Bio-MEMS Market Synopsis

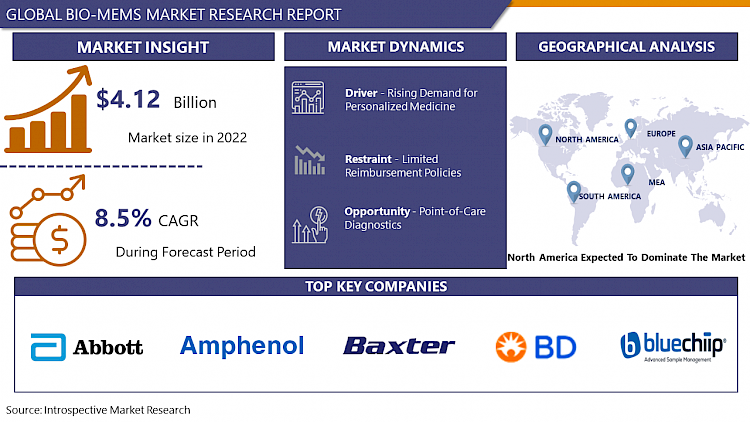

Bio-MEMS Market Size Was Valued at USD 4.12 Billion in 2022, and is Projected to Reach USD 7.91 Billion by 2030, Growing at a CAGR of 8.5% From 2023-2030.

Bio-MEMS (Biological Micro-Electro-Mechanical Systems) refer to miniaturized devices that merge biology with microfabrication technology. These systems integrate biological components, such as cells or molecules, with small-scale mechanical and electrical components on a single platform.

- Applications of Bio-MEMS span various domains within healthcare. They're used in diagnostic devices like lab-on-chip systems, enabling rapid and precise analysis of biological samples. In therapeutics, Bio-MEMS facilitate targeted drug delivery and implantable devices for controlled release. Monitoring devices, including wearable sensors, provide continuous health data collection. Additionally, in surgical settings, Bio-MEMS aid in minimally invasive procedures and robotic-assisted surgeries, enhancing precision and reducing invasiveness.

- Advantages of Bio-MEMS lie in their compact size, allowing for portability and minimally invasive procedures. They offer improved sensitivity and specificity in diagnostics, enabling early disease detection. Their integration with biological systems enhances compatibility and reduces adverse reactions, while their miniaturization decreases sample and reagent volumes, cutting costs and analysis time. Moreover, their ability to offer personalized and precise treatment options underscores their potential impact on advancing healthcare towards more tailored and effective interventions.

Bio-MEMS Market Trend Analysis

Rising Demand for Personalized Medicine

- Personalized medicine tailors’ medical treatments to individual characteristics, including genetic makeup, lifestyle, and specific health conditions. Bio-MEMS devices play a crucial role in this paradigm shift by enabling precise diagnostics, targeted therapies, and continuous monitoring, aligning perfectly with the ethos of personalized healthcare.

- Bio-MEMS devices facilitate the collection of real-time data, such as genetic information, biomarkers, and physiological parameters, allowing for a deeper understanding of an individual's health profile. These devices aid in early disease detection, offer accurate diagnostics, and enable the delivery of targeted therapies with reduced side effects. For instance, lab-on-chip systems integrated into Bio-MEMS platforms can analyze small samples of blood or tissue to identify specific biomarkers, guiding clinicians in prescribing personalized treatment regimens.

- As the demand for tailored healthcare solutions intensifies, Bio-MEMS technologies provide the means to develop and deliver these personalized interventions. Their ability to integrate biological components with micro-scale mechanical and electrical systems facilitates the creation of precise and efficient medical devices. This aligns with the evolving healthcare landscape, where customization and precision are becoming increasingly imperative for improved patient outcomes, driving the growth of the Bio-MEMS market.

Point-of-Care Diagnostics

- Point-of-care diagnostics (POC) represents a significant opportunity within the Bio-MEMS market, revolutionizing healthcare by providing rapid, accurate, and convenient testing at the patient's side. Bio-MEMS technologies play a pivotal role in this domain, enabling the development of portable and miniaturized diagnostic devices.

- These devices integrate microfluidics, sensors, and other components onto a single chip, facilitating quick analysis of biological samples such as blood, saliva, or urine. The ability to perform complex assays in a compact and automated manner offers immense potential for decentralized healthcare delivery, especially in remote or resource-limited settings.

- POC diagnostics powered by Bio-MEMS enhance accessibility to healthcare by reducing the reliance on centralized laboratories and lengthy turnaround times for test results. This is especially critical for rapid diagnosis and treatment initiation in emergency situations or infectious disease outbreaks.

- Moreover, these devices hold promise for managing chronic conditions by enabling frequent monitoring and timely intervention, thereby improving patient outcomes and reducing healthcare costs associated with hospital visits.

- The market opportunity lies in the continued development of Bio-MEMS-based POC devices that are user-friendly, cost-effective, and capable of performing a wide range of tests with high sensitivity and specificity. Their ability to democratize healthcare by bringing sophisticated diagnostics closer to the patient's bedside represents a transformative opportunity in the medical landscape.

Bio-MEMS Market Segment Analysis:

Bio-MEMS Market Segmented on the basis of type, material, product and application.

By Type, MEMS Sensors segment is expected to dominate the market during the forecast period

- In the realm of Bio-MEMS, the MEMS (Micro-Electro-Mechanical Systems) sensors segment is poised to dominate the market throughout the forecast period. MEMS sensors form a critical component of Bio-MEMS devices, facilitating the measurement and detection of various biological parameters and environmental factors with high precision and sensitivity.

- These sensors enable the monitoring of vital signs, biomarkers, and physiological parameters, playing a key role in diagnostics, continuous health monitoring, and therapeutic applications. Their miniaturized form factor allows for integration into wearable devices, implantable systems, and point-of-care diagnostic tools.

- As healthcare increasingly emphasizes personalized and remote monitoring, the demand for MEMS sensors continues to surge due to their ability to provide real-time data for timely interventions and treatment adjustments. Their versatility, low power consumption, and cost-effectiveness further contribute to their dominance within the Bio-MEMS market, catering to diverse applications and driving advancements in personalized medicine and healthcare delivery.

By Application, Patient Monitoring segment held the largest market share of 37.8% in 2022

- Within the Bio-MEMS market, the Patient Monitoring segment has emerged as a frontrunner, capturing the largest market share due to its pivotal role in continuous health tracking and disease management. Patient Monitoring Bio-MEMS devices encompass a spectrum of sensors, microfluidic systems, and wearable technologies that facilitate real-time monitoring of vital signs, biomarkers, and other physiological parameters.

- These devices enable remote and continuous monitoring of patients, providing healthcare professionals with critical data for timely interventions and personalized treatment adjustments. They find extensive use in chronic disease management, post-operative care, and elderly patient monitoring, enhancing patient comfort while ensuring timely medical attention.

- The rise in chronic diseases and the aging population has augmented the demand for these monitoring systems, driving their market dominance. Their ability to offer real-time insights into a patient's health status, coupled with advancements in sensor technology and data analytics, positions the Patient Monitoring segment at the forefront of Bio-MEMS applications, promising improved patient outcomes and efficient healthcare management.

Bio-MEMS Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is anticipated to maintain its dominance in the Bio-MEMS market over the forecast period. This region's leading position is attributed to several factors, including robust technological advancements, significant investments in healthcare R&D, and a favorable regulatory framework supporting innovation in medical devices.

- The presence of key market players, research institutions, and a well-established healthcare infrastructure contributes to the region's prominence. Moreover, the growing prevalence of chronic diseases, an aging population, and the emphasis on personalized medicine in North America drive the demand for advanced biomedical technologies such as Bio-MEMS.

- Additionally, increased awareness among healthcare professionals and patients about the benefits of these devices, coupled with a higher adoption rate of novel medical technologies, further bolsters the market in North America. The region's conducive ecosystem for research, development, and commercialization of Bio-MEMS applications solidifies its position as a frontrunner in the global market landscape.

Bio-MEMS Market Top Key Players:

- Abbott Laboratories (U.S.)

- Amphenol Corporation (U.S.)

- Baxter International, Inc. (U.S.)

- Becton, Dickinson, And Company (U.S.)

- Bluechiip Ltd. (Australia)

- Boston Scientific Corporation (U.S.)

- Danaher Corp. (U.S.)

- Debiotech Sa (Switzerland)

- Integrated Sensing Systems Inc. (U.S.)

- Intellisense Software Corporation (U.S.)

- Medtronic Plc (Ireland)

- Micronit Micro Technologies Bv (Netherlands)

- Perkinelmer Inc (U.S.)

- Philips Engineering Solutions

- Redbud Labs, Inc. (U.S.)

- Sensera Limited (Australia)

- Stmicroelectronics Inc. (Switzerland)

- Taylor Hobson (Ametek Inc.) (U.K.)

- Teledyne Dalsa Inc. (Canada)

- Texas Instruments Inc (U.S.)

- Ufluidix, Inc (Canada) And Other Major Players

|

Global Bio-MEMS Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 4.12 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.5 % |

Market Size in 2030: |

USD 7.91 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- BIO-MEMS MARKET BY TYPE (2016-2030)

- BIO-MEMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEMS SENSORS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MICRO FLUIDS

- BIO-MEMS MARKET BY MATERIAL (2016-2030)

- BIO-MEMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SILICON AND GLASS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PLASTICS AND POLYMERS

- PAPER

- BIOLOGICAL MATERIAL

- BIO-MEMS MARKET BY PRODUCT (2016-2030)

- BIO-MEMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- INJECTABLES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- IMPLANTABLE

- BIO-MEMS MARKET BY APPLICATION (2016-2030)

- BIO-MEMS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PATIENT MONITORING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- IVD TESTING

- MEDICAL IMAGING

- DRUG DELIVERY

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- BIO-MEMS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABBOTT LABORATORIES (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AMPHENOL CORPORATION (U.S.)

- BAXTER INTERNATIONAL, INC. (U.S.)

- BECTON, DICKINSON, AND COMPANY (U.S.)

- BLUECHIIP LTD. (AUSTRALIA)

- BOSTON SCIENTIFIC CORPORATION (U.S.)

- DANAHER CORP. (U.S.)

- DEBIOTECH SA (SWITZERLAND)

- INTEGRATED SENSING SYSTEMS INC. (U.S.)

- INTELLISENSE SOFTWARE CORPORATION (U.S.)

- MEDTRONIC PLC (IRELAND)

- MICRONIT MICRO TECHNOLOGIES BV (NETHERLANDS)

- PERKINELMER INC (U.S.)

- PHILIPS ENGINEERING SOLUTIONS

- REDBUD LABS, INC. (U.S.)

- SENSERA LIMITED (AUSTRALIA)

- STMICROELECTRONICS INC. (SWITZERLAND)

- TAYLOR HOBSON (AMETEK INC.) (U.K.)

- TELEDYNE DALSA INC. (CANADA)

- TEXAS INSTRUMENTS INC (U.S.)

- UFLUIDIX, INC (CANADA) AND OTHER MAJOR PLAYERS

- COMPETITIVE LANDSCAPE

- GLOBAL BIO-MEMS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TYPE

- Historic And Forecasted Market Size By MATERIAL

- Historic And Forecasted Market Size By PRODUCT

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Bio-MEMS Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 4.12 Bn. |

|

Forecast Period 2023-30 CAGR: |

8.5 % |

Market Size in 2030: |

USD 7.91 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Material |

|

||

|

By Product |

|

||

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. BIO-MEMS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. BIO-MEMS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. BIO-MEMS MARKET COMPETITIVE RIVALRY

TABLE 005. BIO-MEMS MARKET THREAT OF NEW ENTRANTS

TABLE 006. BIO-MEMS MARKET THREAT OF SUBSTITUTES

TABLE 007. BIO-MEMS MARKET BY TYPE

TABLE 008. BIO-MEDICAL MEMS MARKET OVERVIEW (2016-2028)

TABLE 009. BIOTECHNOLOGY MEMS MARKET OVERVIEW (2016-2028)

TABLE 010. BIO-MEMS MARKET BY APPLICATION

TABLE 011. SAMPLE PREPARATION MARKET OVERVIEW (2016-2028)

TABLE 012. SCREENING MARKET OVERVIEW (2016-2028)

TABLE 013. DIAGNOSTICS MARKET OVERVIEW (2016-2028)

TABLE 014. MONITORING MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. BIO-MEMS MARKET BY DISTRIBUTION CHANNEL

TABLE 017. HOME DIAGNOSTICS MARKET OVERVIEW (2016-2028)

TABLE 018. HOSPITALS MARKET OVERVIEW (2016-2028)

TABLE 019. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

TABLE 020. AGRICULTURAL INDUSTRY MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA BIO-MEMS MARKET, BY TYPE (2016-2028)

TABLE 023. NORTH AMERICA BIO-MEMS MARKET, BY APPLICATION (2016-2028)

TABLE 024. NORTH AMERICA BIO-MEMS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 025. N BIO-MEMS MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE BIO-MEMS MARKET, BY TYPE (2016-2028)

TABLE 027. EUROPE BIO-MEMS MARKET, BY APPLICATION (2016-2028)

TABLE 028. EUROPE BIO-MEMS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 029. BIO-MEMS MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC BIO-MEMS MARKET, BY TYPE (2016-2028)

TABLE 031. ASIA PACIFIC BIO-MEMS MARKET, BY APPLICATION (2016-2028)

TABLE 032. ASIA PACIFIC BIO-MEMS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 033. BIO-MEMS MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA BIO-MEMS MARKET, BY TYPE (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA BIO-MEMS MARKET, BY APPLICATION (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA BIO-MEMS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 037. BIO-MEMS MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA BIO-MEMS MARKET, BY TYPE (2016-2028)

TABLE 039. SOUTH AMERICA BIO-MEMS MARKET, BY APPLICATION (2016-2028)

TABLE 040. SOUTH AMERICA BIO-MEMS MARKET, BY DISTRIBUTION CHANNEL (2016-2028)

TABLE 041. BIO-MEMS MARKET, BY COUNTRY (2016-2028)

TABLE 042. INTEGRATED SENSING SYSTEM INC. (ISSYS): SNAPSHOT

TABLE 043. INTEGRATED SENSING SYSTEM INC. (ISSYS): BUSINESS PERFORMANCE

TABLE 044. INTEGRATED SENSING SYSTEM INC. (ISSYS): PRODUCT PORTFOLIO

TABLE 045. INTEGRATED SENSING SYSTEM INC. (ISSYS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. BLUECHIIP LTD: SNAPSHOT

TABLE 046. BLUECHIIP LTD: BUSINESS PERFORMANCE

TABLE 047. BLUECHIIP LTD: PRODUCT PORTFOLIO

TABLE 048. BLUECHIIP LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. GIVEN IMAGING: SNAPSHOT

TABLE 049. GIVEN IMAGING: BUSINESS PERFORMANCE

TABLE 050. GIVEN IMAGING: PRODUCT PORTFOLIO

TABLE 051. GIVEN IMAGING: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. CEPHEID INC: SNAPSHOT

TABLE 052. CEPHEID INC: BUSINESS PERFORMANCE

TABLE 053. CEPHEID INC: PRODUCT PORTFOLIO

TABLE 054. CEPHEID INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. TDK CORPORATION: SNAPSHOT

TABLE 055. TDK CORPORATION: BUSINESS PERFORMANCE

TABLE 056. TDK CORPORATION: PRODUCT PORTFOLIO

TABLE 057. TDK CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. SPTS TECHNOLOGIES LTD: SNAPSHOT

TABLE 058. SPTS TECHNOLOGIES LTD: BUSINESS PERFORMANCE

TABLE 059. SPTS TECHNOLOGIES LTD: PRODUCT PORTFOLIO

TABLE 060. SPTS TECHNOLOGIES LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. BOSTON SCIENTIFIC HEIMANN SENSOR: SNAPSHOT

TABLE 061. BOSTON SCIENTIFIC HEIMANN SENSOR: BUSINESS PERFORMANCE

TABLE 062. BOSTON SCIENTIFIC HEIMANN SENSOR: PRODUCT PORTFOLIO

TABLE 063. BOSTON SCIENTIFIC HEIMANN SENSOR: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. LEPU MEDICAL TECHNOLOGY: SNAPSHOT

TABLE 064. LEPU MEDICAL TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 065. LEPU MEDICAL TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 066. LEPU MEDICAL TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. NANOPASS TECHNOLOGIES: SNAPSHOT

TABLE 067. NANOPASS TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 068. NANOPASS TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 069. NANOPASS TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. UNITED GENE HIGH-TECH GROUP MICRON TECHNOLOGY: SNAPSHOT

TABLE 070. UNITED GENE HIGH-TECH GROUP MICRON TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 071. UNITED GENE HIGH-TECH GROUP MICRON TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 072. UNITED GENE HIGH-TECH GROUP MICRON TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. ABBOTT DIAGNOSTICS: SNAPSHOT

TABLE 073. ABBOTT DIAGNOSTICS: BUSINESS PERFORMANCE

TABLE 074. ABBOTT DIAGNOSTICS: PRODUCT PORTFOLIO

TABLE 075. ABBOTT DIAGNOSTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. CALIPER LIFE SCIENCES: SNAPSHOT

TABLE 076. CALIPER LIFE SCIENCES: BUSINESS PERFORMANCE

TABLE 077. CALIPER LIFE SCIENCES: PRODUCT PORTFOLIO

TABLE 078. CALIPER LIFE SCIENCES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. ANALOG DEVICES: SNAPSHOT

TABLE 079. ANALOG DEVICES: BUSINESS PERFORMANCE

TABLE 080. ANALOG DEVICES: PRODUCT PORTFOLIO

TABLE 081. ANALOG DEVICES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. TRONICS: SNAPSHOT

TABLE 082. TRONICS: BUSINESS PERFORMANCE

TABLE 083. TRONICS: PRODUCT PORTFOLIO

TABLE 084. TRONICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. NOVA BIOMEDICAL: SNAPSHOT

TABLE 085. NOVA BIOMEDICAL: BUSINESS PERFORMANCE

TABLE 086. NOVA BIOMEDICAL: PRODUCT PORTFOLIO

TABLE 087. NOVA BIOMEDICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. FORTEBIO: SNAPSHOT

TABLE 088. FORTEBIO: BUSINESS PERFORMANCE

TABLE 089. FORTEBIO: PRODUCT PORTFOLIO

TABLE 090. FORTEBIO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. BIOSENSORS INTERNATIONAL LTD: SNAPSHOT

TABLE 091. BIOSENSORS INTERNATIONAL LTD: BUSINESS PERFORMANCE

TABLE 092. BIOSENSORS INTERNATIONAL LTD: PRODUCT PORTFOLIO

TABLE 093. BIOSENSORS INTERNATIONAL LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 093. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 094. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 095. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 096. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. BIO-MEMS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. BIO-MEMS MARKET OVERVIEW BY TYPE

FIGURE 012. BIO-MEDICAL MEMS MARKET OVERVIEW (2016-2028)

FIGURE 013. BIOTECHNOLOGY MEMS MARKET OVERVIEW (2016-2028)

FIGURE 014. BIO-MEMS MARKET OVERVIEW BY APPLICATION

FIGURE 015. SAMPLE PREPARATION MARKET OVERVIEW (2016-2028)

FIGURE 016. SCREENING MARKET OVERVIEW (2016-2028)

FIGURE 017. DIAGNOSTICS MARKET OVERVIEW (2016-2028)

FIGURE 018. MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. BIO-MEMS MARKET OVERVIEW BY DISTRIBUTION CHANNEL

FIGURE 021. HOME DIAGNOSTICS MARKET OVERVIEW (2016-2028)

FIGURE 022. HOSPITALS MARKET OVERVIEW (2016-2028)

FIGURE 023. PHARMACEUTICAL MARKET OVERVIEW (2016-2028)

FIGURE 024. AGRICULTURAL INDUSTRY MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA BIO-MEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE BIO-MEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC BIO-MEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA BIO-MEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA BIO-MEMS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Bio-MEMS Market research report is 2022-2028.

Abbott Laboratories (U.S.),Amphenol Corporation (U.S.),Baxter International, Inc. (U.S.),Becton, Dickinson, and Company (U.S.),Bluechiip Ltd. (Australia),Boston Scientific Corporation (U.S.),Danaher Corp. (U.S.), Debiotech SA (Switzerland),Integrated Sensing Systems Inc. (U.S.),IntelliSense Software Corporation (U.S.),Medtronic PLC (Ireland), Micronit Micro Technologies BV (Netherlands),PerkinElmer Inc (U.S.),Philips Engineering Solutions, Redbud Labs, Inc. (U.S.), Sensera Limited (Australia),STMicroelectronics Inc. (Switzerland),Taylor Hobson (Ametek Inc.) (U.K.),Teledyne DALSA Inc. (Canada),Texas Instruments Inc (U.S.), uFluidix, Inc (Canada) and Other Major Players.

The Bio-MEMS Market is segmented into Type, Material, Product, Application, and region. By Type, the market is categorized into MEMS Sensors, Micro fluids. By Material, the market is categorized into Silicon and Glass, Plastics and Polymers, Paper, Biological Material. By Product, the market is categorized into Injectables, Implantable. By Application, the market is categorized into Patient Monitoring, IVD Testing, Medical Imaging, Drug Delivery. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Bio-MEMS (Biological Micro-Electro-Mechanical Systems) refer to miniaturized devices that merge biology with microfabrication technology. These systems integrate biological components, such as cells or molecules, with small-scale mechanical and electrical components on a single platform.

Bio-MEMS Market Size Was Valued at USD 4.12 Billion in 2022, and is Projected to Reach USD 7.91 Billion by 2030, Growing at a CAGR of 8.5% From 2023-2030.