Synthetic Food Market Synopsis

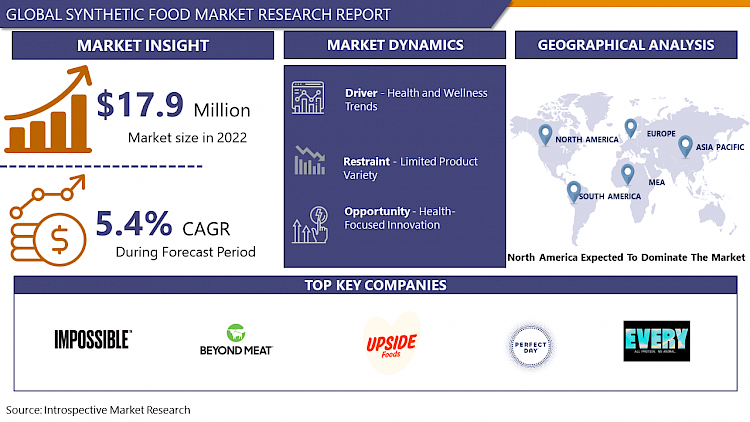

Global Synthetic Food Market Size Was Valued at USD 17.9 Billion In 2022 And Is Projected to Reach USD 27.3 Billion By 2030, Growing at A CAGR of 5.4% From 2023 To 2030.

- Synthetic Foods that have been produced by using new technique with the help of advancements in technology. Synthetic Foods usually consist of a high amount of protein. Synthetic foods are manufactured from food substances that have been chemically incorporated. Synthetic foods are artificial foods, these foods generally emulate the appearance, odor and taste of natural foods.

- Furthermore, synthetic and cellular-based foods are appearing in response to consumer surge. Many consumers want to know the food they eat is manufactured ethically and sustainably, hence the birth of foods production in labs like non-meat protein. According to the Center for Food Integrity, in the ratio of only one in four consumers believe livestock animals are well taken care of, which has propelled demand for synthesized and cellular-based foods specifically in the non-meat protein industry.

- Synthetic food items contain nutritive substances such as proteins, vitamins, fats, or their components, and trace elements. Some primary synthesized food products include milk, cereals, cakes, ice-creams, and bread. Occasionally, it becomes difficult for the food industry to bring farm-fresh vegetables & fruits, synthetic food products, have come under the spotlight these days. Therefore, it is safe to forecast that the global market for synthetic food would attract a lot of revenue in projected period.

- Some synthetic foods are produced using microorganisms such as bacteria or yeast. These microorganisms can be genetically engineered to produce specific proteins or nutrients that can be used in food production. Synthetic food can also refer to the development of nutrient supplements and meal replacements. These products aim to provide a complete and balanced set of nutrients in a convenient form, often in the form of powders, shakes, or bars.

Synthetic Food Market Trend Analysis

Health and Wellness Trends

- Health and wellness trends play a pivotal role in propelling the growth of the synthetic food market, as consumers increasingly prioritize nutritious and sustainable dietary choices. The heightened awareness of the link between diet and overall well-being has fueled a shift towards healthier eating habits, creating a fertile ground for the adoption of synthetic or alternative foods. As individuals seek to optimize their nutritional intake, synthetic food products, often engineered to be rich in essential nutrients, appeal to health-conscious consumers.

- The growing emphasis on plant-based diets, driven by concerns about the environmental impact of traditional livestock farming and the desire for cruelty-free options, aligns with health and wellness objectives. Synthetic foods, particularly plant-based alternatives and lab-grown proteins, cater to those looking to reduce their consumption of animal products without compromising nutritional value. These innovations leverage advancements in food technology, providing viable alternatives that align with the broader narrative of conscious and responsible eating.

- Furthermore, the integration of functional ingredients in synthetic foods enhances their appeal to health-conscious consumers. The development of fortified products, designed to address specific health concerns or dietary deficiencies, aligns with the contemporary focus on preventive healthcare. As regulatory bodies acknowledge the safety and nutritional adequacy of these alternative food sources, consumers are more inclined to incorporate synthetic foods into their diets, contributing to the sustained growth of this dynamic market.

Health-Focused Innovation

- The synthetic food market presents a myriad of opportunities that extend beyond addressing current dietary trends. One significant opportunity lies in the realm of environmental sustainability. As the global population burgeons and concerns over the ecological impact of traditional agriculture intensify, synthetic foods offer a sustainable solution. By reducing the dependence on resource-intensive livestock farming and minimizing the carbon footprint associated with food production, synthetic alternatives pave the way for a more environmentally conscious and resilient food supply.

- Moreover, the increasing prevalence of food allergies and intolerances opens up a niche for synthetic food products. Innovations in ingredient engineering allow for the creation of hypoallergenic alternatives, providing consumers with safe and inclusive dietary choices. This not only addresses health-related concerns but also broadens the market reach of synthetic foods to cater to a diverse range of dietary needs.

- The versatility of synthetic food technology also unlocks opportunities in addressing global food security challenges. With the ability to produce food in controlled environments, regardless of climatic conditions or arable land availability, synthetic food methods offer a means to enhance resilience against climate change and ensure a stable food supply in regions susceptible to agricultural disruptions.

Synthetic Food Market Segment Analysis:

Synthetic Food Market Segmented on the basis of Product Type, Application, and Distribution Channel.

By Product Type, Color segment is expected to dominate the market during the forecast period

- Color plays a crucial role in consumer perception of food. Vibrant and appealing colors are often associated with freshness, flavor, and overall quality. Synthetic food products can be designed to have consistent and visually attractive colors, meeting consumer expectations and enhancing the product's aesthetic appeal.

- Food manufacturers often leverage color to differentiate their products and create a strong brand identity. Synthetic food producers may focus on developing visually striking products to stand out in the market, attract consumers, and build brand recognition.

- With a growing emphasis on natural and clean label products, synthetic food producers may use naturally derived colors to meet consumer demand for more wholesome and minimally processed options. Synthetic colors that mimic those found in nature can be used to create visually appealing products without compromising on the clean label trend.

- Advances in food technology allow for precise control over the color of synthetic foods. This capability enables producers to experiment with a wide range of colors, textures, and visual effects, expanding the possibilities for product development.

By Application, Beverages segment held the largest share of 35% in 2022

- The beverage industry has been at the forefront of innovation, with companies actively exploring new ingredients and formulations. Synthetic food ingredients can be tailored to meet specific taste, texture, and nutritional requirements, allowing for the creation of innovative and appealing beverages.

- As consumers increasingly seek healthier beverage options, synthetic ingredients can be utilized to enhance the nutritional profile of drinks. Functional beverages, enriched with vitamins, minerals, and other beneficial compounds, align with the growing demand for health-conscious products.

- The trend towards plant-based and alternative ingredients is prominent in beverages, with synthetic alternatives often providing the desired taste and texture without relying on traditional animal-derived components. Plant-based synthetic flavors, sweeteners, and colorings cater to the preferences of consumers seeking plant-centric choices.

- Synthetic ingredients can be designed to mimic natural flavors and colors, addressing the clean label trend. Beverage manufacturers may choose synthetic ingredients to achieve a consistent and stable product while meeting consumer expectations for recognizable and natural-sounding ingredients.

Synthetic Food Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period.

- North American consumers have shown a high level of awareness and early adoption of trends related to alternative and synthetic foods. The region has a significant population of health-conscious consumers who actively seek out innovative and sustainable food options.

- North America is home to numerous innovation hubs, research facilities, and tech startups focused on food technology and synthetic food production. Investments in research and development contribute to the creation of novel synthetic food products that cater to evolving consumer preferences.

- The availability of venture capital and investment funding in North America supports the growth of companies involved in synthetic food production. Funding allows for the development and scaling of innovative technologies and products in the synthetic food sector.

- Regulatory frameworks in North America may be conducive to the development and commercialization of synthetic food products. Clear guidelines and support from regulatory bodies can encourage companies to invest in and bring synthetic food products to market more efficiently.

Synthetic Food Market Top Key Players:

- Impossible Foods (US)

- Beyond Meat (US)

- Memphis Meats (US)

- Perfect Day (US)

- Clara Foods (US)

- MycoTechnology (US)

- Terramino Foods (US)

- NovoNutrients (US)

- BlueNalu (US)

- Benson Hill (US)

- New Age Meats (US)

- Wild Type (US)

- Eat Just, Inc. (formerly Hampton Creek) (US)

- Motif FoodWorks (US)

- Geltor (US)

- Cellular Agriculture Ltd. (Canada)

- Biftek (Canada)

- Quorn Foods (UK)

- Mosa Meat (Netherlands)

- Nutreco (Netherlands)

- Solar Foods (Finland)

- Biofood Systems (France)

- NotCo (Chile)

- Shiok Meats (Singapore)

- Aleph Farms (Israel)

Key Industry Developments in the Synthetic Food Market:

- In September 2023, Quorn Foods partners with MycoTechnology to develop fungal protein ingredients: The UK-based food giant aims to incorporate MycoTechnology's fermentation-derived protein into its vegetarian and vegan products, offering a sustainable alternative to traditional ingredients.

- In January 2022, Oterra, a Denmark-based food and beverage manufacturing company, acquired Food Ingredient Solutions for an undisclosed amount. Through this acquisition, Oterra owns more than two decades of experience with natural colors and a portfolio of synthetic colors and natural antioxidants. Oterra now has a presence in the enormous U.S. market, where demand from consumers for foods and drinks with natural hues isn't slowing down. Food Ingredient Solutions is a US-based company offering synthetic colors, natural pigments, and other food ingredients.

|

Synthetic Food Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 17.9 Bn. |

|

Forecast Period 2023-32 CAGR: |

5.4 % |

Market Size in 2030: |

USD 27.3 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SYNTHETIC FOOD MARKET BY PRODUCT TYPE (2016-2030)

- Synthetic Food MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- COLOR

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- NTIOXIDANTS

- EMULSIFIERS

- FAT REPLACERS

- FLAVOR & FRAGRANCES

- HYDROCOLLOIDS

- SYNTHETIC FOOD MARKET BY APPLICATION (2016-2030)

- Synthetic Food MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BEVERAGES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- MEAT

- POULTRY & SEAFOODS

- CONVENIENCE FOOD & BEVERAGES

- DAIRY & FROZEN PRODUCTS

- PROCESSED FOOD

- SYNTHETIC FOOD MARKET BY DISTRIBUTION CHANNEL (2016-2030)

- Synthetic Food MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUPERMARKETS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONVENTIONAL STORES

- ONLINE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Synthetic Food Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- IMPOSSIBLE FOODS (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BEYOND MEAT (US)

- MEMPHIS MEATS (US)

- PERFECT DAY (US)

- CLARA FOODS (US)

- MYCOTECHNOLOGY (US)

- TERRAMINO FOODS (US)

- NOVONUTRIENTS (US)

- BLUENALU (US)

- BENSON HILL (US)

- NEW AGE MEATS (US)

- WILD TYPE (US)

- EAT JUST, INC. (FORMERLY HAMPTON CREEK) (US)

- MOTIF FOODWORKS (US)

- GELTOR (US)

- CELLULAR AGRICULTURE LTD. (CANADA)

- BIFTEK (CANADA)

- QUORN FOODS (UK)

- MOSA MEAT (NETHERLANDS)

- NUTRECO (NETHERLANDS)

- COMPETITIVE LANDSCAPE

- GLOBAL Synthetic Food MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Product Type

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Distribution Channel

- Historic And Forecasted Market Size By Country

- US

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- UK

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Synthetic Food Market |

|||

|

Base Year: |

2022 |

Forecast Period: |

2023-2030 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2022: |

USD 17.9 Bn. |

|

Forecast Period 2023-32 CAGR: |

5.4 % |

Market Size in 2030: |

USD 27.3 Bn. |

|

Segments Covered: |

By Product Type |

|

|

|

By Application |

|

||

|

By Distribution Channel |

|

||

|

By Distribution Channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SYNTHETIC FOOD MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SYNTHETIC FOOD MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SYNTHETIC FOOD MARKET COMPETITIVE RIVALRY

TABLE 005. SYNTHETIC FOOD MARKET THREAT OF NEW ENTRANTS

TABLE 006. SYNTHETIC FOOD MARKET THREAT OF SUBSTITUTES

TABLE 007. SYNTHETIC FOOD MARKET BY PRODUCT TYPE

TABLE 008. COLOR MARKET OVERVIEW (2016-2028)

TABLE 009. ANTIOXIDANTS MARKET OVERVIEW (2016-2028)

TABLE 010. EMULSIFIERS MARKET OVERVIEW (2016-2028)

TABLE 011. FAT REPLACERS MARKET OVERVIEW (2016-2028)

TABLE 012. FLAVOR & FRAGRANCES MARKET OVERVIEW (2016-2028)

TABLE 013. HYDROCOLLOIDS MARKET OVERVIEW (2016-2028)

TABLE 014. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 015. SYNTHETIC FOOD MARKET BY APPLICATION

TABLE 016. BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 017. MEAT MARKET OVERVIEW (2016-2028)

TABLE 018. POULTRY & SEAFOODS MARKET OVERVIEW (2016-2028)

TABLE 019. CONVENIENCE FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

TABLE 020. DAIRY & FROZEN PRODUCTS MARKET OVERVIEW (2016-2028)

TABLE 021. PROCESSED FOODS MARKET OVERVIEW (2016-2028)

TABLE 022. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 023. NORTH AMERICA SYNTHETIC FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 024. NORTH AMERICA SYNTHETIC FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 025. N SYNTHETIC FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE SYNTHETIC FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 027. EUROPE SYNTHETIC FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 028. SYNTHETIC FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 029. ASIA PACIFIC SYNTHETIC FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 030. ASIA PACIFIC SYNTHETIC FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 031. SYNTHETIC FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 032. MIDDLE EAST & AFRICA SYNTHETIC FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 033. MIDDLE EAST & AFRICA SYNTHETIC FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 034. SYNTHETIC FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 035. SOUTH AMERICA SYNTHETIC FOOD MARKET, BY PRODUCT TYPE (2016-2028)

TABLE 036. SOUTH AMERICA SYNTHETIC FOOD MARKET, BY APPLICATION (2016-2028)

TABLE 037. SYNTHETIC FOOD MARKET, BY COUNTRY (2016-2028)

TABLE 038. FMC CORPORATION: SNAPSHOT

TABLE 039. FMC CORPORATION: BUSINESS PERFORMANCE

TABLE 040. FMC CORPORATION: PRODUCT PORTFOLIO

TABLE 041. FMC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. FLAVORCHEM CORPORATION: SNAPSHOT

TABLE 042. FLAVORCHEM CORPORATION: BUSINESS PERFORMANCE

TABLE 043. FLAVORCHEM CORPORATION: PRODUCT PORTFOLIO

TABLE 044. FLAVORCHEM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. CHR HANSEN A/S: SNAPSHOT

TABLE 045. CHR HANSEN A/S: BUSINESS PERFORMANCE

TABLE 046. CHR HANSEN A/S: PRODUCT PORTFOLIO

TABLE 047. CHR HANSEN A/S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. D.D WILLIAMSON & CO. INC.: SNAPSHOT

TABLE 048. D.D WILLIAMSON & CO. INC.: BUSINESS PERFORMANCE

TABLE 049. D.D WILLIAMSON & CO. INC.: PRODUCT PORTFOLIO

TABLE 050. D.D WILLIAMSON & CO. INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. DOHLER GROUP.: SNAPSHOT

TABLE 051. DOHLER GROUP.: BUSINESS PERFORMANCE

TABLE 052. DOHLER GROUP.: PRODUCT PORTFOLIO

TABLE 053. DOHLER GROUP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. ALLIED BIOTECH CORPORATION: SNAPSHOT

TABLE 054. ALLIED BIOTECH CORPORATION: BUSINESS PERFORMANCE

TABLE 055. ALLIED BIOTECH CORPORATION: PRODUCT PORTFOLIO

TABLE 056. ALLIED BIOTECH CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. AARKAY FOOD PRODUCTS: SNAPSHOT

TABLE 057. AARKAY FOOD PRODUCTS: BUSINESS PERFORMANCE

TABLE 058. AARKAY FOOD PRODUCTS: PRODUCT PORTFOLIO

TABLE 059. AARKAY FOOD PRODUCTS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. ROYAL DSM N.V.: SNAPSHOT

TABLE 060. ROYAL DSM N.V.: BUSINESS PERFORMANCE

TABLE 061. ROYAL DSM N.V.: PRODUCT PORTFOLIO

TABLE 062. ROYAL DSM N.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. ARCHER DANIELS MIDLAND COMPANY: SNAPSHOT

TABLE 063. ARCHER DANIELS MIDLAND COMPANY: BUSINESS PERFORMANCE

TABLE 064. ARCHER DANIELS MIDLAND COMPANY: PRODUCT PORTFOLIO

TABLE 065. ARCHER DANIELS MIDLAND COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. FIORIO COLORI: SNAPSHOT

TABLE 066. FIORIO COLORI: BUSINESS PERFORMANCE

TABLE 067. FIORIO COLORI: PRODUCT PORTFOLIO

TABLE 068. FIORIO COLORI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. YOUNG LIVING ESSENTIAL OILS.: SNAPSHOT

TABLE 069. YOUNG LIVING ESSENTIAL OILS.: BUSINESS PERFORMANCE

TABLE 070. YOUNG LIVING ESSENTIAL OILS.: PRODUCT PORTFOLIO

TABLE 071. YOUNG LIVING ESSENTIAL OILS.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. SYMRISE AG: SNAPSHOT

TABLE 072. SYMRISE AG: BUSINESS PERFORMANCE

TABLE 073. SYMRISE AG: PRODUCT PORTFOLIO

TABLE 074. SYMRISE AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. FRUTAROM INDUSTRIES LTD.: SNAPSHOT

TABLE 075. FRUTAROM INDUSTRIES LTD.: BUSINESS PERFORMANCE

TABLE 076. FRUTAROM INDUSTRIES LTD.: PRODUCT PORTFOLIO

TABLE 077. FRUTAROM INDUSTRIES LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. NATUREX S.A.: SNAPSHOT

TABLE 078. NATUREX S.A.: BUSINESS PERFORMANCE

TABLE 079. NATUREX S.A.: PRODUCT PORTFOLIO

TABLE 080. NATUREX S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. BASF SE.: SNAPSHOT

TABLE 081. BASF SE.: BUSINESS PERFORMANCE

TABLE 082. BASF SE.: PRODUCT PORTFOLIO

TABLE 083. BASF SE.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. SENSIENT TECHNOLOGIES: SNAPSHOT

TABLE 084. SENSIENT TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 085. SENSIENT TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 086. SENSIENT TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 087. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 088. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 089. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SYNTHETIC FOOD MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SYNTHETIC FOOD MARKET OVERVIEW BY PRODUCT TYPE

FIGURE 012. COLOR MARKET OVERVIEW (2016-2028)

FIGURE 013. ANTIOXIDANTS MARKET OVERVIEW (2016-2028)

FIGURE 014. EMULSIFIERS MARKET OVERVIEW (2016-2028)

FIGURE 015. FAT REPLACERS MARKET OVERVIEW (2016-2028)

FIGURE 016. FLAVOR & FRAGRANCES MARKET OVERVIEW (2016-2028)

FIGURE 017. HYDROCOLLOIDS MARKET OVERVIEW (2016-2028)

FIGURE 018. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 019. SYNTHETIC FOOD MARKET OVERVIEW BY APPLICATION

FIGURE 020. BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 021. MEAT MARKET OVERVIEW (2016-2028)

FIGURE 022. POULTRY & SEAFOODS MARKET OVERVIEW (2016-2028)

FIGURE 023. CONVENIENCE FOOD & BEVERAGES MARKET OVERVIEW (2016-2028)

FIGURE 024. DAIRY & FROZEN PRODUCTS MARKET OVERVIEW (2016-2028)

FIGURE 025. PROCESSED FOODS MARKET OVERVIEW (2016-2028)

FIGURE 026. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 027. NORTH AMERICA SYNTHETIC FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. EUROPE SYNTHETIC FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. ASIA PACIFIC SYNTHETIC FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. MIDDLE EAST & AFRICA SYNTHETIC FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 031. SOUTH AMERICA SYNTHETIC FOOD MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Synthetic Food Market research report is 2023-2030.

Impossible Foods (US), Beyond Meat (US), Memphis Meats (US), Perfect Day (US), Clara Foods (US), MycoTechnology (US), Terramino Foods (US), NovoNutrients (US), BlueNalu (US), Benson Hill (US), New Age Meats (US), Wild Type (US), Eat Just, Inc. (formerly Hampton Creek) (US), Motif FoodWorks (US), Geltor (US), Cellular Agriculture Ltd. (Canada), Biftek (Canada), Quorn Foods (UK), Mosa Meat (Netherlands), Nutreco (Netherlands), Solar Foods (Finland), Biofood Systems (France), NotCo (Chile), Shiok Meats (Singapore), Aleph Farms (Israel), and Other Major Players.

The Synthetic Food Market is segmented into Product Type, Application, Distribution Channel and region. By Product Type, the market is categorized into Color, Antioxidants, Emulsifiers, Fat Replacers, Flavor & Fragrances, Hydrocolloids. By Application, the market is categorized into Beverages, Meat, Poultry & Seafoods, Convenience Food & Beverages, Dairy & Frozen Products, Processed Food. By Distribution Channel, the market is categorized into Supermarkets, Conventional Stores, Online. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Synthetic Foods that have been produced by using new technique with the help of advancements in technology. Synthetic Foods usually consist of a high amount of protein. Synthetic foods are manufactured from food substances that have been chemically incorporated. Synthetic foods are artificial foods, these foods generally emulate the appearance, odor and taste of natural foods.

Global Synthetic Food Market Size Was Valued at USD 17.9 Billion In 2022 And Is Projected to Reach USD 27.3 Billion By 2030, Growing at A CAGR of 5.4% From 2023 To 2030.