Global Probiotic Skin Care Cosmetic Product Market Overview

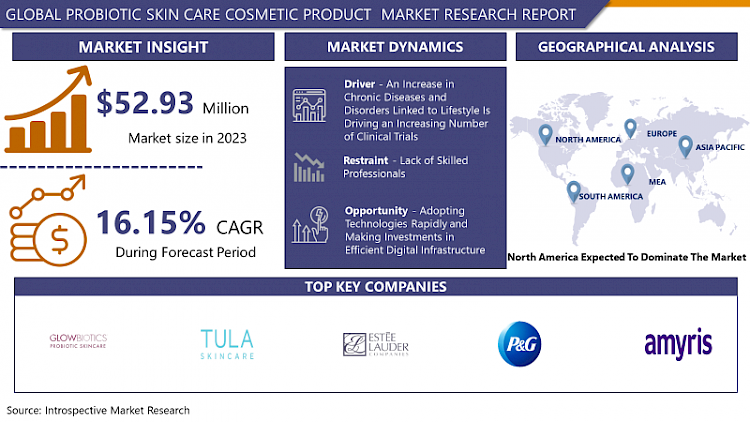

Probiotic Skin Care Cosmetic Product Market Size Was Valued at USD 52.93 Million in 2023, and is Projected to Reach USD 203.65 Million by 2032, Growing at a CAGR of 16.15 % From 2024-2032.

Probiotics are frequently included in skincare products because they help balance the skin's microbiota, which is frequently destroyed by severe exfoliation, chemical peels, and obsessive washing. The skin's natural microorganisms support the body's ability to have healthy skin functions. Various bacteria that reside in and on the surface of our bodies are found in probiotics.

The probiotic skincare market is experiencing a surge in consumer interest due to the growing awareness of the link between skin health and the microbiome. These products aim to promote a healthy skin microbiome and address various skin concerns. Probiotics are incorporated into cosmetic formulations to enhance the skin's natural defence mechanisms, balance the microbiome, and improve overall skin health. Probiotic skin care products claim to offer benefits such as improved hydration, reduced inflammation, and support for skin conditions like acne and eczema. The market includes a variety of probiotic skin care products, including cleansers, creams, serums, and masks. Companies are investing in research and development to understand the mechanisms by which probiotics influence the skin and create more effective formulations.

- The probiotic skin care cosmetic product market has experienced significant growth, with more brands entering the space. Consumer education is also being actively engaged in to build consumer trust and confidence in the efficacy of these products. The market for probiotic skin care products is global, with consumers worldwide showing interest in incorporating probiotics into their skincare routines. The competitive landscape includes well-established beauty and skincare brands and newer entrants focusing on probiotic formulations. Companies are differentiating themselves through innovative marketing, unique formulations, and strategic collaborations. Regulatory considerations, particularly regarding product claims and labeling, are becoming more important as brands work to ensure compliance with regulations while effectively communicating the benefits of probiotic ingredients.

Probiotic Skin Care Cosmetic Product Market Trend Analysis:

Growing Demand for Natural and Organic Skin Care Products

- Consumers are increasingly focusing on clean beauty, avoiding harmful chemicals and synthetic additives in skincare products. Probiotic skin care products, often formulated with natural and organic ingredients, align with this trend. The growing emphasis on ingredient transparency is attracting consumers who seek authenticity and transparency in their skincare choices. The demand for probiotic skincare aligns with the broader trend towards holistic wellness, where skincare is seen as an integral part of overall well-being. The use of natural and organic ingredients, including probiotics, reinforces this holistic approach to beauty and self-care. Additionally, individuals with sensitive skin or allergies may be drawn to natural and organic skincare products, as they are perceived as gentler and less likely to cause skin irritation.

- Probiotic skin care products are gaining popularity due to their minimal environmental impact, natural ingredients, and sustainable packaging. These products are often part of a holistic skincare routine, addressing multiple skin concerns and promoting overall health and radiance. Wellness influencers and advocates for clean living have played a significant role in popularizing natural and organic skincare, shaping consumer perceptions and market growth. Offering natural and organic probiotic products provides a competitive edge in a crowded market, as the perceived health benefits and environmentally friendly aspects contribute to a positive brand image and differentiation.

Develop New and Innovative Probiotic Skin Care Products

- The skincare market is highly competitive, and innovation allows companies to differentiate their products by developing unique probiotic formulations. Tailoring probiotic skincare products to address diverse skin concerns, such as anti-ageing, acne-prone, sensitivity, or hydration, expands the market's appeal. Combining probiotics with other beneficial ingredients, such as antioxidants, vitamins, and hyaluronic acid, enhances the overall effectiveness of the product. Advanced delivery systems, such as encapsulation technologies or time-release mechanisms, can optimize the efficacy of probiotic skincare. The opportunity lies in creating personalized probiotic skincare products based on individual skin types and concerns, aligning with the growing trend of tailored skincare routines. This approach offers a comprehensive skincare solution that caters to the diverse needs of consumers.

- The development of multi-functional probiotic skincare products, which combine moisturization, anti-ageing, and environmental protection, can appeal to consumers seeking simplicity and efficiency in their skincare routines. Innovative application formats, such as patches, sticks, or serums with unique textures, can enhance the user experience and make probiotic skincare more accessible. Sustainable and eco-friendly packaging is also an opportunity, as consumers value environmentally conscious choices.

- The integration of AI and technology in skincare formulations can provide innovative solutions, such as AI analyzing skin conditions and suggesting personalized routines. Clinical studies and scientific backing for probiotic skincare products can enhance credibility, as consumers are more likely to trust products with proven benefits. Designing probiotic skincare products specifically for different age groups or demographics presents an opportunity, such as anti-ageing benefits for mature skin or acne prevention for younger consumers.

Probiotic Skin Care Cosmetic Product Market Segment Analysis:

Probiotic Skin Care Cosmetic Product Market Segmented on the basis of type, application, and end-users.

By Application, Individual use segment is expected to dominate the market during the forecast period

- The probiotic skincare market is experiencing a significant shift towards personalized skincare routines, driven by the demand for products that cater to individual preferences, skin types, and concerns. This trend is driven by the desire for products that can be seamlessly integrated into existing routines, allowing for flexibility and adaptability. Individual-use products often target specific skin concerns, such as anti-ageing, hydration, acne, or sensitivity, and cater to diverse skin types. These products offer formulations that address the specific needs and characteristics of each skin type. Consumer empowerment is another key aspect of this segment, allowing consumers to curate their skincare regimens based on personal preferences and experiences.

- The market's focus on individual use reflects the evolving demands of consumers who seek products that resonate with their personal preferences, values, and lifestyles. Brands catering to individual use can leverage digital platforms for consumer engagement and education, providing information about product benefits, usage guidelines, and personalized skincare tips. Continuous product innovation is encouraged by the emphasis on individual use, as brands can develop new formulations, textures, and application methods to meet the evolving needs of consumers. As a result, the probiotic skincare market is poised for sustained growth, meeting the diverse and individualized skincare preferences of consumers.

Probiotic Skin Care Cosmetic Product Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North American consumers are increasingly aware of skincare trends and innovations, driven by a strong health and wellness culture. The mature beauty and personal care industry in the region is home to numerous established skincare brands, retailers, and beauty influencers. The demand for natural and organic skincare products is a significant driver, and probiotic skincare, often associated with natural ingredients, aligns well with the growing demand for clean beauty products.

- North America is a hub for innovation and product development in the beauty and skincare sector, with continuous research and development activities aimed at creating cutting-edge formulations, including those incorporating probiotics for skincare benefits. The relatively high disposable income of consumers in North America contributes to their willingness to invest in premium and innovative skincare products.

- The cultural emphasis on self-care and personal well-being aligns with probiotic skincare products, which contribute to overall skin health and wellness. Diverse climate conditions in North America create opportunities for probiotic skincare products to address various skin concerns associated with changing weather conditions. The region's well-established regulatory framework for cosmetics and skin care products also contributes to the growth of the probiotic skincare market.

Key Players Covered in Probiotic Skin Care Cosmetic Product Market:

- Mother Dirt (U.S.)

- Estee Lauder Inc. (U.S)

- Amyris, Inc (U.S.)

- Procter & Gamble Co. (U.S.)

- Too Faced Cosmetics, LLC (U.S.)

- TULA Life, INC (U.S.)

- Clinique Laboratories, LLC (U.S)

- GLOWBIOTICS Inc (U.S.)

- The Clorox Company (U.S.)

- LaFlore Probiotic Skincare (U.S.)

- BeBe & Bella (U.S)

- Burt's Bees, Inc. (U.S.)

- NUDE brands (U.S.)

- Eminence Organic Skincare (Canada)

- Aurelia Probiotic Skincare (UK)

- Unilever plc (UK)

- L’oreal S.A. (France)

- La Roche-Posay (France)

- Esse Skincare (South Africa)

- Biore (Japan),and Other Major Players.

Key Industry Developments in the Probiotic Skin Care Cosmetic Product Market:

- In August 2023, L’Oréal finalized its acquisition of esteemed luxury beauty brand Aesop. Nicolas Hieronimus, CEO of L’Oréal Groupe, expressed eagerness to integrate Aesop’s urban, luxurious essence into their portfolio, particularly eyeing growth in China. Cyril Chapuy, President of L’Oréal Luxe, anticipates Aesop’s ascent to the esteemed 'Billionaire Brands' club. Aesop's CEO, Michael O’Keeffe, lauded the partnership, envisioning global expansion while maintaining brand integrity.

- In November 2022, A new probiotic skincare brand called Soufflé Beauty, made in Singapore, was launched into the Chinese market and introduced a wide range of products. According to Soufflé Beauty, the company does not use animal testing and is a PETA-certified cruelty-free brand. All goods are securely produced in a Singapore-based GMP-certified lab by stringent legal requirements.

|

Global Clinical Trial Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 52.93 Mn. |

|

Forecast Period 2023-30 CAGR: |

16.02% |

Market Size in 2032: |

USD 203.65 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging Type |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- ANALYSIS OF THE IMPACT OF COVID-19

- Impact On The Overall Market

- Impact On The Supply Chain

- Impact On The Key Manufacturers

- Impact On The Pricing

- Post COVID Situation

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET BY TYPE (2016-2030)

- PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CREAM

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERUM

- SPRAY

- PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET BY PACKAGING TYPE (2016-2030)

- PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- TUBES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- JARS

- BOTTLES

- PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET BY APPLICATION (2016-2030)

- PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INDIVIDUAL USE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL USE

- PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET BY END-USER (2016-2030)

- PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MALE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FEMALE

- PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SPECIALITY STORES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SUPERMARKETS/HYPERMARKETS

- CONVENIENCE STORES

- ONLINE RETAIL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Probiotic Skin Care Cosmetic Product Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- MOTHER DIRT (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ESTEE LAUDER INC. (U.S)

- AMYRIS, INC (U.S.)

- PROCTER & GAMBLE CO. (U.S.)

- TOO FACED COSMETICS, LLC (U.S.)

- TULA LIFE, INC (U.S.)

- CLINIQUE LABORATORIES, LLC (U.S)

- GLOWBIOTICS INC (U.S.)

- THE CLOROX COMPANY (U.S.)

- LAFLORE PROBIOTIC SKINCARE (U.S.)

- BEBE & BELLA (U.S)

- BURT'S BEES, INC. (U.S.)

- NUDE BRANDS (U.S.)

- EMINENCE ORGANIC SKINCARE (CANADA)

- AURELIA PROBIOTIC SKINCARE (UK)

- UNILEVER PLC (UK)

- L’OREAL S.A. (FRANCE)

- LA ROCHE-POSAY (FRANCE)

- ESSE SKINCARE (SOUTH AFRICA)

- BIORE (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Packaging Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End-User

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Impact Of Covid-19

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Clinical Trial Management Software Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 52.93 Mn. |

|

Forecast Period 2023-30 CAGR: |

16.02% |

Market Size in 2032: |

USD 203.65 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Packaging Type |

|

||

|

By Application |

|

||

|

By End-User |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET COMPETITIVE RIVALRY

TABLE 005. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET THREAT OF NEW ENTRANTS

TABLE 006. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET THREAT OF SUBSTITUTES

TABLE 007. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET BY TYPE

TABLE 008. CREAM MARKET OVERVIEW (2016-2028)

TABLE 009. SPRAY MARKET OVERVIEW (2016-2028)

TABLE 010. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET BY APPLICATION

TABLE 011. INDIVIDUALS MARKET OVERVIEW (2016-2028)

TABLE 012. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 013. NORTH AMERICA PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY TYPE (2016-2028)

TABLE 014. NORTH AMERICA PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY APPLICATION (2016-2028)

TABLE 015. N PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY COUNTRY (2016-2028)

TABLE 016. EUROPE PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY TYPE (2016-2028)

TABLE 017. EUROPE PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY APPLICATION (2016-2028)

TABLE 018. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY COUNTRY (2016-2028)

TABLE 019. ASIA PACIFIC PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY TYPE (2016-2028)

TABLE 020. ASIA PACIFIC PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY APPLICATION (2016-2028)

TABLE 021. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY COUNTRY (2016-2028)

TABLE 022. MIDDLE EAST & AFRICA PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY TYPE (2016-2028)

TABLE 023. MIDDLE EAST & AFRICA PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY APPLICATION (2016-2028)

TABLE 024. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY COUNTRY (2016-2028)

TABLE 025. SOUTH AMERICA PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY TYPE (2016-2028)

TABLE 026. SOUTH AMERICA PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY APPLICATION (2016-2028)

TABLE 027. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET, BY COUNTRY (2016-2028)

TABLE 028. MOTHER DIRT: SNAPSHOT

TABLE 029. MOTHER DIRT: BUSINESS PERFORMANCE

TABLE 030. MOTHER DIRT: PRODUCT PORTFOLIO

TABLE 031. MOTHER DIRT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 031. ESSE: SNAPSHOT

TABLE 032. ESSE: BUSINESS PERFORMANCE

TABLE 033. ESSE: PRODUCT PORTFOLIO

TABLE 034. ESSE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 034. YUN PROBIOTHERAPY: SNAPSHOT

TABLE 035. YUN PROBIOTHERAPY: BUSINESS PERFORMANCE

TABLE 036. YUN PROBIOTHERAPY: PRODUCT PORTFOLIO

TABLE 037. YUN PROBIOTHERAPY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. CLINIQUE LABORATORIES: SNAPSHOT

TABLE 038. CLINIQUE LABORATORIES: BUSINESS PERFORMANCE

TABLE 039. CLINIQUE LABORATORIES: PRODUCT PORTFOLIO

TABLE 040. CLINIQUE LABORATORIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. LLC: SNAPSHOT

TABLE 041. LLC: BUSINESS PERFORMANCE

TABLE 042. LLC: PRODUCT PORTFOLIO

TABLE 043. LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. GALLINÉE: SNAPSHOT

TABLE 044. GALLINÉE: BUSINESS PERFORMANCE

TABLE 045. GALLINÉE: PRODUCT PORTFOLIO

TABLE 046. GALLINÉE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. GLOWBIOTICS: SNAPSHOT

TABLE 047. GLOWBIOTICS: BUSINESS PERFORMANCE

TABLE 048. GLOWBIOTICS: PRODUCT PORTFOLIO

TABLE 049. GLOWBIOTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. BEBE & BELLA: SNAPSHOT

TABLE 050. BEBE & BELLA: BUSINESS PERFORMANCE

TABLE 051. BEBE & BELLA: PRODUCT PORTFOLIO

TABLE 052. BEBE & BELLA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. TULA LIFE: SNAPSHOT

TABLE 053. TULA LIFE: BUSINESS PERFORMANCE

TABLE 054. TULA LIFE: PRODUCT PORTFOLIO

TABLE 055. TULA LIFE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. EMINENCE ORGANIC SKIN CARE: SNAPSHOT

TABLE 056. EMINENCE ORGANIC SKIN CARE: BUSINESS PERFORMANCE

TABLE 057. EMINENCE ORGANIC SKIN CARE: PRODUCT PORTFOLIO

TABLE 058. EMINENCE ORGANIC SKIN CARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. AURELIA: SNAPSHOT

TABLE 059. AURELIA: BUSINESS PERFORMANCE

TABLE 060. AURELIA: PRODUCT PORTFOLIO

TABLE 061. AURELIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. BURT’S BEES: SNAPSHOT

TABLE 062. BURT’S BEES: BUSINESS PERFORMANCE

TABLE 063. BURT’S BEES: PRODUCT PORTFOLIO

TABLE 064. BURT’S BEES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. NUDE BRANDS: SNAPSHOT

TABLE 065. NUDE BRANDS: BUSINESS PERFORMANCE

TABLE 066. NUDE BRANDS: PRODUCT PORTFOLIO

TABLE 067. NUDE BRANDS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. TOO FACED COSMETICS: SNAPSHOT

TABLE 068. TOO FACED COSMETICS: BUSINESS PERFORMANCE

TABLE 069. TOO FACED COSMETICS: PRODUCT PORTFOLIO

TABLE 070. TOO FACED COSMETICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET OVERVIEW BY TYPE

FIGURE 012. CREAM MARKET OVERVIEW (2016-2028)

FIGURE 013. SPRAY MARKET OVERVIEW (2016-2028)

FIGURE 014. PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET OVERVIEW BY APPLICATION

FIGURE 015. INDIVIDUALS MARKET OVERVIEW (2016-2028)

FIGURE 016. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 017. NORTH AMERICA PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 018. EUROPE PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 019. ASIA PACIFIC PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. MIDDLE EAST & AFRICA PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. SOUTH AMERICA PROBIOTIC SKIN CARE COSMETIC PRODUCT MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the market research report is 2024–2032.

Mother Dirt (U.S.), Estee Lauder Inc. (U.S), Amyris, Inc (U.S.), Procter & Gamble Co. (U.S.), Too Faced Cosmetics, LLC (U.S.), TULA Life, INC (U.S.), Clinique Laboratories, LLC (U.S), GLOWBIOTICS Inc (U.S.), The Clorox Company (U.S.), LaFlore Probiotic Skincare (U.S.), BeBe & Bella (U.S), Burt's Bees, Inc. (U.S.), NUDE brands (U.S.), Eminence Organic Skincare (Canada), Aurelia Probiotic Skincare (UK), Unilever plc (UK), L’oreal S.A. (France), La Roche-Posay (France), Esse Skincare (South Africa), Biore (Japan), and Other Major Players.

The Probiotic Skin Care Cosmetic Product Market is segmented into Type, Packaging Type, Application End-User, Distribution Channel and region. By Type, the market is categorized into Cream, Serum, and Spray. By Packaging Type, the market is categorized into Tubes, Jars, and Bottles. By Application, the market is categorized into Individual Use and Commercial Use. By End-User, the market is categorized into Male and Female. By Distribution Channel, the market is categorized into Speciality Stores, Supermarkets/Hypermarkets Convenience Stores, and Online Retail. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Probiotics are frequently included in skincare products because they help balance the skin's microbiota, which is frequently destroyed by severe exfoliation, chemical peels, and obsessive washing. The skin's natural microorganisms support the body's ability to have healthy skin functions. Various bacteria that reside in and on the surface of our bodies are found in probiotics.

Probiotic Skin Care Cosmetic Product Market Size Was Valued at USD 52.93 Million in 2023, and is Projected to Reach USD 203.65 Million by 2032, Growing at a CAGR of 16.15 % From 2024-2032.