Serological Pipettes Market Synopsis

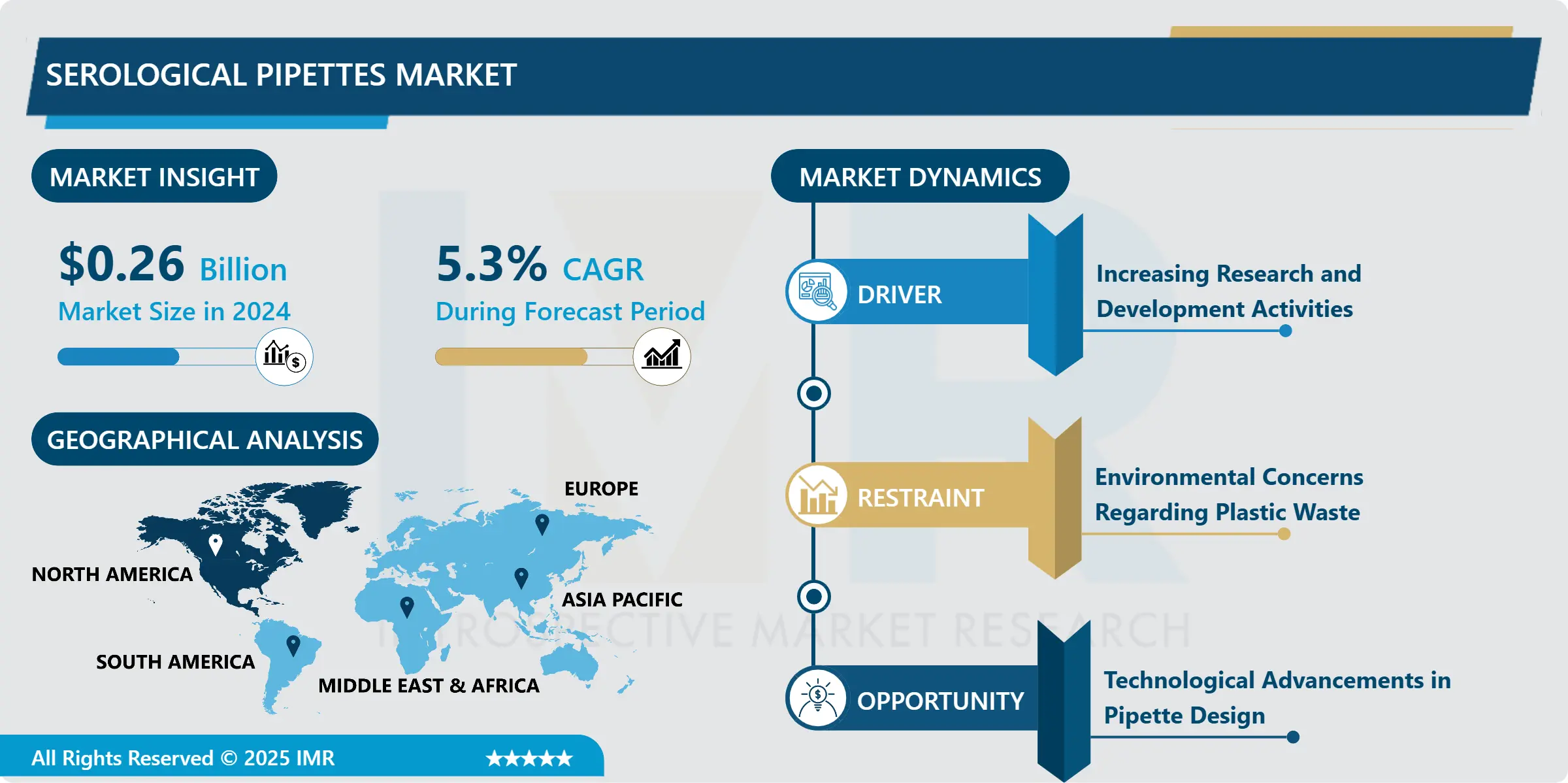

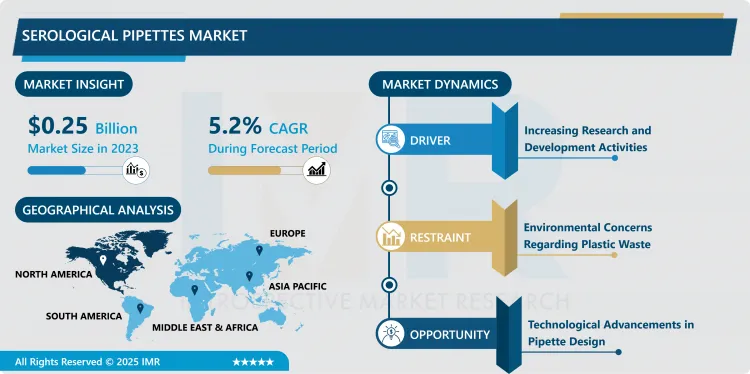

Serological Pipettes Market Size Was Valued at USD 0.26 Billion in 2024, and is Projected to Reach USD 0.46 Billion by 2035, Growing at a CAGR of 5.3% From 2025-2035.

Serological pipettes are simple and delicate laboratory tools used for Measuring particular quantities of fluid or for transferring liquids. They are most commonly produced from glass or plastic and are used widely in cell culture; microbiological and clinical diagnostics where accurate aspiration and dispensing is required.

It is established that the market of serological pipettes has recently progressed considerably, spurred by the increased production of biotechnological products and pharmaceuticals, growth of the R&D programs, and the number of clinical facilities globally. Disposable plastic pipettes have therefore increased in popularity because of increased concern of hygiene in laboratories and to avoid cross contamination. Also, growth in technology has increased more efficiency and innovative functionality of the pipettes thereby increasing the market growth.

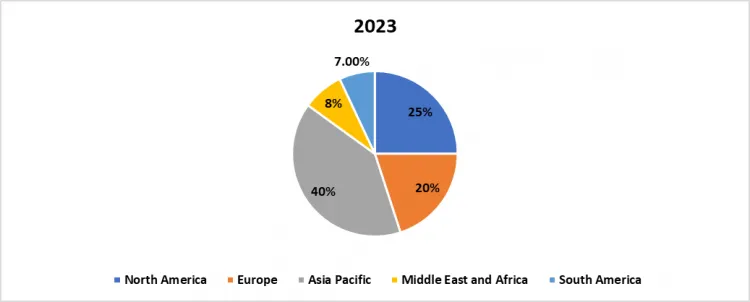

Globally, regionally, China has become the largest consumer of serological pipettes in 2024, holding the market share of about 35%. Such dominance can be explained by the highly developed pharmaceutical industry, increased investments in biotechnology, and constantly increasing number of clinical laboratories. China has enhance its position majorly due to numerous domestic manufacturers they are offering inexpensive product.

Serological Pipettes Market Trend Analysis

Shift Towards Eco-Friendly Pipettes

- Another interesting factor to be also explored in the market is that of the growing demand for environment friendly and sustainable products in the existing serological pipettes market. Taking into consideration the constant increase in environmental protection and new restrictions for using plastics and associated products in laboratories, manufacturers are creating biodegradable and easily recyclable pipettes.

- This trend is growing progressively in research institutions and laboratories which seeks to exhibit environmental sensitivity in practices while maintaining precision in their results and quality.

Expansion in Emerging Markets

- There are several trends in the serological pipettes industry that make it possible for it to obtain new growth opportunities in emerging markets. The countries in Asia-Pacific, Latin America, and Africa have had increased development of the healthcare sector in such areas as infrastructure advanced research, and generally an emphasis on enhancement of diagnostic facilities.

- These factors are expected to make the demand for the serological pipettes to grow and give the manufacturers the opportunity to break into new markets and supply new customer base in these regions.

Serological Pipettes Market Segment Analysis:

Serological Pipettes Market Segmented on the basis of by material, application and end user.

By Material, Glass Pipettes segment is expected to dominate the market during the forecast period

- This growth is mainly attributed to the use of serological pipettes in the tissue cultures. Techniques as tissue culture, widely used in regenerative medicine, drug discovery, or genetic engineering require accurate aspiration or pipetting of liquids. Serological pipettes are useful when transferring media, reagents and cells under aseptic conditions enhancing accuracy and repeatability. The growth of this segment in demand towards more effective treatments and enhancing the stem cell biology display the Serological Pipettes suitability towards this market.

- Furthermore, uptake in bacterial culture and testing labs showcases versatility of the products in microbiology and diagnose. Clinical and research uses of serological pipettes include the transfer of bacterial suspensions, culture media and reagents. These pipettes are indispensable working tools in testing laboratories and are useful in sample preparation and analysis for a myriad of tests. Other uses include; environmental analysis, food testing and in industries, and as such, they are widely essential in a variety of scientific fields.

By Application, Testing Lab segment expected to held the largest share

- Diagnostic laboratories and clinical research offer a highly important application for serological pipettes, making hospitals a steep consumer. These pipettes are usually applied in mundane clinical analysis, preliminary sample, and general fluid manipulation, all of which are accurate in results. The rising incidence of chronic diseases and the shift towards the use of specialized diagnostic equipment are among the reasons that have Antibodies been retained from hospitalized patients as a significant source of demand for serological pipettes.

- From the present market point of view, academic and research institutes, and pharmaceutical and biotechnology sectors comprise a significant part of the entire market. Serological pipettes are an essential part of laboratory use for study at academic and research level in cell biology, microbiology and molecular level research. At the same time, companies involved in the production of drugs and biotechnological preparations use these pipettes intensively at stages in drug development and in the creation of vaccines, and in diagnostic activities. These sectors show the immediate demand for accurate and sterile liquid handling which gives them the capability to drive the market.

Serological Pipettes Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- Chinese companies took around 35% of the total market in 2024 as quantified by Martinelli. This spectacular performance can be attributed to the developed industry of production of pharmaceutical products which remains in high demand both on domestic and international markets. In addition, increased funding for biological research in general and for biotechnology in particular created a demand for more extensive use of serological pipettes primarily in the context of research and development in such areas of life sciences as pharmaceuticals, genomics, and molecular biology. The trend of clinics in China is also growing accordingly with the development of laboratory facilities, infrastructure and diagnostic services which are indispensably demanded and results to consistent consumer sales.

- To this growth is the fact that there are many domestic manufacturers that supply serological pipettes of high quality and relatively low price. The local manufacturing capability is not only helping to minimize importation, but also enabling reasonable pricing for a number of laboratory types, including academic and commercial laboratories. These factors complement government policies towards development of scientific research and innovation for serological pipette manufacturing and consumption have made China the global market leader.

Active Key Players in the Serological Pipettes Market

- Argos Technologies (USA)

- Bio fil (China)

- CAPP (Denmark)

- Cam lab (UK)

- CITOTEST (China)

- Corning (USA)

- Eppendorf (Germany)

- Greiner Bio-One (Austria)

- Hi Media Laboratories (India)

- Merck (Germany)

- NEST (China)

- Sarstedt (Germany)

- Sorfa (China)

- Thermo Fisher Scientific (USA)

- VWR (USA)

- Other key Players

|

Serological Pipettes Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2023: |

USD 0.26 Billion |

|

Forecast Period 2025-35 CAGR: |

5.3% |

Market Size in 2035: |

USD 0.46 Billion |

|

Segments Covered: |

By Material |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||

Chapter 1: Introduction

1.1 Scope and Coverage

Chapter 2:Executive Summary

Chapter 3: Market Landscape

3.1 Market Dynamics

3.1.1 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 Market Trend Analysis

3.3 PESTLE Analysis

3.4 Porter's Five Forces Analysis

3.5 Industry Value Chain Analysis

3.6 Ecosystem

3.7 Regulatory Landscape

3.8 Price Trend Analysis

3.9 Patent Analysis

3.10 Technology Evolution

3.11 Investment Pockets

3.12 Import-Export Analysis

Chapter 4: Serological Pipettes Market by Material (2018-2035)

4.1 Serological Pipettes Market Snapshot and Growth Engine

4.2 Market Overview

4.3 Glass Pipettes

4.3.1 Introduction and Market Overview

4.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

4.3.3 Key Market Trends, Growth Factors, and Opportunities

4.3.4 Geographic Segmentation Analysis

4.4 Plastic Pipettes

Chapter 5: Serological Pipettes Market by Application (2018-2035)

5.1 Serological Pipettes Market Snapshot and Growth Engine

5.2 Market Overview

5.3 Tissue Culture

5.3.1 Introduction and Market Overview

5.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

5.3.3 Key Market Trends, Growth Factors, and Opportunities

5.3.4 Geographic Segmentation Analysis

5.4 Bacterial Culture

5.5 Testing Lab

5.6 Others

Chapter 6: Serological Pipettes Market by End User (2018-2035)

6.1 Serological Pipettes Market Snapshot and Growth Engine

6.2 Market Overview

6.3 Hospitals

6.3.1 Introduction and Market Overview

6.3.2 Historic and Forecasted Market Size in Value USD and Volume Units

6.3.3 Key Market Trends, Growth Factors, and Opportunities

6.3.4 Geographic Segmentation Analysis

6.4 Academic and Research Institutes

6.5 Pharmaceutical and Biotechnology Companies

6.6 Others

Chapter 7: Company Profiles and Competitive Analysis

7.1 Competitive Landscape

7.1.1 Competitive Benchmarking

7.1.2 Serological Pipettes Market Share by Manufacturer (2024)

7.1.3 Industry BCG Matrix

7.1.4 Heat Map Analysis

7.1.5 Mergers and Acquisitions

7.2 ARGOS TECHNOLOGIES (USA)

7.2.1 Company Overview

7.2.2 Key Executives

7.2.3 Company Snapshot

7.2.4 Role of the Company in the Market

7.2.5 Sustainability and Social Responsibility

7.2.6 Operating Business Segments

7.2.7 Product Portfolio

7.2.8 Business Performance

7.2.9 Key Strategic Moves and Recent Developments

7.2.10 SWOT Analysis

7.3 BIO FIL (CHINA)

7.4 CAPP (DENMARK)

7.5 CAM LAB (UK)

7.6 CITOTEST (CHINA)

7.7 CORNING (USA)

7.8 EPPENDORF (GERMANY)

7.9 GREINER BIO-ONE (AUSTRIA)

7.10 HI MEDIA LABORATORIES (INDIA)

7.11 MERCK (GERMANY)

7.12 NEST (CHINA)

7.13 SARSTEDT (GERMANY)

7.14 SORFA (CHINA)

7.15 THERMO FISHER SCIENTIFIC (USA)

7.16 VWR (USA)

7.17 OTHER ACTIVE PLAYERS

Chapter 8: Global Serological Pipettes Market By Region

8.1 Overview

8.2. North America Serological Pipettes Market

8.2.1 Key Market Trends, Growth Factors and Opportunities

8.2.2 Top Key Companies

8.2.3 Historic and Forecasted Market Size by Segments

8.2.4 Historic and Forecasted Market Size by Material

8.2.4.1 Glass Pipettes

8.2.4.2 Plastic Pipettes

8.2.5 Historic and Forecasted Market Size by Application

8.2.5.1 Tissue Culture

8.2.5.2 Bacterial Culture

8.2.5.3 Testing Lab

8.2.5.4 Others

8.2.6 Historic and Forecasted Market Size by End User

8.2.6.1 Hospitals

8.2.6.2 Academic and Research Institutes

8.2.6.3 Pharmaceutical and Biotechnology Companies

8.2.6.4 Others

8.2.7 Historic and Forecast Market Size by Country

8.2.7.1 US

8.2.7.2 Canada

8.2.7.3 Mexico

8.3. Eastern Europe Serological Pipettes Market

8.3.1 Key Market Trends, Growth Factors and Opportunities

8.3.2 Top Key Companies

8.3.3 Historic and Forecasted Market Size by Segments

8.3.4 Historic and Forecasted Market Size by Material

8.3.4.1 Glass Pipettes

8.3.4.2 Plastic Pipettes

8.3.5 Historic and Forecasted Market Size by Application

8.3.5.1 Tissue Culture

8.3.5.2 Bacterial Culture

8.3.5.3 Testing Lab

8.3.5.4 Others

8.3.6 Historic and Forecasted Market Size by End User

8.3.6.1 Hospitals

8.3.6.2 Academic and Research Institutes

8.3.6.3 Pharmaceutical and Biotechnology Companies

8.3.6.4 Others

8.3.7 Historic and Forecast Market Size by Country

8.3.7.1 Russia

8.3.7.2 Bulgaria

8.3.7.3 The Czech Republic

8.3.7.4 Hungary

8.3.7.5 Poland

8.3.7.6 Romania

8.3.7.7 Rest of Eastern Europe

8.4. Western Europe Serological Pipettes Market

8.4.1 Key Market Trends, Growth Factors and Opportunities

8.4.2 Top Key Companies

8.4.3 Historic and Forecasted Market Size by Segments

8.4.4 Historic and Forecasted Market Size by Material

8.4.4.1 Glass Pipettes

8.4.4.2 Plastic Pipettes

8.4.5 Historic and Forecasted Market Size by Application

8.4.5.1 Tissue Culture

8.4.5.2 Bacterial Culture

8.4.5.3 Testing Lab

8.4.5.4 Others

8.4.6 Historic and Forecasted Market Size by End User

8.4.6.1 Hospitals

8.4.6.2 Academic and Research Institutes

8.4.6.3 Pharmaceutical and Biotechnology Companies

8.4.6.4 Others

8.4.7 Historic and Forecast Market Size by Country

8.4.7.1 Germany

8.4.7.2 UK

8.4.7.3 France

8.4.7.4 The Netherlands

8.4.7.5 Italy

8.4.7.6 Spain

8.4.7.7 Rest of Western Europe

8.5. Asia Pacific Serological Pipettes Market

8.5.1 Key Market Trends, Growth Factors and Opportunities

8.5.2 Top Key Companies

8.5.3 Historic and Forecasted Market Size by Segments

8.5.4 Historic and Forecasted Market Size by Material

8.5.4.1 Glass Pipettes

8.5.4.2 Plastic Pipettes

8.5.5 Historic and Forecasted Market Size by Application

8.5.5.1 Tissue Culture

8.5.5.2 Bacterial Culture

8.5.5.3 Testing Lab

8.5.5.4 Others

8.5.6 Historic and Forecasted Market Size by End User

8.5.6.1 Hospitals

8.5.6.2 Academic and Research Institutes

8.5.6.3 Pharmaceutical and Biotechnology Companies

8.5.6.4 Others

8.5.7 Historic and Forecast Market Size by Country

8.5.7.1 China

8.5.7.2 India

8.5.7.3 Japan

8.5.7.4 South Korea

8.5.7.5 Malaysia

8.5.7.6 Thailand

8.5.7.7 Vietnam

8.5.7.8 The Philippines

8.5.7.9 Australia

8.5.7.10 New Zealand

8.5.7.11 Rest of APAC

8.6. Middle East & Africa Serological Pipettes Market

8.6.1 Key Market Trends, Growth Factors and Opportunities

8.6.2 Top Key Companies

8.6.3 Historic and Forecasted Market Size by Segments

8.6.4 Historic and Forecasted Market Size by Material

8.6.4.1 Glass Pipettes

8.6.4.2 Plastic Pipettes

8.6.5 Historic and Forecasted Market Size by Application

8.6.5.1 Tissue Culture

8.6.5.2 Bacterial Culture

8.6.5.3 Testing Lab

8.6.5.4 Others

8.6.6 Historic and Forecasted Market Size by End User

8.6.6.1 Hospitals

8.6.6.2 Academic and Research Institutes

8.6.6.3 Pharmaceutical and Biotechnology Companies

8.6.6.4 Others

8.6.7 Historic and Forecast Market Size by Country

8.6.7.1 Turkiye

8.6.7.2 Bahrain

8.6.7.3 Kuwait

8.6.7.4 Saudi Arabia

8.6.7.5 Qatar

8.6.7.6 UAE

8.6.7.7 Israel

8.6.7.8 South Africa

8.7. South America Serological Pipettes Market

8.7.1 Key Market Trends, Growth Factors and Opportunities

8.7.2 Top Key Companies

8.7.3 Historic and Forecasted Market Size by Segments

8.7.4 Historic and Forecasted Market Size by Material

8.7.4.1 Glass Pipettes

8.7.4.2 Plastic Pipettes

8.7.5 Historic and Forecasted Market Size by Application

8.7.5.1 Tissue Culture

8.7.5.2 Bacterial Culture

8.7.5.3 Testing Lab

8.7.5.4 Others

8.7.6 Historic and Forecasted Market Size by End User

8.7.6.1 Hospitals

8.7.6.2 Academic and Research Institutes

8.7.6.3 Pharmaceutical and Biotechnology Companies

8.7.6.4 Others

8.7.7 Historic and Forecast Market Size by Country

8.7.7.1 Brazil

8.7.7.2 Argentina

8.7.7.3 Rest of SA

Chapter 9 Analyst Viewpoint and Conclusion

9.1 Recommendations and Concluding Analysis

9.2 Potential Market Strategies

Chapter 10 Research Methodology

10.1 Research Process

10.2 Primary Research

10.3 Secondary Research

|

Serological Pipettes Market |

|||

|

Base Year: |

2024 |

Forecast Period: |

2025-2035 |

|

Historical Data: |

2018 to 2023 |

Market Size in 2023: |

USD 0.26 Billion |

|

Forecast Period 2025-35 CAGR: |

5.3% |

Market Size in 2035: |

USD 0.46 Billion |

|

Segments Covered: |

By Material |

|

|

|

By Application |

|

||

|

By End User |

|

||

|

By Region |

|

||

|

Key Market Drivers: |

|

||

|

Key Market Restraints: |

|

||

|

Key Opportunities: |

|

||

|

Companies Covered in the report: |

|

||