Smart Materials Handling Solutions Market Synopsis

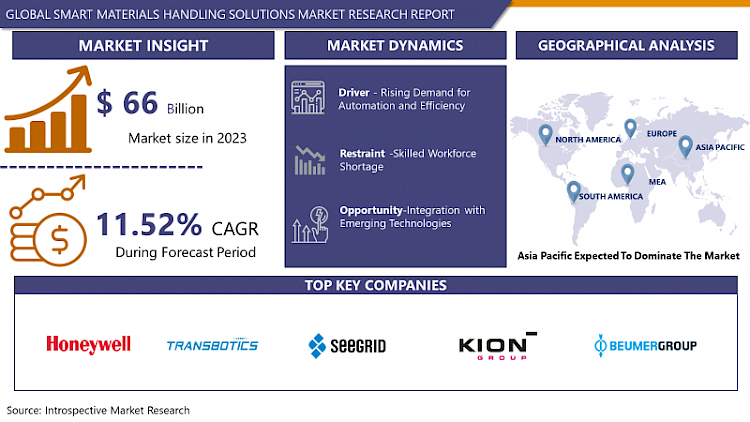

Global Smart Materials Handling Solutions Market Size Was Valued at USD 66 Billion in 2023, and is Projected to Reach USD 177.17 Billion by 2032, Growing at a CAGR of 11.52% From 2024-2032.

Smart materials handling solutions encompass cutting-edge technologies and systems engineered to automate and streamline the transport, storage, and retrieval of goods across diverse industries. Employing sophisticated sensors, robotics, and artificial intelligence, these solutions elevate operational efficiency, precision, and safety throughout the material handling and distribution processes within the supply chain.

- Smart materials handling solutions have applications across diverse industries, transforming logistics and supply chain operations. These cutting-edge technologies are deployed in warehouses, manufacturing facilities, distribution centers, and transportation hubs to automate and optimize the movement, storage, and retrieval of goods. Through the integration of advanced sensors, robotics, and artificial intelligence, these solutions enhance efficiency, accuracy, and safety in material handling processes, ultimately boosting overall productivity and slashing operational costs.

- They empower organizations to streamline workflows and achieve heightened levels of operational efficiency by automating repetitive tasks and minimizing manual labor. Secondly, these solutions bolster accuracy and precision in material handling operations, mitigating errors and reducing the risk of damage to goods. Moreover, smart materials handling solutions enhance workplace safety by diminishing the need for manual lifting and handling of heavy or hazardous materials, thus decreasing the likelihood of workplace accidents and injuries.

- There is anticipated significant growth in the demand for smart materials handling solutions. As industries continue to prioritize efficiency, productivity, and safety in their operations, the adoption of these advanced technologies is poised to become increasingly widespread. Furthermore, with the ongoing trends towards digitalization and automation across industries, there will be an expanding need for smart materials handling solutions to bolster agile and responsive supply chain management. Technological advancements, such as the Internet of Things (IoT) and machine learning, will further elevate the capabilities and efficacy of these solutions, propelling continued growth and innovation in the materials handling field.

Smart Materials Handling Solutions Market Trend Analysis:

Rising Demand for Automation and Efficiency

- The surging demand for automation and efficiency emerges as a primary driver propelling the growth of the Smart Materials Handling Solutions market. Industries across various sectors, including manufacturing, logistics, and e-commerce, are increasingly turning to smart materials handling solutions to streamline their operations and enhance productivity. These innovative technologies leverage advanced sensors, robotics, and artificial intelligence to automate tasks such as material movement, storage, and retrieval, thereby reducing manual labor and minimizing errors in handling processes.

- Furthermore, the quest for improved operational efficiency is pushing organizations to adopt smart materials handling solutions to optimize their workflows. By automating repetitive tasks and integrating real-time data analytics, these solutions enable companies to achieve higher levels of efficiency, accuracy, and cost-effectiveness in their material handling operations. Additionally, smart materials handling solutions offer scalability and flexibility, allowing businesses to adapt to changing demands and maintain a competitive edge in dynamic market landscape.

- The demand for automation and efficiency in material handling is expected to continue driving the growth of the Smart Materials Handling Solutions market. As industries strive to improve productivity, reduce operational costs, and enhance customer satisfaction, the adoption of these innovative technologies will become increasingly widespread. Moreover, advancements in technology, such as the Internet of Things (IoT) and machine learning, will further enhance the capabilities and functionalities of smart materials handling solutions, fueling their adoption and contributing to market expansion in the foreseeable future.

Integration with Emerging Technologies

- The integration with emerging technologies presents a substantial opportunity for propelling the Smart Materials Handling Solutions market forward. As industries progress and adopt digital transformation, there emerges a pressing need to amalgamate smart materials handling solutions with emerging technologies to unlock novel capabilities and efficiencies. Innovations such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning hold vast potential for augmenting the functionality and efficacy of materials handling systems.

- A pivotal opportunity lies in harnessing IoT-enabled sensors and devices to establish interconnected material handling systems capable of gathering and analyzing real-time data. By outfitting material handling equipment with sensors, organizations can glean valuable insights into variables such as inventory levels, equipment utilization, and operational efficiency. This data-centric approach empowers proactive decision-making and the streamlining of material handling processes, ultimately culminating in heightened productivity and reduced costs

- Moreover, the incorporation of AI and machine learning algorithms into smart materials handling solutions unveils new avenues for predictive maintenance, autonomous operation, and adaptive control. AI-driven systems possess the capability to scrutinize extensive datasets, identify patterns, prognosticate equipment failures, and refine workflow algorithms in real-time. This not only mitigates downtime and maintenance expenditures but also amplifies the agility and responsiveness of material handling operations to dynamic market conditions. As enterprises increasingly acknowledge the potential of amalgamating emerging technologies with smart materials handling solutions, the market stands poised for substantial growth and innovation in the foreseeable future.

Smart Materials Handling Solutions Market Segment Analysis:

Smart Materials Handling Solutions Market Segmented on the basis of Type and Industry

By Industry, Automotive Systems segment is expected to dominate the market during the forecast period

- The Smart Materials Handling Solutions Market is set to be led by the Automotive Chain segment. As the automotive industry progressively adopts automation and efficiency-boosting technologies in its manufacturing and logistics activities, there's a heightened demand for smart materials handling solutions. These solutions incorporate cutting-edge innovations like automated guided vehicles (AGVs), robotic arms, and sensor-equipped conveyor systems, all powered by artificial intelligence to optimize material handling within automotive facilities and warehouses.

- Furthermore, the Automotive Chain segment reaps benefits from the increasing focus on lean manufacturing practices and just-in-time inventory management within the automotive sector. Smart materials handling solutions empower automotive manufacturers to streamline production processes, curtail waste, and enhance overall operational efficiency. By harnessing these advanced technologies, automotive companies can bolster their competitiveness, trim costs, and align with the evolving market demands, thereby propelling the growth of the Smart Materials Handling Solutions Market within the Automotive Chain segment

By Type, Storage and Staging Equipment segment held the largest share of 44.10% in 2022

- The Storage and Staging Equipment segment is set to lead the expansion of the Smart Materials Handling Solutions Market. This sector comprises various solutions aimed at optimizing the storage and staging processes within warehouses and distribution centers. With supply chains becoming increasingly intricate and the demand for efficient inventory management growing, there is a rising need for intelligent storage and staging equipment.

- These solutions encompass automated storage systems like vertical lift modules and automated storage and retrieval systems (AS/RS), along with advanced staging equipment such as conveyor systems and sortation systems. By harnessing technologies like robotics, sensors, and data analytics, these solutions empower organizations to maximize the utilization of storage space, enhance inventory visibility, and improve order fulfillment procedures. As companies endeavor to meet the requirements of e-commerce and omnichannel distribution, the Storage and Staging Equipment segment is anticipated to maintain its pivotal role in propelling the growth of the Smart Materials Handling Solutions Market.

Smart Materials Handling Solutions Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is poised to emerge as the leading region propelling the expansion of the Smart Materials Handling Solutions market. The region's rapid industrialization, urbanization, and the burgeoning e-commerce sector are driving a surging demand for efficient logistics and material handling solutions. Notably, countries such as China, India, and Japan are witnessing substantial investments in infrastructure development and automation technologies, further catalyzing market growth.

- Furthermore, the escalating adoption of smart manufacturing practices and Industry 4.0 initiatives across diverse industries in Asia Pacific is spurring the need for advanced materials handling solutions. Companies operating in sectors like automotive, electronics, retail, and e-commerce are actively investing in cutting-edge technologies such as robotics, automation, and data analytics to streamline operations and bolster productivity. Consequently, Asia Pacific is anticipated to assert dominance in the Smart Materials Handling Solutions market, presenting lucrative prospects for manufacturers and service providers across the region.

Smart Materials Handling Solutions Market Top Key Players:

- Honeywell International, Inc. (U.S.)

- Transbotics Corporation (U.S.)

- Seegrid Corporation (U.S.)

- Kion Group AG (Germany)

- Beumer Group GmbH (Germany)

- SSI Schaefer Group (Germany)

- Swisslog Holding AG (Switzerland)

- Vanderlande Industries B.V (Netherland)

- Knapp AG (Austria)

- Fives Group (France)

- Dematic Limited (UK)

- Mecalux, S.A. (Spain)

- Daifuku Co., Ltd. (Japan)

- Murata Manufacturing Co., Ltd. (Japan), and Other Major Players.

Key Industry Developments in the Smart Materials Handling Solutions Market:

- In March 2024, Movu Robotics, a leading provider of warehouse automation solutions globally, partnered with Bastian Solutions, a Toyota Advanced Logistics company. This collaboration allowed Bastian to incorporate Movu’s range of flexible robotics technologies into its global automation solutions, including the North American market. The announcement solidified Bastian's ability to provide customers with the advantages of Movu's portfolio of flexible robotics solutions.

- In November 2023, KPI Solutions, a prominent provider of supply chain consulting, software, and automation solutions, forged a strategic alliance with Movu Robotics, previously known as Stow Robotics, a renowned global leader in warehouse automation. This partnership aimed to combine KPI's expertise in supply chain optimization with Movu Robotics' innovative warehouse automation solutions.

|

Global Smart Materials Handling Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 66 Billion. |

|

Forecast Period 2024-32 CAGR: |

11.52% |

Market Size in 2032: |

USD 177.17 Billion. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SMART MATERIALS HANDLING SOLUTIONS MARKET BY TYPE (2017-2032)

- SMART MATERIALS HANDLING SOLUTIONS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- STORAGE AND STAGING EQUIPMENT

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TRANSPORTATION DEVICES

- PICKING UNITS

- SORTATION SYSTEMS

- INFORMATION MANAGEMENT SYSTEMS

- SMART MATERIALS HANDLING SOLUTIONS MARKET BY INDUSTRY (2017-2032)

- SMART MATERIALS HANDLING SOLUTIONS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- MANUFACTURING

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2017 – 2032F)

- Historic And Forecasted Market Size in Volume (2017 – 2032F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- WAREHOUSING & LOGISTICS

- E-COMMERCE

- AUTOMOTIVE

- FOOD AND BEVERAGE

- HEALTHCARE

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- Smart Materials Handling Solutions Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- HONEYWELL INTERNATIONAL, INC. (U.S.)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- TRANSBOTICS CORPORATION (U.S.)

- SEEGRID CORPORATION (U.S.)

- KION GROUP AG (GERMANY)

- BEUMER GROUP GMBH (GERMANY)

- SSI SCHAEFER GROUP (GERMANY)

- SWISSLOG HOLDING AG (SWITZERLAND)

- VANDERLANDE INDUSTRIES B.V (NETHERLAND)

- KNAPP AG (AUSTRIA)

- FIVES GROUP (FRANCE)

- DEMATIC LIMITED (UK)

- MECALUX, S.A. (SPAIN)

- DAIFUKU CO., LTD. (JAPAN)

- MURATA MANUFACTURING CO., LTD. (JAPAN)

- COMPETITIVE LANDSCAPE

- GLOBAL SMART MATERIALS HANDLING SOLUTIONS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Type

- Historic And Forecasted Market Size By Industry

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Smart Materials Handling Solutions Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 66 Billion. |

|

Forecast Period 2024-32 CAGR: |

11.52% |

Market Size in 2032: |

USD 177.17 Billion. |

|

Segments Covered: |

By Type |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SMART MATERIALS HANDLING SOLUTIONS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SMART MATERIALS HANDLING SOLUTIONS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SMART MATERIALS HANDLING SOLUTIONS MARKET COMPETITIVE RIVALRY

TABLE 005. SMART MATERIALS HANDLING SOLUTIONS MARKET THREAT OF NEW ENTRANTS

TABLE 006. SMART MATERIALS HANDLING SOLUTIONS MARKET THREAT OF SUBSTITUTES

TABLE 007. SMART MATERIALS HANDLING SOLUTIONS MARKET BY TYPE

TABLE 008. TRANSPORTATION DEVICES MARKET OVERVIEW (2016-2028)

TABLE 009. STORAGE AND STAGING EQUIPMENT MARKET OVERVIEW (2016-2028)

TABLE 010. PICKING UNITS MARKET OVERVIEW (2016-2028)

TABLE 011. SORTATION SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 012. INFORMATION MANAGEMENT SYSTEMS MARKET OVERVIEW (2016-2028)

TABLE 013. SMART MATERIALS HANDLING SOLUTIONS MARKET BY APPLICATION

TABLE 014. RETAIL MARKET OVERVIEW (2016-2028)

TABLE 015. TRANSPORTATION & LOGISTICS MARKET OVERVIEW (2016-2028)

TABLE 016. MANUFACTURING MARKET OVERVIEW (2016-2028)

TABLE 017. ENERGY MARKET OVERVIEW (2016-2028)

TABLE 018. OTHER MARKET OVERVIEW (2016-2028)

TABLE 019. NORTH AMERICA SMART MATERIALS HANDLING SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 020. NORTH AMERICA SMART MATERIALS HANDLING SOLUTIONS MARKET, BY APPLICATION (2016-2028)

TABLE 021. N SMART MATERIALS HANDLING SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 022. EUROPE SMART MATERIALS HANDLING SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 023. EUROPE SMART MATERIALS HANDLING SOLUTIONS MARKET, BY APPLICATION (2016-2028)

TABLE 024. SMART MATERIALS HANDLING SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 025. ASIA PACIFIC SMART MATERIALS HANDLING SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 026. ASIA PACIFIC SMART MATERIALS HANDLING SOLUTIONS MARKET, BY APPLICATION (2016-2028)

TABLE 027. SMART MATERIALS HANDLING SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 028. MIDDLE EAST & AFRICA SMART MATERIALS HANDLING SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 029. MIDDLE EAST & AFRICA SMART MATERIALS HANDLING SOLUTIONS MARKET, BY APPLICATION (2016-2028)

TABLE 030. SMART MATERIALS HANDLING SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 031. SOUTH AMERICA SMART MATERIALS HANDLING SOLUTIONS MARKET, BY TYPE (2016-2028)

TABLE 032. SOUTH AMERICA SMART MATERIALS HANDLING SOLUTIONS MARKET, BY APPLICATION (2016-2028)

TABLE 033. SMART MATERIALS HANDLING SOLUTIONS MARKET, BY COUNTRY (2016-2028)

TABLE 034. DAIFUKU CO. LTD.: SNAPSHOT

TABLE 035. DAIFUKU CO. LTD.: BUSINESS PERFORMANCE

TABLE 036. DAIFUKU CO. LTD.: PRODUCT PORTFOLIO

TABLE 037. DAIFUKU CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 037. SCHAEFER HOLDING INTERNATIONAL GMBH: SNAPSHOT

TABLE 038. SCHAEFER HOLDING INTERNATIONAL GMBH: BUSINESS PERFORMANCE

TABLE 039. SCHAEFER HOLDING INTERNATIONAL GMBH: PRODUCT PORTFOLIO

TABLE 040. SCHAEFER HOLDING INTERNATIONAL GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 040. DEMATIC: SNAPSHOT

TABLE 041. DEMATIC: BUSINESS PERFORMANCE

TABLE 042. DEMATIC: PRODUCT PORTFOLIO

TABLE 043. DEMATIC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 043. HONEYWELL INTELLIGRATED: SNAPSHOT

TABLE 044. HONEYWELL INTELLIGRATED: BUSINESS PERFORMANCE

TABLE 045. HONEYWELL INTELLIGRATED: PRODUCT PORTFOLIO

TABLE 046. HONEYWELL INTELLIGRATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 046. MURATA MACHINERY LTD.: SNAPSHOT

TABLE 047. MURATA MACHINERY LTD.: BUSINESS PERFORMANCE

TABLE 048. MURATA MACHINERY LTD.: PRODUCT PORTFOLIO

TABLE 049. MURATA MACHINERY LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 049. KNAPP AG: SNAPSHOT

TABLE 050. KNAPP AG: BUSINESS PERFORMANCE

TABLE 051. KNAPP AG: PRODUCT PORTFOLIO

TABLE 052. KNAPP AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 052. VANDERLANDE INDUSTRIES B.V.: SNAPSHOT

TABLE 053. VANDERLANDE INDUSTRIES B.V.: BUSINESS PERFORMANCE

TABLE 054. VANDERLANDE INDUSTRIES B.V.: PRODUCT PORTFOLIO

TABLE 055. VANDERLANDE INDUSTRIES B.V.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 055. BEUMER GROUP GMBH: SNAPSHOT

TABLE 056. BEUMER GROUP GMBH: BUSINESS PERFORMANCE

TABLE 057. BEUMER GROUP GMBH: PRODUCT PORTFOLIO

TABLE 058. BEUMER GROUP GMBH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 058. SWISSLOG AG: SNAPSHOT

TABLE 059. SWISSLOG AG: BUSINESS PERFORMANCE

TABLE 060. SWISSLOG AG: PRODUCT PORTFOLIO

TABLE 061. SWISSLOG AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SMART MATERIALS HANDLING SOLUTIONS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SMART MATERIALS HANDLING SOLUTIONS MARKET OVERVIEW BY TYPE

FIGURE 012. TRANSPORTATION DEVICES MARKET OVERVIEW (2016-2028)

FIGURE 013. STORAGE AND STAGING EQUIPMENT MARKET OVERVIEW (2016-2028)

FIGURE 014. PICKING UNITS MARKET OVERVIEW (2016-2028)

FIGURE 015. SORTATION SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 016. INFORMATION MANAGEMENT SYSTEMS MARKET OVERVIEW (2016-2028)

FIGURE 017. SMART MATERIALS HANDLING SOLUTIONS MARKET OVERVIEW BY APPLICATION

FIGURE 018. RETAIL MARKET OVERVIEW (2016-2028)

FIGURE 019. TRANSPORTATION & LOGISTICS MARKET OVERVIEW (2016-2028)

FIGURE 020. MANUFACTURING MARKET OVERVIEW (2016-2028)

FIGURE 021. ENERGY MARKET OVERVIEW (2016-2028)

FIGURE 022. OTHER MARKET OVERVIEW (2016-2028)

FIGURE 023. NORTH AMERICA SMART MATERIALS HANDLING SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. EUROPE SMART MATERIALS HANDLING SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. ASIA PACIFIC SMART MATERIALS HANDLING SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 026. MIDDLE EAST & AFRICA SMART MATERIALS HANDLING SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 027. SOUTH AMERICA SMART MATERIALS HANDLING SOLUTIONS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Smart Materials Handling Solutions Market research report is 2024-2032.

Honeywell International, Inc. (U.S.), Transbotics Corporation (U.S.), Seegrid Corporation (U.S.),Kion Group AG (Germany), Beumer Group GmbH (Germany), SSI Schaefer Group (Germany), Swisslog Holding AG (Switzerland),Vanderlande Industries B.V (Netherland), Knapp AG (Austria),Fives Group (France), Dematic Limited (UK), Mecalux, S.A. (Spain), Daifuku Co., Ltd. (Japan),Murata Manufacturing Co., Ltd. (Japan), and Other Major Players.

The Smart Materials Handling Solutions Market is segmented into Type, Industry, and region. By Type, the market is categorized into Storage and Staging Equipment, Transportation Devices, Picking Units, Sortation Systems, and Information Management Systems. By Industry, the market is categorized into Manufacturing, Warehousing & Logistics, E-commerce, Automotive, Food and Beverage, and Healthcare. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Smart materials handling solutions encompass cutting-edge technologies and systems engineered to automate and streamline the transport, storage, and retrieval of goods across diverse industries. Employing sophisticated sensors, robotics, and artificial intelligence, these solutions elevate operational efficiency, precision, and safety throughout the material handling and distribution processes within the supply chain.

Global Smart Materials Handling Solutions Market Size Was Valued at USD 66 Billion in 2023, and is Projected to Reach USD 177.17 Billion by 2032, Growing at a CAGR of 11.52% From 2024-2032.