Stationary Electric Vehicle Charging Gun Market Synopsis

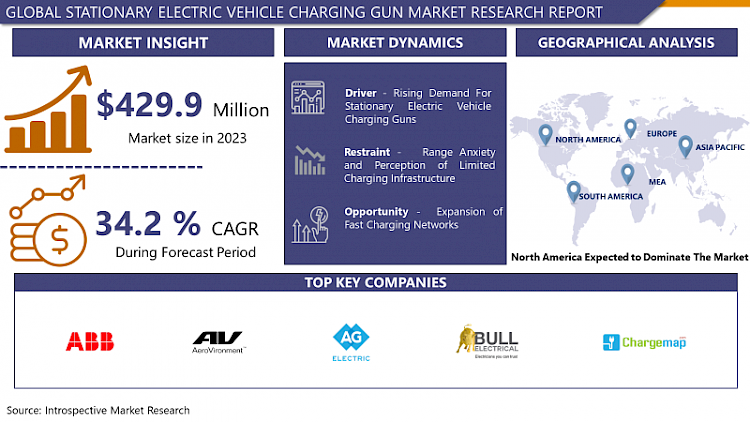

Stationary Electric Vehicle Charging Gun Market Size Was Valued at USD 429.9 Million in 2023, and is Projected to Reach USD 6,069.3 Million by 2032, Growing at a CAGR of 34.2% From 2024-2032.

- Stationary charging guns are primarily used for charging electric cars at stationary charging stations. These guns connect the rechargeable battery of the electric vehicle to the charging station. Both charging station and electric car manufacturers must provide guidelines for manufacturers to ensure compatibility between the charging gun and vehicle.

- The seven joints in the charging gun for AC charging heaps and nine for DC charging piles signify various power sources or control signals. The increased demand for clean and sustainable energy and the reduction of carbon emissions are expected to boost the EV charger market globally.

- The world’s transition towards clean energy and the rising popularity of EVs are among the main factors that contribute to the development of the EV charger market. With more nations committing to low-carbon development and the adoption of electric vehicles, the need for EV charging stations is expected to increase.

- The efforts you mentioned for standardizing the charging guns are very important in promoting this growth because they make the products interoperable and acceptable for consumers. Furthermore, technological improvements, including faster charging and more user-friendly features, also make EVs more appealing as a product alternative to conventional gasoline cars.

Stationary Electric Vehicle Charging Gun Market Trend Analysis

Development and adoption of smart charging solutions

- Smart charging systems offer additional functionalities, including the remote monitoring and management of the charging process, the dynamic balancing of electrical loads to avoid overloading the grid, and the ability to detect and troubleshoot potential problems in advance. All these capabilities do not only improve the efficiency and reliability of the charging infrastructure but also offer insights for charging infrastructure operators and electric utilities.

- In addition, smart charging can be used to facilitate grid integration to allow bi-directional energy flow between the grid and electric vehicles to function as mobile energy storage devices. This concept is known as vehicle-to-grid (V2G) technology where the EVs are used to store excess renewable energy in the grid and use it during peak hours or when there is low production of renewable energy in the grid.

The Growth of Fast Charging Stations.

- With the number of electric cars on the road rising, people are looking for more accessible and faster ways to charge their cars. One such opportunity includes the growth of fast charging networks especially along highways and in cities. The companies that produce charging guns with a stationary charging can take advantage of this trend by creating solutions with high power for quick charging of electric vehicles. With the help of fast charging stations, manufacturers can interest both private EV owners and large fleet operators in purchasing their charging gun products.

- Other areas of opportunity for stationary charging gun manufacturers include the increased sustainability and efficiency of the gun. With the increased demand for clean energy across the world, there is a concern with the sustainable means of powering vehicles, including the use of charging stations. This presents an opportunity for manufacturers to incorporate renewable energy technologies like solar or wind energy into their charging stations. The use of renewable energy sources not only allows manufacturers to reduce emissions during EV charging, but also offers opportunities for cost savings in the future.

- Additionally, the integration of energy storage systems, including batteries, can enhance the utilization of renewable energy sources and help ensure the continuous provision of charging services, especially in regions with weak grid infrastructure. The adoption of sustainable and efficient charging technologies offers manufacturers a unique opportunity to not only address the changing demands of EV owners but also accelerate the shift towards sustainable mobility.

Stationary Electric Vehicle Charging Gun Market Segment Analysis:

- Stationary Electric Vehicle Charging Gun Market is Segmented on the basis of Charging Type, Vehicle Type, and End Users

By Charging Type, On-board Charger segment is expected to dominate the market during the forecast period

- Many EVs have an onboard charger that controls the amount of electricity that flows from the charging station to the car’s battery. This segment can be targeted by manufacturers of the stationary charging guns by products that are specially designed to be compatible with different on-board charger types. This includes factors like voltages and currents support as well as communication methods between the charging gun and the car’s charging system. Manufacturers can charge guns appropriately for various configurations of the on-board charger to guarantee compatibility among EVs and broaden their market base.

- In addition, the opportunities for manufacturers in the on-board charger segment include the use of charging speed and efficiency as key product-differentiation factors. Others are fitted with more sophisticated on-board chargers that can accommodate higher power levels thus reducing the charging time. Manufacturers can design charging guns that can be compatible with such high-power on-board chargers which will help in faster charging of electric vehicles and consequently reduce overall charging time of EV owners.

- To continue meeting the demands of the market, manufacturers need to address the current limitations of on-board chargers by providing charging solutions that support future advancements in the technology.

By Vehicle Type, Plug-in Hybrid Vehicle (PHEV), segment held the largest share in 2023

- Among these vehicles are the plug-in hybrid vehicles which are known to be a middle ground for consumers who want to adapt to electric mobility. Charging gun manufacturers are actively responding to the specific charging demands of PHEVs, which often call for charging equipment with both electric and conventional fueling capabilities. Hence, charging solutions specific to the charging needs of PHEVs are being established and designed to work with hybrid powertrains and will not disrupt the existing charging infrastructure.

- Furthermore, the focus on PHEV vehicles for segmentation by vehicle type in the stationary electric vehicle charging gun market shows the dynamic context of car electrification. With growing environmental concerns and increasing support for electric and hybrid cars, there is a strong demand for charging stations that can accommodate various car models. Such gun manufacturers are also realizing the significance of providing PHEV owners with a quick and easy way of charging their vehicles as part of the transition towards cleaner and more sustainable mobility.

- Manufacturers that target this segment of the market will be able to benefit from the increasing demand for charging solutions that specifically address the needs of hybrid electric vehicles and contribute to the continued growth and development of the stationary electric vehicle charging sector.

Stationary Electric Vehicle Charging Gun Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- The stationary electric vehicle charging gun market in North America is also growing rapidly due to several factors. Governments, businesses, and consumers in the region have become more conscious of the need to address climate change and promote sustainable mobility, focusing on the adoption of electric vehicles (EVs). This has led to a rapid increase in the demand for EV charging stations as well as the stationary charging guns to support the growing number of EVs on the road.

- Additionally, North America has a high density of EV charging stations along highways, cities, and businesses. This infrastructure is constantly developing and growing due to investments from various governmental programs, utilities, and private corporations. Therefore, stationary charging gun manufacturers in North America are taking advantage of this increasing market potential by developing and improving their products to better serve the needs of EV owners.

- With the development of high-speed charging and intelligent charging, the manufacturers meet the diversified needs of consumers and enterprises, which further promote the development of the North American stationary electric vehicle charging gun market.

Active Key Players in the Stationary Electric Vehicle Charging Gun Market

- ABB Ltd.

- Aerovironment Inc.

- AG Electrical

- BULL

- Chargemaster PLC

- Chroma ATE

- Delphi Automotive

- Fisher Electronic Technology

- JAE

- Jointlean Electrical Technology

- Kaiye Xinneng Yuan

- kedesen

- Phoenix Contact

- Robert Bosch GmbH

- Shenglan Technology

- Shenzhen Lilutong Electronic

- Shenzhen Woer Heat

- Siemens AG

- Silicon Laboratories

- SINBON

- Suzhou Recodeal

- Teison

- Teison Energy

- Weihai Honglin Electronic

- Other key players

Key Industry Developments in the Stationary Electric Vehicle Charging Gun Market:

- In September 2023, GreenCharge Networks announced a new solar-powered charging station. This forward-looking structure harnesses solar power to charge electric cars – promoting both renewable and independence.

- In July 2023, EVgo announced that it intended to expand the total number of North American Charging Standard (NACS) EV charging ports at fast chargers in North America. This program showcases EVgo’s commitment to consistency and compatibility in its efforts to provide owners of electric vehicles with seamless charging experiences.

|

Global Stationary Electric Vehicle Charging Gun Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 429.9 Mn. |

|

Forecast Period 2024-32 CAGR: |

34.2 % |

Market Size in 2032: |

USD 6,069.3 Mn. |

|

Segments Covered: |

By Charging Type |

|

|

|

By Vehicle Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET BY CHARGING TYPE (2017-2032)

- STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-BOARD CHARGER

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- OFF-BOARD CHARGER

- STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET BY VEHICLE TYPE (2017-2032)

- STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PLUG-IN HYBRID VEHICLE (PHEV)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- BATTERY ELECTRIC VEHICLE (BEV)

- HYBRID ELECTRIC VEHICLE (HEV)

- STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET BY END USERS (2017-2032)

- STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- RESIDENTIAL

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- COMMERCIAL

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- STATIONARY ELECTRIC VEHICLE CHARGING GUN Market Share By Manufacturer (2023)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- ABB LTD

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- AEROVIRONMENT INC.

- AG ELECTRICAL

- BULL

- CHARGEMASTER PLC

- CHROMA ATE

- DELPHI AUTOMOTIVE

- FISHER ELECTRONIC TECHNOLOGY

- JAE

- JOINTLEAN ELECTRICAL TECHNOLOGY

- KAIYE XINNENG YUAN

- KEDESEN

- PHOENIX CONTACT

- ROBERT BOSCH GMBH

- SHENGLAN TECHNOLOGY

- SHENZHEN LILUTONG ELECTRONIC

- SHENZHEN WOER HEAT

- SIEMENS AG

- SILICON LABORATORIES

- SINBON

- SUZHOU RECODEAL

- TEISON

- TEISON ENERGY

- WEIHAI HONGLIN ELECTRONIC

- COMPETITIVE LANDSCAPE

- GLOBAL STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Charging Type

- Historic And Forecasted Market Size By Vehicle Type

- Historic And Forecasted Market Size By End Users

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Stationary Electric Vehicle Charging Gun Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 429.9 Mn. |

|

Forecast Period 2024-32 CAGR: |

34.2 % |

Market Size in 2032: |

USD 6,069.3 Mn. |

|

Segments Covered: |

By Charging Type |

|

|

|

By Vehicle Type |

|

||

|

By End Users |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET COMPETITIVE RIVALRY

TABLE 005. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET THREAT OF NEW ENTRANTS

TABLE 006. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET THREAT OF SUBSTITUTES

TABLE 007. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET BY CHARGING TYPE

TABLE 008. ON BOARD CHARGER MARKET OVERVIEW (2016-2028)

TABLE 009. OFF BOARD CHARGER MARKET OVERVIEW (2016-2028)

TABLE 010. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET BY VEHICLE TYPE

TABLE 011. PLUG-IN HYBRID VEHICLE (PHEV) MARKET OVERVIEW (2016-2028)

TABLE 012. BATTERY ELECTRIC VEHICLE (BEV) MARKET OVERVIEW (2016-2028)

TABLE 013. HYBRID ELECTRIC VEHICLE (HEV) MARKET OVERVIEW (2016-2028)

TABLE 014. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET BY END USERS

TABLE 015. RESIDENTIAL MARKET OVERVIEW (2016-2028)

TABLE 016. COMMERCIAL MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY CHARGING TYPE (2016-2028)

TABLE 018. NORTH AMERICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 019. NORTH AMERICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY END USERS (2016-2028)

TABLE 020. N STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY COUNTRY (2016-2028)

TABLE 021. EUROPE STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY CHARGING TYPE (2016-2028)

TABLE 022. EUROPE STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 023. EUROPE STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY END USERS (2016-2028)

TABLE 024. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY CHARGING TYPE (2016-2028)

TABLE 026. ASIA PACIFIC STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 027. ASIA PACIFIC STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY END USERS (2016-2028)

TABLE 028. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY COUNTRY (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY CHARGING TYPE (2016-2028)

TABLE 030. MIDDLE EAST & AFRICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 031. MIDDLE EAST & AFRICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY END USERS (2016-2028)

TABLE 032. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY COUNTRY (2016-2028)

TABLE 033. SOUTH AMERICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY CHARGING TYPE (2016-2028)

TABLE 034. SOUTH AMERICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY VEHICLE TYPE (2016-2028)

TABLE 035. SOUTH AMERICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY END USERS (2016-2028)

TABLE 036. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET, BY COUNTRY (2016-2028)

TABLE 037. ABB LTD: SNAPSHOT

TABLE 038. ABB LTD: BUSINESS PERFORMANCE

TABLE 039. ABB LTD: PRODUCT PORTFOLIO

TABLE 040. ABB LTD: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. ROBERT BOSCH GMBH: SNAPSHOT

TABLE 041. ROBERT BOSCH GMBH: BUSINESS PERFORMANCE

TABLE 042. ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 043. ROBERT BOSCH GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. SIEMENS AG: SNAPSHOT

TABLE 044. SIEMENS AG: BUSINESS PERFORMANCE

TABLE 045. SIEMENS AG: PRODUCT PORTFOLIO

TABLE 046. SIEMENS AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. DELPHI AUTOMOTIVE: SNAPSHOT

TABLE 047. DELPHI AUTOMOTIVE: BUSINESS PERFORMANCE

TABLE 048. DELPHI AUTOMOTIVE: PRODUCT PORTFOLIO

TABLE 049. DELPHI AUTOMOTIVE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. CHROMA ATE: SNAPSHOT

TABLE 050. CHROMA ATE: BUSINESS PERFORMANCE

TABLE 051. CHROMA ATE: PRODUCT PORTFOLIO

TABLE 052. CHROMA ATE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. AEROVIRONMENT INC: SNAPSHOT

TABLE 053. AEROVIRONMENT INC: BUSINESS PERFORMANCE

TABLE 054. AEROVIRONMENT INC: PRODUCT PORTFOLIO

TABLE 055. AEROVIRONMENT INC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. SILICON LABORATORIES: SNAPSHOT

TABLE 056. SILICON LABORATORIES: BUSINESS PERFORMANCE

TABLE 057. SILICON LABORATORIES: PRODUCT PORTFOLIO

TABLE 058. SILICON LABORATORIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. CHARGEMASTER PLC: SNAPSHOT

TABLE 059. CHARGEMASTER PLC: BUSINESS PERFORMANCE

TABLE 060. CHARGEMASTER PLC: PRODUCT PORTFOLIO

TABLE 061. CHARGEMASTER PLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 061. SINBON: SNAPSHOT

TABLE 062. SINBON: BUSINESS PERFORMANCE

TABLE 063. SINBON: PRODUCT PORTFOLIO

TABLE 064. SINBON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 064. PHOENIX CONTACT: SNAPSHOT

TABLE 065. PHOENIX CONTACT: BUSINESS PERFORMANCE

TABLE 066. PHOENIX CONTACT: PRODUCT PORTFOLIO

TABLE 067. PHOENIX CONTACT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 067. SUZHOU RECODEAL: SNAPSHOT

TABLE 068. SUZHOU RECODEAL: BUSINESS PERFORMANCE

TABLE 069. SUZHOU RECODEAL: PRODUCT PORTFOLIO

TABLE 070. SUZHOU RECODEAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 070. FISHER ELECTRONIC TECHNOLOGY: SNAPSHOT

TABLE 071. FISHER ELECTRONIC TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 072. FISHER ELECTRONIC TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 073. FISHER ELECTRONIC TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 073. SHENGLAN TECHNOLOGY: SNAPSHOT

TABLE 074. SHENGLAN TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 075. SHENGLAN TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 076. SHENGLAN TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 076. BULL: SNAPSHOT

TABLE 077. BULL: BUSINESS PERFORMANCE

TABLE 078. BULL: PRODUCT PORTFOLIO

TABLE 079. BULL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 079. KAIYE XINNENG YUAN: SNAPSHOT

TABLE 080. KAIYE XINNENG YUAN: BUSINESS PERFORMANCE

TABLE 081. KAIYE XINNENG YUAN: PRODUCT PORTFOLIO

TABLE 082. KAIYE XINNENG YUAN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 082. KEDESEN: SNAPSHOT

TABLE 083. KEDESEN: BUSINESS PERFORMANCE

TABLE 084. KEDESEN: PRODUCT PORTFOLIO

TABLE 085. KEDESEN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 085. SHENZHEN LILUTONG ELECTRONIC: SNAPSHOT

TABLE 086. SHENZHEN LILUTONG ELECTRONIC: BUSINESS PERFORMANCE

TABLE 087. SHENZHEN LILUTONG ELECTRONIC: PRODUCT PORTFOLIO

TABLE 088. SHENZHEN LILUTONG ELECTRONIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 088. WEIHAI HONGLIN ELECTRONIC: SNAPSHOT

TABLE 089. WEIHAI HONGLIN ELECTRONIC: BUSINESS PERFORMANCE

TABLE 090. WEIHAI HONGLIN ELECTRONIC: PRODUCT PORTFOLIO

TABLE 091. WEIHAI HONGLIN ELECTRONIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 091. JAE: SNAPSHOT

TABLE 092. JAE: BUSINESS PERFORMANCE

TABLE 093. JAE: PRODUCT PORTFOLIO

TABLE 094. JAE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 094. TEISON: SNAPSHOT

TABLE 095. TEISON: BUSINESS PERFORMANCE

TABLE 096. TEISON: PRODUCT PORTFOLIO

TABLE 097. TEISON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 097. AG ELECTRICAL: SNAPSHOT

TABLE 098. AG ELECTRICAL: BUSINESS PERFORMANCE

TABLE 099. AG ELECTRICAL: PRODUCT PORTFOLIO

TABLE 100. AG ELECTRICAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 100. TEISON ENERGY: SNAPSHOT

TABLE 101. TEISON ENERGY: BUSINESS PERFORMANCE

TABLE 102. TEISON ENERGY: PRODUCT PORTFOLIO

TABLE 103. TEISON ENERGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 103. SHENZHEN WOER HEAT: SNAPSHOT

TABLE 104. SHENZHEN WOER HEAT: BUSINESS PERFORMANCE

TABLE 105. SHENZHEN WOER HEAT: PRODUCT PORTFOLIO

TABLE 106. SHENZHEN WOER HEAT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106. JOINTLEAN ELECTRICAL TECHNOLOGY: SNAPSHOT

TABLE 107. JOINTLEAN ELECTRICAL TECHNOLOGY: BUSINESS PERFORMANCE

TABLE 108. JOINTLEAN ELECTRICAL TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 109. JOINTLEAN ELECTRICAL TECHNOLOGY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 109. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 110. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 111. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 112. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY CHARGING TYPE

FIGURE 012. ON BOARD CHARGER MARKET OVERVIEW (2016-2028)

FIGURE 013. OFF BOARD CHARGER MARKET OVERVIEW (2016-2028)

FIGURE 014. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY VEHICLE TYPE

FIGURE 015. PLUG-IN HYBRID VEHICLE (PHEV) MARKET OVERVIEW (2016-2028)

FIGURE 016. BATTERY ELECTRIC VEHICLE (BEV) MARKET OVERVIEW (2016-2028)

FIGURE 017. HYBRID ELECTRIC VEHICLE (HEV) MARKET OVERVIEW (2016-2028)

FIGURE 018. STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY END USERS

FIGURE 019. RESIDENTIAL MARKET OVERVIEW (2016-2028)

FIGURE 020. COMMERCIAL MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA STATIONARY ELECTRIC VEHICLE CHARGING GUN MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Stationary Electric Vehicle Charging Gun Market research report is 2024-2032.

ABB Ltd., Aerovironment Inc., AG Electrical, BULL, Chargemaster PLC, and Other Major Players.

The Stationary Electric Vehicle Charging Gun Market is segmented into Charging Type, Vehicle Type, End Users and region. by Charging Type the market is categorized into On-board Charger, Off-board Charger, by Vehicle Type the market is categorized into Plug-in Hybrid Vehicle (PHEV), Battery Electric Vehicle (BEV), Hybrid Electric Vehicle (HEV), by End Users the market is categorized into Residential, Commercial. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Charging electric cars at stationary charging stations is the main use of stationary charging guns. These guns link the rechargeable battery of the electric vehicle to the charging station. Manufacturers are required to follow the guidelines established by both charging station and electric car manufacturers in order to guarantee uniformity in the connection between the charging gun and the vehicle.

Stationary Electric Vehicle Charging Gun Market Size Was Valued at USD 429.9 Million in 2023, and is Projected to Reach USD 6,069.3 Million by 2032, Growing at a CAGR of 34.2% From 2024-2032.