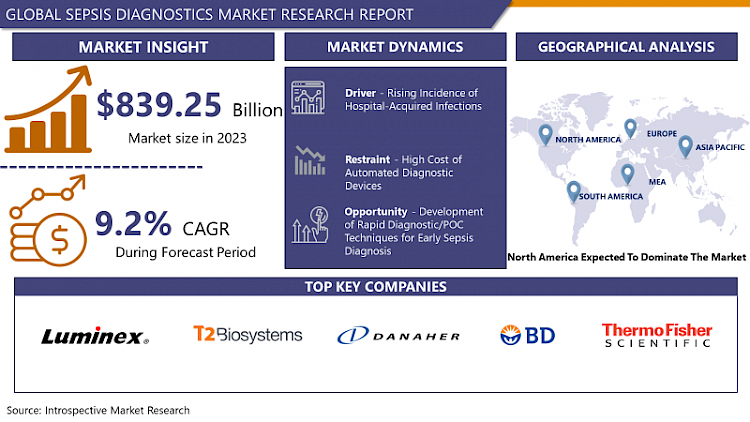

Sepsis Diagnostics Market Synopsis

Sepsis Diagnostics Market Size Was Valued at USD 839.25 Million in 2023 and is Projected to Reach USD 1696.96 Million by 2032, Growing at a CAGR of 9.2% From 2024-2032.

- Sepsis diagnostics refers to the methods and processes used by healthcare professionals to identify and confirm the presence of sepsis, a potentially life-threatening condition triggered by the body's overwhelming response to an infection. Diagnosis typically involves a combination of clinical assessments, such as vital signs monitoring, laboratory tests and sometimes imaging studies, aimed at recognizing specific signs of infection spreading throughout the body.

- The sepsis diagnostics market encompasses a broad array of tools, technologies, and methodologies used in healthcare settings to identify and manage sepsis, a critical condition stemming from the body's response to infections. The market for these diagnostic tools has been witnessing steady growth owing to several factors. These include an increasing incidence of sepsis cases globally, advancements in diagnostic technologies offering quicker and more accurate results, and a growing emphasis on early detection and intervention to improve patient outcomes

- Various diagnostic methods contribute to this market, ranging from routine laboratory tests like blood cultures and biomarker analysis (such as measuring levels of procalcitonin or C-reactive protein) to more advanced techniques like molecular diagnostics and point-of-care testing. The integration of novel biomarkers and rapid diagnostic tools into healthcare systems has shown promising results in enhancing the efficiency of sepsis detection and subsequent treatment strategies

Sepsis Diagnostics Market Trend Analysis

Rising Incidence of Hospital-Acquired Infections

- The escalating incidence of hospital-acquired infections (HAIs) stands as a pivotal driver propelling the growth of the sepsis diagnostics market. HAIs, also known as nosocomial infections, are infections that patients acquire during their hospital stay, often linked to invasive procedures, medical devices, or contact with healthcare personnel. These infections pose a substantial risk factor for the development of sepsis, as they introduce pathogens into vulnerable patients, potentially leading to systemic infections and subsequent organ dysfunction.

- The rise in HAIs amplifies the urgency for early and accurate diagnosis of sepsis, as prompt identification is crucial in preventing its progression to severe stages. Hospital-acquired infections can involve various pathogens, including bacteria, viruses, fungi, and parasites, necessitating comprehensive and rapid diagnostic approaches to detect and manage sepsis effectively. As a result, healthcare systems are increasingly emphasizing the implementation of advanced diagnostic tools and protocols aimed at swift identification and targeted treatment of sepsis stemming from these infections.

- The demand for innovative diagnostic solutions is surging to combat the challenge posed by HAIs and their potential to trigger sepsis. Market players are investing in research and development to create novel diagnostic technologies capable of detecting a wide array of pathogens quickly and accurately. Collaborations between healthcare facilities and diagnostic companies are also driving the development and adoption of these cutting-edge solutions, aiming to curb the impact of HAIs on patient health outcomes while fueling the growth of the sepsis diagnostics market. As HAIs continue to pose a significant threat, the focus on effective diagnostic measures remains pivotal in addressing sepsis emergence and improving patient care within hospital settings.

Opportunity

Development of Rapid Diagnostic/POC Techniques for Early Sepsis Diagnosis.

- Sepsis is a very difficult condition to diagnose and the risk of mortality increases by 7.6% with a delay of even 1 minute in antibiotic administration in septic shock patients with hypertension. Thus, increasing the need for the rapid diagnosis of sepsis to reduce the delay of antibiotic therapy among patients with sepsis. Many sepsis diagnostic manufacturers are expanding their product offering in point of care technology rapidly detecting sepsis and reducing the overall turnaround time of diagnosis.

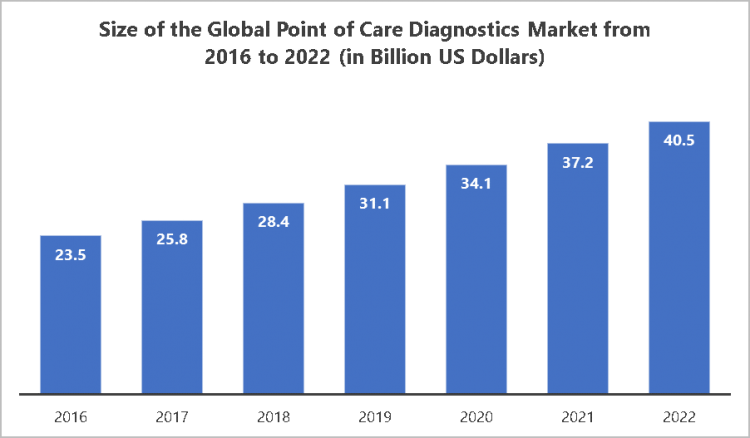

- The evolution of rapid diagnostic and point-of-care (POC) techniques stands as a significant opportunity within the sepsis diagnostics market, revolutionizing the landscape of early sepsis detection. These advanced diagnostic methods aim to swiftly identify sepsis at its onset, enabling timely intervention and improving patient outcomes. POC technologies empower healthcare providers to perform diagnostic tests closer to the patient, often within minutes, expediting the decision-making process and enabling prompt initiation of targeted therapies.

- The emergence of innovative POC devices and rapid diagnostic tools offers a promising avenue for enhancing the efficiency and accuracy of sepsis diagnosis. These technologies typically involve the utilization of biomarkers, molecular assays, and innovative testing platforms designed to deliver quick and reliable results at the bedside or in emergency settings. By enabling rapid identification of potential sepsis cases, these tools play a pivotal role in guiding clinicians in their treatment decisions, optimizing patient care pathways, and potentially reducing the risk of sepsis progression.

- The market opportunity lies in the continuous refinement and development of these rapid diagnostic and POC techniques. Advancements in miniaturization, automation, and integration of multiple diagnostic parameters into single platforms are key focal points for innovators. Moreover, collaborations between diagnostic companies, healthcare providers, and regulatory bodies are instrumental in accelerating the adoption of these cutting-edge technologies, ensuring their accessibility and adherence to stringent quality standards.

Sepsis Diagnostics Market Segment Analysis:

Sepsis Diagnostics Market Segmented on the basis of Technology, Product, Method, Pathogen Test Type, and End-Users.

By Technology, Blood culture segment is expected to dominate the market during the forecast period

- Blood culture methods involve culturing a patient's blood sample to identify the specific pathogens causing the infection. While it remains a gold standard, it often requires a longer time (ranging from hours to days) to yield results, which might delay the initiation of targeted treatment. Despite this drawback, blood cultures have historically been widely used for identifying the causative organisms in sepsis cases.

- However, the landscape is shifting towards more rapid and advanced technologies. Immunoassays, molecular diagnostics, and biomarkers are gaining prominence due to their ability to offer quicker results and, in some cases, greater accuracy. Immunoassays, for instance, detect specific proteins or antibodies in the blood, aiding in the identification of infections. Molecular diagnostics, including polymerase chain reaction (PCR) tests, allow for the detection of DNA or RNA of pathogens, providing rapid and specific identification.

- Biomarkers, such as procalcitonin and C-reactive protein, are also increasingly used for their ability to indicate the presence of an infection and guide clinical decision-making. They offer quick results and aid in differentiating sepsis from other conditions.

By Product, Assays & reagents segment held the largest share of 36.4% in 2022

- Assays & reagents represent a pivotal category within the sepsis diagnostics realm, constituting a diverse range of essential tools and components integral to accurate and efficient diagnosis. This category encapsulates an extensive array of diagnostic methodologies, including immunoassays and molecular assays, along with a spectrum of reagents critical for identifying infections and pathogens associated with sepsis. These diagnostic tools are fundamental in conducting precise tests aimed at detecting specific biomarkers, proteins, or genetic material indicative of infections, thereby enabling clinicians to swiftly and accurately diagnose sepsis.

- Immunoassays, a prominent component within this segment, involve techniques that detect and quantify particular molecules, such as antigens or antibodies, present in blood or other bodily fluids. These assays aid in identifying infection-related markers, contributing significantly to the diagnostic process. Molecular assays, on the other hand, delve into the genetic material of pathogens, allowing for the detection of DNA or RNA sequences specific to infectious agents. This molecular-level insight plays a crucial role in pinpointing the exact causative pathogens behind sepsis and guiding targeted treatment strategies.

By Method, Conventional diagnostics segment held the largest share in 2022

- Conventional diagnostics have long served as the cornerstone of sepsis diagnosis, relying on established methodologies that involve manual processes and older techniques. These methods often encompass manual analysis of patient samples, relying on culture-based approaches to identify the causative pathogens behind the infection. In addition, older immunoassays, while effective, might demand more time and human intervention for conducting tests and interpreting results compared to the streamlined processes offered by automated diagnostics.

- The reliance on conventional diagnostics in sepsis diagnosis stems from their historical efficacy and familiarity within healthcare settings. Culture-based techniques, for instance, involve growing pathogens from patient samples in specialized mediums to identify the specific microorganisms causing the infection. While these methods have been fundamental in diagnosing sepsis, they often necessitate longer turnaround times for results, potentially delaying the initiation of targeted treatment.

By Pathogen, Bacterial Sepsis segment held the largest share in 2022

- Bacterial infections are the leading cause of sepsis globally. The majority of sepsis cases originate from bacterial pathogens, commonly derived from urinary tract infections, pneumonia, abdominal infections, or bloodstream infections. The sheer prevalence of bacterial infections contributing to sepsis cases significantly influences the prominence of diagnostics for bacterial sepsis within the market.

- Bacterial sepsis tends to progress rapidly and can lead to severe complications if not promptly diagnosed and treated. Healthcare providers prioritize the early identification of bacterial pathogens causing sepsis to initiate targeted antibiotic therapy promptly. Consequently, diagnostics specifically designed to detect and identify bacterial infections in sepsis cases hold paramount clinical importance.

- Diagnostic technologies have historically focused extensively on identifying bacterial pathogens due to their primary role in sepsis. Blood culture methods, immunoassays targeting bacterial antigens or markers, and molecular diagnostics designed for bacterial DNA or RNA detection have been developed and refined to diagnose bacterial sepsis efficiently.

By Test Type, Point-of-Care Tests segment held the largest share in 2022

- Point-of-care (POC) tests have emerged as pivotal tools in sepsis diagnostics, revolutionizing the speed and accessibility of diagnostic assessments right at the patient's side. Engineered to deliver rapid results within healthcare facilities, these tests provide invaluable support by offering quick and actionable insights without the necessity of extensive laboratory infrastructure. In the realm of sepsis, POC tests encompass a spectrum of rapid immunoassays and molecular assays specifically tailored to swiftly identify pathogens or detect key biomarkers associated with sepsis onset. Their design prioritizes ease of use, empowering healthcare providers to make informed decisions promptly, thereby expediting treatment initiation and potentially improving patient outcomes.

- The appeal of POC tests in sepsis diagnosis lies in their ability to bridge the gap between diagnosis and treatment, particularly in critical situations where time is of the essence. By delivering rapid results at the bedside or within healthcare facilities, these tests streamline the diagnostic process, enabling healthcare providers to promptly assess and respond to suspected cases of sepsis. Rapid immunoassays target specific infection-related markers, while molecular assays delve into genetic material to identify pathogens swiftly, aiding clinicians in making informed decisions about tailored treatments.

By End User, Hospitals and Specialty Clinics segment held the largest share in 2022

- Hospitals and specialty clinics stand as the frontline in the battle against sepsis, serving as crucial hubs for diagnosing and managing this life-threatening condition. Equipped with comprehensive infrastructure and a diverse array of medical resources, these healthcare facilities handle a substantial influx of patients, including a significant portion presenting with sepsis or sepsis-related conditions. Hospitals, particularly those housing intensive care units (ICUs) and emergency departments encounter a notable volume of cases requiring prompt diagnosis and immediate intervention. This prevalence places them at the epicenter of the demand for sepsis diagnostics, underscoring their pivotal role in driving the utilization and advancement of diagnostic tools tailored for swift and accurate identification of sepsis.

- The significance of hospitals and specialty clinics in the realm of sepsis diagnostics is amplified by their ability to conduct a wide range of diagnostic tests essential for identifying and confirming sepsis. These facilities possess the requisite infrastructure, expertise, and diverse diagnostic modalities to conduct blood cultures, immunoassays, molecular diagnostics, and other specialized tests crucial for detecting the presence of infections or specific biomarkers indicative of sepsis. Their capacity to swiftly perform these tests aids in timely diagnosis and the initiation of targeted treatments, pivotal in addressing the urgency and severity of sepsis cases.

Sepsis Diagnostics Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast period

- North America is a well-established market for medical devices. The presence of a highly developed healthcare system, high adoption of innovative sepsis diagnostic technologies among medical professionals, reigning number of surgical procedures, increasing incidence of healthcare-associated infections (HAIs) and technological advancements in the field of sepsis diagnostics are the major factors driving the growth of the sepsis diagnostics market in North America.

- The United States has historically held a dominant position in the sepsis diagnostics market. The U.S. healthcare sector is characterized by its advanced infrastructure, robust research and development initiatives, and a strong focus on technological innovation. These factors contribute to the country's leading position in driving advancements and market growth within the sepsis diagnostics domain.

Sepsis Diagnostics Market Top Key Players:

- Luminex (US)

- T2 Biosystems (US)

- Danaher Corporation (US)

- Dickinson and Company (US)

- Thermo Fisher Scientific (US)

- Bruker Corporation (US)

- Abbott Laboratories (US)

- Quidel Corporation (US)

- AdvanDx (US)

- Immunoexpress, Inc (US)

- Abbott Laboratories (US)

- Beckman Coulter (US)

- Pfizer (US)

- Eli Lilly and Company (US)

- Merck & Co (US)

- BioMérieux (France)

- F. Hoffmann-La Roche AG(Switzerland)

- Roche Diagnostics (Switzerland)

- Siemens Healthineers AG(Germany)

- Qiagen N.V(Germany)

- GlaxoSmithKline (UK)

- Axis-Shield Diagnostics (UK)

- EKF Diagnostics (UK)

- AstraZeneca (UK)

- Seegene Inc. (South Korea)

Key Industry Developments in the Sepsis Diagnostics Market:

- In November 2023, The University of Oxford partnered with Danaher Corporation to develop a new test to enable precision medicine care for sepsis.

- In November 2023, Oxford Nanopore Technologies collaborated with Day Zero Diagnostics to develop an end-to-end diagnostic solution for bloodstream infections.

|

Sepsis Diagnostics Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 839.25 Mn. |

|

|

CAGR (2024-2032) : |

9.2% |

Market Size in 2032: |

USD 1696.96 Mn. |

|

|

Segments Covered: |

By Technology |

|

|

|

|

By Product |

|

|

||

|

By Method |

|

|

||

|

By Pathogen |

|

|

||

|

By Test Type |

|

|

||

|

By End Users |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

- INTRODUCTION

- RESEARCH OBJECTIVES

- RESEARCH METHODOLOGY

- RESEARCH PROCESS

- SCOPE AND COVERAGE

- Market Definition

- Key Questions Answered

- MARKET SEGMENTATION

- EXECUTIVE SUMMARY

- MARKET OVERVIEW

- GROWTH OPPORTUNITIES BY SEGMENT

- MARKET LANDSCAPE

- PORTER’S FIVE FORCES ANALYSIS

- Bargaining Power Of Supplier

- Threat Of New Entrants

- Threat Of Substitutes

- Competitive Rivalry

- Bargaining Power Among Buyers

- INDUSTRY VALUE CHAIN ANALYSIS

- MARKET DYNAMICS

- Drivers

- Restraints

- Opportunities

- Challenges

- MARKET TREND ANALYSIS

- REGULATORY LANDSCAPE

- PESTLE ANALYSIS

- PRICE TREND ANALYSIS

- PATENT ANALYSIS

- TECHNOLOGY EVALUATION

- MARKET IMPACT OF THE RUSSIA-UKRAINE WAR

- Geopolitical Market Disruptions

- Supply Chain Disruptions

- Instability in Emerging Markets

- ECOSYSTEM

- PORTER’S FIVE FORCES ANALYSIS

- SEPSIS DIAGNOSTICS MARKET BY TECHNOLOGY (2016-2030)

- SEPSIS DIAGNOSTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BLOOD CULTURE

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- IMMUNOASSAYS

- MOLECULAR DIAGNOSTICS

- FLOW CYTOMETRY

- MICROFLUIDICS

- BIOMARKERS

- SEPSIS DIAGNOSTICS MARKET BY PRODUCT (2016-2030)

- SEPSIS DIAGNOSTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BLOOD CULTURE MEDIA

- Introduction and Market Overview

- Historic and Forecasted Market Size in Value (2016 – 2030F)

- Historic and Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors and Opportunities

- Geographic Segmentation Analysis

- ASSAYS & REAGENTS

- INSTRUMENTS

- SOFTWARE

- SEPSIS DIAGNOSTICS MARKET BY METHOD (2016-2030)

- SEPSIS DIAGNOSTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- AUTOMATED DIAGNOSTICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- CONVENTIONAL DIAGNOSTICS

- SEPSIS DIAGNOSTICS MARKET BY PATHOGEN (2016-2030)

- SEPSIS DIAGNOSTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- BACTERIAL SEPSIS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- FUNGAL SEPSIS

- VIRAL SEPSIS

- SEPSIS DIAGNOSTICS MARKET BY TEST TYPE (2016-2030)

- SEPSIS DIAGNOSTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- LABORATORY TESTS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- POINT-OF-CARE TESTS

- SEPSIS DIAGNOSTICS MARKET BY END USERS (2016-2030)

- SEPSIS DIAGNOSTICS MARKET SNAPSHOT AND GROWTH ENGINE

- MARKET OVERVIEW

- HOSPITALS AND SPECIALTY CLINICS

- Introduction And Market Overview

- Historic And Forecasted Market Size in Value (2016 – 2030F)

- Historic And Forecasted Market Size in Volume (2016 – 2030F)

- Key Market Trends, Growth Factors And Opportunities

- Geographic Segmentation Analysis

- PATHOLOGY & REFERENCE LABORATORIES

- RESEARCH LABORATORIES & ACADEMIC INSTITUTES

- COMPANY PROFILES AND COMPETITIVE ANALYSIS

- COMPETITIVE LANDSCAPE

- Competitive Positioning

- SEPSIS DIAGNOSTICS Market Share By Manufacturer (2022)

- Industry BCG Matrix

- Heat Map Analysis

- Mergers & Acquisitions

- LUMINEX (US)

- Company Overview

- Key Executives

- Company Snapshot

- Role of the Company in the Market

- Sustainability and Social Responsibility

- Operating Business Segments

- Product Portfolio

- Business Performance (Production Volume, Sales Volume, Sales Margin, Production Capacity, Capacity Utilization Rate)

- Key Strategic Moves And Recent Developments

- SWOT Analysis

- T2 BIOSYSTEMS (US)

- DANAHER CORPORATION (US)

- DICKINSON AND COMPANY (US)

- THERMO FISHER SCIENTIFIC (US)

- BRUKER CORPORATION (US)

- ABBOTT LABORATORIES (US)

- QUIDEL CORPORATION (US)

- ADVANDX (US)

- IMMUNOEXPRESS, INC (US)

- ABBOTT LABORATORIES (US)

- BECKMAN COULTER (US)

- PFIZER (US)

- ELI LILLY AND COMPANY (US)

- MERCK & CO (US)

- BIOMÉRIEUX (FRANCE)

- F. HOFFMANN-LA ROCHE AG(SWITZERLAND)

- ROCHE DIAGNOSTICS (SWITZERLAND)

- SIEMENS HEALTHINEERS AG(GERMANY)

- QIAGEN N.V(GERMANY)

- GLAXOSMITHKLINE (UK)

- AXIS-SHIELD DIAGNOSTICS (UK)

- EKF DIAGNOSTICS (UK)

- ASTRAZENECA (UK)

- SEEGENE INC. (SOUTH KOREA)

- COMPETITIVE LANDSCAPE

- GLOBAL SEPSIS DIAGNOSTICS MARKET BY REGION

- OVERVIEW

- NORTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Technology

- Historic And Forecasted Market Size By Product

- Historic And Forecasted Market Size By Method

- Historic And Forecasted Market Size By Pathogen

- Historic And Forecasted Market Size By Test Type

- Historic And Forecasted Market Size By End User

- Historic And Forecasted Market Size By Country

- USA

- Canada

- Mexico

- EASTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Russia

- Bulgaria

- The Czech Republic

- Hungary

- Poland

- Romania

- Rest Of Eastern Europe

- WESTERN EUROPE

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Germany

- United Kingdom

- France

- The Netherlands

- Italy

- Spain

- Rest Of Western Europe

- ASIA PACIFIC

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- China

- India

- Japan

- South Korea

- Malaysia

- Thailand

- Vietnam

- The Philippines

- Australia

- New-Zealand

- Rest Of APAC

- MIDDLE EAST & AFRICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Turkey

- Bahrain

- Kuwait

- Saudi Arabia

- Qatar

- UAE

- Israel

- South Africa

- SOUTH AMERICA

- Key Market Trends, Growth Factors And Opportunities

- Key Manufacturers

- Historic And Forecasted Market Size By Segments

- Historic And Forecasted Market Size By Country

- Brazil

- Argentina

- Rest of South America

- INVESTMENT ANALYSIS

- ANALYST VIEWPOINT AND CONCLUSION

- Recommendations and Concluding Analysis

- Potential Market Strategies

|

Sepsis Diagnostics Market |

||||

|

Base Year: |

2023 |

Forecast Period: |

2024-2032 |

|

|

Historical Data: |

2017 to 2023 |

Market Size in 2023: |

USD 839.25 Mn. |

|

|

CAGR (2024-2032) : |

9.2% |

Market Size in 2032: |

USD 1696.96 Mn. |

|

|

Segments Covered: |

By Technology |

|

|

|

|

By Product |

|

|

||

|

By Method |

|

|

||

|

By Pathogen |

|

|

||

|

By Test Type |

|

|

||

|

By End Users |

|

|

||

|

By Region |

|

|

||

|

Key Market Drivers: |

|

|||

|

Key Market Restraints: |

|

|||

|

Key Opportunities: |

|

|||

|

Companies Covered in the Report: |

|

|||

Frequently Asked Questions :

The forecast period in the Sepsis Diagnostics Market research report is 2023-2030.

Luminex (US), T2 Biosystems (US), Danaher Corporation (US), Dickinson and Company (US), Thermo Fisher Scientific (US), Bruker Corporation (US), Abbott Laboratories (US), Quidel Corporation (US), AdvanDx (US), Immunoexpress, Inc (US), Abbott Laboratories (US), Beckman Coulter (US), Pfizer (US), Eli Lilly and Company (US), Merck & Co (US), BioMérieux (France), F. Hoffmann-La Roche AG (Switzerland), Roche Diagnostics (Switzerland), Siemens Healthineers AG (Germany), Qiagen N.V (Germany), GlaxoSmithKline (UK), Axis-Shield Diagnostics (UK), EKF Diagnostics (UK), AstraZeneca (UK), Seegene Inc. (South Korea), and Other Major Players.

The Sepsis Diagnostics Market is segmented into Technology, Product, Method, Pathogen, Test Type, and End-Users. By Technology, the market is categorized into Blood Culture, Immunoassays, Molecular Diagnostics, Flow Cytometry, Microfluidics, and Biomarkers. By Product, the market is categorized into Blood Culture Media, Assays and reagents, Instruments, and Software. By Method, the market is categorized into Automated Diagnostics and Conventional Diagnostics. By Pathogen, the market is categorized into Bacterial Sepsis, Fungal Sepsis, and Viral Sepsis. By Test Type, the market is categorized into Laboratory Tests and Point-of-Care Tests. By Pathogen, the market is categorized into Hospitals and specialty clinics, Pathology and reference Laboratories, Research Laboratories, and academic Institutes. By region, it is analyzed across North America (U.S.; Canada; Mexico), Eastern Europe (Bulgaria; The Czech Republic; Hungary; Poland; Romania; Rest of Eastern Europe), Western Europe (Germany; UK; France; Netherlands; Italy; Russia; Spain; Rest of Western Europe), Asia-Pacific (China; India; Japan; Southeast Asia, etc.), South America (Brazil; Argentina, etc.), Middle East & Africa (Saudi Arabia; South Africa, etc.).

Sepsis diagnostics refer to the methods and processes used by healthcare professionals to identify and confirm the presence of sepsis, a potentially life-threatening condition triggered by the body's overwhelming response to an infection. Diagnosis typically involves a combination of clinical assessments, such as vital signs monitoring, laboratory tests and sometimes imaging studies, aimed at recognizing specific signs of infection spreading throughout the body.

Sepsis Diagnostics Market Size Was Valued at USD 839.25 Million in 2023 and is Projected to Reach USD 1696.96 Million by 2032, Growing at a CAGR of 9.2% From 2024-2032.