Synthetic Graphite Market Synopsis:

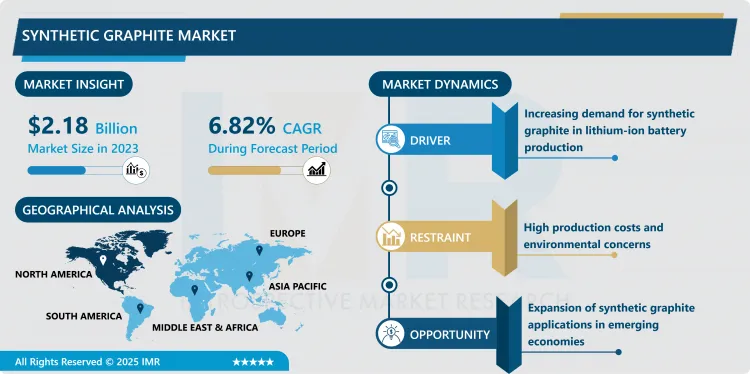

Synthetic Graphite Market Size Was Valued at USD 2.18 Billion in 2023, and is Projected to Reach USD 3.95 Billion by 2032, Growing at a CAGR of 6.82 % From 2024-2032.

The synthetic graphite market covers only synthetic graphite, which is a high pure carbon material through processing petroleum coke and other carbon resources. Synthetic graphite is defined as an important industrial material for its attractive features for heat and electricity transfer, chemical inertness, and heat-shock stability. The usages of the durable composite are in energy storage, metallurgical, electronics and aerospace industry where it comes in handy in the industrial revolution stage.

The overall synthetic graphite market has experienced impressive growth due to its essential application in the formulation of lithium-ion batteries because of advanced demand for electric vehicles (EVs) and other renewable power storage systems. Thus, with the global shift towards clean power sources, coupled with the ever-increasing requirement for high-performing battery components, synthetic graphite has been demanded. Due to its high co-efficient and performance than the natural graphite in battery anodes, it has become the favorite of most manufacturers.

Also, the metallurgical industries still use synthetic graphite for steelmaking and foundries uses as well. Due to its improved characteristics as a heat-resistant material it is widely used in industries such as electric arc furnaces and other high-temperature processes. Accompanying the growth of this market is the development of new materials for synthetic graphite manufacturing and increased energy efficiency and eco-friendliness of the manufacturing process.

Synthetic Graphite Market Trend Analysis:

Rising Demand for EV Batteries Driving Market Expansion

- Integration of efficient electrical powered vehicles around the world is one of the significant trends which has a direct impact on the synthetic graphite market. Besides, as governments and industries are entering the era of decarbonization, the market of EVs has been growing rapidly, and lithium-ion batteries are experiencing high demand. Synthetic graphite as one of the main components of battery anodes is in a good position to benefit from this for of change. Major players in the production of synthetic graphite for use in batteries are now directing resources into research and development of better technologies to produce better materials that will deliver higher energy densities and longer cycle times. It will continue as EV grows and batteries develop new technologies to support it as well as boosting consumer awareness of its use.

Growth in Emerging Economies

- The synthetic graphite market has huge opportunities in emerging economies such as Asia Pacific and African countries. These regions are easily getting industrialized and urbanized hence they are demanding for steel, electronic products and energy storage. These markets have enormous raw material availability, and the government encourages industrial development here immensely. Furthermore, other factors such as the increasing demands for renewable energy sources in these areas escalate the need for energy storage systems in synthetic graphite production.

Synthetic Graphite Market Segment Analysis:

Synthetic Graphite Market is Segmented on the basis of Type, Application, and Region

By Type, Graphite Anode segment is expected to dominate the market during the forecast period

- The graphite anode segment is expected to lead the market for synthetic graphite over the forecast timeline because of its importance in lithium-ion batteries. Natural graphite has issues of conductivity, structural stability, and consistency, which synthetic graphite anodes resolve to make them among the most useful in high-performance batteries. As more consumers continue to explore the possibility of purchasing EVs and with the increased demand for natural resources as storage for renewable energy, the use of synthetic graphite in anode manufacturing has skyrocketed.

By Application, the Metallurgy segment is expected to held the largest share

- The metallurgy segment should dominate the synthetic graphite market due to the large consumption of synthetic graphite in steel and other high-temperature applications. Due to their ability to resist high temperatures and consummate thermal conductivity, synthetic graphite is normally used in electric arc furnaces and foundry purposes. As the construction of global infrastructure and industrial processes advance especially in developing nations, demand for steel and other metallurgical products should increase. This will eventually create the demand for synthetic graphite and the Metallurgical application segment will continue to dominate the market.

Synthetic Graphite Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast Period

- The synthetic graphite market should be led by the Asia Pacific during the forecast period due to its increased industrialization across the continental and global manufacturing capabilities as well as in energy storage. Major consumers of synthetic graphite such as the lithium-ion batteries and steel are produced in countries such as China, Japan and South Korea. China being currently the largest manufacturer and exporter of EVs coupled with a clear vision to popularize the usage of renewable energy also strengthen the region’s presence in the market.

- Besides, Asia Pacific enjoys a scale of raw material availability and cheaper production resources. Market drivers include very effective industrial base especially as pertains advanced materials and renewable energy systems together with government’s supportive policies towards such markets. Therefore, Asia Pacific is expected to retain its importance within the synthetic graphite industry to meet the needs of both the domestic and international markets.

Active Key Players in the Synthetic Graphite Market:

- Asbury Carbons (United States)

- China Carbon Graphite Group, Inc. (China)

- ENEOS Corporation (Japan)

- Fangda Carbon New Material Co., Ltd. (China)

- GrafTech International Ltd. (United States)

- Graphite India Limited (India)

- HEG Limited (India)

- Imerys Graphite & Carbon (Switzerland)

- Jilin Carbon Co., Ltd. (China)

- Nippon Graphite Industries, Co., Ltd. (Japan)

- SEC Carbon, Ltd. (Japan)

- Showa Denko K.K. (Japan)

- Tokai Carbon Co., Ltd. (Japan)

- Toyo Tanso Co., Ltd. (Japan)

- Xuzhou Jianglong Carbon Manufacture Co., Ltd. (China)

- Other Active Players

|

Synthetic Graphite Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.18 Billion |

|

Forecast Period 2024-32 CAGR: |

6.82% |

Market Size in 2032: |

USD 3.95 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Synthetic Graphite Market by Type (2018-2032)

4.1 Synthetic Graphite Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Graphite Anode

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Graphite Block (Fine Carbon)

4.5 Other Types (Graphite Electrode

4.6 etc.)

Chapter 5: Synthetic Graphite Market by Application (2018-2032)

5.1 Synthetic Graphite Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Metallurgy

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Parts and Components

5.5 Batteries Nuclear

5.6 Other Applications

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Synthetic Graphite Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 ADAMA AGRICULTURAL SOLUTIONS LTD. (ISRAEL)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 ANTICIMEX INTERNATIONAL AB (SWEDEN)

6.4 BASF SE (GERMANY)

6.5 BAYER AG (GERMANY)

6.6 DOW AGROSCIENCES LLC (UNITED STATES)

6.7 ECOLAB INC. (UNITED STATES)

6.8 ENSYSTEX INC. (UNITED STATES)

6.9 FMC CORPORATION (UNITED STATES)

6.10 NIPPON SODA CO. LTD. (JAPAN)

6.11 PELGAR INTERNATIONAL (UNITED KINGDOM)

6.12 RENTOKIL INITIAL PLC (UNITED KINGDOM)

6.13 ROLLINS INC. (UNITED STATES)

6.14 SUMITOMO CHEMICAL CO. LTD. (JAPAN)

6.15 SYNGENTA AG (SWITZERLAND)

6.16 THE TERMINIX INTERNATIONAL COMPANY LIMITED PARTNERSHIP (UNITED STATES)

6.17 OTHER ACTIVE PLAYERS

Chapter 7: Global Synthetic Graphite Market By Region

7.1 Overview

7.2. North America Synthetic Graphite Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Graphite Anode

7.2.4.2 Graphite Block (Fine Carbon)

7.2.4.3 Other Types (Graphite Electrode

7.2.4.4 etc.)

7.2.5 Historic and Forecasted Market Size by Application

7.2.5.1 Metallurgy

7.2.5.2 Parts and Components

7.2.5.3 Batteries Nuclear

7.2.5.4 Other Applications

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Synthetic Graphite Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Graphite Anode

7.3.4.2 Graphite Block (Fine Carbon)

7.3.4.3 Other Types (Graphite Electrode

7.3.4.4 etc.)

7.3.5 Historic and Forecasted Market Size by Application

7.3.5.1 Metallurgy

7.3.5.2 Parts and Components

7.3.5.3 Batteries Nuclear

7.3.5.4 Other Applications

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Synthetic Graphite Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Graphite Anode

7.4.4.2 Graphite Block (Fine Carbon)

7.4.4.3 Other Types (Graphite Electrode

7.4.4.4 etc.)

7.4.5 Historic and Forecasted Market Size by Application

7.4.5.1 Metallurgy

7.4.5.2 Parts and Components

7.4.5.3 Batteries Nuclear

7.4.5.4 Other Applications

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Synthetic Graphite Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Graphite Anode

7.5.4.2 Graphite Block (Fine Carbon)

7.5.4.3 Other Types (Graphite Electrode

7.5.4.4 etc.)

7.5.5 Historic and Forecasted Market Size by Application

7.5.5.1 Metallurgy

7.5.5.2 Parts and Components

7.5.5.3 Batteries Nuclear

7.5.5.4 Other Applications

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Synthetic Graphite Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Graphite Anode

7.6.4.2 Graphite Block (Fine Carbon)

7.6.4.3 Other Types (Graphite Electrode

7.6.4.4 etc.)

7.6.5 Historic and Forecasted Market Size by Application

7.6.5.1 Metallurgy

7.6.5.2 Parts and Components

7.6.5.3 Batteries Nuclear

7.6.5.4 Other Applications

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Synthetic Graphite Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Graphite Anode

7.7.4.2 Graphite Block (Fine Carbon)

7.7.4.3 Other Types (Graphite Electrode

7.7.4.4 etc.)

7.7.5 Historic and Forecasted Market Size by Application

7.7.5.1 Metallurgy

7.7.5.2 Parts and Components

7.7.5.3 Batteries Nuclear

7.7.5.4 Other Applications

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Synthetic Graphite Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.18 Billion |

|

Forecast Period 2024-32 CAGR: |

6.82% |

Market Size in 2032: |

USD 3.95 Billion |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||