Spend Analytics Market Synopsis

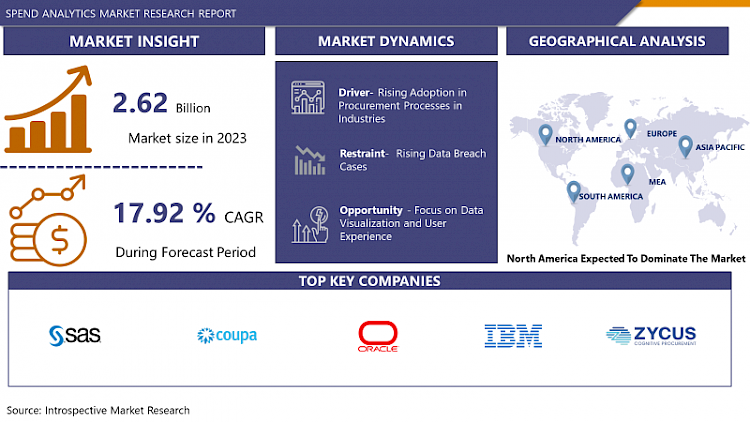

Global Spend Analytics Market Size Was Valued at USD 2.62 Billion in 2023, and is Projected to Reach USD 11.55 Billion by 2032, Growing at a CAGR of 17.92 % From 2024-2032.

Spend analytics involves gathering, categorizing, and examining procurement data to understand an organization's spending habits and costs. Through the utilization of sophisticated analytics methods like data visualization and predictive modeling, spend analytics aids companies in refining procurement tactics, pinpointing areas for cost reduction, and improving overall financial efficacy.

- Spend analytics is utilized across various business operations, providing multiple benefits and promising future demand growth. It allows organizations to obtain comprehensive insights into their spending habits and expenses, enabling informed decision-making in procurement and sourcing strategies. Through the analysis of historical spending data, companies can pinpoint opportunities for cost reduction, negotiate improved contracts with suppliers, and streamline purchasing procedures to achieve enhanced efficiency and savings.

- it empowers organizations to increase transparency and visibility into their financial transactions, enabling stakeholders to effectively monitor and manage spending. Additionally, by identifying instances of unauthorized spending and non-compliant purchasing behavior, spend analytics aids in mitigating risks and ensuring adherence to regulatory requirements and internal policies. Furthermore, by leveraging advanced analytics methodologies like predictive modeling and machine learning, businesses can anticipate future spending patterns, forecast market fluctuations, and proactively address potential risks and opportunities.

- The future demand for spend analytics is expected to be fueled by several factors. The rise of globalization and the digitization of business processes have led to the generation of large volumes of procurement data, necessitating advanced analysis tools to derive actionable insights. Moreover, the increasing adoption of cloud-based analytics platforms and artificial intelligence technologies is democratizing access to spend analytics, making it more accessible and scalable for organizations of all sizes. Furthermore, as businesses continue to prioritize cost optimization, risk management, and compliance with regulations, the demand for sophisticated spend analytics solutions is anticipated to surge, driving innovation and transforming procurement and financial management practices

Spend Analytics Market Trend Analysis

Rising Adoption in Procurement Processes in Industries

- The increased adoption of spend analytics in procurement processes across industries acts as a significant catalyst for market growth. As businesses aim to optimize their procurement strategies and improve operational efficiency, the demand for thorough insights into spending patterns rises. Spend analytics empowers organizations to analyze and comprehend their expenditure data, enabling informed decision-making in areas such as sourcing, vendor selection, and contract negotiation. Through leveraging insights from spend analytics, businesses can uncover opportunities for cost savings, negotiate more favorable terms with suppliers, and mitigate risks linked to inefficient procurement practices.

- Furthermore, the escalating complexity of supply chains and the growing volume of transactional data emphasize the pivotal role of spend analytics in procurement. With the globalization of markets and the expansion of supplier networks, organizations encounter challenges in managing diverse supplier relationships and ensuring compliance with regulations. Spend analytics offers a comprehensive view of spending across the entire procurement lifecycle, empowering organizations to pinpoint inefficiencies, monitor supplier performance, and optimize resource allocation. This heightened visibility and control enable businesses to make data-driven decisions that drive cost reductions and operational excellence.

- Moreover, the ongoing shift towards digital transformation and the adoption of advanced analytics technologies are fueling increased adoption of spend analytics solutions. With the proliferation of cloud-based analytics platforms and artificial intelligence tools, organizations now have access to robust analytical capabilities that were previously inaccessible or costly. This democratization of analytics allows businesses of all sizes to deploy spend analytics solutions, propelling market expansion. As industries increasingly acknowledge the value of data-driven insights in procurement decision-making, the demand for spend analytics is projected to surge, fostering innovation and reshaping procurement practices across diverse sectors.

Focus on Data Visualization and User Experience

- The emphasis on data visualization and user experience stands as a significant opportunity for propelling the expansion of the Spend Analytics Market. As enterprises acknowledge the criticality of actionable insights from procurement data, there emerges an increasing need for intuitive and user-friendly analytics platforms. Data visualization assumes a pivotal role in simplifying intricate datasets and presenting them in visually engaging formats, thereby enabling users to interpret and analyze data more efficiently. Through interactive dashboards, customizable reports, and graphical depictions of spending patterns, analytics solutions elevate user experience and facilitate improved decision-making across organizational domains.

- Moreover, the focus on enhancing user experience transcends data visualization to encompass the overall usability and accessibility of spend analytics platforms. Guided by user-centric design principles, platforms prioritize the development of intuitive interfaces, streamlined workflows, and personalized user experiences tailored to the specific requirements of procurement professionals. By furnishing seamless navigation, intuitive controls, and robust search capabilities, analytics solutions empower users to effortlessly explore data and derive actionable insights with minimal exertion. This user-centric approach fosters heightened adoption and utilization of spend analytics tools within enterprises, driving enhancements in efficiency and cost savings within procurement processes.

- Furthermore, as enterprises increasingly grasp the value of user-friendly analytics solutions, vendors are channeling investments into innovation aimed at augmenting data visualization capabilities and user experience. Integration of advanced features like predictive analytics, natural language processing, and augmented reality interfaces into spend analytics platforms enriches user interactions and decision-making capabilities further. By harnessing emerging technologies and adhering to user-centric design principles, vendors can distinguish their offerings in the market and capitalize on the burgeoning demand for intuitive and impactful spend analytics solutions. the focus on data visualization and user experience presents a significant opportunity for fostering innovation and expansion in the Spend AnalyticsMarket, empowering enterprises to unleash the full potential of their procurement data.

Spend Analytics Market Segment Analysis:

Spend Analytics Market Segmented on the basis of Component, Deployment Model, Analytics Type, Organization Size, Business Function, and Industry Vertical.

By Deployment Model, Cloud segment is expected to dominate the market during the forecast period

- The Cloud segment is positioned to spearhead the expansion of the Spend Analytics Market. As cloud-based solutions gain traction across various industries, there is a growing demand for cloud-centric spend analytics platforms. These platforms offer numerous benefits, such as scalability, accessibility, and cost-effectiveness, making them an appealing option for organizations aiming to streamline their procurement processes. Furthermore, cloud-based spend analytics platforms facilitate real-time data access from any location with internet connectivity, empowering users to make well-informed decisions on the fly.

- Furthermore, cloud-based solutions eliminate the necessity for extensive IT infrastructure and upkeep, thereby reducing upfront expenses and deployment timelines for organizations. This enhanced accessibility and affordability democratizes the availability of spend analytics capabilities, enabling businesses of all scales to utilize advanced analytics tools to optimize their procurement strategies. the Cloud segment is poised for substantial growth within the Spend Analytics Market, propelling innovation and reshaping the landscape of procurement analytics solutions.

By Industry Vertical, Retail segment held the largest share of .46.22% in 2022

- The Retail segment stands out as a leader in propelling the expansion of the Spend Analytics Market. As the retail sector undergoes rapid digitalization and faces heightened competition, there's a growing focus on utilizing data-driven insights to optimize operational efficiency and profitability. Spend analytics solutions are instrumental in empowering retailers to thoroughly analyze their procurement data, refine sourcing strategies, and pinpoint areas for cost reduction.

- Furthermore, retailers encounter distinctive challenges like fluctuating consumer demand, seasonal variations, and intricate supply chains. Spend analytics platforms equip retailers with the necessary tools to efficiently oversee procurement processes, negotiate advantageous supplier terms, and enhance inventory management practices. By leveraging spend analytics, retailers can derive actionable intelligence from their spending patterns, streamline procurement workflows, and ultimately enhance their financial performance. the Retail segment commands the largest portion of the Spend Analytics Market, underscoring the industry's growing appreciation for data-centric decision-making as a catalyst for business success.

Spend Analytics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is positioned to lead the growth of the Spend Analytics market, supported by its robust economy, advanced technological infrastructure, and widespread adoption of data analytics solutions. The region's diverse business landscape, spanning industries like retail, healthcare, manufacturing, and finance, drives demand for sophisticated spend analytics tools to enhance procurement processes and operational efficiency.

- Furthermore, North America fosters a culture of innovation and entrepreneurship, facilitating the development of cutting-edge analytics technologies. As organizations increasingly value data-driven decision-making, the demand for spend analytics is anticipated to rise across sectors. Stringent regulatory requirements, combined with the imperative for cost optimization and risk management, further accelerate the adoption of spend analytics solutions in the region. North America is poised to shape the future of procurement analytics practices, leading the global Spend Analytics market with its innovation-driven approach.

Spend Analytics Market Top Key Players:

- SAS Institute, Inc. (U.S.)

- IBM Corporation (U.S.)

- Oracle Corporation (U.S.)

- Coupa Software Inc. (U.S.)

- Zycus Inc. (U.S.)

- JAGGAER (U.S.)

- Tradeshift (U.S.)

- Vroozi, Inc. (U.S.)

- Xeeva, Inc. (U.S.)

- Ivalua Inc. (U.S.)

- GEP Worldwide (U.S.)

- Determine Inc. (U.S.)

- BravoSolution SPA (U.S.)

- Proactis Holdings Plc (France)

- SAP SE (Germany)

- Basware Corporation (Finland)

- Proactis (UK)

- Rosslyn Analytics, Ltd. (UK)

- Tejari Solutions

- Empronc Solutions Pvt. Ltd. (India), and Other Major Players

Key Industry Developments in the Spend Analytics Market:

-

In May 2024, IBM and SAP announced their vision for expanding their collaboration, including new generative AI capabilities and industry-specific cloud solutions to help clients unlock business value. John Granger, Senior Vice President of IBM Consulting, stated that IBM and SAP's shared approach to generative AI, built on an open ecosystem, trust, and purpose-built models, would empower clients to optimize business outcomes. The new Value Generation partnership initiative aimed to enable clients to accelerate innovation, gain competitive advantage, and evolve into next-generation enterprises through the use of generative AI.

In February 2024, Accenture acquired GemSeek, a prominent customer experience analytics provider that aids global businesses in understanding customers through insights, analytics, and AI-powered predictive models. This acquisition highlighted Accenture Song's ongoing investment—the world’s largest tech-powered creative group—in enhancing data and AI capabilities. The goal was to assist clients in growing their businesses and maintaining relevance with customers.

|

Global Spend Analytics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.92% |

Market Size in 2032: |

USD 11.55 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Model |

|

||

|

By Analytics Type |

|

||

|

By Organization Size |

|

||

|

By Business Function |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SPEND ANALYTICS MARKET BY COMPONENT (2017-2032)

- SPEND ANALYTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SOFTWARE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 - 2032F

- Historic And Forecasted Market Size in Volume (2017 - 2032F

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- SERVICES

- SPEND ANALYTICS MARKET BY DEPLOYMENT MODEL (2017-2032)

- SPEND ANALYTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ON-PREMISES

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 - 2032F

- Historic And Forecasted Market Size in Volume (2017 - 2032F

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CLOUD

- SPEND ANALYTICS MARKET BY ANALYTICS TYPE (2017-2032)

- SPEND ANALYTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- PREDICTIVE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 - 2032F

- Historic And Forecasted Market Size in Volume (2017 - 2032F

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PRESCRIPTIVE

- DESCRIPTIVE

- SPEND ANALYTICS MARKET BY ORGANIZATION SIZE (2017-2032)

- SPEND ANALYTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SMALL AND MEDIUM ENTERPRISES (SMES)

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 - 2032F

- Historic And Forecasted Market Size in Volume (2017 - 2032F

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- LARGE ENTERPRISES

- SPEND ANALYTICS MARKET BY BUSINESS FUNCTION (2017-2032)

- SPEND ANALYTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- FINANCE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 - 2032F

- Historic And Forecasted Market Size in Volume (2017 - 2032F

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- INFORMATION TECHNOLOGY

- MARKETING

- PROCUREMENT

- SPEND ANALYTICS MARKET BY INDUSTRY VERTICAL (2017-2032)

- SPEND ANALYTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MANUFACTURING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 - 2032F

- Historic And Forecasted Market Size in Volume (2017 - 2032F

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- GOVERNMENT AND DEFENSE

- RETAIL

- HEALTHCARE AND LIFE SCIENCES

- BFSI

- TELECOMMUNICATIONS AND IT

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Spend Analytics Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- SAS INSTITUTE, INC. (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- IBM CORPORATION (U.S.)

- ORACLE CORPORATION (U.S.)

- COUPA SOFTWARE INC. (U.S.)

- ZYCUS INC. (U.S.)

- JAGGAER (U.S.)

- TRADESHIFT (U.S.)

- VROOZI, INC. (U.S.)

- XEEVA, INC. (U.S.)

- IVALUA INC. (U.S.)

- GEP WORLDWIDE (U.S.)

- DETERMINE INC. (U.S.)

- BRAVOSOLUTION SPA (U.S.)

- PROACTIS HOLDINGS PLC (FRANCE)

- SAP SE (GERMANY)

- BASWARE CORPORATION (FINLAND)

- PROACTIS (UK)

- ROSSLYN ANALYTICS, LTD. (UK)

- TEJARI SOLUTIONS

- EMPRONC SOLUTIONS PVT. LTD. (INDIA)

- COMPETITIVE LANDSCAPE

- GLOBAL SPEND ANALYTICS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Component

- Historic And Forecasted Market Size By Deployment Model

- Historic And Forecasted Market Size By Analytics Type

- Historic And Forecasted Market Size By Organization Size

- Historic And Forecasted Market Size By Business Function

- Historic And Forecasted Market Size By Industry Vertical

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Spend Analytics Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 2.62 Bn. |

|

Forecast Period 2024-32 CAGR: |

17.92% |

Market Size in 2032: |

USD 11.55 Bn. |

|

Segments Covered: |

By Type |

|

|

|

By Deployment Model |

|

||

|

By Analytics Type |

|

||

|

By Organization Size |

|

||

|

By Business Function |

|

||

|

By Industry Vertical |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SPEND ANALYTICS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SPEND ANALYTICS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SPEND ANALYTICS MARKET COMPETITIVE RIVALRY

TABLE 005. SPEND ANALYTICS MARKET THREAT OF NEW ENTRANTS

TABLE 006. SPEND ANALYTICS MARKET THREAT OF SUBSTITUTES

TABLE 007. SPEND ANALYTICS MARKET BY TYPE

TABLE 008. PREDICTIVE MARKET OVERVIEW (2016-2028)

TABLE 009. PRESCRIPTIVE MARKET OVERVIEW (2016-2028)

TABLE 010. DESCRIPTIVE MARKET OVERVIEW (2016-2028)

TABLE 011. SPEND ANALYTICS MARKET BY APPLICATION

TABLE 012. APPLICATION A MARKET OVERVIEW (2016-2028)

TABLE 013. APPLICATION B MARKET OVERVIEW (2016-2028)

TABLE 014. APPLICATION C MARKET OVERVIEW (2016-2028)

TABLE 015. NORTH AMERICA SPEND ANALYTICS MARKET, BY TYPE (2016-2028)

TABLE 016. NORTH AMERICA SPEND ANALYTICS MARKET, BY APPLICATION (2016-2028)

TABLE 017. N SPEND ANALYTICS MARKET, BY COUNTRY (2016-2028)

TABLE 018. EUROPE SPEND ANALYTICS MARKET, BY TYPE (2016-2028)

TABLE 019. EUROPE SPEND ANALYTICS MARKET, BY APPLICATION (2016-2028)

TABLE 020. SPEND ANALYTICS MARKET, BY COUNTRY (2016-2028)

TABLE 021. ASIA PACIFIC SPEND ANALYTICS MARKET, BY TYPE (2016-2028)

TABLE 022. ASIA PACIFIC SPEND ANALYTICS MARKET, BY APPLICATION (2016-2028)

TABLE 023. SPEND ANALYTICS MARKET, BY COUNTRY (2016-2028)

TABLE 024. MIDDLE EAST & AFRICA SPEND ANALYTICS MARKET, BY TYPE (2016-2028)

TABLE 025. MIDDLE EAST & AFRICA SPEND ANALYTICS MARKET, BY APPLICATION (2016-2028)

TABLE 026. SPEND ANALYTICS MARKET, BY COUNTRY (2016-2028)

TABLE 027. SOUTH AMERICA SPEND ANALYTICS MARKET, BY TYPE (2016-2028)

TABLE 028. SOUTH AMERICA SPEND ANALYTICS MARKET, BY APPLICATION (2016-2028)

TABLE 029. SPEND ANALYTICS MARKET, BY COUNTRY (2016-2028)

TABLE 030. SAP: SNAPSHOT

TABLE 031. SAP: BUSINESS PERFORMANCE

TABLE 032. SAP: PRODUCT PORTFOLIO

TABLE 033. SAP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 033. SAS: SNAPSHOT

TABLE 034. SAS: BUSINESS PERFORMANCE

TABLE 035. SAS: PRODUCT PORTFOLIO

TABLE 036. SAS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 036. IBM CORPORATION: SNAPSHOT

TABLE 037. IBM CORPORATION: BUSINESS PERFORMANCE

TABLE 038. IBM CORPORATION: PRODUCT PORTFOLIO

TABLE 039. IBM CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 039. ORACLE: SNAPSHOT

TABLE 040. ORACLE: BUSINESS PERFORMANCE

TABLE 041. ORACLE: PRODUCT PORTFOLIO

TABLE 042. ORACLE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 042. COUPA SOFTWARE: SNAPSHOT

TABLE 043. COUPA SOFTWARE: BUSINESS PERFORMANCE

TABLE 044. COUPA SOFTWARE: PRODUCT PORTFOLIO

TABLE 045. COUPA SOFTWARE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 045. ZYCUS: SNAPSHOT

TABLE 046. ZYCUS: BUSINESS PERFORMANCE

TABLE 047. ZYCUS: PRODUCT PORTFOLIO

TABLE 048. ZYCUS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 048. PROACTIS: SNAPSHOT

TABLE 049. PROACTIS: BUSINESS PERFORMANCE

TABLE 050. PROACTIS: PRODUCT PORTFOLIO

TABLE 051. PROACTIS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 051. EMPRONC SOLUTIONS: SNAPSHOT

TABLE 052. EMPRONC SOLUTIONS: BUSINESS PERFORMANCE

TABLE 053. EMPRONC SOLUTIONS: PRODUCT PORTFOLIO

TABLE 054. EMPRONC SOLUTIONS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 054. JAGGAER: SNAPSHOT

TABLE 055. JAGGAER: BUSINESS PERFORMANCE

TABLE 056. JAGGAER: PRODUCT PORTFOLIO

TABLE 057. JAGGAER: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 057. ROSSLYN ANALYTICS: SNAPSHOT

TABLE 058. ROSSLYN ANALYTICS: BUSINESS PERFORMANCE

TABLE 059. ROSSLYN ANALYTICS: PRODUCT PORTFOLIO

TABLE 060. ROSSLYN ANALYTICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 060. IVALUA: SNAPSHOT

TABLE 061. IVALUA: BUSINESS PERFORMANCE

TABLE 062. IVALUA: PRODUCT PORTFOLIO

TABLE 063. IVALUA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 063. BRAVOSOLUTION SPA: SNAPSHOT

TABLE 064. BRAVOSOLUTION SPA: BUSINESS PERFORMANCE

TABLE 065. BRAVOSOLUTION SPA: PRODUCT PORTFOLIO

TABLE 066. BRAVOSOLUTION SPA: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SPEND ANALYTICS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SPEND ANALYTICS MARKET OVERVIEW BY TYPE

FIGURE 012. PREDICTIVE MARKET OVERVIEW (2016-2028)

FIGURE 013. PRESCRIPTIVE MARKET OVERVIEW (2016-2028)

FIGURE 014. DESCRIPTIVE MARKET OVERVIEW (2016-2028)

FIGURE 015. SPEND ANALYTICS MARKET OVERVIEW BY APPLICATION

FIGURE 016. APPLICATION A MARKET OVERVIEW (2016-2028)

FIGURE 017. APPLICATION B MARKET OVERVIEW (2016-2028)

FIGURE 018. APPLICATION C MARKET OVERVIEW (2016-2028)

FIGURE 019. NORTH AMERICA SPEND ANALYTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 020. EUROPE SPEND ANALYTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 021. ASIA PACIFIC SPEND ANALYTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. MIDDLE EAST & AFRICA SPEND ANALYTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. SOUTH AMERICA SPEND ANALYTICS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Spend Analytics Market research report is 2024-2032.

IBM Corporation (U.S.), Oracle Corporation (U.S.), Coupa Software Inc. (U.S.), Zycus Inc. (U.S.), JAGGAER (U.S.), Tradeshift (U.S.), Vroozi, Inc. (U.S.), Xeeva, Inc. (U.S.), Ivalua Inc. (U.S.), GEP Worldwide (U.S.), Determine Inc. (U.S.), BravoSolution SPA (U.S.), Proactis Holdings Plc (France), SAP SE (Germany), Basware Corporation (Finland), Proactis (UK), Rosslyn Analytics, Ltd. (UK), Tejari Solutions, Empronc Solutions Pvt. Ltd. (India), and Other Major Players.

categorized into On-Premises and Cloud. By Analytics Type, the market is categorized into Predictive, Prescriptive, and Descriptive. By Organization Size, the market is categorized into Small and Medium Enterprises (SMEs) and large Enterprises. By Business Function, the market is categorized into Finance, Information Technology, Marketing, and Procurement. By Industry Vertical, the market is categorized into Manufacturing, Government and defense, Retail, Healthcare and Life Sciences, BFSI, and Telecommunications and IT. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Spend analytics involves gathering, categorizing, and examining procurement data to understand an organization's spending habits and costs. Through the utilization of sophisticated analytics methods like data visualization and predictive modeling, spend analytics aids companies in refining procurement tactics, pinpointing areas for cost reduction, and improving overall financial efficacy.

Global Spend Analytics Market Size Was Valued at USD 2.62 Billion in 2023, and is Projected to Reach USD 11.55 Billion by 2032, Growing at a CAGR of 17.92 % From 2024-2032.