Security as a Service Market Synopsis

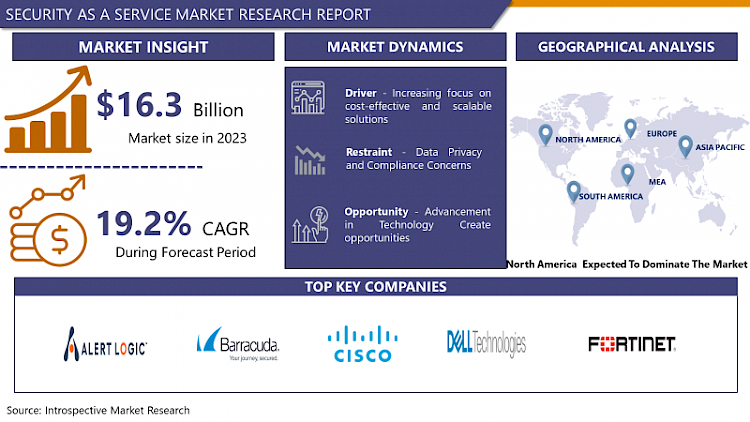

Security as a Service Market Size Was Valued at USD 16.3 Billion in 2023 and is Projected to Reach USD 79.2 Billion by 2032, Growing at a CAGR of 19.2% From 2024-2032.

Security as a Service (SECaaS) is a business model that a service provider implements a security service into a corporate network basis for a subscription wherein it is way cheaper than most people or companies could possibly implement on their own especially if one takes into account the cost recovery of the equipment and/or software required for such implementation. It allows organizations to unload cybersecurity management responsibility onto an unrelated third party. Outsourced information security services include services like data loss prevention service, anti virus administration service and intrusion detection service.

Moreover, SECaaS has been getting a very important solution for the current IT security. The new vulnerabilities rise with growing digital needs in firms. This make occur to require flexible security solutions, in this respect, SECaaS offers. It provides security as a service that creates value adaptively depending on the changes in an organization’s needs and security threats.

- The nature of threats and attacks has evolved and this has led to growth of security risks hence encouraging growth of security as a service Market. Cyber-security threats have tremendously risen since more organizations and people are inter-connecting online. This is has caused a high levels of security as a service, where an organization hands over its security measures to a service provider.

- In addition, there is increased demand for various solutions to meet emerging and more complex threats, which has contributed to the growth of the SECaaS market. The tactics of fraudsters are often updated with new methods, which are often beyond the protection of system-based security measures, and therefore, firms look for more sophisticated security protocols.

- Moreover, it is pointed out that with the rising tendency towards cloud-based services, Saas is the biggest factor driving the security as a service market. On the other hand, the safety of information and data while using outsourcing models remains a significant factor in the expansion of the SECaaS market.

- Furthermore it lies in complexities concerning the successful implementation of SECaaS that fuels the existing IT infrastructure hindering the overall growth of the market. Some of the companies that implement these security solutions often face issues with compatibility where the solution may not integrate well with the existing systems of the company thus compromising operational processes. This, on the other hand, is going to trigger the growth of security as a service in the future years due to the increased demand for enhanced threat intelligence and analytics solutions.

Security as a Service Market Trend Analysis

Rise in Cyber Attacks Drive the Market

- The rising trends in cyber-attacks prove to be a bigger challenge to various organizations across the various industries. Hackers are smart and change tactics frequently, engaging in different types of malicious software, ransomware, and phishing attacks that might target the system and the networks. But, with increasing threat levels, SECaaS is increasingly becoming strategic in helping enterprises bolster their security and manage risk levels. As per the 2023 research of Cybersecurity Ventures, The global average ransomware cost to the organization is USD 1. 85 million. This estimate is that, by 2031 there will be a ransomware attack every two seconds. Such trends unambiguously underlined the importance of improving security measures to a higher level.

- Besides, there is still an ever-present threat posed by phishing, whereby impostors send emails with a view to obtaining personal information from people. The application of SECaaS, including email security services is useful especially in combating phishing attacks. According to the study conducted by the Anti-Phishing Working Group (APWG), the global internet users suffered from 1,286,208 phishing attacks in the second quarter of the year 2023. This was the third largest quarterly figure documented by the APWG. To overcome these problems, SECaaS companies tend to employ improved threat intelligence and analysis in real-time. Yet, as noted by the APWG, there was a decline in the incidence of phishing.

Rise in Remote work culture

- The use of SECaaS to meet increasing security demands stemming from the new normal of remote work is expected to drive the growth of the market. Along these lines, there is growing realization about the need for protecting remote endpoints as well as distributed work environments to support the market. In addition, endpoint security threats, unauthorized access and data leak, information theft loom large as the working population expands their connectivity to enterprise networks and data anywhere any time with any device. Additionally, the inherent difficulties described above are managed by SECaaS solutions, allowing for endpoint protection, remote access security, and data encryption. Moreover, organisations can not only augment security for remote locations, but also control access and detect unusual activity regardless of the location or the device used by the employees, if cloud-based services are utilised.

- In addition to this, the solutions provided through SECaaS come with centralized control and visibility benefit that security personnel can easily oversee remote work spaces while adhering to regulations and best practices, which in turn is driving the growth of the market.

Security as a Service Market Segment Analysis:

Security as a Service Market is Segmented based on Component, Application, Organization Size, and Verticals.

By Application, Network Security segment is expected to dominate the market during the forecast period

- The network security segment is expected to show more market dominance in the near future. Network Security is a preventive measures of the network hostile-activity, which involves gathering and analyzing of various kinds of the network security event.

- Network security event is a sum of the data which is received from different network security devices and systems, which watch and protect a network from hostile activity. As the threat increases, there is an increased push of more cloud-based network security solutions to safeguard the network in term of restricting management of devices on the network to terminals.

By Organization Size, SMEs segment held the largest share in 2023

- The largest market share is enjoyed by the SME sector because of the emergence of numerous organizations and their need for cloud services. SMEs specific SECaaS products are intended for giving extensive yet cheap security solutions for the enterprises specifically possessing lesser resources. A survey conducted on Small Businesses by National Federation of Self-Employed & Small Businesses Limited reveals that these businesses are attacked by cyber criminals every day and the figure goes up to 10000. The improved data security and cost, efficiency, and client space and ease of access that cloud services provide over SMEs lead to the market’s expansion.

Security as a Service Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America dominates the global security as a service market and is likely to expand at an 19 % CAGR during the forecast period. While this rate of increase is expected across the forecast period, the compound annual growth rate to be achieved is 3%. North America takes the largest share of the security industry as a service industry bearing basic firms with the likes of McAfee, Zscaler, International Business Machines Corporation and Microsoft Corporation, and others. The region also has a technologically advanced network and more and more users of the cloud services as well Internet users. As indicated in the ‘CISCO Annual Internet Report, 2018’, internet user by 2023 will be at 92% of the total population of the region. Competition and the stringently set security standards by the U. S. government have also compelled the business to grow a better service, which adheres to the set standards by the government, planning to extend the growth of Security as a service as demand is anticipated toincrease.

- Further, in the blog article published on January 6, 2023 by CompTIA the United States is named as the country most targeted out of the global attacks with a statistical percentage of 46%. Blackberry November 2023 research showcased that the US, Canada, Japan, Peru, & India would be amongst the most penetrated countries for generating demands for security service. Additionally, the key managers in the C-Suite and legislators in America buy security software, Infrastructure, and future technology to shield data from escalating threats in the digital realm. Rising adoption of the security application and an emerging interest from domestic security players in security solutions are other factors that are boosting the opportunity for security-as-a-service in the United States.

Active Key Players in the Security as a Service Market

- Alert Logic Inc.

- Barracuda Networks Inc.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Fortinet Inc.

- International Business Machines Corporation

- McAfee LLC

- Microsoft Corporation

- Okta Inc.

- Proofpoint Inc.

- Qualys Inc.

- Radware Ltd.

- Trend Micro Incorporated

- Zscaler Inc.

- Other Key Players

Key Industry Developments in the Security as a Service Market:

- December 2023, Cisco Isovalent multi-clown networking and security- the acquisition art of devise.

- September 2023, Symantec, a division of Broadcom Inc. (NASDAQ: (BZ), partnered with Google Cloud to incorporate gen AI into the Symantec Security platform in stages that will afford customers a vast technological edge in identifying, comprehending, and eradicating complex cyber threats with this techdifferentiation.

|

Global Security as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

19.2 % |

Market Size in 2032: |

USD 79.2 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Organization Size |

|

||

|

By Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SECURITY AS A SERVICE MARKET BY COMPONENT (2017-2032)

- SECURITY AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOFTWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- SECURITY AS A SERVICE MARKET BY APPLICATION (2017-2032)

- SECURITY AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- NETWORK SECURITY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ENDPOINT SECURITY

- APPLICATION SECURITY

- CLOUD SECURITY

- OTHERS (EMAIL SECURITY, WEB SECURITY, DATABASE SECURITY)

- SECURITY AS A SERVICE MARKET BY ORGANIZATION SIZE (2017-2032)

- SECURITY AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISES

- SECURITY AS A SERVICE MARKET BY VERTICALS (2017-2032)

- SECURITY AS A SERVICE MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BANKING, FINANCIAL SERVICES, INSURANCE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GOVERNMENT AND DEFENSE

- RETAIL

- HEALTHCARE

- IT AND TELECOM

- ENERGY AND UTILITIES

- MANUFACTURING

- OTHERS (TRAVEL AND HOSPITALITY, EDUCATION, MEDIA, AND ENTERTAINMENT)

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Security as a Service Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ALERT LOGIC INC.

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- BARRACUDA NETWORKS INC.

- CISCO SYSTEMS INC.

- DELL TECHNOLOGIES INC.

- FORTINET INC.

- INTERNATIONAL BUSINESS MACHINES CORPORATION

- MCAFEE LLC

- MICROSOFT CORPORATION

- OKTA INC.

- PROOFPOINT INC.

- QUALYS INC.

- RADWARE LTD.

- TREND MICRO INCORPORATED

- ZSCALER INC.

- COMPETITIVE LANDSCAPE

- GLOBAL SECURITY AS A SERVICE MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Application

- Historic And Forecasted Market Size By Organization Size

- Historic And Forecasted Market Size By Verticals

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Security as a Service Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 16.3 Bn. |

|

Forecast Period 2024-32 CAGR: |

19.2 % |

Market Size in 2032: |

USD 79.2 Bn. |

|

Segments Covered: |

By Component |

|

|

|

By Application |

|

||

|

By Organization Size |

|

||

|

By Verticals |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SECURITY AS A SERVICE MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SECURITY AS A SERVICE MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SECURITY AS A SERVICE MARKET COMPETITIVE RIVALRY

TABLE 005. SECURITY AS A SERVICE MARKET THREAT OF NEW ENTRANTS

TABLE 006. SECURITY AS A SERVICE MARKET THREAT OF SUBSTITUTES

TABLE 007. SECURITY AS A SERVICE MARKET BY COMPONENT

TABLE 008. SOLUTIONS MARKET OVERVIEW (2016-2028)

TABLE 009. SERVICES MARKET OVERVIEW (2016-2028)

TABLE 010. SECURITY AS A SERVICE MARKET BY APPLICATION

TABLE 011. CONTINUOUS MONITORING MARKET OVERVIEW (2016-2028)

TABLE 012. ENDPOINT SECURITY MARKET OVERVIEW (2016-2028)

TABLE 013. NETWORK SECURITY MARKET OVERVIEW (2016-2028)

TABLE 014. CLOUD SECURITY MARKET OVERVIEW (2016-2028)

TABLE 015. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 016. SECURITY AS A SERVICE MARKET BY VERTICAL

TABLE 017. BFSI MARKET OVERVIEW (2016-2028)

TABLE 018. RETAIL & ECOMMERCE MARKET OVERVIEW (2016-2028)

TABLE 019. TRAVEL & HOSPITALITY MARKET OVERVIEW (2016-2028)

TABLE 020. IT AND TELECOM HEALTHCARE MARKET OVERVIEW (2016-2028)

TABLE 021. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 022. NORTH AMERICA SECURITY AS A SERVICE MARKET, BY COMPONENT (2016-2028)

TABLE 023. NORTH AMERICA SECURITY AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 024. NORTH AMERICA SECURITY AS A SERVICE MARKET, BY VERTICAL (2016-2028)

TABLE 025. N SECURITY AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 026. EUROPE SECURITY AS A SERVICE MARKET, BY COMPONENT (2016-2028)

TABLE 027. EUROPE SECURITY AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 028. EUROPE SECURITY AS A SERVICE MARKET, BY VERTICAL (2016-2028)

TABLE 029. SECURITY AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 030. ASIA PACIFIC SECURITY AS A SERVICE MARKET, BY COMPONENT (2016-2028)

TABLE 031. ASIA PACIFIC SECURITY AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 032. ASIA PACIFIC SECURITY AS A SERVICE MARKET, BY VERTICAL (2016-2028)

TABLE 033. SECURITY AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 034. MIDDLE EAST & AFRICA SECURITY AS A SERVICE MARKET, BY COMPONENT (2016-2028)

TABLE 035. MIDDLE EAST & AFRICA SECURITY AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 036. MIDDLE EAST & AFRICA SECURITY AS A SERVICE MARKET, BY VERTICAL (2016-2028)

TABLE 037. SECURITY AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 038. SOUTH AMERICA SECURITY AS A SERVICE MARKET, BY COMPONENT (2016-2028)

TABLE 039. SOUTH AMERICA SECURITY AS A SERVICE MARKET, BY APPLICATION (2016-2028)

TABLE 040. SOUTH AMERICA SECURITY AS A SERVICE MARKET, BY VERTICAL (2016-2028)

TABLE 041. SECURITY AS A SERVICE MARKET, BY COUNTRY (2016-2028)

TABLE 042. LOOKOUT INC.: SNAPSHOT

TABLE 043. LOOKOUT INC.: BUSINESS PERFORMANCE

TABLE 044. LOOKOUT INC.: PRODUCT PORTFOLIO

TABLE 045. LOOKOUT INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. PANDA SECURITY SL: SNAPSHOT

TABLE 046. PANDA SECURITY SL: BUSINESS PERFORMANCE

TABLE 047. PANDA SECURITY SL: PRODUCT PORTFOLIO

TABLE 048. PANDA SECURITY SL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. CISCO SYSTEMS INC.: SNAPSHOT

TABLE 049. CISCO SYSTEMS INC.: BUSINESS PERFORMANCE

TABLE 050. CISCO SYSTEMS INC.: PRODUCT PORTFOLIO

TABLE 051. CISCO SYSTEMS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. CLEARSWIFT: SNAPSHOT

TABLE 052. CLEARSWIFT: BUSINESS PERFORMANCE

TABLE 053. CLEARSWIFT: PRODUCT PORTFOLIO

TABLE 054. CLEARSWIFT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. SILVERSKY: SNAPSHOT

TABLE 055. SILVERSKY: BUSINESS PERFORMANCE

TABLE 056. SILVERSKY: PRODUCT PORTFOLIO

TABLE 057. SILVERSKY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. TREND MICRO INC.: SNAPSHOT

TABLE 058. TREND MICRO INC.: BUSINESS PERFORMANCE

TABLE 059. TREND MICRO INC.: PRODUCT PORTFOLIO

TABLE 060. TREND MICRO INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. FORTINET INC.: SNAPSHOT

TABLE 061. FORTINET INC.: BUSINESS PERFORMANCE

TABLE 062. FORTINET INC.: PRODUCT PORTFOLIO

TABLE 063. FORTINET INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. ZSCALER INC.: SNAPSHOT

TABLE 064. ZSCALER INC.: BUSINESS PERFORMANCE

TABLE 065. ZSCALER INC.: PRODUCT PORTFOLIO

TABLE 066. ZSCALER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 066. MICROSOFT LLC: SNAPSHOT

TABLE 067. MICROSOFT LLC: BUSINESS PERFORMANCE

TABLE 068. MICROSOFT LLC: PRODUCT PORTFOLIO

TABLE 069. MICROSOFT LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 069. RADWARE LTD.: SNAPSHOT

TABLE 070. RADWARE LTD.: BUSINESS PERFORMANCE

TABLE 071. RADWARE LTD.: PRODUCT PORTFOLIO

TABLE 072. RADWARE LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 072. HELPSYSTEMS: SNAPSHOT

TABLE 073. HELPSYSTEMS: BUSINESS PERFORMANCE

TABLE 074. HELPSYSTEMS: PRODUCT PORTFOLIO

TABLE 075. HELPSYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 075. SYMANTEC CORPORATION: SNAPSHOT

TABLE 076. SYMANTEC CORPORATION: BUSINESS PERFORMANCE

TABLE 077. SYMANTEC CORPORATION: PRODUCT PORTFOLIO

TABLE 078. SYMANTEC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 078. IBM CORPORATION: SNAPSHOT

TABLE 079. IBM CORPORATION: BUSINESS PERFORMANCE

TABLE 080. IBM CORPORATION: PRODUCT PORTFOLIO

TABLE 081. IBM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 081. ALERT LOGIC INC.: SNAPSHOT

TABLE 082. ALERT LOGIC INC.: BUSINESS PERFORMANCE

TABLE 083. ALERT LOGIC INC.: PRODUCT PORTFOLIO

TABLE 084. ALERT LOGIC INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 084. ZSCALER INC.: SNAPSHOT

TABLE 085. ZSCALER INC.: BUSINESS PERFORMANCE

TABLE 086. ZSCALER INC.: PRODUCT PORTFOLIO

TABLE 087. ZSCALER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 087. MCAFEE: SNAPSHOT

TABLE 088. MCAFEE: BUSINESS PERFORMANCE

TABLE 089. MCAFEE: PRODUCT PORTFOLIO

TABLE 090. MCAFEE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 090. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 091. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 092. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 093. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SECURITY AS A SERVICE MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SECURITY AS A SERVICE MARKET OVERVIEW BY COMPONENT

FIGURE 012. SOLUTIONS MARKET OVERVIEW (2016-2028)

FIGURE 013. SERVICES MARKET OVERVIEW (2016-2028)

FIGURE 014. SECURITY AS A SERVICE MARKET OVERVIEW BY APPLICATION

FIGURE 015. CONTINUOUS MONITORING MARKET OVERVIEW (2016-2028)

FIGURE 016. ENDPOINT SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 017. NETWORK SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 018. CLOUD SECURITY MARKET OVERVIEW (2016-2028)

FIGURE 019. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 020. SECURITY AS A SERVICE MARKET OVERVIEW BY VERTICAL

FIGURE 021. BFSI MARKET OVERVIEW (2016-2028)

FIGURE 022. RETAIL & ECOMMERCE MARKET OVERVIEW (2016-2028)

FIGURE 023. TRAVEL & HOSPITALITY MARKET OVERVIEW (2016-2028)

FIGURE 024. IT AND TELECOM HEALTHCARE MARKET OVERVIEW (2016-2028)

FIGURE 025. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 026. NORTH AMERICA SECURITY AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. EUROPE SECURITY AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 028. ASIA PACIFIC SECURITY AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 029. MIDDLE EAST & AFRICA SECURITY AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 030. SOUTH AMERICA SECURITY AS A SERVICE MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Security as a Service Market research report is 2024-2032.

Alert Logic Inc., Barracuda Networks Inc., Cisco Systems Inc., Dell Technologies Inc., Fortinet Inc., International Business Machines Corporation, McAfee LLC, Microsoft Corporation, Okta Inc., Proofpoint Inc., Qualys Inc., Radware Ltd., Trend Micro Incorporated, Zscaler Inc., etc., and Other Major Players.

The Security as a Service Market is segmented into component, application, organization size, verticals, and region. By component, the market is categorized into software, services. By application, the market is categorized into network security, endpoint security, application security, cloud security, others (email security, web security, database security). By organization size, the market is categorized into SMEs, large enterprises. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Security as a Service or SECaaS is a cloud delivery model that delivers enterprise various security tools on an on-demand basis through a subscription model. Instead of deploying and managing in-house security systems, SECaaS provides a way for organizations to call on the services of third party practitioners in the management of their security services. This method tries to enhance the overall security of the environment, minimize the complexity, and offer compatibility in matters concerning the growing threats.

Security as a Service Market Size Was Valued at USD 16.3 Billion in 2023, and is Projected to Reach USD 79.2 Billion by 2032, Growing at a CAGR of 19.2% From 2024-2032.