Storage as a Service (STaaS) Market Synopsis

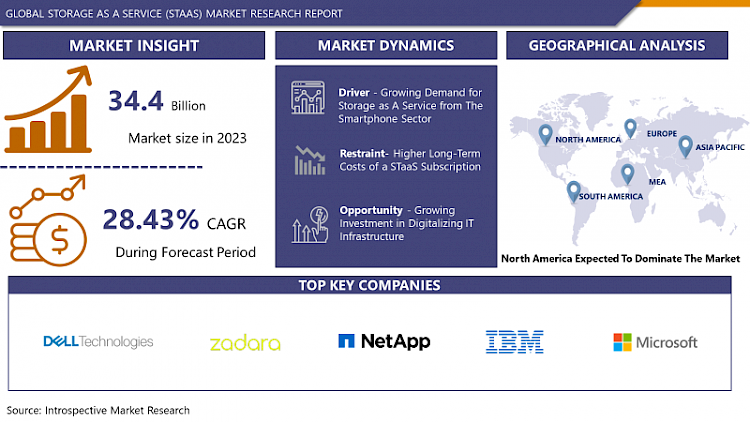

Global Storage as a Service (STaaS) Market Size Was Valued at USD 34.4 Billion in 2023 and is Projected to Reach USD 327.01 Billion by 2032, Growing at a CAGR of 28.43% From 2024-2032.

Storage as a Service (STaaS) defines a cloud computing approach where storage infrastructure is provided by a third-party provider through subscription. Users access and pay for the storage space they require, remotely over the internet. This model eliminates the necessity for on-site storage hardware and offers scalable and adaptable storage solutions.

- Storage as a Service (STaaS) represents a cloud computing model where a third-party provider delivers storage infrastructure through a subscription framework. This setup allows users to remotely access storage space via the internet, eliminating the necessity for on-premises storage hardware. STaaS brings forth numerous benefits, such as scalability, adaptability, and cost-effectiveness. Users can effortlessly adjust their storage resources according to fluctuating demands, facilitating efficient resource utilization and cost management.

- The STaaS Users can readily modify their storage capacity to align with evolving business requirements, sidestepping the need for additional hardware investments. This adaptability empowers organizations to seamlessly respond to changing storage needs and optimize resource distribution. Additionally, STaaS enhances data accessibility and bolsters disaster recovery capabilities by storing data in secure, off-site locations.

- STaaS is poised to surge as businesses increasingly turn to cloud-based storage solutions. With data proliferation and the necessity for scalable storage infrastructure on the rise, STaaS emerges as an appealing option for organizations seeking economical and effective storage solutions. Moreover, technological advancements like edge computing and the Internet of Things (IoT) are propelling the requirement for distributed storage solutions, further boosting the demand for STaaS. As organizations prioritize agility, scalability, and cost-efficiency, STaaS is positioned to play a pivotal role in fulfilling their evolving storage needs.

Storage as a Service (STaaS) Market Trend Analysis:

Growing Demand for Storage as A Service from The Smartphone Sector

- The significant driver propelling the growth of the Storage as a Service (STaaS) market is the increasing demand from the smartphone sector. With smartphone usage witnessing an exponential rise globally, driven by factors such as expanding internet accessibility, advancements in mobile technology, and the proliferation of digital content, there's an urgent requirement for scalable and accessible storage solutions. STaaS emerges as a practical solution for both smartphone manufacturers and users, facilitating seamless storage expansion devoid of physical hardware limitations.

- Moreover, as smartphones become primary devices for storing and retrieving various forms of multimedia content like photos, videos, and applications, the necessity for cloud-based storage solutions intensifies. STaaS providers address this demand by offering customizable and cost-effective storage options tailored to the specific requirements of smartphone users. Additionally, the convenience of accessing stored data from any location, at any time, further enhances the attractiveness of STaaS for smartphone users, thereby stimulating market growth.

- The sustained demand for STaaS is anticipated due to the increasing reliance on smartphones for diverse tasks such as communication, entertainment, and productivity. As smartphone manufacturers persist in innovating and introducing devices with enhanced functionalities, the need for scalable and dependable storage solutions will remain crucial. The interdependent relationship between the smartphone sector and the STaaS market is poised to perpetuate continuous growth and advancement in storage technology.

Focus on Security and Compliance

- The burgeoning investment in digitizing IT infrastructure offers a significant growth opportunity for the Storage as a Service (STaaS) market. With organizations acknowledging the necessity of digital transformation to retain competitiveness in today's rapidly evolving business environment, there's a heightened focus on modernizing IT infrastructure. This entails shifting away from conventional, on-premises storage solutions towards more adaptable and scalable cloud-based alternatives like STaaS.

- Moreover, the adoption of STaaS complements the strategic goals of organizations aiming to optimize their IT expenditures and streamline operations. Through the utilization of STaaS, enterprises can realize cost savings by reducing capital expenditure on physical storage hardware, along with decreased expenses for maintenance and management. The cost-effectiveness of STaaS, combined with its scalability and flexibility, presents an appealing proposition for businesses seeking to modernize their IT infrastructure while optimizing resource utilization.

- The sustained investment in digitalization endeavors across diverse industries, such as healthcare, finance, manufacturing, and retail, is anticipated to propel the demand for STaaS. As organizations increasingly prioritize agility, scalability, and cost efficiency in managing their data storage requirements, STaaS providers are well-positioned to leverage this expanding market opportunity. By delivering innovative solutions tailored to the evolving needs of digitized IT infrastructure, STaaS providers can position themselves for enduring growth and success in the ever-evolving technology landscape.

Storage as a Service (STaaS) Market Segment Analysis:

Storage as a Service (STaaS) Market Segmented on the basis of Service Type, Enterprise Size, and Industry Vertical.

By Enterprise Size, Large Enterprises segment is expected to dominate the market during the forecast period

- The Large Enterprises segment is poised to lead growth. Large corporations typically have significant data storage needs due to their extensive operations and complex IT setups. As these organizations aim to modernize their IT frameworks and adapt to evolving market dynamics, they increasingly turn to STaaS solutions for efficient data management. STaaS offers large enterprises the flexibility to scale their storage capacities according to changing requirements, without the hassle of maintaining on-premises infrastructure.

- Moreover, large enterprises prioritize security, compliance, and reliability in their storage solutions, areas where STaaS providers excel. Through STaaS adoption, large corporations can access secure and compliant storage solutions while simultaneously reducing operational costs and improving operational agility. With data volumes continually expanding and the demand for robust storage solutions increasing, the Large Enterprises segment is expected to maintain its dominance in the STaaS market, driving advancements and widespread adoption across the sector.

By Industry Vertical, BFSI segment held the largest share of 34.20% in 2022

- The BFSI (Banking, Financial Services, and Insurance) segment stands out as the primary driver behind the expansion of the Storage as a Service (STaaS) Market. This sector, known for its substantial data storage needs and stringent security and compliance standards, heavily depends on scalable and secure storage solutions to handle large volumes of sensitive financial data. With BFSI entities navigating the digital transformation landscape and embracing cloud-based technologies, the adoption of STaaS solutions is increasingly prevalent to cater to their evolving storage requirements.

- Moreover, STaaS providers tailor their offerings to meet the specific demands of the BFSI sector, providing robust security features, data encryption protocols, and compliance frameworks aligned with industry regulations such as GDPR and PCI DSS. This ensures that BFSI institutions can securely store and manage their data while staying compliant with regulatory mandates. Additionally, the scalability and flexibility inherent in STaaS empower BFSI organizations to effectively manage fluctuations in data volumes and adapt to changing market dynamics, thereby fueling further adoption and growth within the segment.

Storage as a Service (STaaS) Market Regional Insights:

North America Expected to Dominate the Market Over the Forecast Period

- North America is poised to lead the region in the growth of the Storage as a Service (STaaS) market. The region boasts a strong technological infrastructure and widespread digital adoption across various industries, setting the stage for significant expansion in the STaaS sector. Key factors contributing to North America's dominance include the widespread adoption of cloud computing, escalating demand for data storage solutions, and the presence of major players in the IT sector.

- Moreover, North America's proactive approach to embracing innovative technologies and its favorable regulatory environment for cloud services further catalyze the growth of the STaaS market. Additionally, the region's mature economy and abundance of enterprises with diverse storage needs drive the adoption of STaaS solutions. As North American organizations prioritize scalability, flexibility, and cost-effectiveness in managing their data storage requirements, the region is expected to maintain its leading position in propelling the growth of the STaaS market.

Storage as a Service (STaaS) Market Top Key Players:

- Hitachi Vantara (U.S.)

- IBM Corporation (U.S.)

- Microsoft (U.S.)

- Dell Technologies (U.S.)

- Zadara Storage (U.S.)

- Backblaze (U.S.)

- Cloudian (U.S.)

- Veritas Technologies LLC (U.S.)

- Quantum Corporation (U.S.)

- AWS (U.S.)

- NetApp (U.S.)

- HPE (U.S.)

- AT&T (U.S.)

- TechTarget (U.S.)

- Pure Storage (U.S.)

- Dell Technologies (U.S.)

- Rackspace Inc. (U.S.), and Other Major Players

Key Industry Developments in the Storage as a Service (STaaS) Market:

- In January 2023, ePlus Inc. launched ePlus Storage-as-a-Service powered by Pure Storage Evergreen//One™, a Managed Services Provider Program that offers flexible subscription models for storage consumption, technical support, and customer success resources.

- In October 2023, Pure Storage, an IT pioneer, introduced a unique commitment to pay customers' power and rack space costs for its Evergreen//One™ Storage-as-a-Service (STaaS) and Evergreen//Flex™ subscriptions. The company also offers new guarantees such as No Data Migration, Zero Data Loss, and Power and Space Efficiency, along with flexible upgrades and financing options.

|

Global Storage as a Service (STaaS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 34.4 Billion. |

|

Forecast Period 2024-32 CAGR: |

28.43% |

Market Size in 2032: |

USD 327.01 Billion. |

|

Segments Covered: |

By Service Type |

|

|

|

By Enterprise Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- STORAGE AS A SERVICE (STAAS) MARKET BY SERVICE TYPE (2017-2032)

- STORAGE AS A SERVICE (STAAS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- CLOUD NAS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032)

- Historic And Forecasted Market Size in Volume (2017-2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOUD SAN

- CLOUD BACKUP

- CLOUD ARCHIVING

- STORAGE AS A SERVICE (STAAS) MARKET BY ENTERPRISE SIZE (2017-2032)

- STORAGE AS A SERVICE (STAAS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMALL & MEDIUM ENTERPRISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032)

- Historic And Forecasted Market Size in Volume (2017-2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISES

- STORAGE AS A SERVICE (STAAS) MARKET BY INDUSTRY VERTICAL (2017-2032)

- STORAGE AS A SERVICE (STAAS) MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MEDIA & ENTERTAINMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017-2032)

- Historic And Forecasted Market Size in Volume (2017-2032)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GOVERNMENT

- HEALTHCARE

- IT & TELECOM

- MANUFACTURING

- BFSI

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Storage as a Service (STaaS) Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HITACHI VANTARA

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- IBM CORPORATION (U.S.)

- MICROSOFT (U.S.)

- DELL TECHNOLOGIES (U.S.)

- ZADARA STORAGE (U.S.)

- BACKBLAZE (U.S.)

- CLOUDIAN (U.S.)

- VERITAS TECHNOLOGIES LLC (U.S.)

- QUANTUM CORPORATION (U.S.)

- AWS (U.S.)

- NETAPP (U.S.)

- HPE (U.S.)

- AT&T (U.S.)

- TECHTARGET (U.S.)

- PURE STORAGE (U.S.)

- DELL TECHNOLOGIES (U.S.)

- RACKSPACE INC. (U.S.)

- COMPETITIVE LANDSCAPE

- GLOBAL STORAGE AS A SERVICE (STAAS) MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Service Type

- Historic And Forecasted Market Size By Enterprise Size

- Historic And Forecasted Market Size By Industry Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Storage as a Service (STaaS) Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2022 |

Market Size in 2023: |

USD 34.4 Billion. |

|

Forecast Period 2024-32 CAGR: |

28.43% |

Market Size in 2032: |

USD 327.01 Billion. |

|

Segments Covered: |

By Service Type |

|

|

|

By Enterprise Size |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. STORAGE AS A SERVICE (STAAS) MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. STORAGE AS A SERVICE (STAAS) MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. STORAGE AS A SERVICE (STAAS) MARKET COMPETITIVE RIVALRY

TABLE 005. STORAGE AS A SERVICE (STAAS) MARKET THREAT OF NEW ENTRANTS

TABLE 006. STORAGE AS A SERVICE (STAAS) MARKET THREAT OF SUBSTITUTES

TABLE 007. STORAGE AS A SERVICE (STAAS) MARKET BY TYPE

TABLE 008. PRIVATE CLOUD MARKET OVERVIEW (2016-2028)

TABLE 009. PUBLIC CLOUD MARKET OVERVIEW (2016-2028)

TABLE 010. HYBRID CLOUD MARKET OVERVIEW (2016-2028)

TABLE 011. STORAGE AS A SERVICE (STAAS) MARKET BY END-USER

TABLE 012. BFSI MARKET OVERVIEW (2016-2028)

TABLE 013. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

TABLE 014. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 015. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA STORAGE AS A SERVICE (STAAS) MARKET, BY TYPE (2016-2028)

TABLE 018. NORTH AMERICA STORAGE AS A SERVICE (STAAS) MARKET, BY END-USER (2016-2028)

TABLE 019. N STORAGE AS A SERVICE (STAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE STORAGE AS A SERVICE (STAAS) MARKET, BY TYPE (2016-2028)

TABLE 021. EUROPE STORAGE AS A SERVICE (STAAS) MARKET, BY END-USER (2016-2028)

TABLE 022. STORAGE AS A SERVICE (STAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC STORAGE AS A SERVICE (STAAS) MARKET, BY TYPE (2016-2028)

TABLE 024. ASIA PACIFIC STORAGE AS A SERVICE (STAAS) MARKET, BY END-USER (2016-2028)

TABLE 025. STORAGE AS A SERVICE (STAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA STORAGE AS A SERVICE (STAAS) MARKET, BY TYPE (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA STORAGE AS A SERVICE (STAAS) MARKET, BY END-USER (2016-2028)

TABLE 028. STORAGE AS A SERVICE (STAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA STORAGE AS A SERVICE (STAAS) MARKET, BY TYPE (2016-2028)

TABLE 030. SOUTH AMERICA STORAGE AS A SERVICE (STAAS) MARKET, BY END-USER (2016-2028)

TABLE 031. STORAGE AS A SERVICE (STAAS) MARKET, BY COUNTRY (2016-2028)

TABLE 032. HITACHI VANTARA: SNAPSHOT

TABLE 033. HITACHI VANTARA: BUSINESS PERFORMANCE

TABLE 034. HITACHI VANTARA: PRODUCT PORTFOLIO

TABLE 035. HITACHI VANTARA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. ZADARA STORAGE: SNAPSHOT

TABLE 036. ZADARA STORAGE: BUSINESS PERFORMANCE

TABLE 037. ZADARA STORAGE: PRODUCT PORTFOLIO

TABLE 038. ZADARA STORAGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. CLOUDIAN: SNAPSHOT

TABLE 039. CLOUDIAN: BUSINESS PERFORMANCE

TABLE 040. CLOUDIAN: PRODUCT PORTFOLIO

TABLE 041. CLOUDIAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. QUANTUM CORPORATION: SNAPSHOT

TABLE 042. QUANTUM CORPORATION: BUSINESS PERFORMANCE

TABLE 043. QUANTUM CORPORATION: PRODUCT PORTFOLIO

TABLE 044. QUANTUM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. AWS: SNAPSHOT

TABLE 045. AWS: BUSINESS PERFORMANCE

TABLE 046. AWS: PRODUCT PORTFOLIO

TABLE 047. AWS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. IBM CORPORATION: SNAPSHOT

TABLE 048. IBM CORPORATION: BUSINESS PERFORMANCE

TABLE 049. IBM CORPORATION: PRODUCT PORTFOLIO

TABLE 050. IBM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. MICROSOFT: SNAPSHOT

TABLE 051. MICROSOFT: BUSINESS PERFORMANCE

TABLE 052. MICROSOFT: PRODUCT PORTFOLIO

TABLE 053. MICROSOFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. HPE: SNAPSHOT

TABLE 054. HPE: BUSINESS PERFORMANCE

TABLE 055. HPE: PRODUCT PORTFOLIO

TABLE 056. HPE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. GOOGLE: SNAPSHOT

TABLE 057. GOOGLE: BUSINESS PERFORMANCE

TABLE 058. GOOGLE: PRODUCT PORTFOLIO

TABLE 059. GOOGLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. AT&T: SNAPSHOT

TABLE 060. AT&T: BUSINESS PERFORMANCE

TABLE 061. AT&T: PRODUCT PORTFOLIO

TABLE 062. AT&T: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. DELL TECHNOLOGIES: SNAPSHOT

TABLE 063. DELL TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 064. DELL TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 065. DELL TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. RACKSPACE INC.: SNAPSHOT

TABLE 066. RACKSPACE INC.: BUSINESS PERFORMANCE

TABLE 067. RACKSPACE INC.: PRODUCT PORTFOLIO

TABLE 068. RACKSPACE INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 069. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 070. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 071. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. STORAGE AS A SERVICE (STAAS) MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. STORAGE AS A SERVICE (STAAS) MARKET OVERVIEW BY TYPE

FIGURE 012. PRIVATE CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 013. PUBLIC CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 014. HYBRID CLOUD MARKET OVERVIEW (2016-2028)

FIGURE 015. STORAGE AS A SERVICE (STAAS) MARKET OVERVIEW BY END-USER

FIGURE 016. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 017. IT & TELECOMMUNICATION MARKET OVERVIEW (2016-2028)

FIGURE 018. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 019. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA STORAGE AS A SERVICE (STAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE STORAGE AS A SERVICE (STAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC STORAGE AS A SERVICE (STAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA STORAGE AS A SERVICE (STAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA STORAGE AS A SERVICE (STAAS) MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Storage as a Service (STaaS) Market research report is 2024-2032.

Hitachi Vantara (U.S.), IBM Corporation (U.S.), Microsoft (U.S.), Dell Technologies (U.S.), Zadara Storage (U.S.), Backblaze (U.S.), Cloudian (U.S.), Veritas Technologies LLC (U.S.), Quantum Corporation (U.S.), AWS (U.S.), NetApp (U.S.), HPE (U.S.), AT&T (U.S.), TechTarget (U.S.), Pure Storage (U.S.), Dell Technologies (U.S.), Rackspace Inc. (U.S.), and Other Major Players.

The Storage as a Service (STaaS) Market is segmented into Service Type, Enterprise Size, Industry Vertical, and Region. By Type, the market is categorized into Cloud NAS, Cloud SAN, Cloud Backup, and Cloud Archiving. By Enterprise Size, the market is categorized into Small & Medium Enterprises and Large Enterprises. By Industry Vertical, the market is categorized into Media & Entertainment, Government, Healthcare, IT & Telecom, Manufacturing, and BFSI. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Storage as a Service (STaaS) defines a cloud computing approach where storage infrastructure is provided by a third-party provider through subscription. Users access and pay for the storage space they require, remotely over the internet. This model eliminates the necessity for on-site storage hardware and offers scalable and adaptable storage solutions.

Global Storage as a Service (STaaS) Market Size Was Valued at USD 34.4 Billion in 2023 and is Projected to Reach USD 327.01 Billion by 2032, Growing at a CAGR of 28.43% From 2024-2032.