OTHER MARKET OVERVIEW (2016-2030)

TABLE 029. NORTH AMERICA BOTTLED WATER MARKET, BY TYPE (2016-2030)

TABLE 030. NORTH AMERICA BOTTLED WATER MARKET, BY PACKAGING (2016-2030)

TABLE 031. NORTH AMERICA BOTTLED WATER MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 032. N BOTTLED WATER MARKET, BY COUNTRY (2016-2030)

TABLE 033. EASTERN EUROPE BOTTLED WATER MARKET, BY TYPE (2016-2030)

TABLE 034. EASTERN EUROPE BOTTLED WATER MARKET, BY PACKAGING (2016-2030)

TABLE 035. EASTERN EUROPE BOTTLED WATER MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 036. BOTTLED WATER MARKET, BY COUNTRY (2016-2030)

TABLE 037. WESTERN EUROPE BOTTLED WATER MARKET, BY TYPE (2016-2030)

TABLE 038. WESTERN EUROPE BOTTLED WATER MARKET, BY PACKAGING (2016-2030)

TABLE 039. WESTERN EUROPE BOTTLED WATER MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 040. BOTTLED WATER MARKET, BY COUNTRY (2016-2030)

TABLE 041. ASIA PACIFIC BOTTLED WATER MARKET, BY TYPE (2016-2030)

TABLE 042. ASIA PACIFIC BOTTLED WATER MARKET, BY PACKAGING (2016-2030)

TABLE 043. ASIA PACIFIC BOTTLED WATER MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 044. BOTTLED WATER MARKET, BY COUNTRY (2016-2030)

TABLE 045. MIDDLE EAST & AFRICA BOTTLED WATER MARKET, BY TYPE (2016-2030)

TABLE 046. MIDDLE EAST & AFRICA BOTTLED WATER MARKET, BY PACKAGING (2016-2030)

TABLE 047. MIDDLE EAST & AFRICA BOTTLED WATER MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 048. BOTTLED WATER MARKET, BY COUNTRY (2016-2030)

TABLE 049. SOUTH AMERICA BOTTLED WATER MARKET, BY TYPE (2016-2030)

TABLE 050. SOUTH AMERICA BOTTLED WATER MARKET, BY PACKAGING (2016-2030)

TABLE 051. SOUTH AMERICA BOTTLED WATER MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 052. BOTTLED WATER MARKET, BY COUNTRY (2016-2030)

TABLE 053. BISLERI INTERNATIONAL(INDIA): SNAPSHOT

TABLE 054. BISLERI INTERNATIONAL(INDIA): BUSINESS PERFORMANCE

TABLE 055. BISLERI INTERNATIONAL(INDIA): PRODUCT PORTFOLIO

TABLE 056. BISLERI INTERNATIONAL(INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. NESTLÉ(SWITZERLAND): SNAPSHOT

TABLE 057. NESTLÉ(SWITZERLAND): BUSINESS PERFORMANCE

TABLE 058. NESTLÉ(SWITZERLAND): PRODUCT PORTFOLIO

TABLE 059. NESTLÉ(SWITZERLAND): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. PEPSICO (UNITED STATES): SNAPSHOT

TABLE 060. PEPSICO (UNITED STATES): BUSINESS PERFORMANCE

TABLE 061. PEPSICO (UNITED STATES): PRODUCT PORTFOLIO

TABLE 062. PEPSICO (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. THE COCA-COLA COMPANY (UNITED STATES): SNAPSHOT

TABLE 063. THE COCA-COLA COMPANY (UNITED STATES): BUSINESS PERFORMANCE

TABLE 064. THE COCA-COLA COMPANY (UNITED STATES): PRODUCT PORTFOLIO

TABLE 065. THE COCA-COLA COMPANY (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. DANONE (FRANCE): SNAPSHOT

TABLE 066. DANONE (FRANCE): BUSINESS PERFORMANCE

TABLE 067. DANONE (FRANCE): PRODUCT PORTFOLIO

TABLE 068. DANONE (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. PRIMO WATER CORPORATION (UNITED STATES): SNAPSHOT

TABLE 069. PRIMO WATER CORPORATION (UNITED STATES): BUSINESS PERFORMANCE

TABLE 070. PRIMO WATER CORPORATION (UNITED STATES): PRODUCT PORTFOLIO

TABLE 071. PRIMO WATER CORPORATION (UNITED STATES): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. GEROLSTEINER BRUNNEN (GERMANY): SNAPSHOT

TABLE 072. GEROLSTEINER BRUNNEN (GERMANY): BUSINESS PERFORMANCE

TABLE 073. GEROLSTEINER BRUNNEN (GERMANY): PRODUCT PORTFOLIO

TABLE 074. GEROLSTEINER BRUNNEN (GERMANY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. TATA CONSUMER PRODUCTS (INDIA): SNAPSHOT

TABLE 075. TATA CONSUMER PRODUCTS (INDIA): BUSINESS PERFORMANCE

TABLE 076. TATA CONSUMER PRODUCTS (INDIA): PRODUCT PORTFOLIO

TABLE 077. TATA CONSUMER PRODUCTS (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. VOSS WATER (US): SNAPSHOT

TABLE 078. VOSS WATER (US): BUSINESS PERFORMANCE

TABLE 079. VOSS WATER (US): PRODUCT PORTFOLIO

TABLE 080. VOSS WATER (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. NONGFU SPRING (CHINA): SNAPSHOT

TABLE 081. NONGFU SPRING (CHINA): BUSINESS PERFORMANCE

TABLE 082. NONGFU SPRING (CHINA): PRODUCT PORTFOLIO

TABLE 083. NONGFU SPRING (CHINA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. NATIONAL BEVERAGE CORP. (US): SNAPSHOT

TABLE 084. NATIONAL BEVERAGE CORP. (US): BUSINESS PERFORMANCE

TABLE 085. NATIONAL BEVERAGE CORP. (US): PRODUCT PORTFOLIO

TABLE 086. NATIONAL BEVERAGE CORP. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. KINLEY (INDIA): SNAPSHOT

TABLE 087. KINLEY (INDIA): BUSINESS PERFORMANCE

TABLE 088. KINLEY (INDIA): PRODUCT PORTFOLIO

TABLE 089. KINLEY (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. AQUAFINA (INDIA): SNAPSHOT

TABLE 090. AQUAFINA (INDIA): BUSINESS PERFORMANCE

TABLE 091. AQUAFINA (INDIA): PRODUCT PORTFOLIO

TABLE 092. AQUAFINA (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. BAILEY (INDIA): SNAPSHOT

TABLE 093. BAILEY (INDIA): BUSINESS PERFORMANCE

TABLE 094. BAILEY (INDIA): PRODUCT PORTFOLIO

TABLE 095. BAILEY (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 095. HIMALAYAN MINERAL WATER (INDIA): SNAPSHOT

TABLE 096. HIMALAYAN MINERAL WATER (INDIA): BUSINESS PERFORMANCE

TABLE 097. HIMALAYAN MINERAL WATER (INDIA): PRODUCT PORTFOLIO

TABLE 098. HIMALAYAN MINERAL WATER (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 098. KINGFISHER MINERAL WATER (INDIA): SNAPSHOT

TABLE 099. KINGFISHER MINERAL WATER (INDIA): BUSINESS PERFORMANCE

TABLE 100. KINGFISHER MINERAL WATER (INDIA): PRODUCT PORTFOLIO

TABLE 101. KINGFISHER MINERAL WATER (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101. QUA MINERAL WATER (INDIA): SNAPSHOT

TABLE 102. QUA MINERAL WATER (INDIA): BUSINESS PERFORMANCE

TABLE 103. QUA MINERAL WATER (INDIA): PRODUCT PORTFOLIO

TABLE 104. QUA MINERAL WATER (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 104. TATA WATER PLUS (INDIA): SNAPSHOT

TABLE 105. TATA WATER PLUS (INDIA): BUSINESS PERFORMANCE

TABLE 106. TATA WATER PLUS (INDIA): PRODUCT PORTFOLIO

TABLE 107. TATA WATER PLUS (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. RAIL NEER (INDIA): SNAPSHOT

TABLE 108. RAIL NEER (INDIA): BUSINESS PERFORMANCE

TABLE 109. RAIL NEER (INDIA): PRODUCT PORTFOLIO

TABLE 110. RAIL NEER (INDIA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. FERRARELLE SPA (ITALY): SNAPSHOT

TABLE 111. FERRARELLE SPA (ITALY): BUSINESS PERFORMANCE

TABLE 112. FERRARELLE SPA (ITALY): PRODUCT PORTFOLIO

TABLE 113. FERRARELLE SPA (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 113. FONTI DI VINADIO SPA (ITALY): SNAPSHOT

TABLE 114. FONTI DI VINADIO SPA (ITALY): BUSINESS PERFORMANCE

TABLE 115. FONTI DI VINADIO SPA (ITALY): PRODUCT PORTFOLIO

TABLE 116. FONTI DI VINADIO SPA (ITALY): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 116. SUNTORY BEVERAGE (JAPAN): SNAPSHOT

TABLE 117. SUNTORY BEVERAGE (JAPAN): BUSINESS PERFORMANCE

TABLE 118. SUNTORY BEVERAGE (JAPAN): PRODUCT PORTFOLIO

TABLE 119. SUNTORY BEVERAGE (JAPAN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 119. MOUNTAIN VALLEY SPRING (US): SNAPSHOT

TABLE 120. MOUNTAIN VALLEY SPRING (US): BUSINESS PERFORMANCE

TABLE 121. MOUNTAIN VALLEY SPRING (US): PRODUCT PORTFOLIO

TABLE 122. MOUNTAIN VALLEY SPRING (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122. CG ROXANE (US): SNAPSHOT

TABLE 123. CG ROXANE (US): BUSINESS PERFORMANCE

TABLE 124. CG ROXANE (US): PRODUCT PORTFOLIO

TABLE 125. CG ROXANE (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 125. FIJI WATER (US): SNAPSHOT

TABLE 126. FIJI WATER (US): BUSINESS PERFORMANCE

TABLE 127. FIJI WATER (US): PRODUCT PORTFOLIO

TABLE 128. FIJI WATER (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 128. KEURIG DR PEPPER INC. (US): SNAPSHOT

TABLE 129. KEURIG DR PEPPER INC. (US): BUSINESS PERFORMANCE

TABLE 130. KEURIG DR PEPPER INC. (US): PRODUCT PORTFOLIO

TABLE 131. KEURIG DR PEPPER INC. (US): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 131. OTHER MAJOR PLAYER: SNAPSHOT

TABLE 132. OTHER MAJOR PLAYER: BUSINESS PERFORMANCE

TABLE 133. OTHER MAJOR PLAYER: PRODUCT PORTFOLIO

TABLE 134. OTHER MAJOR PLAYER: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BOTTLED WATER MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BOTTLED WATER MARKET OVERVIEW BY TYPE

FIGURE 012. MINERAL WATER MARKET OVERVIEW (2016-2030)

FIGURE 013. SPRING WATER MARKET OVERVIEW (2016-2030)

FIGURE 014. SPARKLING WATER MARKET OVERVIEW (2016-2030)

FIGURE 015. FLAVOURED WATER MARKET OVERVIEW (2016-2030)

FIGURE 016. ALKALINE WATER MARKET OVERVIEW (2016-2030)

FIGURE 017. ARTESIAN WATER MARKET OVERVIEW (2016-2030)

FIGURE 018. FLUORIDATED MARKET OVERVIEW (2016-2030)

FIGURE 019. GROUNDWATER MARKET OVERVIEW (2016-2030)

FIGURE 020. SPARKLING WATER MARKET OVERVIEW (2016-2030)

FIGURE 021. STERILE WATER MARKET OVERVIEW (2016-2030)

FIGURE 022. STERILE WATERWHEEL WATER MARKET OVERVIEW (2016-2030)

FIGURE 023. OTHER MARKET OVERVIEW (2016-2030)

FIGURE 024. BOTTLED WATER MARKET OVERVIEW BY PACKAGING

FIGURE 025. POLYETHYLENE TEREPHTHALATE MARKET OVERVIEW (2016-2030)

FIGURE 026. HIGH-DENSITY POLYETHYLENE MARKET OVERVIEW (2016-2030)

FIGURE 027. POLYCARBONATE MARKET OVERVIEW (2016-2030)

FIGURE 028. CANS MARKET OVERVIEW (2016-2030)

FIGURE 029. BOTTLED WATER MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 030. SUPERMARKETS & HYPERMARKETS MARKET OVERVIEW (2016-2030)

FIGURE 031. CONVENIENCE STORES MARKET OVERVIEW (2016-2030)

FIGURE 032. OTHER MARKET OVERVIEW (2016-2030)

FIGURE 033. NORTH AMERICA BOTTLED WATER MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 034. EASTERN EUROPE BOTTLED WATER MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 035. WESTERN EUROPE BOTTLED WATER MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 036. ASIA PACIFIC BOTTLED WATER MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 037. MIDDLE EAST & AFRICA BOTTLED WATER MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 038. SOUTH AMERICA BOTTLED WATER MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Bottled Water Market research report is 2024-2032.

Bisleri International(India), Nestlé(Switzerland), PepsiCo (United States), The Coca-Cola Company (United States), DANONE (France), Primo Water Corporation (United States), Goaltender Brunnen (Germany), Tata Consumer Products (India), VOSS WATER (US), Nongfu Spring (China), National Beverage Corp. (US), Kinley (India), Aquafina (India), Bailey (India), Himalayan Mineral Water (India), Kingfisher Mineral Water (India), Qua Mineral Water (India), Tata Water Plus (India), Rail Neer (India), Ferrarelle Spa (Italy), Fonti di Vinadio SpA (Italy), Suntory beverage (Japan), Mountain Valley Spring (US), CG Roxane (US), Fiji water (US), Keurig Dr Pepper Inc. (US) and other major player.

The Bottle Water market is segmented into Type, Packaging, Distribution Channel, and region. By Type, the market is categorized into Mineral water, Spring water, Sparkling water, and Flavoured water. By Packaging, the market is categorized into Polyethylene terephthalate, High-density polyethylene, Polycarbonate, and Cans. By Distribution Channel, the market is categorized into Supermarkets & Hypermarkets, and Convenience Stores. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

The bottled water industry originated in the late 18th century with mineral water sales in Europe, evolving now with eco-friendly packaging, advanced purification, and a consumer focus on sustainability and tap water awareness. The bottled water market to the industry segment that involves the production, packaging, and distribution of drinking water that is intended for consumption and sold in sealed containers, typically made of plastic, glass, or other materials.

Global Bottled Market size was valued at USD 342 billion in 2023 and is projected to reach USD 564.21 Billion by 2032, growing at a CAGR of 5.72%from 2024 to 2032.