Smart Glass Market Synopsis

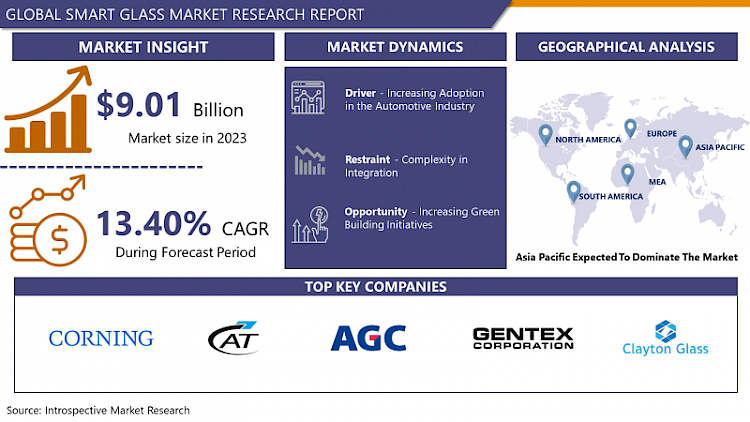

Smart Glass Market Size Was Valued at USD 9.01 Billion in 2023 and is Projected to Reach USD 27.94 Billion by 2032, Growing at a CAGR of 13.40% From 2024-2032.

Smart glass, also known as switchable glass or privacy glass, refers to a high-tech material capable of altering its light transmission properties when voltage, light, or heat is applied. It can switch between transparent and opaque states, offering privacy, glare reduction, and energy efficiency.

- Applications of smart glass span various industries. In architecture, it enhances privacy in windows, sunroofs, and partitions while controlling sunlight and heat. In automotive, it improves comfort and safety by regulating light and heat transmission in car windows. Additionally, it's used in display cases, electronics, and healthcare for privacy or interactive purposes.

- Current trends in the smart glass market highlight a growing demand due to increasing awareness of energy efficiency and sustainability. The construction sector sees a rise in the adoption of smart glass for green buildings, reducing energy consumption by controlling heating and cooling. In automobiles, there's a shift toward incorporating smart glass for improved comfort and aesthetics. Technological advancements focusing on cost-effectiveness and durability are key trends, making smart glass more accessible and reliable for various applications. As research continues, the market anticipates more innovative functionalities and expanded use cases, further driving its adoption across industries.

Smart Glass Market Trend Analysis

Increasing Adoption in the Automotive Industry

- The automotive industry has witnessed a significant surge in the adoption of smart glass, acting as a pivotal driver for the market's growth. This adoption is primarily fuelled by the industry's constant pursuit of innovation, safety enhancement, and improving the overall driving experience.

- Smart glass technology is increasingly integrated into vehicles to offer advanced functionalities. Electrochromic glass, a type of smart glass, allows automatic tinting to regulate light transmission, reducing glare and UV exposure inside the vehicle. This not only enhances driving comfort but also contributes to better visibility and reduces eye strain for drivers and passengers.

- Moreover, smart glass provides opportunities for enhanced vehicle design, enabling innovative panoramic sunroofs, interactive displays, and privacy partitions within automobiles. These features cater to the evolving consumer demands for aesthetically appealing, technologically advanced, and comfortable vehicles.

- Safety improvements also drive smart glass adoption in automobiles. Variable transparency in windows and mirrors can enhance driver visibility in different lighting conditions, contributing to safer driving experiences by minimizing blind spots and distractions.

- As automakers increasingly prioritize incorporating smart technologies for both luxury and mainstream vehicles, the demand for smart glass in the automotive sector continues to grow. This surge in adoption reflects a crucial driver propelling the expansion of the smart glass market, with ongoing research and development focused on further improving functionalities and cost-effectiveness for widespread implementation across vehicle types and models.

Increasing Green Building Initiatives

- Green building initiatives represent a pivotal opportunity for the smart glass market, aligning with the global focus on sustainability and energy-efficient solutions in construction. Smart glass technology perfectly complements these initiatives by offering a dynamic solution to reduce energy consumption and enhance the overall performance of buildings.

- Smart glass helps optimize energy efficiency by controlling the amount of sunlight and heat entering a building. This regulation of natural light reduces the reliance on artificial lighting and minimizes the load on heating, ventilation, and air conditioning (HVAC) systems, consequently lowering energy consumption. Such efficiency aligns with green building certifications like LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method), driving the demand for smart glass in both new constructions and retrofitting existing buildings to meet these stringent standards.

- Moreover, as governments and regulatory bodies worldwide emphasize reducing carbon footprints and promoting sustainable practices, incentives and mandates for energy-efficient technologies in buildings continue to grow. This creates a favorable environment for smart glass adoption, positioning it as a crucial component in the quest for environmentally friendly and energy-saving construction practices. As the green building movement gains momentum, the smart glass market stands poised to capitalize on this opportunity by offering a sustainable and technologically advanced solution for energy-efficient building designs.

Smart Glass Market Segment Analysis:

Smart Glass Market Segmented on the basis of type and application.

By Type, Electrochromic segment is expected to dominate the market during the forecast period

- In the forecast period, the electrochromic segment is anticipated to lead the smart glass market due to its versatile applications and technological advancements. Electrochromic smart glass offers dynamic tinting capabilities, allowing seamless control over light transmission by changing its opacity in response to electrical stimuli.

- Its dominance is attributed to several factors: first, electrochromic smart glass provides efficient glare reduction, UV protection, and thermal management, catering to the needs of both commercial and residential sectors. Second, ongoing R&D efforts have improved the durability, response time, and cost-effectiveness of electrochromic technology, making it increasingly attractive to consumers and industries. Finally, its compatibility with smart building automation systems and integration capabilities with IoT devices further enhances its appeal.

- As energy efficiency and user-controlled environments become more critical in architecture and automotive design, the versatile nature and advancements in electrochromic smart glass position it as the leading segment driving the market's growth and adoption.

By Application, Transportation segment held the largest market share of 48,9% in 2022

- The transportation segment has consistently held the largest market share in the smart glass industry due to the extensive adoption of smart glass technologies in various modes of transportation. In automotive applications, smart glass is integrated into vehicles for windows, sunroofs, mirrors, and displays, enhancing comfort, safety, and aesthetics.

- In the automotive sector, the demand for smart glass continues to surge as automakers prioritize integrating advanced technologies into vehicles. The implementation of smart glass in cars not only improves the driving experience by reducing glare and regulating interior temperature but also contributes to safety by minimizing blind spots and enhancing visibility. Luxury vehicle manufacturers have notably embraced smart glass for its premium features.

- Additionally, smart glass finds applications in other transportation means, such as airplanes, trains, and marine vessels. These sectors leverage smart glass for windows, displays, and privacy partitions, further solidifying the transportation segment's dominance in the smart glass market due to its widespread and diverse use across multiple modes of transportation.

Smart Glass Market Regional Insights:

Asia Pacific is Expected to Dominate the Market Over the Forecast period

- Asia Pacific is anticipated to dominate the smart glass market throughout the forecast period due to several key factors driving its growth in the region. The increasing construction activities, rapid urbanization, and infrastructure development initiatives in countries like China, India, Japan, and South Korea are major contributors to the market's expansion.

- The region's booming automotive industry, characterized by technological advancements and rising consumer demand for high-end vehicles with advanced features, is also a significant driver for smart glass adoption. The growing awareness of energy efficiency and sustainability further propels the demand for smart glass in green building initiatives across Asia Pacific.

- Moreover, government initiatives and regulations promoting energy-efficient technologies in construction and transportation sectors fuel the market's growth. The large population and expanding middle-class demographic in the region, with a rising disposable income, drive the demand for smart glass applications in both residential and commercial sectors. These factors collectively position Asia Pacific as the dominant region in the global smart glass market during the forecast period.

Smart Glass Market Top Key Players:

- Corning Incorporated (US)

- Active Glass Technologies (US)

- Agc Inc. (Japan)

- Gentex Corporation (US)

- Clayton Glass Ltd. (UK)

- Nippon Sheet Glass Co. Ltd. (Japan)

- Essex Safety Glass Ltd. (UK)

- Sage Electrochromics Inc. (US)

- Solos Glass Pty Ltd (Australia)

- Glass Apps Llc (US)

- Guardian Industries (US)

- Ravenwindow (US)

- Research Frontiers Inc. (US)

- Invisishade Llc (US)

- Schott Corporation (Germany)

- Smartglass International Limited (Ireland)

- Intelligent Glass (UK)

- Vario Glass Inc. (Canada)

- View Inc. (US)

- Huawei (China) And Other Major Players

Key Industry Developments in the Smart Glass Market:

- In November 2023, HALIO, designer of the world’s fastest, most beautiful, eco-friendly, and technologically advanced electrochromic (smart) glass, and SKC Ltd., a leading company in the ESG Materials Solution industry based in South Korea, announced that HALIO has raised up to $70M in funding from SKC to further market and develop the industry’s next generation of smart glass technology, focusing on energy savings, environmental impact, and creating beautiful facades, while enabling occupant wellness and comfort.

- In September 2023, Meta Connect launched a new generation of Ray-Ban Meta smart glasses in partnership with EssilorLuxottica.

- In October 2023, Guardian Industries Holdings, LLC introduced SunGuard SNX 70+, a triple silver-coated glass featuring a visible light transmission of 68% and a solar heat gain coefficient of 0.28 when applied to Guardian UltraClear low-iron glass. Engineered to ensure a uniform neutral reflected color, this glass maintains its aesthetic appeal whether observed directly or from an angled perspective.

|

Global Smart Glass Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.01 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.40 % |

Market Size in 2032: |

USD 27.94 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SMART GLASS MARKET BY TECHNOLOGY (2016-2030)

- SMART GLASS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- SUSPENDED PARTICLE DISPLAY

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- ELECTROCHROMIC

- LIQUID CRYSTAL

- MICROBLIND

- PHOTOCHROMIC

- THERMOCHROMIC

- SMART GLASS MARKET BY APPLICATION (2016-2030)

- SMART GLASS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- ARCHITECTURE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- TRANSPORTATION

- POWER GENERATION PLANTS (SOLAR)

- CONSUMER ELECTRONICS

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- SMART GLASS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- CORNING INCORPORATED (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- ACTIVE GLASS TECHNOLOGIES (US)

- AGC INC. (JAPAN)

- GENTEX CORPORATION (US)

- CLAYTON GLASS LTD. (UK)

- NIPPON SHEET GLASS CO. LTD. (JAPAN)

- ESSEX SAFETY GLASS LTD. (UK)

- SAGE ELECTROCHROMICS INC. (US)

- SOLOS GLASS PTY LTD (AUSTRALIA)

- GLASS APPS LLC (US)

- GUARDIAN INDUSTRIES (US)

- RAVENWINDOW (US)

- RESEARCH FRONTIERS INC. (US)

- INVISISHADE LLC (US)

- SCHOTT CORPORATION (GERMANY)

- SMARTGLASS INTERNATIONAL LIMITED (IRELAND)

- INTELLIGENT GLASS (UK)

- VARIO GLASS INC. (CANADA)

- VIEW INC. (US)

- HUAWEI (CHINA) AND OTHER MAJOR PLAYERS

- COMPETITIVE LANDSCAPE

- GLOBAL SMART GLASS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By TECHNOLOGY

- Historic And Forecasted Market Size By APPLICATION

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Global Smart Glass Market |

|||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 9.01 Bn. |

|

Forecast Period 2024-32 CAGR: |

13.40 % |

Market Size in 2032: |

USD 27.94 Bn. |

|

Segments Covered: |

By Technology |

|

|

|

By Application |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

LIST OF TABLES

TABLE 001. EXECUTIVE SUMMARY

TABLE 002. SMART GLASS MARKET BARGAINING POWER OF SUPPLIERS

TABLE 003. SMART GLASS MARKET BARGAINING POWER OF CUSTOMERS

TABLE 004. SMART GLASS MARKET COMPETITIVE RIVALRY

TABLE 005. SMART GLASS MARKET THREAT OF NEW ENTRANTS

TABLE 006. SMART GLASS MARKET THREAT OF SUBSTITUTES

TABLE 007. SMART GLASS MARKET BY TECHNOLOGY

TABLE 008. SUSPENDED PARTICLE DEVICES (SPD) MARKET OVERVIEW (2016-2028)

TABLE 009. ELECTROCHROMIC MARKET OVERVIEW (2016-2028)

TABLE 010. POLYMER DISPERSED LIQUID CRYSTAL (PDLC) MARKET OVERVIEW (2016-2028)

TABLE 011. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 012. SMART GLASS MARKET BY APPLICATION

TABLE 013. TRANSPORTATION MARKET OVERVIEW (2016-2028)

TABLE 014. ARCHITECTURAL MARKET OVERVIEW (2016-2028)

TABLE 015. CONSUMER ELECTRONICS MARKET OVERVIEW (2016-2028)

TABLE 016. OTHERS MARKET OVERVIEW (2016-2028)

TABLE 017. NORTH AMERICA SMART GLASS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 018. NORTH AMERICA SMART GLASS MARKET, BY APPLICATION (2016-2028)

TABLE 019. N SMART GLASS MARKET, BY COUNTRY (2016-2028)

TABLE 020. EUROPE SMART GLASS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 021. EUROPE SMART GLASS MARKET, BY APPLICATION (2016-2028)

TABLE 022. SMART GLASS MARKET, BY COUNTRY (2016-2028)

TABLE 023. ASIA PACIFIC SMART GLASS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 024. ASIA PACIFIC SMART GLASS MARKET, BY APPLICATION (2016-2028)

TABLE 025. SMART GLASS MARKET, BY COUNTRY (2016-2028)

TABLE 026. MIDDLE EAST & AFRICA SMART GLASS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 027. MIDDLE EAST & AFRICA SMART GLASS MARKET, BY APPLICATION (2016-2028)

TABLE 028. SMART GLASS MARKET, BY COUNTRY (2016-2028)

TABLE 029. SOUTH AMERICA SMART GLASS MARKET, BY TECHNOLOGY (2016-2028)

TABLE 030. SOUTH AMERICA SMART GLASS MARKET, BY APPLICATION (2016-2028)

TABLE 031. SMART GLASS MARKET, BY COUNTRY (2016-2028)

TABLE 032. CORNING INCORPORATED: SNAPSHOT

TABLE 033. CORNING INCORPORATED: BUSINESS PERFORMANCE

TABLE 034. CORNING INCORPORATED: PRODUCT PORTFOLIO

TABLE 035. CORNING INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 035. ACTIVE GLASS TECHNOLOGIES: SNAPSHOT

TABLE 036. ACTIVE GLASS TECHNOLOGIES: BUSINESS PERFORMANCE

TABLE 037. ACTIVE GLASS TECHNOLOGIES: PRODUCT PORTFOLIO

TABLE 038. ACTIVE GLASS TECHNOLOGIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 038. AGC INC.: SNAPSHOT

TABLE 039. AGC INC.: BUSINESS PERFORMANCE

TABLE 040. AGC INC.: PRODUCT PORTFOLIO

TABLE 041. AGC INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 041. GENTEX CORPORATION: SNAPSHOT

TABLE 042. GENTEX CORPORATION: BUSINESS PERFORMANCE

TABLE 043. GENTEX CORPORATION: PRODUCT PORTFOLIO

TABLE 044. GENTEX CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 044. CLAYTON GLASS LTD.: SNAPSHOT

TABLE 045. CLAYTON GLASS LTD.: BUSINESS PERFORMANCE

TABLE 046. CLAYTON GLASS LTD.: PRODUCT PORTFOLIO

TABLE 047. CLAYTON GLASS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 047. NIPPON SHEET GLASS CO. LTD.: SNAPSHOT

TABLE 048. NIPPON SHEET GLASS CO. LTD.: BUSINESS PERFORMANCE

TABLE 049. NIPPON SHEET GLASS CO. LTD.: PRODUCT PORTFOLIO

TABLE 050. NIPPON SHEET GLASS CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 050. ESSEX SAFETY GLASS LTD.: SNAPSHOT

TABLE 051. ESSEX SAFETY GLASS LTD.: BUSINESS PERFORMANCE

TABLE 052. ESSEX SAFETY GLASS LTD.: PRODUCT PORTFOLIO

TABLE 053. ESSEX SAFETY GLASS LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 053. SAGE ELECTROCHROMICS INC.: SNAPSHOT

TABLE 054. SAGE ELECTROCHROMICS INC.: BUSINESS PERFORMANCE

TABLE 055. SAGE ELECTROCHROMICS INC.: PRODUCT PORTFOLIO

TABLE 056. SAGE ELECTROCHROMICS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 056. SOLOS GLASS PTY LTD.: SNAPSHOT

TABLE 057. SOLOS GLASS PTY LTD.: BUSINESS PERFORMANCE

TABLE 058. SOLOS GLASS PTY LTD.: PRODUCT PORTFOLIO

TABLE 059. SOLOS GLASS PTY LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 059. GLASS APPS LLC: SNAPSHOT

TABLE 060. GLASS APPS LLC: BUSINESS PERFORMANCE

TABLE 061. GLASS APPS LLC: PRODUCT PORTFOLIO

TABLE 062. GLASS APPS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 062. GUARDIAN INDUSTRIES: SNAPSHOT

TABLE 063. GUARDIAN INDUSTRIES: BUSINESS PERFORMANCE

TABLE 064. GUARDIAN INDUSTRIES: PRODUCT PORTFOLIO

TABLE 065. GUARDIAN INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 065. RAVENWINDOW: SNAPSHOT

TABLE 066. RAVENWINDOW: BUSINESS PERFORMANCE

TABLE 067. RAVENWINDOW: PRODUCT PORTFOLIO

TABLE 068. RAVENWINDOW: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 068. RESEARCH FRONTIERS INC.: SNAPSHOT

TABLE 069. RESEARCH FRONTIERS INC.: BUSINESS PERFORMANCE

TABLE 070. RESEARCH FRONTIERS INC.: PRODUCT PORTFOLIO

TABLE 071. RESEARCH FRONTIERS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 071. INVISISHADE LLC: SNAPSHOT

TABLE 072. INVISISHADE LLC: BUSINESS PERFORMANCE

TABLE 073. INVISISHADE LLC: PRODUCT PORTFOLIO

TABLE 074. INVISISHADE LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 074. SCHOTT CORPORATION: SNAPSHOT

TABLE 075. SCHOTT CORPORATION: BUSINESS PERFORMANCE

TABLE 076. SCHOTT CORPORATION: PRODUCT PORTFOLIO

TABLE 077. SCHOTT CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 077. SMARTGLASS INTERNATIONAL LIMITED: SNAPSHOT

TABLE 078. SMARTGLASS INTERNATIONAL LIMITED: BUSINESS PERFORMANCE

TABLE 079. SMARTGLASS INTERNATIONAL LIMITED: PRODUCT PORTFOLIO

TABLE 080. SMARTGLASS INTERNATIONAL LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 080. INTELLIGENT GLASS: SNAPSHOT

TABLE 081. INTELLIGENT GLASS: BUSINESS PERFORMANCE

TABLE 082. INTELLIGENT GLASS: PRODUCT PORTFOLIO

TABLE 083. INTELLIGENT GLASS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 083. VARIO GLASS INC.: SNAPSHOT

TABLE 084. VARIO GLASS INC.: BUSINESS PERFORMANCE

TABLE 085. VARIO GLASS INC.: PRODUCT PORTFOLIO

TABLE 086. VARIO GLASS INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 086. VIEW INC.: SNAPSHOT

TABLE 087. VIEW INC.: BUSINESS PERFORMANCE

TABLE 088. VIEW INC.: PRODUCT PORTFOLIO

TABLE 089. VIEW INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 089. HUAWEI: SNAPSHOT

TABLE 090. HUAWEI: BUSINESS PERFORMANCE

TABLE 091. HUAWEI: PRODUCT PORTFOLIO

TABLE 092. HUAWEI: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 092. OTHER MAJOR PLAYERS: SNAPSHOT

TABLE 093. OTHER MAJOR PLAYERS: BUSINESS PERFORMANCE

TABLE 094. OTHER MAJOR PLAYERS: PRODUCT PORTFOLIO

TABLE 095. OTHER MAJOR PLAYERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 001. YEARS CONSIDERED FOR ANALYSIS

FIGURE 002. SCOPE OF THE STUDY

FIGURE 003. SMART GLASS MARKET OVERVIEW BY REGIONS

FIGURE 004. PORTER'S FIVE FORCES ANALYSIS

FIGURE 005. BARGAINING POWER OF SUPPLIERS

FIGURE 006. COMPETITIVE RIVALRYFIGURE 007. THREAT OF NEW ENTRANTS

FIGURE 008. THREAT OF SUBSTITUTES

FIGURE 009. VALUE CHAIN ANALYSIS

FIGURE 010. PESTLE ANALYSIS

FIGURE 011. SMART GLASS MARKET OVERVIEW BY TECHNOLOGY

FIGURE 012. SUSPENDED PARTICLE DEVICES (SPD) MARKET OVERVIEW (2016-2028)

FIGURE 013. ELECTROCHROMIC MARKET OVERVIEW (2016-2028)

FIGURE 014. POLYMER DISPERSED LIQUID CRYSTAL (PDLC) MARKET OVERVIEW (2016-2028)

FIGURE 015. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 016. SMART GLASS MARKET OVERVIEW BY APPLICATION

FIGURE 017. TRANSPORTATION MARKET OVERVIEW (2016-2028)

FIGURE 018. ARCHITECTURAL MARKET OVERVIEW (2016-2028)

FIGURE 019. CONSUMER ELECTRONICS MARKET OVERVIEW (2016-2028)

FIGURE 020. OTHERS MARKET OVERVIEW (2016-2028)

FIGURE 021. NORTH AMERICA SMART GLASS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 022. EUROPE SMART GLASS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 023. ASIA PACIFIC SMART GLASS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 024. MIDDLE EAST & AFRICA SMART GLASS MARKET OVERVIEW BY COUNTRY (2016-2028)

FIGURE 025. SOUTH AMERICA SMART GLASS MARKET OVERVIEW BY COUNTRY (2016-2028)

Frequently Asked Questions :

The forecast period in the Smart Glass Market research report is 2024-2032.

Corning Incorporated (US), Active Glass Technologies (US), AGC Inc. (Japan), Gentex Corporation (US), Clayton Glass Ltd. (UK), Nippon Sheet Glass Co. Ltd. (Japan), Essex Safety Glass Ltd. (UK), SAGE Electrochromics Inc. (US), SOLOS Glass Pty Ltd (Australia), Glass Apps LLC (US), Guardian Industries (US), RavenWindow (US), Research Frontiers Inc. (US), InvisiShade LLC (US), Schott Corporation (Germany), Smartglass International Limited (Ireland), Intelligent Glass (UK), Vario Glass Inc. (Canada), View Inc. (US), Huawei (China) and Other Major Players.

The Smart Glass Market is segmented into Technology, Application, and region. By Technology, the market is categorized into Suspended Particle Display, Electrochromic, Liquid Crystal, Microblind, Photochromic, Thermochromic. By Application, the market is categorized into Architecture, Transportation, Power Generation Plants (Solar), Consumer Electronics. By region, it is analyzed across North America (U.S.; Canada; Mexico), Europe (Germany; U.K.; France; Italy; Russia; Spain, etc.), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Smart glass, also known as switchable glass or privacy glass, refers to a high-tech material capable of altering its light transmission properties when voltage, light, or heat is applied. It can switch between transparent and opaque states, offering privacy, glare reduction, and energy efficiency.

Smart Glass Market Size Was Valued at USD 9.01 Billion in 2023 and is Projected to Reach USD 27.94 Billion by 2032, Growing at a CAGR of 13.40% From 2024-2032.