Surgical Lasers Market Synopsis

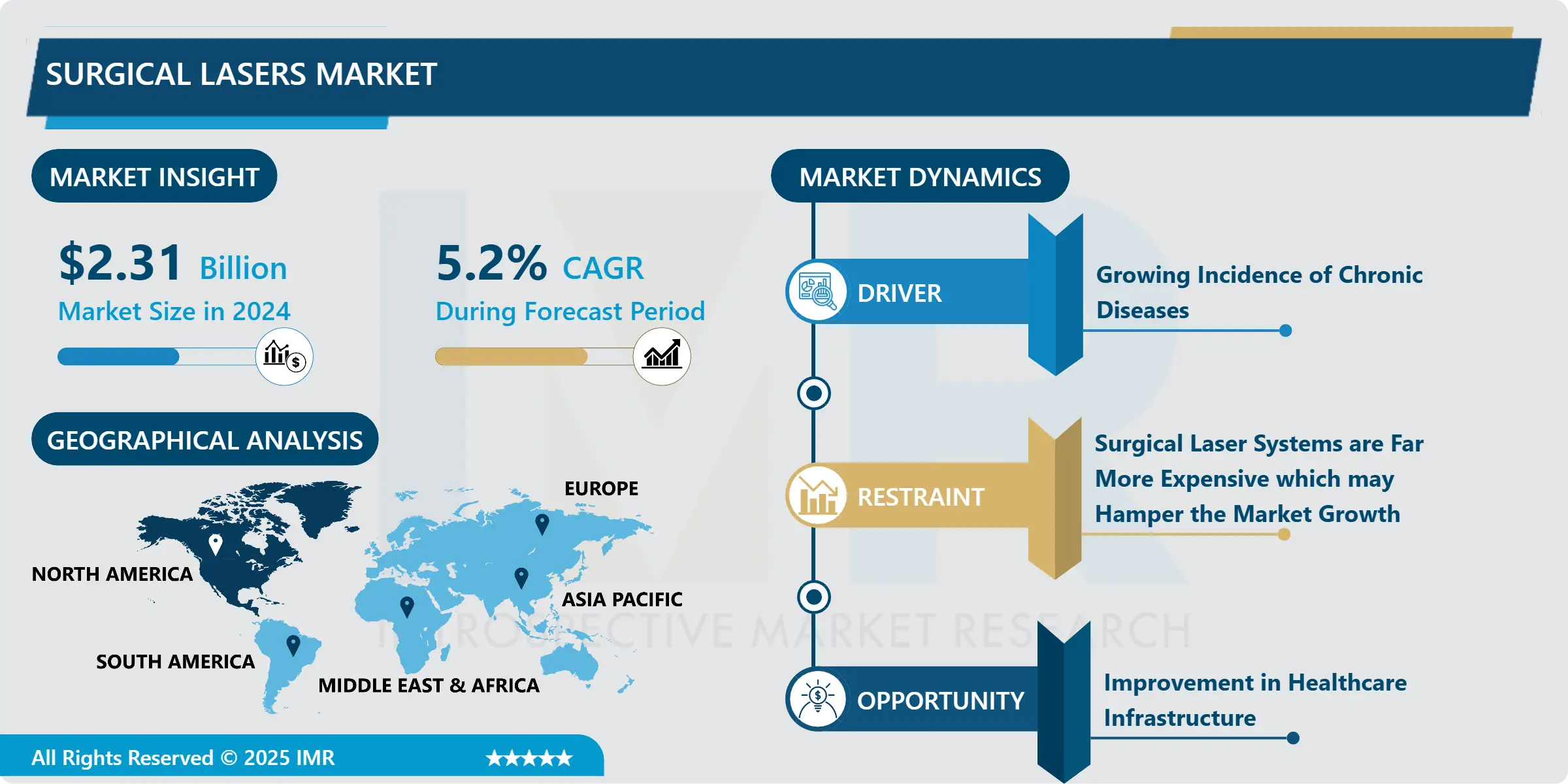

Surgical Lasers Market Size Was Valued at USD 2.31 Billion in 2024, and is Projected to Reach USD 3.5 Billion by 2032, Growing at a CAGR of 5.2% From 2025-2032.

Surgical lasers are the use of lasers in conducting a surgery process or carrying out a surgical operation. Laser is known as an instrument used in emitting light with the help of the optical amplification process associated with the method of stimulated band emission of electromagnetic radiation. While traditional surgery entails the use of the scalpel to manage the routine activities of surgery, surgical lasers involves the use of the laser to incise tissues amongst many other tasks. There exist various consequences of surgical lasers including light chemical consequences, light mechanical consequences, light ablative consequences, and light thermal consequences.

Surgical laser products are used in laser operations such purposes as coagulation, excision, resection, ablation, vaporization, desiccation, evaporation, and excision of aberrant or diseased tissues, destruction or shrinkage or removal of lesions and tumours, sealing of Lymph arteries, removal of moles and tattoo and sealing of blood vessels and nerve endings. They are applied in disorders related to skin, urological and gynaecological disorders, cardiovascular diseases, cancers, eye disorders and dental problems and in laparoscopic operations, percutaneous operations and open surgical procedures. The different types are available, including argon, diode, neodymium: YAG, YAG: Yttrium Aluminum Garnet, CO2 : Carbon Dioxide.

Rising trend towards less invasions, noninvasive procedures and the tendency of a shorter hospital stay are the reasons which drive manufacturers to produce uniquely and technologically enhanced products and equipment. This is increasing the levels of competition with innovations such as new product developments. For instance, July last year, Candela Corporation received the U. S. Food and Drug Administration approval for its Vbeam Prima, a Pulsed Dye Laser (PDL) applicable in skin diseases such as rosacea, acne, facial leg and spider veins, scar, port wine stain, warts, stretch mark, and wrinkle.

Positive growth aspect that is driving the dental laser market is the rising use of dental lasers due to the surgical opportunities and the strategies of the developers to increase concern. In February 2018, Biolase, Inc. made plans on how to increase the knowledge level of dental laser by proffering dental laser training programs through which dentists can be best prepared to attend to the needs of their patients.

There are a number of factors that have been instrumental in making cosmetic procedures more acceptable and sought-after across the world, both in the developed and the developing countries; one of the most significant factors has been the increasing awareness of new fancy procedures. Indeed, in the recent past, there as an influx of various operations that incorporate the surgical laser equipment.

Surgical Lasers Market Trend Analysis

Surgical Lasers Market Drivers- Growing Incidence of Chronic Diseases

- The increase in cases of chronic diseases, for example cardiovascular illnesses, diabetes, and cancer is boosting the demand for surgical lasers. Most of these diseases necessitate accurate and confined treatments, which the surgical lasers make possible. Laser surgeries provide benefits like lesser bleeding, short recovery time, and better asepsis, which makes laser surgeries more appropriate when dealing with complications arising out of chronic diseases. With the rate of occurrences of these diseases growing globally, health care practitioners are relying in enhanced surgical laser hence fostering growth in the same market.

Surgical Lasers Market Opportunities- Improvement in Healthcare Infrastructure

- Developed healthcare systems in the form of better infrastructure like better facilities like better hospitals, clinics, improved medical tools or equipments, and better human resource in the form of improved competencies of doctors, surgeons etc are increasing the use of surgical lasers. In addition, as healthcare facilities get more advanced, they also tend to apply new technologies in their daily functioning such as the use of surgical lasers for the best results. Such lasers are less invasive, have shorter recovery times, and tend to yield better results, in compliance with the current global shift in health care systems to enhance outcome and effectiveness. Therefore, the increasing development of healthcare in various regions leads to growth in the use of surgical lasers that in turn will also help the market in the further growth next year.

Surgical Lasers Market Segment Analysis:

Surgical Lasers Market Segmented based on Type, Procedure, Application, and End Use.

By End Use, Hospital segment is expected to dominate the market during the forecast period

- The segment is expected to retain its leadership in the overall market throughout the forecast period. The factor that has contributed to the growth of the hospital segment is the rising number of aesthetic treatments performed in hospitals across the significant markets, namely the United States, Germany, and Japan. For instance, ASPS recorded that in 2018, a total of 4,488,550 cosmetic procedures were conducted in hospitals across the U. S. Additionally, the upsurge in awareness regarding aesthetic and cosmetic procedures in emerging markets such as India and China is expected to boost the segment.

- Among all these specialized facilities, ambulatory surgical centers registered the highest growth rates as the number of surgical operations being performed in the ASCs increases. This goes a long way in cutting down the total time taken for a patient from the time they seek medical attention to the time they are treated without having to dig deep in their pockets. ASCs also play the role of enhancing access to more complex procedures in rural areas.

By Type, Carbon Dioxide Laser segment held the largest share in 2023

- Based on the Type, the market is bifurcated into Carbon Dioxide (CO2) Lasers, Argon Lasers, ND: YAG (Neodymium: Yttrium-Aluminum-Garnet) Lasers, Diode Lasers, and Other Surgical Lasers.

- Other common surgical lasers belong to the category of solid-state lasers, and include:CO2 Laser is expected to have the largest market share; it is one of the most commonly used in the medical field. They can be generalized to the notable innovation in the field of cosmetic laser treatment and massive popularization of novel CO2 based operative lasers.

Surgical Lasers Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is going to dominate the large part of this market due to the presence of a significantly higher number of cosmetic laser equipment manufacturers and medical practitioners using advanced surgical technologies.

- The key factors are well-developed healthcare system and healthcare infrastructure along with high utilization of technologically advanced aesthetic laser systems mainly in North America and rising trends towards aesthetic and plastic surgeries. In addition, the major players having operational facilities in the region and the new strategic measures being continued to be launched by them are expected to consolidate a conducive environment for the market in the region.

Active Key Players in the Surgical Lasers Market

- Abbott Laboratories, Inc.

- Boston Scientific Corporation

- Biolitec AG

- Alma Lasers

- Bison Medical Co., Ltd.

- IPG Photonics Corporation

- Lumenis

- Fotona D.O.O.

- Cynosure, Inc.

- Spectranetics Corporation and Other Key Players

|

Global Surgical Lasers Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.31Bn. |

|

Forecast Period 2024-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 3.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Procedure |

|

||

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Surgical Lasers Market by Type (2018-2032)

4.1 Surgical Lasers Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Carbon Dioxide (CO2) Lasers

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Argon Lasers

4.5 ND: YAG (Neodymium: Yttrium-Aluminum-Garnet) Lasers

4.6 Diode Lasers

4.7 Other Surgical Lasers

Chapter 5: Surgical Lasers Market by Procedure (2018-2032)

5.1 Surgical Lasers Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Open Surgery

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Laparoscopic Surgery

5.5 Percutaneous Surgery

Chapter 6: Surgical Lasers Market by Application (2018-2032)

6.1 Surgical Lasers Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Cardiology

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Dental

6.5 Dermatology

6.6 Gynecology

6.7 Others

Chapter 7: Surgical Lasers Market by End Use (2018-2032)

7.1 Surgical Lasers Market Snapshot and Growth Engine

7.2 Market Overview

7.3 Hospitals

7.3.1 Introduction and Market Overview

7.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

7.3.3 Key Market Trends, Growth Factors, and Opportunities

7.3.4 Geographic Segmentation Analysis

7.4 Specialty Clinics

7.5 Ambulatory Surgical Centers

Chapter 8: Company Profiles and Competitive Analysis

8.1 Competitive Landscape

8.1.1 Competitive Benchmarking

8.1.2 Surgical Lasers Market Share by Manufacturer (2024)

8.1.3 Industry BCG Matrix

8.1.4 Heat Map Analysis

8.1.5 Mergers and Acquisitions

8.2 BARCO

8.2.1 Company Overview

8.2.2 Key Executives

8.2.3 Company Snapshot

8.2.4 Role of the Company in the Market

8.2.5 Sustainability and Social Responsibility

8.2.6 Operating Business Segments

8.2.7 Product Portfolio

8.2.8 Business Performance

8.2.9 Key Strategic Moves and Recent Developments

8.2.10 SWOT Analysis

8.3 EIZO

8.4 FSN MEDICAL TECHNOLOGIES

8.5 LG DISPLAY

8.6 NOVANTA

8.7 SIEMENS HEALTHINEERS

8.8 SONY

8.9 STERIS

8.10 QUEST INTERNATIONAL

8.11 ADVANTECH

8.12 STRYKER

8.13 OLYMPUS

8.14 WINMATE

8.15 JOIMAX GMBH

8.16 PANASONIC

8.17 INTEGRITECH

8.18 OTHER MAJOR PLAYERS

8.19

Chapter 9: Global Surgical Lasers Market By Region

9.1 Overview

9.2. North America Surgical Lasers Market

9.2.1 Key Market Trends, Growth Factors and Opportunities

9.2.2 Top Key Companies

9.2.3 Historic and Forecasted Market Size by Segments

9.2.4 Historic and Forecasted Market Size by Type

9.2.4.1 Carbon Dioxide (CO2) Lasers

9.2.4.2 Argon Lasers

9.2.4.3 ND: YAG (Neodymium: Yttrium-Aluminum-Garnet) Lasers

9.2.4.4 Diode Lasers

9.2.4.5 Other Surgical Lasers

9.2.5 Historic and Forecasted Market Size by Procedure

9.2.5.1 Open Surgery

9.2.5.2 Laparoscopic Surgery

9.2.5.3 Percutaneous Surgery

9.2.6 Historic and Forecasted Market Size by Application

9.2.6.1 Cardiology

9.2.6.2 Dental

9.2.6.3 Dermatology

9.2.6.4 Gynecology

9.2.6.5 Others

9.2.7 Historic and Forecasted Market Size by End Use

9.2.7.1 Hospitals

9.2.7.2 Specialty Clinics

9.2.7.3 Ambulatory Surgical Centers

9.2.8 Historic and Forecast Market Size by Country

9.2.8.1 US

9.2.8.2 Canada

9.2.8.3 Mexico

9.3. Eastern Europe Surgical Lasers Market

9.3.1 Key Market Trends, Growth Factors and Opportunities

9.3.2 Top Key Companies

9.3.3 Historic and Forecasted Market Size by Segments

9.3.4 Historic and Forecasted Market Size by Type

9.3.4.1 Carbon Dioxide (CO2) Lasers

9.3.4.2 Argon Lasers

9.3.4.3 ND: YAG (Neodymium: Yttrium-Aluminum-Garnet) Lasers

9.3.4.4 Diode Lasers

9.3.4.5 Other Surgical Lasers

9.3.5 Historic and Forecasted Market Size by Procedure

9.3.5.1 Open Surgery

9.3.5.2 Laparoscopic Surgery

9.3.5.3 Percutaneous Surgery

9.3.6 Historic and Forecasted Market Size by Application

9.3.6.1 Cardiology

9.3.6.2 Dental

9.3.6.3 Dermatology

9.3.6.4 Gynecology

9.3.6.5 Others

9.3.7 Historic and Forecasted Market Size by End Use

9.3.7.1 Hospitals

9.3.7.2 Specialty Clinics

9.3.7.3 Ambulatory Surgical Centers

9.3.8 Historic and Forecast Market Size by Country

9.3.8.1 Russia

9.3.8.2 Bulgaria

9.3.8.3 The Czech Republic

9.3.8.4 Hungary

9.3.8.5 Poland

9.3.8.6 Romania

9.3.8.7 Rest of Eastern Europe

9.4. Western Europe Surgical Lasers Market

9.4.1 Key Market Trends, Growth Factors and Opportunities

9.4.2 Top Key Companies

9.4.3 Historic and Forecasted Market Size by Segments

9.4.4 Historic and Forecasted Market Size by Type

9.4.4.1 Carbon Dioxide (CO2) Lasers

9.4.4.2 Argon Lasers

9.4.4.3 ND: YAG (Neodymium: Yttrium-Aluminum-Garnet) Lasers

9.4.4.4 Diode Lasers

9.4.4.5 Other Surgical Lasers

9.4.5 Historic and Forecasted Market Size by Procedure

9.4.5.1 Open Surgery

9.4.5.2 Laparoscopic Surgery

9.4.5.3 Percutaneous Surgery

9.4.6 Historic and Forecasted Market Size by Application

9.4.6.1 Cardiology

9.4.6.2 Dental

9.4.6.3 Dermatology

9.4.6.4 Gynecology

9.4.6.5 Others

9.4.7 Historic and Forecasted Market Size by End Use

9.4.7.1 Hospitals

9.4.7.2 Specialty Clinics

9.4.7.3 Ambulatory Surgical Centers

9.4.8 Historic and Forecast Market Size by Country

9.4.8.1 Germany

9.4.8.2 UK

9.4.8.3 France

9.4.8.4 The Netherlands

9.4.8.5 Italy

9.4.8.6 Spain

9.4.8.7 Rest of Western Europe

9.5. Asia Pacific Surgical Lasers Market

9.5.1 Key Market Trends, Growth Factors and Opportunities

9.5.2 Top Key Companies

9.5.3 Historic and Forecasted Market Size by Segments

9.5.4 Historic and Forecasted Market Size by Type

9.5.4.1 Carbon Dioxide (CO2) Lasers

9.5.4.2 Argon Lasers

9.5.4.3 ND: YAG (Neodymium: Yttrium-Aluminum-Garnet) Lasers

9.5.4.4 Diode Lasers

9.5.4.5 Other Surgical Lasers

9.5.5 Historic and Forecasted Market Size by Procedure

9.5.5.1 Open Surgery

9.5.5.2 Laparoscopic Surgery

9.5.5.3 Percutaneous Surgery

9.5.6 Historic and Forecasted Market Size by Application

9.5.6.1 Cardiology

9.5.6.2 Dental

9.5.6.3 Dermatology

9.5.6.4 Gynecology

9.5.6.5 Others

9.5.7 Historic and Forecasted Market Size by End Use

9.5.7.1 Hospitals

9.5.7.2 Specialty Clinics

9.5.7.3 Ambulatory Surgical Centers

9.5.8 Historic and Forecast Market Size by Country

9.5.8.1 China

9.5.8.2 India

9.5.8.3 Japan

9.5.8.4 South Korea

9.5.8.5 Malaysia

9.5.8.6 Thailand

9.5.8.7 Vietnam

9.5.8.8 The Philippines

9.5.8.9 Australia

9.5.8.10 New Zealand

9.5.8.11 Rest of APAC

9.6. Middle East & Africa Surgical Lasers Market

9.6.1 Key Market Trends, Growth Factors and Opportunities

9.6.2 Top Key Companies

9.6.3 Historic and Forecasted Market Size by Segments

9.6.4 Historic and Forecasted Market Size by Type

9.6.4.1 Carbon Dioxide (CO2) Lasers

9.6.4.2 Argon Lasers

9.6.4.3 ND: YAG (Neodymium: Yttrium-Aluminum-Garnet) Lasers

9.6.4.4 Diode Lasers

9.6.4.5 Other Surgical Lasers

9.6.5 Historic and Forecasted Market Size by Procedure

9.6.5.1 Open Surgery

9.6.5.2 Laparoscopic Surgery

9.6.5.3 Percutaneous Surgery

9.6.6 Historic and Forecasted Market Size by Application

9.6.6.1 Cardiology

9.6.6.2 Dental

9.6.6.3 Dermatology

9.6.6.4 Gynecology

9.6.6.5 Others

9.6.7 Historic and Forecasted Market Size by End Use

9.6.7.1 Hospitals

9.6.7.2 Specialty Clinics

9.6.7.3 Ambulatory Surgical Centers

9.6.8 Historic and Forecast Market Size by Country

9.6.8.1 Turkiye

9.6.8.2 Bahrain

9.6.8.3 Kuwait

9.6.8.4 Saudi Arabia

9.6.8.5 Qatar

9.6.8.6 UAE

9.6.8.7 Israel

9.6.8.8 South Africa

9.7. South America Surgical Lasers Market

9.7.1 Key Market Trends, Growth Factors and Opportunities

9.7.2 Top Key Companies

9.7.3 Historic and Forecasted Market Size by Segments

9.7.4 Historic and Forecasted Market Size by Type

9.7.4.1 Carbon Dioxide (CO2) Lasers

9.7.4.2 Argon Lasers

9.7.4.3 ND: YAG (Neodymium: Yttrium-Aluminum-Garnet) Lasers

9.7.4.4 Diode Lasers

9.7.4.5 Other Surgical Lasers

9.7.5 Historic and Forecasted Market Size by Procedure

9.7.5.1 Open Surgery

9.7.5.2 Laparoscopic Surgery

9.7.5.3 Percutaneous Surgery

9.7.6 Historic and Forecasted Market Size by Application

9.7.6.1 Cardiology

9.7.6.2 Dental

9.7.6.3 Dermatology

9.7.6.4 Gynecology

9.7.6.5 Others

9.7.7 Historic and Forecasted Market Size by End Use

9.7.7.1 Hospitals

9.7.7.2 Specialty Clinics

9.7.7.3 Ambulatory Surgical Centers

9.7.8 Historic and Forecast Market Size by Country

9.7.8.1 Brazil

9.7.8.2 Argentina

9.7.8.3 Rest of SA

Chapter 10 Analyst Viewpoint and Conclusion

10.1 Recommendations and Concluding Analysis

10.2 Potential Market Strategies

Chapter 11 Research Methodology

11.1 Research Process

11.2 Primary Research

11.3 Secondary Research

|

Global Surgical Lasers Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2032 |

|

Historical Data: |

2018 to 2024 |

Market Size in 2024: |

USD 2.31Bn. |

|

Forecast Period 2024-32 CAGR: |

5.2 % |

Market Size in 2032: |

USD 3.5 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Procedure |

|

||

|

By Application |

|

||

|

By End Use |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||