Global Wine Cellar Market Overview

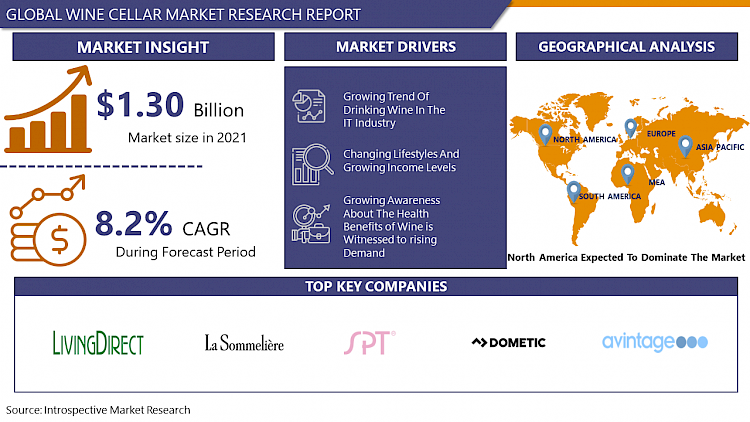

The Global Wine Cellar Market size is expected to grow from USD 1.41 billion in 2022 to USD 2.71 billion by 2030, at a CAGR of 8.5% during the forecast period (2023-2030).

A wine cellar is a place where wine is stored in bottles, barrels, or, less commonly, carboys, amphorae, or plastic containers. A climate control system keeps crucial parameters like temperature and humidity in an operating wine cellar under control. Passive wine cellars, on the other hand, are not climate-controlled and are typically built below to minimize temperature changes. A wine room is a phrase used to describe an aboveground wine cellar, whereas a wine closet is a term used to describe a tiny wine cellar (less than 500 bottles). The buttery was the domestic department of a big medieval home that was responsible for the storage, care, and service of wine. Over 3700 years ago, large wine cellars were built. Wine cellars provide darkness, stable temperature, and constant humidity to preserve alcoholic drinks from potentially dangerous external effects. Wine is a perishable, natural food product made from the fermentation of fruit. All varieties of wine can rot if exposed to heat, light, vibration, or temperature and humidity variations. When kept properly, wines not only retain their quality but also increase in scent, taste, and complexity as they age. Wines are more or less susceptible to temperature changes depending on their sugar and alcohol concentration; wines with greater alcohol and/or sugar content are less sensitive to temperature changes. Drinking wine is now seen as a technique to achieve high social standing as a result of changing lifestyles and growing income levels. This is projected to increase demand for wines all across the world. As a result, the wine cellar market will grow throughout the forecast period.

Market Dynamics And Factors For Wine Cellar Market

Drivers:

Prevention of Wine from Being Spoiled

Wine is a perishable commodity. Because it is a natural food product, it can spoil if exposed to heat, light, or if stored in an environment where temperature and humidity change. Wine can be ruined by even a minor temperature increase. The quality of wine may be retained or even increased when properly stored; this is one of the main reasons professional wine collectors build wine cellars. Wine freezers are only suitable for wine enthusiasts who wish to keep their wines for a limited period before drinking them. A wine cellar is for people who want to keep their bottles for a long time. A well-aged wine can acquire a more nuanced flavor and fragrance over time. A wine cellar should be kept at a constant temperature of 55 degrees Fahrenheit or slightly lower. Corks can be damaged by excessive humidity, causing the wine to oxidize and deteriorate. The optimal humidity for cork preservation is between 50 to 70%.

Protection From the Effects of Vibrations

As red wines mature, they "throw sediment"; vibrations in the wine's surroundings can disrupt this sediment, lowering the wine's quality. According to studies, a vibration-rich atmosphere can degrade the quality of a wine in as little as 18 months. One of the advantages of having a wine cellar is that it keeps your wines safe from vibrations caused by machinery or movement. Once you've placed a bottle in storage, don't move it again until you're ready to open it.

Growing Wine Consumption

Wine consumption has been influenced by changing lifestyles in various regions of the world. Wine consumption is predicted to rise as purchasing power rises, contributing to the development of smart wine cellars as a result of a better lifestyle. Red wine drinking enhances the health of the cells lining blood arteries, which promotes blood flow and heart health, according to researchers at the Israel Institute of Technology. A daily glass of red wine can also aid to prevent cell death, often known as apoptosis. As a result of the numerous health advantages of wine, people are increasingly changing toward its consumption, which is predicted to favorably affect the growth of the smart wine cellar market throughout the forecast period.

Restraints:

Wines are expensive by nature, and only a small portion of the population can afford them, hence they are enjoyed by a select few. The installation of wine cellars necessitates a substantial amount of money. Wine cellars add costs to the production of wines in the form of storage space rent, power bills, and refrigeration prices, among other things. Due to decreasing wine consumption, producers would be unable to recover these expenses, hampering the wine cellar market throughout the projection period. Furthermore, the wine cellar market is being hampered by an increasing number of government laws and regulations, as well as the imposition of taxation systems on wine and wine cellars. Over the projected period, the availability of replacements such as cabinet home bars is likely to limit the wine cellar market.

Opportunities:

Technological development in terms of smart store technology, dynamic partnership models, are lucrative growth opportunities for the wine cellar market in the upcoming years. In addition, China and India are the regions for generating market opportunities for the wine cellar owing to the growing consumption rate of wine and other alcoholic beverages. France leads the export market by the value of the wine. Moreover, there are major African nations in the top ten countries for import growth, Nigeria, Namibia, and the Ivory Coast. This is projected to create opportunities in the upcoming years.

Market Segmentation

Segmentation Analysis of Wine Cellar Market:

Based on the capacity, the Up To 500 Bottle Wine Cellars segment is expected to hold the maximum market share during the forecast period, owing to gaining popularity. By 2027, wine cellars with a capacity of up to 500 bottles are predicted to produce 45% of their income. In addition, owing to its cost-effectiveness, simplicity of transition, hassle-free installation and maintenance, and lower replacement costs, this market is projected to continue to lead, according to the report.

Based on the application, residential application for the wine segment is expected to dominate the wine cellar market over the forecast period. The rise in demand is mostly attributable to a rising preference for enjoying fine wines at home. The attraction of smart homes is growing in tandem with the need for them. Individuals seeking advanced connection choices such as entertainment systems, climate management, and security are increasingly purchasing wine cellars as a result of the dining and drinking trend. Furthermore, during the COVID-19 epidemic, wine consumption surged due to fear and vulnerability, as well as taste and the digital environment. One of the most important characteristics of confinement is that the pandemic's worry is a factor associated with increased intake of all alcoholic drinks in all nations. People questioned are more concerned about the economic ramifications of the health problem than they are about the virus itself. This economic anxiety has a direct influence on the increasing frequency of alcoholic beverage usage.

Regional Analysis of Wine Cellar Market:

North America region is expected to lead the wine cellar market throughout the market. Growing technological developments in the infrastructure and availability of adequate finance to set up the wine cellar are leading to the growth of the market. Furthermore, consumption in the United States has climbed gradually every year for the past decade. It is well-liked by people from all walks of life. It is taken at all times of the year, in times of war and in times of prosperity. Even though other recreational beverages have sparked consumer interest in specialty products, the number of individuals who drink beer has been declining. Meanwhile, clients have been placing increasing purchases with online wine vendors. According to Statista, the United States consumes about 2.8 gallons of wine each year. Wine has become more inexpensive and available to customers regardless of their location thanks to online wine sales. 71% of online customers feel they can get greater bargains from an online wine shop than they do in-store. The use of digital communication technology has enhanced the purchasing experience for a variety of items.

Europe region is observed a significant growth rate of the market over the projected period. The spread of European culture to the farthest reaches of the globe boosted the production and popularity of wine. Advancements in the winemaking process, the accessibility of international commerce, historic traditions, and a plethora of unique new wine tastes have all contributed to the wine's continued appeal. Furthermore, Germany is the largest market for smart wine cellars in Europe, with revenue predicted to increase by 50% over the projection period. Due to well-developed industrial facilities and rising demand from the commercial and residential industries, Germany's market is expanding.

Asia Pacific region witnessed a steady growth rate for the wine cellar market over the forecast period. Due to demand from bars, restaurants, and residential sectors, China leads the region's wine cellar market, and leading firms' use of innovative technologies is assisting market progress in China. Consumers in India are increasingly prepared to pay more on higher-value items, placing a premium on better experiences. This has resulted in a purposeful preference for imported wines of diverse brands. For example, red wine (49%) was one of the most popular wine categories among Indian consumers in 2018, whereas effervescent sparkling wine (3%), and white wine (13%) were still reserved for experienced wine lovers.

Players Covered in Wine Cellars Market are:

- Sunpentown Inc.

- Living Direct Inc.

- Dometic Group

- La Sommeliere

- Avintage

- Viking Range Corporation

- Avanti Products

- The Liebherr Group

- Climadiff S.A.

- Electrolux AB

COVID-19 Impact on Wine Cellar Market

The COVID-19 pandemic influences wine cellar sales as well as the supply chain that supports product manufacture and distribution. Market data have been influenced further by financial troubles in several business sectors as well as consumer categories. The COVID-19 epidemic had a significant impact on consumer attitudes. During the epidemic, people in many parts of the world practiced mindful consumption. As a result, consumer spending has migrated from non-essential to vital categories, affecting wine cellar sales in the market. The pandemic epidemic caused significant variations in the demand for wine coolers in several industries. For example, the epidemic compelled many wine fans to drink wine at home, necessitating the necessity for appropriate wine storage among wine enthusiasts in the residential sector. Furthermore, regional government prohibitions on the operation of public areas such as restaurants, cafeterias, and other similar establishments harmed demand for wine cellars in the commercial sector. However, as the world's economy begins to recover, the market is likely to rise in the following years.

Key Industry Developments In Wine Cellar Market

- In January 2021, METIS, the Pacific Northwest's leading M&A advisory firm focused on the global adult beverage and hospital industries, on this day declared that it has advised Walla Walla-based Basel Cellars Estate on the sale of the winery, vineyard, brand, inventory, equipment, and all real estate, including the on-site Estate Resort and Event Facilities.

- In June 2020, LG SIGNATURE, the ultra-premium brand recognized for cutting-edge technology and world-class design, today announced the debut of the LG SIGNATURE Wine Cellar in the United States. The new LG SIGNATURE Wine Cellar, with its elegant, seamless design, offers optimum cellar conditions for each variety or vintage by managing temperatures and humidity levels, as well as limiting vibrations and light exposure. The unit can hold up to 65 bottles and comes with a drawer for storing food like cheese and wine.

|

Global Wine Cellar Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.41 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.5% |

Market Size in 2030: |

USD 2.71 Bn. |

|

Segments Covered: |

By Capacity |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Research Objectives

1.2 Research Methodology

1.3 Research Process

1.4 Scope and Coverage

1.4.1 Market Definition

1.4.2 Key Questions Answered

1.5 Market Segmentation

Chapter 2:Executive Summary

Chapter 3:Growth Opportunities By Segment

3.1 By Capacity

3.2 By Application

Chapter 4: Market Landscape

4.1 Porter's Five Forces Analysis

4.1.1 Bargaining Power of Supplier

4.1.2 Threat of New Entrants

4.1.3 Threat of Substitutes

4.1.4 Competitive Rivalry

4.1.5 Bargaining Power Among Buyers

4.2 Industry Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.2 Restraints

4.3.3 Opportunities

4.5.4 Challenges

4.4 Pestle Analysis

4.5 Technological Roadmap

4.6 Regulatory Landscape

4.7 SWOT Analysis

4.8 Price Trend Analysis

4.9 Patent Analysis

4.10 Analysis of the Impact of Covid-19

4.10.1 Impact on the Overall Market

4.10.2 Impact on the Supply Chain

4.10.3 Impact on the Key Manufacturers

4.10.4 Impact on the Pricing

Chapter 5: Wine Cellar Market by Capacity

5.1 Wine Cellar Market Overview Snapshot and Growth Engine

5.2 Wine Cellar Market Overview

5.3 Up To 500 Bottle Wine Cellars

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size (2016-2028F)

5.3.3 Key Market Trends, Growth Factors and Opportunities

5.3.4 Up To 500 Bottle Wine Cellars: Grographic Segmentation

5.4 Up To 1

5.4.1 Introduction and Market Overview

5.4.2 Historic and Forecasted Market Size (2016-2028F)

5.4.3 Key Market Trends, Growth Factors and Opportunities

5.4.4 Up To 1: Grographic Segmentation

5.5 000 Bottle Wine Cellars

5.5.1 Introduction and Market Overview

5.5.2 Historic and Forecasted Market Size (2016-2028F)

5.5.3 Key Market Trends, Growth Factors and Opportunities

5.5.4 000 Bottle Wine Cellars: Grographic Segmentation

5.6 Up To 1

5.6.1 Introduction and Market Overview

5.6.2 Historic and Forecasted Market Size (2016-2028F)

5.6.3 Key Market Trends, Growth Factors and Opportunities

5.6.4 Up To 1: Grographic Segmentation

5.7 500 Bottle Wine Cellars

5.7.1 Introduction and Market Overview

5.7.2 Historic and Forecasted Market Size (2016-2028F)

5.7.3 Key Market Trends, Growth Factors and Opportunities

5.7.4 500 Bottle Wine Cellars: Grographic Segmentation

5.8 More Than 1

5.8.1 Introduction and Market Overview

5.8.2 Historic and Forecasted Market Size (2016-2028F)

5.8.3 Key Market Trends, Growth Factors and Opportunities

5.8.4 More Than 1: Grographic Segmentation

5.9 500 Bottle Wine Cellars

5.9.1 Introduction and Market Overview

5.9.2 Historic and Forecasted Market Size (2016-2028F)

5.9.3 Key Market Trends, Growth Factors and Opportunities

5.9.4 500 Bottle Wine Cellars: Grographic Segmentation

Chapter 6: Wine Cellar Market by Application

6.1 Wine Cellar Market Overview Snapshot and Growth Engine

6.2 Wine Cellar Market Overview

6.3 Residential Wine Cellars

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size (2016-2028F)

6.3.3 Key Market Trends, Growth Factors and Opportunities

6.3.4 Residential Wine Cellars: Grographic Segmentation

6.4 Commercial Wine Cellars

6.4.1 Introduction and Market Overview

6.4.2 Historic and Forecasted Market Size (2016-2028F)

6.4.3 Key Market Trends, Growth Factors and Opportunities

6.4.4 Commercial Wine Cellars: Grographic Segmentation

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Positioning

7.1.2 Wine Cellar Sales and Market Share By Players

7.1.3 Industry BCG Matrix

7.1.4 Ansoff Matrix

7.1.5 Wine Cellar Industry Concentration Ratio (CR5 and HHI)

7.1.6 Top 5 Wine Cellar Players Market Share

7.1.7 Mergers and Acquisitions

7.1.8 Business Strategies By Top Players

7.2 SUNPENTOWN INC.

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Operating Business Segments

7.2.5 Product Portfolio

7.2.6 Business Performance

7.2.7 Key Strategic Moves and Recent Developments

7.2.8 SWOT Analysis

7.3 LIVING DIRECT INC.

7.4 DOMETIC GROUP

7.5 LA SOMMELIERE

7.6 AVINTAGE

7.7 VIKING RANGE CORPORATION

7.8 AVANTI PRODUCTS

7.9 THE LIEBHERR GROUP

7.10 CLIMADIFF S.A.

7.11 ELECTROLUX AB

7.12 OTHER MAJOR PLAYERS

Chapter 8: Global Wine Cellar Market Analysis, Insights and Forecast, 2016-2028

8.1 Market Overview

8.2 Historic and Forecasted Market Size By Capacity

8.2.1 Up To 500 Bottle Wine Cellars

8.2.2 Up To 1

8.2.3 000 Bottle Wine Cellars

8.2.4 Up To 1

8.2.5 500 Bottle Wine Cellars

8.2.6 More Than 1

8.2.7 500 Bottle Wine Cellars

8.3 Historic and Forecasted Market Size By Application

8.3.1 Residential Wine Cellars

8.3.2 Commercial Wine Cellars

Chapter 9: North America Wine Cellar Market Analysis, Insights and Forecast, 2016-2028

9.1 Key Market Trends, Growth Factors and Opportunities

9.2 Impact of Covid-19

9.3 Key Players

9.4 Key Market Trends, Growth Factors and Opportunities

9.4 Historic and Forecasted Market Size By Capacity

9.4.1 Up To 500 Bottle Wine Cellars

9.4.2 Up To 1

9.4.3 000 Bottle Wine Cellars

9.4.4 Up To 1

9.4.5 500 Bottle Wine Cellars

9.4.6 More Than 1

9.4.7 500 Bottle Wine Cellars

9.5 Historic and Forecasted Market Size By Application

9.5.1 Residential Wine Cellars

9.5.2 Commercial Wine Cellars

9.6 Historic and Forecast Market Size by Country

9.6.1 U.S.

9.6.2 Canada

9.6.3 Mexico

Chapter 10: Europe Wine Cellar Market Analysis, Insights and Forecast, 2016-2028

10.1 Key Market Trends, Growth Factors and Opportunities

10.2 Impact of Covid-19

10.3 Key Players

10.4 Key Market Trends, Growth Factors and Opportunities

10.4 Historic and Forecasted Market Size By Capacity

10.4.1 Up To 500 Bottle Wine Cellars

10.4.2 Up To 1

10.4.3 000 Bottle Wine Cellars

10.4.4 Up To 1

10.4.5 500 Bottle Wine Cellars

10.4.6 More Than 1

10.4.7 500 Bottle Wine Cellars

10.5 Historic and Forecasted Market Size By Application

10.5.1 Residential Wine Cellars

10.5.2 Commercial Wine Cellars

10.6 Historic and Forecast Market Size by Country

10.6.1 Germany

10.6.2 U.K.

10.6.3 France

10.6.4 Italy

10.6.5 Russia

10.6.6 Spain

10.6.7 Rest of Europe

Chapter 11: Asia-Pacific Wine Cellar Market Analysis, Insights and Forecast, 2016-2028

11.1 Key Market Trends, Growth Factors and Opportunities

11.2 Impact of Covid-19

11.3 Key Players

11.4 Key Market Trends, Growth Factors and Opportunities

11.4 Historic and Forecasted Market Size By Capacity

11.4.1 Up To 500 Bottle Wine Cellars

11.4.2 Up To 1

11.4.3 000 Bottle Wine Cellars

11.4.4 Up To 1

11.4.5 500 Bottle Wine Cellars

11.4.6 More Than 1

11.4.7 500 Bottle Wine Cellars

11.5 Historic and Forecasted Market Size By Application

11.5.1 Residential Wine Cellars

11.5.2 Commercial Wine Cellars

11.6 Historic and Forecast Market Size by Country

11.6.1 China

11.6.2 India

11.6.3 Japan

11.6.4 Singapore

11.6.5 Australia

11.6.6 New Zealand

11.6.7 Rest of APAC

Chapter 12: Middle East & Africa Wine Cellar Market Analysis, Insights and Forecast, 2016-2028

12.1 Key Market Trends, Growth Factors and Opportunities

12.2 Impact of Covid-19

12.3 Key Players

12.4 Key Market Trends, Growth Factors and Opportunities

12.4 Historic and Forecasted Market Size By Capacity

12.4.1 Up To 500 Bottle Wine Cellars

12.4.2 Up To 1

12.4.3 000 Bottle Wine Cellars

12.4.4 Up To 1

12.4.5 500 Bottle Wine Cellars

12.4.6 More Than 1

12.4.7 500 Bottle Wine Cellars

12.5 Historic and Forecasted Market Size By Application

12.5.1 Residential Wine Cellars

12.5.2 Commercial Wine Cellars

12.6 Historic and Forecast Market Size by Country

12.6.1 Turkey

12.6.2 Saudi Arabia

12.6.3 Iran

12.6.4 UAE

12.6.5 Africa

12.6.6 Rest of MEA

Chapter 13: South America Wine Cellar Market Analysis, Insights and Forecast, 2016-2028

13.1 Key Market Trends, Growth Factors and Opportunities

13.2 Impact of Covid-19

13.3 Key Players

13.4 Key Market Trends, Growth Factors and Opportunities

13.4 Historic and Forecasted Market Size By Capacity

13.4.1 Up To 500 Bottle Wine Cellars

13.4.2 Up To 1

13.4.3 000 Bottle Wine Cellars

13.4.4 Up To 1

13.4.5 500 Bottle Wine Cellars

13.4.6 More Than 1

13.4.7 500 Bottle Wine Cellars

13.5 Historic and Forecasted Market Size By Application

13.5.1 Residential Wine Cellars

13.5.2 Commercial Wine Cellars

13.6 Historic and Forecast Market Size by Country

13.6.1 Brazil

13.6.2 Argentina

13.6.3 Rest of SA

Chapter 14 Investment Analysis

Chapter 15 Analyst Viewpoint and Conclusion

|

Global Wine Cellar Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 1.41 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.5% |

Market Size in 2030: |

USD 2.71 Bn. |

|

Segments Covered: |

By Capacity |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. WINE CELLAR MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. WINE CELLAR MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. WINE CELLAR MARKET COMPETITIVE RIVALRY

TABLE 005. WINE CELLAR MARKET THREAT OF NEW ENTRANTS

TABLE 006. WINE CELLAR MARKET THREAT OF SUBSTITUTES

TABLE 007. WINE CELLAR MARKET BY CAPACITY

TABLE 008. UP TO 500 BOTTLE WINE CELLARS MARKET OVERVIEW (2016-2028)

TABLE 009. UP TO 1 MARKET OVERVIEW (2016-2028)

TABLE 010. 000 BOTTLE WINE CELLARS MARKET OVERVIEW (2016-2028)

TABLE 011. UP TO 1 MARKET OVERVIEW (2016-2028)

TABLE 012. 500 BOTTLE WINE CELLARS MARKET OVERVIEW (2016-2028)

TABLE 013. MORE THAN 1 MARKET OVERVIEW (2016-2028)

TABLE 014. 500 BOTTLE WINE CELLARS MARKET OVERVIEW (2016-2028)

TABLE 015. WINE CELLAR MARKET BY APPLICATION

TABLE 016. RESIDENTIAL WINE CELLARS MARKET OVERVIEW (2016-2028)

TABLE 017. COMMERCIAL WINE CELLARS MARKET OVERVIEW (2016-2028)

TABLE 018. NORTH AMERICA WINE CELLAR MARKET, BY CAPACITY (2016-2028)

TABLE 019. NORTH AMERICA WINE CELLAR MARKET, BY APPLICATION (2016-2028)

TABLE 020. N WINE CELLAR MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE WINE CELLAR MARKET, BY CAPACITY (2016-2028)

TABLE 022. EUROPE WINE CELLAR MARKET, BY APPLICATION (2016-2028)

TABLE 023. WINE CELLAR MARKET, BY COUNTRY (2016-2028)

TABLE 024. ASIA PACIFIC WINE CELLAR MARKET, BY CAPACITY (2016-2028)

TABLE 025. ASIA PACIFIC WINE CELLAR MARKET, BY APPLICATION (2016-2028)

TABLE 026. WINE CELLAR MARKET, BY COUNTRY (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA WINE CELLAR MARKET, BY CAPACITY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA WINE CELLAR MARKET, BY APPLICATION (2016-2028)

TABLE 029. WINE CELLAR MARKET, BY COUNTRY (2016-2028)

TABLE 030. SOUTH AMERICA WINE CELLAR MARKET, BY CAPACITY (2016-2028)

TABLE 031. SOUTH AMERICA WINE CELLAR MARKET, BY APPLICATION (2016-2028)

TABLE 032. WINE CELLAR MARKET, BY COUNTRY (2016-2028)

TABLE 033. SUNPENTOWN INC.: SNAPSHOT

TABLE 034. SUNPENTOWN INC.: BUSINESS PERFORMANCE

TABLE 035. SUNPENTOWN INC.: PRODUCT PORTFOLIO

TABLE 036. SUNPENTOWN INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. LIVING DIRECT INC.: SNAPSHOT

TABLE 037. LIVING DIRECT INC.: BUSINESS PERFORMANCE

TABLE 038. LIVING DIRECT INC.: PRODUCT PORTFOLIO

TABLE 039. LIVING DIRECT INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. DOMETIC GROUP: SNAPSHOT

TABLE 040. DOMETIC GROUP: BUSINESS PERFORMANCE

TABLE 041. DOMETIC GROUP: PRODUCT PORTFOLIO

TABLE 042. DOMETIC GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. LA SOMMELIERE: SNAPSHOT

TABLE 043. LA SOMMELIERE: BUSINESS PERFORMANCE

TABLE 044. LA SOMMELIERE: PRODUCT PORTFOLIO

TABLE 045. LA SOMMELIERE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. AVINTAGE: SNAPSHOT

TABLE 046. AVINTAGE: BUSINESS PERFORMANCE

TABLE 047. AVINTAGE: PRODUCT PORTFOLIO

TABLE 048. AVINTAGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. VIKING RANGE CORPORATION: SNAPSHOT

TABLE 049. VIKING RANGE CORPORATION: BUSINESS PERFORMANCE

TABLE 050. VIKING RANGE CORPORATION: PRODUCT PORTFOLIO

TABLE 051. VIKING RANGE CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. AVANTI PRODUCTS: SNAPSHOT

TABLE 052. AVANTI PRODUCTS: BUSINESS PERFORMANCE

TABLE 053. AVANTI PRODUCTS: PRODUCT PORTFOLIO

TABLE 054. AVANTI PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. THE LIEBHERR GROUP: SNAPSHOT

TABLE 055. THE LIEBHERR GROUP: BUSINESS PERFORMANCE

TABLE 056. THE LIEBHERR GROUP: PRODUCT PORTFOLIO

TABLE 057. THE LIEBHERR GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. CLIMADIFF S.A.: SNAPSHOT

TABLE 058. CLIMADIFF S.A.: BUSINESS PERFORMANCE

TABLE 059. CLIMADIFF S.A.: PRODUCT PORTFOLIO

TABLE 060. CLIMADIFF S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. ELECTROLUX AB: SNAPSHOT

TABLE 061. ELECTROLUX AB: BUSINESS PERFORMANCE

TABLE 062. ELECTROLUX AB: PRODUCT PORTFOLIO

TABLE 063. ELECTROLUX AB: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 064. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 065. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 066. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. WINE CELLAR MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. WINE CELLAR MARKET OVERVIEW BY CAPACITY

FIGURE 012. UP TO 500 BOTTLE WINE CELLARS MARKET OVERVIEW (2016-2028)

FIGURE 013. UP TO 1 MARKET OVERVIEW (2016-2028)

FIGURE 014. 000 BOTTLE WINE CELLARS MARKET OVERVIEW (2016-2028)

FIGURE 015. UP TO 1 MARKET OVERVIEW (2016-2028)

FIGURE 016. 500 BOTTLE WINE CELLARS MARKET OVERVIEW (2016-2028)

FIGURE 017. MORE THAN 1 MARKET OVERVIEW (2016-2028)

FIGURE 018. 500 BOTTLE WINE CELLARS MARKET OVERVIEW (2016-2028)

FIGURE 019. WINE CELLAR MARKET OVERVIEW BY APPLICATION

FIGURE 020. RESIDENTIAL WINE CELLARS MARKET OVERVIEW (2016-2028)

FIGURE 021. COMMERCIAL WINE CELLARS MARKET OVERVIEW (2016-2028)

FIGURE 022. NORTH AMERICA WINE CELLAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. EUROPE WINE CELLAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. ASIA PACIFIC WINE CELLAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. MIDDLE EAST & AFRICA WINE CELLAR MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. SOUTH AMERICA WINE CELLAR MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Wine Cellar Market research report is 2023-2030.

Sunpentown Inc., Living Direct Inc., Dometic Group, La Sommeliere, Avintage, Viking Range Corporation, Avanti Products, The Liebherr Group, Climadiff S.A., Electrolux AB, and other major players.

The Wine Cellar Market is segmented into Capacity, Application, and region. By Capacity, the market is categorized into Up To 500 Bottle Wine Cellars, Up To 1,000 Bottle Wine Cellars, Up To 1,500 Bottle Wine Cellars, and More Than 1,500 Bottle Wine Cellars. By Application, the market is categorized into Residential Wine Cellars and Commercial Wine Cellars. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

A wine cellar is a place where wine is stored in bottles, barrels, or, less commonly, carboys, amphorae, or plastic containers. A climate control system keeps crucial parameters like temperature and humidity in an operating wine cellar under control. Passive wine cellars, on the other hand, are not climate-controlled and are typically built below to minimize temperature changes.

The Global Wine Cellar Market size is expected to grow from USD 1.41 billion in 2022 to USD 2.71 billion by 2030, at a CAGR of 8.5% during the forecast period (2023-2030).