Advanced Ceramics Market Synopsis

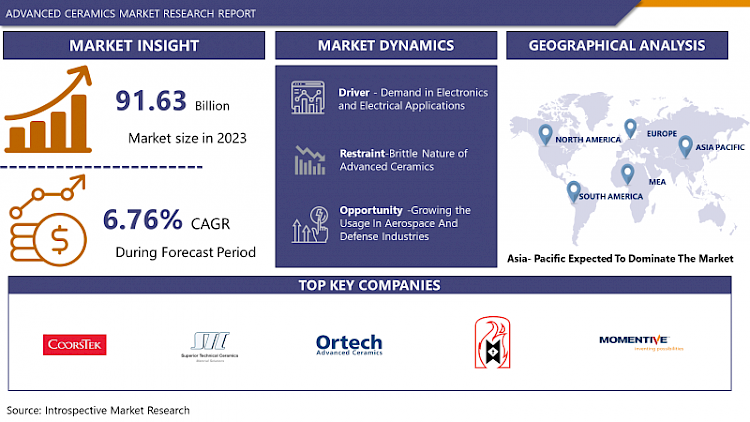

Advanced Ceramics Market Size Was Valued at USD 91.63 Billion in 2023, and is Projected to Reach USD 165.09 Billion by 2032, Growing at a CAGR of 6.76% From 2024-2032.

Advanced ceramics, also known as engineered or technical ceramics, refer to a class of high-performance ceramics with exceptional mechanical, thermal, and electrical properties.

- Advanced ceramics, substances, and methods applied in the development and production of ceramic materials that exhibit special properties. According to Versailles Project on Advanced Materials and Standards (VAMAS), advanced ceramics is an inorganic, nonmetallic (ceramic), basically crystalline material of strictly managed composition and produced with detailed regulation from highly refined and characterized raw materials giving precisely specified attributes.

- Advanced ceramics are inorganic and non-metallic solids that have many various properties. In addition, it has several factors such as strength and corrosion resistance, low coefficient of thermal expansion, high heat stability and are lightweight compared to their traditional counterparts. These highly versatile properties make ceramics a preferred choice in different sectors. In advanced and emerging countries, ceramics are growingly being accepted by different sectors, such as electrical and electronics, transportation, chemicals, and defense and security.

- The composition of advanced ceramics typically involves complex combinations of oxides, carbides, nitrides, and other non-metallic elements. This diversity allows for tailoring the properties of the ceramics to meet the demands of various industrial applications. Silicon carbide, alumina, and zirconia are among the commonly utilized materials in advanced ceramics due to their high strength, hardness, and resistance to wear.

Advanced Ceramics Market Trend Analysis

Demand in Electronics and Electrical Applications

- As electronic devices become smaller, lighter, and more powerful, the demand for advanced ceramics in electronics and electrical applications has surged. Advanced ceramics, with their excellent electrical insulating properties and thermal conductivity, are used in components like insulators, substrates, and semiconductors.

- The aerospace sector is a significant driver for advanced ceramics due to the materials' ability to withstand extreme conditions. Components like turbine blades, heat shields, and aircraft sensors benefit from the high strength, heat resistance, and light weight of advanced ceramics, contributing to improved fuel efficiency and overall performance.

- Advanced ceramics find extensive use in the healthcare industry, particularly in medical implants and prosthetics. Their biocompatibility, corrosion resistance, and durability make them ideal materials for applications such as dental implants, joint replacements, and bone grafts.

- Advanced ceramics are often favored for their durability and resistance to corrosion, which leads to longer lifecycles of products. In an era of increasing environmental awareness, the longevity and recyclability of advanced ceramics make them attractive for industries seeking sustainable and eco-friendly solutions.

Growing The Usage In Aerospace And Defense Industries

- Expanding the usage of advanced ceramics in the aerospace and defense industries presents a significant opportunity for market growth. These industries demand materials that can withstand extreme conditions, provide high-performance capabilities, and contribute to the overall efficiency and safety of aerospace systems. The unique properties of advanced ceramics position them as key enablers for innovation in these sectors.

- One of the primary opportunities lies in the development and application of advanced ceramics for critical components in aircraft and spacecraft. Turbine blades, engine components, and heat-resistant coatings benefit from the high strength, thermal stability, and lightweight characteristics of advanced ceramics. As the aerospace industry continues to push the boundaries of performance and fuel efficiency, the demand for these materials is likely to increase.

- The defense sector relies on advanced ceramics for the production of armor materials, ballistic protection, and durable components in military equipment. The ability of ceramics to provide excellent ballistic resistance while remaining lightweight is crucial for enhancing the mobility and survivability of military platforms. The ongoing advancements in materials science offer the opportunity to tailor ceramics to meet specific defense requirements, ensuring the development of cutting-edge protective solutions.

- The opportunity for advanced ceramics in aerospace and defense extends beyond traditional applications. The integration of ceramics in electronic components, sensors, and communication systems is gaining traction. The materials' electrical insulating properties and resistance to harsh environments make them valuable for enhancing the performance and reliability of electronic systems in aerospace and defense applications.

Advanced Ceramics Market Segment Analysis:

Advanced Ceramics Market Segmented on the basis of Type, Application, And End-Users.

By Type, Alumina segment is expected to dominate the market during the forecast period

- Alumina is renowned for its exceptional hardness and wear resistance. This property makes it a preferred material for applications where components are subjected to abrasive wear, such as in cutting tools, ball bearings, and wear-resistant linings. The ability of alumina to withstand wear and abrasion contributes to its dominance in industries where durability is a critical factor.

- Alumina possesses remarkable thermal stability, enabling it to withstand high temperatures without significant degradation. This makes alumina suitable for applications in environments with elevated temperatures, such as furnace components, heat-resistant coatings, and aerospace applications. Its thermal stability contributes to the material's dominance in industries requiring resistance to extreme heat.

- Alumina is chemically inert and resistant to corrosion, making it an ideal choice for applications in aggressive chemical environments. This property is particularly valuable in industries such as chemical processing, where materials must withstand exposure to corrosive substances. Alumina's corrosion resistance contributes to its dominance in these applications.

By End-User, Electrical & Electronics segment held the largest share of 42.34% in 2022

- The demand for smaller, lighter, and more powerful electronic devices continues to drive innovations in the E&E sector. Advanced ceramics play a crucial role in enabling miniaturization while enhancing the performance of electronic components. Their excellent electrical insulating properties, combined with high thermal conductivity, make them ideal for use in semiconductors, insulators, and substrates.

- The E&E segment encompasses a wide range of high-tech applications, including smartphones, tablets, wearables, and other consumer electronics. Advanced ceramics are used in the manufacturing of components that require precise engineering to meet the stringent performance standards of modern electronic devices.

- The semiconductor industry relies heavily on advanced ceramics for various applications, such as wafer processing, packaging, and insulating components. As semiconductor technologies advance, the demand for ceramics with specific electrical and thermal

- The proliferation of electronic components in various industries, including automotive, healthcare, and communication, fuels the demand for advanced ceramics. Components like sensors, actuators, and circuitry benefit from the materials' unique combination of electrical, thermal, and mechanical properties.

Advanced Ceramics Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia-Pacific, particularly countries like China, Japan, and South Korea, has established itself as a global manufacturing hub for a wide range of industries. The region's strong emphasis on industrialization and manufacturing has fueled the demand for advanced ceramics in applications such as electronics, automotive, and aerospace.

- The Asia-Pacific region is a major player in the global electronics and semiconductor industry. With the production of a significant portion of the world's electronic devices, there is a substantial demand for advanced ceramics in semiconductor manufacturing. These materials find applications in components like insulators, substrates, and packaging materials, contributing to the dominance of the region.

- The ongoing industrialization and economic development in Asia-Pacific countries have led to increased investments in infrastructure, construction, and various industries. This has, in turn, driven the demand for advanced ceramics in sectors such as energy, construction, and transportation.

- The automotive industry in Asia-Pacific, especially in countries like China and Japan, has experienced significant growth. Advanced ceramics are used in various automotive components, including catalytic converters, sensors, and engine parts. The expanding automotive sector contributes to the demand for advanced ceramics in the region.

Advanced Ceramics Market Top Key Players:

- CoorsTek, Inc. (US)

- Superior Technical Ceramics (US)

- Ortech Advanced Ceramics (US)

- Applied Ceramics, Inc. (US)

- LSP Industrial Ceramics, Inc. (US)

- Momentive Performance Materials Inc. (US)

- International Ceramic Engineering (US)

- 3M Company (US)

- McDanel Advanced Ceramic Technologies (US)

- Corning Incorporated (US)

- H.C. Starck GmbH (Germany)

- Rauschert GmbH (Germany)

- CeramTec GmbH (Germany)

- Saint-Gobain S.A. (France)

- Morgan Advanced Materials plc (UK)

- Mantec Technical Ceramics Ltd. (UK)

- CERAM Research Ltd. (UK)

- Pingxiang Chemshun Ceramics Co., Ltd. (China)

- Toshiba Materials Co., Ltd. (Japan)

- Kyocera Corporation (Japan)

- Murata Manufacturing Co., Ltd. (Japan)

- Ibiden Co., Ltd. (Japan)

- Kyocera Fineceramics Corporation (Japan)

- NGK Spark Plug Co., Ltd. (Japan)

- Ferrotec Corporation (Japan), and Other Major Players.

Key Industry Developments in the Advanced Ceramics Market:

In October 2023, Alteo launches HYCal®: alumina solutions for Advanced Ceramics.

As a major specialty aluminas supplier for advance ceramics, Alteo strengthens its leadership by expanding its range of high performing and innovative specialty aluminas. Alteo has announced the launch of Alteo’s HYCal® brand of aluminas. The new brand is dedicated to advanced ceramics and strengthens Alteo’s commitment to excellence and quality to support to their customers’ growth.

In April 2022, Kyocera reached an agreement to acquire about 37 acres of land for a new smart factory at the Minami Shaaya Industrial Park in Ishayu City, Nagasaki Prefecture. Kyocera is designing this new factory for fine ceramic components production, set to start operating in 2026, in order to meet the growing demand in the electronics industry and advanced semiconductor technology.

In May 2022, Ceram Tec developed a new product under the name AlN HP. It is a high-performance substrate made of aluminum nitride. The newly launched AlN HP substrate offers 40 percent more flexural strength than the previous generation of AlN substrates.

|

Global Advanced Ceramics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 91.63 Billion. |

|

Forecast Period 2024-32 CAGR: |

6.76% |

Market Size in 2032: |

USD 165.09 Billion. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- ADVANCED CERAMICS MARKET BY TYPE (2017-2032)

- ADVANCED CERAMICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ALUMINA

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032)

- Historic And Forecasted Market Size in Volume (2017-2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TITANITE

- ZIRCONIA

- SILICON CARBIDE

- ALUMINIUM NITRIDE

- SILICON NITRIDE

- ADVANCED CERAMICS MARKET BY APPLICATION (2017-2032)

- ADVANCED CERAMICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MONOLITHIC CERAMICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032)

- Historic And Forecasted Market Size in Volume (2017-2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CERAMIC MATRIX COMPOSITES

- CERAMIC COATING

- ADVANCED CERAMICS MARKET BY END USER INDUSTRY (2017-2032)

- ADVANCED CERAMICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ELECTRICAL & ELECTRONICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032)

- Historic And Forecasted Market Size in Volume (2017-2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TRANSPORTATION

- MEDICAL

- DEFENSE

- SECURITY CHEMICAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Advanced Ceramics Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- COORSTEK, INC. (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- SUPERIOR TECHNICAL CERAMICS (US)

- ORTECH ADVANCED CERAMICS (US)

- APPLIED CERAMICS, INC. (US)

- LSP INDUSTRIAL CERAMICS, INC. (US)

- MOMENTIVE PERFORMANCE MATERIALS INC. (US)

- INTERNATIONAL CERAMIC ENGINEERING (US)

- 3M COMPANY (US)

- MCDANEL ADVANCED CERAMIC TECHNOLOGIES (US)

- CORNING INCORPORATED (US)

- H.C. STARCK GMBH (GERMANY)

- RAUSCHERT GMBH (GERMANY)

- CERAMTEC GMBH (GERMANY)

- SAINT-GOBAIN S.A. (FRANCE)

- MORGAN ADVANCED MATERIALS PLC (UK)

- MANTEC TECHNICAL CERAMICS LTD. (UK)

- CERAM RESEARCH LTD. (UK)

- PINGXIANG CHEMSHUN CERAMICS CO., LTD. (CHINA)

- TOSHIBA MATERIALS CO., LTD. (JAPAN)

- KYOCERA CORPORATION (JAPAN)

- MURATA MANUFACTURING CO., LTD. (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL Advanced Ceramics MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By End User Industry

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- UK

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Advanced Ceramics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 91.63 Billion. |

|

Forecast Period 2024-32 CAGR: |

6.76% |

Market Size in 2032: |

USD 165.09 Billion. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By End User Industry |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Frequently Asked Questions :

The forecast period in the Advanced Ceramics Market research report is 2024-2032.

CoorsTek, Inc., Superior Technical Ceramics, Ortech Advanced Ceramics, Applied Ceramics, Inc., LSP Industrial Ceramics, Inc., Momentive Performance Materials Inc., International Ceramic Engineering, 3M Company, McDanel Advanced Ceramic Technologies, Corning Incorporated, H.C. Starck GmbH, Rauschert GmbH, CeramTec GmbH, Saint-Gobain S.A., Morgan Advanced Materials plc, Mantec Technical Ceramics Ltd., CERAM Research Ltd., Pingxiang Chemshun Ceramics Co., Ltd., Toshiba Materials Co., Ltd., Kyocera Corporation, Murata Manufacturing Co., Ltd., Ibiden Co., Ltd., Kyocera Fineceramics Corporation, NGK Spark Plug Co., Ltd., Ferrotec Corporation, and Other Major Players.

The Advanced Ceramics Market is segmented into Type, Application, End User Industry and region. By Type, the market is categorized into Alumina, Titanite, Zirconia, Silicon Carbide, Aluminium Nitride, Silicon Nitride. By Application, the market is categorized into Monolithic Ceramics, Ceramic Matrix Composites, Ceramic Coating. By End User Industry, the market is categorized into Electrical & Electronics, Transportation, Medical, Defense, Security Chemical. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Advanced ceramics, also known as engineered or technical ceramics, refer to a class of high-performance ceramics with exceptional mechanical, thermal, and electrical properties.

Advanced Ceramics Market Size Was Valued at USD 91.63 Billion in 2023, and is Projected to Reach USD 165.09 Billion by 2032, Growing at a CAGR of 6.76% From 2024-2032.