Super Food Infused Beverages Market Synopsis

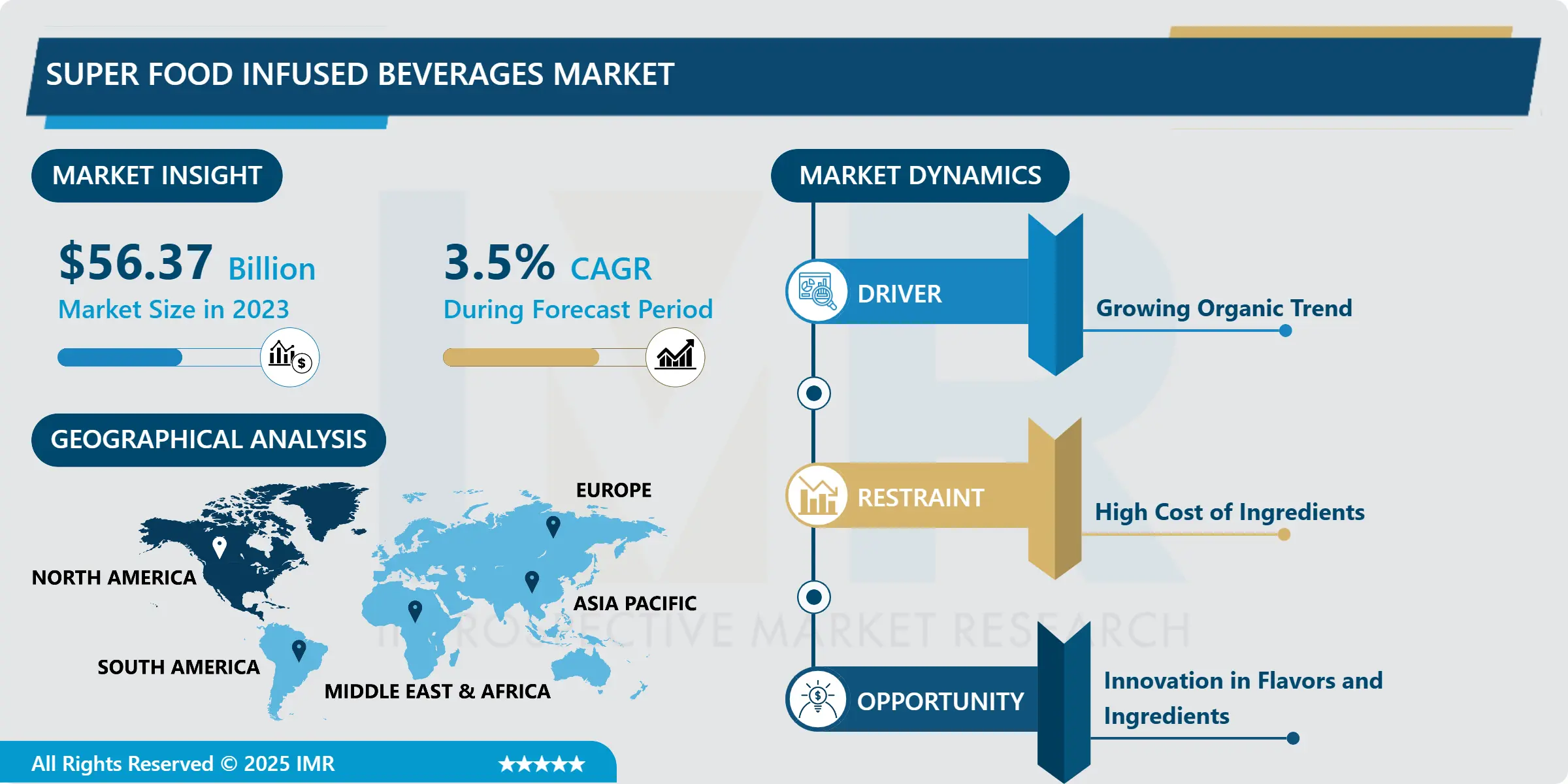

Super Food Infused Beverages Market Size Was Valued at USD 56.37 Billion in 2023, and is Projected to Reach USD 76.83 Billion by 2032, Growing at a CAGR of 3.50% From 2024-2032.

The drinks with elements of the terms on the list of superfoods include kale, chia seed and goji berry. They are also packed with vitamin, antioxidant, and mineral content with the intention of improving general health and vitality. Most of these beverages are sold as healthy products for individuals who want to take drinks with nutritional and functional attributes different from those of normal drinks. Some examples include green smoothes and other drinks which include acai berry.

The market for Super Food Infused Beverages has shown a great deal of growth in recent years due to health awareness among the consumer and the preference of healthy and functional foods and beverages. These products containing what is believed to have health enhancing ingredients like antioxidants, vitamins, and minerals are preferred as substitutes for regular high sugar products. It is more so evident from millennials and others who are health conscious and looking for easier ways of improving their nutritional value of foods. Consequently, COVID19 has acted as a catalyst for the growth of other health-care products because more people would fancy products that would boost their immunity. This has created a change in formulation offering including smoothies, cold pressed juices, herbal teas and energy drinks containing ingredients such as acai, spirulina and matcha.

Players are keen on finding ways to attract the attention of the new SC and ultimately increase the number of products in a short time, and foster increased collaborations between beverage firms and superfood providers. This competition has also led to a rise in the intake of organic and natural products that fitness the growing clean-label attitude habitual by consumers. Moreover, the modern availability of the products has been made easier through the help of the internet, making it easy for the consumers to find the superfood enriched drinks. With sustainability emerging as the new consideration act, brands are also found innovating for sustainable packaging and product sourcing. In conclusion, the Super Food Infused Beverages market has opportunities to grow with health conscious consumers, new product development, and manufacturers focus on sustainability that can benefit both, the incumbents and entrants in this market.

Super Food Infused Beverages Market Trend Analysis

Growth of Health-Conscious Consumerism in the Super Food Infused Beverages Market

- The following is an examination of global trends noting that the global population is gradually becoming conscious of the type of foods they are taking hence adopting functional beverages that will complement the nutrients in the foods. This is so much more apparent from millennials and generation Z both of whom are in search of products that will help them achieve their wellness objectives. Such consumers are wiser and selective in their consumerism; they consume more of ingredients that provide measurable health gains. They are shifting to the consumption of products such as tea, coffee, wine, fresh fruit juices, fresh vegetables and many other products that have got antioxidant vitamins as well as minerals that are within the human body system. Consequently, an expanding interest in augmented products has pushed supplementation into a diverse range of beverages with traditional superfoods acai, matcha, turmeric, and spirulina. This trend can be seen through the rising consumption of smoothies, cold pressed juices and health shots for they are tasty and are just as convenient for the consumers to take in loads of nutrients in form of powders and liquids.

- However, the factor which is specifically attributable to the current status is the shift toward healthier options in the product formulation and advertising. Thus, brands adapt to the expectations of consumers and diversify segments with respect to new functional added values, with superfoods focused on immunity, energy, digestion, etc. This has led to more product differentiation, and today there are flowing convenience products that are actually medical drinks like functional teas; flavoured, energized water and probiotic beverages. Also, there is more attention to where specific ingredients come from and what a product contains, which helps to gain consumer’s trust and make them loyal. In the future, as the trends regarding the health and wellbeing of people change, the manufactures of the products are likely to change the blends of the superfood and even the flavors of the beverages, hence propelling the growth of this market as well as continuously responding to the ever changing needs of consumers.

The Impact of Sustainability on the Super Food Infused Beverages Market

- The global driving force for sustainability is being keenly talked in the Super Food Infused Beverages Market because customers are becoming conscious about their products’ environmental impact. Consumers look for products that are organic, non-GMO and which are sourced from those suppliers who embrace sustainable farming and manufacturing. Appealing to consumers through sustainability leads this shift and is forcing brands to transform their supply chain and sourcing from responsible farms and the promotion and investment in sustainable agriculture. In this context, by implementing these practices, companies serve consumers’ needs and demands and create free word of mouth among sustainable shoppers. This shift towards sustainability is now is also emerging as a key driver since products with an emphasis on the environment make a brand stand out as unique in a saturated market.

- However, the factor, sustainable sourcing for raw materials to package the Super Food Infused Beverages Market is slowly transforming into another important innovation. With the average customer now being more conscious of environmental degradation, companies are looking for ways of making their ‘packaging’ either biodegradable or at least recyclable. This shift also correlates well with consumers’ perception, and solves the problem of increasing pressure from regulatory authorities and environmental non-governmental organizations to minimize the use of plastics. Further, with the growth of e-com and other online retailers selling health-focused foods, these can now be easily found and purchase, thus the discovery of such more sustainable-packaged superfood beverages can easily be accessed. With the growing development of the market, it can be expected that manufacturers will continue to invest in new, distinctive tastes and beneficial properties for consumers meaning additional development and differentiation within the beverages market. The company benefits from the people-conscious objective of the products besides contributing to the emerging environmental sensitivity for the food and beverage products.

Super Food Infused Beverages Market Segment Analysis

Super Food Infused Beverages Market Segmented based on By Type and By Distribution channel

By Type, Alcoholic segment is expected to dominate the market during the forecast period

- The alcoholic segment is not only the key segment of the global beverage industry but also a promising sector that recognizes and adapts to each change in the consumer’s preferences. When within this segment, a rather broad range of products is available with beers, wines, and spirits at its core as well as RTD cocktail drinks and flavoured alcoholic beverages. Has particularly been transformed by the craft beer movement which has precipitated the increased production local brewers adjusting to the use of complicated recipes. This focus on quality, or so called ‘artisanal’, production has not only improved the taste characteristics of beer but has also inspired consumers. For this reason, consumers have shifted their preferences towards experimentation with the new varieties and passing the information across with others leading to the formation of a craft beverage community.

- Furthermore, the trend of premiumization has resulted in enhancement of the purchasing behaviours of alcoholic beverages consumer where they are now willing to spend significantly in Provoked alcoholic products that can provoke them. This is in consonance of the social phenomenon of mindful and appreciative consumption partly encouraged through the sustainability of the quantity gap. This particular focus has resulted to abstract ofniche distilleries and vintages companies that specialize in the production of limited quantity products using local materials. Further consumers occasions and festivities are still core to the category as these occasions enable consumers to interact with these alcoholic beverage products. Despite the threats the sector is facing for example regulatory constraints, changing perception on health implication of alcohol consumption, furor growth of the alcoholic beverage market is strengthened by the fact that it can bear the impacts of change which is very rampant due to ever changing consumer preferences and demand for touch experience especially in consuming alcoholic beverages.

By Distribution channel, Online segment held the largest share in 2023

- Distribution channel especially the on-line mode of distribution has already affected the beverage market deeply by allowing a full access to a rather large range of products. Through e-commerce customer has an opportunity to choose a variety of alcoholic and non-alcoholic beverages regardless of the time and geographical location of the store. This accessibility is especially helpful for the specific business types like specialty stores or manufacturers who may not have a major share in the physical business. This shift might has been precipitated by the COVID-19 pandemic as a result of which many consumers shifted to buying products online due to fear of contacting the virus. It would appear that after they adapted to ordering the beverages online then, this particular behavior has stuck even when physical shopping appearances are possible, an indication that there is a new normal when it comes to buying.

- Moreover, there has been growth in subscription services and home delivery which highly improved beverage’s online shopping experience. These services enable consumers to have their anticipated preferred brands and types of drinks automatically delivered to their homes at regular intervals making the shopping process more interesting. Consumers on their part, are eager to spend additional time shopping, thus, retailers are spending money on convenient websites and mobile applications that make easy browsing and secure purchasing possible as well as customized recommendations according to the customer’s previous purchases and behavior patterns. The use of new technologies, including artificial intelligence, and data analysis in the delivery of services deepen this personalization element to guarantee the consumers get offers and promotions that best suit them. In light of these technological advancements, the use of online distribution channel is expected to grow bigger to meet the growing need of consumers in the convenience of beverage shopping and become one of the most opted for shopping methods.

Super Food Infused Beverages Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Currently, the Super Food Infused Beverages Market in North America is also growing tremendously, as more and more people turn towards natural and health beneficial products. This is especially driven by the increased awareness of the nutritional value that comes with the so-called superfoods like acai, kale and spirulina mainly due to their antioxidant content and for other general health enhancing effects. The increasing consumer awareness about health and wellness provides a lot of opportunities for companies in form of gods and services as people look forward to getting more than hydration; rather, functional value as well. This shift in consumer behavior is specifically especially among the youth and especially toward millennials and epicureanism toward highly nutritious products. The convenience of getting information on the health implications of these raw materials via media has also boosted the consumption levels by customers thus the increasing trends of products that have position these as a superfoods.

- In addition, the strong base of beverage companies present in North America has played significant role in the development of Super Food Infused Beverages Market. The firmly knit distribution channels for those players make it easy for consumers across the region to access and integrate these health-conscious products into their lifestyles. Retail store representations in both offline and online modes add to product exposure while consumers can search for new superfoods. Furthermore, the utilization of various media by manufacturers and health organizations has the responsibility of creating awareness among consumers on the merits of consuming special food containing beverages. Not only do these initiatives sell goods but they are also pro-healthy as the need for better health choice products is internationally recognized and on the rise. These aspects of consumer pull, corporate push, and educational pull work together to provide a healthy climate for the establishment of the superfood containing beverages market in North America.

Active Key Players in the Super Food Infused Beverages Market

- Bai (U.S.)

- Herbal Brands, Inc. (U.S.)

- Justia (U.S.)

- PepsiCo (U.S.)

- The Coca?Cola Company (U.S.)

- KeVita (U.S.)

- Kuli Kuli Foods (U.S.)

- The Republic of Tea (U.S.)

- Suja Life, LLC (U.S.)

- Naked Juice Company (U.S.)

- Harmless Harvest (U.S.)

- Other Key Players

|

Super Food Infused Beverages Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 56.37 Bn. |

|

Forecast Period 2023-34 CAGR: |

3.50% |

Market Size in 2032: |

USD 76.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Super Food Infused Beverages Market by Type (2018-2032)

4.1 Super Food Infused Beverages Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Alcoholic

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Non-Alcoholic

Chapter 5: Super Food Infused Beverages Market by Distribution channel (2018-2032)

5.1 Super Food Infused Beverages Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Online

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Offline

Chapter 6: Company Profiles and Competitive Analysis

6.1 Competitive Landscape

6.1.1 Competitive Benchmarking

6.1.2 Super Food Infused Beverages Market Share by Manufacturer (2024)

6.1.3 Industry BCG Matrix

6.1.4 Heat Map Analysis

6.1.5 Mergers and Acquisitions

6.2 BAI (U.S.)

6.2.1 Company Overview

6.2.2 Key Executives

6.2.3 Company Snapshot

6.2.4 Role of the Company in the Market

6.2.5 Sustainability and Social Responsibility

6.2.6 Operating Business Segments

6.2.7 Product Portfolio

6.2.8 Business Performance

6.2.9 Key Strategic Moves and Recent Developments

6.2.10 SWOT Analysis

6.3 HERBAL BRANDS INC. (U.S.)

6.4 JUSTIA (U.S.)

6.5 PEPSICO (U.S.)

6.6 THE COCA?COLA COMPANY (U.S.)

6.7 KEVITA (U.S.)

6.8 KULI KULI FOODS (U.S.)

6.9 THE REPUBLIC OF TEA (U.S.)

6.10 SUJA LIFE

6.11 LLC (U.S.)

6.12 NAKED JUICE COMPANY (U.S.)

6.13 HARMLESS HARVEST (U.S.)

6.14 OTHER KEY PLAYERS

6.15

Chapter 7: Global Super Food Infused Beverages Market By Region

7.1 Overview

7.2. North America Super Food Infused Beverages Market

7.2.1 Key Market Trends, Growth Factors and Opportunities

7.2.2 Top Key Companies

7.2.3 Historic and Forecasted Market Size by Segments

7.2.4 Historic and Forecasted Market Size by Type

7.2.4.1 Alcoholic

7.2.4.2 Non-Alcoholic

7.2.5 Historic and Forecasted Market Size by Distribution channel

7.2.5.1 Online

7.2.5.2 Offline

7.2.6 Historic and Forecast Market Size by Country

7.2.6.1 US

7.2.6.2 Canada

7.2.6.3 Mexico

7.3. Eastern Europe Super Food Infused Beverages Market

7.3.1 Key Market Trends, Growth Factors and Opportunities

7.3.2 Top Key Companies

7.3.3 Historic and Forecasted Market Size by Segments

7.3.4 Historic and Forecasted Market Size by Type

7.3.4.1 Alcoholic

7.3.4.2 Non-Alcoholic

7.3.5 Historic and Forecasted Market Size by Distribution channel

7.3.5.1 Online

7.3.5.2 Offline

7.3.6 Historic and Forecast Market Size by Country

7.3.6.1 Russia

7.3.6.2 Bulgaria

7.3.6.3 The Czech Republic

7.3.6.4 Hungary

7.3.6.5 Poland

7.3.6.6 Romania

7.3.6.7 Rest of Eastern Europe

7.4. Western Europe Super Food Infused Beverages Market

7.4.1 Key Market Trends, Growth Factors and Opportunities

7.4.2 Top Key Companies

7.4.3 Historic and Forecasted Market Size by Segments

7.4.4 Historic and Forecasted Market Size by Type

7.4.4.1 Alcoholic

7.4.4.2 Non-Alcoholic

7.4.5 Historic and Forecasted Market Size by Distribution channel

7.4.5.1 Online

7.4.5.2 Offline

7.4.6 Historic and Forecast Market Size by Country

7.4.6.1 Germany

7.4.6.2 UK

7.4.6.3 France

7.4.6.4 The Netherlands

7.4.6.5 Italy

7.4.6.6 Spain

7.4.6.7 Rest of Western Europe

7.5. Asia Pacific Super Food Infused Beverages Market

7.5.1 Key Market Trends, Growth Factors and Opportunities

7.5.2 Top Key Companies

7.5.3 Historic and Forecasted Market Size by Segments

7.5.4 Historic and Forecasted Market Size by Type

7.5.4.1 Alcoholic

7.5.4.2 Non-Alcoholic

7.5.5 Historic and Forecasted Market Size by Distribution channel

7.5.5.1 Online

7.5.5.2 Offline

7.5.6 Historic and Forecast Market Size by Country

7.5.6.1 China

7.5.6.2 India

7.5.6.3 Japan

7.5.6.4 South Korea

7.5.6.5 Malaysia

7.5.6.6 Thailand

7.5.6.7 Vietnam

7.5.6.8 The Philippines

7.5.6.9 Australia

7.5.6.10 New Zealand

7.5.6.11 Rest of APAC

7.6. Middle East & Africa Super Food Infused Beverages Market

7.6.1 Key Market Trends, Growth Factors and Opportunities

7.6.2 Top Key Companies

7.6.3 Historic and Forecasted Market Size by Segments

7.6.4 Historic and Forecasted Market Size by Type

7.6.4.1 Alcoholic

7.6.4.2 Non-Alcoholic

7.6.5 Historic and Forecasted Market Size by Distribution channel

7.6.5.1 Online

7.6.5.2 Offline

7.6.6 Historic and Forecast Market Size by Country

7.6.6.1 Turkiye

7.6.6.2 Bahrain

7.6.6.3 Kuwait

7.6.6.4 Saudi Arabia

7.6.6.5 Qatar

7.6.6.6 UAE

7.6.6.7 Israel

7.6.6.8 South Africa

7.7. South America Super Food Infused Beverages Market

7.7.1 Key Market Trends, Growth Factors and Opportunities

7.7.2 Top Key Companies

7.7.3 Historic and Forecasted Market Size by Segments

7.7.4 Historic and Forecasted Market Size by Type

7.7.4.1 Alcoholic

7.7.4.2 Non-Alcoholic

7.7.5 Historic and Forecasted Market Size by Distribution channel

7.7.5.1 Online

7.7.5.2 Offline

7.7.6 Historic and Forecast Market Size by Country

7.7.6.1 Brazil

7.7.6.2 Argentina

7.7.6.3 Rest of SA

Chapter 8 Analyst Viewpoint and Conclusion

8.1 Recommendations and Concluding Analysis

8.2 Potential Market Strategies

Chapter 9 Research Methodology

9.1 Research Process

9.2 Primary Research

9.3 Secondary Research

|

Super Food Infused Beverages Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 56.37 Bn. |

|

Forecast Period 2023-34 CAGR: |

3.50% |

Market Size in 2032: |

USD 76.83 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Distribution channel |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||