Wine Corks Market Synopsis

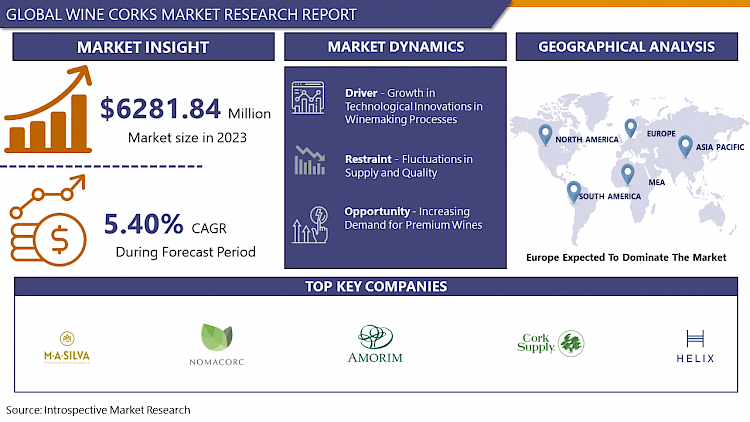

The Global Market for Wine Corks Estimated at USD 6281.84 Million In the Year 2023, Is Projected To Reach A Revised Size Of USD 10084.45 Million By 2032, Growing At A CAGR Of 5.40% Over The Forecast Period 2024-2032.

Wine corks are the traditional stoppers used to seal wine bottles. They are generally manufactured from the bark of cork oak trees, which are native to the Mediterranean region. Cork is harvested by removing the outer layer of bark from the tree, which may be done without hurting the tree. The cork is then boiled, sliced, and molded into the iconic cylindrical wine bottle stoppers.

- The use of cork as a wine bottle stopper has been around for centuries, and it remains a popular choice today. There are several reasons why cork is preferred over other materials. Cork is a natural material that is biodegradable, making it an environmentally friendly option. Additionally, cork is an excellent sealing material because it is compressible, elastic, and impermeable to gases and liquids.

- However, there are some drawbacks to using cork as a wine bottle stopper. One of the most significant issues is cork taint, which occurs when the cork is contaminated with a chemical compound called 2,4,6-trichloroanisole (TCA). TCA can cause a musty or moldy smell in wine, which can significantly impact the flavor and aroma.

- Alternative materials for wine bottle stoppers, such as synthetic corks, screw caps, and glass stoppers, have become more popular in recent years. While these materials may not have the same visual appeal as real cork, they are less susceptible to cork taint and can be less expensive.

- In conclusion, wine corks are traditional stoppers that are manufactured from the bark of cork oak trees. They offer various benefits, like being ecologically friendly and superb sealing material, but they also have problems, such as the potential of cork taint.

The Wine Corks Market Trend Analysis

Growth in Technological Innovations in Winemaking Processes

- The increase in technological advances in winemaking operations might be viewed as a business potential for wine corks. Technological breakthroughs in the winemaking sector have resulted in considerable gains in wine quality and consistency. These advancements have also resulted in the creation of new and inventive wine packaging options, which can open doors for wine cork producers.

- For example, advancements in bottling technology have led to the development of wine bottles with narrower necks, which require smaller and more specialized wine corks. This creates opportunities for wine cork manufacturers to develop new and innovative cork solutions that can meet the specific needs of these bottles.

- Furthermore, technical advances in the winemaking process have led to in the development of new types of wines that necessitate the use of specialized wine corks. For example, the growing popularity of sparkling wines and natural wines has resulted in the creation of specialized corks that can keep the pressure in sparkling wine bottles and allow natural wines to age and ferment properly.

- Additionally, technical developments in the cork manufacturing process may generate prospects for wine cork makers. New cork extraction techniques and manufacturing procedures can result in higher-quality wine corks that are less prone to cork taint and other problems.

- In conclusion, technological developments in the winemaking process might provide chances for wine cork producers to develop new and creative cork solutions that address the wine industry's specialized demands. Wine cork makers may differentiate themselves from the competition and acquire additional market share by developing new wine kinds, bottle designs, and cork production procedures.

Increasing Demand for Premium Wines

- The growing demand for premium wines is a key opportunity of the wine corks market. Corks remain the preferred closure for premium wines because they offer several advantages over alternative closures, such as screw caps or synthetic corks. Corks are breathable, allowing the wine to age gracefully over time by allowing a small amount of oxygen to enter the bottle, which helps to develop the wine's character and complexity. Additionally, natural cork closures are biodegradable and renewable, making them a more sustainable choice than other materials.

- The rising demand for premium wines has created competition among winemakers to develop unique high-quality goods that stand out in a crowded market. This rivalry has also fueled innovation in wine closures, with producers creating new types of corks with increased quality and utility.

- For example, the development of technical corks, which are made from a blend of natural cork and synthetic materials. Technical corks offer the best of both worlds, providing the natural look and feel of a traditional cork, while also offering consistent performance and reduced risk of cork taint, a condition that can affect the taste and quality of the wine.

- Another development in wine closures is the use of screw caps, which were long seen as a lower-quality alternative to corks but are increasingly gaining popularity among winemakers due to their affordability and consistency. Even as screw caps become more common, natural cork closures remain the preferred choice for premium wines since they are seen as a crucial component of the traditional wine experience.

- Overall, the increasing demand for premium wines represents a significant opportunity for the wine corks market.

Segmentation Analysis Of The Wine Corks Market

Wine Corks Market segments cover the Type, Distribution Channel, and Material Type. By Type, the Natural Cork segment is Anticipated to Dominate the Market Over the Forecast period.

- Natural Cork is made from the bark of the cork oak tree and is valued for its ability to allow the wine to age properly.

- Natural cork provides a traditional and aesthetically pleasing closure that is still preferred by many winemakers, particularly for premium and high-end wines.

- Despite the emergence of alternative closures, such as screw caps and synthetic corks, natural cork remains popular among winemakers and consumers alike.

- In recent years, there has been an increase in demand for environmentally friendly and sustainable products, which has resulted in the creation of new and creative varieties of a wine cork, such as biodegradable and recycled cork.

- These alternative cork closures are gaining popularity among environmentally conscious consumers and winemakers who are looking for sustainable packaging options.

Regional Analysis of The Wine Corks Market

Europe is Expected to Dominate the Market Over the Forecast Period.

- Due to its long history of wine production and the presence of established cork businesses in countries like Portugal, Spain, and France, Europe is a leading participant in the global wine cork market. These nations also house many of the world's finest wine producers, who are noted for producing high-quality wines with premium cork closures.

- Portugal is the world's largest manufacturer of wine corks, accounting for more than 70% of worldwide output. Other European nations with substantial cork-producing sectors include Italy and Germany, and many of these producers export their goods to other parts of the world.

- Additionally, the European market is characterized by high levels of demand for premium wine corks, particularly among winemakers who value sustainability and quality in their products.

- As a result, the European region is expected to continue to dominate the wine corks market in the coming years.

Covid-19 Impact Analysis On Wine Corks Market

Due to the Covid-19 outbreak, the Wine Cork material end-use industries are experiencing difficulties in getting cork material from producers due to commodity import and export restrictions. Furthermore, there are delays in receiving raw materials, which results in delayed supplies to the consumer. Furthermore, cargo orders are being severely impacted owing to vessel non-availability and blank sailing, resulting in decreasing winery storage stock. The COVID-19 epidemic has also had a significant influence on the wine sector. Wine production has been disrupted, amounting to a significant loss in the business. With the drop in wine output, demand for Wine Corks has decreased dramatically, acting as a key market restraint.

Top Key Players Covered in The Wine Corks Market

- Amorim Cork (Portugal)

- Nomacorc (Belgium)

- Diam Bouchage (France)

- Cork Supply Group (USA)

- M.A. Silva USA (USA)

- Cork Concepts(Portugal)

- Helix (Portugal)

- Maverick Enterprises (USA)

- WidgetCo (USA)

- Intercork (Portugal)

- Novatwist (Canada)

- Rich Xiberta (Spain)

- G3 Enterprises (USA) and Other Major Players

Key Industry Developments in the Wine Corks Market

- In May 2024, Legacy, the newest innovation from Cork Supply, was released to provide protection against both excess oxygen ingress and TCA cork taint. The newly introduced Legacy cork from Cork Supply was touted as the most consistent natural cork accessible in the market. With years of research backing it, including a recently concluded project, it was poised to assure protection against both excess oxygen ingress and TCA cork taint. Reflecting the company's commitment to both technology and personnel, the cork depended on both advanced techniques and a skilled team to deliver Cork Supply's ultimate closure.

- In February 2023, Vinventions launched Nomacorc Ocean, marking the debut of the first wine closure designed to contribute to ocean protection. Nomacorc Ocean, a new closure from Vinventions, was the world's pioneering closure crafted using Ocean Bound Plastic. To support this release, Vinventions had established two partnerships. In Sicily, the Donnafugata estate had collaborated with Vinventions to preserve the oceans by selecting Nomacorc Ocean for its Damarino cuvée.

|

Global Wine Corks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 6281.84 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.40% |

Market Size in 2032: |

USD 10084.45 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Material Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Type

3.2 By Distribution Channel

3.3 By Material Type

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Wine Corks Market by Type

5.1 Wine Corks Market Overview Snapshot and Growth Engine

5.2 Wine Corks Market Overview

5.3 Natural

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2017-2032F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Natural: Geographic Segmentation

5.4 Synthetic

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2017-2032F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Synthetic: Geographic Segmentation

Chapter 6: Wine Corks Market by Distribution Channel

6.1 Wine Corks Market Overview Snapshot and Growth Engine

6.2 Wine Corks Market Overview

6.3 Offline

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2017-2032F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Offline: Geographic Segmentation

6.4 Online

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2017-2032F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Online: Geographic Segmentation

Chapter 7: Wine Corks Market by Material Type

7.1 Wine Corks Market Overview Snapshot and Growth Engine

7.2 Wine Corks Market Overview

7.3 Wood

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size (2017-2032F)

7.3.3 Key Market Trends, Growth Factors and Opportunities

7.3.4 Wood: Geographic Segmentation

7.4 Aluminium

7.4.1 Introduction and Market Overview

7.4.2 Historic and Forecasted Market Size (2017-2032F)

7.4.3 Key Market Trends, Growth Factors and Opportunities

7.4.4 Aluminium: Geographic Segmentation

7.5 Plastic

7.5.1 Introduction and Market Overview

7.5.2 Historic and Forecasted Market Size (2017-2032F)

7.5.3 Key Market Trends, Growth Factors and Opportunities

7.5.4 Plastic: Geographic Segmentation

7.6 Glass

7.6.1 Introduction and Market Overview

7.6.2 Historic and Forecasted Market Size (2017-2032F)

7.6.3 Key Market Trends, Growth Factors and Opportunities

7.6.4 Glass: Geographic Segmentation

7.7 Others

7.7.1 Introduction and Market Overview

7.7.2 Historic and Forecasted Market Size (2017-2032F)

7.7.3 Key Market Trends, Growth Factors and Opportunities

7.7.4 Others: Geographic Segmentation

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Positioning

8.1.2 Wine Corks Sales and Market Share By Players

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Wine Corks Industry Concentration Ratio (CR5 and HHI)

8.1.6 Top 5 Wine Corks Players Market Share

8.1.7 Mergers and Acquisitions

8.1.8 Business Strategies By Top Players

8.2 AMORIM CORK (PORTUGAL)

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Operating Business Segments

8.2.5 Product Portfolio

8.2.6 Business Performance

8.2.7 Key Strategic Moves and Recent Developments

8.2.8 SWOT Analysis

8.3 NOMACORC (BELGIUM)

8.4 DIAM BOUCHAGE (FRANCE)

8.5 CORK SUPPLY GROUP (USA)

8.6 M.A. SILVA USA (USA)

8.7 CORK CONCEPTS (PORTUGAL)

8.8 HELIX (PORTUGAL)

8.9 MAVERICK ENTERPRISES (USA)

8.10 WIDGETCO (USA)

8.11 INTERCORK (PORTUGAL)

8.12 NOVATWIST (CANADA)

8.13 RICH XIBERTA (SPAIN)

8.14 G3 ENTERPRISES (USA)

8.15 OTHER MAJOR PLAYERS

Chapter 9: Global Wine Corks Market Analysis, Insights and Forecast, 2017-2032

9.1 Market Overview

9.2 Historic and Forecasted Market Size By Type

9.2.1 Natural

9.2.2 Synthetic

9.3 Historic and Forecasted Market Size By Distribution Channel

9.3.1 Offline

9.3.2 Online

9.4 Historic and Forecasted Market Size By Material Type

9.4.1 Wood

9.4.2 Aluminium

9.4.3 Plastic

9.4.4 Glass

9.4.5 Others

Chapter 10: North America Wine Corks Market Analysis, Insights and Forecast, 2017-2032

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Type

10.4.1 Natural

10.4.2 Synthetic

10.5 Historic and Forecasted Market Size By Distribution Channel

10.5.1 Offline

10.5.2 Online

10.6 Historic and Forecasted Market Size By Material Type

10.6.1 Wood

10.6.2 Aluminium

10.6.3 Plastic

10.6.4 Glass

10.6.5 Others

10.7 Historic and Forecast Market Size by Country

10.7.1 US

10.7.2 Canada

10.7.3 Mexico

Chapter 11: Eastern Europe Wine Corks Market Analysis, Insights and Forecast, 2017-2032

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Type

11.4.1 Natural

11.4.2 Synthetic

11.5 Historic and Forecasted Market Size By Distribution Channel

11.5.1 Offline

11.5.2 Online

11.6 Historic and Forecasted Market Size By Material Type

11.6.1 Wood

11.6.2 Aluminium

11.6.3 Plastic

11.6.4 Glass

11.6.5 Others

11.7 Historic and Forecast Market Size by Country

11.7.1 Bulgaria

11.7.2 The Czech Republic

11.7.3 Hungary

11.7.4 Poland

11.7.5 Romania

11.7.6 Rest of Eastern Europe

Chapter 12: Western Europe Wine Corks Market Analysis, Insights and Forecast, 2017-2032

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Type

12.4.1 Natural

12.4.2 Synthetic

12.5 Historic and Forecasted Market Size By Distribution Channel

12.5.1 Offline

12.5.2 Online

12.6 Historic and Forecasted Market Size By Material Type

12.6.1 Wood

12.6.2 Aluminium

12.6.3 Plastic

12.6.4 Glass

12.6.5 Others

12.7 Historic and Forecast Market Size by Country

12.7.1 Germany

12.7.2 UK

12.7.3 France

12.7.4 Netherlands

12.7.5 Italy

12.7.6 Russia

12.7.7 Spain

12.7.8 Rest of Western Europe

Chapter 13: Asia Pacific Wine Corks Market Analysis, Insights and Forecast, 2017-2032

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Type

13.4.1 Natural

13.4.2 Synthetic

13.5 Historic and Forecasted Market Size By Distribution Channel

13.5.1 Offline

13.5.2 Online

13.6 Historic and Forecasted Market Size By Material Type

13.6.1 Wood

13.6.2 Aluminium

13.6.3 Plastic

13.6.4 Glass

13.6.5 Others

13.7 Historic and Forecast Market Size by Country

13.7.1 China

13.7.2 India

13.7.3 Japan

13.7.4 South Korea

13.7.5 Malaysia

13.7.6 Thailand

13.7.7 Vietnam

13.7.8 The Philippines

13.7.9 Australia

13.7.10 New Zealand

13.7.11 Rest of APAC

Chapter 14: Middle East & Africa Wine Corks Market Analysis, Insights and Forecast, 2017-2032

14.1 Key Market Trends, Growth Factors and Opportunities

14.2 Impact of Covid-19

14.3 Key Players

14.4 Key Market Trends, Growth Factors and Opportunities

14.4 Historic and Forecasted Market Size By Type

14.4.1 Natural

14.4.2 Synthetic

14.5 Historic and Forecasted Market Size By Distribution Channel

14.5.1 Offline

14.5.2 Online

14.6 Historic and Forecasted Market Size By Material Type

14.6.1 Wood

14.6.2 Aluminium

14.6.3 Plastic

14.6.4 Glass

14.6.5 Others

14.7 Historic and Forecast Market Size by Country

14.7.1 Turkey

14.7.2 Bahrain

14.7.3 Kuwait

14.7.4 Saudi Arabia

14.7.5 Qatar

14.7.6 UAE

14.7.7 Israel

14.7.8 South Africa

Chapter 15: South America Wine Corks Market Analysis, Insights and Forecast, 2017-2032

15.1 Key Market Trends, Growth Factors and Opportunities

15.2 Impact of Covid-19

15.3 Key Players

15.4 Key Market Trends, Growth Factors and Opportunities

15.4 Historic and Forecasted Market Size By Type

15.4.1 Natural

15.4.2 Synthetic

15.5 Historic and Forecasted Market Size By Distribution Channel

15.5.1 Offline

15.5.2 Online

15.6 Historic and Forecasted Market Size By Material Type

15.6.1 Wood

15.6.2 Aluminium

15.6.3 Plastic

15.6.4 Glass

15.6.5 Others

15.7 Historic and Forecast Market Size by Country

15.7.1 Brazil

15.7.2 Argentina

15.7.3 Rest of SA

Chapter 16 Investment Analysis

Chapter 17 Analyst Viewpoint and Conclusion

|

Global Wine Corks Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2032 |

Market Size in 2023: |

USD 6281.84 Mn. |

|

Forecast Period 2024-32 CAGR: |

5.40% |

Market Size in 2032: |

USD 10084.45 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution Channel |

|

||

|

By Material Type |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WINE CORKS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WINE CORKS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WINE CORKS MARKET COMPETITIVE RIVALRY

TABLE 005. WINE CORKS MARKET THREAT OF NEW ENTRANTS

TABLE 006. WINE CORKS MARKET THREAT OF SUBSTITUTES

TABLE 007. WINE CORKS MARKET BY TYPE

TABLE 008. NATURAL MARKET OVERVIEW (2016-2030)

TABLE 009. SYNTHETIC MARKET OVERVIEW (2016-2030)

TABLE 010. WINE CORKS MARKET BY DISTRIBUTION CHANNEL

TABLE 011. OFFLINE MARKET OVERVIEW (2016-2030)

TABLE 012. ONLINE MARKET OVERVIEW (2016-2030)

TABLE 013. WINE CORKS MARKET BY MATERIAL TYPE

TABLE 014. WOOD MARKET OVERVIEW (2016-2030)

TABLE 015. ALUMINIUM MARKET OVERVIEW (2016-2030)

TABLE 016. PLASTIC MARKET OVERVIEW (2016-2030)

TABLE 017. GLASS MARKET OVERVIEW (2016-2030)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2030)

TABLE 019. NORTH AMERICA WINE CORKS MARKET, BY TYPE (2016-2030)

TABLE 020. NORTH AMERICA WINE CORKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 021. NORTH AMERICA WINE CORKS MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 022. N WINE CORKS MARKET, BY COUNTRY (2016-2030)

TABLE 023. EASTERN EUROPE WINE CORKS MARKET, BY TYPE (2016-2030)

TABLE 024. EASTERN EUROPE WINE CORKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 025. EASTERN EUROPE WINE CORKS MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 026. WINE CORKS MARKET, BY COUNTRY (2016-2030)

TABLE 027. WESTERN EUROPE WINE CORKS MARKET, BY TYPE (2016-2030)

TABLE 028. WESTERN EUROPE WINE CORKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 029. WESTERN EUROPE WINE CORKS MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 030. WINE CORKS MARKET, BY COUNTRY (2016-2030)

TABLE 031. ASIA PACIFIC WINE CORKS MARKET, BY TYPE (2016-2030)

TABLE 032. ASIA PACIFIC WINE CORKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 033. ASIA PACIFIC WINE CORKS MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 034. WINE CORKS MARKET, BY COUNTRY (2016-2030)

TABLE 035. MIDDLE EAST & AFRICA WINE CORKS MARKET, BY TYPE (2016-2030)

TABLE 036. MIDDLE EAST & AFRICA WINE CORKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 037. MIDDLE EAST & AFRICA WINE CORKS MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 038. WINE CORKS MARKET, BY COUNTRY (2016-2030)

TABLE 039. SOUTH AMERICA WINE CORKS MARKET, BY TYPE (2016-2030)

TABLE 040. SOUTH AMERICA WINE CORKS MARKET, BY DISTRIBUTION CHANNEL (2016-2030)

TABLE 041. SOUTH AMERICA WINE CORKS MARKET, BY MATERIAL TYPE (2016-2030)

TABLE 042. WINE CORKS MARKET, BY COUNTRY (2016-2030)

TABLE 043. AMORIM CORK (PORTUGAL): SNAPSHOT

TABLE 044. AMORIM CORK (PORTUGAL): BUSINESS PERFORMANCE

TABLE 045. AMORIM CORK (PORTUGAL): PRODUCT PORTFOLIO

TABLE 046. AMORIM CORK (PORTUGAL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. NOMACORC (BELGIUM): SNAPSHOT

TABLE 047. NOMACORC (BELGIUM): BUSINESS PERFORMANCE

TABLE 048. NOMACORC (BELGIUM): PRODUCT PORTFOLIO

TABLE 049. NOMACORC (BELGIUM): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. DIAM BOUCHAGE (FRANCE): SNAPSHOT

TABLE 050. DIAM BOUCHAGE (FRANCE): BUSINESS PERFORMANCE

TABLE 051. DIAM BOUCHAGE (FRANCE): PRODUCT PORTFOLIO

TABLE 052. DIAM BOUCHAGE (FRANCE): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. CORK SUPPLY GROUP (USA): SNAPSHOT

TABLE 053. CORK SUPPLY GROUP (USA): BUSINESS PERFORMANCE

TABLE 054. CORK SUPPLY GROUP (USA): PRODUCT PORTFOLIO

TABLE 055. CORK SUPPLY GROUP (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. M.A. SILVA USA (USA): SNAPSHOT

TABLE 056. M.A. SILVA USA (USA): BUSINESS PERFORMANCE

TABLE 057. M.A. SILVA USA (USA): PRODUCT PORTFOLIO

TABLE 058. M.A. SILVA USA (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. CORK CONCEPTS (PORTUGAL): SNAPSHOT

TABLE 059. CORK CONCEPTS (PORTUGAL): BUSINESS PERFORMANCE

TABLE 060. CORK CONCEPTS (PORTUGAL): PRODUCT PORTFOLIO

TABLE 061. CORK CONCEPTS (PORTUGAL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. HELIX (PORTUGAL): SNAPSHOT

TABLE 062. HELIX (PORTUGAL): BUSINESS PERFORMANCE

TABLE 063. HELIX (PORTUGAL): PRODUCT PORTFOLIO

TABLE 064. HELIX (PORTUGAL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. MAVERICK ENTERPRISES (USA): SNAPSHOT

TABLE 065. MAVERICK ENTERPRISES (USA): BUSINESS PERFORMANCE

TABLE 066. MAVERICK ENTERPRISES (USA): PRODUCT PORTFOLIO

TABLE 067. MAVERICK ENTERPRISES (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. WIDGETCO (USA): SNAPSHOT

TABLE 068. WIDGETCO (USA): BUSINESS PERFORMANCE

TABLE 069. WIDGETCO (USA): PRODUCT PORTFOLIO

TABLE 070. WIDGETCO (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. INTERCORK (PORTUGAL): SNAPSHOT

TABLE 071. INTERCORK (PORTUGAL): BUSINESS PERFORMANCE

TABLE 072. INTERCORK (PORTUGAL): PRODUCT PORTFOLIO

TABLE 073. INTERCORK (PORTUGAL): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. NOVATWIST (CANADA): SNAPSHOT

TABLE 074. NOVATWIST (CANADA): BUSINESS PERFORMANCE

TABLE 075. NOVATWIST (CANADA): PRODUCT PORTFOLIO

TABLE 076. NOVATWIST (CANADA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. RICH XIBERTA (SPAIN): SNAPSHOT

TABLE 077. RICH XIBERTA (SPAIN): BUSINESS PERFORMANCE

TABLE 078. RICH XIBERTA (SPAIN): PRODUCT PORTFOLIO

TABLE 079. RICH XIBERTA (SPAIN): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. G3 ENTERPRISES (USA): SNAPSHOT

TABLE 080. G3 ENTERPRISES (USA): BUSINESS PERFORMANCE

TABLE 081. G3 ENTERPRISES (USA): PRODUCT PORTFOLIO

TABLE 082. G3 ENTERPRISES (USA): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 083. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 084. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 085. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WINE CORKS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WINE CORKS MARKET OVERVIEW BY TYPE

FIGURE 012. NATURAL MARKET OVERVIEW (2016-2030)

FIGURE 013. SYNTHETIC MARKET OVERVIEW (2016-2030)

FIGURE 014. WINE CORKS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 015. OFFLINE MARKET OVERVIEW (2016-2030)

FIGURE 016. ONLINE MARKET OVERVIEW (2016-2030)

FIGURE 017. WINE CORKS MARKET OVERVIEW BY MATERIAL TYPE

FIGURE 018. WOOD MARKET OVERVIEW (2016-2030)

FIGURE 019. ALUMINIUM MARKET OVERVIEW (2016-2030)

FIGURE 020. PLASTIC MARKET OVERVIEW (2016-2030)

FIGURE 021. GLASS MARKET OVERVIEW (2016-2030)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2030)

FIGURE 023. NORTH AMERICA WINE CORKS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 024. EASTERN EUROPE WINE CORKS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 025. WESTERN EUROPE WINE CORKS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 026. ASIA PACIFIC WINE CORKS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 027. MIDDLE EAST & AFRICA WINE CORKS MARKET OVERVIEW BY COUNTRY (2016-2030)

FIGURE 028. SOUTH AMERICA WINE CORKS MARKET OVERVIEW BY COUNTRY (2016-2030)

Frequently Asked Questions :

The forecast period in the Wine Corks Market research report is 2024-2032.

Amorim Cork (Portugal), Nomacorc (Belgium), Diam Bouchage (France), Cork Supply Group (USA), M.A. Silva USA (USA), Cork Concepts (Portugal), Helix (Portugal), Maverick Enterprises (USA), WidgetCo (USA), Intercork (Portugal), Novatwist (Canada), Rich Xiberta (Spain), G3 Enterprises (USA), and Other Major Players.

The Wine Corks Market has been segmented into Type, Distribution Channel, Material Type, and region. By Type, the market is categorized into Natural, Synthetic. By Distribution Channel, the market is categorized Offline, Online. By Material Type, the market is categorized into Wood, Aluminium, Plastic, Glass, and Others. By region, it is analyzed across North America (US, Canada, Mexico), Eastern Europe (Bulgaria, The Czech Republic, Hungary, Poland, Romania, Rest of Eastern Europe), Western Europe (Germany, UK, France, Netherlands, Italy, Russia, Spain, Rest of Western Europe), Asia Pacific (China, India, Japan, South Korea, Malaysia, Thailand, Vietnam, The Philippines, Australia, New Zealand, Rest of APAC), Middle East & Africa (Turkey, Bahrain, Kuwait, Saudi Arabia, Qatar, UAE, Israel, South Africa), South America (Brazil, Argentina, Rest of SA).

Wine corks are the traditional stoppers used to seal wine bottles. They are generally manufactured from the bark of cork oak trees, which are native to the Mediterranean region. Cork is harvested by removing the outer layer of bark from the tree, which may be done without hurting the tree. The cork is then boiled, sliced, and molded into the iconic cylindrical wine bottle stoppers.

The Global Market for Wine Corks Estimated at USD 6281.84 Million In the Year 2023, Is Projected To Reach A Revised Size Of USD 10084.45 Million By 2032, Growing At A CAGR Of 5.40% Over The Forecast Period 2024-2032.