Nanoelectromechanical System (NEMS) Market Synopsis

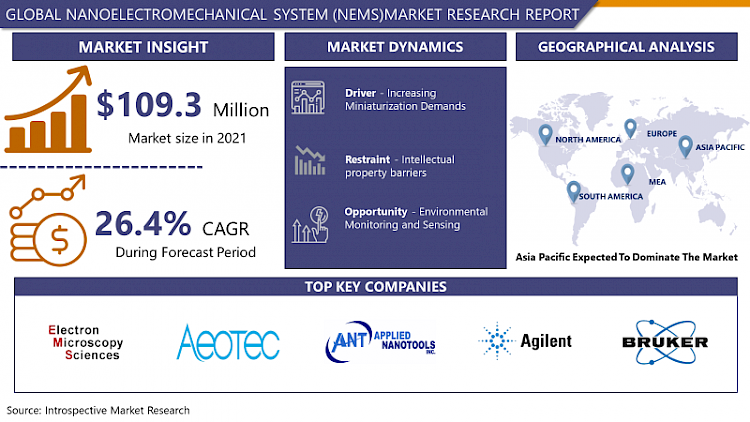

Nanoelectromechanical System (NEMS) Market Size Was Valued at USD 109.31 Million in 2022 and is Projected to Reach USD 712.26 Million by 2030, Growing at a CAGR of 26.4% From 2023-2030.

Nanoelectromechanical Systems (NEMS) are devices that integrate electrical and mechanical functionalities at the manometer scale. These systems typically involve tiny structures, such as nanowires, nanotubes, or nanoscale resonators, that exhibit both electronic and mechanical properties. They operate on the principle that at such small scales, quantum effects become significant, enabling unique functionalities.

- Applications of NEMS span various fields. In electronics, NEMS devices contribute to advancements in sensors, actuators, and high-frequency resonators due to their superior sensitivity and small size. They find use in healthcare for highly precise biomedical sensors, in telecommunications for ultra-fast signal processing, and in environmental monitoring for detecting minute changes.

- In the market, NEMS have shown promising trends with ongoing research and development. Their potential for highly sensitive sensors has attracted attention, especially in medical diagnostics, environmental monitoring, and defense technologies. The pursuit of higher efficiency and miniaturization in electronics has also driven interest in NEMS-based computing and communication devices. Additionally, the scalability of NEMS fabrication techniques continues to improve, paving the way for cost-effective mass production.

- NEMS' integration of electrical and mechanical functionalities at the nanoscale offers vast possibilities across multiple industries, shaping a future of ultra-sensitive, miniaturized, and efficient devices.

Nanoelectromechanical System (NEMS) Market Trend Analysis

Increasing Miniaturization Demands

- The increasing demand for miniaturization acts as a major driver propelling the growth of the Nanoelectromechanical Systems (NEMS) market. Industries across diverse sectors, from electronics to healthcare, are seeking smaller yet more powerful devices. NEMS technology, with its ability to integrate electrical and mechanical functionalities at the manometer scale, perfectly aligns with this demand for miniaturization.

- Miniaturization is pivotal in addressing the need for compact, high-performance devices. NEMS offer a remarkable advantage due to their incredibly small size, enabling the creation of ultra-sensitive sensors, faster communication devices, and highly efficient actuators. This drive towards smaller form factors is particularly crucial in industries such as healthcare, where portable and implantable medical devices benefit significantly from miniaturization, allowing for less invasive procedures and more comfortable patient experiences.

- Moreover, as the demand for wearable electronics, IoT devices, and miniaturized sensors increases, NEMS technology stands out for its potential to deliver compact yet powerful solutions. The quest for smaller, more energy-efficient devices also aligns with environmental and sustainability goals, further emphasizing the importance of NEMS in shaping the future of technology.

- As industries continue to push the boundaries of miniaturization, NEMS technology remains at the forefront, poised to revolutionize multiple sectors by delivering highly efficient, compact, and powerful devices.

Environmental Monitoring and Sensing

- Environmental monitoring and sensing represent a significant opportunity for the Nanoelectromechanical Systems (NEMS) market due to the pressing need for accurate, sensitive, and real-time detection of environmental parameters. NEMS-based sensors offer unique advantages in this domain, providing unparalleled sensitivity and precision at the nanoscale.

- NEMS sensors can detect and measure various environmental factors, including pollutants, gases, toxins, and particulate matter, with exceptional accuracy and sensitivity. These sensors have the capability to identify minute concentrations of substances, making them invaluable in applications such as air quality monitoring, water quality assessment, and soil analysis.

- One of the crucial aspects of environmental monitoring is the ability to detect pollutants at extremely low concentrations. NEMS sensors, owing to their nanoscale dimensions and high surface-to-volume ratio, can detect trace amounts of pollutants, enabling early detection of environmental hazards and ensuring timely mitigation measures.

- Furthermore, the miniaturization and low power consumption of NEMS devices allow for the development of compact, low-cost, and energy-efficient environmental monitoring systems. These systems can be deployed across diverse settings, including urban areas, industrial sites, and remote locations, providing comprehensive and real-time data for environmental assessment and management.

- The demand for reliable, high-performance sensors for environmental monitoring continues to grow, driven by regulatory requirements, environmental concerns, and the need for sustainable practices. NEMS technology's ability to offer precise, real-time, and cost-effective solutions positions it as a promising opportunity in addressing critical environmental challenges, fostering better resource management, and supporting initiatives aimed at environmental preservation and sustainability.

Nanoelectromechanical System (NEMS) Market Segment Analysis:

Nanoelectromechanical System (NEMS) Market Segmented on the basis of type, material and application.

By Type, Nano-tweezers segment is expected to dominate the market during the forecast period

- In the realm of Nanoelectromechanical Systems (NEMS), the Nano-tweezers segment is anticipated to assert dominance during the forecast period. Nano-tweezers, characterized by their nanoscale manipulation capabilities, exhibit remarkable precision and control over tiny objects at the molecular and cellular levels.

- These devices employ electric fields or mechanical forces at the nanoscale to manipulate, position, and assemble nanoparticles, biomolecules, or even individual atoms. Their applications span various fields, including nanoscale assembly, biological and biomedical research, semiconductor manufacturing, and nanoscale sensing.

- The Nano-tweezers' ability to precisely handle and position nanoscale components holds immense promise in enabling advancements in nanotechnology, biotechnology, and material science. The increasing demand for precise manipulation and assembly of nanostructures, especially in fields like nanomedicine and nanoelectronics, propels the Nano-tweezers segment to the forefront, indicating its potential dominance in the evolving landscape of NEMS applications.

By Application, Sensing & Control Applications segment held the largest market share of 49.7% in 2022

- In the Nanoelectromechanical Systems (NEMS) market, the Sensing & Control Applications segment has secured the largest market share. This dominance is primarily attributed to the inherent capabilities of NEMS devices in delivering highly sensitive, accurate, and responsive sensing and control functionalities at the nanoscale.

- Sensing applications leverage NEMS' exceptional sensitivity to detect and measure various physical, chemical, and biological parameters with unprecedented precision. These sensors find extensive use in healthcare for diagnostic tools, environmental monitoring for detecting pollutants, and in industries requiring precise measurements.

- Moreover, NEMS excel in control applications, offering superior capabilities in manipulating and controlling nanoscale components and systems. Their ability to actuate and control at the nanoscale enables advancements in areas such as nanorobotics, nanomanufacturing, and precision instrumentation.

- The reliability, miniaturization, and efficiency of NEMS-based sensing and control systems drive their widespread adoption across industries, thus securing the largest market share within the application segment of the NEMS market.

Nanoelectromechanical System (NEMS) Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- The Asia Pacific region is poised to dominate the Nanoelectromechanical Systems (NEMS) market over the forecast period owing to various contributing factors. One significant factor is the region's robust manufacturing infrastructure and technological advancements, particularly in countries like China, Japan, South Korea, and India. These nations have heavily invested in research and development, fostering innovation in nanotechnology and nanofabrication techniques, thus driving the growth of the NEMS market.

- Additionally, the increasing demand for consumer electronics, healthcare devices, and automotive applications in the Asia Pacific region fuels the adoption of NEMS technology. The rising population and urbanization further boost the market, creating opportunities for NEMS-based sensors, actuators, and communication devices across diverse industries.

- Moreover, supportive government initiatives, collaborations between academia and industry, and a growing focus on sustainable technologies contribute to the market's expansion in the Asia Pacific. These factors collectively position the region as a frontrunner in the NEMS market, expected to maintain its dominance throughout the forecast period.

Nanoelectromechanical System (NEMS) Market Top Key Players:

- Bruker Corporation (U.S.)

- Keysight Technologies (U.S.)

- Agilent Technologies (U.S.)

- Anasys Instruments (U.S.)

- Thermo Fisher Scientific (U.S.)

- Asylum Research (Oxford Instruments) (U.S.)

- Fei Company (U.S.)

- Molecular Vista (U.S.)

- Park Systems (South Korea)

- Nt-Mdt Spectrum Instruments (Russia)

- Hitachi High-Technologies Corporation (Japan)

- Jeol Ltd. (Japan)

- Aist-Nt (Lithuania)

- Oxford Instruments (U.K.)

- Nanosurf Ag (Switzerland)

- Nanoscience Instruments (U.S.)

- Nanosensors (Switzerland)

- Nanoandmore Gmbh (Germany)

- Nanomechanics Inc. (U.S.)

- Aspex Corporation (U.S.)

- Nanomagnetics Instruments Ltd. (Canada)

- Nanomagnetics Instruments (U.S.)

- Nt-Mdt Development (Russia)

- Phasis (France)

- Nanonics Imaging (Israel) And Other Major Players

|

Global Nanoelectromechanical System (NEMS) Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 109.31 Mn. |

|

Forecast Period 2023-30 CAGR: |

26.4 % |

Market Size in 2030: |

USD 712.26 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET BY TYPE (2016-2030)

- NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NANO-ACCELEROMETERS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NANO-TWEEZERS

- NANO-SWITCHES

- NANO-FLUIDIC MODULES

- NANO-CANTILEVERS

- NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET BY MATERIAL (2016-2030)

- NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- GRAPHENE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CARBON NANOTUBES

- SIC

- SIO2

- NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET BY APPLICATION (2016-2030)

- NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SENSING & CONTROL APPLICATIONS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SOLID STATE ELECTRONICS

- TOOLS & EQUIPMENT APPLICATION

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- NANOELECTROMECHANICAL SYSTEM (NEMS) Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- BRUKER CORPORATION (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- KEYSIGHT TECHNOLOGIES (U.S.)

- AGILENT TECHNOLOGIES (U.S.)

- ANASYS INSTRUMENTS (U.S.)

- THERMO FISHER SCIENTIFIC (U.S.)

- ASYLUM RESEARCH (OXFORD INSTRUMENTS) (U.S.)

- FEI COMPANY (U.S.)

- MOLECULAR VISTA (U.S.)

- PARK SYSTEMS (SOUTH KOREA)

- NT-MDT SPECTRUM INSTRUMENTS (RUSSIA)

- HITACHI HIGH-TECHNOLOGIES CORPORATION (JAPAN)

- JEOL LTD. (JAPAN)

- AIST-NT (LITHUANIA)

- OXFORD INSTRUMENTS (U.K.)

- NANOSURF AG (SWITZERLAND)

- NANOSCIENCE INSTRUMENTS (U.S.)

- NANOSENSORS (SWITZERLAND)

- NANOANDMORE GMBH (GERMANY)

- NANOMECHANICS INC. (U.S.)

- ASPEX CORPORATION (U.S.)

- NANOMAGNETICS INSTRUMENTS LTD. (CANADA)

- NANOMAGNETICS INSTRUMENTS (U.S.)

- NT-MDT DEVELOPMENT (RUSSIA)

- PHASIS (FRANCE)

- NANONICS IMAGING (ISRAEL) AND OTHER MAJOR PLAYERS

- COMPETITIVE LANDSCAPE

- GLOBAL NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By MATERIAL

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Nanoelectromechanical System (NEMS) Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 109.31 Mn. |

|

Forecast Period 2023-30 CAGR: |

26.4 % |

Market Size in 2030: |

USD 712.26 Mn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET COMPETITIVE RIVALRY

TABLE 005. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET THREAT OF NEW ENTRANTS

TABLE 006. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET THREAT OF SUBSTITUTES

TABLE 007. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET BY TYPE

TABLE 008. NANO-ACCELEROMETERS MARKET OVERVIEW (2016-2028)

TABLE 009. NANO-TWEEZERS MARKET OVERVIEW (2016-2028)

TABLE 010. NANO-SWITCHES MARKET OVERVIEW (2016-2028)

TABLE 011. NANO-FLUIDIC MODULES MARKET OVERVIEW (2016-2028)

TABLE 012. NANO-CANTILEVERS MARKET OVERVIEW (2016-2028)

TABLE 013. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET BY MATERIAL

TABLE 014. GRAPHENE MARKET OVERVIEW (2016-2028)

TABLE 015. CARBON NANOTUBES MARKET OVERVIEW (2016-2028)

TABLE 016. SIC MARKET OVERVIEW (2016-2028)

TABLE 017. SIO2 MARKET OVERVIEW (2016-2028)

TABLE 018. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 019. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET BY APPLICATION

TABLE 020. SENSING & CONTROL APPLICATIONS MARKET OVERVIEW (2016-2028)

TABLE 021. SOLID STATE ELECTRONICS MARKET OVERVIEW (2016-2028)

TABLE 022. TOOLS & EQUIPMENT APPLICATION MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY TYPE (2016-2028)

TABLE 024. NORTH AMERICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY MATERIAL (2016-2028)

TABLE 025. NORTH AMERICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY APPLICATION (2016-2028)

TABLE 026. N NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY COUNTRY (2016-2028)

TABLE 027. EUROPE NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY TYPE (2016-2028)

TABLE 028. EUROPE NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY MATERIAL (2016-2028)

TABLE 029. EUROPE NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY APPLICATION (2016-2028)

TABLE 030. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY COUNTRY (2016-2028)

TABLE 031. ASIA PACIFIC NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY TYPE (2016-2028)

TABLE 032. ASIA PACIFIC NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY MATERIAL (2016-2028)

TABLE 033. ASIA PACIFIC NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY APPLICATION (2016-2028)

TABLE 034. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY COUNTRY (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY TYPE (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY MATERIAL (2016-2028)

TABLE 037. MIDDLE EAST & AFRICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY APPLICATION (2016-2028)

TABLE 038. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY COUNTRY (2016-2028)

TABLE 039. SOUTH AMERICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY TYPE (2016-2028)

TABLE 040. SOUTH AMERICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY MATERIAL (2016-2028)

TABLE 041. SOUTH AMERICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY APPLICATION (2016-2028)

TABLE 042. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET, BY COUNTRY (2016-2028)

TABLE 043. VISTEC ELECTRON BEAM GMBH: SNAPSHOT

TABLE 044. VISTEC ELECTRON BEAM GMBH: BUSINESS PERFORMANCE

TABLE 045. VISTEC ELECTRON BEAM GMBH: PRODUCT PORTFOLIO

TABLE 046. VISTEC ELECTRON BEAM GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. CRANFIELD UNIVERSITY: SNAPSHOT

TABLE 047. CRANFIELD UNIVERSITY: BUSINESS PERFORMANCE

TABLE 048. CRANFIELD UNIVERSITY: PRODUCT PORTFOLIO

TABLE 049. CRANFIELD UNIVERSITY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. NANOCYL SA.: SNAPSHOT

TABLE 050. NANOCYL SA.: BUSINESS PERFORMANCE

TABLE 051. NANOCYL SA.: PRODUCT PORTFOLIO

TABLE 052. NANOCYL SA.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. SUN INNOVATIONS INC.: SNAPSHOT

TABLE 053. SUN INNOVATIONS INC.: BUSINESS PERFORMANCE

TABLE 054. SUN INNOVATIONS INC.: PRODUCT PORTFOLIO

TABLE 055. SUN INNOVATIONS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. ASYLUM RESEARCH CORPORATION: SNAPSHOT

TABLE 056. ASYLUM RESEARCH CORPORATION: BUSINESS PERFORMANCE

TABLE 057. ASYLUM RESEARCH CORPORATION: PRODUCT PORTFOLIO

TABLE 058. ASYLUM RESEARCH CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SHOWA DENKO K.K.: SNAPSHOT

TABLE 059. SHOWA DENKO K.K.: BUSINESS PERFORMANCE

TABLE 060. SHOWA DENKO K.K.: PRODUCT PORTFOLIO

TABLE 061. SHOWA DENKO K.K.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. CNANO TECHNOLOGY LIMITED: SNAPSHOT

TABLE 062. CNANO TECHNOLOGY LIMITED: BUSINESS PERFORMANCE

TABLE 063. CNANO TECHNOLOGY LIMITED: PRODUCT PORTFOLIO

TABLE 064. CNANO TECHNOLOGY LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. NANOSHELL COMPANY LLC: SNAPSHOT

TABLE 065. NANOSHELL COMPANY LLC: BUSINESS PERFORMANCE

TABLE 066. NANOSHELL COMPANY LLC: PRODUCT PORTFOLIO

TABLE 067. NANOSHELL COMPANY LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. AGILENT TECHNOLOGIES INC.: SNAPSHOT

TABLE 068. AGILENT TECHNOLOGIES INC.: BUSINESS PERFORMANCE

TABLE 069. AGILENT TECHNOLOGIES INC.: PRODUCT PORTFOLIO

TABLE 070. AGILENT TECHNOLOGIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. CALIFORNIA INSTITUTE OF TECHNOLOGY: SNAPSHOT

TABLE 071. CALIFORNIA INSTITUTE OF TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 072. CALIFORNIA INSTITUTE OF TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 073. CALIFORNIA INSTITUTE OF TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. APPLIED NANOTOOLS INC.: SNAPSHOT

TABLE 074. APPLIED NANOTOOLS INC.: BUSINESS PERFORMANCE

TABLE 075. APPLIED NANOTOOLS INC.: PRODUCT PORTFOLIO

TABLE 076. APPLIED NANOTOOLS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. BRUKER CORPORATION: SNAPSHOT

TABLE 077. BRUKER CORPORATION: BUSINESS PERFORMANCE

TABLE 078. BRUKER CORPORATION: PRODUCT PORTFOLIO

TABLE 079. BRUKER CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. AMPRIUS INC.: SNAPSHOT

TABLE 080. AMPRIUS INC.: BUSINESS PERFORMANCE

TABLE 081. AMPRIUS INC.: PRODUCT PORTFOLIO

TABLE 082. AMPRIUS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. BROADCOM CORPORATION: SNAPSHOT

TABLE 083. BROADCOM CORPORATION: BUSINESS PERFORMANCE

TABLE 084. BROADCOM CORPORATION: PRODUCT PORTFOLIO

TABLE 085. BROADCOM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. FRAUNHOFER-GESELLSCHAFT: SNAPSHOT

TABLE 086. FRAUNHOFER-GESELLSCHAFT: BUSINESS PERFORMANCE

TABLE 087. FRAUNHOFER-GESELLSCHAFT: PRODUCT PORTFOLIO

TABLE 088. FRAUNHOFER-GESELLSCHAFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. INTERUNIVERSITY MICROELECTRONICS CENTRE: SNAPSHOT

TABLE 089. INTERUNIVERSITY MICROELECTRONICS CENTRE: BUSINESS PERFORMANCE

TABLE 090. INTERUNIVERSITY MICROELECTRONICS CENTRE: PRODUCT PORTFOLIO

TABLE 091. INTERUNIVERSITY MICROELECTRONICS CENTRE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 092. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 093. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 094. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET OVERVIEW BY TYPE

FIGURE 012. NANO-ACCELEROMETERS MARKET OVERVIEW (2016-2028)

FIGURE 013. NANO-TWEEZERS MARKET OVERVIEW (2016-2028)

FIGURE 014. NANO-SWITCHES MARKET OVERVIEW (2016-2028)

FIGURE 015. NANO-FLUIDIC MODULES MARKET OVERVIEW (2016-2028)

FIGURE 016. NANO-CANTILEVERS MARKET OVERVIEW (2016-2028)

FIGURE 017. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET OVERVIEW BY MATERIAL

FIGURE 018. GRAPHENE MARKET OVERVIEW (2016-2028)

FIGURE 019. CARBON NANOTUBES MARKET OVERVIEW (2016-2028)

FIGURE 020. SIC MARKET OVERVIEW (2016-2028)

FIGURE 021. SIO2 MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 023. NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET OVERVIEW BY APPLICATION

FIGURE 024. SENSING & CONTROL APPLICATIONS MARKET OVERVIEW (2016-2028)

FIGURE 025. SOLID STATE ELECTRONICS MARKET OVERVIEW (2016-2028)

FIGURE 026. TOOLS & EQUIPMENT APPLICATION MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA NANOELECTROMECHANICAL SYSTEM (NEMS) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Nanoelectromechanical System (NEMS) Market research report is 2023-2030.

Bruker Corporation (U.S.), Keysight Technologies (U.S.), Agilent Technologies (U.S.), Anasys Instruments (U.S.), Thermo Fisher Scientific (U.S.), Asylum Research (Oxford Instruments) (U.S.), FEI Company (U.S.), Molecular Vista (U.S.),Park Systems (South Korea), NT-MDT Spectrum Instruments (Russia), Hitachi High-Technologies Corporation (Japan),JEOL Ltd. (Japan), AIST-NT (Lithuania), Oxford Instruments (U.K.), Nanosurf AG (Switzerland), Nanoscience Instruments (U.S.), Nanosensors (Switzerland), NanoAndMore GmbH (Germany), Nanomechanics Inc. (U.S.), Aspex Corporation (U.S.), Nanomagnetics Instruments Ltd. (Canada), NanoMagnetics Instruments (U.S.),NT-MDT Development (Russia), Phasis (France), Nanonics Imaging (Israel) and Other Major Players.

The Nanoelectromechanical System (NEMS) Market is segmented into Type, Material, Application, and region. By Type, the market is categorized into Nano-Accelerometers, Nano-Tweezers, Nano-Switches, Nano-Fluidic Modules, and Nano-Cantilevers. By Material, the market is categorized into Graphene, Carbon Nanotubes, Sic, and Sio2. By Application, the market is categorized into Sensing and Control Applications, Solid State Electronics, Tools & Equipment Application. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Nanoelectromechanical Systems (NEMS) are devices that integrate electrical and mechanical functionalities at the manometer scale. These systems typically involve tiny structures, such as nanowires, nanotubes, or nanoscale resonators, that exhibit both electronic and mechanical properties. They operate on the principle that at such small scales, quantum effects become significant, enabling unique functionalities.

Nanoelectromechanical System (NEMS) Market Size Was Valued at USD 109.31 Million in 2022 and is Projected to Reach USD 712.26 Million by 2030, Growing at a CAGR of 26.4% From 2023-2030.